Market Overview

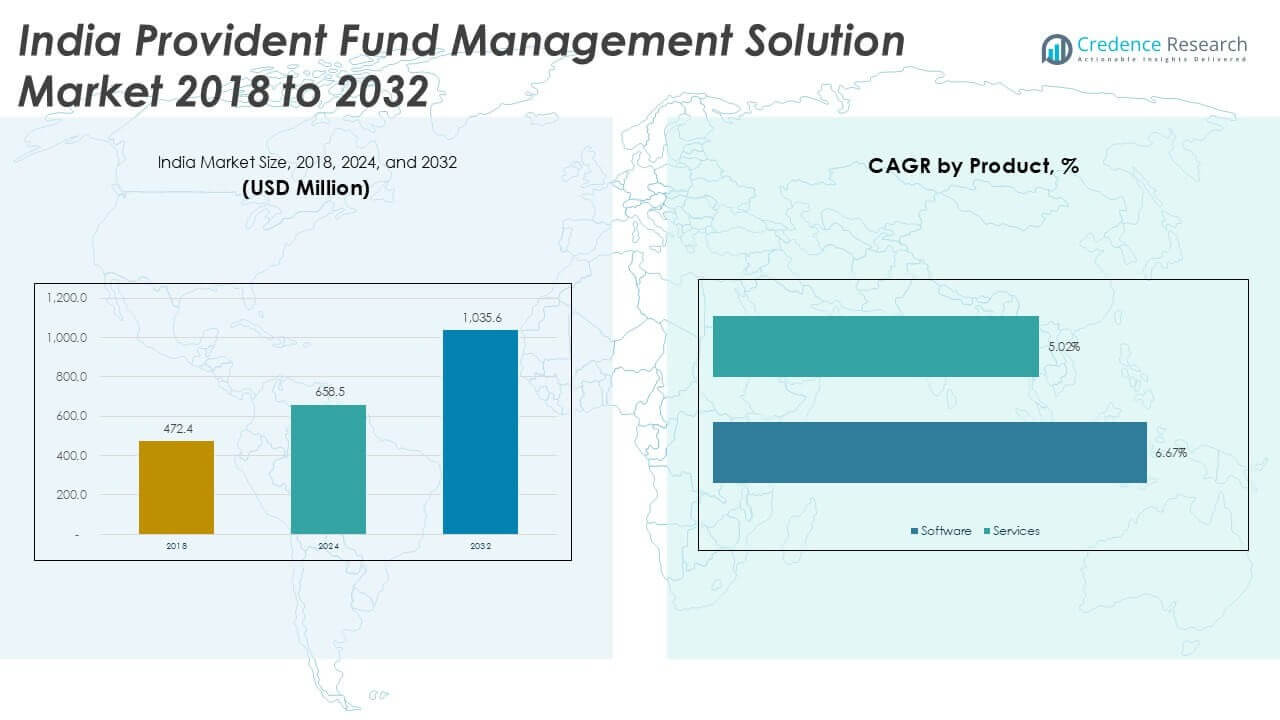

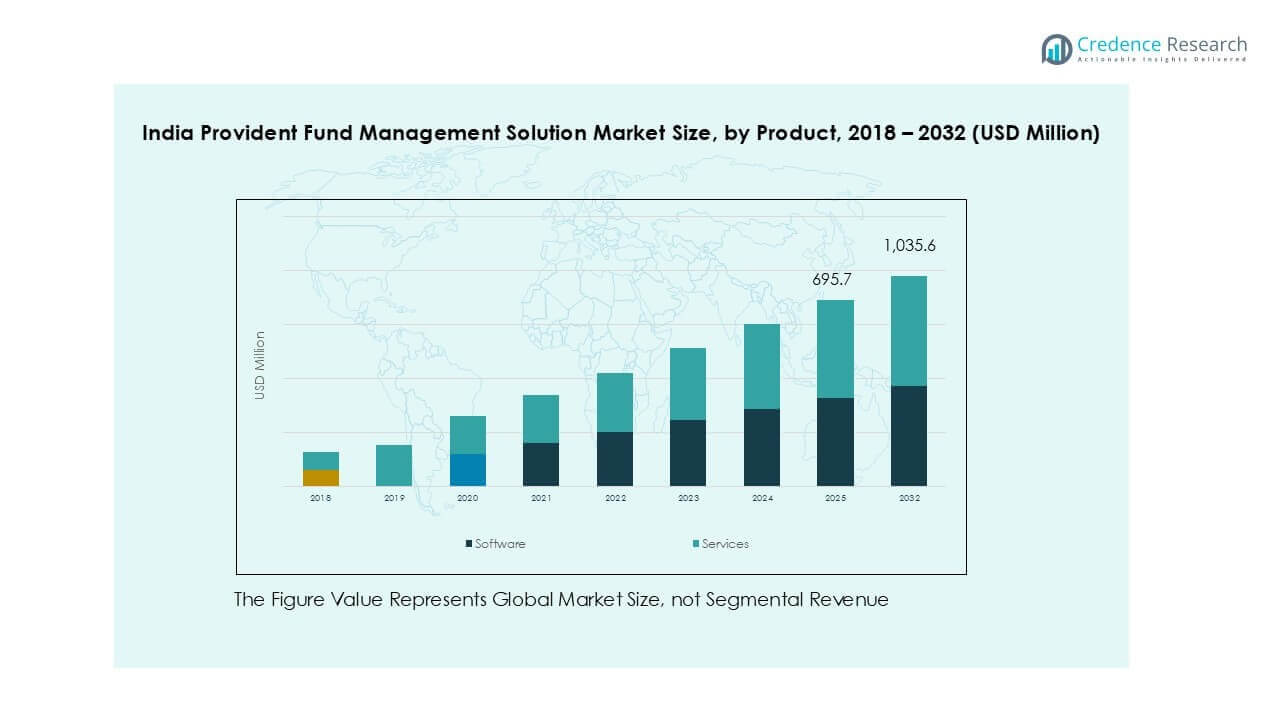

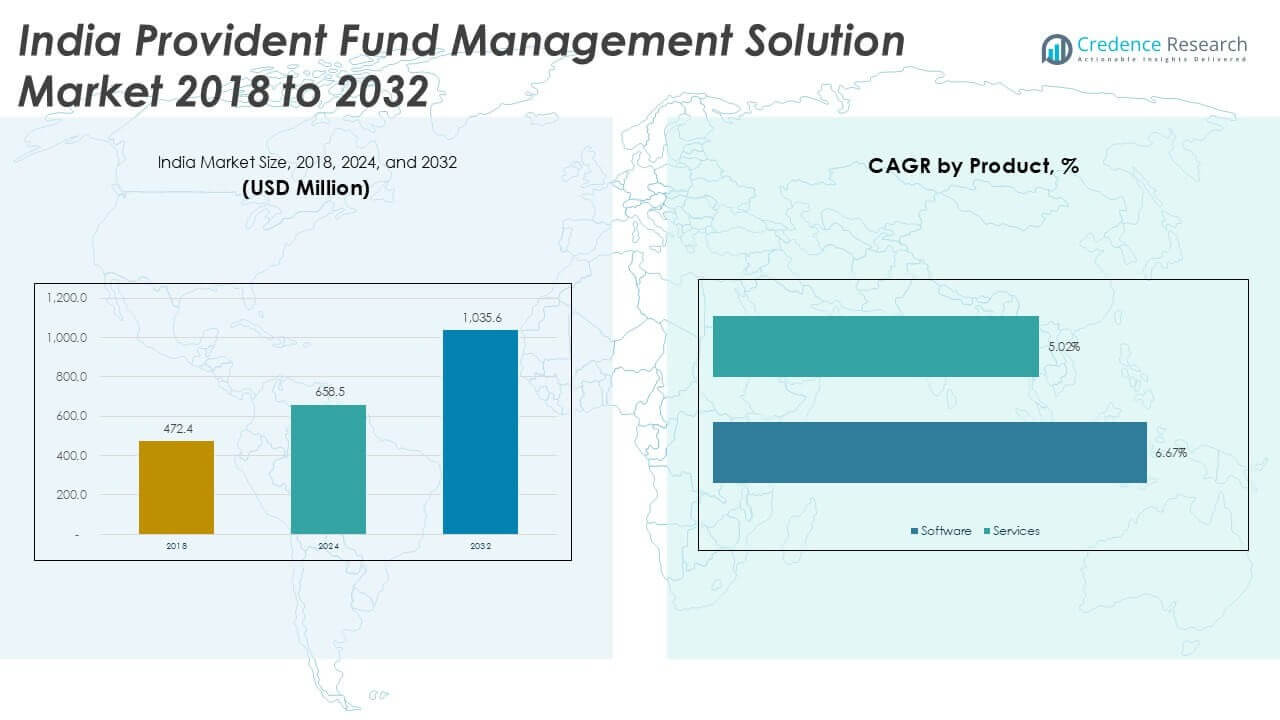

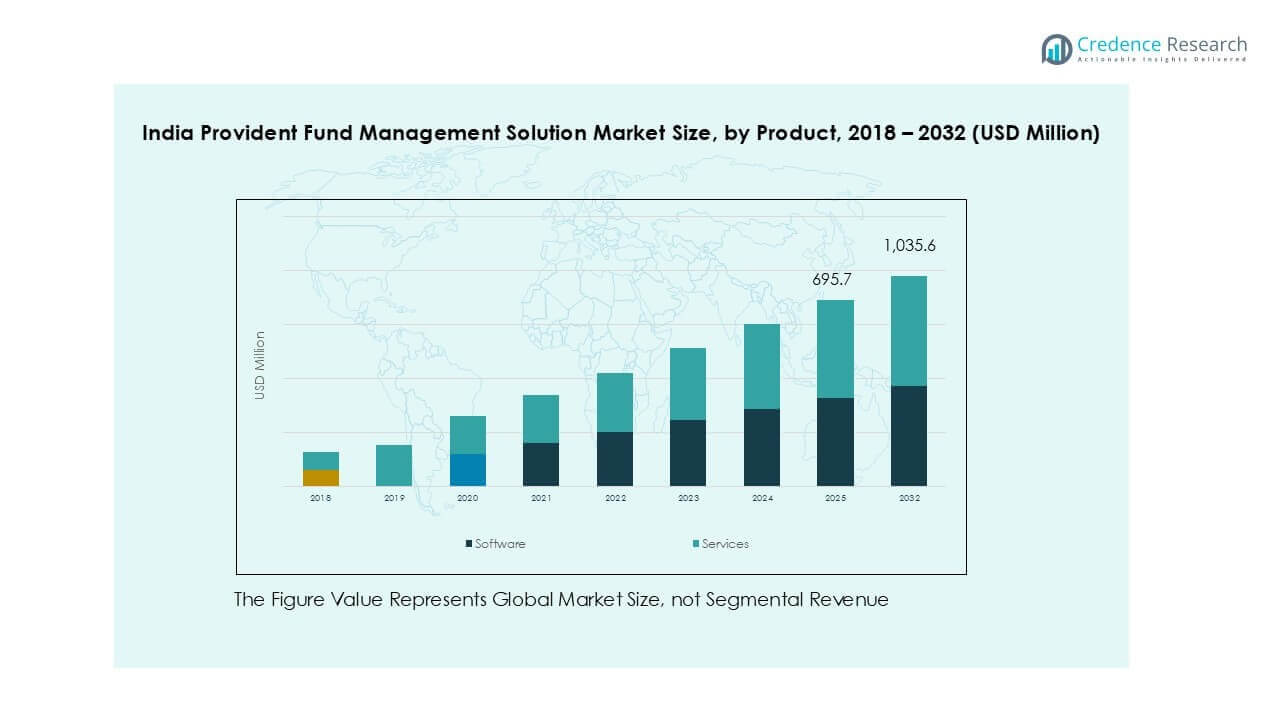

India Provident Fund Management Solution Market size was valued at USD 472.4 million in 2018 to USD 658.5 million in 2024 and is anticipated to reach USD 1035.6 million by 2032, at a CAGR of 5.83% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Provident Fund Management Solution Market Size 2024 |

USD 658.5 Million |

| India Provident Fund Management Solution Market, CAGR |

5.83% |

| India Provident Fund Management Solution Market Size 2032 |

USD 1035.6 Million |

The India Provident Fund Management Solution market is led by key players including Kalpak Solutions, Renessa Info Systems Limited, Ray Computech Pvt. Ltd., Workday, C-Quel India, Vitech Systems Group, and Andolasoft, Inc. These companies focus on compliance automation, seamless payroll integration, and employee self-service platforms to improve accuracy and efficiency. West India leads the market with 31% share, driven by strong adoption across IT hubs and BFSI sectors, followed by South India with 30% share, supported by its large tech and manufacturing base. North India accounts for 29% share, anchored by PSU and automotive demand, while East India holds 10% share, showing steady growth as companies digitize fund management operations.

Market Insights

Market Insights

- The India Provident Fund Management Solution market was valued at USD 658.5 million in 2024 and is projected to reach USD 1,035.6 million by 2032, growing at a CAGR of 5.83%.

- Growth is fueled by rising regulatory compliance requirements, automation adoption, and increased focus on employee benefit transparency, driving demand for digital PF management platforms.

- Key trends include rapid migration to cloud-based and mobile-first solutions, integration with HRMS and payroll systems, and deployment of AI-driven workflows to improve efficiency and reduce manual errors.

- The market is moderately competitive with players like Kalpak Solutions, Renessa Info Systems, Ray Computech, Workday, C-Quel India, and Vitech Systems focusing on compliance automation, cybersecurity, and scalable SaaS offerings.

- West India leads with 31% share, followed by South India at 30%, North India at 29%, and East India at 10%; software holds the dominant product share, supported by strong adoption among large enterprises.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

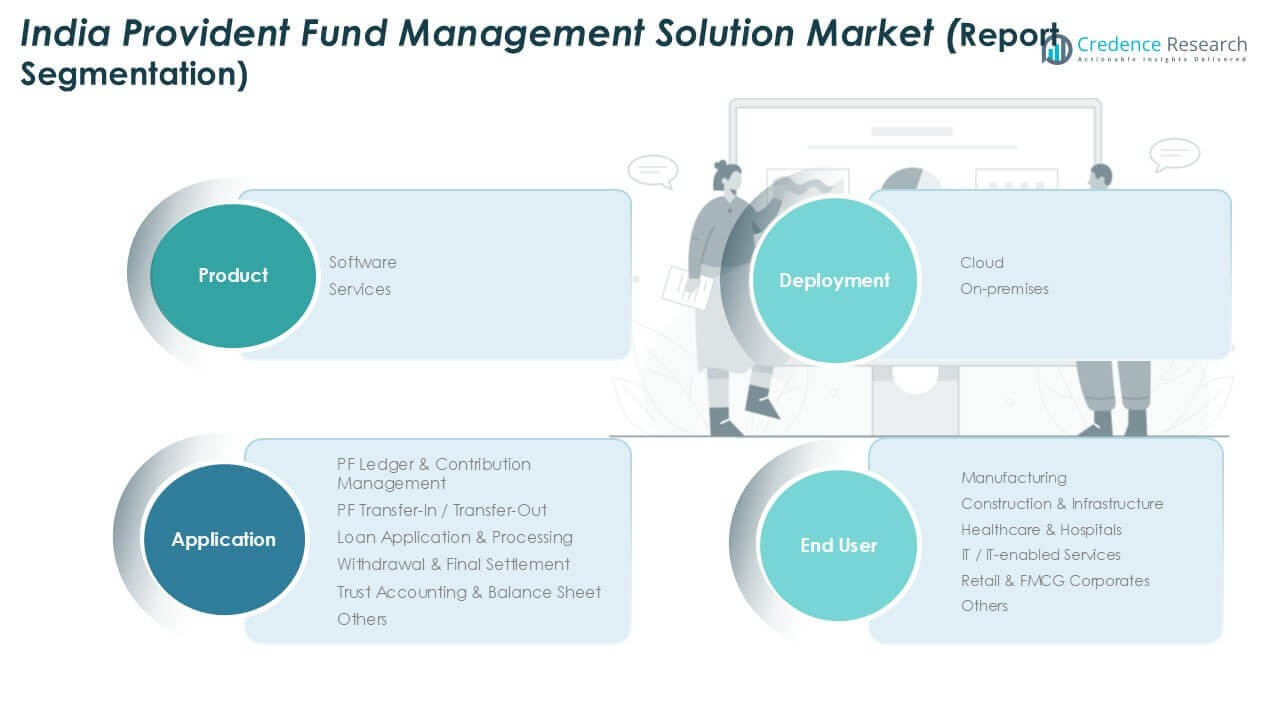

By Product

Software dominated the India Provident Fund Management Solution market in 2024, holding over 60% of the market share. This growth is driven by the rising adoption of automated payroll integration, real-time compliance updates, and user-friendly interfaces that improve fund tracking accuracy. Organizations are investing in scalable software solutions to reduce manual errors and streamline contribution processing. Services follow as a complementary segment, with demand driven by outsourcing requirements for fund administration, advisory, and compliance audits. Growing awareness of digital transformation is expected to keep software the preferred choice during the forecast period.

- For instance, greytHR processed provident fund contributions for over 1.2 million employees monthly in 2024, automating filings for more than 18,000 Indian businesses.

By Application

PF Ledger & Contribution Management was the leading application segment, capturing more than 35% share in 2024. Companies rely on this function for accurate record-keeping, timely contributions, and compliance with statutory norms. Increasing digitization and automation initiatives have boosted adoption, reducing human intervention and processing delays. Loan Application & Processing and Withdrawal & Final Settlement are growing segments as employees seek faster digital approvals and transparent settlement processes. Trust Accounting & Balance Sheet solutions are also witnessing steady uptake, particularly among large enterprises managing multiple employee benefit trusts efficiently.

- For instance, in 2024, RazorpayX Payroll analyzed payroll data for over 4 lakh (400,000+) employees and ensured real-time EPF compliance for over 10,000 organizations across India.

By Deployment

Cloud deployment held the dominant share of over 55% in 2024, supported by the need for scalable, cost-effective, and secure fund management platforms. SMEs and large enterprises prefer cloud-based solutions for their real-time accessibility, low infrastructure costs, and easy updates. The growth of remote work and mobile access requirements has further accelerated the adoption of cloud platforms. On-premises solutions remain relevant for organizations with strict data security policies and in-house IT infrastructure but are experiencing slower growth as businesses migrate to cloud-based models for better flexibility and compliance management.

Key Growth Drivers

Rising Regulatory Compliance Requirements

The India Provident Fund Management Solution market is driven by strict compliance mandates from the Employees’ Provident Fund Organisation (EPFO) and government authorities. Companies are adopting digital fund management systems to ensure timely contributions, automated reporting, and error-free compliance. Frequent updates to labor laws and contribution rules are pushing enterprises to invest in solutions that offer real-time updates and regulatory alerts. This adoption minimizes penalties and improves audit readiness, making compliance a significant growth driver for solution providers.

- For instance, ADP’s services are designed to improve compliance and minimize the risk of penalties, which have been significantly simplified by recent EPFO changes.

Digital Transformation and Automation Adoption

The shift toward automation is a major driver for market growth. Organizations are increasingly implementing AI-enabled and cloud-based platforms to streamline payroll processing, contribution tracking, and withdrawal settlements. Automated workflows reduce manual errors, improve data accuracy, and speed up processing time. This digital transformation supports real-time employee self-service portals and ensures better transparency in fund management. The trend aligns with India’s broader digitalization initiatives, encouraging both SMEs and large enterprises to adopt modern provident fund management solutions.

- For instance, HROne’s own “Our Story” timeline, Google Play store page, and LinkedIn page, which provides a more accurate picture of the company’s growth as of September 2024.

Growing Workforce and Employee Benefit Awareness

India’s expanding formal workforce and rising awareness about employee welfare benefits are boosting demand for provident fund management solutions. Companies seek efficient systems to manage contributions for a growing number of employees while maintaining transparency and trust. Enhanced focus on employee financial security, especially post-pandemic, has driven organizations to prioritize robust fund management processes. This shift supports better employee retention and satisfaction, encouraging corporates to adopt scalable and efficient fund management platforms.

Key Trends & Opportunities

Key Trends & Opportunities

Cloud-Based and Mobile-First Solutions

The adoption of cloud-based and mobile-friendly provident fund management solutions is a key market trend. Businesses are shifting toward SaaS platforms that provide remote access, real-time data synchronization, and easy integration with HR and payroll systems. Mobile-first solutions allow employees to view balances, request withdrawals, and track contributions on the go. This trend offers solution providers opportunities to expand their offerings with advanced security features, API integrations, and analytics capabilities, meeting the growing demand for flexibility and accessibility.

- For instance, according to the HR tech company Keka, its mobile PF module processed over 3 million withdrawal and balance check requests in 2024. Keka also states it serves employees across more than 10,000 Indian businesses.

Integration with Payroll and HRMS Platforms

There is a growing trend of integrating provident fund management systems with existing HR and payroll software. This integration streamlines operations by enabling automated deduction, seamless reconciliation, and instant compliance reporting. Vendors offering plug-and-play solutions that work with popular HRMS platforms gain a competitive edge. The opportunity lies in developing highly interoperable systems that reduce administrative burdens and deliver end-to-end visibility of employee benefits, particularly for large enterprises managing diverse workforces across multiple locations.

- For instance, Zoho Payroll features integrated PF compliance modules for companies in India, automating monthly contributions for their employees. It integrates with other Zoho products like Zoho People and Zoho Books for seamless data transfer, and as of 2024, it helps process payroll for over 17,000 employees monthly.

Key Challenges

Data Security and Privacy Concerns

Data security remains a major challenge in the India Provident Fund Management Solution market. The storage and transfer of sensitive employee financial information make these systems prime targets for cyberattacks. Organizations must comply with strict data protection regulations, requiring vendors to invest heavily in encryption, secure hosting, and compliance frameworks. Failure to secure data can lead to financial loss, legal penalties, and reputational damage, making security a critical barrier to adoption for some enterprises.

Limited Adoption Among Small Enterprises

Small and medium enterprises (SMEs) often face budget constraints and limited awareness regarding advanced provident fund management solutions. Many rely on manual processes or basic software that lacks automation and compliance features. High upfront costs, training requirements, and resistance to change hinder adoption in this segment. Vendors need to offer affordable, user-friendly solutions with flexible pricing models to penetrate the SME market and encourage wider adoption across India’s diverse business landscape.

Regional Analysis

North India

North India accounted for around 29% of the India Provident Fund Management Solution market in 2024, driven by strong adoption in Delhi NCR, Punjab, and Haryana where manufacturing, automotive, and government PSUs dominate. Organizations increasingly implement integrated payroll and PF management platforms to ensure compliance with EPFO norms and to streamline ledger reconciliation across multiple facilities. Hybrid deployments are popular, addressing strict data security policies while enabling real-time access for HR teams. Demand is also rising in tier-2 cities as SMEs and MSMEs adopt automated solutions to reduce manual errors and ensure timely contribution submissions and settlements.

West India

West India led the market with 31% share in 2024, supported by a strong base of IT hubs, BFSI companies, and industrial clusters in Maharashtra and Gujarat. Enterprises in this region favor cloud-based SaaS models for scalability, cost efficiency, and faster deployment. Advanced analytics and AI-driven reconciliation tools are gaining popularity, enabling early detection of compliance gaps. Vendors also benefit from a mature regulatory ecosystem and digital-friendly corporate culture, which encourages automated reporting and paperless workflows. Regional demand is further strengthened by startups and fintech players seeking seamless integration between payroll, compliance, and employee self-service systems.

South India

South India held a 30% share in 2024, driven by its large IT, healthcare, and electronics manufacturing base across Bengaluru, Hyderabad, and Chennai. Companies in the region prioritize AI-enabled workflows, chatbots for employee queries, and automated loan or withdrawal approvals to improve turnaround times. Cloud deployment remains the dominant model, supporting remote teams and distributed workforce management. Enterprises invest heavily in platforms with strong cybersecurity compliance such as SOC-2 and ISO certifications. Vendor presence and local implementation partners play a key role in driving adoption, offering training, integration support, and ongoing system optimization for large enterprises.

East India

East India contributed 10% share in 2024, with growing adoption among manufacturing, steel, mining, and logistics companies across Odisha, Jharkhand, and West Bengal. Many businesses are transitioning from manual spreadsheets to modular PF management platforms for the first time, focusing on error-free ledger maintenance and automated transfer-in processes. On-premises deployments are still common due to strict internal IT policies, though cloud adoption is accelerating with affordable subscription models. Regional vendors emphasize vernacular interfaces and localized training to boost employee participation. Government-led digital initiatives and compliance drives are also fueling adoption in public and cooperative sector organizations.

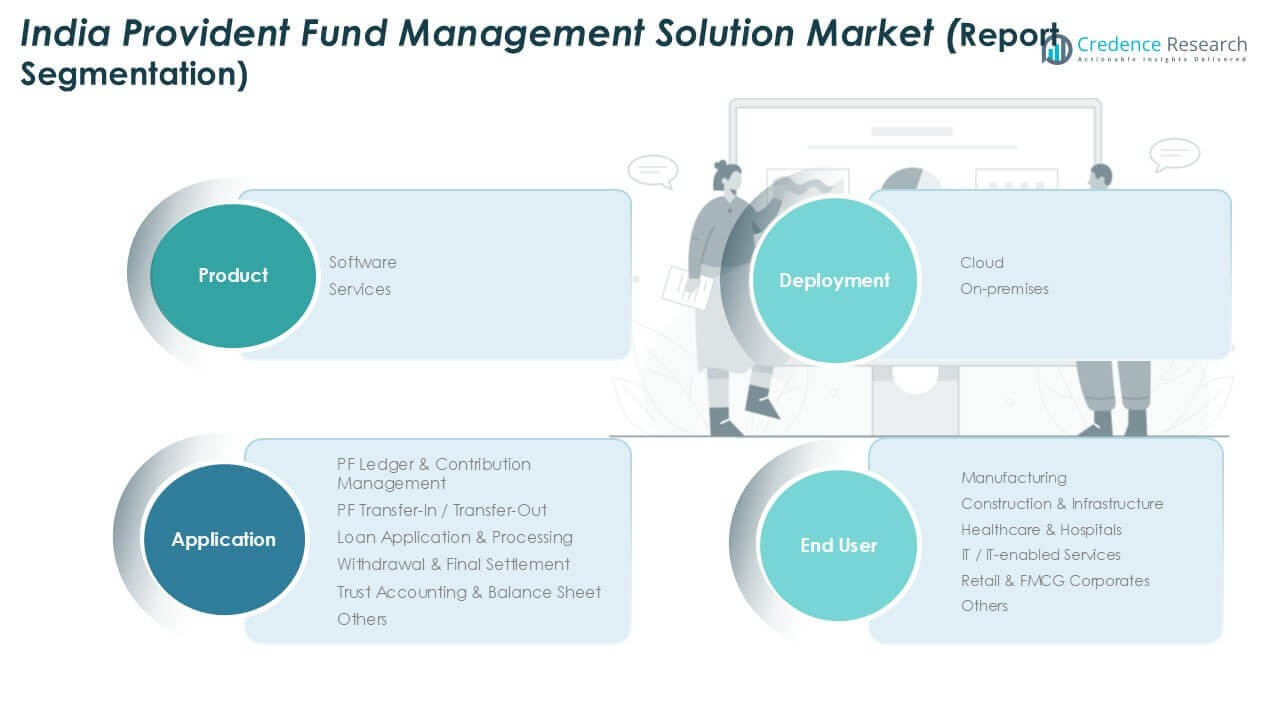

Market Segmentations:

Market Segmentations:

By Product

By Application

- PF Ledger & Contribution Management

- PF Transfer-In / Transfer-Out

- Loan Application & Processing

- Withdrawal & Final Settlement

- Trust Accounting & Balance Sheet

- Others

By Deployment

By End User

- Manufacturing

- Construction & Infrastructure

- Healthcare & Hospitals

- IT / IT-enabled Services

- Retail & FMCG Corporates

- Others

By Geography

- North India

- West India

- South India

- East India

Competitive Landscape

The India Provident Fund Management Solution market is moderately competitive, featuring a mix of domestic players and global solution providers. Leading companies such as Kalpak Solutions, Renessa Info Systems Limited, Ray Computech Pvt. Ltd., Workday, C-Quel India, Vitech Systems Group, and Andolasoft, Inc. focus on delivering end-to-end PF management platforms with compliance automation, ledger accuracy, and employee self-service capabilities. Domestic vendors compete by offering cost-effective, customizable solutions tailored to Indian regulatory requirements, while global firms leverage advanced analytics, AI-driven workflows, and cloud-native architectures to attract large enterprises. Strategic partnerships with HRMS and payroll providers are common, enabling seamless integrations and quicker deployment. Companies also invest in localized language support, training modules, and mobile-first features to expand adoption among SMEs. Recent developments highlight product upgrades with real-time EPFO updates, strengthened cybersecurity features, and automation capabilities that address the growing demand for accuracy, scalability, and regulatory compliance across diverse industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kalpak Solutions

- Renessa Info Systems Limited

- Ray Computech Pvt. Ltd.

- Workday

- C-Quel India

- Vitech Systems Group

- Andolasoft, Inc.

- Other Key Players

Recent Developments

- In July 2025, Workday announced it will deepen its presence in India by setting up a new Global Capability Center (GCC) in Chennai.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Deployment, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see higher adoption of cloud-based platforms for scalability and remote access.

- AI and machine learning will drive predictive analytics and automated compliance alerts.

- Integration with HRMS and payroll systems will become a standard requirement for enterprises.

- Mobile-first solutions will gain traction, enabling employees to manage PF accounts anytime.

- SMEs will increasingly adopt affordable subscription-based PF management solutions.

- Vendors will focus on strengthening data security and compliance with privacy regulations.

- Demand will rise for real-time reporting and automated ledger reconciliation.

- Employee self-service portals will expand to include loans, transfers, and settlements.

- Partnerships between solution providers and payroll service companies will increase.

- Regional adoption will accelerate in East India as digital awareness and compliance enforcement improve.

Market Insights

Market Insights Key Trends & Opportunities

Key Trends & Opportunities Market Segmentations:

Market Segmentations: