Market Overview

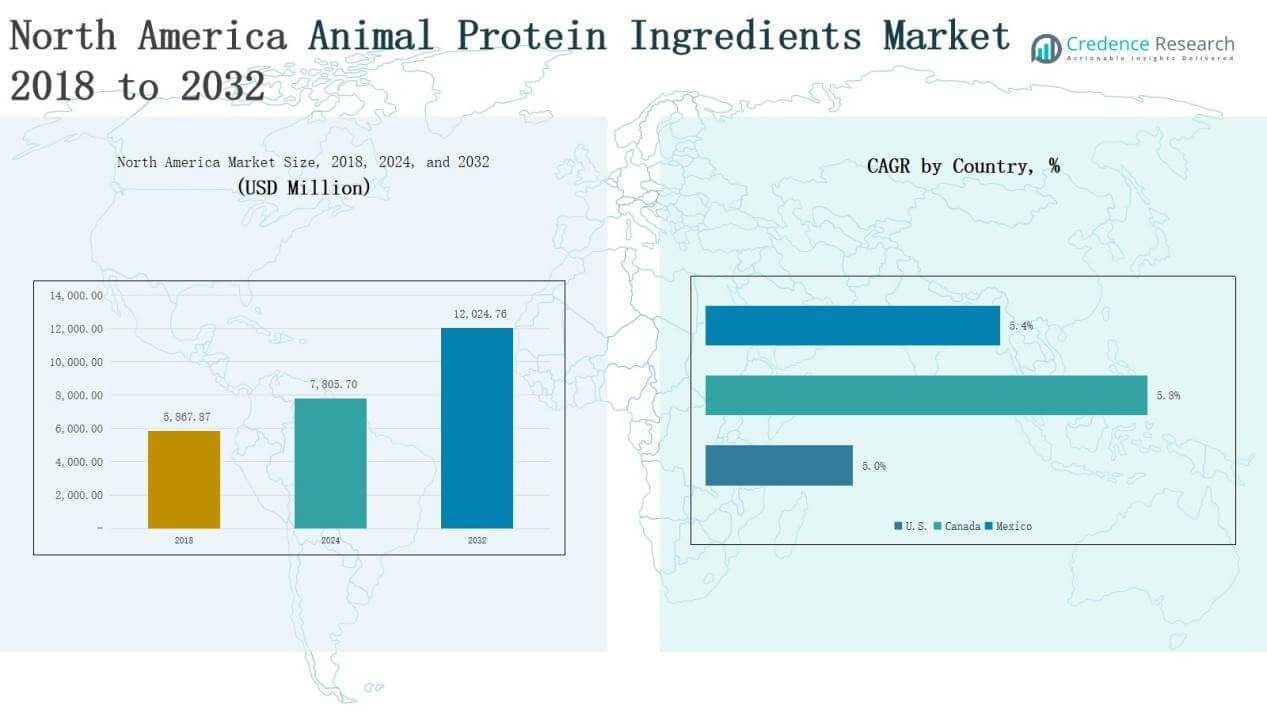

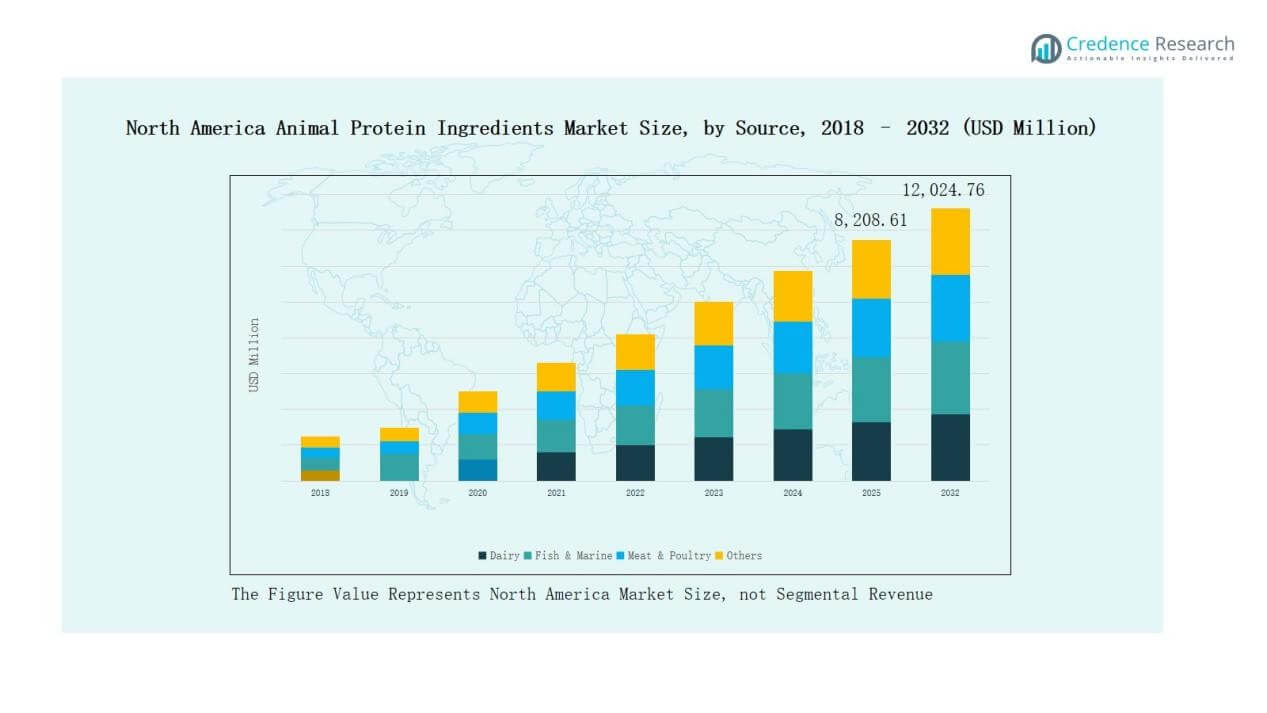

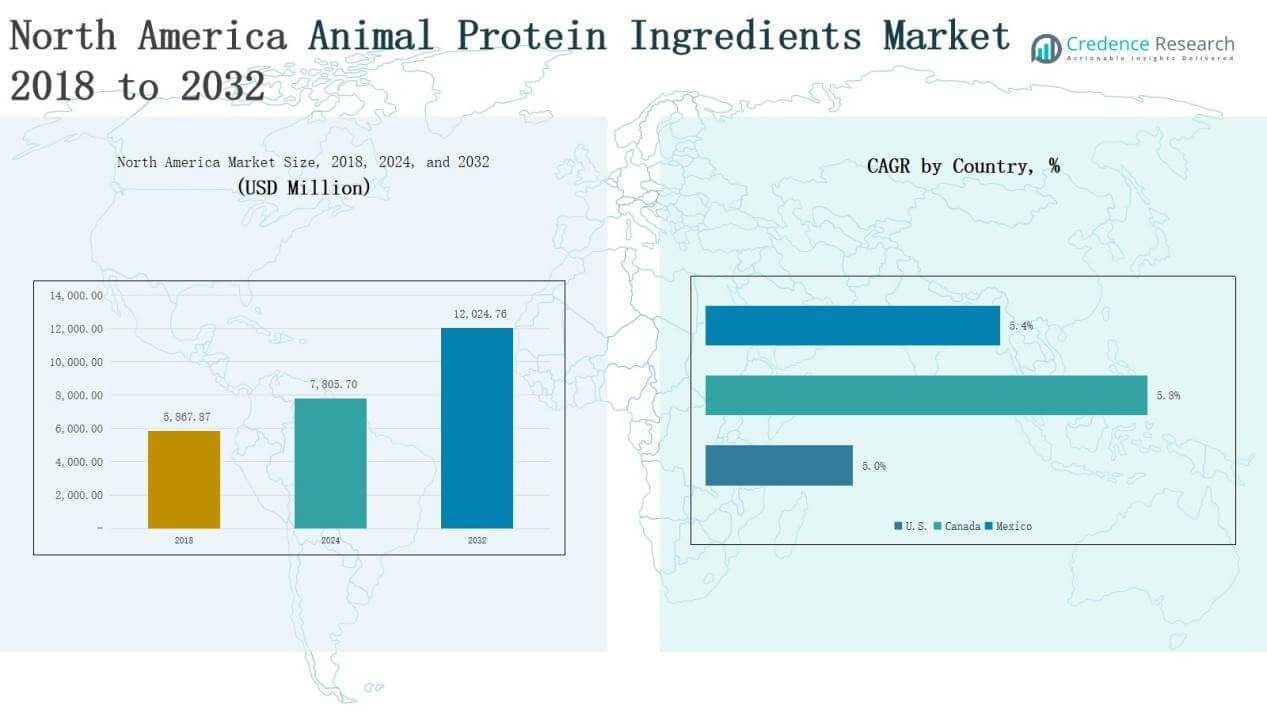

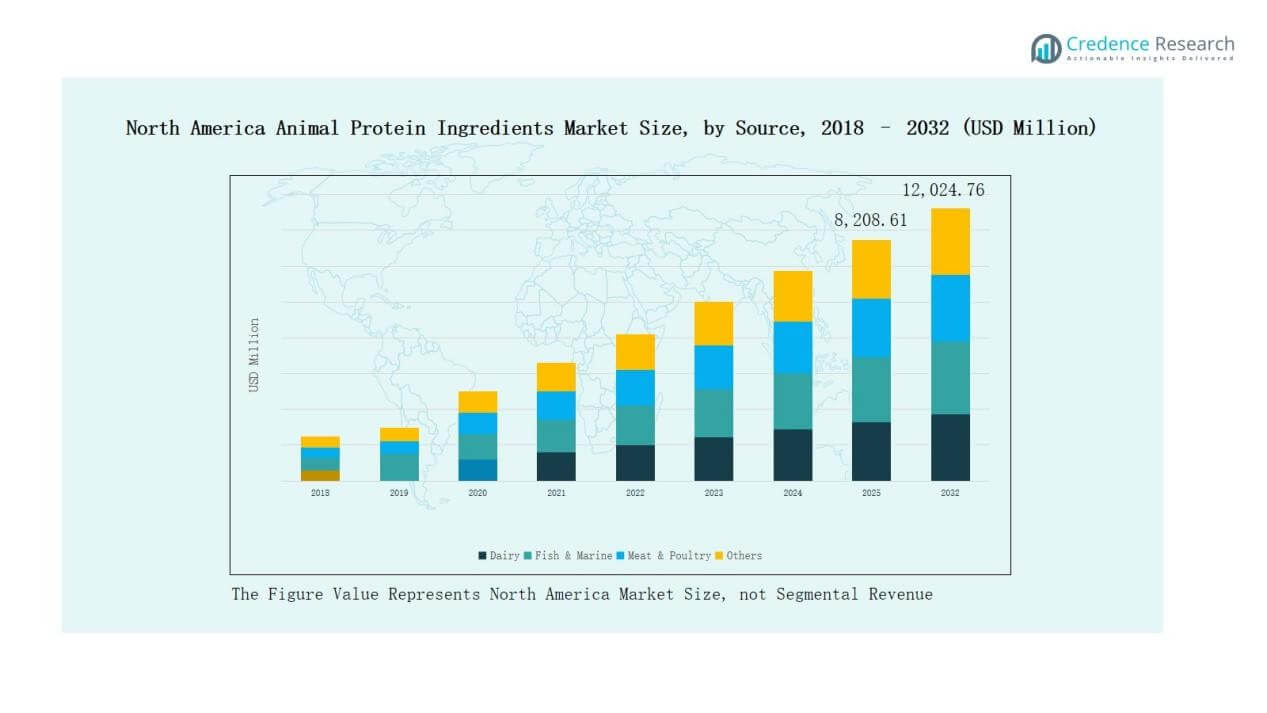

The North America Animal Protein Ingredients Market size was valued at USD 5,867.87 million in 2018, rising to USD 7,805.70 million in 2024, and is anticipated to reach USD 12,024.76 million by 2032, at a CAGR of 5.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Animal Protein Ingredients Market Size 2024 |

USD 7,805.70 Million |

| North America Animal Protein Ingredients Market, CAGR |

5.52% |

| North America Animal Protein Ingredients Market Size 2032 |

USD 12,024.76 Million |

The North America Animal Protein Ingredients Market features strong competition led by global and regional companies. Major players include Cargill, Tyson Foods, ADM Animal Nutrition, Kemin Industries, Prinova, Nutraferma LLC, Green Labs LLC, GRF Ingredients, CJ Selecta, and NCC Food Ingredients. These companies strengthen their market positions through diverse protein portfolios, advanced processing technologies, and expanding applications in sports nutrition, clinical nutrition, pet food, and aquafeed. The United States emerges as the leading region, commanding a 65% market share, supported by high consumer demand for dairy proteins, strong presence of pet food manufacturers, and consistent investment in innovative protein solutions.

Market Insights

Market Insights

- The North America Animal Protein Ingredients Market grew from USD 5,867.87 million in 2018 to USD 7,805.70 million in 2024 and will reach USD 12,024.76 million by 2032, expanding at 5.52%.

- Dairy leads by source with 40% share, followed by meat & poultry at 28%, fish & marine at 25%, and others at 7%, driven by diverse nutritional applications.

- Powders dominate by form with 55% share due to stability and versatility, while liquids/pastes hold 28% and granules/flakes account for 17%.

- Sports & active nutrition is the largest application with 35% share, followed by pet food at 25%, aquafeed & livestock feed at 20%, clinical nutrition at 15%, and others at 5%.

- The United States holds 65% share, Canada 20%, and Mexico 15%, with strong growth driven by sports nutrition demand, pet food expansion, and aquaculture feed solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Source

Dairy dominates the North America Animal Protein Ingredients Market with a share of 40%. Strong demand for whey and casein proteins in sports nutrition and medical applications drives this leadership. Fish & marine ingredients hold 25%, supported by omega-rich applications in aquafeed and clinical nutrition. Meat & poultry account for 28%, reflecting high use in pet food and dietary supplements. The remaining 7% share comes from other sources, including emerging specialty protein blends.

For instance, Omega Protein (Cooke Inc.) expanded production of fish oil concentrates in Virginia to meet rising aquafeed and clinical nutrition demand.

By Form

Powders lead the market with a share of 55%, driven by their stability, ease of formulation, and extensive use in supplements and clinical nutrition. Liquids/pastes represent 28%, favored for applications in medical nutrition and pet food. Granules/flakes capture 17%, with growth linked to convenience in feed formulations and ready-to-mix nutrition products. The dominance of powders is reinforced by rising demand for high-protein shakes and performance supplements.

For instance, FrieslandCampina Ingredients launched Nutri Whey Isolate Clear, a powder designed for clear protein drinks, highlighting the demand for stable, versatile whey formats.

By Application

Sports & active nutrition is the largest application segment with 35% share, fueled by strong consumer focus on fitness, bodybuilding, and protein-enriched diets. Pet food follows with 25%, supported by premiumization trends and rising adoption of companion animals. Aquafeed & livestock feed contributes 20%, reflecting demand for sustainable protein sources in aquaculture and animal farming. Clinical & medical nutrition holds 15%, driven by increasing use in therapeutic diets and elderly nutrition, while others account for 5%.

Key Growth Drivers

Key Growth Drivers

Rising Demand for High-Protein Nutrition

The growing focus on health, fitness, and balanced diets is boosting demand for protein-rich foods in North America. Consumers increasingly incorporate whey, casein, and collagen proteins into sports supplements, functional beverages, and dietary products. This demand is reinforced by rising obesity rates and an emphasis on weight management. Sports nutrition brands and food manufacturers are expanding protein-fortified offerings, making dairy and meat-based ingredients key contributors to revenue growth in the regional animal protein ingredients market.

For instance, ADM partnered with Benson Hill to scale Ultra-High Protein soybeans, boosting plant-based protein supply for food ingredients in North America, meeting growing consumer preferences for high-protein nutrition.

Expansion of Pet Food and Animal Feed Industry

The region’s robust pet adoption rates and preference for premium pet foods are driving sustained demand for protein ingredients. Pet owners increasingly choose formulations rich in meat, fish, and poultry proteins to ensure animal health and wellness. Similarly, aquaculture and livestock farming depend on protein-rich feed formulations to enhance productivity. This dual demand from the pet food and feed industries supports steady growth for animal protein ingredient suppliers, with emphasis on consistent quality and traceability standards.

For instance, Hound & Gatos emphasized natural, high-quality animal protein as the main ingredient across their pet food products, avoiding fillers and meat by-products to ensure nutrient density and transparency.

Advancements in Processing and Functional Applications

Technological improvements in protein extraction and processing have enhanced ingredient functionality, solubility, and shelf life. These advancements enable manufacturers to tailor proteins for diverse applications, including clinical nutrition, performance supplements, and fortified foods. The ability to meet clean-label expectations and deliver high-performance formulations strengthens market penetration. Continuous investment in R&D for bioactive protein peptides and specialty blends further supports growth, allowing producers to cater to both health-conscious consumers and medical nutrition applications.

Key Trends & Opportunities

Shift Toward Functional and Specialty Proteins

Consumers in North America are seeking proteins with added health benefits, such as immune support, muscle recovery, and digestive wellness. This shift is opening opportunities for collagen, hydrolyzed whey, and marine-based proteins. Demand for multifunctional proteins in clinical nutrition and lifestyle-driven diets is accelerating innovation. Manufacturers are also launching fortified snacks and beverages, capitalizing on consumer willingness to pay premium prices for targeted health benefits.

For instance, BioCell Collagen launched hydrolyzed collagen supplements formulated for skin elasticity improvement and faster muscle recovery, backed by clinical trials showing reduction in wrinkles and enhanced hydration.

Growing Focus on Sustainable Sourcing and Transparency

Sustainability is emerging as a critical trend in the animal protein market. Companies are investing in responsible sourcing, improved waste management, and transparent supply chains. Marine protein producers, for example, are adopting certifications to ensure responsible fisheries. Consumer preference for traceable, ethically sourced animal proteins creates opportunities for brands that highlight sustainability credentials. This trend also supports long-term competitiveness by aligning with evolving regulatory standards and corporate ESG commitments in North America.

For instance, Mowi was ranked number 1 for sustainable animal protein production by the Coller FAIRR Protein Producer Index for the sixth consecutive year, driven by its robust policies on responsible sourcing, animal welfare, and environmental sustainability.

Key Challenges

Competition from Plant-Based and Alternative Proteins

The rise of plant-based protein options poses a significant challenge for animal protein suppliers. Growing consumer concerns about health, sustainability, and animal welfare are fueling plant-based adoption. This shift diverts market share, particularly in sports nutrition and functional foods. To counter competition, animal protein producers must emphasize superior amino acid profiles, functional properties, and clinical validation of benefits. However, overcoming consumer perception challenges remains a key hurdle in maintaining growth momentum.

Volatility in Raw Material Costs

Fluctuations in livestock, dairy, and marine raw material prices directly affect production costs of protein ingredients. Feed shortages, disease outbreaks, and climate-related risks add to supply instability. These cost pressures create pricing challenges for manufacturers and reduce profit margins. Companies must balance procurement strategies, supplier diversification, and process efficiencies to mitigate risks. The volatility further complicates long-term contracts with food and feed producers, limiting flexibility in pricing models.

Regulatory and Quality Compliance Pressure

The animal protein industry in North America operates under strict safety and quality regulations. Meeting evolving standards for food safety, labeling, and sustainability requires continuous investment in compliance systems. Manufacturers face risks of recalls, penalties, and reputational damage if standards are not met. Additionally, increasing scrutiny on antibiotics, allergens, and contaminants adds operational complexity. Smaller players, in particular, struggle with the financial and technical burden of adhering to stringent compliance requirements.

Regional Analysis

United States

The United States dominates the North America Animal Protein Ingredients Market with a 65% share. It benefits from strong demand for dairy-based proteins in sports nutrition and clinical nutrition, alongside rising popularity of collagen in dietary supplements and beauty products. The pet food industry in the country also supports high consumption of meat and poultry protein ingredients. Leading manufacturers invest in advanced processing technologies and product innovation to meet clean-label and functional food requirements. Growth is reinforced by established fitness trends, large healthcare spending, and rising demand for fortified foods. The market continues to expand as consumer awareness of high-protein diets strengthens.

Canada

Canada holds a 20% share of the North America Animal Protein Ingredients Market. Its growth is supported by increasing demand for premium pet food, clinical nutrition, and dairy protein supplements. Canadian consumers show high awareness of health and wellness, creating opportunities for fortified food and beverage launches. The country’s aquaculture sector contributes significantly to the use of marine-based proteins in feed formulations. Local producers and multinational players focus on sustainability certifications and transparent sourcing to align with consumer preferences. It demonstrates steady expansion across both human nutrition and animal feed applications.

Mexico

Mexico accounts for 15% share of the North America Animal Protein Ingredients Market. Rising disposable income and urbanization are driving demand for sports and active nutrition products, while livestock and aquafeed industries increase reliance on protein-rich formulations. Meat and poultry ingredients dominate consumption, supported by the country’s strong agricultural and farming base. Demand for affordable yet nutrient-rich food products is shaping growth in both functional and mass-market protein applications. Manufacturers are also expanding their presence in clinical and medical nutrition, supported by growing awareness of dietary health. The market is gaining momentum through both domestic demand and regional exports.

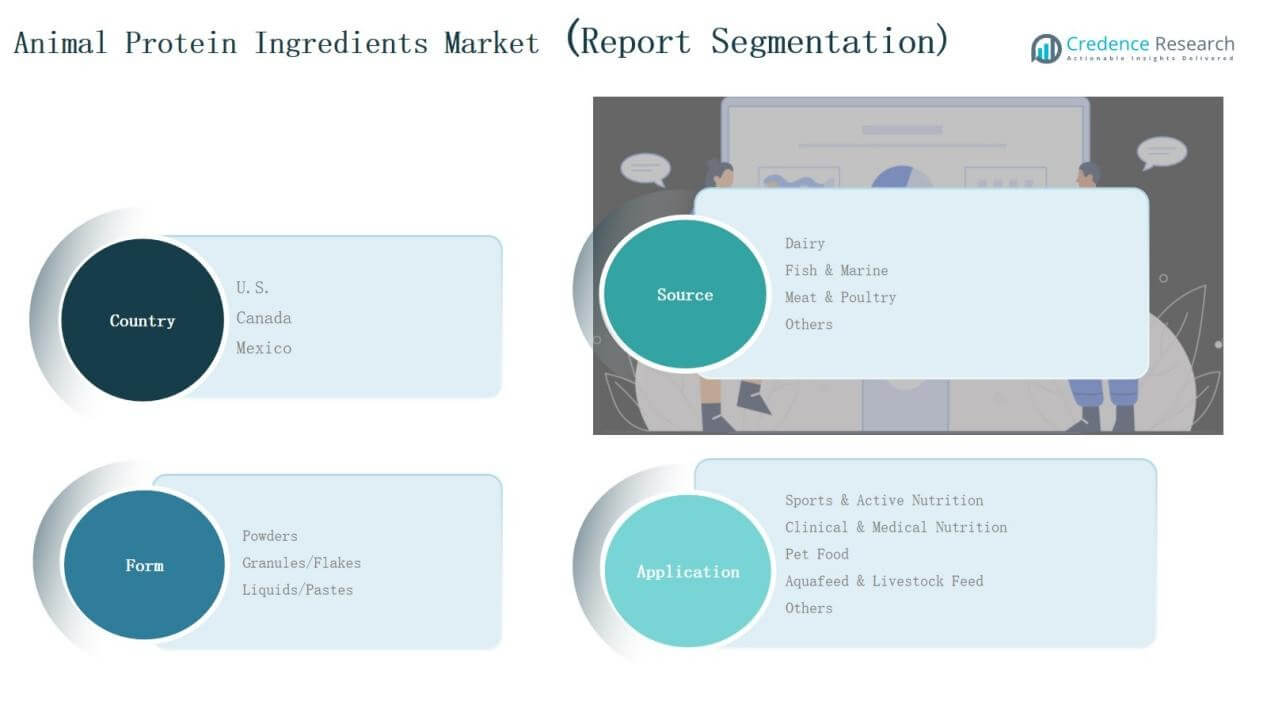

Market Segmentations:

Market Segmentations:

By Source

- Dairy

- Fish & Marine

- Meat & Poultry

- Others

By Form

- Powders

- Granules/Flakes

- Liquids/Pastes

By Application

- Sports & Active Nutrition

- Clinical & Medical Nutrition

- Pet Food

- Aquafeed & Livestock Feed

- Others

By Region

Competitive Landscape

The North America Animal Protein Ingredients Market is moderately consolidated, with a mix of global corporations and regional suppliers competing for market share. Leading companies such as Cargill, Tyson Foods, ADM Animal Nutrition, and Kemin Industries dominate through diversified product portfolios, advanced processing capabilities, and extensive distribution networks. These players focus on innovation in dairy, meat, and marine-based proteins, responding to strong demand from sports nutrition, clinical applications, and pet food sectors. Mid-sized firms including Nutraferma LLC, Green Labs LLC, and GRF Ingredients strengthen competition by offering specialized and sustainable protein solutions tailored to evolving consumer needs. Strategic partnerships, acquisitions, and product launches remain key growth strategies, enabling companies to expand market reach and address shifting preferences for functional and clean-label protein products. Intense rivalry drives continuous investment in research, quality compliance, and sustainable sourcing practices, ensuring competitiveness across both human and animal nutrition segments in the region.

Key Players

Recent Developments

- In April 2025, Actus Nutrition acquired the Foremost Farms whey protein facility in Sparta, Wisconsin, to expand whey production.

- In March 2025, Arla Foods Ingredients partnered with Valley Queen in South Dakota to manufacture its Nutrilac ProteinBoost whey line and signed a U.S. distribution deal for PB-8420.

- In March 2025, Burcon NutraScience’s alliance partner, RE ProMan, acquired a protein production facility in North America to strengthen plant-based protein operations.

- In March 2025, Vivici launched Vivitein™ BLG, a precision-fermented dairy protein ingredient in the U.S. with reduced carbon and water footprint.

Report Coverage

The research report offers an in-depth analysis based on Source, Form, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for dairy proteins will remain strong due to sports and clinical nutrition growth.

- Collagen and specialty proteins will see wider adoption in beauty and wellness applications.

- Pet food will continue driving meat and poultry protein consumption across the region.

- Marine proteins will expand with rising focus on sustainable aquaculture feed solutions.

- Functional food and beverage launches will strengthen the role of animal proteins in daily diets.

- Clean-label and traceable sourcing will become a key purchasing factor for consumers.

- Investments in advanced processing technologies will improve efficiency and product quality.

- Strategic mergers and acquisitions will reshape competition and expand distribution networks.

- Regulatory focus on safety and sustainability will influence product innovation and compliance.

- Growth in Mexico and Canada will complement U.S. dominance, supporting regional balance.

Market Insights

Market Insights Key Growth Drivers

Key Growth Drivers Market Segmentations:

Market Segmentations: