Market Overview:

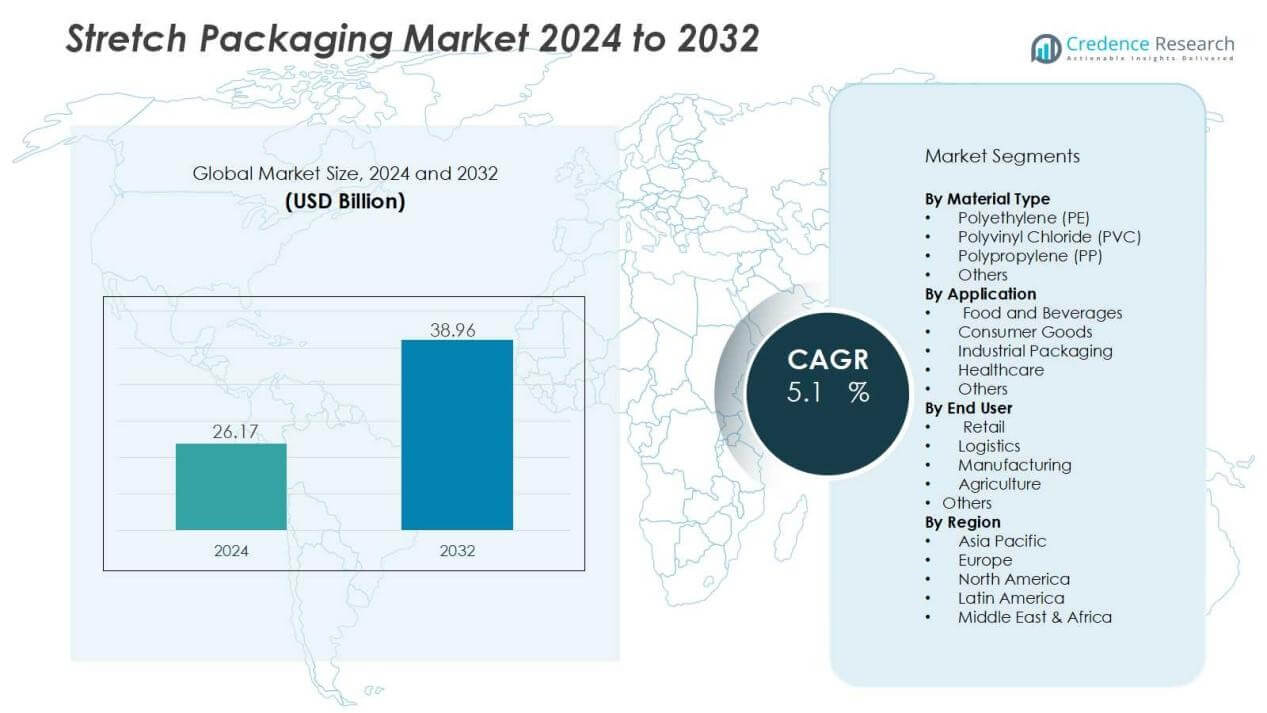

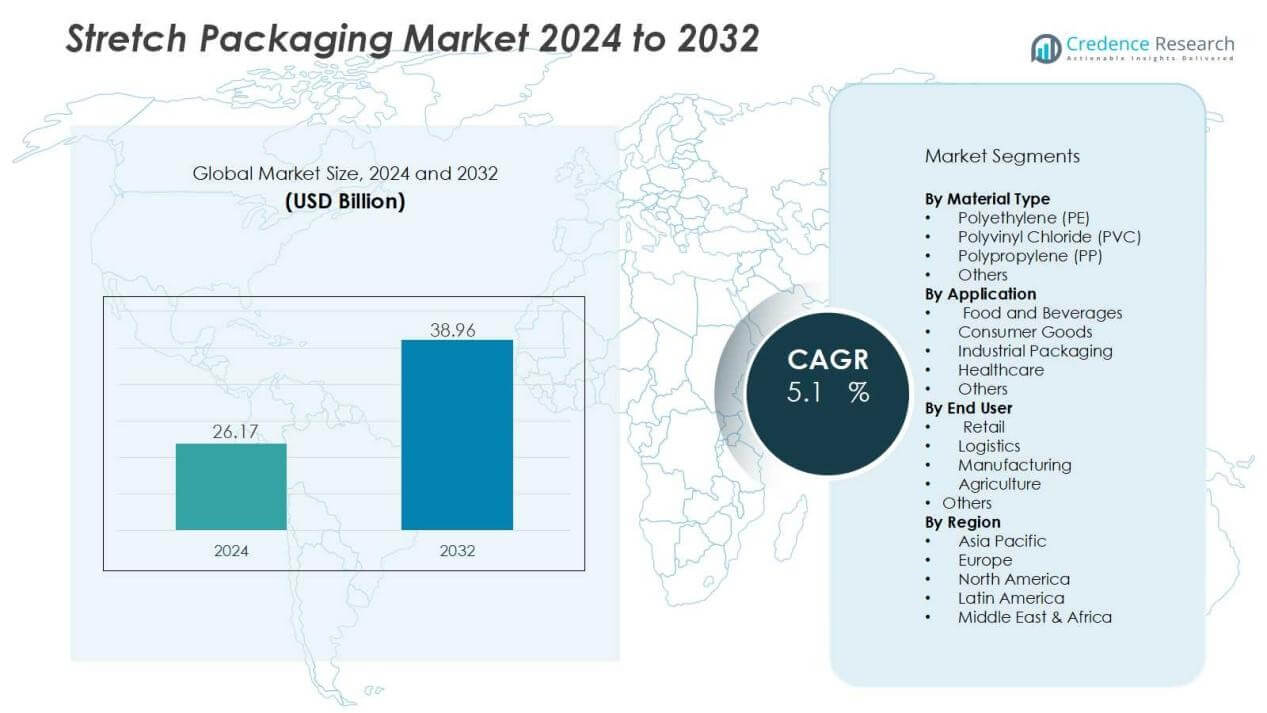

The stretch packaging market size was valued at USD 26.17 billion in 2024 and is anticipated to reach USD 38.96 billion by 2032, at a CAGR of 5.1% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Stretch Packaging Market Size 2024 |

USD 26.17 Billion |

| Stretch Packaging Market, CAGR |

5.1% |

| Stretch Packaging Market Size 2032 |

USD 38.96 Billion |

Key market drivers include the need for secure transportation of goods, rising e-commerce shipments, and strong demand for extended shelf life in packaged food. Cost efficiency, reduced product damage during logistics, and growing consumer preference for recyclable materials further support adoption. Continuous innovation in bio-based and high-performance stretch films is enhancing market opportunities, particularly in industries seeking sustainability and operational efficiency.

Regionally, North America and Europe hold significant shares due to established packaging industries and advanced retail logistics. Asia-Pacific is the fastest-growing region, driven by rapid urbanization, expansion of organized retail, and industrial growth in China and India. Latin America and the Middle East & Africa are witnessing gradual adoption, supported by increasing infrastructure development, rising trade activities, and growing demand for packaged consumer goods.

Market Insights:

- The stretch packaging market was valued at USD 26.17 billion in 2024 and is projected to reach USD 38.96 billion by 2032, growing at a CAGR of 5.1%.

- Rising demand from the food and beverage industry drives adoption, with stretch films ensuring product safety, extended shelf life, and reduced contamination risks.

- E-commerce and retail logistics expansion strengthen market growth as stretch films provide secure, lightweight, and cost-effective protection for goods in transit.

- Sustainability trends fuel innovation, with manufacturers investing in recyclable and bio-based films to meet regulatory requirements and consumer expectations.

- Cost efficiency supports industrial adoption, as films lower material use, reduce transport costs, and improve wrapping speed and load stability.

- Challenges include environmental regulations and fluctuating raw material prices, creating pressure on producers to innovate while managing high competition.

- Regionally, North America holds 31% share, Europe 28%, and Asia-Pacific 27% in 2024, with Asia-Pacific emerging as the fastest-growing market, while Latin America and the Middle East & Africa show steady expansion supported by trade and retail growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand from Food and Beverage Industry:

The stretch packaging market benefits greatly from strong demand across the food and beverage sector. Stretch films offer product safety, longer shelf life, and tamper resistance, making them a preferred choice. Growing consumption of packaged and ready-to-eat food drives the need for efficient packaging. It supports large-scale distribution by minimizing product damage and reducing contamination risks.

- For instance, a leading bottled water company partnered with Lantech to optimize stretch wrapping, achieving a reduction in stretch film usage per load while ensuring damage-free shipments of more than 12,000 pallets annually.

Expanding E-Commerce and Retail Logistics:

Growth in e-commerce and organized retail significantly strengthens demand for stretch packaging. Rising shipments require secure, lightweight, and cost-effective wrapping to protect goods in transit. It ensures product stability during handling and transportation, reducing loss and returns. Retailers also adopt stretch films to improve storage efficiency and maintain supply chain reliability.

- For instance, Lantech’s stretch wrap technology helped a global consumer goods company maintain a specific containment force across over 300 truckloads, substantially reducing in-transit damages, with the company securing loads that met new EU load stability standards as of June 2018, backed by over 40 years of data on load security.

Increasing Focus on Sustainability and Recyclable Materials:

Sustainability trends create strong opportunities for the stretch packaging market. Consumers and regulators demand eco-friendly packaging with reduced environmental impact. Manufacturers invest in recyclable and bio-based stretch films to address these concerns. It helps businesses meet compliance standards while improving brand reputation through greener packaging choices.

Cost Efficiency and Operational Advantages Driving Adoption:

Cost reduction and performance efficiency continue to drive adoption in industrial applications. Stretch films are lightweight, require less material than traditional alternatives, and lower transportation costs. The packaging provides high load stability, reducing product damage and warehouse losses. It also allows faster wrapping processes, improving operational productivity across diverse industries.

Market Trends:

Adoption of Sustainable and High-Performance Packaging Solutions:

The stretch packaging market is witnessing a clear shift toward sustainable and high-performance materials. Manufacturers are investing in recyclable, bio-based, and downgauged films to reduce plastic consumption while maintaining strength and durability. Growing pressure from governments, retailers, and consumers is encouraging companies to redesign packaging portfolios with lower environmental impact. It supports both cost savings and brand positioning for businesses targeting eco-conscious customers. Technological advancements in film extrusion and resin formulations are also enabling higher load stability and puncture resistance. This trend highlights a balance between sustainability goals and functional performance.

- For instance, in June 2025 Amcor partnered with Bulldog to reduce the wall thickness of its 50 mm flexible tube sleeves by 16.67%, saving 8.5 metric tonnes of plastic annually.

Integration of Automation and Smart Packaging Technologies:

Automation and smart technologies are increasingly shaping the future of stretch packaging. Companies are adopting automated wrapping machines to improve speed, consistency, and labor efficiency in warehouses and distribution centers. It reduces operational costs and enhances packaging accuracy across industries such as logistics, food, and manufacturing. Smart packaging solutions, including sensors and printed indicators, are also being integrated to monitor product integrity during transit. Growing adoption of Industry 4.0 practices further accelerates this transition by connecting packaging equipment to data-driven systems. The trend reflects a strong move toward efficiency, quality control, and real-time supply chain visibility.

- For Instance,Prime Robotics has partnered with Wulftec to offer automated stretch wrapping solutions, and some Wulftec systems can wrap up to 50 pallets per hour, Prime Robotics highlights a 67% throughput increase as an advertised outcome of their integrated automation, comparing it to slower manual processes.

Market Challenges Analysis:

Environmental Concerns and Regulatory Pressures:

The stretch packaging market faces growing challenges from environmental concerns and strict regulatory frameworks. Governments worldwide are introducing policies to reduce single-use plastics and encourage recyclable alternatives. It creates pressure on manufacturers to redesign films that balance strength with sustainability. High costs of adopting eco-friendly materials often limit small and medium enterprises. Consumer demand for green packaging further raises expectations for compliance and innovation. Companies that fail to adapt risk losing market share to more sustainable competitors.

Fluctuating Raw Material Prices and High Competition:

Volatility in raw material prices presents another major challenge for the stretch packaging market. Dependence on petroleum-based resins exposes producers to unpredictable cost fluctuations, impacting profitability. It forces companies to constantly adjust pricing strategies while maintaining competitiveness. Intense market rivalry from global and regional players also increases price pressure. Low switching costs for customers make retention difficult, driving firms to innovate and differentiate. These challenges collectively hinder stable growth and require continuous investment in efficiency and product development.

Market Opportunities:

Expansion into Emerging Economies and Industrial Applications:

The stretch packaging market holds strong opportunities in emerging economies where industrialization and retail growth are accelerating. Rising demand for packaged food, beverages, and consumer goods in Asia-Pacific, Latin America, and Africa creates high potential. It supports greater adoption of stretch films in logistics, agriculture, and manufacturing. Growing export activities also increase the need for secure, cost-effective, and durable packaging solutions. Investments in infrastructure and trade networks further expand usage across multiple industries. This opportunity allows manufacturers to strengthen presence in fast-growing markets with long-term demand.

Innovation in Sustainable and Advanced Packaging Technologies:

Advancements in bio-based, recyclable, and downgauged stretch films create significant growth potential. The stretch packaging market is shifting toward eco-friendly alternatives to meet regulatory requirements and consumer expectations. It enables companies to differentiate through sustainable solutions that also deliver cost efficiency. Automated wrapping systems and smart packaging integration add further value by improving operational efficiency and real-time monitoring. Businesses that invest in R&D for high-performance, eco-conscious films can capture premium segments. This trend presents clear opportunities for players to align innovation with sustainability goals and industry needs.

Market Segmentation Analysis:

By Material Type:

The stretch packaging market is segmented into polyethylene (PE), polyvinyl chloride (PVC), polypropylene (PP), and others. Polyethylene dominates due to its flexibility, durability, and cost-effectiveness in film production. It provides excellent puncture resistance and clarity, making it suitable for multiple industries. PVC maintains usage in specialty applications, but sustainability concerns limit its growth. Polypropylene is gaining momentum with rising demand for lightweight and recyclable packaging. Manufacturers are focusing on bio-based and downgauged materials to reduce plastic use and meet regulatory requirements.

- For instance, Dow partnered with Plastigaur to commercialize a PCR-containing LDPE shrink film that was downgauged from 45 microns to 40 microns while maintaining full packaging performance.

By Application:

Key applications include food and beverages, consumer goods, industrial packaging, healthcare, and others. Food and beverages account for the largest share due to growing packaged food demand and safety requirements. It supports product shelf life and ensures secure transportation in supply chains. Industrial packaging is expanding with increased manufacturing and logistics activities worldwide. Healthcare applications benefit from the need for sterile and protective wrapping solutions. Consumer goods also contribute to growth, supported by rising e-commerce adoption.

- For instance, Liberty Coca-Cola Beverages introduced the KeelClip™ packaging system in the United States, which replaced plastic ring holders on can multipacks and is estimated to remove 75,000 pounds of plastic annually from the supply chain, impacting approximately 3.1 million cases.

By End Use:

End-use industries include retail, logistics, manufacturing, agriculture, and others. Logistics holds a leading share as stretch films improve load stability and reduce damage during transit. It helps companies cut costs while ensuring efficient bulk transportation. Retail uses stretch packaging to improve storage efficiency and protect products in warehouses and stores. Manufacturing and agriculture sectors adopt stretch films for cost savings, durability, and product protection. Growing trade activities and warehouse automation further expand end-use adoption globally.

Segmentations:

By Material Type:

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Others

By Application:

- Food and Beverages

- Consumer Goods

- Industrial Packaging

- Healthcare

- Others

By End Use:

- Retail

- Logistics

- Manufacturing

- Agriculture

- Others

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America and Europe:

North America held 31% share of the stretch packaging market in 2024, while Europe accounted for 28%. Together, these regions represent a major portion of global demand, supported by advanced retail infrastructure and industrial logistics. The U.S. and Germany drive adoption due to high consumption of packaged goods and strong e-commerce networks. It benefits from early integration of automated wrapping systems and stringent safety standards in transportation. Sustainability initiatives in Europe further promote recyclable and downgauged films. Strong demand from food, beverage, and consumer goods industries continues to sustain growth.

Asia-Pacific:

Asia-Pacific accounted for 27% share of the stretch packaging market in 2024, emerging as the fastest-growing regional segment. High demand is supported by industrialization, urbanization, and retail expansion in China, India, and Southeast Asia. It benefits from growing trade volumes and manufacturing output that require efficient and durable packaging. Rising consumption of packaged food and beverages further accelerates adoption. Governments are also supporting local manufacturing and sustainable packaging initiatives. Strong population growth and rising disposable incomes create long-term opportunities for regional players.

Latin America and Middle East & Africa:

Latin America accounted for 8% share of the stretch packaging market in 2024, while the Middle East & Africa held 6%. Growth in these regions is supported by expanding retail networks, infrastructure investments, and rising consumer demand. It gains traction in agriculture, construction, and logistics sectors where cost-effective packaging is critical. Limited manufacturing capacity and high import dependence present challenges but also opportunities for local development. Countries like Brazil, South Africa, and the UAE are key contributors to adoption. Growing interest in sustainable and recyclable packaging solutions is expected to support steady regional expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The stretch packaging market is highly competitive with strong participation from global and regional players. Key companies include TIPA Corp, Futamura, BioBag, Paragon Films, Berry Global, and Armando Alvarez. These firms compete on product innovation, sustainability, and cost efficiency to strengthen their positions. It is driven by rising demand for recyclable and bio-based films that align with regulatory requirements and consumer expectations. Leading companies invest heavily in research and development to introduce downgauged, high-performance, and eco-friendly materials. Strategic partnerships, acquisitions, and expansions remain central strategies to broaden product portfolios and extend market reach. Competition is also influenced by customer preference for reliable supply chains and advanced packaging technologies, making differentiation essential for sustained growth.

Recent Developments:

- In May 2023, TIPA Corp acquired Bio4Pack, a European leader in compostable packaging solutions, expanding its product portfolio and presence in Europe on May 3, 2023.

- n July 2025, Futamura announced a £15 million investment to upgrade and improve sustainability at its UK Wigton site, focusing on reducing emissions and energy consumption as of July 2, 2025.

Report Coverage:

The research report offers an in-depth analysis based on Material Type, Application, End Use and Region . It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The stretch packaging market is expected to expand with rising demand from food and beverage industries.

- Sustainability will drive product innovation, with stronger focus on recyclable and bio-based stretch films.

- E-commerce growth will continue to strengthen adoption of cost-effective and durable wrapping solutions.

- Automation in packaging processes will increase, supported by rising use of high-speed wrapping machines.

- Smart packaging technologies with monitoring capabilities will gain traction in logistics and retail supply chains.

- Emerging economies will offer strong growth potential through rising industrialization and retail expansion.

- Investment in downgauged films with improved load stability will reduce material use and enhance efficiency.

- Global trade activities will fuel adoption, supported by secure and damage-resistant packaging demand.

- Regulatory pressures on plastics will accelerate adoption of eco-friendly alternatives across industries.

- Strategic partnerships and R&D investments will help companies differentiate through innovation and sustainability.