Market Overview

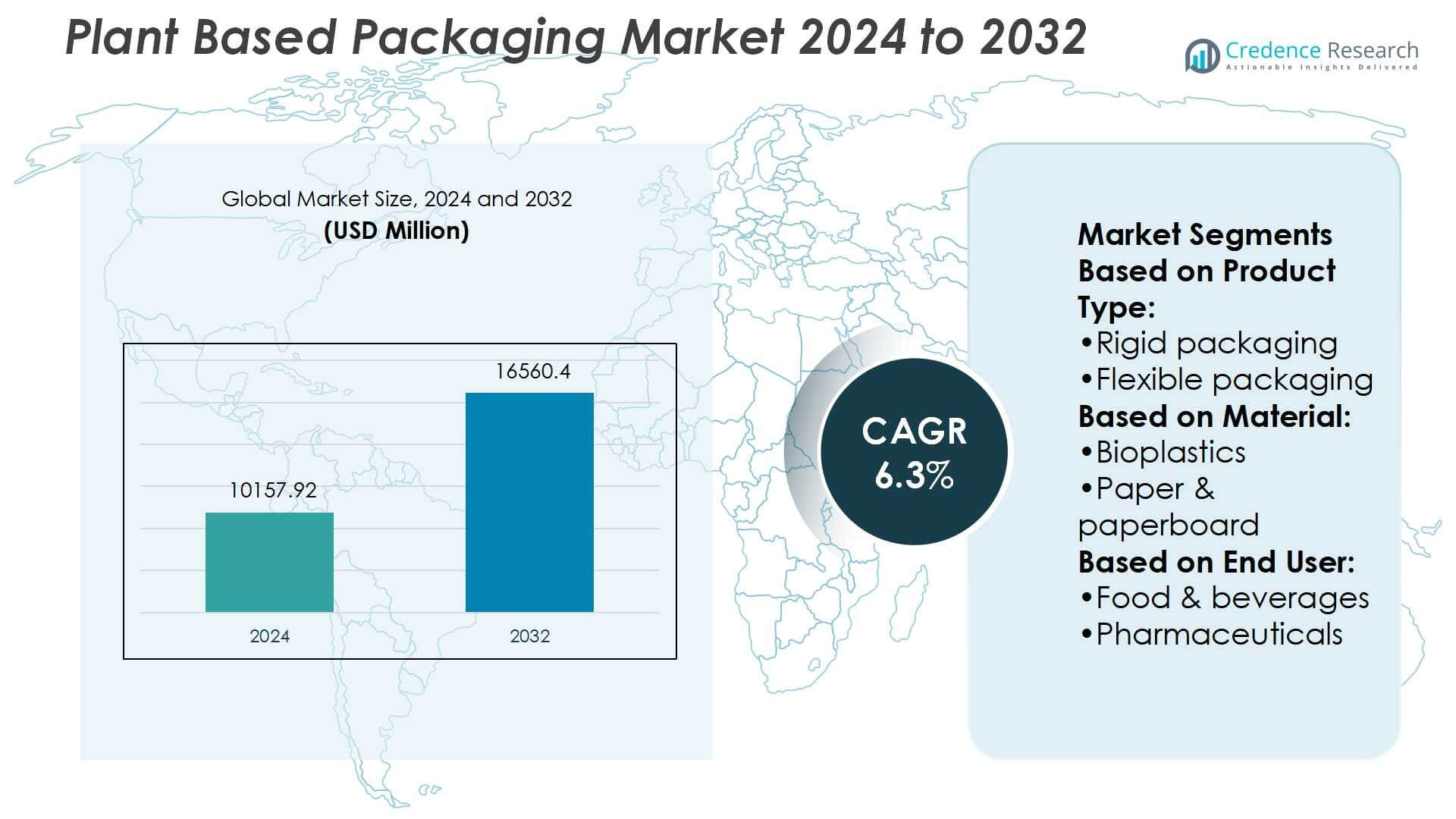

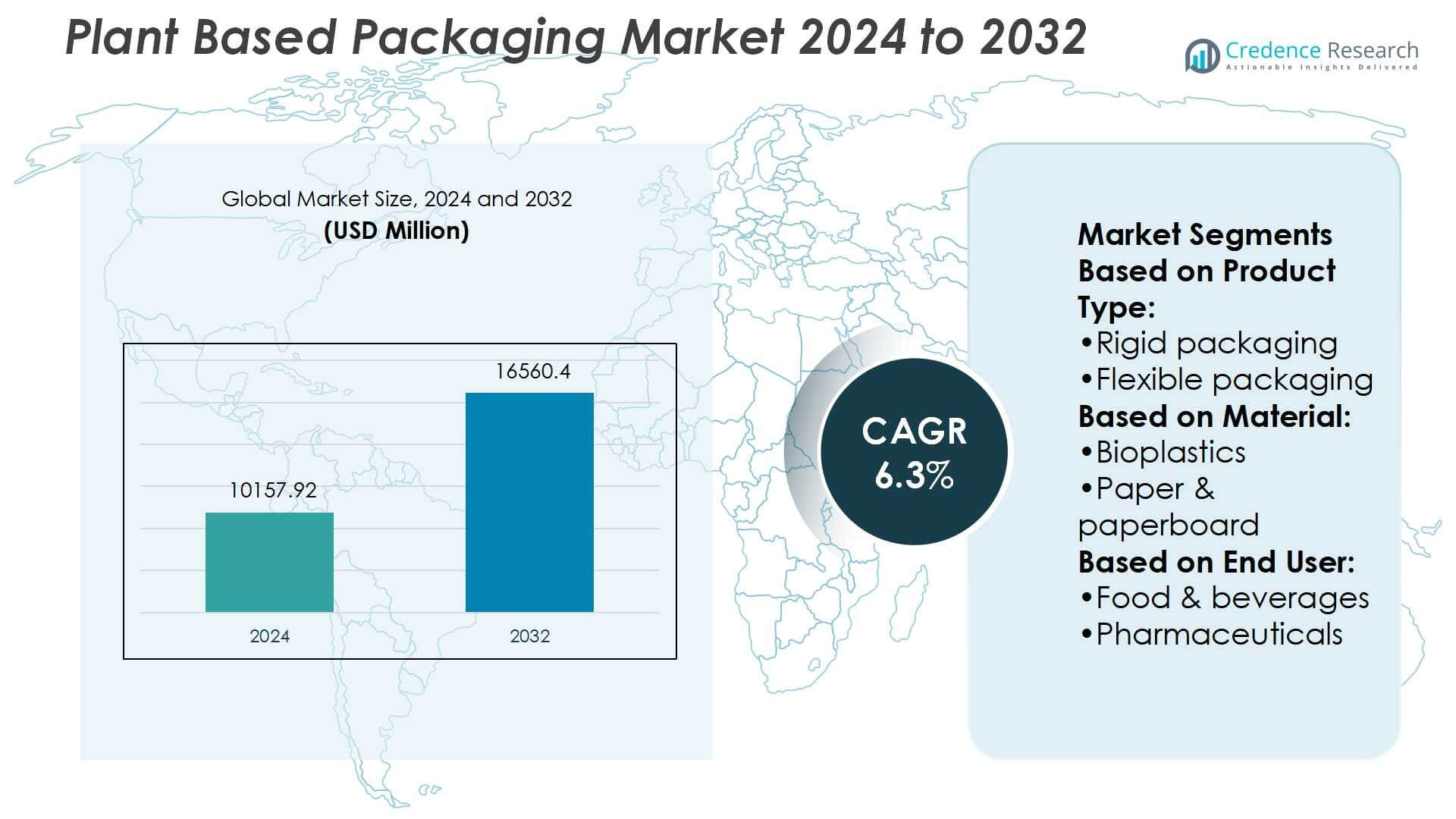

Plant Based Packaging Market size was valued USD 10157.92 million in 2024 and is anticipated to reach USD 16560.4 million by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plant Based Packaging Market Size 2024 |

USD 10157.92 Million |

| Plant Based Packaging Market, CAGR |

6.3% |

| Plant Based Packaging Market Size 2032 |

USD 16560.4 Million |

The plant-based packaging market is shaped by leading players such as Amcor, Mondi Group PLC, Tetra Pak International SA, Berry Global, WestRock, BASF, Vegware, Biorgani, and Emsur, each contributing through innovation, scale, and sustainability-focused strategies. These companies emphasize advancements in bioplastics, molded fiber, and recyclable paperboard to strengthen their global positions and cater to food, beverages, cosmetics, and e-commerce sectors. Among regions, North America leads the market with a 35% share, supported by strong regulatory policies, consumer demand for eco-friendly products, and significant investments in sustainable packaging technologies. This leadership reflects a mature infrastructure and high adoption rates across industries.

Market Insights

Market Insights

- The plant-based packaging market was valued at USD 10157.92 million in 2024 and is projected to reach USD 16560.4 million by 2032, growing at a CAGR of 6.3% during the forecast period.

- Rising demand for sustainable packaging solutions in food, beverages, and retail sectors acts as a key driver, supported by regulations on single-use plastics and growing consumer awareness.

- The market shows strong trends in bioplastics, molded fiber, and recyclable paperboard adoption, with leading companies investing in innovation and circular economy initiatives.

- High production costs and limited performance in water and heat resistance remain major restraints, restricting adoption in some industrial and pharmaceutical applications.

- North America leads with 35% market share, while rigid packaging dominates the product type segment, and food and beverages remain the top end-user category, highlighting strong adoption across developed markets and fast-growing opportunities in Asia-Pacific.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Rigid packaging holds the dominant share in the plant-based packaging market due to its widespread use in bottles, trays, and containers. Its durability and protective features make it highly suitable for food and beverage applications, where maintaining product integrity is essential. The growing preference for sustainable rigid alternatives over petroleum-based plastics further strengthens this segment. Demand is supported by advancements in molded fiber and bioplastic rigid packaging that combine strength with eco-friendliness, ensuring compliance with stricter packaging regulations and boosting adoption across industries.

- For instance, ecovio® IS1335 is a mineral-filled, compostable injection-molding grade certified under DIN EN 13432. Its tensile (Young’s) modulus is about 3,600 MPa at 23 °C; strain at break is approximately 4 %.

By Material Type

Paper and paperboard represent the leading material segment, capturing the largest share of the market. Their recyclability, versatility, and cost-effectiveness drive extensive usage in retail and e-commerce packaging, including cartons, wraps, and bags. The rapid growth of online shopping and consumer demand for sustainable solutions has accelerated adoption in this category. Additionally, improvements in barrier coatings and strength-enhancing technologies have expanded applications of paper-based packaging to include liquid and perishable goods, strengthening its market dominance over other plant-based materials like bagasse and bamboo.

- For instance, Mondi Advantage High Strength sack kraft paper with a basis weight of 80 g/m² reaches a machine-direction (MD) tensile strength of 6.8 kN/m and cross-direction (CD) strength of 5.2 kN/m, per ISO 1924-3.

By End User

Food and beverages account for the largest end-user segment in the plant-based packaging market, supported by high consumption levels and strict sustainability requirements. This segment dominates due to rising consumer awareness of eco-friendly packaging and regulations targeting single-use plastics in food service and retail. Companies in this sector increasingly adopt compostable and recyclable solutions for cups, trays, bottles, and wrappers. Growing partnerships between food brands and packaging innovators further boost adoption, with plant-based alternatives helping reduce environmental footprints while meeting consumer expectations for safe and sustainable packaging.

Key Growth Drivers

Rising Demand for Sustainable Packaging

The shift toward eco-friendly packaging is a major driver in the plant-based packaging market. Increasing consumer awareness about plastic pollution and government bans on single-use plastics are fueling adoption. Companies across industries, particularly food and beverages, are actively transitioning to biodegradable, compostable, and recyclable alternatives. Plant-based packaging aligns with corporate sustainability goals, helping brands strengthen their environmental commitments and enhance consumer trust. The strong push for circular economy models further drives growth, positioning sustainable packaging as a strategic necessity rather than an option.

- For instance, Vegware’s Close the Loop composting service processed 10,000 binloads of used packaging and food waste from customers in Central Belt Scotland, including sites like the Glasgow Science Centre and Fife College.

Expansion of Food and Beverage Industry

The food and beverage sector plays a pivotal role in driving plant-based packaging adoption. Growing demand for ready-to-eat meals, beverages, and packaged snacks has created significant opportunities for sustainable packaging solutions. Rigid and flexible formats made from paperboard, bioplastics, and bagasse are increasingly used to replace conventional plastics. Rising urbanization and a growing middle-class population worldwide further accelerate packaged food consumption. This sector’s dominance ensures continuous demand for innovative packaging that balances durability, food safety, and environmental responsibility, making it the largest growth contributor.

- For instance, Amcor’s “Grace head” pump actuator is part of the mono-material Wave 2CC pump line, which uses 100% polyolefin construction. It can also be produced with Amcor’s CleanStream post-consumer recycled polypropylene (PCR).

Technological Advancements in Materials

Innovations in bioplastics, molded fiber, and coated paperboard are strengthening the capabilities of plant-based packaging. Advanced technologies enhance barrier properties, durability, and flexibility, enabling applications across diverse industries such as pharmaceuticals, cosmetics, and e-commerce. Developments in water-resistant coatings, heat-sealable bioplastics, and high-strength bamboo or bagasse composites are expanding market scope. These advancements address long-standing concerns over product safety and shelf life while offering cost-effective solutions. The integration of smart and functional features into sustainable packaging further boosts adoption, aligning with evolving consumer and regulatory expectations.

Key Trends & Opportunities

Growth of E-commerce and Retail Packaging

The rapid growth of e-commerce presents a significant opportunity for plant-based packaging providers. Online retailers require durable yet sustainable solutions for shipping goods across categories, from groceries to electronics. Paper-based cartons, molded fiber trays, and compostable mailers are gaining traction as eco-friendly options. Consumer preference for brands that prioritize green packaging also boosts adoption. With rising online sales worldwide, demand for plant-based solutions that ensure product protection while meeting sustainability goals is expected to remain a strong market trend.

- For instance, Tetra Pak’s Tray Shrink 30 film-wrapper can handle 40 different tray sizes using a film as thin as 40 µm, aiming to minimize both material usage and electricity consumption.

Rising Adoption in Personal Care and Cosmetics

The personal care and cosmetics sector is emerging as a key adopter of plant-based packaging. Consumers increasingly demand eco-friendly solutions that align with natural and sustainable product positioning. Bioplastics, bamboo, and molded fiber are being used for jars, tubes, and cartons in this industry. Premium brands leverage sustainable packaging to differentiate themselves and appeal to environmentally conscious buyers. With growth in natural and organic cosmetics, this sector offers untapped potential for plant-based packaging companies, driving innovation and new product launches.

- For instance, Berry’s B Circular Range now includes 35 distinct items (closures, jars, triggers etc.) that can use 30% to 100% post-consumer recycled (PCR) plastic per item.

Key Challenges

Higher Production Costs Compared to Conventional Packaging

One of the key challenges for the plant-based packaging market is its relatively high production cost. Materials such as bioplastics and bamboo often require advanced processing technologies and specialized infrastructure, increasing manufacturing expenses. These costs can limit adoption, especially among small and medium enterprises. While large corporations absorb the costs for sustainability branding, widespread market penetration remains restricted. Reducing costs through economies of scale, government subsidies, and material innovations is essential to address this challenge and ensure competitive pricing.

Performance Limitations in Certain Applications

Despite advancements, plant-based packaging still faces performance-related challenges in areas like durability, water resistance, and heat tolerance. For instance, traditional plastic outperforms many biodegradable alternatives in preserving shelf life for perishable goods and ensuring leak-proof packaging. These limitations can restrict use in demanding sectors such as pharmaceuticals or industrial packaging. Although new coatings and composite solutions are emerging, widespread adoption depends on consistent performance that matches or exceeds conventional materials. Addressing these technical barriers is critical for market expansion across all end-user industries.

Regional Analysis

North America

North America holds the largest share of the plant-based packaging market, driven by strong regulatory frameworks and rising consumer awareness about sustainability. The U.S. leads the region with widespread adoption across food and beverages, retail, and pharmaceuticals. Companies invest heavily in bioplastics, paperboard, and molded fiber innovations to meet eco-friendly standards. Major brands such as Amazon and PepsiCo have integrated sustainable packaging into their operations, accelerating regional growth. Canada also supports expansion with government-backed initiatives promoting circular economy models. North America accounts for nearly 35% of global market share, reflecting its leadership in sustainable packaging adoption.

Europe

Europe maintains a significant position in the plant-based packaging market, supported by stringent EU directives on reducing single-use plastics and promoting recyclable materials. Countries such as Germany, France, and the U.K. are at the forefront of adopting paperboard, bagasse, and bioplastic solutions. Strong consumer demand for eco-friendly packaging in food and personal care sectors accelerates regional adoption. Investments in advanced recycling infrastructure and innovation in compostable materials further strengthen Europe’s market presence. With sustainability embedded in corporate and government strategies, Europe commands 30% of global market share, making it a critical hub for sustainable packaging innovation and compliance.

Asia-Pacific

Asia-Pacific is the fastest-growing region in the plant-based packaging market, driven by expanding food and beverage consumption and rapid e-commerce growth. Countries such as China, India, and Japan are leading adoption with government-backed bans on plastic usage and rising urbanization fueling demand. Manufacturers increasingly shift to paperboard and bagasse-based packaging to cater to eco-conscious consumers and regulatory requirements. The region’s vast population and rising middle class create large-scale opportunities for sustainable packaging adoption. Asia-Pacific accounts for 25% of global market share, and its strong growth trajectory positions it as a future leader in plant-based packaging solutions.

Latin America

Latin America is emerging as a growing market for plant-based packaging, supported by increasing environmental concerns and evolving regulatory frameworks. Brazil and Mexico are key contributors, with expanding retail and foodservice industries driving demand for compostable and recyclable alternatives. Companies in the region are gradually shifting from traditional plastics to paperboard and bagasse packaging, supported by consumer preference for eco-friendly products. Economic development and trade expansion further promote adoption across industrial and retail sectors. Latin America currently represents 6% of global market share, and ongoing sustainability initiatives are expected to strengthen its role in the global market.

Middle East & Africa

The Middle East & Africa region shows gradual growth in the plant-based packaging market, fueled by government policies to reduce plastic waste and promote sustainable alternatives. South Africa and the UAE lead regional adoption, with rising investments in eco-friendly packaging for food, beverages, and retail. Limited recycling infrastructure poses a challenge, but growing consumer awareness and international trade are encouraging adoption of paperboard and bioplastic packaging. The food and hospitality sectors serve as key growth areas in this region. Middle East & Africa account for 4% of global market share, with growth potential tied to regulatory advancements.

Market Segmentations:

By Product Type:

- Rigid packaging

- Flexible packaging

By Material:

- Bioplastics

- Paper & paperboard

By End User:

- Food & beverages

- Pharmaceuticals

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The plant-based packaging market is highly competitive, with key players including Biorgani, BASF, Mondi Group PLC, Vegware, Amcor, Tetra Pak International SA, Berry Global, Emsur, and WestRock. The plant-based packaging market is characterized by strong competition, with companies focusing on innovation, sustainability, and scalability to gain an edge. Market participants are investing in advanced materials such as bioplastics, molded fiber, and coated paperboard to replace conventional plastics while maintaining product safety and durability. Strategic collaborations, mergers, and acquisitions are common approaches to expand regional presence and enhance production capacity. Continuous research into improving barrier properties, heat resistance, and recyclability ensures broader applications across food, pharmaceuticals, cosmetics, and e-commerce. The competitive landscape is further shaped by sustainability commitments and compliance with evolving environmental regulations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Biorgani

- BASF

- Mondi Group PLC

- Vegware

- Amcor

- Tetra Pak International SA

- Berry Global

- Emsur

- WestRock

- Amcor

Recent Developments

- In August 2024, the Defence Research and Development Organisation (DRDO) developed PBAT-based biodegradable packaging that decomposes within three months. This eco-friendly packaging is used in various applications, including food and medical waste bags.

- In June 2024, Xampla’s plant-based coating was supplied to Huhtamaki for takeaway packaging. Huhtamaki and 2M Group of Companies will apply Xampla’s plant-based Morro Coating polymer to a range of takeaway boxes in a new, multi-year supply deal set to help Huhtamaki transition into recyclable, compostable, and renewable packaging solutions.

- In June 2024, Mondi adopts a traceless’ plant-based coating to upscale it into the paper industry. In a partnership with Mondi, traceless hopes to scale its plant-based coating across the paper industry and combat the generation of unnecessary plastic packaging waste.

- In December 2023, Novolex, through its brand Waddington North America (WNA), introduced food packaging containers that are recyclable and made with a minimum of 10% post-consumer recycled (PCR) content.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for sustainable packaging will continue to rise due to stricter plastic regulations.

- Food and beverage companies will remain the largest adopters of plant-based packaging solutions.

- Advancements in bioplastics will improve durability, heat resistance, and barrier performance.

- E-commerce growth will drive higher adoption of recyclable and compostable packaging formats.

- Personal care and cosmetics brands will increasingly use eco-friendly packaging for differentiation.

- Investment in recycling infrastructure will support wider adoption of circular packaging systems.

- Cost reduction strategies will make plant-based packaging more accessible to small businesses.

- Partnerships between material innovators and packaging manufacturers will accelerate product development.

- Asia-Pacific will emerge as the fastest-growing regional market for plant-based packaging.

- Corporate sustainability goals will push global brands to integrate plant-based solutions at scale.

Market Insights

Market Insights