Market Overview:

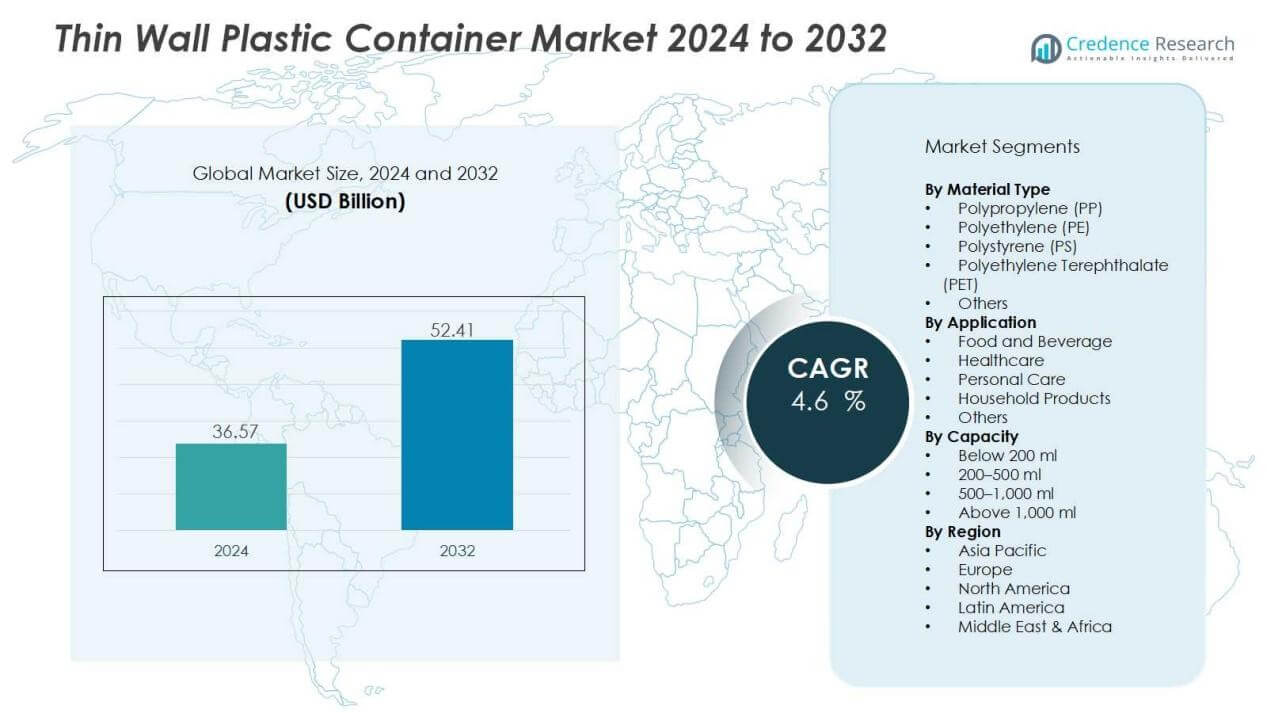

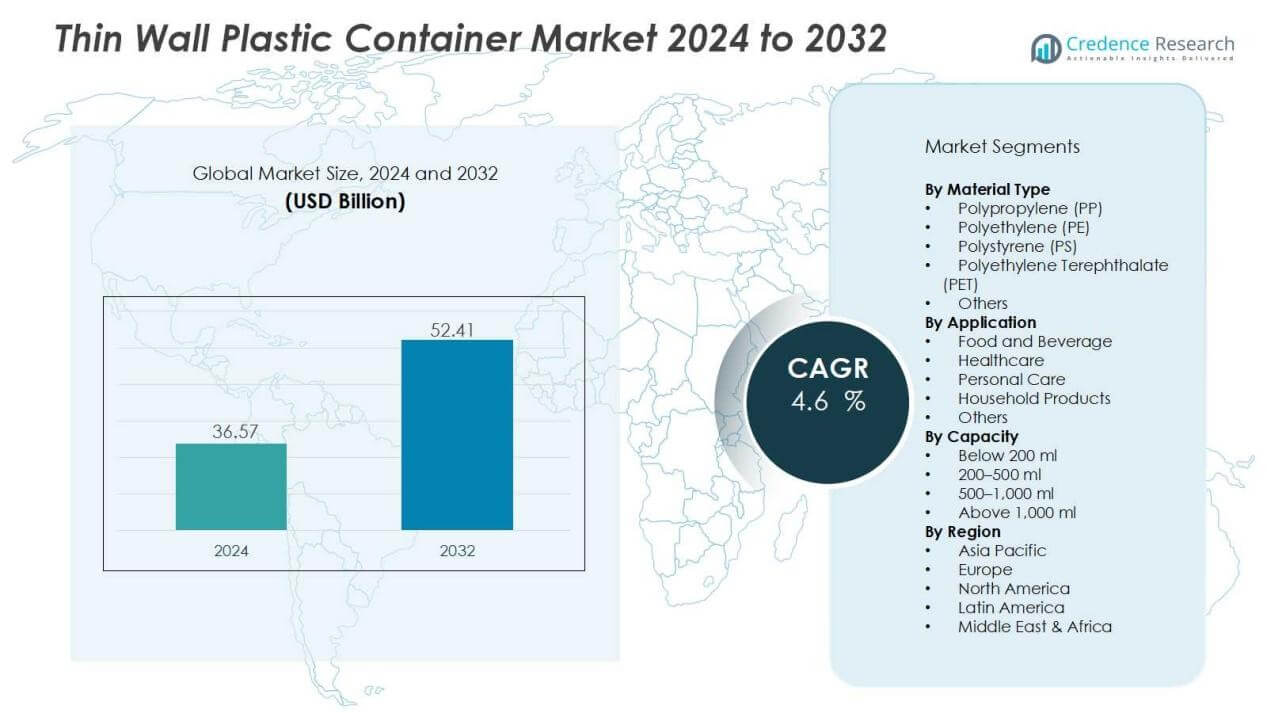

The thin wall plastic container market size was valued at USD 36.57 billion in 2024 and is anticipated to reach USD 52.41 billion by 2032, at a CAGR of 4.6 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Thin Wall Plastic Containers Market Size 2024 |

USD 36.57 Billion |

| Thin Wall Plastic Containers Market, CAGR |

4.6% |

| Thin Wall Plastic Containers Market Size 2032 |

USD 52.41 Billion |

Market drivers include the rising demand for convenience packaging in food and beverage, pharmaceuticals, and personal care sectors. Consumers prefer packaging that offers portability, product safety, and extended shelf life. Growing urbanization, a surge in quick-service restaurants, and rising e-commerce activity further accelerate market demand. The sustainability trend is also shaping innovations, with manufacturers focusing on recyclable and eco-friendly plastics to align with environmental regulations and consumer preferences.

Regionally, Asia-Pacific dominates the thin wall plastic container market due to rapid industrialization, high population density, and expanding retail infrastructure. North America and Europe follow closely, supported by strong consumer demand for ready-to-eat meals and sustainable packaging practices. Emerging regions, including Latin America and the Middle East & Africa, are witnessing increasing adoption driven by rising disposable incomes, expanding food service industries, and growing retail penetration. This regional spread ensures strong global market momentum over the forecast period.

Market Insights:

Market Insights:

- The thin wall plastic container market was valued at USD 36.57 billion in 2024 and is expected to reach USD 52.41 billion by 2032, growing at a CAGR of 4.6%.

- Rising demand for convenience and ready-to-eat meals continues to drive large-scale adoption of thin wall containers.

- Foodservice outlets, supermarkets, and quick-service restaurants favor cost-efficient, tamper-proof, and lightweight packaging solutions.

- Sustainability trends are encouraging manufacturers to invest in recyclable polymers and eco-friendly product designs.

- E-commerce growth boosts demand for durable, leak-proof containers that ensure product safety during delivery.

- Challenges include strict environmental regulations on single-use plastics and volatility in raw material costs.

- Asia-Pacific leads the market with 41% share, supported by rapid urbanization, strong retail infrastructure, and rising e-commerce.

- North America and Europe follow with 27% and 21% shares, driven by consumer demand for sustainable and high-performance packaging.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Convenience and Ready-to-Eat Packaging:

The thin wall plastic container market benefits from the global preference for convenient packaging. Growing urban populations rely heavily on ready-to-eat meals, takeaway foods, and packaged snacks. Lightweight, stackable, and easy-to-handle containers meet these consumer needs effectively. It supports time-sensitive lifestyles while ensuring food safety and extended shelf life.

- For instance, in October 2023, Netstal introduced a 100% polypropylene thin-wall dairy cup with a 200 g filling capacity weighing just 5.4 g per cup and featuring a 0.3 mm wall thickness to enhance portability and durability.

Expanding Foodservice and Retail Industries:

Foodservice outlets, quick-service restaurants, and supermarkets are driving adoption of thin wall plastic containers. These industries favor cost-effective solutions that reduce storage and logistics expenses. It allows businesses to maintain efficiency while offering attractive, tamper-proof packaging to customers. The expansion of retail infrastructure and online grocery platforms further strengthens container demand.

- For Instance, In May 2010, Amcor introduced the industry’s lightest 16-ounce PET salad dressing container, which achieved a nearly 6-gram reduction in weight thanks to proprietary lightweighting technology.

Shift Toward Sustainable and Recyclable Materials:

Sustainability pressures are reshaping the thin wall plastic container market. Manufacturers are introducing recyclable polymers and eco-friendly designs to reduce environmental impact. It aligns with regulatory frameworks and consumer expectations for sustainable packaging. The trend promotes innovation in lightweight plastics that minimize resource consumption without sacrificing performance.

Growth of E-Commerce and Changing Consumer Preferences:

E-commerce growth creates new opportunities for thin wall plastic containers, especially in food delivery and direct-to-consumer channels. These containers offer durability, leakage resistance, and secure closures, which are essential for long-distance shipping. It helps retailers build trust by ensuring products arrive intact and fresh. Rising health awareness and demand for hygienic packaging further boost container adoption across multiple sectors.

Market Trends:

Integration of Sustainable Packaging Solutions:

The thin wall plastic container market is witnessing a strong shift toward eco-friendly packaging innovations. Manufacturers are focusing on recyclable plastics, biodegradable resins, and lightweight designs that reduce raw material use. It helps companies comply with regulatory standards while addressing consumer demand for environmentally responsible products. Brands are also adopting clear labeling and green certifications to highlight their commitment to sustainability. The push for circular economy models is encouraging partnerships with recyclers and raw material suppliers. This focus on sustainability is not only reducing carbon footprints but also creating opportunities for premium product positioning.

- For Instance, Greiner Packaging has achieved the internationally recognized ISCC PLUS certification for multiple sites, including those within Greiner Packaging International, to produce packaging with traceable recycled and bio-based content using the mass balance approach

Technological Advancements and Customization Demand:

Technological innovation is shaping the thin wall plastic container market with improved molding techniques and advanced resin formulations. It enables higher durability, design flexibility, and faster production cycles that meet the needs of high-volume industries. Food and beverage companies are requesting customized containers with tamper-evident seals, unique shapes, and branding options. The rise of e-commerce and food delivery services is fueling demand for containers that ensure freshness and prevent leakage during transport. Smart packaging features, such as QR codes for traceability, are also gaining traction. These advancements are making containers more functional while enhancing consumer engagement and brand visibility.

- For instance, Berry Global optimized its multi-cavity cover molding process by reducing the filling time from 1.6 s to 1.2 s per cycle, saving 0.4 s on each molding operation.

Market Challenges Analysis:

Environmental Concerns and Regulatory Pressures:

The thin wall plastic container market faces increasing scrutiny due to its environmental footprint. Rising concerns about plastic waste and pollution have prompted governments to impose strict regulations on single-use plastics. It challenges manufacturers to invest in recyclable materials and redesign products to meet compliance standards. High costs associated with sustainable alternatives create barriers for smaller producers. Consumer awareness of eco-friendly packaging is also pressuring brands to adopt greener solutions. These dynamics are pushing the industry toward innovation while adding complexity to operations.

Volatility in Raw Material Costs and Supply Chain Issues:

Fluctuating crude oil prices directly impact the cost of polymers used in thin wall plastic containers. It creates uncertainty for manufacturers and affects profitability across the value chain. Supply chain disruptions, driven by global events and trade restrictions, further challenge consistent material availability. Rising transportation and logistics expenses add to overall production costs. The competitive nature of the packaging industry limits the ability to pass these costs on to consumers. Such pressures highlight the vulnerability of manufacturers and emphasize the need for efficient sourcing strategies and diversified supply networks.

Market Opportunities:

Rising Adoption in Food, Beverage, and Healthcare Sectors:

The thin wall plastic container market has strong opportunities in food, beverage, and healthcare applications. Growing demand for ready-to-eat meals, frozen foods, and packaged snacks is creating a steady need for lightweight and durable packaging. It supports extended shelf life, tamper resistance, and cost efficiency, which align with consumer expectations. In healthcare, containers provide secure storage for medical supplies and pharmaceuticals. The versatility of design also allows brands to offer innovative, portion-controlled, and sustainable options. These features enhance product appeal while expanding opportunities across multiple industries.

Expansion in Emerging Markets and E-Commerce Channels:

Emerging economies present significant growth potential for the thin wall plastic container market due to rapid urbanization and rising disposable incomes. Expanding retail networks and foodservice industries in Asia-Pacific, Latin America, and Africa are fueling container adoption. It creates opportunities for local manufacturers to scale operations and for global players to expand presence. E-commerce growth is another key driver, with demand for packaging that ensures product safety and hygiene during delivery. Companies investing in region-specific designs and efficient distribution strategies can capture new customer bases. This expansion highlights untapped potential in developing regions and online channels.

Market Segmentation Analysis:

By Material Type:

The thin wall plastic container market is segmented by material into polypropylene, polyethylene, polystyrene, polyethylene terephthalate, and others. Polypropylene dominates due to its durability, cost efficiency, and heat resistance, making it ideal for food packaging. It is also preferred for microwave-safe applications. PET is gaining traction in beverages and ready-to-eat meals due to its clarity and recyclability. Polystyrene serves niche demand in dairy and disposable foodservice items, though sustainability concerns limit growth.

- For instance, Borealis developed the next-generation Borpact™ SH950MO polypropylene grade featuring enhanced transparency and drop impact performance, with improved stiffness of 1050 MPa and melt flow rate of 40, enabling processing temperature reductions of 20°C during production trials.

By Application:

Applications span food and beverage, healthcare, personal care, and household products. The food and beverage segment holds the largest share, driven by demand for ready-to-eat meals, frozen foods, and packaged snacks. It is supported by rising quick-service restaurants and online grocery platforms. Healthcare adoption is growing, with containers used for medical supplies and pharmaceuticals that require secure and sterile packaging. Personal care and household goods segments are adopting lightweight containers for convenience and product differentiation.

- For Instance, the Tetra Pak A3/Speed aseptic filler can produce portion-sized packages at up to 24,000 packs per hour

By Capacity:

By capacity, the market covers containers below 200 ml, 200–500 ml, 500–1,000 ml, and above 1,000 ml. Containers between 200–500 ml dominate everyday food packaging applications such as sauces, dips, and snacks. It is widely used in retail and foodservice due to its balance of portability and storage efficiency. Small containers under 200 ml cater to single-use and travel-size products. Larger capacities above 1,000 ml are mainly used for bulk food storage, family packs, and institutional catering.

Segmentations:

By Material Type

- Polypropylene (PP)

- Polyethylene (PE)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Others

By Application:

- Food and Beverage

- Healthcare

- Personal Care

- Household Products

- Others

By Capacity:

- Below 200 ml

- 200–500 ml

- 500–1,000 ml

- Above 1,000 ml

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

Asia-Pacific:

Asia-Pacific holds 41% market share in the thin wall plastic container market, making it the largest regional contributor. Rapid urbanization, population growth, and expanding foodservice industries are driving strong adoption of lightweight packaging solutions. It benefits from increasing demand for ready-to-eat meals, packaged snacks, and frozen foods. Government focus on sustainable packaging also encourages the use of recyclable materials in the region. Strong retail infrastructure in China, India, and Southeast Asia supports widespread availability. The region’s growing e-commerce activity further strengthens demand across consumer and commercial applications.

North America:

North America accounts for 27% market share in the thin wall plastic container market, supported by advanced packaging innovations and sustainability initiatives. Strong consumer demand for convenience foods and hygienic packaging fuels consistent adoption. It is influenced by regulations encouraging eco-friendly practices and recyclable product designs. Food delivery services and quick-service restaurants rely heavily on thin wall containers for cost efficiency. Manufacturers in the region are focusing on lightweight designs with tamper-evident and resealable features. Expanding online grocery platforms further enhance regional growth prospects.

Europe:

Europe represents 21% market share in the thin wall plastic container market, driven by strict regulatory frameworks and strong consumer preference for sustainable solutions. Stringent bans on single-use plastics are pushing manufacturers toward recyclable and biodegradable alternatives. It benefits from mature food and beverage industries that demand reliable and high-performance packaging. Rising popularity of private labels in retail chains also increases container usage. Countries such as Germany, France, and the UK remain at the forefront of innovation and adoption. Growing emphasis on circular economy models ensures steady demand and continuous advancements in eco-friendly packaging designs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Greiner Packaging International GmbH

- Amcor Plc

- Reynolds Group Holdings Limited

- DS Smith Plc

- Graham Packaging Company, L.P.

- Silgan Holdings Inc.

- Huhtamaki Oyj

- Berry Group, Inc.

- Coveris Holdings S.A.

- Teijin Limited

- Winpak Ltd.

- RPC Group Plc

Competitive Analysis:

The thin wall plastic container market is highly competitive, with global and regional players investing in innovation and sustainability. Key companies include Greiner Packaging International GmbH, Amcor Plc, Reynolds Group Holdings Limited, DS Smith Plc, Graham Packaging Company L.P., and Silgan Holdings Inc. These firms focus on developing lightweight, recyclable, and customizable solutions to meet diverse end-user needs. It is shaped by strategic initiatives such as mergers, acquisitions, and partnerships aimed at expanding production capacity and distribution networks. Leading companies emphasize cost efficiency, advanced molding technologies, and eco-friendly materials to strengthen market presence. Strong competition is also driven by increasing demand from food, beverage, and healthcare industries. The shift toward sustainable packaging creates opportunities for differentiation, with players prioritizing innovation to align with regulatory and consumer requirements.

Recent Developmnts:

- In May 2025, Greiner Packaging strengthened its partnership with Orthomol by launching a high-tech production line for manufacturing Orthomol’s nutritional supplement vials using recycled PET, enhancing quality and sustainability.

- In March 2025, Amcor unveiled an industry-first 2oz retort bottle for nutritional shots with its proprietary StormPanel™ technology enabling 12-month shelf stability and high product performance.

Report Coverage:

The research report offers an in-depth analysis based on Material Type, Application, Capacity and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Sustainability will remain a core focus, with manufacturers adopting recyclable and biodegradable materials.

- Demand for convenience packaging in food and beverage will continue to drive large-scale adoption.

- Healthcare and pharmaceutical applications will expand, offering new opportunities for secure and hygienic packaging.

- E-commerce growth will fuel the need for durable, tamper-resistant, and leak-proof thin wall containers.

- Technological advancements in injection molding will improve efficiency and enable complex, customized designs.

- Brand differentiation through unique shapes, graphics, and labeling will strengthen consumer engagement.

- Regulatory pressures will accelerate the shift toward eco-friendly polymers and circular economy models.

- Emerging markets in Asia-Pacific, Latin America, and Africa will provide strong growth prospects.

- Collaborations between packaging manufacturers and foodservice providers will enhance product innovation.

- Digital integration such as QR codes and smart labeling will increase traceability and product transparency.

Market Insights:

Market Insights: