Market Overview

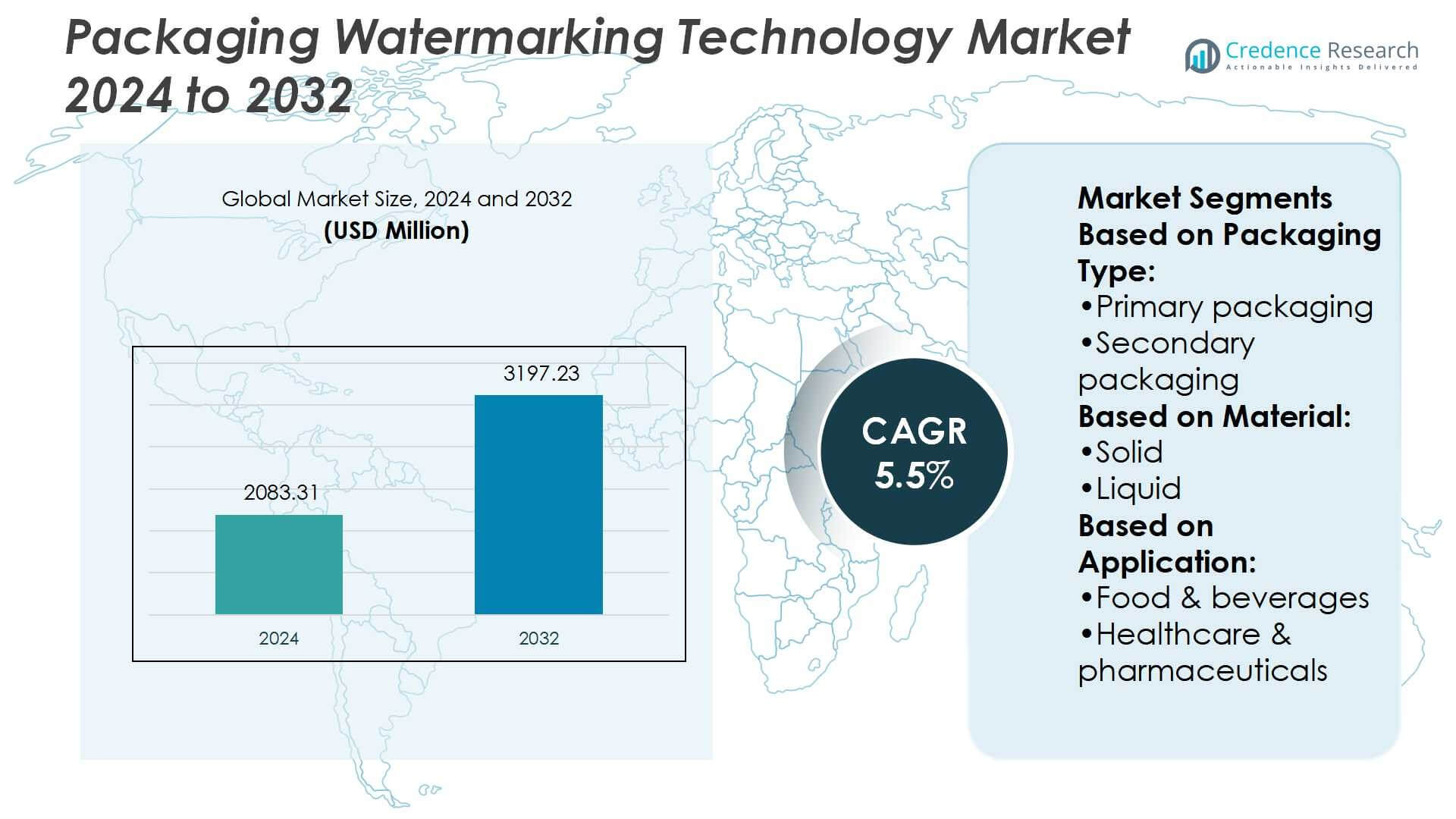

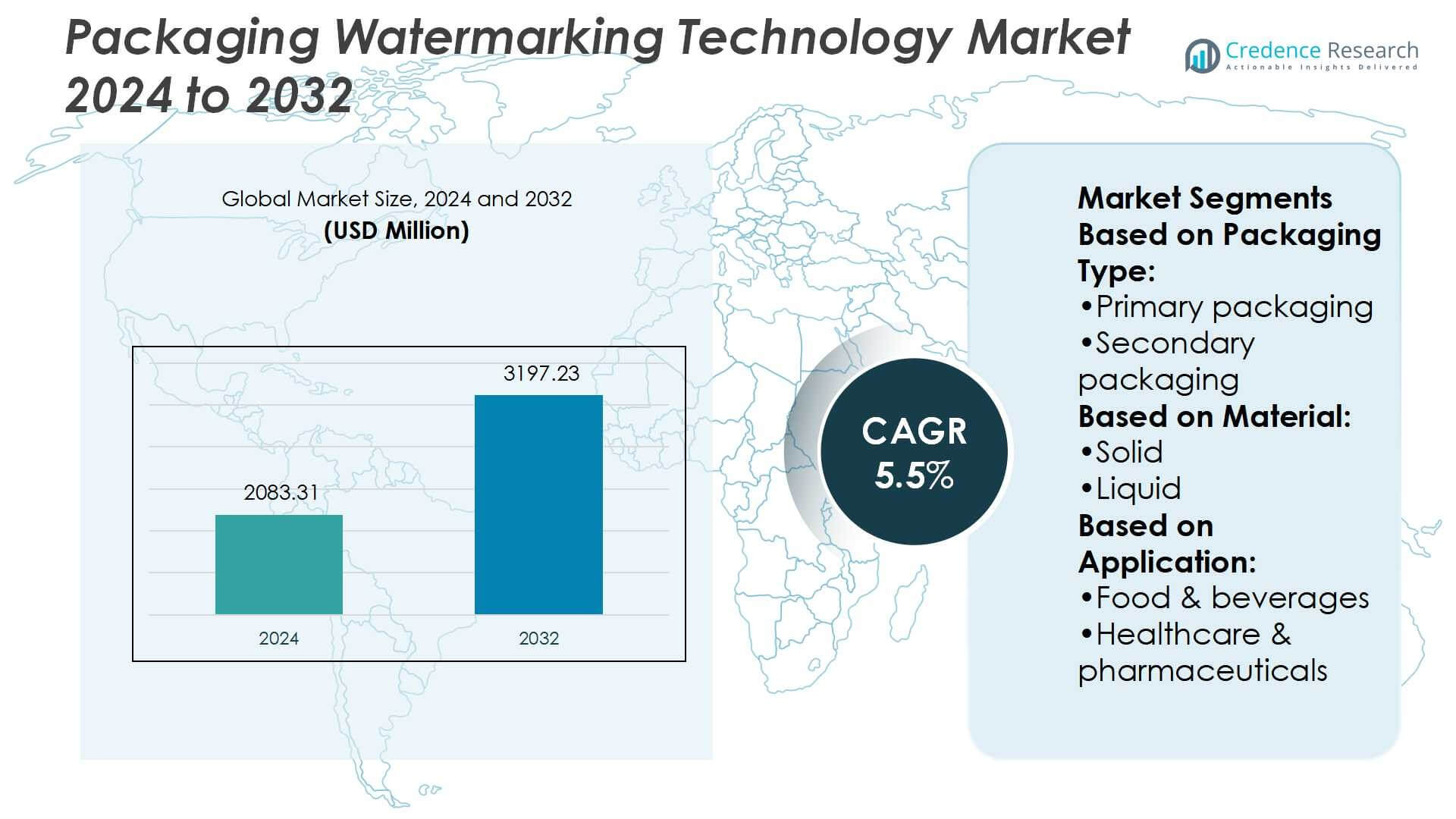

Packaging Watermarking Technology Market size was valued USD 2083.31 million in 2024 and is anticipated to reach USD 3197.23 million by 2032, at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Packaging Watermarking Technology Market Size 2024 |

USD 2083.31 Million |

| Packaging Watermarking Technology Market, CAGR |

5.5% |

| Packaging Watermarking Technology Market Size 2032 |

USD 3197.23 Million |

The packaging watermarking technology market is shaped by leading players including Zebra Technologies Corp. (Temptime Corporation), BASF SE, International Paper, Ball Corporation, Sysco Corporation, Crown, Stora Enso, R.R. Donnelley & Sons Company, 3M, and Avery Dennison Corporation. These companies focus on advancing digital watermarking for enhanced security, traceability, and sustainability, targeting industries such as food, beverages, healthcare, and logistics. Asia-Pacific emerges as the leading region with a 34% market share, driven by rapid industrialization, high consumption of packaged goods, and rising concerns over counterfeiting. The region’s strong manufacturing base and regulatory focus on safety and transparency further strengthen its dominance in the global market.

Market Insights

Market Insights

- The Packaging Watermarking Technology Market size was valued at USD 2083.31 million in 2024 and is expected to reach USD 3197.23 million by 2032, growing at a CAGR of 5.5%.

- Rising demand for anti-counterfeit solutions in food, beverages, and pharmaceuticals is a major driver, supported by strict regulatory frameworks emphasizing product safety and authenticity.

- The market is witnessing strong trends in sustainability, with watermarks increasingly embedded in recyclable and fiber-based materials to meet circular economy goals and consumer expectations.

- Competition is shaped by global players focusing on digital printing integration, R&D investments, and strategic partnerships to enhance security, traceability, and smart packaging functionalities.

- Asia-Pacific leads with a 34% share, followed by North America at 29% and Europe at 26%, while food and beverages dominate application segments with 48% share, reflecting high consumer demand for safe and traceable packaging across global supply chains.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Packaging Type

Primary packaging holds the largest share in the packaging watermarking technology market, accounting for nearly 52% of the total segment. Its dominance is driven by the rising adoption of watermarking in bottles, pouches, and cartons to ensure product authenticity and traceability. Growing concerns about counterfeit food and beverages strengthen the demand for secure primary packaging solutions. Manufacturers prefer watermarking in this category as it enables fast scanning, consumer engagement, and supply chain monitoring. Enhanced regulatory focus on labeling accuracy and transparency further drives this segment’s leadership.

- For instance, BASF has been an active supporter of the HolyGrail 2.0 digital watermarking initiative, where semi-industrial trials demonstrated 99% detection rates and 95% material purity during sorting.

By Material

Solid materials dominate the segment with a market share exceeding 60%, primarily due to their extensive use in cartons, labels, and rigid containers. Watermarking in solid substrates supports durability, clear visibility, and long-lasting security features. Food and beverage companies prefer solid-based packaging because of higher resistance to tampering and damage during transportation. Innovations in digital watermark integration with fiber-based packaging solutions enhance recyclability while meeting sustainability targets. The liquid segment, though smaller, is gaining traction in flexible pouches and coatings that require dynamic identification.

- For instance, Sustainability Report states they process over 7 million tons of recovered paper annually.They also report restoring around 1,158,000 acres of ecologically significant forestland.

By Application

Food and beverages lead the application segment with a commanding 48% share. This dominance is fueled by the need for tamper-proof, trackable packaging across bottled drinks, dairy, and processed foods. Watermarking supports quick authentication during retail scanning and strengthens consumer trust in safety standards. Stringent food safety regulations and brand protection initiatives push companies to embed digital watermarking in packaging. Healthcare and pharmaceuticals are also expanding adoption, driven by anti-counterfeiting needs, though food remains the clear leader due to its high consumption volume and regulatory oversight.

Key Growth Drivers

Rising Demand for Anti-Counterfeit Solutions

The increasing prevalence of counterfeit products across food, beverages, and pharmaceuticals is driving adoption of packaging watermarking technology. Brands are using invisible digital watermarks to secure authenticity and enhance traceability throughout supply chains. Regulatory agencies also encourage anti-counterfeit measures, making watermarking a vital compliance tool. As consumer trust becomes central to brand equity, manufacturers prioritize packaging solutions that guarantee product safety. This rising demand positions watermarking as a critical driver for long-term industry growth across diverse end-use applications.

- For instance, Sysco saved 83,000 pounds of corrugated by switching packaging from traditional white cases to kraft corrugated for its Sysco Brand exterior packaging.

Advancements in Digital Printing Integration

The integration of watermarking technology with advanced digital printing systems supports precise, scalable, and cost-efficient applications. Digital watermarking embedded during the printing stage ensures consistency and reduces production errors. It also enables customized solutions for small-batch runs and promotional campaigns, boosting flexibility for brand owners. The technology enhances data encoding capabilities, supporting real-time scanning and authentication across distribution channels. These advancements expand its appeal for manufacturers aiming to align packaging security with operational efficiency, sustainability, and customer engagement strategies.

- For instance, Crown global beverage can volume was 82 billion cans, growing over 5% compared to prior year. The company’s beverage can revenue represented 67% of its total revenue in its most recent reporting period.

Regulatory Push for Traceability and Transparency

Global regulations emphasizing product traceability and labeling transparency are accelerating adoption of watermarking solutions. Authorities in regions such as the EU and North America enforce strict standards for tracking food safety, pharmaceutical authenticity, and consumer information. Watermarking allows compliance through encoded data without compromising design aesthetics. By embedding unique identifiers, companies can meet regulatory demands while enhancing supply chain visibility. This regulatory push creates sustained growth momentum, ensuring manufacturers integrate watermarking as a standard feature in secure packaging.

Key Trends & Opportunities

Integration with Smart Packaging Ecosystems

Watermarking technology is increasingly linked with smart packaging solutions, enabling digital connectivity. By embedding watermarks, brands provide consumers with access to product details, promotions, and sustainability credentials via smartphone scans. This integration aligns with the broader shift toward IoT-enabled packaging, where connectivity enhances engagement and loyalty. Opportunities exist for companies to expand consumer-facing applications beyond authentication into interactive marketing and data-driven insights. This trend positions watermarking as a dual-purpose tool for security and customer experience enhancement.

- For instance, Stora Enso launched Performa Nova, a high-yield folding boxboard for consumer packaging. It is available in grammages from 200 to 315 g/m² and designed for dry, frozen, and chilled food and confectionery.

Sustainability-Driven Adoption

The shift toward eco-friendly packaging creates opportunities for watermarking solutions integrated into recyclable substrates. Unlike traditional labels or tags, watermarks embedded in solid and fiber-based packaging reduce the need for extra materials. Companies adopting sustainable packaging benefit from watermarks that maintain recyclability while supporting authentication. This aligns with global sustainability goals and circular economy principles, driving adoption across food, beverage, and cosmetics sectors. Watermarking technology thus emerges as a sustainable enabler that balances environmental responsibility with product security.

- For instance, Labels Insight Report surveyed 300 U.S. packaging/label decision makers. Among packaging respondents, 68% reported that material recyclability is a top sustainability consideration when making packaging design decisions.

Key Challenges

High Implementation Costs

The initial investment for packaging watermarking technology, including printing upgrades and scanning infrastructure, remains a key challenge. Smaller manufacturers face budget constraints in adopting these systems, limiting scalability in cost-sensitive markets. Integration with existing production lines also requires significant capital expenditure and technical expertise. These factors can slow adoption rates, particularly in emerging economies. To overcome this challenge, vendors must focus on cost optimization strategies, standardized processes, and partnerships that reduce the overall financial burden on manufacturers.

Limited Consumer Awareness and Adoption

Despite technological advantages, consumer awareness of packaging watermarking remains limited. Many end-users are unfamiliar with the scanning process, reducing engagement and perceived value. Without widespread consumer education, the potential for interactive and traceability features is underutilized. This limits the return on investment for companies implementing watermarking in packaging. Addressing this challenge requires coordinated awareness campaigns, clear on-pack communication, and retailer collaboration to encourage consumer interaction. Greater familiarity will unlock broader adoption and maximize the technology’s market potential.

Regional Analysis

North America

North America holds a 29% share of the packaging watermarking technology market, driven by strong regulatory frameworks and high adoption across food, beverage, and pharmaceutical sectors. Stringent labeling laws in the U.S. and Canada push companies to embed traceability and anti-counterfeit measures in primary packaging. Leading players actively invest in integrating watermarking with smart packaging to enhance supply chain visibility and consumer engagement. Rising demand for e-commerce packaging also fuels adoption, as brands focus on authenticity and product differentiation. The region benefits from mature technological infrastructure, supporting large-scale implementation across industries.

Europe

Europe accounts for 26% of the market, led by Germany, France, and the U.K., where sustainability and regulatory compliance dominate packaging innovation. The European Union’s focus on digital product passports and circular economy initiatives drives adoption of watermarking technologies integrated into recyclable substrates. Food and beverage companies lead demand, with pharmaceutical firms following due to strict anti-counterfeit mandates. Watermarking enhances supply chain transparency and aligns with consumer expectations for traceable, eco-friendly packaging. Strong investments in digital printing integration across the region further strengthen Europe’s position as a key market for advanced watermarking applications.

Asia-Pacific

Asia-Pacific dominates the global market with a 34% share, supported by rapid industrialization, growing food demand, and expanding e-commerce. Countries such as China, Japan, and India are leading adoption, driven by rising counterfeit risks and consumer safety concerns. The region’s fast-paced retail and logistics growth boosts demand for primary and secondary packaging with embedded watermarks for real-time tracking. Increasing regulatory focus on food safety standards adds momentum, particularly in China and Southeast Asia. Asia-Pacific’s large manufacturing base and cost-efficient production create strong opportunities for scaling watermarking technology adoption across diverse industries.

Latin America

Latin America holds a 6% share of the packaging watermarking technology market, with Brazil and Mexico emerging as key growth centers. Rising concerns over counterfeit pharmaceuticals and food products drive adoption of secure packaging technologies. The region’s expanding retail and e-commerce sectors also stimulate demand for traceable and interactive packaging solutions. Watermarking supports compliance with evolving labeling standards and enhances consumer confidence in branded products. While adoption is slower due to high initial costs, partnerships with global technology providers are increasing market penetration and creating opportunities for broader implementation across key industries.

Middle East & Africa

The Middle East & Africa region represents 5% of the market, with adoption mainly concentrated in the Gulf states and South Africa. Growing demand for secure packaging in pharmaceuticals, cosmetics, and premium food products drives interest in watermarking solutions. Governments focus on tightening anti-counterfeit regulations, particularly in healthcare, creating growth opportunities. However, limited awareness and infrastructure challenges slow large-scale implementation across many countries. International players are expanding partnerships to introduce watermarking as part of digital transformation initiatives in logistics and retail. The region shows gradual growth potential, supported by regulatory reforms and premium product demand.

Market Segmentations:

By Packaging Type:

- Primary packaging

- Secondary packaging

By Material:

By Application:

- Food & beverages

- Healthcare & pharmaceuticals

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The competitive landscape of the packaging watermarking technology market features prominent players such as Zebra Technologies Corp. (Temptime Corporation), BASF SE, International Paper, Ball Corporation, Sysco Corporation, Crown, Stora Enso, R.R. Donnelley & Sons Company, 3M, and Avery Dennison Corporation. The competitive landscape of the packaging watermarking technology market is defined by rapid innovation, sustainability initiatives, and regulatory compliance. Companies are investing heavily in digital watermarking solutions to enhance product authenticity, improve traceability, and engage consumers through interactive packaging. Advancements in digital printing and integration with smart packaging ecosystems are enabling scalable, cost-efficient adoption across industries such as food, beverages, healthcare, and logistics. Sustainability remains a central focus, with growing emphasis on embedding watermarks into recyclable and fiber-based materials to align with circular economy goals. Strategic collaborations, research investments, and technology-driven differentiation continue to shape competition, as firms aim to strengthen global presence, reduce counterfeiting risks, and meet increasing demand for secure, eco-friendly, and intelligent packaging solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Zebra Technologies Corp. (Temptime Corporation)

- BASF SE

- International Paper

- Ball Corporation

- Sysco Corporation

- Crown

- Stora Enso

- R. Donnelley & Sons Company

- 3M

- Avery Dennison Corporation

Recent Developments

- In January 2025, Micron announced the groundbreaking of a USD 7 billion High-Bandwidth Memory (HBM) advanced packaging facility in Singapore, set to begin operations in 2026. The facility will support AI-driven semiconductor demand, create up to 3,000 jobs, and integrate AI automation and sustainable practices, strengthening Singapore’s semiconductor ecosystem and Micron’s advanced packaging leadership.

- In October 2024, TSMC and Amkor announced their partnership to establish advanced packaging and testing capabilities in Peoria, Arizona. This collaboration will integrate TSMC’s InFO and CoWoS technologies, enhancing semiconductor manufacturing for AI and HPC applications.

- In September 2024, Pakka, a producer of compostable packaging options, introduced a new line of flexible compostable packaging products. The innovative product line has been created to meet the rising need for flexible packaging in the food and beverage industry with compostable options and to help promote a cleaner environment.

- In June 2024, Crocco and Versalis collaborated to create food packaging film utilizing recycled post-consumer plastics. By using Versalis’ Balance product, this packaging upholds crucial food safety and performance standards.

Report Coverage

The research report offers an in-depth analysis based on Packaging Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness rising adoption in food and beverage packaging for product authenticity.

- Regulatory compliance will drive greater integration of watermarking in pharmaceutical and healthcare packaging.

- Sustainability goals will encourage embedding watermarks into recyclable and fiber-based materials.

- Advancements in digital printing will support scalable and cost-effective watermarking solutions.

- Smart packaging ecosystems will expand, linking watermarks to consumer engagement platforms.

- E-commerce growth will increase demand for secure and traceable packaging formats.

- Anti-counterfeit measures will remain a key driver across global supply chains.

- Partnerships between technology providers and packaging manufacturers will strengthen market expansion.

- Emerging economies will present growth opportunities due to rising retail and logistics sectors.

- Continuous innovation will enable interactive and value-added packaging experiences for consumers.

Market Insights

Market Insights