Market Overview

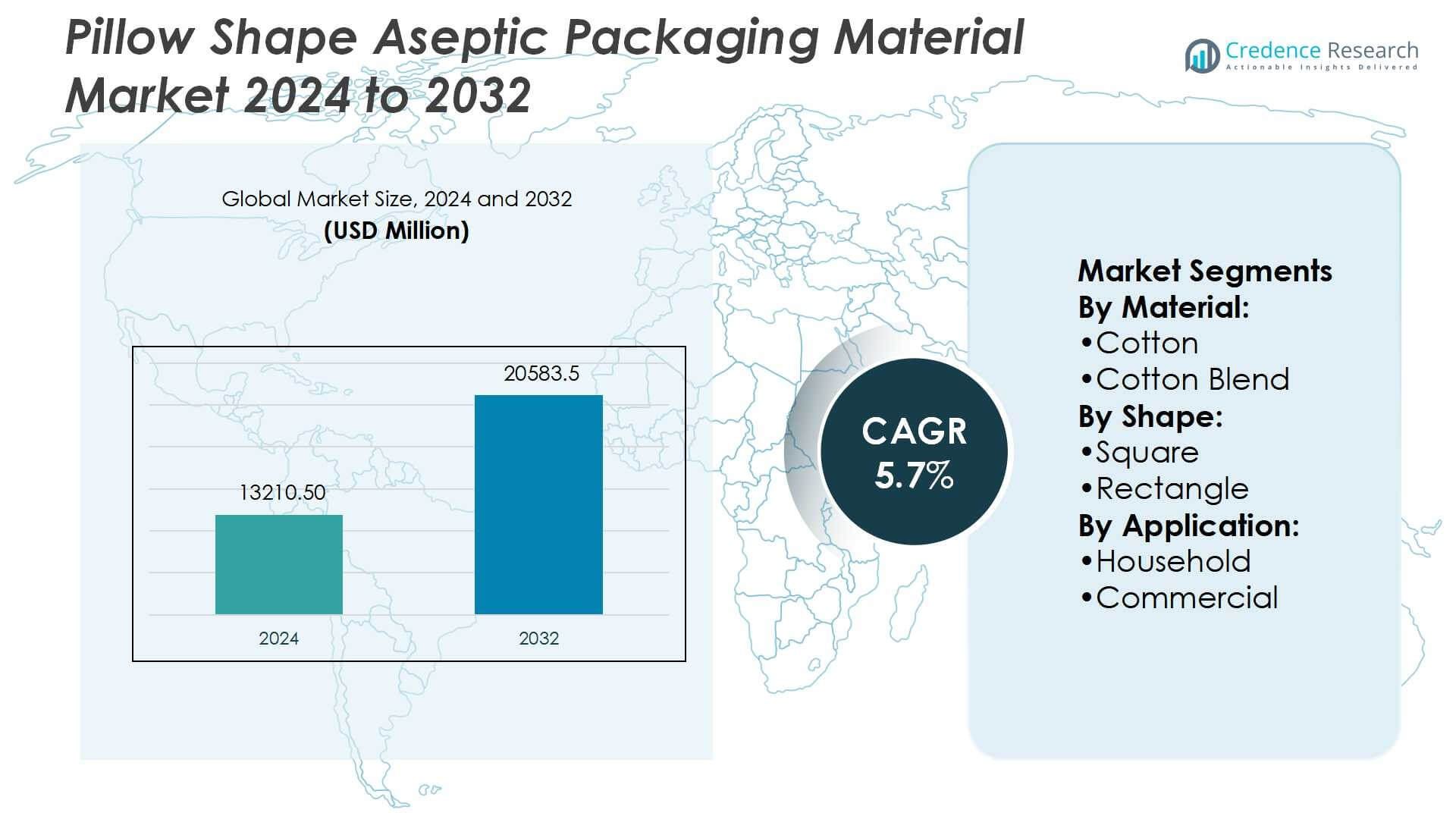

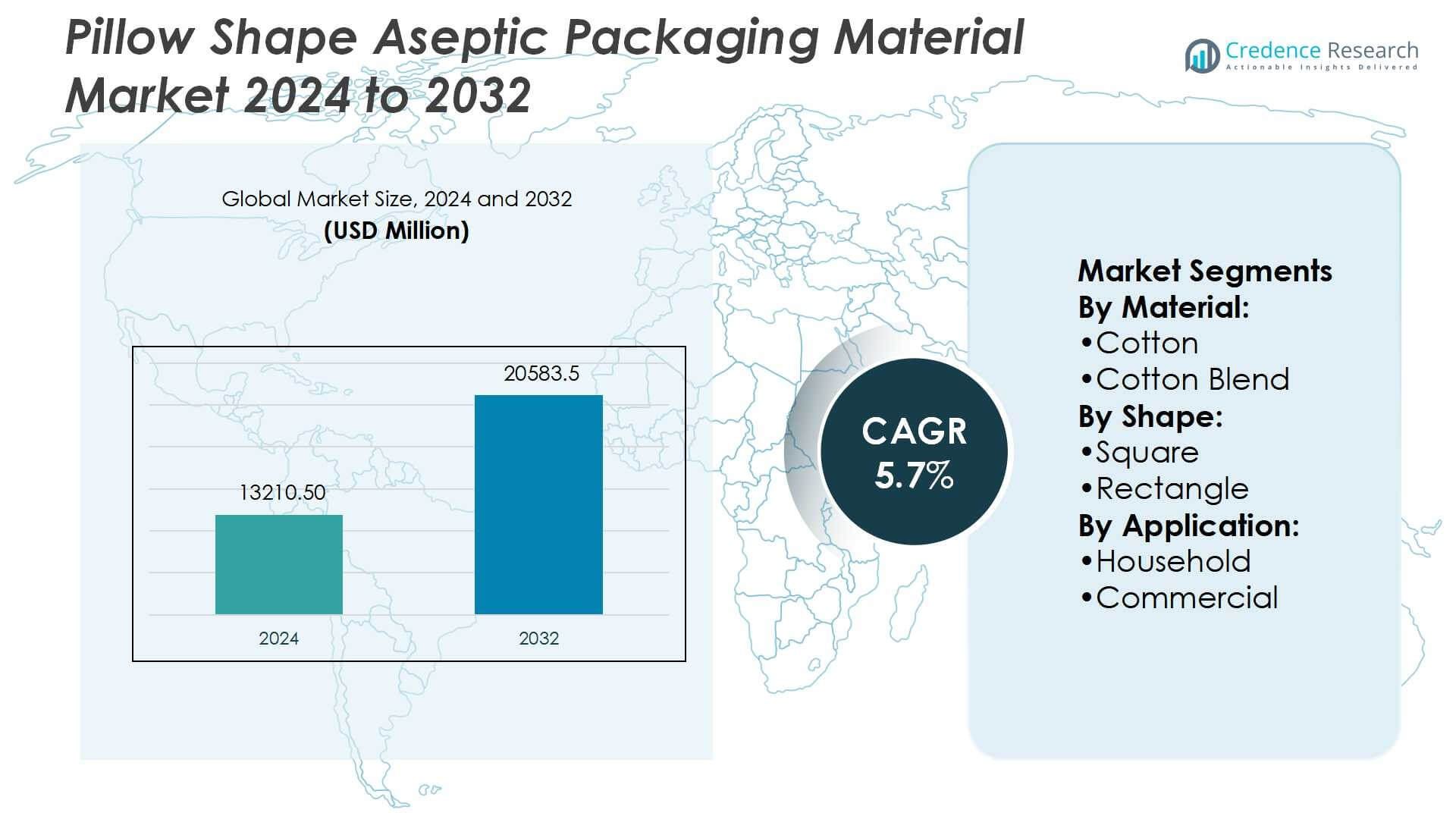

Pillow Shape Aseptic Packaging Material Market size was valued USD 13210.50 million in 2024 and is anticipated to reach USD 20583.5 million by 2032, at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pillow Shape Aseptic Packaging Material Market Size 2024 |

USD 13210.50 Million |

| Pillow Shape Aseptic Packaging Material Market, CAGR |

5.7% |

| Pillow Shape Aseptic Packaging Material Market Size 2032 |

USD 20583.5 Million |

The Pillow Shape Aseptic Packaging Material Market is shaped by prominent players including Wayfair (U.S.), Caldeira (U.K.), Jaipur Living (India), Paradise Pillow (Philadelphia), Crate & Barrel (U.S.), Ryohin Keikaku (MUJI) (Japan), Lacefield Designs (U.S.), Serena & Lily (U.S.), Bed Bath & Beyond (U.S.), and Shenzhen Fuanna Bedding Co (China). These companies strengthen their positions through sustainable material adoption, product innovation, and expansion into household and commercial segments. Asia-Pacific leads the global market with a 34% share, driven by rapid urbanization, strong manufacturing capacity, and growing e-commerce channels. The region’s emphasis on cost efficiency and eco-friendly packaging solutions reinforces its leadership in the global market landscape.

Market Insights

Market Insights

- The Pillow Shape Aseptic Packaging Material Market was valued at USD 13210.50 million in 2024 and is projected to reach USD 20583.5 million by 2032, growing at a CAGR of 5.7%.

- Strong demand for sustainable and eco-friendly materials such as cotton and cotton blends is driving growth, supported by rising household consumption and expanding commercial applications.

- Market players focus on innovation, premium designs, and e-commerce integration to remain competitive, with top companies strengthening their presence through sustainable product offerings and digital retail strategies.

- High production costs of biodegradable materials act as a restraint, making affordability a challenge for smaller firms while cost-sensitive regions continue to prefer synthetic alternatives.

- Asia-Pacific holds the largest share at 34%, followed by North America at 32% and Europe at 29%, while household applications dominate with 58% share, reinforcing the importance of convenience, hygiene, and premium packaging demand globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

In the Pillow Shape Aseptic Packaging Material Market, cotton holds the dominant share of 34%. Cotton leads due to its breathable nature, durability, and consumer preference for natural fabrics in premium pillow packaging. Its biodegradable profile also supports sustainability goals, strengthening its adoption in household and commercial uses. Cotton blends follow closely, offering a balance of cost efficiency and performance. Demand is further supported by regulatory push for eco-friendly materials, driving manufacturers to expand cotton-based packaging solutions and maintain their leadership in the material segment.

- For instance, ProAmpac has launched ProActive Recyclable FibreSculpt, a thermoforming material which boasts over 90% fibre content. The product is compliant with OPRL guidelines in the UK and Ireland.

By Shape

The square shape segment dominates the market with a 42% share. Square pillow packaging is favored for its versatility, space efficiency, and ease of stacking in both retail and logistics. Its uniform design lowers production costs and supports streamlined supply chain operations. Commercial users, including hospitality and retail, prefer square designs due to consistency in branding and storage. Rising consumer demand for compact and easy-to-handle pillow packs strengthens the position of square-shaped packaging, making it the leading format in the shape category.

- For instance, Amcor offers its Shield Pack Fitmented Small Pillow Pouches (Bag-in-Box) in capacities between 1 and 5 gallons. These pouches feature a multi-ply construction for protection against oxygen and moisture, and are available with various fitments.

By Application

Household applications account for the largest market share at 58%. Growing consumer preference for hygienic, sustainable, and aesthetically pleasing packaging drives demand in this segment. Household users favor pillow-shaped aseptic packaging for convenience, durability, and suitability in food storage and daily use. Strong growth in e-commerce and retail distribution further supports adoption at the household level. Meanwhile, commercial use is expanding steadily in hospitality and institutional sectors, but household applications remain dominant due to higher consumption frequency and stronger influence of eco-friendly material choices.

Key Growth Drivers

Rising Demand for Sustainable Materials

Sustainability is a key driver in the pillow shape aseptic packaging material market. Consumers and regulators increasingly favor eco-friendly materials such as cotton and cotton blends due to their biodegradability and reduced environmental impact. Companies are investing in recyclable and renewable options to align with green initiatives. This shift not only addresses environmental concerns but also boosts brand reputation. As awareness of plastic waste grows, sustainable packaging adoption accelerates, making eco-friendly materials central to market expansion and competitive differentiation.

- For instance, Bemis Associates has launched multiple seam tapes certified to the Recycled Claim Standard (RCS). For instance, its SRT4000RC tape is made with 89% post-consumer recycled polyester fabric, contributing to 43.3% recycled content by overall weight.

Growth in Household Consumption

The household segment dominates market demand, fueled by rising consumer focus on hygiene, convenience, and aesthetic appeal. Pillow-shaped aseptic packaging is widely used for food storage and daily household applications. Increasing retail and e-commerce penetration further accelerates household consumption, as compact and attractive pillow packs appeal to urban buyers. Manufacturers are introducing innovative designs to meet household preferences. The growing adoption of eco-conscious lifestyles and premium product packaging strengthens the household segment’s contribution to overall market growth.

- For instance, Billerud’s CrownBoard Prestige products offer grammages as low as 170 gsm with a 3-ply structure, combining 100% primary fibres to reduce board weight by up to 20% while retaining strength and shapeability for packaging such as pillow packs.

Expanding Commercial Applications

Commercial use in hospitality, healthcare, and retail sectors is steadily expanding, driving significant growth opportunities. Pillow-shaped aseptic packaging is favored in commercial environments for its space efficiency, easy handling, and hygienic properties. Hotels and institutions increasingly adopt sustainable pillow packaging to align with corporate social responsibility goals. Additionally, rising demand from food service chains for safe, compact, and cost-effective packaging solutions supports the segment’s growth. Strong demand in commercial spaces ensures long-term opportunities and adds stability to market development.

Key Trends & Opportunities

Innovation in Packaging Design

Advancements in design and printing technologies are creating opportunities for customized pillow-shaped aseptic packaging. Brands increasingly seek unique shapes, finishes, and eco-friendly printing to differentiate products and enhance consumer appeal. Digital printing enables small-batch runs with high-quality visuals, meeting seasonal or promotional demands. This trend supports brand loyalty while offering consumers more personalized experiences. As competition intensifies, design-driven differentiation and premium finishes present strong opportunities for players to capture niche and premium segments in the market.

- For instance, Dow’s RHOBARR™ 320 Barrier Dispersion coating is applied at low coat weights yet supports up to 99% fiber recovery when paper packaging is recycled, combining a fine finish with eco-friendly recyclability.

E-Commerce and Retail Expansion

The growth of e-commerce and organized retail is reshaping packaging demand, favoring pillow-shaped aseptic materials. Compact, lightweight, and durable packaging enhances logistics efficiency and supports online delivery models. Retailers prefer such packaging for its shelf appeal, while e-commerce players prioritize it for its ability to protect products during shipping. The increasing shift to online shopping drives continuous demand for innovative packaging that balances sustainability and convenience. This creates a long-term opportunity for manufacturers to tailor solutions for digital and retail supply chains.

- For instance, The OceanPoly® line of polyethylene bag materials contains a minimum of 25% post-consumer recycled plastic collected from coastal pollution areas. With an additional 25% of pre-consumer recycled content, the products feature a total of 50% recycled content in their film.

Key Challenges

High Production Costs of Sustainable Materials

One of the major challenges is the high production cost associated with eco-friendly materials such as cotton and biodegradable blends. These materials require specialized sourcing and processing, which increases manufacturing expenses. Smaller manufacturers often face difficulties adopting these solutions due to cost constraints, limiting scalability. Price-sensitive markets may continue favoring low-cost synthetic alternatives, slowing sustainable adoption. Without cost optimization strategies, widespread use of sustainable pillow packaging could be restricted, impacting growth potential in emerging economies.

Intense Market Competition

The market faces strong competition from both global players and regional manufacturers. Larger companies leverage scale, technology, and distribution networks to dominate, while smaller firms compete on price and customization. This competitive pressure often results in thin margins and challenges for new entrants. Rapid innovation cycles further intensify competition, requiring continuous investments in R&D and product differentiation. Companies failing to adapt to changing consumer preferences or sustainability standards risk losing market share in this highly competitive environment.

Regional Analysis

North America

North America holds a 32% share of the pillow shape aseptic packaging material market. The region benefits from strong demand in both household and commercial sectors, particularly in the U.S., where eco-friendly packaging adoption is driven by regulatory support and consumer awareness. Leading manufacturers actively invest in sustainable materials such as cotton and blends to align with environmental policies. E-commerce growth further boosts demand for compact, durable pillow-shaped packaging. With premiumization trends and strong innovation capabilities, North America remains a leading market with consistent opportunities for advanced packaging solutions.

Europe

Europe accounts for 29% of the market, supported by stringent environmental regulations and strong sustainability adoption. Countries like Germany, France, and the U.K. emphasize recyclable and biodegradable materials, accelerating the use of cotton-based packaging. The region’s advanced retail infrastructure and strong presence of multinational packaging firms also support market expansion. Pillow-shaped packaging is widely used across household and commercial applications, with design innovation playing a key role in brand differentiation. Europe’s sustainability-driven policies and consumer eco-consciousness position it as a mature yet steadily growing regional market.

Asia-Pacific

Asia-Pacific leads with a 34% share, making it the largest regional market. Rapid urbanization, growing disposable incomes, and expanding e-commerce in countries such as China, India, and Japan drive demand for compact and cost-effective pillow-shaped aseptic packaging. The region’s manufacturing base supports large-scale production, helping companies offer affordable sustainable options. Household consumption dominates, supported by changing lifestyles and increased focus on hygiene. With a strong push toward sustainability and expanding commercial use in hospitality and retail, Asia-Pacific presents significant growth potential and remains the most dynamic market globally.

Latin America

Latin America captures a 3% share of the pillow shape aseptic packaging material market. Growth is primarily concentrated in Brazil and Mexico, where rising middle-class consumption and food service expansion support packaging demand. Household applications dominate due to growing awareness of sustainable solutions. However, limited affordability of eco-friendly materials constrains adoption compared to synthetic options. Commercial sectors, including hospitality, are gradually shifting to pillow-shaped packaging for space efficiency. Despite economic challenges, urbanization and regional retail development are expected to drive steady growth, with opportunities for sustainable packaging adoption over the forecast period.

Middle East & Africa (MEA)

The Middle East & Africa region holds a 2% share of the market, reflecting its early-stage adoption. Growth is centered in Gulf countries, where rising urbanization and retail expansion create demand for modern packaging solutions. Household applications dominate, but commercial use in hospitality and healthcare is gradually increasing. Limited manufacturing capacity and cost barriers for sustainable materials hinder large-scale adoption. However, growing awareness of eco-friendly packaging and investments in retail infrastructure provide long-term opportunities. While MEA remains a smaller market, it offers emerging growth potential as sustainability trends strengthen regionally.

Market Segmentations:

By Material:

By Shape:

By Application:

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The competitive landscape of the Pillow Shape Aseptic Packaging Material Market features key players such as Wayfair (U.S.), Caldeira (U.K.), Jaipur Living (India), Paradise Pillow (Philadelphia), Crate & Barrel (U.S.), Ryohin Keikaku (MUJI) (Japan), Lacefield Designs (U.S.), Serena & Lily (U.S.), Bed Bath & Beyond (U.S.), and Shenzhen Fuanna Bedding Co (China). The competitive landscape of the Pillow Shape Aseptic Packaging Material Market is defined by strong innovation, sustainability initiatives, and regional expansion. Companies focus on developing eco-friendly materials such as cotton and biodegradable blends to meet regulatory requirements and consumer demand for green packaging. Design differentiation and premium finishes play a key role in brand positioning, while e-commerce integration enhances direct-to-consumer reach. Market players increasingly invest in digital printing technologies to support customization and small-batch production. Competitive pressure encourages continuous R&D, driving advancements in lightweight, durable, and sustainable pillow-shaped packaging that caters to both household and commercial applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Wayfair (U.S.)

- Caldeira (U.K.)

- Jaipur Living (India)

- Paradise Pillow (Philadelphia)

- Crate & Barrel (U.S.)

- Ryohin Keikaku (MUJI) (Japan)

- Lacefield Designs (U.S.)

- Serena & Lily (U.S.)

- Bed Bath & Beyond (U.S.)

- Shenzhen Fuanna Bedding Co (China)

Recent Developments

- In March 2025, Corvaglia Group, a leading global manufacturer of innovative closure solutions, presents the SabreCap, its first closure for aseptic carton packaging. The SabreCap can be seamlessly integrated into existing carton packaging filling lines without any technical adjustments. It thus offers bottling companies a high degree of flexibility and investment security.

- In January 2025, BEDGEAR expanded its modular hybrid mattress lineup and updated its pillow and sheet collections at the Las Vegas Market. The company highlighted its sustainability efforts by incorporating recycled materials in its pillows and launching tree-planting initiatives linked to e-commerce purchases.

- In October 2024, UFlex announced plans to expand its aseptic packaging capacity in Egypt through its wholly-owned subsidiary, Flex Asepto (Egypt) SAE. The company has decided to invest in a new facility with an annual production capacity of 12 billion packs. This expansion is expected to strengthen UFlex’s position in the Egyptian market and support the growing demand for aseptic packaging solutions in the region.

- In June 2024, Syntegon announced the acquisition of Telstar. This strategic move was expected to strengthen Syntegon’s capabilities in pharmaceutical processing and packaging, particularly in the area of lyophilized vial filling.

Report Coverage

The research report offers an in-depth analysis based on Material, Shape, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow with strong demand for sustainable materials.

- Cotton and cotton blends will remain the leading choice in premium packaging.

- Digital printing and customization will drive product differentiation in retail.

- Household consumption will dominate due to hygiene and convenience needs.

- Commercial adoption will rise in hospitality and healthcare sectors.

- E-commerce growth will create higher demand for compact pillow-shaped packaging.

- Asia-Pacific will remain the fastest-growing region with strong manufacturing support.

- North America and Europe will lead in sustainable packaging adoption.

- High production costs of eco-friendly materials will challenge smaller players.

- Innovation in lightweight and recyclable designs will shape future competitiveness.

Market Insights

Market Insights