| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cable Protection Tubes Market Size 2023 |

USD 7,933.25 Million |

| Cable Protection Tubes Market, CAGR |

7.54% |

| Cable Protection Tubes Market Size 2032 |

USD 14,127.36 Million |

Market Overview:

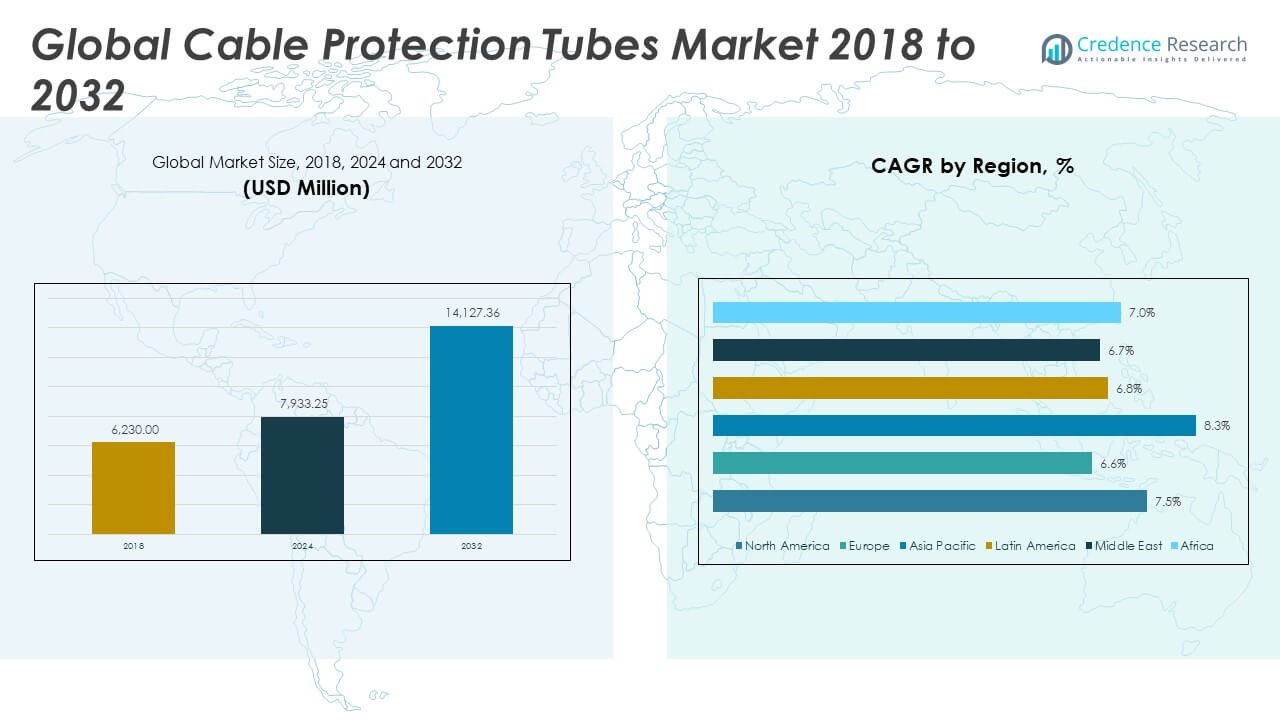

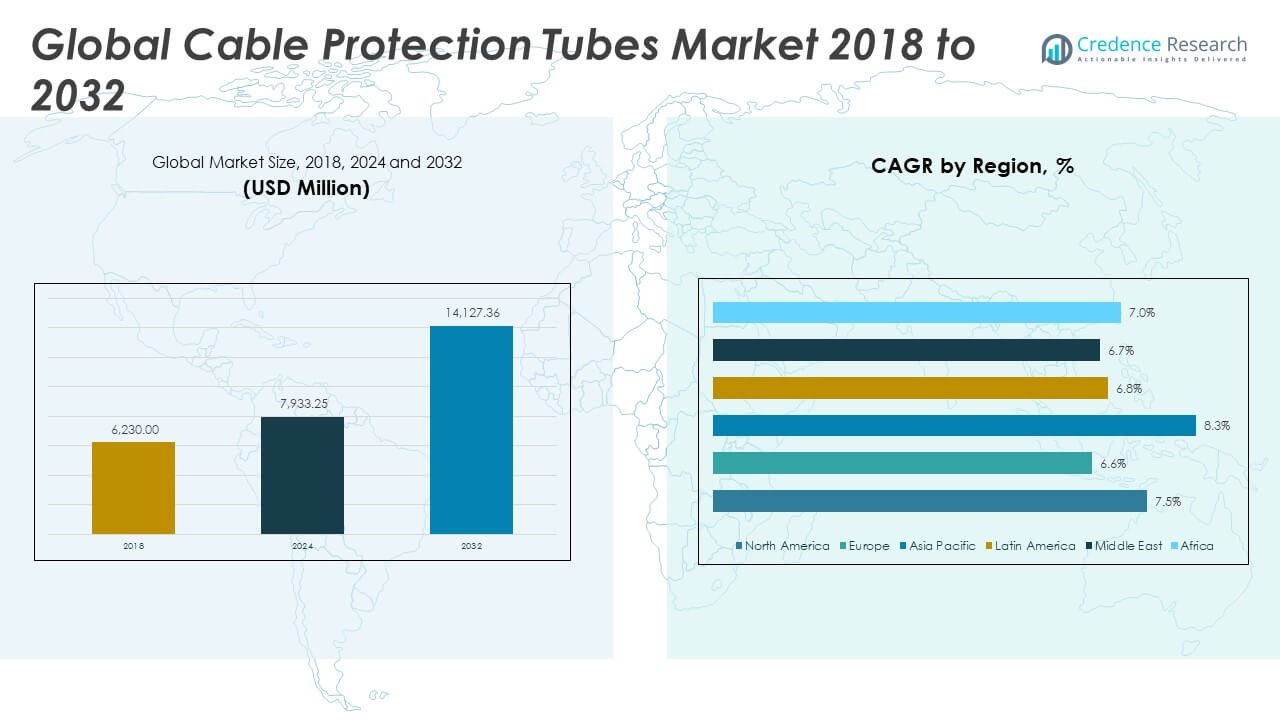

The Cable Protection Tubes Market size was valued at USD 6,230.00 million in 2018 to USD 7,933.25 million in 2024 and is anticipated to reach USD 14,127.36 million by 2032, at a CAGR of 7.54% during the forecast period.

The Cable Protection Tubes Market is experiencing robust growth due to several key drivers shaping demand across industries. The rapid development of urban infrastructure, including smart cities, transportation networks, and industrial corridors, is driving the need for reliable cable protection systems. These tubes ensure the safety and longevity of underground and surface-laid cables, especially in energy, telecommunications, and utility sectors. Technological advancements in tube materials such as HDPE, PVC, GRP, and FRP have significantly improved product durability, flexibility, UV resistance, and ease of installation, making them well-suited for complex, large-scale deployments. The proliferation of fiber optic cables in telecom networks, the expansion of electric vehicle charging infrastructure, and the rising investment in renewable energy installations are further contributing to the surge in demand. Additionally, growing awareness of safety regulations and environmental standards is pushing industries toward certified and eco-friendly protection solutions. These collective factors are strengthening the market’s growth trajectory and encouraging continuous product innovation and expansion strategies.

Regionally, the Asia-Pacific market leads the global cable protection tubes industry, driven by large-scale infrastructure projects, ongoing urbanization, and the expansion of telecommunications and energy networks in countries such as China, India, and South Korea. The region benefits from both strong government initiatives and private investments aimed at modernizing public utilities and expanding digital connectivity. North America, particularly the United States, also holds a significant share, supported by infrastructure modernization programs, rapid deployment of renewable energy assets, and a growing focus on electric mobility. Europe follows closely, where stringent regulatory standards, sustainability targets, and renovation of aging infrastructure are fueling steady market growth. Meanwhile, Latin America and the Middle East & Africa regions are emerging as high-potential markets due to increasing investments in smart grid systems, power generation, and transportation upgrades.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Cable Protection Tubes Market is projected to grow from USD 7,933.25 million in 2024 to USD 14,127.36 million by 2032, at a CAGR of 7.54%, reflecting strong industrial and infrastructure demand worldwide.

- Rapid infrastructure modernization, including smart cities, energy corridors, and transport networks, is significantly increasing the need for cable protection systems across urban and industrial environments.

- Telecom expansion and 5G network rollouts are accelerating protective tubing adoption, especially for safeguarding fiber optic cables in both developed and emerging markets.

- Material innovation, such as advanced polymers and flame-retardant composites, is improving tube durability, flexibility, and ease of deployment in harsh operating conditions.

- Rising compliance with international safety and environmental standards is prompting industries to adopt certified, eco-friendly, and fire-resistant cable protection solutions.

- High costs of advanced materials and specialized installation processes are limiting adoption in cost-sensitive markets and small-scale infrastructure projects.

- Asia Pacific dominates regional growth, followed by North America and Europe, while Latin America, the Middle East, and Africa present strong future potential through investments in digital infrastructure and power networks.

Market Drivers:

Infrastructure Modernization Across Sectors is Creating Strong Demand

The surge in infrastructure development across transportation, energy, and smart city projects is significantly driving the Cable Protection Tubes Market. Governments and private investors are prioritizing underground and overhead utility installations to improve reliability and reduce maintenance costs. These projects require robust protection for electrical and communication cables, particularly in urban and industrial zones. It is benefiting from this demand by providing solutions that protect cables from physical stress, moisture, corrosion, and environmental wear. The construction of highways, rail networks, airports, and energy grids continues to expand in both developed and developing nations. This infrastructure boom is reinforcing the market’s relevance and fostering consistent procurement of durable and flexible tubing systems.

- For example, The U.S. Infrastructure Investment and Jobs Act allocates $1.2 trillion for transportation, energy, broadband, and utility upgrades. Industry reports confirm growing demand for cable protection solutions driven by infrastructure and grid modernization.

Expanding Telecommunications and Fiber Optic Networks Accelerate Adoption

The rapid rollout of broadband connectivity and 5G networks is expanding the global demand for cable protection systems. Telecom service providers require secure pathways for fiber optic cables in both urban and rural environments, leading to a rise in protective tubing installations. The Cable Protection Tubes Market is witnessing strong traction from these developments, as network uptime and longevity depend on protecting sensitive data cables from external threats. The trend is particularly evident in emerging markets investing heavily in digital infrastructure. Government-backed connectivity programs and private sector expansions are collectively driving the need for cable management and shielding systems. This dynamic is positioning the market as a critical enabler of global digital transformation.

Material Advancements and Product Innovation Improve Functionality

Manufacturers are investing in advanced materials to enhance the performance, flexibility, and cost-efficiency of cable protection tubes. Innovations in polymers, composites, and flame-retardant compounds are enabling tubes to withstand harsh environmental and operational conditions. It is benefiting from these advancements by offering products that meet varied application needs, including resistance to UV exposure, chemical corrosion, and mechanical impacts. These developments also support easier installation and longer operational life, which align with evolving customer requirements. The focus on lightweight, recyclable, and compliant materials is also driving product upgrades across industries. These innovations are not only enhancing reliability but also enabling faster deployment in complex infrastructure layouts.

Regulatory Compliance and Safety Standards Fuel Market Penetration

Rising awareness of electrical safety, fire resistance, and environmental protection is prompting industries to adopt certified cable protection solutions. Governments and industry bodies are enforcing stricter regulations regarding cable insulation, conduit durability, and fire containment. The Cable Protection Tubes Market is responding to these challenges by aligning products with international standards such as ISO, IEC, and UL. Compliance ensures reliability and reduces operational risks, especially in critical sectors like energy, transportation, and construction. Companies are increasingly prioritizing certified systems to mitigate liability and meet procurement guidelines. This regulatory push is strengthening the adoption of technically advanced, safety-compliant cable protection systems across the global market.

- For example, Rigid PVC conduits certified under UL 651 must retain structural integrity after 168 hours of aging and 24 hours of water submersion. They also meet strict impact and flame resistance standards as part of UL 651 compliance.

Market Trends:

Growing Preference for Smart and Sensor-Enabled Protection Systems

The integration of smart technologies into cable management systems is becoming a key trend across industries. Manufacturers are embedding sensors and monitoring capabilities within protection tubes to enable real-time diagnostics and fault detection. This shift is enhancing preventive maintenance strategies and reducing the risk of system failure in high-risk environments. The Cable Protection Tubes Market is evolving to meet this demand by incorporating IoT-ready features into product designs. These smart solutions are especially valuable in mission-critical applications like power transmission, railways, and data centers. The ability to track performance and identify faults remotely is reshaping expectations around system reliability and maintenance.

- For example, the ABB Smart Cable Protection System utilizes wireless, self-charging smart sensors capable of detecting key fault indicators such as condensation, leakage, fractures, and high heat within cable conduits.

Surge in Modular and Pre-Engineered System Adoption

Demand for modular cable protection systems is rising as industries prioritize rapid deployment and system scalability. Pre-engineered tube systems offer time-saving advantages, especially in large-scale projects with tight timelines and complex cable layouts. It is responding to this need by offering solutions that feature plug-and-play components, adjustable configurations, and reduced labor requirements. These modular systems are gaining popularity in sectors like manufacturing, oil and gas, and renewable energy. They support streamlined installation and easy integration with existing infrastructure, which increases operational efficiency. This trend is shifting procurement preferences toward systems that offer adaptability and low installation overheads.

- For example, The Yellow Jacket® Modular Cable Protector System (AMS) features interlocking channels measuring 10″ high × 1.25″ wide, with a modular design that allows adding sections to accommodate an unlimited number of cables.

Aesthetic Integration in Urban and Architectural Projects

Urban planners and architects are increasingly demanding cable protection systems that blend seamlessly with modern infrastructure designs. The trend is pushing manufacturers to develop low-profile, color-customizable, and compact tube variants. The Cable Protection Tubes Market is adapting by introducing products that provide both functional safety and visual conformity to the built environment. These solutions are particularly relevant in commercial buildings, smart lighting installations, and public spaces where visual appeal is a consideration. Aesthetic-driven demand is fostering a design-centric approach in product development and specification. It reflects a broader push to harmonize functionality with urban design principles.

Focus on Lifecycle Sustainability and Recyclability

Environmental considerations are shaping product development strategies in the cable protection space. Stakeholders are demanding solutions with reduced carbon footprints, longer service lives, and end-of-life recyclability. The Cable Protection Tubes Market is shifting toward using eco-friendly polymers, recycled materials, and circular design practices. Governments and corporate clients are aligning their purchasing decisions with green procurement policies, reinforcing the need for sustainable cable protection systems. This trend is influencing supply chains, material sourcing, and product certifications. The emphasis on environmental compliance is reshaping market competition and encouraging innovation in low-impact, high-performance products.

Market Challenges Analysis:

High Material and Installation Costs Limit Widespread Adoption

One of the major challenges in the Cable Protection Tubes Market is the high cost associated with premium materials and complex installation requirements. Advanced tubes made from GRP, FRP, or flame-retardant polymers offer superior protection but carry significantly higher procurement and maintenance costs. This becomes a barrier, especially for small-scale infrastructure projects and budget-constrained markets. It faces resistance in cost-sensitive sectors where conventional conduits or unprotected cabling are still widely used. The need for skilled labor and specialized tools for installation further escalates overall project expenses. These cost-related concerns continue to restrict market penetration in developing regions and among smaller contractors.

Lack of Standardization and Compatibility Across Systems

The absence of globally harmonized standards for cable protection tubes complicates product interoperability and regulatory compliance. Manufacturers often design products to meet local codes, which hinders cross-border scalability and limits supplier flexibility. The Cable Protection Tubes Market encounters challenges when clients require customized configurations that may not align with off-the-shelf systems. It struggles to achieve universal compatibility with existing infrastructure, particularly in retrofit projects. Discrepancies in performance benchmarks and certification protocols further delay procurement decisions. This lack of uniformity increases engineering complexity and slows adoption across multinational infrastructure developments.

Market Opportunities:

Expansion of Renewable Energy and EV Infrastructure Unlocks New Applications

The global transition to renewable energy and the expansion of electric vehicle (EV) charging infrastructure present strong growth avenues for the Cable Protection Tubes Market. Solar farms, wind parks, and EV networks require extensive underground and overhead cable routing, which increases the demand for robust protection systems. It stands to benefit from the rising need to secure power lines and communication cables in harsh and remote environments. Government initiatives and clean energy investments are accelerating deployments across both developed and emerging markets. These large-scale installations demand durable, corrosion-resistant, and flexible tubing solutions tailored to energy sector requirements. The opportunity lies in aligning product offerings with evolving green energy and mobility standards.

Smart Infrastructure and Industrial Automation Drive Strategic Adoption

Smart buildings, intelligent transport systems, and Industry 4.0 upgrades are driving demand for advanced cable management solutions. These applications require high-performance protective systems to support complex sensor networks, data lines, and power cables. The Cable Protection Tubes Market is well-positioned to serve this demand with products that offer integrated functionality, quick deployment, and long service life. Increased automation in manufacturing and logistics hubs calls for protective tubing that ensures uninterrupted power and data flow. The opportunity lies in customizing solutions for smart infrastructure projects where reliability, modularity, and real-time monitoring are key procurement criteria.

Market Segmentation Analysis:

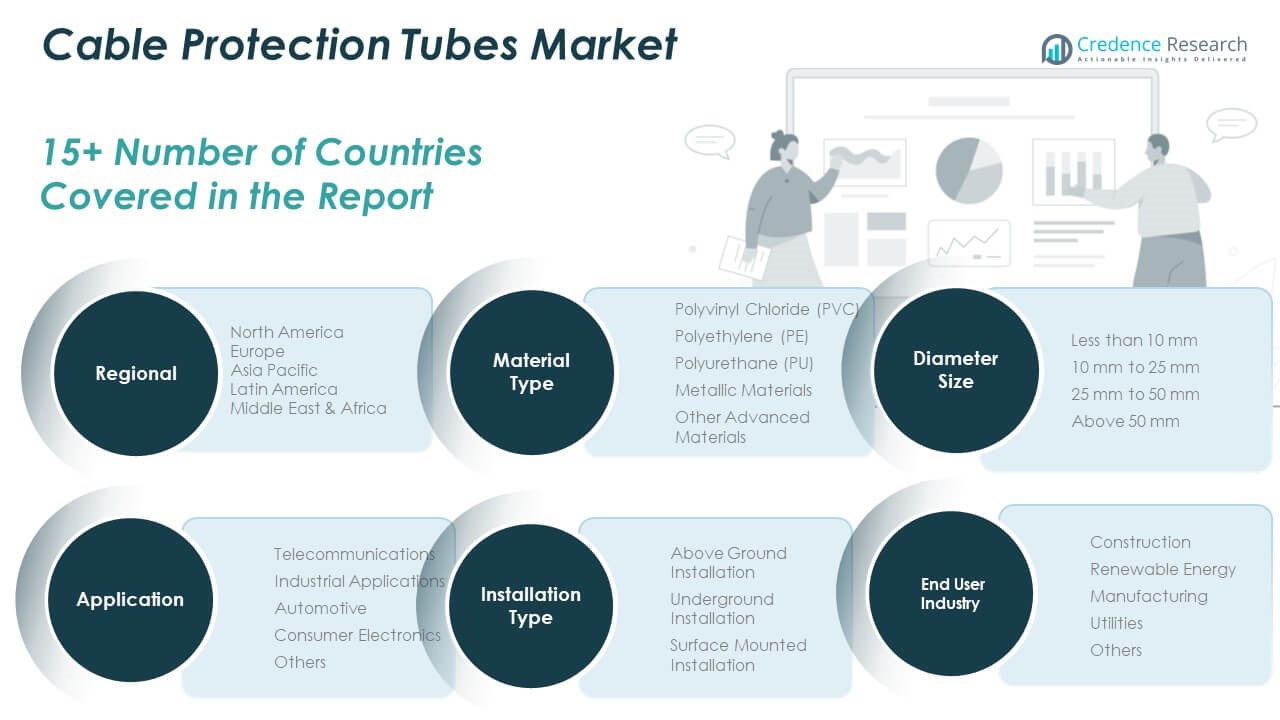

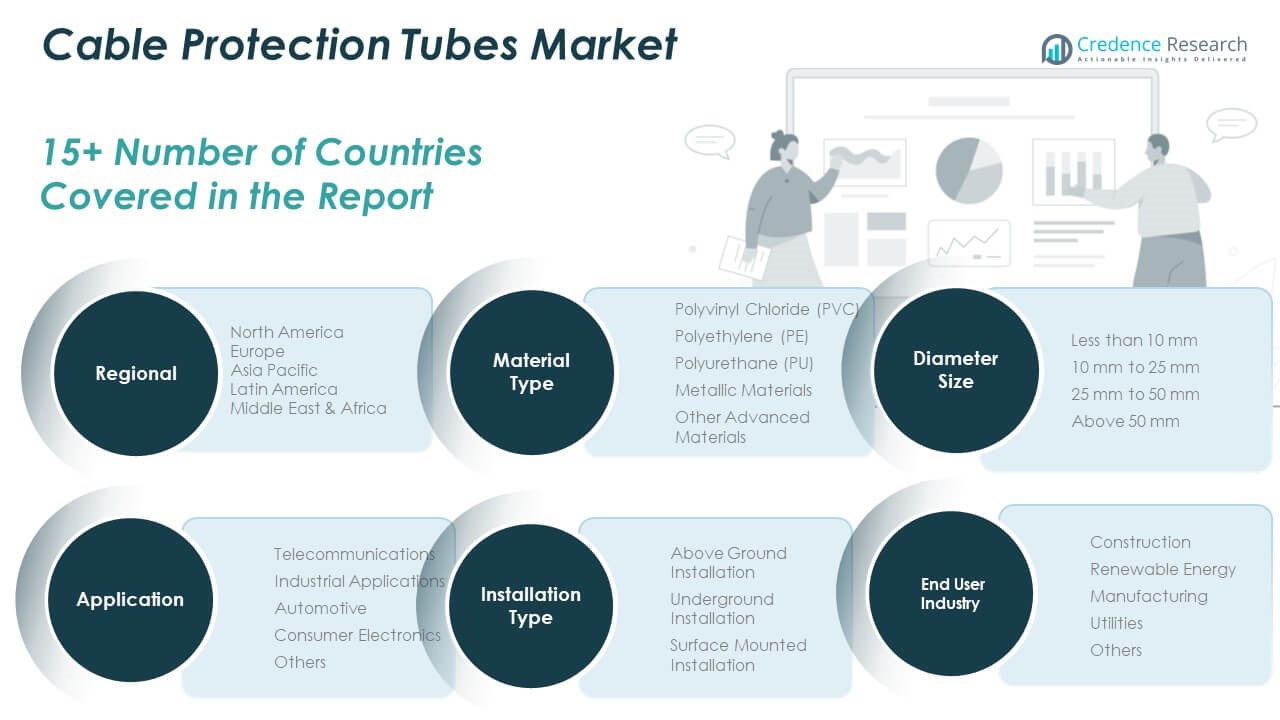

The Cable Protection Tubes Market is segmented by material type, application, end-user, diameter size, and installation type, reflecting its diverse industrial relevance.

By material type, polyethylene (PE) and polyvinyl chloride (PVC) lead in demand due to their cost-effectiveness, flexibility, and chemical resistance. Polyurethane (PU) and metallic materials cater to environments requiring high mechanical strength and thermal stability, while advanced materials offer premium performance in specialized sectors.

- For example, ABB’s PMA® XR90 conduit is made from polyamide-12 and offers a service temperature range of –40°C to +95°C (short-term up to +150°C). It meets UL94 V0 flame-retardance and complies with EN 61386 performance standards.

By application, telecommunications hold a significant share driven by fiber optic deployments, followed by industrial applications and automotive sectors where wiring integrity is critical. Consumer electronics and other niche uses contribute to growing adoption in smaller-scale environments.

- For example, Corning’s ALTOS® gel-free cables feature water-swellable PE jackets for longitudinal water blocking and mechanical protection, designed for telecom duct and aerial installations. They comply with GR-20 and ICEA standards, though no public source confirms a 45 kgf crush rating or 2.5 million km installed.

By end user, The Cable Protection Tubes Market serves a broad end-user base including construction, renewable energy, manufacturing, and utilities, where durability and compliance guide product selection.

By diameter size, the 10 mm to 25 mm segment remains dominant due to its versatility across industries. Larger sizes above 25 mm are preferred in power infrastructure. In terms of installation, underground systems account for the largest share due to safety and regulatory preferences, followed by above-ground and surface-mounted configurations.

Segmentation:

By Material Type:

- Polyvinyl Chloride (PVC)

- Polyethylene (PE)

- Polyurethane (PU)

- Metallic Materials

- Other Advanced Materials

By Application:

- Telecommunications

- Industrial Applications

- Automotive

- Consumer Electronics

- Others

By End-User:

- Construction

- Renewable Energy

- Manufacturing

- Utilities

- Others

By Diameter Size:

- Less than 10 mm

- 10 mm to 25 mm

- 25 mm to 50 mm

- Above 50 mm

By Installation Type:

- Above Ground Installation

- Underground Installation

- Surface Mounted Installation

By Region:

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis:

North America

The North America Cable Protection Tubes Market size was valued at USD 1,577.44 million in 2018 to USD 1,973.74 million in 2024 and is anticipated to reach USD 3,497.79 million by 2032, at a CAGR of 7.5% during the forecast period. The region accounts for approximately 22.6% of the global market share. It benefits from steady investments in electric utility upgrades, smart grid development, and advanced data centers. The U.S. leads the regional market due to its early adoption of high-specification conduit systems and growing deployment of renewable energy and EV infrastructure. Government funding for broadband expansion and electric mobility is further driving regional demand. Canada follows with a growing focus on clean energy transmission and urban infrastructure modernization. The region shows strong uptake of high-performance materials like FRP and HDPE across commercial, industrial, and residential applications.

Europe

The Europe Cable Protection Tubes Market size was valued at USD 1,274.04 million in 2018 to USD 1,541.21 million in 2024 and is anticipated to reach USD 2,546.49 million by 2032, at a CAGR of 6.6% during the forecast period. Europe holds around 17.8% of the global market share, driven by stringent regulatory frameworks and sustainability goals. Countries like Germany, France, and the U.K. are investing in grid reliability, offshore wind farms, and electric rail infrastructure. It benefits from increased focus on fire-resistant and recyclable cable management systems that align with EU directives. The market also sees rising demand in retrofitting aging infrastructure in urban centers. Advanced manufacturing hubs across Western Europe are integrating automated systems that require extensive protected cabling. This regional push for compliance and environmental performance supports consistent growth.

Asia Pacific

The Asia Pacific Cable Protection Tubes Market size was valued at USD 2,292.64 million in 2018 to USD 3,005.48 million in 2024 and is anticipated to reach USD 5,692.18 million by 2032, at a CAGR of 8.3% during the forecast period. Asia Pacific dominates the global market with a share exceeding 34%, led by rapid urbanization, industrial expansion, and government-led infrastructure programs. China and India are the primary growth engines, focusing on high-voltage power transmission, metro rail, and smart city developments. It is experiencing strong momentum from telecom fiber rollouts and solar energy projects. Southeast Asian countries are investing in coastal and urban resilience programs, creating further demand. Local production capacities and competitive pricing also support regional market expansion. The presence of global and domestic players boosts product availability and innovation.

Latin America

The Latin America Cable Protection Tubes Market size was valued at USD 543.88 million in 2018 to USD 687.73 million in 2024 and is anticipated to reach USD 1,160.84 million by 2032, at a CAGR of 6.8% during the forecast period. The region contributes roughly 8.1% to the global market share. Brazil and Mexico are the key contributors, supported by energy diversification programs and industrial corridor developments. It is gaining traction in sectors such as mining, transportation, and telecommunications. Public infrastructure upgrades and regional electrification projects are driving tube installations. The demand for low-cost, durable, and compliant solutions is prompting manufacturers to localize production. The market is gradually shifting toward modular and environmentally friendly options suited for tropical and rugged conditions.

Middle East

The Middle East Cable Protection Tubes Market size was valued at USD 361.34 million in 2018 to USD 441.04 million in 2024 and is anticipated to reach USD 736.11 million by 2032, at a CAGR of 6.7% during the forecast period. The region accounts for around 5.3% of the global market share. It is witnessing demand driven by mega-infrastructure projects, oil and gas investments, and smart city developments in countries like the UAE and Saudi Arabia. Harsh climatic conditions require UV-resistant and thermally stable cable protection solutions. Expansion of airport facilities, stadiums, and renewable energy parks is also contributing to market momentum. Governments are enforcing safety and durability standards for cabling systems in large-scale public utilities. The market is poised to grow with ongoing diversification of Gulf economies.

Africa

The Africa Cable Protection Tubes Market size was valued at USD 180.67 million in 2018 to USD 284.04 million in 2024 and is anticipated to reach USD 493.94 million by 2032, at a CAGR of 7.0% during the forecast period. Africa holds an estimated 3.7% of the global market share and is emerging as a high-potential region. Investments in rural electrification, cross-border transmission lines, and telecom infrastructure are creating fresh opportunities. It benefits from foreign aid, development bank funding, and public-private partnerships aimed at energy access. Countries like South Africa, Kenya, and Nigeria are leading in grid modernization and digital connectivity. Market expansion is supported by the demand for weather-resistant and cost-effective protection systems. The region is expected to attract more manufacturers offering tailored solutions for remote and resource-constrained environments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ABB

- HellermannTyton

- Farinia Group

- Bide Science and Technology

- Thomas & Betts

- Gerich GmbH

- Symalit AG

- Conductix Wampfler

- Cavotec SA

- HUMMEL AG

- GANTREX

- NORRES Group

- Schlemmer

- DKC Group

- HELUKABEL

- Flexicon

Competitive Analysis:

The Cable Protection Tubes Market features a competitive landscape dominated by global players and supported by a growing base of regional manufacturers. Key companies such as ABB Ltd., Atkore International, Eaton Corporation, HellermannTyton, and PMA AG focus on expanding product portfolios through innovation in materials, design, and compliance standards. It is marked by strategic partnerships, mergers, and acquisitions aimed at strengthening distribution networks and technological capabilities. Players compete on durability, customization, ease of installation, and pricing efficiency. Regional manufacturers are gaining ground by offering localized solutions tailored to specific climate and infrastructure needs. The market also sees increasing emphasis on sustainable and recyclable materials, prompting companies to adapt production practices. Competitive intensity remains high due to the rising demand from infrastructure, telecommunications, and energy sectors. Companies that invest in smart protection systems, modular designs, and environmental compliance are securing long-term growth and reinforcing their global market presence.

Recent Developments:

- In March 2025, ABB launched the ABB Ability™ Industrial Knowledge Vault, a digital platform developed to capture and operationalize industrial expertise, with a focus on supporting its electrification segment. This launch holds relevance for the Cable Protection Tubes Market, as ABB’s electrification portfolio includes advanced cable protection systems. The platform is designed to enhance operational efficiency, knowledge retention, and decision-making across infrastructure and industrial environments, reinforcing ABB’s position in delivering integrated and intelligent cable management solutions.

- In June 2023, Conductix-Wampfler formed a strategic partnership with R3 Solutions to develop exclusive WiFi 6 products aimed at advancing data transmission and cable protection management in industrial mobility applications. This collaboration is significant for the Cable Protection Tubes Market, as Conductix-Wampfler’s core expertise in conductor rail systems and cable protection products aligns with the demand for integrated, high-performance solutions.

- In April 2023, HellermannTyton acquired Höhle, a specialist in microduct systems for fiber optic cables, as part of their strategy to expand their presence in the fiber broadband and conduit solutions market for telecommunications infrastructure.

Market Concentration & Characteristics:

The Cable Protection Tubes Market demonstrates moderate to high market concentration, with a mix of established global firms and emerging regional players. It is characterized by product standardization, strong regulatory influence, and increasing demand for material innovation. Leading companies focus on high-performance solutions that meet evolving safety, environmental, and installation requirements across diverse applications. The market exhibits steady technological advancement, with a growing shift toward smart tubing systems and recyclable materials. Customization, modular design, and compliance with global standards shape procurement decisions. Entry barriers remain moderate due to technical expertise and capital requirements, but regional manufacturers continue to expand through cost-effective offerings. Competitive differentiation hinges on durability, ease of deployment, and alignment with sector-specific needs.

Report Coverage:

The research report offers an in-depth analysis based on material type, application, end-user, diameter size, and installation type, It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption of fiber optic networks will drive demand for durable underground cable protection systems.

- Expansion of renewable energy projects will increase the need for UV-resistant and corrosion-proof tubing.

- Smart city infrastructure will boost the deployment of intelligent cable protection with integrated monitoring features.

- Growth in electric vehicle charging networks will create new applications for flexible and heat-resistant tubing.

- Advancements in recyclable and eco-friendly materials will reshape product development strategies.

- Regulatory shifts toward stricter fire safety and insulation standards will influence purchasing behavior.

- Modular and pre-engineered systems will gain traction for their fast installation and scalability.

- Emerging markets in Africa and Southeast Asia will present strong opportunities for localized production.

- Integration of IoT in industrial automation will increase demand for high-performance cable management solutions.

- Strategic collaborations and technological investments will define competitive positioning and market share.