Market Overview:

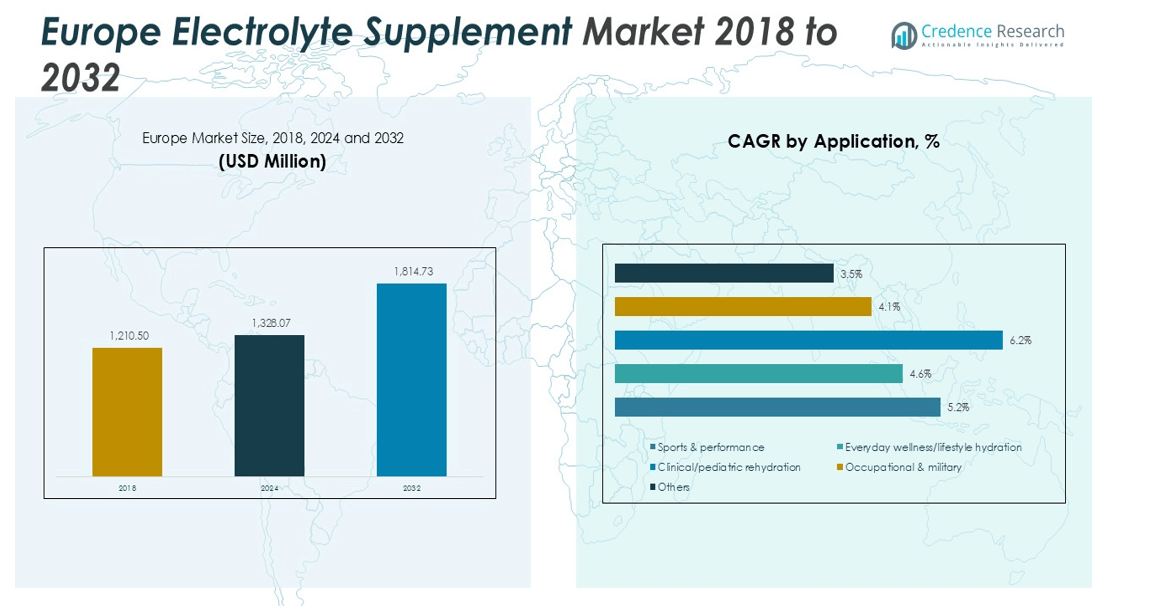

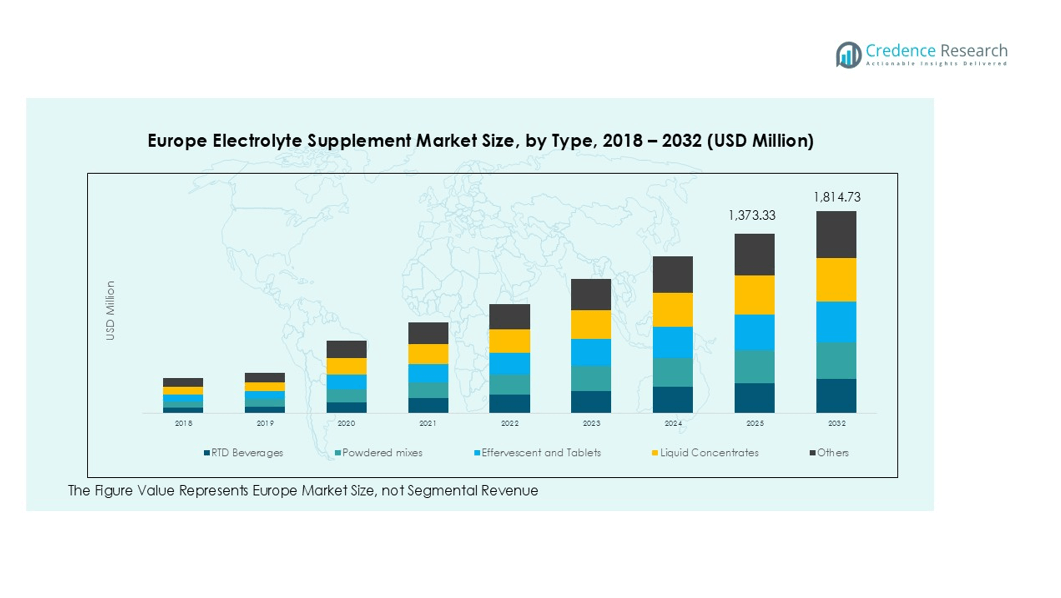

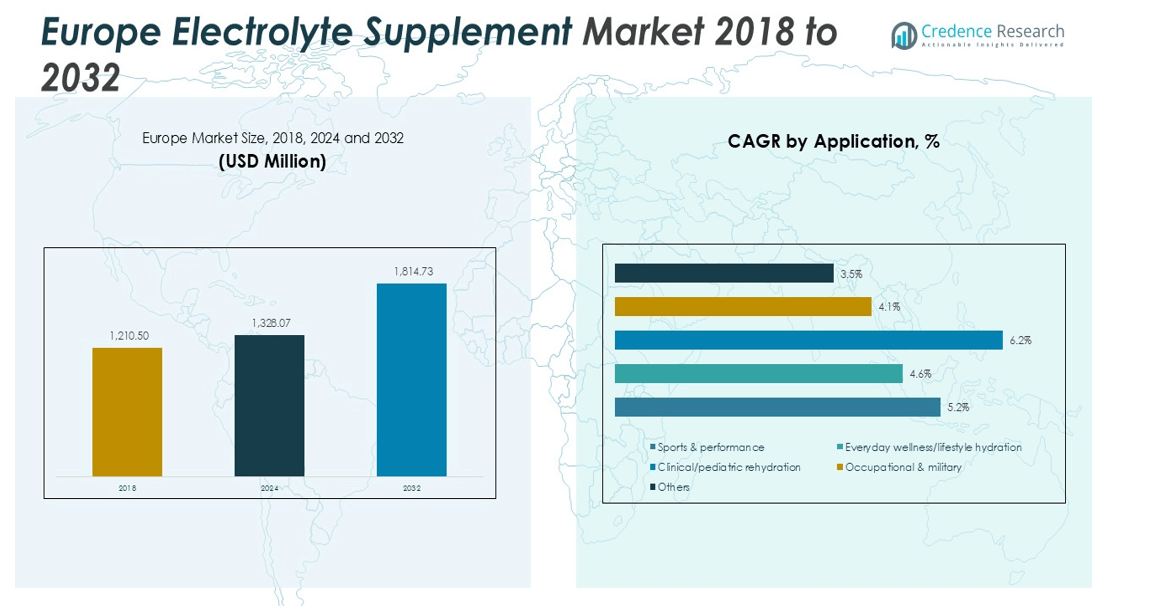

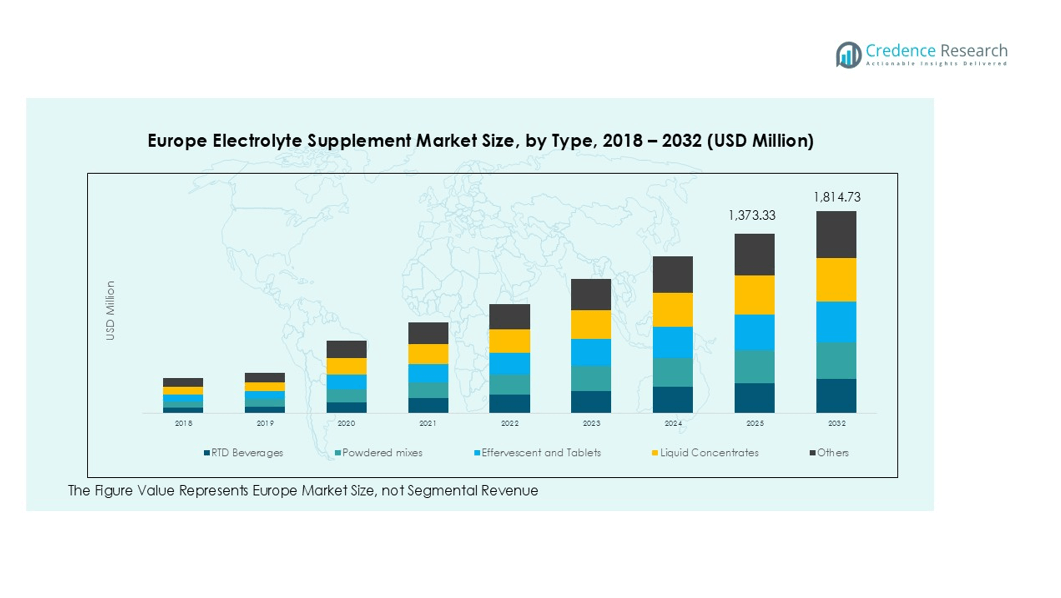

The Europe Electrolyte Supplement Market size was valued at USD 1,210.50 million in 2018 to USD 1,328.07 million in 2024 and is anticipated to reach USD 1,814.73 million by 2032, at a CAGR of 2.93% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Dairy Herd Management Market Size 2024 |

USD 1,328.07 million |

| Europe Dairy Herd Management Market, CAGR |

2.93% |

| Europe Dairy Herd Management Market Size 2032 |

USD 1,814.73 million |

Key drivers of market growth include the rising demand for electrolyte supplements to enhance physical performance, support recovery, and address dehydration issues. Additionally, the growing trend of active and healthy lifestyles has led to a surge in the consumption of electrolyte products such as drinks, powders, and capsules. The market is also benefiting from a shift towards natural and organic electrolyte supplement options, as consumers are becoming more health-conscious and prefer plant-based or sugar-free formulations.

Geographically, the market is experiencing strong growth across Western and Northern Europe, with the highest demand observed in the UK, Germany, and France. These regions have a high concentration of health-conscious consumers and a well-established retail infrastructure for sports and wellness products. Eastern Europe is also witnessing steady growth, supported by increasing awareness and availability of electrolyte supplements in key markets.

Market Insights:

- The Europe Electrolyte Supplement Market size was valued at USD 1,210.50 million in 2018 and is projected to reach USD 1,814.73 million by 2032, growing at a CAGR of 2.93%.

- Rising demand for electrolyte supplements to improve physical performance, recovery, and address dehydration issues is a key driver in the market’s growth.

- The growing trend of active and healthy lifestyles in Europe, alongside increasing fitness activities, has led to higher consumption of electrolyte products such as drinks, powders, and capsules.

- Increased availability and variety of electrolyte supplements across both physical and online retail channels are enhancing consumer access and driving market expansion.

- There is a shift towards natural and organic electrolyte products, with consumers increasingly favoring clean labels, plant-based ingredients, and sugar-free options.

- Intense competition and market saturation present challenges, with numerous brands offering similar products, leading to pressure on pricing and innovation strategies.

- Western Europe holds the largest share of the Europe Electrolyte Supplement Market (45%), followed by Northern Europe (25%) and Eastern and Southern Europe (30%), with steady growth in emerging markets like Spain and Italy.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Consumer Awareness of Hydration and Electrolyte Imbalance

The growing awareness among consumers about the importance of maintaining proper hydration and electrolyte balance significantly drives the Europe Electrolyte Supplement Market. More people are becoming aware of the health risks associated with dehydration and electrolyte imbalances, including fatigue, muscle cramps, and poor performance. This has led to a shift in consumer behavior, where individuals are seeking effective solutions such as electrolyte supplements to maintain optimal health. Health education campaigns and wellness initiatives continue to push the message of hydration and electrolyte replenishment in daily routines.

Rise of Fitness and Active Lifestyles

The increasing participation in fitness and recreational activities plays a major role in the market’s expansion. Many fitness enthusiasts, athletes, and individuals with active lifestyles actively seek electrolyte supplements to improve hydration and enhance performance during exercise. The growing popularity of sports, gym memberships, and outdoor activities in Europe has created a high demand for electrolyte replenishment products. The rise of fitness culture directly influences consumer preferences for convenient, on-the-go electrolyte solutions.

- For instance, Science in Sport (SiS) designed its GO Electrolyte powder to support athletic performance, formulating it with 36 grams of carbohydrates per serving to provide sustained energy and enhance hydration during intense exercise.

Expansion of Retail Availability and Product Variety

The Europe Electrolyte Supplement Market benefits from the wider availability of these products across both physical and online retail channels. Supermarkets, health stores, pharmacies, and e-commerce platforms provide easy access to a variety of electrolyte supplements, offering consumers more choices than ever before. Product innovation in formats such as electrolyte drinks, powders, capsules, and gels caters to different consumer preferences. Increased distribution networks ensure that electrolyte supplements are accessible to a broader demographic, helping the market expand further.

Shift Toward Natural and Organic Electrolyte Products

Consumers in Europe are increasingly leaning towards natural and organic electrolyte supplements, driven by a preference for clean labels and plant-based ingredients. This shift aligns with the broader health and wellness trend, where natural ingredients are valued over artificial additives or excessive sugars. Manufacturers are responding by developing electrolyte products that offer organic or naturally derived ingredients. The growing demand for sugar-free, non-GMO, and vegan electrolyte options further fuels this market development.

- For instance, Nuun successfully met the demand for clean-label supplements with its vegan and non-GMO electrolyte tablets, formulating its core “Nuun Sport” product with 5 essential electrolytes and just 1 gram of sugar to appeal to health-conscious consumers.

Market Trends:

Rising Demand for Sugar-Free and Clean-Label Electrolyte Supplements

The Europe Electrolyte Supplement Market is experiencing a growing preference for sugar-free and clean-label products. Consumers are increasingly concerned about their sugar intake and the quality of ingredients in the products they consume. This trend is fueling the demand for electrolyte supplements that feature no added sugars, artificial sweeteners, or unnecessary additives. As more individuals seek natural and transparent ingredient lists, manufacturers are focusing on creating products with organic, non-GMO, and plant-based formulations. This shift towards cleaner alternatives reflects broader consumer preferences for health-conscious options that align with overall wellness goals.

- For instance, Humantra offers a plant-based electrolyte blend that is naturally sweetened and provides all six essential electrolytes, including magnesium and potassium, to support optimal hydration without artificial ingredients.

Growth of On-the-Go Electrolyte Solutions

The demand for convenient, on-the-go electrolyte solutions is rapidly growing in Europe, driven by busy lifestyles and increased mobility. Consumers now prefer easy-to-consume formats such as ready-to-drink beverages, portable electrolyte tablets, and single-serving powder sachets that can be carried anywhere. This trend caters to a wide variety of consumers, including athletes, professionals, and health-conscious individuals. The market is seeing innovations in product design and packaging to enhance convenience, making it easier for consumers to stay hydrated throughout their day. These innovations help address the increasing demand for practical and accessible electrolyte supplements that fit into fast-paced routines.

- For instance, Science in Sport (SiS) offers its Go Hydro effervescent tablets, which provide 345 mg of sodium per tablet to effectively replenish electrolytes lost through sweat in a convenient format.

Market Challenges Analysis:

Intense Competition and Market Saturation

The Europe Electrolyte Supplement Market faces significant competition due to the high number of brands offering similar products. With numerous companies entering the market, product differentiation becomes increasingly difficult, leading to market saturation. Established players and new entrants alike are vying for consumer attention, making it challenging to stand out in a crowded space. This intense competition puts pressure on pricing strategies, forcing companies to continuously innovate and adjust their offerings to maintain consumer interest. As the market grows, firms must find unique selling propositions to carve out their market share.

Regulatory Compliance and Ingredient Sourcing Issues

The European market also faces challenges in regulatory compliance and ingredient sourcing. Stringent regulations on food and supplement labeling, health claims, and ingredient safety require constant monitoring and adjustment by manufacturers. These regulations can slow down product launches or lead to increased costs for reformulating products to meet compliance standards. Additionally, sourcing high-quality, sustainable ingredients for electrolyte supplements can be difficult, especially with increasing demand for natural and organic options. Securing reliable and ethical sources of these ingredients is critical for companies aiming to meet consumer expectations and regulatory requirements.

Market Opportunities:

Expansion of Product Offerings and Innovations

The Europe Electrolyte Supplement Market presents significant opportunities for innovation, especially in product offerings. Companies can tap into the growing demand for specialized products such as electrolyte supplements for specific health needs, like hydration for the elderly, children, or those with medical conditions like diabetes. Innovation in flavors, formats, and delivery methods, such as effervescent tablets, ready-to-drink beverages, or powders, can appeal to diverse consumer preferences. Brands can explore creating products with added functional benefits, such as immune support or energy enhancement, to meet the evolving needs of health-conscious consumers.

Growing Demand for Sports and Wellness-Oriented Electrolyte Supplements

The increasing focus on sports and wellness opens substantial opportunities in the Europe Electrolyte Supplement Market. Athletes and fitness enthusiasts continue to seek ways to optimize hydration and performance, presenting a growing demand for products tailored to this segment. Expanding partnerships with fitness centers, gyms, and health professionals could drive further product adoption. Companies can also focus on the rise of wellness trends like holistic health, where electrolyte supplements serve as a vital part of overall health and well-being routines. Targeting these niche segments with specific marketing and product development strategies could drive substantial growth in the market.

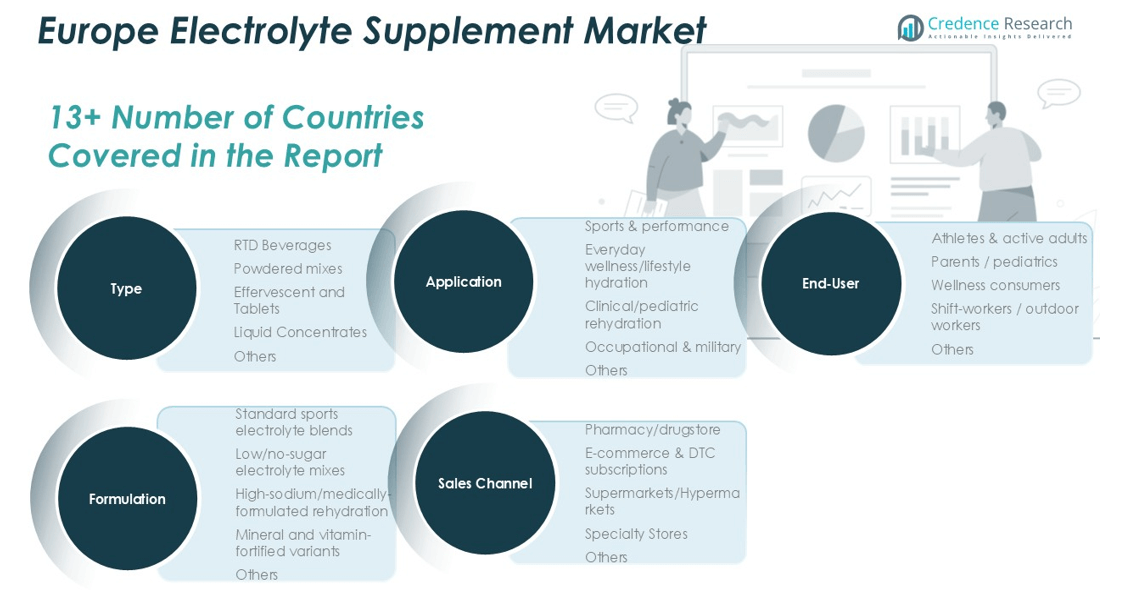

Market Segmentation Analysis:

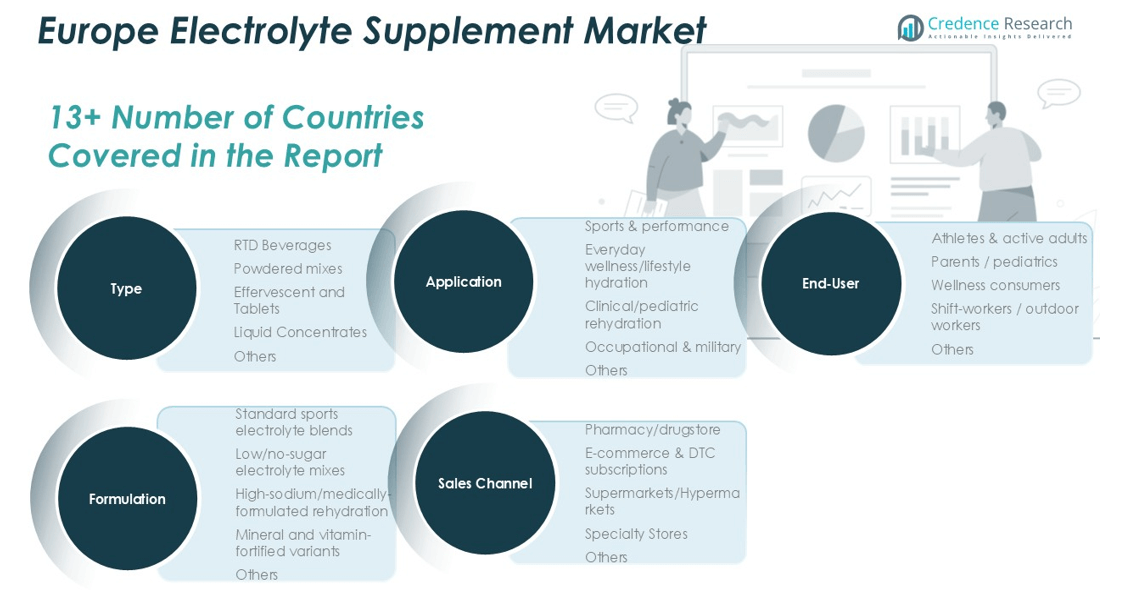

By Type:

The market is driven by various product types, including RTD beverages, powdered mixes, effervescent tablets, and liquid concentrates. RTD beverages hold a significant share due to their convenience, offering ready-to-consume options for hydration. Powdered mixes are growing in popularity due to their easy storage and customization. Effervescent tablets appeal to consumers looking for fast-acting hydration solutions, while liquid concentrates remain a staple in both sports and wellness sectors.

By Application:

The primary applications of electrolyte supplements in Europe include sports & performance, everyday wellness, clinical/pediatric rehydration, and occupational & military hydration. Sports & performance segments dominate, driven by the growing number of fitness enthusiasts and athletes. Everyday wellness/lifestyle hydration is gaining traction as consumers adopt healthy habits. Clinical and pediatric rehydration is a niche yet essential segment, particularly for managing dehydration in vulnerable groups. Occupational & military applications also contribute significantly, addressing hydration needs for workers in high-stress environments.

- For instance, The Coca-Cola Company’s Powerade brand utilizes the ION4 advanced electrolyte system, which is engineered to replenish 4 key electrolytes that are lost in sweat during physical exertion.

By End-User:

End-users of electrolyte supplements in Europe are categorized into athletes & active adults, parents/pediatrics, wellness consumers, and shift-workers/outdoor workers. Athletes and active adults represent the largest user base, seeking products for performance enhancement and recovery. Wellness consumers are increasingly purchasing supplements for daily hydration. Parents and pediatric segments cater to those needing specialized hydration solutions for children, while shift-workers and outdoor workers rely on electrolyte supplements to stay hydrated during long, physically demanding shifts.

- For instance, to meet the needs of its core athletic user base, each serving of GU Energy Labs’ GU Hydration Drink Tabs is formulated to deliver 320 milligrams of sodium to help maintain water balance.

Segmentations:

By Type:

- RTD Beverages

- Powdered Mixes

- Effervescent and Tablets

- Liquid Concentrates

- Others

By Application:

- Sports & Performance

- Everyday Wellness/Lifestyle Hydration

- Clinical/Pediatric Rehydration

- Occupational & Military

- Others

By End-User:

- Athletes & Active Adults

- Parents/Pediatrics

- Wellness Consumers

- Shift-Workers/Outdoor Workers

- Others

By Formulation:

- Standard Sports Electrolyte Blends

- Low/No-Sugar Electrolyte Mixes

- High-Sodium/Medically-Formulated Rehydration

- Mineral and Vitamin-Fortified Variants

- Others

By Sales Channel:

- Pharmacy/Drugstore

- E-commerce & DTC Subscriptions

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

Regional Analysis:

Western Europe: Dominant Market for Electrolyte Supplements

Western Europe holds the largest share of the Europe Electrolyte Supplement Market, accounting for 45%. Countries like the United Kingdom, Germany, and France lead the market due to high consumer awareness and a robust health and wellness culture. The region benefits from a well-established retail infrastructure, with widespread availability of electrolyte supplements across supermarkets, health stores, and online platforms. Western Europe also sees a growing preference for sugar-free and organic electrolyte products, aligning with the shift towards natural, clean-label ingredients.

Northern Europe: Expanding Demand for Functional Hydration Products

Northern Europe holds a 25% share of the Europe Electrolyte Supplement Market, with countries like Sweden, Denmark, and Norway driving growth. These nations emphasize fitness and outdoor activities, creating a steady demand for products that aid in hydration and recovery. Consumers in this region are highly receptive to innovations in product formats, including portable electrolyte solutions and convenient packaging. The increasing popularity of sports such as running, cycling, and winter sports further boosts demand, as athletes seek supplements to optimize performance and maintain hydration.

Eastern and Southern Europe: Emerging Markets with Growth Potential

Eastern and Southern Europe together account for 30% of the Europe Electrolyte Supplement Market. Countries such as Spain, Italy, Poland, and Hungary are experiencing steady growth as health awareness and fitness activities rise. Although these regions have smaller market shares compared to Western Europe, the potential for growth is significant due to expanding retail networks and the increasing popularity of sports and wellness. Manufacturers focusing on affordability and targeted marketing can capture the attention of price-sensitive consumers, positioning themselves for future growth in these emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Abbott Laboratories

- PepsiCo

- The Coca-Cola Company

- Nestlé S.A.

- Unilever PLC

- GlaxoSmithKline plc

- Otsuka Pharmaceutical Co., Ltd.

- GU Energy Labs

- Ultima Health Products

- Hammer Nutrition

- SOS Hydration Inc.

- Tailwind Nutrition

- Hydralyte LLC

- First Endurance

- Denver Bodega LLC

- Sequel Natural LLC

Competitive Analysis:

The Europe Electrolyte Supplement market is highly competitive, with both global giants and regional players vying for market share. Multinational companies like Nestlé, PepsiCo, The Coca-Cola Company, and Unilever dominate the market, offering a broad range of products across various types, such as ready-to-drink beverages, powdered mixes, and effervescent tablets. These players benefit from strong brand recognition and extensive distribution networks. At the same time, regional brands like Orthomol Holding GmbH, Enervit S.p.A., and Pharma Nord cater to niche segments by focusing on specialized consumer needs, including sports nutrition and high-quality dietary supplements. Emerging brands like GU Energy Labs, Skratch Labs, and Ultima Health Products are gaining ground by offering innovative, clean-label products that emphasize plant-based, sugar-free, and organic ingredients. This competitive landscape drives innovation, with companies differentiating themselves through product offerings, quality, and targeted marketing strategies to appeal to diverse consumer preferences.

Recent Developments:

- In August 2025, Abbott’s Navitor Transcatheter Aortic Valve Implantation (TAVI) system received a CE Mark for an expanded indication, allowing for the treatment of a wider range of individuals with aortic stenosis.

- In August 2025, PepsiCo and Celsius Holdings entered into an agreement to reinforce their long-term strategic partnership, aiming to enhance their combined multi-brand energy drink portfolio.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, End-User, Formulation, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for electrolyte supplements in Europe will continue to rise as consumers increasingly prioritize hydration and wellness in their daily routines.

- Sports & performance applications will maintain dominance, driven by the growing participation in fitness activities and sports.

- Everyday wellness and lifestyle hydration segments will experience significant growth as health-conscious consumers seek convenient hydration solutions.

- The shift toward natural and organic ingredients will intensify, with consumers seeking clean-label, sugar-free, and plant-based electrolyte options.

- Innovation in product formats, such as portable solutions and convenient packaging, will cater to the busy lifestyles of consumers, boosting market demand.

- Clinical and pediatric rehydration segments will see steady growth, particularly with a focus on products for children and vulnerable populations.

- Expansion of online retail channels and direct-to-consumer subscriptions will make electrolyte supplements more accessible to a wider audience.

- Demand for functional electrolyte supplements that offer added benefits, such as immunity support or energy boosts, will increase.

- Countries in Eastern and Southern Europe will witness accelerated market penetration due to rising health awareness and expanding retail networks.

- The increasing adoption of eco-friendly and sustainable packaging will align with consumer preferences for environmentally responsible products, shaping future market trends.