Market Overview:

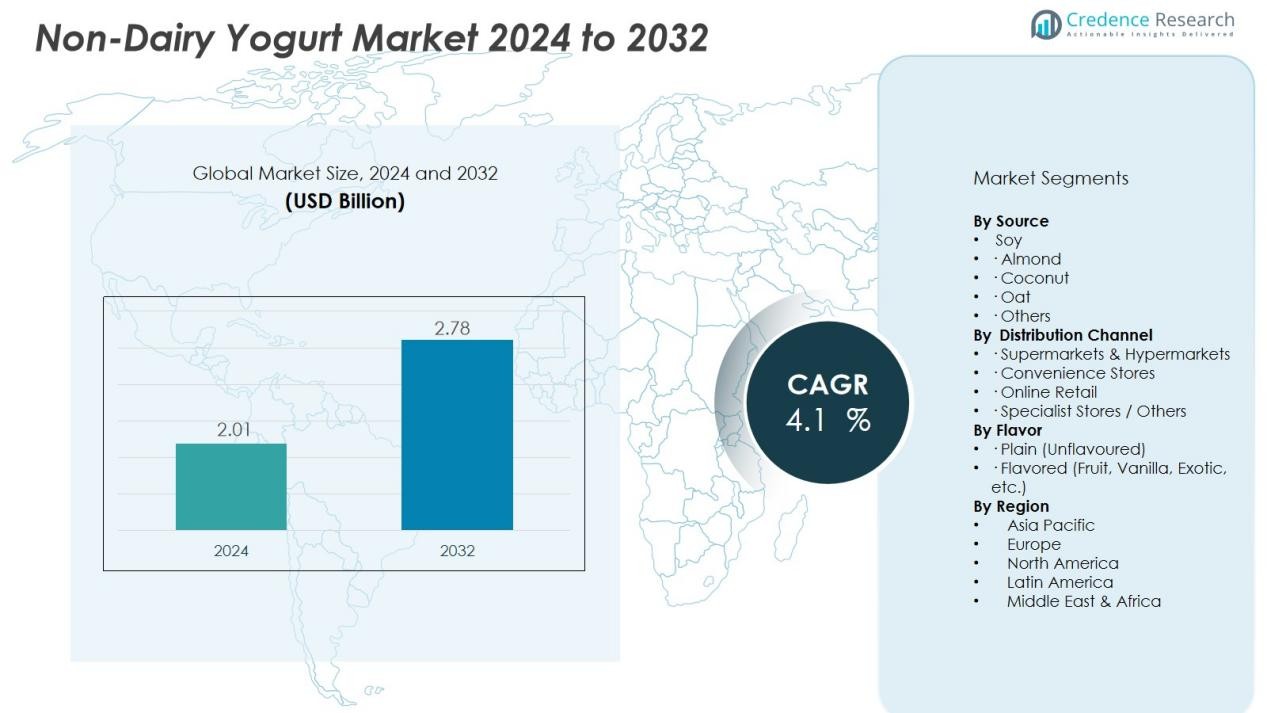

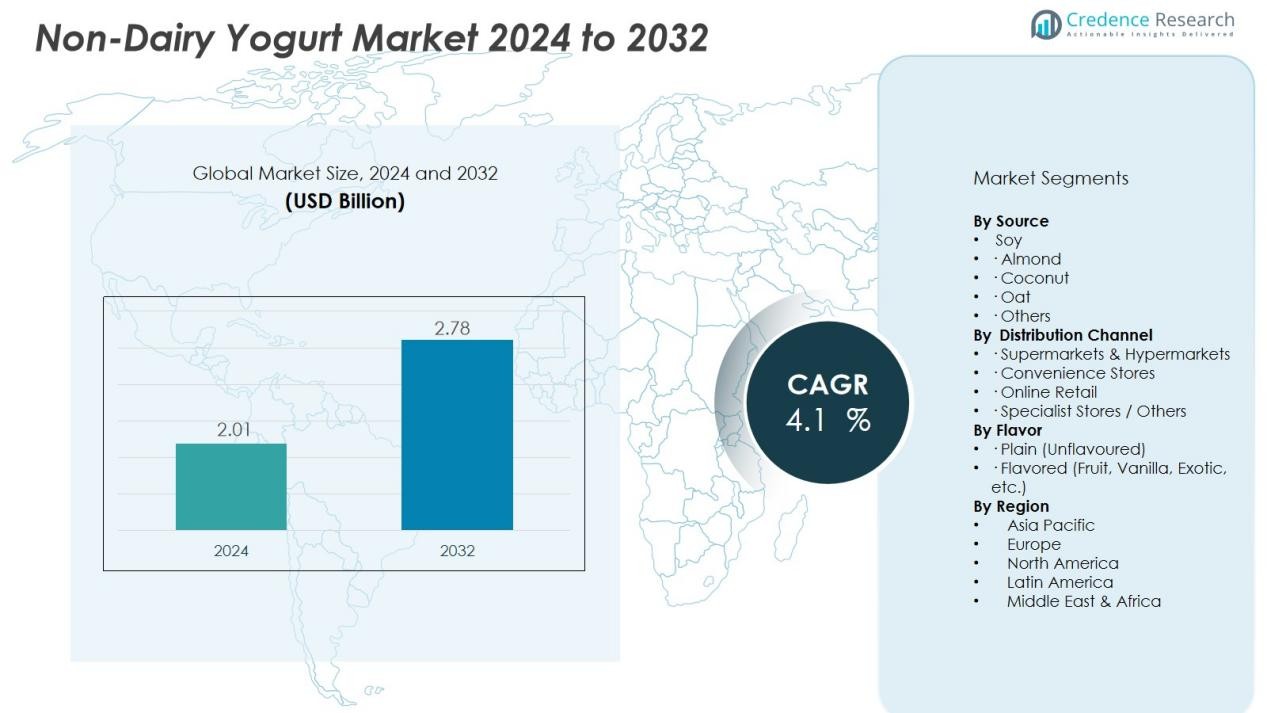

The Non-Dairy Yogurt Market size was valued at USD 2.01 billion in 2024 and is anticipated to reach USD 2.78 billion by 2032, at a CAGR of 4.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Non-Dairy Yogurt Market Size 2024 |

USD 2.01 Billion |

| Non-Dairy Yogurt Market, CAGR |

4.1% |

| Non-Dairy Yogurt Market Size 2032 |

USD 2.78 Billion |

Key drivers behind the market’s expansion include growing consumer awareness of lactose intolerance, milk allergies, and dietary restrictions that prompt a preference for dairy-free products. The rising adoption of vegan, flexitarian, and plant-based diets is further fueling demand for non-dairy yogurt made from plant sources like almond, oat, soy, and coconut. Additionally, ongoing improvements in product formulation have enhanced taste, texture, and nutritional profiles, which are helping to capture a broader consumer base. Furthermore, greater availability in retail stores and e-commerce platforms is facilitating market growth.

Europe currently leads the non-dairy yogurt market, benefiting from a well-established preference for plant-based products and robust retail distribution networks. North America also remains a significant market, driven by consumer awareness and strong innovation in non-dairy products. Meanwhile, the Asia-Pacific region is emerging as the fastest-growing market due to rising urbanization, growing disposable incomes, and increasing health-consciousness among consumers. These trends present substantial opportunities for market players in this region.

Market Insights:

Market Insights:

- The Non-Dairy Yogurt Market was valued at USD 2.01 billion in 2024 and is expected to reach USD 2.78 billion by 2032, growing at a CAGR of 4.1% during the forecast period.

- Europe holds the largest share of the Non-Dairy Yogurt Market at 39%, driven by high consumer health awareness, a strong preference for plant-based alternatives, and well-established retail networks.

- North America follows with a 20% market share, supported by consumer awareness, strong innovation in non-dairy products, and widespread distribution channels.

- Asia-Pacific is the fastest-growing region, accounting for 20% of the market, driven by rising urbanization, growing disposable incomes, and an increasing preference for plant-based diets.

- In terms of segmentation, soy-based non-dairy yogurt leads the market with the largest share, followed by almond and coconut-based variants, which cater to health-conscious consumers seeking allergen-friendly and sustainable options.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Consumer Awareness of Health and Dietary Preferences

The increasing awareness of health benefits associated with plant-based diets is a major driver of the Non-Dairy Yogurt Market. Consumers are becoming more conscious of the negative health implications of dairy, particularly for individuals with lactose intolerance or milk allergies. This shift in dietary preferences has driven demand for non-dairy yogurt, as it offers an alternative that caters to specific health needs. The growing recognition of plant-based eating as a healthier option fuels the market’s expansion, particularly among individuals adopting vegan or flexitarian diets.

- For instance, Danone Canada launched Silk Greek-style plant-based yogurt in February 2024, featuring Canadian pea protein and delivering 12 grams of protein per 175-gram serving.

Rise in Lactose Intolerance and Milk Allergy

Lactose intolerance and milk allergies are common conditions affecting a significant portion of the global population, prompting a growing demand for dairy-free products. The Non-Dairy Yogurt Market benefits from the increasing prevalence of these conditions, as consumers actively seek alternatives to traditional dairy products. This factor has pushed brands to develop diverse non-dairy yogurt options, such as almond, coconut, and soy-based variants, which cater to these consumer needs while offering similar nutritional benefits as dairy yogurt.

- For instance, Danone’s plant-based brand “Alpro” contributed to the overall positive performance of the company’s Essential Dairy and Plant-based (EDP) category in Europe in 2024, which achieved positive volume/mix growth each quarter.

Innovation in Product Formulation and Taste

Innovation in non-dairy yogurt formulations has played a crucial role in driving market growth. Producers are focusing on improving the taste, texture, and nutritional profiles of their products to closely resemble dairy yogurt while enhancing their appeal to a broader consumer base. Through advancements in flavoring, fortification with probiotics, and the use of alternative plant-based ingredients, non-dairy yogurt is increasingly perceived as a viable substitute for traditional yogurt. These improvements have attracted health-conscious and environmentally aware consumers, further accelerating market demand.

Expansion of Distribution Channels and Retail Access

The growing availability of non-dairy yogurt in mainstream retail outlets and online platforms has contributed significantly to its market growth. Retail chains are expanding their offerings of plant-based food products, including non-dairy yogurt, due to the rising demand from consumers. The convenience and accessibility of purchasing non-dairy yogurt, particularly through e-commerce platforms, have allowed it to reach a wider audience. This increased distribution is driving market penetration and making non-dairy yogurt more accessible to health-conscious consumers worldwide.

Market Trends:

Expansion of Premium and Functional Product Offerings

The Non‑Dairy Yogurt Market is witnessing a robust push into premium and functional categories. Brands now incorporate probiotics, added protein and fortified nutrients to satisfy consumers seeking more than basic nutrition. It has responded to the demand for clean‑label formulations by offering varieties that avoid artificial additives and emphasise plant‑based ingredients. It has improved texture and taste through technological enhancements, which has helped narrow the sensory gap compared to traditional dairy yogurts. This shift elevates non‑dairy yogurts from niche allergy‑friendly products to mainstream premium options. It encourages consumers to trade up rather than simply substitute.

- For Instance, Chobani offers a variety of plant-based products, including the Chobani Oat Vanilla Non-Dairy Yogurt made with an organic oat blend and fortified with pea protein, which contains 6 grams of plant-based protein per 5.3-ounce serving and includes six live and active cultures.

Diversification of Base Ingredients and Global Flavour Engagement

The market is increasingly diversifying its ingredient base by using almond, oat, coconut, soy and legume milks to craft non‑dairy yogurts that appeal across preferences and dietary needs. It adapts to regional taste profiles by offering novel flavour combinations—such as exotic fruits, spice‑infused varieties and culturally relevant offerings. The expansion of e‑commerce and direct‑to‑consumer models facilitates global rollout and enables small brands to engage niche audiences. It also fosters regional innovation, where local plant sources and fermentations produce unique textures and tastes. The deployment of premium packaging, limited‑edition flavours and collaborations with lifestyle brands further fuels interest and repeat purchase. Through these strategies, the Non‑Dairy Yogurt Market positions itself not only as an alternative but as a desirable choice in the broader yogurt category.

- For instance, Kite Hill produces almond milk yogurts using proprietary cultures and enzymes that separate the milk into curds and whey—a patented cheese-making technique that delivers between 15 and 17 grams of protein per serving in their Greek-style yogurt variant, differentiating it through artisanal fermentation methods rather than ingredient approximation.

Market Challenges Analysis:

High Production Costs and Raw‐Material Volatility

The Non‑Dairy Yogurt Market faces pressure from elevated production costs that exceed those of traditional dairy yogurt. Manufacturers invest in specialty plant‑based ingredients, which typically cost more than conventional dairy inputs and often fluctuate in price due to crop yields and global supply chain constraints. It must absorb higher costs for fermentation technologies and texture‑enhancement systems designed to mimic dairy yogurt mouthfeel. When raw‑material prices spike, it reduces margin flexibility and may force brands to raise prices or reduce promotional activity. These cost dynamics hinder scaling of new product lines and slow broader market penetration.

Consumer Perception, Taste & Labeling Complexities

The market must contend with consumer perception issues concerning taste, texture and nutritional equivalence of non‑dairy yogurt. Some consumers compare plant‑based yogurts unfavourably with dairy equivalents, which limits repeat purchase and broader adoption. It also navigates regulatory and labeling challenges: in many regions plant‑based yogurts cannot use dairy‑derived terms, causing potential confusion in shelf‑placement and consumer understanding. Limited awareness of the benefits of non‑dairy yogurt in certain markets further constrains growth beyond early‑adopter segments. These combined barriers make brand education and differentiation more resource‑intensive.

Market Opportunities:

Expansion into Emerging Geographies with Rising Plant‑Based Demand

The Non‑Dairy Yogurt Market presents a clear opportunity in rapidly developing regions where consumers shift toward dairy‑free and plant‑based alternatives. Urbanisation and rising disposable incomes in parts of Asia Pacific and Latin America lead it toward stronger demand. Manufacturers stand to tap this growth by tailoring formulations and packaging to regional taste profiles and retail dynamics. It can capitalise on under‑penetrated markets where traditional dairy yogurt dominates but plant‑based alternatives carry limited share. Retailers and online platforms that adopt targeted launches can accelerate access and awareness. This geographic expansion offers both volume growth and diversification for brands.

Personalised Nutrition and Premiumisation Trends Unlock Value‑Added Segments

It can leverage growing consumer focus on enhanced functionality and premium positioning within non‑dairy yogurts. Demand rises for formulations enriched with protein, probiotics, and clean‑label credentials, offering it a chance to differentiate beyond basic dairy‑free substitution. Value‑added product tiers command higher margins, and premium packaging or limited‑edition flavours further strengthen appeal. Innovations in plant‑based ingredient combinations, texture enhancement, and formulation transparency enable it to align with wellness‑ and lifestyle‑driven consumption. Strategic partnerships and niche brand positioning enable capturing affluent or health‑driven segments that might otherwise stick to traditional dairy yogurt.

Market Segmentation Analysis:

By Source (Plant‑Based Ingredient Base)

The Non‑Dairy Yogurt Market breaks down by source into key plant‑based bases such as soy, almond, coconut, oat and other emerging alternatives. Soy‑based yogurt holds a leading revenue share, owing to its high protein content and consumer familiarity. The oat and almond segments gain momentum thanks to allergen‑friendly profiles and growing sustainability appeal. Coconut‑based yogurts attract health‑conscious consumers seeking clean‑label and novel textures. Brands in the market deploy source diversification to meet varied nutritional needs, regional taste preferences and sustainability demands.

- For Instance, Oatly’s Singapore facility, which opened in October 2021, had an expected annual capacity of 60 million liters (approximately 60,000 metric tons).

By Distribution Channel (Retail and Online Pathways)

The market segments its distribution channels into supermarkets & hypermarkets, convenience stores, online retail and specialist stores. Supermarkets and hypermarkets dominate due to broad shelf presence, varied product assortment and high consumer traffic. Online retail exhibits stronger growth because it offers convenience, greater selection and direct access to niche plant‑based brands. Convenience stores and specialist retailers contribute by targeting impulse buys and dedicated vegan or health‑food shoppers. The channel mix enables each brand in the market to tailor its go‑to‑market strategy based on consumer behaviour, geography and price‑tier.

- For instance, Tesco in the UK has observed a shift in consumer preference towards whole-food, vegetable-led dishes rather than highly processed meat alternatives. These veg-led options now account for 40% of all plant-based sales, with Tesco selling nearly an extra 600,000 such dishes in a specific period in 2024 compared to the previous year.

By Flavor (Plain vs Flavored Variants)

Flavor segmentation divides the market into plain (unflavoured) and flavored (fruit, vanilla, chocolate, exotic) variants. Flavored variants command a larger share by appealing to mainstream taste preferences, promoting trial among dairy‑users making the switch. Plain variants attract health‑driven consumers and offer versatility for culinary use and lower‑sugar positioning. The trend toward novel and premium flavours—such as exotic fruits or herb‑infused profiles—enables brands to raise margins and differentiate their products. Flavor innovation remains a key lever for growth in the market.

Segmentations:

By Source

- Soy

- Almond

- Coconut

- Oat

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Retail

- Specialist Stores / Others

By Flavor

- Plain (Unflavoured)

- Flavored (Fruit, Vanilla, Exotic, etc.)

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Europe Regional Analysis

Europe currently holds a market share of approximately 39% in the Non‑Dairy Yogurt Market. It leads due to high consumer health awareness, strong demand for plant‑based alternatives and well‑developed retail frameworks. Consumers in countries like Germany, the UK and France adopt vegan or flexitarian diets more frequently, which supports it. Producers in this region introduce formats with improved texture and taste, enabling easier acceptance of non‑dairy options. Retailers allocate dedicated shelf space for plant‑based yogurts and major chains ramp up distribution, which strengthens it further. Regulatory frameworks in Europe favour clear labelling of dairy‑free and plant‑based foods, which gives brands greater transparency and builds trust. Because of these dynamics, Europe remains the most established region for the Non‑Dairy Yogurt Market, although growth rates are moderate due to market maturity.

Asia‑Pacific Regional Analysis

Asia‑Pacific currently holds a market share near 20% in the Non‑Dairy Yogurt Market. It records the highest growth potential driven by rising urbanisation, increasing disposable incomes and growing preference for plant‑based diets. It benefits from diverse consumer bases in China, India, Japan and Australia who seek clean‑label, lactose‑free alternatives. Brands tailor products to regional tastes and launch in both modern retail and e‑commerce channels, which enhances penetration. Investment in manufacturing and supply‑chain adapts to local plant‑ingredient sourcing, which reduces dependence on imports and supports cost‑competitiveness. While the base size remains smaller compared to Europe, the rate of growth positions Asia‑Pacific as a key priority region for the Non‑Dairy Yogurt Market.

North America and Emerging Regions Analysis

North America holds roughly 20% share of the Non‑Dairy Yogurt Market and remains a significant region due to health‑conscious consumer trends and high innovation levels. It features strong distribution networks, advanced retail infrastructure and frequent product launches in clean‑label and plant‑based categories. Emerging markets in South & Central America, the Middle East and Africa display lower current shares but present sizable opportunity due to rising awareness and retail access. These regions face challenges such as limited product availability and price sensitivity, yet they benefit from shifting dietary preferences and improving infrastructure. Collectively, North America and emerging regions contribute to the global footprint of the Non‑Dairy Yogurt Market, providing both stabilised demand and growth‑oriented opportunities.

Key Player Analysis:

- Danone

- Hain Celestial

- General Mills Inc.

- Stonyfield Farm, Inc.

- Kite Hill

- Daiya Foods Inc

- Chobani, LLC

- Hudson River Foods

- Good Karma Foods, Inc.

- NANCY’S

Competitive Analysis:

In the competitive landscape of the Non‑Dairy Yogurt Market, key players such as Danone, Hain Celestial, General Mills Inc., Stonyfield Farm, Inc. and Kite Hill dominate the field with strong global footprints and differentiated portfolios. These companies leverage significant R&D investments, strategic acquisitions and brand extensions to maintain their leadership and to innovate in form, flavor and source. It navigates intense competition by accelerating product launches that emphasise plant‑based sources such as almond, oat and soy to meet changing consumer demands. It faces pressure to optimise supply chains and ingredient cost efficiencies while maintaining premium pricing and margin structures. Many of these leading firms utilise partnerships with retailers and e‑commerce platforms to expand shelf presence and consumer reach. Their scale allows them to execute marketing campaigns focused on health credentials, sustainability credentials and flavour experiences, thereby strengthening their competitive advantage in the non‑dairy yogurt category.

Recent Developments:

- In June 2025, Danone acquired a majority stake in Kate Farms, a leading US provider of plant-based, organic nutrition products, enhancing its medical nutrition portfolio in the United States.

- In September 2024, Hain Celestial completed the sale of its ParmCrisps® snack brand to Our Home, continuing its portfolio optimization efforts.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Source, Distribution Channel, Flavor and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The Non‑Dairy Yogurt Market will increasingly benefit from innovations that replicate dairy‑like texture and taste while maintaining clean‑label credentials.

- It will expand penetration in emerging geographies where urbanisation and disposable income growth accelerate plant‑based adoption.

- It will shape product portfolios around tailored nutrition, with formulations enriched for probiotics, high protein and low sugar content.

- It will shift toward premiumisation, where consumers pay higher prices for functional benefits, brand identity and sustainable sourcing.

- It will diversify base ingredients beyond soy and almond to include oat, pea, coconut and hybrid blends, enabling differentiation and allergen‑friendly options.

- It will broaden distribution through e‑commerce, direct‑to‑consumer channels and subscription models, reaching younger, digitally native audiences.

- It will form strategic alliances between legacy dairy companies and plant‑based disruptors to share manufacturing, innovation and market access.

- It will adapt packaging and portion formats for on‑the‑go consumption, snack‑driven occasions and convenience‑focused retail shelves.

- It will emphasise sustainability credentials such as reduced carbon footprint, responsible sourcing and recyclable packaging to align with consumer values.

- It will face increasing regulatory scrutiny on labeling and health claims, prompting manufacturers to strengthen transparency and supply‑chain traceability.

Market Insights:

Market Insights: