Market Overview:

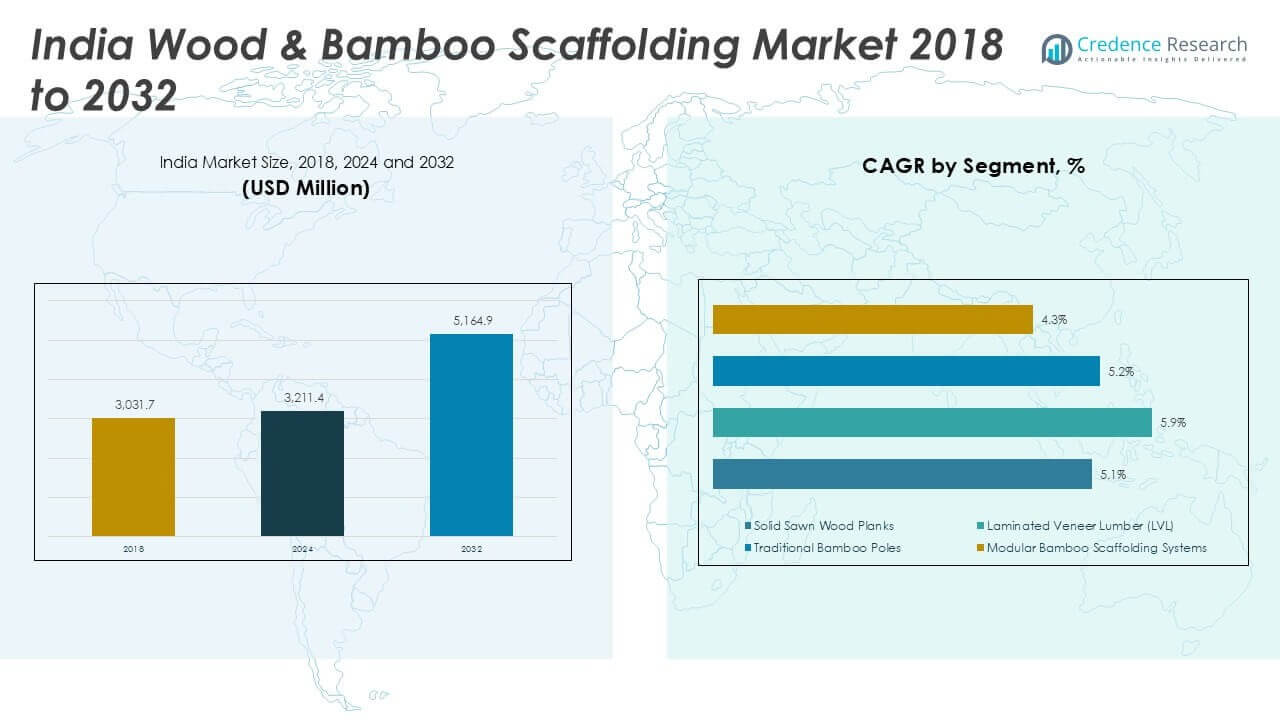

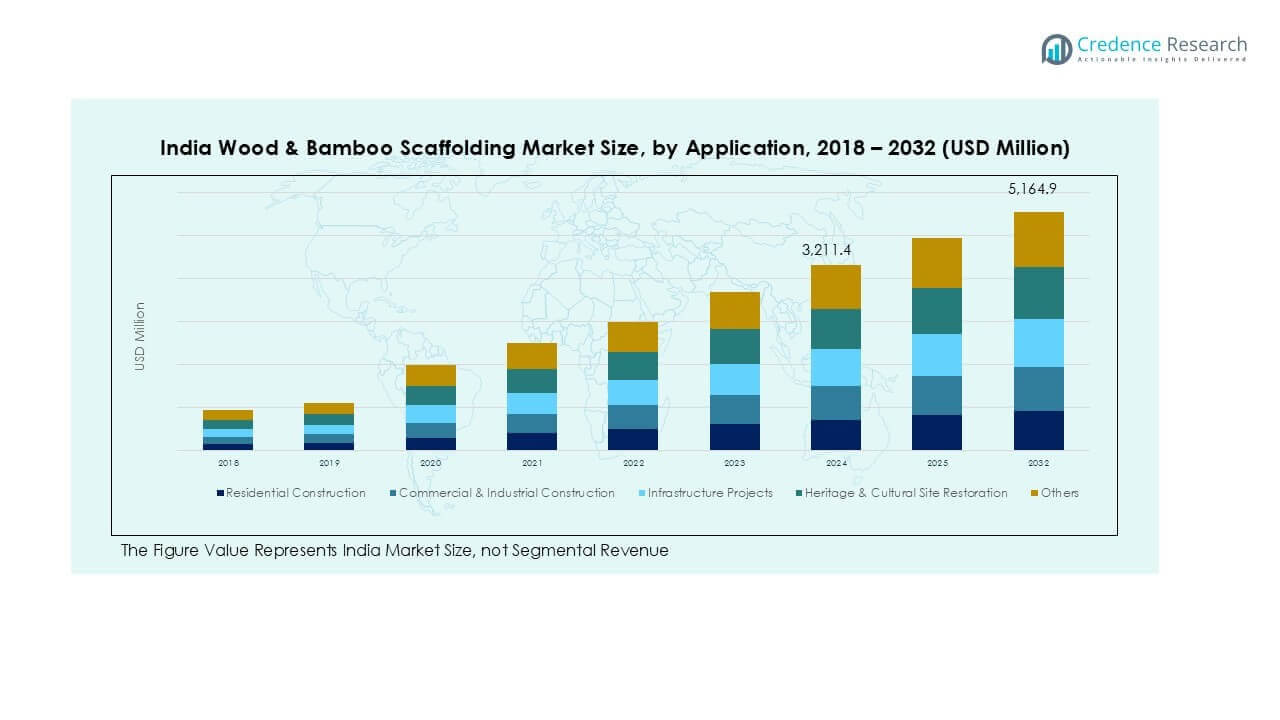

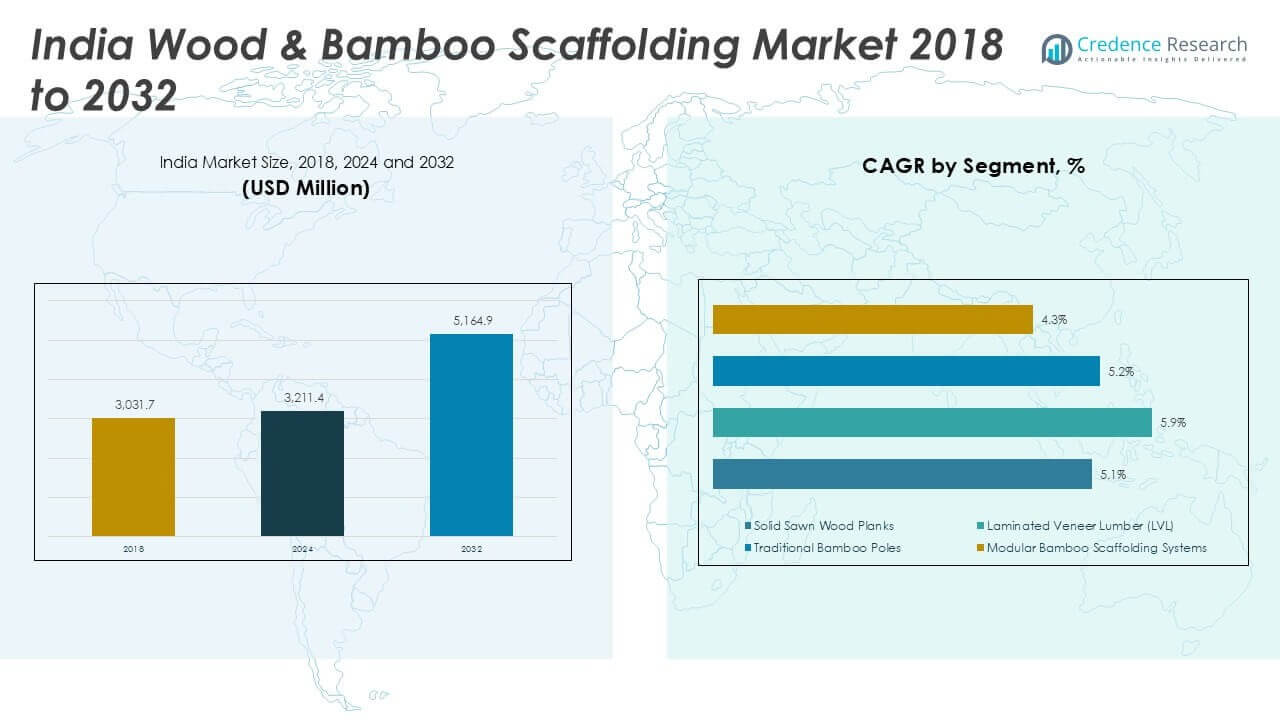

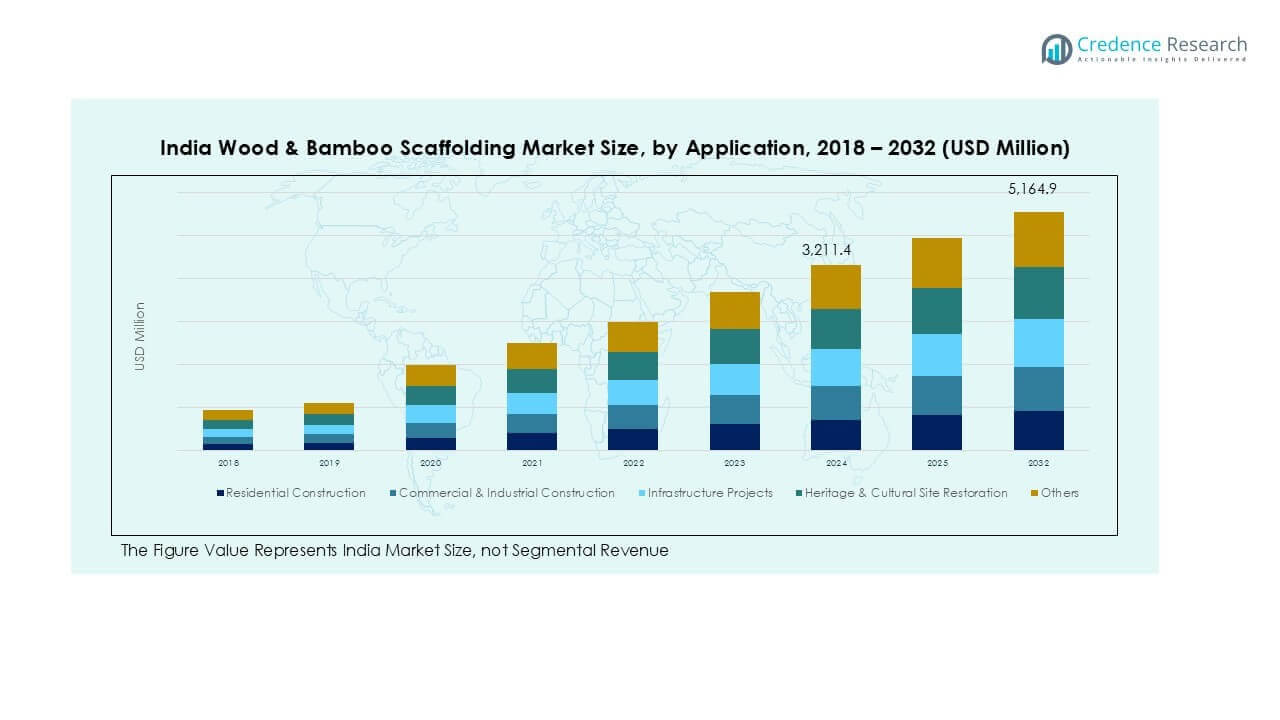

India Wood & Bamboo Scaffolding market size was valued at USD 3,031.71 million in 2018, growing to USD 3,211.39 million in 2024. The market is anticipated to reach USD 5,164.86 million by 2032, registering a CAGR of 6.12% during the forecast period (2024–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Wood & Bamboo Scaffolding Market Size 2024 |

USD 3,211.39 million |

| India Wood & Bamboo Scaffolding Market, CAGR |

6.12% |

| India Wood & Bamboo Scaffolding Market Size 2032 |

USD 5,164.86 million |

Leading players in the India wood and bamboo scaffolding market include United Scaffolding Group, SS Group, SGB Scaffolding & Industrial Services, VSR Infratech, and Technocraft Industries (India) Ltd, supported by regional firms like Prime Steeltech and Spantech Engineers. These companies focus on engineered scaffolding systems, modular bamboo solutions, and rental services to meet rising demand across construction and infrastructure projects. North India leads the market with 28% share, driven by metro rail, expressway, and housing projects, followed by South India with 24% share, supported by IT park and airport construction.

Market Insights

- The India wood and bamboo scaffolding market was valued at USD 3,211.39 million in 2024 and is projected to reach USD 5,164.86 million by 2032, growing at a CAGR of 6.12% during 2024–2032.

- Rapid urbanization, smart city projects, and infrastructure expansion such as metro rail and expressways drive strong demand for solid sawn wood planks and modular bamboo systems, supporting faster construction timelines.

- Trends include rising adoption of engineered LVL, modular bamboo scaffolding for sustainability, and digital monitoring tools to improve site safety and compliance with IS codes.

- The market is moderately fragmented with key players including United Scaffolding Group, SGB Scaffolding & Industrial Services, and Technocraft Industries focusing on rental services, product innovation, and safety-certified solutions.

- North India leads with 28% share, followed by South India at 24% and West India at 22%, while commercial and industrial construction accounts for nearly 38% of total demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

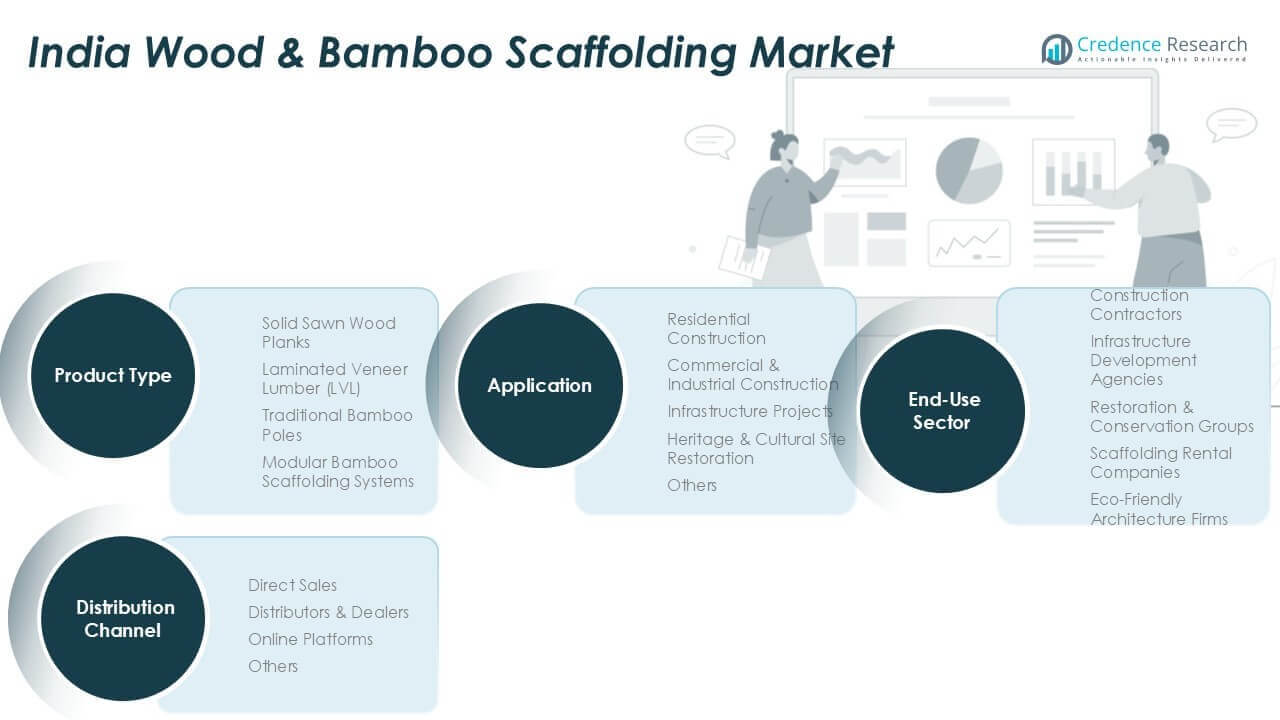

Market Segmentation Analysis:

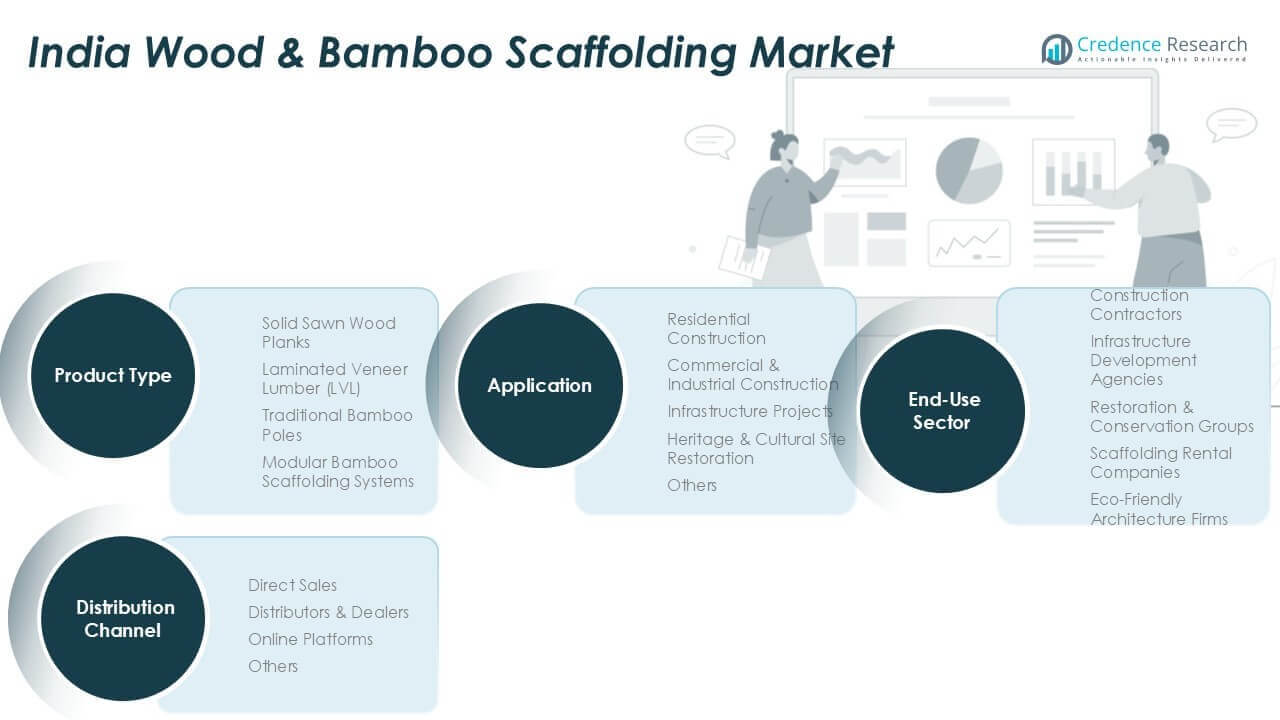

By Product Type

Solid sawn wood planks dominated the India wood and bamboo scaffolding market in 2024, holding over 40% share. Their strength, affordability, and availability make them the preferred choice for large construction projects. Laminated veneer lumber (LVL) is gaining momentum, supported by its uniform quality and compliance with safety standards. Traditional bamboo poles remain popular in rural construction due to their low cost and eco-friendly nature. Modular bamboo scaffolding systems are expanding quickly, driven by demand for faster assembly and compliance with green building codes in urban developments.

- For instance, in 2024, Shreeji Woodcraft focused on manufacturing and supplying its core products, which include premium wooden and metal doors, door frames, and modular kitchens. The company showcased these products at events like the Big 5 Global exhibition in Dubai and held its annual review meeting.

By Application

Commercial and industrial construction accounted for the largest share, capturing nearly 38% of total demand. The segment is fueled by rising investments in industrial parks, manufacturing plants, and real estate projects. Residential construction follows, supported by government housing schemes and rapid urbanization in tier-2 cities. Infrastructure projects such as highways, bridges, and metro networks contribute significantly, creating demand for durable scaffolding solutions. Heritage and cultural site restoration represents a niche but growing segment, where bamboo solutions are favored for sustainability and minimal impact on historic structures.

- For instance, Larsen & Toubro was involved in multiple large-scale construction projects in both Gujarat and Tamil Nadu during 2024, including new manufacturing facilities and IT park developments.

By End-use Sector

Construction contractors dominated the end-use sector, holding over 45% share in 2024, as they represent the primary buyers of scaffolding systems for diverse projects. Infrastructure development agencies are key users, adopting engineered scaffolding for large-scale public projects to meet safety standards. Restoration and conservation groups prefer bamboo scaffolding for projects that require minimal structural impact. Scaffolding rental companies are seeing steady demand growth, offering cost-effective solutions for small contractors. Eco-friendly architecture firms are emerging as a niche end-user, promoting bamboo-based solutions for sustainable and green-certified projects.

Market Overview

Rapid Urbanization and Infrastructure Development

India’s rapid urbanization and infrastructure expansion are major drivers for the wood and bamboo scaffolding market. Government-backed initiatives like Smart Cities Mission and Bharatmala Pariyojana are fueling construction of highways, metro rail projects, and urban infrastructure. These projects require durable, cost-effective scaffolding systems for high-rise buildings and large-scale public works. The growing demand for industrial zones, manufacturing hubs, and housing developments in tier-1 and tier-2 cities is boosting the use of solid sawn wood planks and modular bamboo scaffolding systems. Faster project timelines and strict safety compliance further encourage adoption of standardized, high-load-bearing scaffolding materials.

- For instance, Tata Projects highlighted its focus on using modular construction techniques, including prefabricated and pre-cast elements, to increase productivity and reduce waste. The company reported using alternative building materials derived from industrial waste, such as Fly Ash, GGBS, and AAC blocks, to reduce its environmental impact.

Sustainability and Eco-Friendly Construction Push

Rising emphasis on green building practices is creating strong demand for bamboo scaffolding solutions in India. Bamboo is renewable, lightweight, and cost-effective, making it suitable for projects aiming for LEED and GRIHA certifications. Government promotion of sustainable construction under the National Green Building Code encourages contractors to opt for eco-friendly materials. Developers and architects are increasingly integrating bamboo scaffolding in residential, commercial, and heritage restoration projects. Modular bamboo systems are also gaining acceptance as they reduce construction waste and enable faster assembly. This sustainability trend supports the transition toward low-carbon construction practices, further driving the market forward.

- For instance, Godrej Properties is dedicated to sustainable and green construction practices, using a variety of eco-friendly materials and techniques to reduce its carbon footprint. Their residential projects in Bengaluru, such as Godrej Yeshwanthpur, incorporate sustainable features like rainwater harvesting, natural ventilation, and energy-efficient lighting to achieve green building certifications.

Growth of Organized Rental and Contracting Services

The expansion of organized scaffolding rental and contracting services is a key growth driver. Rental firms offer ready-to-use, certified scaffolding systems, reducing upfront capital costs for small and mid-size contractors. Availability of modular scaffolding through rental models ensures flexibility for projects of varying scale and complexity. Increased focus on worker safety and compliance with OSHA and IS codes is driving contractors to rent high-quality, engineered scaffolding solutions. The professionalization of this sector also reduces project delays and improves construction efficiency. This shift toward rental-based solutions is helping expand market reach across urban and semi-urban construction projects.

Key Trends & Opportunities

Adoption of Modular and Engineered Scaffolding Systems

A major trend shaping the market is the shift from traditional bamboo poles to modular bamboo and engineered wood scaffolding systems. These systems offer higher load capacity, faster installation, and improved safety, meeting the needs of modern construction projects. Growing adoption is visible in metro rail projects, high-rise buildings, and industrial facilities. Manufacturers are introducing quick-lock mechanisms and standardized components that reduce assembly time and labor costs. This trend opens opportunities for domestic players to innovate with hybrid wood-bamboo designs that combine sustainability with structural performance, creating a competitive edge in the Indian market.

- For instance, in 2024, Greenply Industries began commercial production through a 50:50 joint venture with Samet, a Turkish company. The Vadodara plant manufactures furniture fittings, such as hinge and slide systems, not scaffolding.

Digitalization and Smart Site Management

Construction companies are increasingly adopting digital platforms and IoT-enabled site management tools to track scaffolding inventory and improve safety compliance. Smart sensors embedded in scaffolding structures can monitor load capacity and detect potential hazards in real time. This integration helps reduce workplace accidents and ensures adherence to safety regulations. Digital adoption also supports predictive maintenance and efficient resource planning, reducing project costs. Vendors providing connected scaffolding solutions will find significant opportunities in large-scale infrastructure and commercial projects, as India continues its shift toward data-driven, technology-enabled construction practices.

Key Challenges

Safety Compliance and Skill Gaps

Ensuring safety compliance remains a significant challenge in India’s wood and bamboo scaffolding market. Many small contractors still rely on unstandardized scaffolding, leading to workplace accidents and project delays. Enforcement of safety standards under IS codes is improving but remains inconsistent across regions. Inadequate training for workers on scaffolding assembly and maintenance worsens the problem. Bridging this skill gap requires collaboration between industry associations, training institutes, and government bodies to promote certified training programs. Without these efforts, safety risks will continue to limit market growth and adoption of advanced scaffolding systems.

Price Volatility and Supply Chain Disruptions

Fluctuating prices of wood and bamboo raw materials pose a challenge for manufacturers and contractors. Seasonal availability of bamboo and transportation disruptions often create supply shortages, impacting project schedules. Rising costs of engineered wood products such as LVL add to the challenge for price-sensitive projects. Additionally, import dependence for certain high-grade materials exposes the industry to currency fluctuations and logistics delays. Companies need to adopt robust procurement strategies and explore sustainable bamboo cultivation to stabilize supply. Failure to address these issues may result in slower adoption of premium scaffolding solutions in cost-sensitive segments.

Regional Analysis

North India

North India led the market with 28% share in 2024. Delhi-NCR, Haryana, and Uttar Pradesh drove demand. Metro rail, expressways, and housing townships boosted volumes. Contractors favored solid sawn wood planks for high-load work. Bamboo poles remained common on smaller sites. Modular bamboo systems grew in smart city corridors. Large rental fleets supported fast project turnarounds. Government corridors improved material movement and pricing. Safety audits increased use of engineered platforms.

South India

South India held 24% share in 2024. Bengaluru, Chennai, and Hyderabad anchored demand. IT parks, manufacturing zones, and airports required standardized scaffolding. LVL adoption rose for quality consistency and safety compliance. Modular bamboo systems gained traction in green buildings. Coastal logistics improved supply reliability. Rental companies expanded certified inventories. Training initiatives reduced assembly errors and downtime. Tier-2 cities added steady residential volumes.

West India

West India captured 22% share in 2024. Mumbai-Pune, Ahmedabad, and Surat were the key hubs. High-rise redevelopment and metro expansions lifted usage. Solid sawn planks dominated heavy worksites. LVL supported premium commercial projects needing uniform strength. Ports and dedicated freight corridors improved inbound timber flows. Modular bamboo systems advanced in sustainability-led projects. Rental penetration rose among small contractors. Safety enforcement increased engineered accessories adoption.

East India

East India accounted for 16% share in 2024. Kolkata and Bhubaneswar led urban demand. Highway, port, and industrial corridors supported growth. Traditional bamboo poles stayed prevalent in semi-urban areas. Modular bamboo systems expanded in institutional projects. Public housing programs sustained baseline volumes. Logistics upgrades reduced seasonal stockouts. Training gaps persisted among small contractors. Gradual shift toward LVL occurred in city projects.

Central India

Central India held 10% share in 2024. Bhopal, Indore, and Nagpur anchored activity. Urban housing and light industrial projects drove demand. Traditional bamboo poles remained cost-effective for smaller sites. Solid sawn planks served municipal works. Rental providers expanded reach across districts. Safety adoption improved but remained uneven. Modular bamboo trials grew in government buildings. Better road links stabilized raw material inflows.

Market Segmentations:

By Product Type

- Solid Sawn Wood Planks

- Laminated Veneer Lumber (LVL)

- Traditional Bamboo Poles

- Modular Bamboo Scaffolding Systems

By Application

- Residential Construction

- Commercial & Industrial Construction

- Infrastructure Projects

- Heritage & Cultural Site Restoration

- Others

By End-use Sector

- Construction Contractors

- Infrastructure Development Agencies

- Restoration & Conservation Groups

- Scaffolding Rental Companies

- Eco-Friendly Architecture Firms

By Distribution Channel

- Direct Sales

- Distributors & Dealers

- Online Platforms

- Others

By Geography

- North India

- West India

- South India

- East India

- Central India

Competitive Landscape

The India wood and bamboo scaffolding market is moderately fragmented, with a mix of organized manufacturers, rental service providers, and regional players. Leading companies such as United Scaffolding Group, SS Group, and SGB Scaffolding & Industrial Services dominate through wide product portfolios and nationwide distribution networks. Technocraft Industries (India) Ltd and Prime Steeltech focus on engineered scaffolding systems and modular solutions, catering to large infrastructure and commercial projects. Regional players like VSR Infratech and Spantech Engineers serve local contractors with cost-effective offerings, including traditional bamboo scaffolding. Rental firms are gaining traction by providing certified scaffolding on flexible terms, reducing capital burden for small and mid-sized contractors. Strategic partnerships, expansion of rental fleets, and compliance with safety standards are key competitive strategies. Companies are also investing in training programs and digital platforms to improve site productivity and ensure adherence to safety norms, strengthening their market position.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- United Scaffolding Group

- SS Group

- SGB Scaffolding & Industrial Services

- VSR Infratech

- Spantech Engineers

- Prime Steeltech

- Keisar Scaffolding

- Wellworth Wire Ropes Pvt. Ltd.

- Technocraft Industries (India) Ltd

- Mefab Engineers

Recent Developments

- In 2025, ULMA Construction’s innovation focus has been on engineering advancements and digital integration for scaffolding systems, especially for modular and steel variants. There is little emphasis from ULMA on wood or bamboo materials, as their recent solutions highlight sustainability efforts and technological enhancements more applicable to metal-based systems.

- In April 2025, at the bauma trade show in Munich, PERI showcased sustainable formwork innovations, including the introduction of a universal formwork system made from biopolymer. Their market direction is toward resource-saving solutions and modularity, with digital tools and even robotic assistance being trialed for assembly.

- In March 2025, the Hong Kong government announced plans to phase out bamboo scaffolding for most public projects, mandating a shift to modern metal alternatives for improved safety and fire resistance.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-use Sector, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily, driven by large-scale infrastructure and housing projects.

- Adoption of modular bamboo scaffolding will rise for faster assembly and sustainability goals.

- Engineered wood products like LVL will gain more traction for high-strength and safety needs.

- Rental-based scaffolding services will see strong demand from small and mid-sized contractors.

- Digital tools and IoT-enabled site monitoring will become standard in major projects.

- Government smart city initiatives will boost demand in tier-1 and tier-2 cities.

- Heritage restoration projects will increasingly prefer eco-friendly bamboo scaffolding solutions.

- Safety compliance and training programs will improve nationwide adoption of certified systems.

- Regional players will expand capacity to compete with organized manufacturers and rental firms.

- Rising investment in commercial real estate and manufacturing hubs will sustain long-term market growth.