Market Overview:

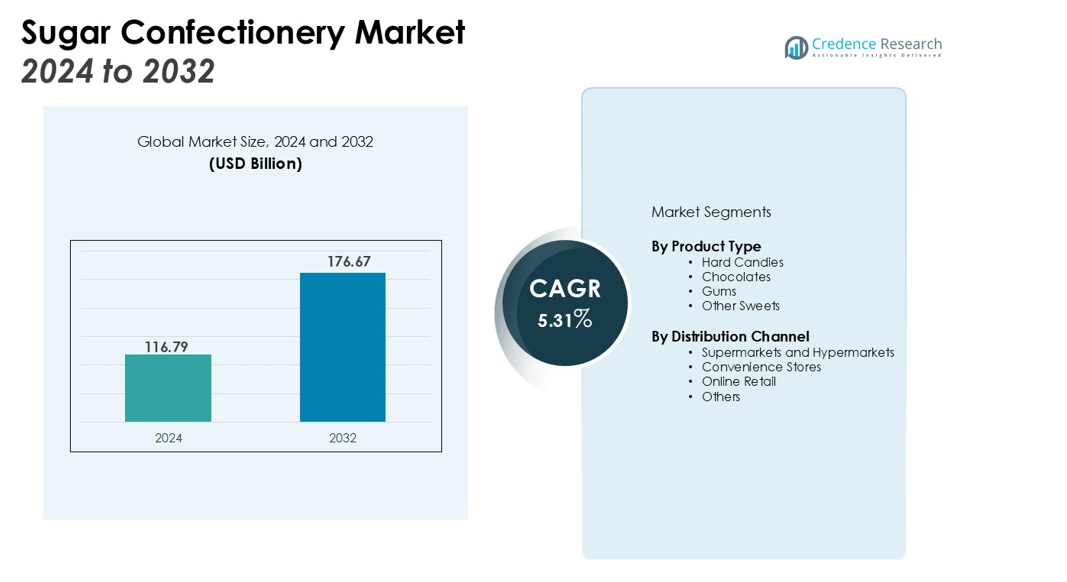

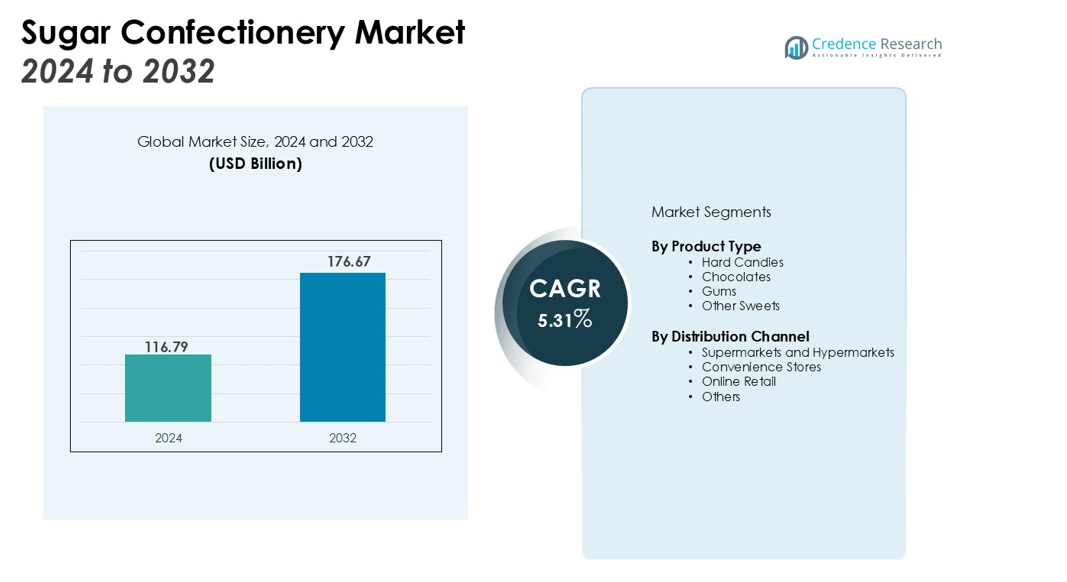

The Sugar Confectionery Market size was valued at USD 116.79 billion in 2024 and is anticipated to reach USD 176.67 billion by 2032, at a CAGR of 5.31% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sugar Confectionery Market Size 2024 |

USD 116.79 billion |

| Sugar Confectionery Market, CAGR |

5.31% |

| Sugar Confectionery Market Size 2032 |

USD 176.67 billion |

The key drivers of the market include the rising popularity of convenience foods, particularly among younger generations, as well as a growing preference for novelty flavors and premium product lines. Additionally, the increasing availability of sugar-free and healthier options caters to health-conscious consumers, thus expanding the market’s reach. The expansion of e-commerce platforms also facilitates the global availability of sugar confectioneries, further propelling the market’s growth.

Regionally, North America holds the largest share of the sugar confectionery market, owing to high consumption rates, advanced distribution channels, and the popularity of innovative products. Europe follows closely, driven by strong demand in countries like Germany and the UK, where traditional confectionery products remain in high demand. The Asia Pacific region is expected to witness the highest growth rate, supported by rising disposable income, urbanization, and changing consumer preferences, especially in emerging economies like China and India.

Market Insights:

- The global sugar confectionery market is valued at USD 116.79 billion in 2024 and is projected to reach USD 176.67 billion by 2032, growing at a CAGR of 5.31% during the forecast period.

- Convenience foods, especially among younger generations, drive the demand for sugar confectionery products, offering quick, portable snack options for busy consumers.

- A shift toward healthier products is emerging, with consumers increasingly seeking sugar-free, low-calorie, and organic alternatives, encouraging manufacturers to innovate.

- E-commerce platforms are boosting the accessibility of sugar confectionery, allowing consumers worldwide to purchase products online and expanding market reach, particularly in remote areas.

- Rising disposable incomes in emerging economies like China and India are contributing to the growing demand for sugar confectionery, especially as urbanization continues to increase.

- The expansion of sugar-free and healthier confectionery options is in response to growing health concerns related to sugar consumption, providing new opportunities for product innovation.

- North America, holding the largest market share at 35%, leads the demand for sugar confectionery, while the Asia Pacific region, capturing 20% of the market, is expected to experience the highest growth rate due to urbanization and changing consumer preferences.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Convenience Foods

The rising demand for convenience foods has significantly impacted the sugar confectionery market. Consumers increasingly seek quick, portable, and ready-to-eat snacks due to busy lifestyles. Sugar confectionery products, such as candies and chocolates, offer an easy and indulgent solution, making them a popular choice among working professionals, students, and families. The availability of these products in a variety of sizes and packaging options further enhances their convenience, fueling market growth.

- For instance, Mars Wrigley enhanced its convenience store strategy by securing 1 patent for its PayPoint Optimizer technology, an advanced analytics tool designed to improve the checkout experience for shoppers.

Health-Conscious Consumer Preferences and Innovations

Health-conscious consumers are demanding sugar-free, low-calorie, and organic alternatives to traditional sugar confectionery. This shift is driving manufacturers to innovate and produce products that cater to this growing segment. The market has seen an increase in the availability of sugar-free and plant-based confectioneries, which use natural sweeteners like stevia or agave. Such innovations aim to maintain taste while offering healthier options, appealing to a broader, health-focused demographic.

Expansion of E-Commerce and Retail Channels

The expansion of modern retail and e-commerce platforms has significantly boosted the accessibility of sugar confectionery products. Online shopping and the growth of specialized retail stores make it easier for consumers to access a wide range of confectionery items, even in remote areas. E-commerce platforms provide detailed product information and enable convenient purchasing options, attracting more customers to the market. This growing distribution network supports market expansion, especially in emerging regions.

- For instance, Ferrero Group leveraged its expanding retail and online presence to close the fiscal year ending in August 2024 with a consolidated turnover of 18.4 billion Euros.

Rising Disposable Income in Emerging Economies

In emerging economies like India and China, rising disposable income is contributing to the increasing demand for sugar confectionery. The growing middle class in these regions is becoming more inclined to spend on non-essential, indulgent products like confectioneries. Urbanization, along with changing lifestyles and evolving dietary habits, is fostering the growth of the sugar confectionery market in these regions. This trend indicates a promising future for market growth, particularly in Asia Pacific.

Market Trends:

Shift Towards Healthier Sugar Confectionery Options

The sugar confectionery market is witnessing a notable shift towards healthier alternatives as consumers become more health-conscious. There is a growing demand for sugar-free, organic, and low-calorie options, driven by increasing awareness of the negative effects of excessive sugar consumption. Products containing natural sweeteners such as stevia, agave, and honey are gaining popularity, catering to health-conscious individuals who still seek indulgent experiences. Manufacturers are responding by innovating and offering sugar confectionery that maintains the same taste but with reduced sugar content, or by incorporating functional ingredients like fiber or vitamins. This trend reflects a broader consumer preference for products that align with a healthier lifestyle without compromising on taste.

- For instance, Cargill became the first stevia producer to have its agricultural program for its entire grower network benchmarked at the Silver level by the SAI Platform’s Farm Sustainability Assessment 3.0 after a one-year validation process.

Technological Advancements in Production and Packaging

Technological advancements in production and packaging are playing a crucial role in the evolution of the sugar confectionery market. Modern manufacturing techniques have led to improved product quality, consistency, and production efficiency. Automation in production lines ensures better scalability and cost reduction for manufacturers. Additionally, innovative packaging solutions, such as resealable and eco-friendly materials, are gaining traction among consumers. These advancements not only enhance the consumer experience but also help brands meet sustainability goals, appealing to environmentally conscious buyers. The combination of these trends strengthens the market by improving accessibility, product differentiation, and consumer satisfaction.

- For instance, Theegarten-Pactec developed its modular CHS packaging machine to gently handle delicate chocolate products, achieving a high-performance output of up to 1,800 items per minute.

Market Challenges Analysis:

Health Concerns and Changing Consumer Preferences

One of the major challenges facing the sugar confectionery market is growing health concerns among consumers. Rising awareness about the risks associated with excessive sugar consumption, such as obesity, diabetes, and other chronic diseases, is prompting many consumers to seek healthier alternatives. This shift in consumer preferences towards sugar-free, organic, or low-calorie products creates pressure on manufacturers to adapt their offerings. However, maintaining taste and texture in these healthier alternatives while meeting consumer expectations remains a significant challenge. The demand for products with natural sweeteners further complicates production, requiring new formulations and ingredient sourcing.

Regulatory Pressure and Sustainability Concerns

The sugar confectionery market also faces increasing regulatory pressure, particularly related to sugar content and food labeling. Governments worldwide are implementing stricter regulations on sugar consumption, with policies aimed at reducing sugar content in processed foods. These regulations may affect the market’s ability to produce traditional sugary products without incurring additional costs for reformulation. Moreover, growing concerns over environmental sustainability are driving demand for eco-friendly packaging and production methods. Adapting to these environmental and regulatory demands while maintaining profitability poses a challenge for many players in the market.

Market Opportunities:

Growth in Emerging Markets and Urbanization

The sugar confectionery market holds significant growth opportunities in emerging economies, particularly in Asia Pacific, Africa, and Latin America. Rising disposable incomes, urbanization, and changing lifestyles in these regions are driving the demand for indulgent snacks like sugar confectionery. Increased access to retail outlets and e-commerce platforms further enhances market reach in these areas. As the middle class expands, consumers in these regions are becoming more willing to spend on confectionery products. This creates a substantial opportunity for companies to introduce their products to new markets, catering to local preferences and regional tastes.

Innovation in Product Offerings and Healthier Alternatives

Innovation plays a key role in opening new opportunities for the sugar confectionery market. There is a growing consumer interest in healthier, functional products that align with wellness trends. Manufacturers can explore options such as sugar-free, low-calorie, or high-protein confections to meet the needs of health-conscious buyers. Additionally, there is increasing demand for premium and artisanal products, which offer unique flavors and ingredients. Companies can capitalize on these trends by investing in R&D to develop novel product offerings that cater to a wide range of dietary needs and preferences, enhancing their competitive edge in the market.

Market Segmentation Analysis:

By Product Type

The sugar confectionery market is segmented into hard candies, chocolates, gums, and other sweets. Chocolates hold the largest market share due to their widespread popularity and indulgence factor across various demographics. Hard candies follow closely, driven by their long shelf life, availability in diverse flavors, and easy consumption. Gums are gaining traction due to their convenience and association with fresh breath, especially among younger consumers. Other sweets, including licorice and marshmallows, contribute a smaller share but remain popular in niche markets. The diversification in product offerings caters to different consumer preferences, supporting market growth.

- For instance, to support its growth in North America, Ferrero opened its first chocolate processing plant in the region, a 70,000-square-foot facility dedicated to producing chocolate for its popular brands.

By Distribution Channel

The distribution channels for sugar confectionery are divided into supermarkets and hypermarkets, convenience stores, online retail, and others. Supermarkets and hypermarkets lead the market due to their wide reach, allowing consumers easy access to a variety of sugar confectionery products. The growing trend of online retail is gaining momentum, with consumers increasingly purchasing sugar confectionery products online due to convenience and ease of comparison. Convenience stores also play a significant role in the distribution, especially in urban areas, providing quick access to confectioneries. Other channels, such as vending machines and specialty stores, contribute to market reach but remain relatively smaller in comparison. The expansion of e-commerce continues to reshape the distribution landscape.

- For instance, 7-Eleven is focusing on growing its delivery arm to enhance its distribution network. The company has set a specific goal to achieve $1 billion in sales through its 7Now delivery platform, underscoring the increasing importance of online and delivery channels.

Segmentations:

- By Product Type

- Hard Candies

- Chocolates

- Gums

- Other Sweets

- By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

- Others

- By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America: Leading Market with Strong Consumer Demand

North America holds the largest share of the sugar confectionery market, accounting for 35% of the global market. The U.S. and Canada exhibit high consumer demand for a variety of confectionery products, supported by strong retail networks and high disposable incomes. A preference for indulgent snacks and innovative confections continues to drive growth. The popularity of seasonal and novelty items, such as holiday-themed candies and chocolates, sustains demand. Additionally, the growing trend toward healthier alternatives, such as sugar-free and low-calorie options, provides opportunities for product diversification.

Europe: Traditional Market with Evolving Health Trends

Europe represents 28% of the global sugar confectionery market share, with major contributions from Germany, the UK, and France. The region has a long-standing tradition of confectionery consumption, maintaining strong demand for both premium products and traditional sugary snacks. However, there is a noticeable shift toward healthier alternatives, with consumers seeking organic, sugar-free, and low-calorie options. This trend drives manufacturers to innovate, offering products that align with evolving dietary preferences. Sustainability and eco-friendly packaging are also increasingly influencing consumer choices and shaping market trends.

Asia Pacific: Fast-Growing Market Driven by Urbanization

The Asia Pacific region captures 20% of the sugar confectionery market, with rapid growth fueled by rising disposable incomes and urbanization. Key countries such as China, India, and Japan contribute significantly to this growth, with increasing demand for both traditional and innovative confectionery products. The expanding middle class and greater access to modern retail channels create lucrative opportunities for market expansion. The rising popularity of Western confectionery brands and the demand for indulgent snacks further propel growth, while local manufacturers tailor products to meet regional preferences.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Lindt & Sprüngli AG

- Nestle S.A.

- The Kraft Heinz Company

- Lotte Confectionery

- HARIBO of America, Inc.

- Jelly Belly Candy Company

- Specialty Food Association, Inc.

- The Hershey Company

- Ferrero SpA

- Perfetti Van Melle

Competitive Analysis:

The sugar confectionery market is highly competitive, with key players such as Mars, Hershey, Nestlé, Ferrero, and Mondelez International leading the global landscape. These companies maintain a strong market presence through extensive distribution networks, innovative product offerings, and significant investments in marketing. Mars and Hershey dominate the chocolate segment, while Nestlé and Ferrero are prominent players in the broader confectionery market. The growing demand for healthier alternatives has encouraged companies to diversify their portfolios, introducing sugar-free, organic, and low-calorie products to cater to health-conscious consumers. The rise of e-commerce has also reshaped competition, with brands strengthening their online retail strategies. Regional players, such as Haribo and Perfetti Van Melle, focus on local tastes and preferences, ensuring a stronghold in specific markets. Companies continue to focus on product innovation, sustainability efforts, and expanding into emerging markets to stay ahead in this dynamic market.

Recent Developments:

- In June 2025, HARIBO of America partnered with the band Linkin Park to launch a special-edition gummy mix with six unique shapes representing the band members, sold exclusively at their concerts.

- In September 2025, The Kraft Heinz Company announced its plan to separate into two independent, publicly traded companies, a process expected to be completed in the second half of 2026.

- In April 2025, HARIBO of America launched two limited-edition tropical-flavored products, Goldbears Tropical and Twin Snakes Tropical, to mark National Gummi Bear Day.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The sugar confectionery market will continue to expand as consumer demand for indulgent snacks remains strong globally.

- Innovation in product offerings, such as sugar-free, low-calorie, and organic options, will drive growth among health-conscious consumers.

- E-commerce platforms will further enhance product accessibility, particularly in emerging markets where retail infrastructure is still developing.

- The preference for premium, artisanal confectionery products will increase, as consumers seek unique flavors and higher-quality ingredients.

- Rising disposable incomes in emerging markets, particularly in Asia Pacific, will result in higher consumption of sugar confectionery products.

- Sustainability will play an essential role in shaping the industry, with eco-friendly packaging and responsible sourcing becoming more important to consumers and manufacturers.

- The expansion of modern retail channels, including hypermarkets, supermarkets, and convenience stores, will continue to provide a broad reach for confectionery brands.

- The demand for seasonal and novelty items, such as holiday-themed candies, will remain strong, contributing to periodic market boosts.

- Manufacturers will continue to focus on reducing sugar content while maintaining flavor and texture to meet changing consumer preferences.

- Regional players will continue to grow by aligning their offerings with local tastes, allowing them to maintain strong positions in specific markets.