Market Overview:

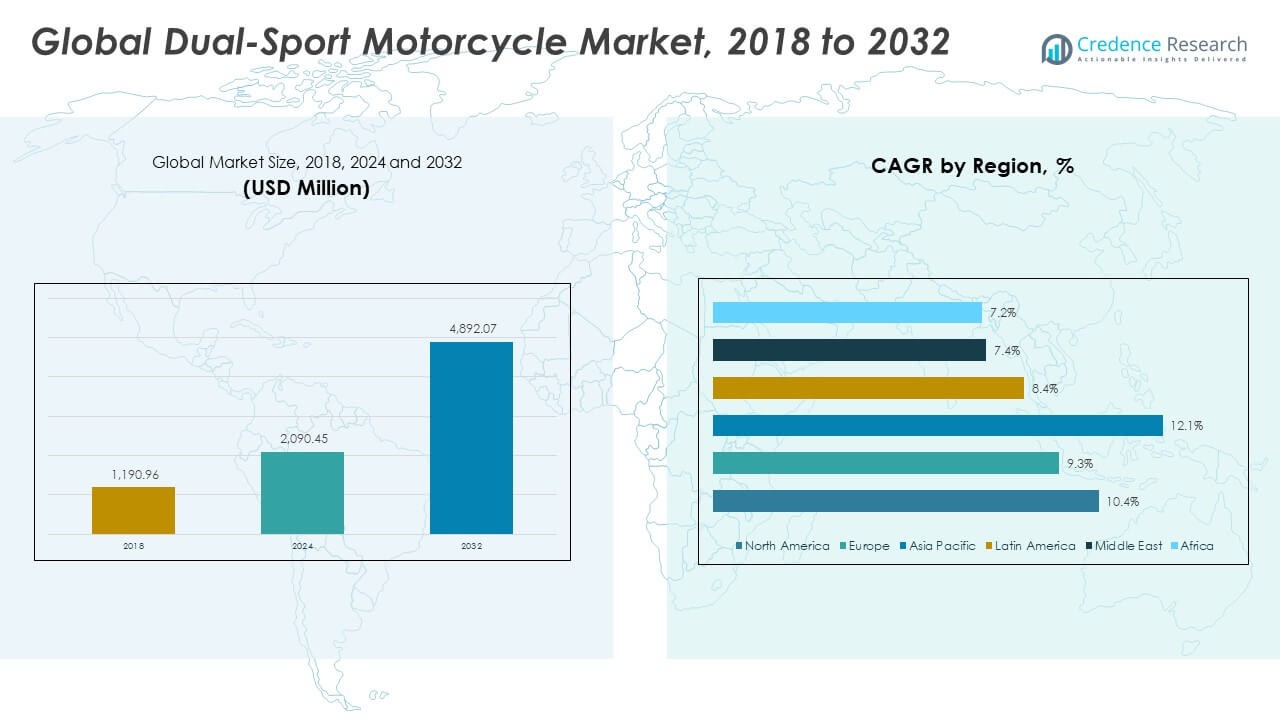

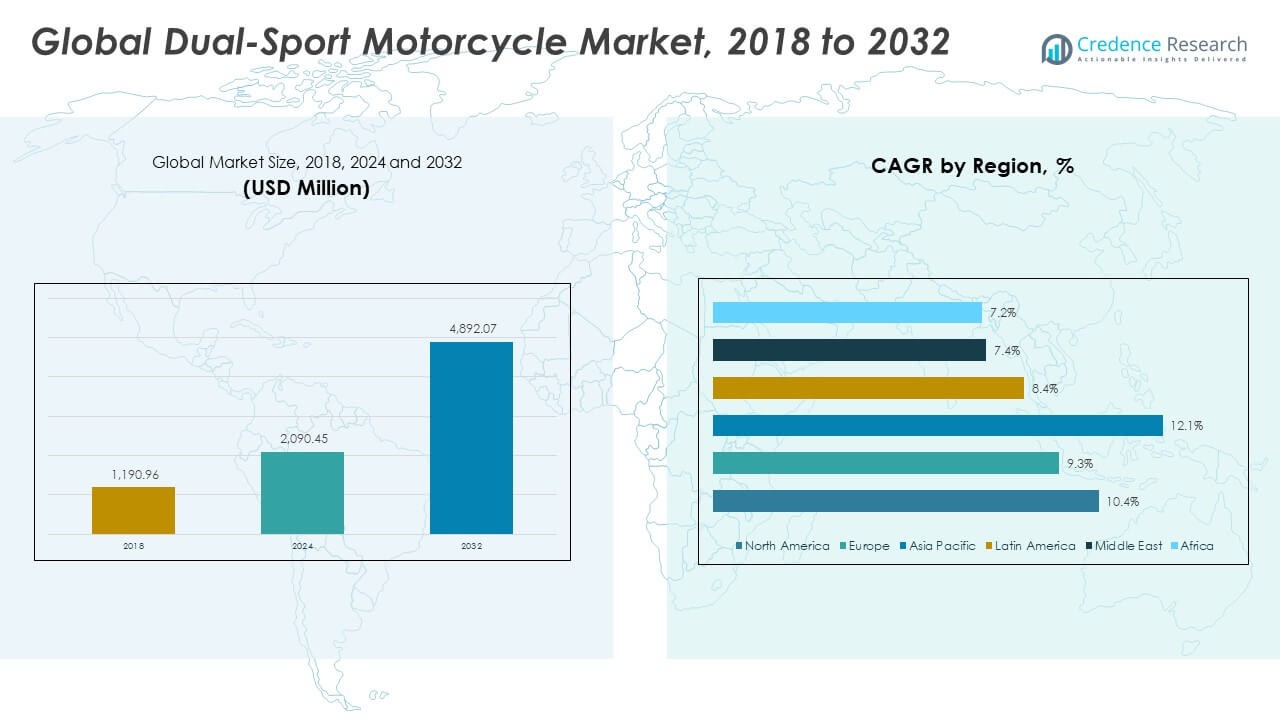

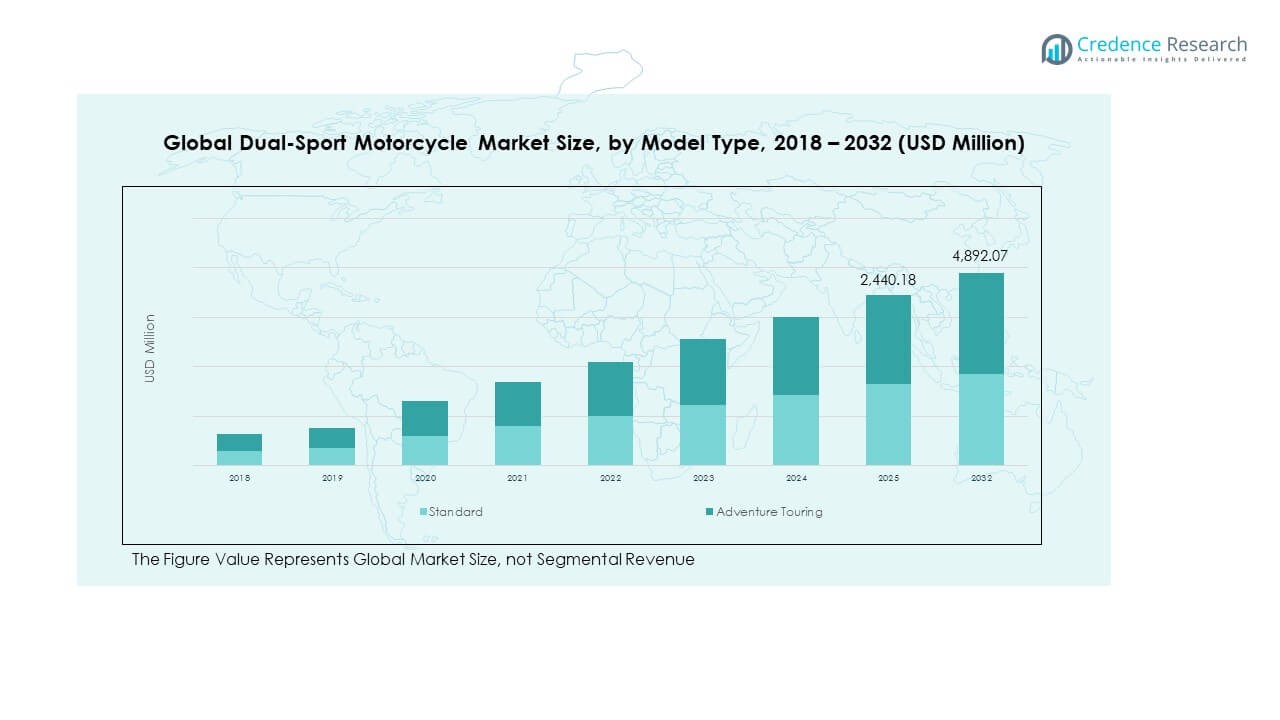

The Global Dual-Sport Motorcycle Market size was valued at USD 1,190.96 million in 2018 to USD 2,090.45 million in 2024 and is anticipated to reach USD 4,892.07 million by 2032, at a CAGR of 10.45% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dual-Sport Motorcycle Market Size 2024 |

USD 2,090.45 Million |

| Dual-Sport Motorcycle Market, CAGR |

10.45% |

| Dual-Sport Motorcycle Market Size 2032 |

USD 4,892.07 Million |

The market is driven by rising consumer demand for versatile motorcycles that serve both urban commuting and off-road adventure needs. Manufacturers are focusing on lightweight frames, advanced suspension, and fuel-efficient engines to enhance performance and reliability. Growing interest in adventure tourism, expanding recreational riding culture, and government support for sustainable mobility options strengthen overall adoption. Expanding financing options and retail channels also make these motorcycles more accessible to a wider consumer base.

Regionally, Asia Pacific leads the Global Dual-Sport Motorcycle Market, supported by rising middle-class incomes, expanding urbanization, and high adoption in countries like India, China, and Japan. North America and Europe maintain strong positions due to a well-established motorcycle culture, premium demand, and infrastructure supporting recreational riding. Latin America and the Middle East show growth through rising adventure tourism and increasing availability of mid-range models. Africa remains an emerging region, with adoption limited but showing potential in urban centers and tourism-driven markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Dual-Sport Motorcycle Market size was USD 1,190.96 million in 2018, reached USD 2,090.45 million in 2024, and is projected to hit USD 4,892.07 million by 2032, registering a CAGR of 10.45% during the forecast period.

- Asia Pacific led with 45.36% share in 2024, supported by rising middle-class income and strong adoption in China, India, and Japan. North America followed with 28.07%, driven by premium demand and recreational culture, while Europe held 17.60% due to its mature motorcycle market and innovation-led brands.

- Asia Pacific is the fastest-growing region, holding the largest share, supported by expanding urbanization, youth-driven demand, and strong presence of leading manufacturers.

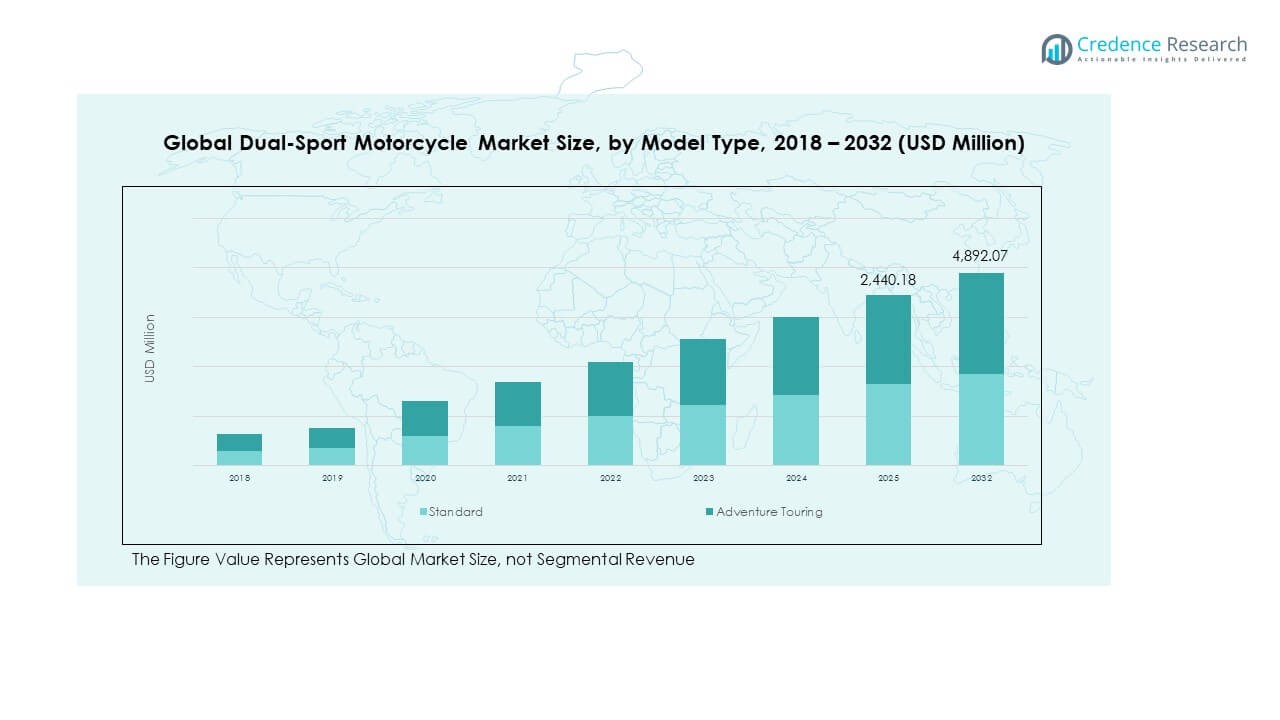

- In 2024, adventure touring motorcycles accounted for 65% of the market share, reflecting consumer preference for long-distance riding and off-road versatility.

- Standard motorcycles held 35% share in 2024, appealing mainly to commuters seeking affordable dual-purpose options with balanced performance.

Market Drivers

Rising Popularity of Adventure Touring and Recreational Riding Among Consumers

Adventure touring has become a strong factor behind motorcycle adoption, with more riders seeking flexible machines for daily commutes and outdoor recreation. The Global Dual-Sport Motorcycle Market benefits from this growing consumer preference as motorcycles offer on-road comfort and off-road performance. Riders value the balance of lightweight designs and durable structures suited for diverse terrains. It appeals to both young enthusiasts and older consumers who see motorcycles as lifestyle products. Expanding interest in adventure tourism strengthens the demand curve. Manufacturers address these needs through hybrid designs combining agility with stability. The market expands steadily through active participation in adventure rallies and events. Consumer demand for exploration and freedom remains a central growth driver.

Growing Influence of Eco-Friendly Mobility and Government Regulatory Measures

Government initiatives encouraging fuel-efficient vehicles strongly affect the Global Dual-Sport Motorcycle Market. Authorities promote policies supporting reduced emissions and low environmental impact. It pushes manufacturers to incorporate efficient engines, lighter materials, and sustainable features. Consumers are increasingly aware of climate challenges and show interest in motorcycles that align with eco-conscious values. Incentives such as reduced taxes or subsidies attract broader segments of buyers. Brands actively redesign engines to comply with evolving emission standards. Market growth is reinforced by infrastructure supporting sustainable two-wheel mobility. Regulatory frameworks create an environment where eco-friendly motorcycles gain credibility and acceptance.

- For instance, the California Air Resources Board announced that, effective with model year 2024, new on-road motorcycles are required to meet revised emissions standards that harmonize with Euro 5 regulations, driving the adoption of zero-emission motorcycles and sharply reducing NOx and ROG emissions from compliant dual-sport motorcycles statewide

Technological Integration and Performance Advancements in Motorcycle Design

Manufacturers drive innovation with suspension systems, braking improvements, and frame enhancements that optimize performance. The Global Dual-Sport Motorcycle Market benefits from consistent R&D investment by leading brands. Features like electronic fuel injection and advanced cooling systems are standard in newer models. It ensures reliability in varied conditions and enhances user confidence. Riders seek machines that merge efficiency with advanced safety technologies. Market leaders differentiate themselves by offering rider-assist features and improved handling systems. Performance upgrades maintain competitiveness while appealing to a wide spectrum of riders. Innovation secures long-term positioning within the motorcycle segment.

- For instance, the 2023 KTM 1290 Super Adventure S features WP Semi-Active Suspension. Riders adjust damping and preload electronically via the handlebar. It enables quick setup changes for on- and off-road use.

Expanding Retail Distribution Networks and Finance Accessibility for Consumers

Wider dealership networks and the growth of online motorcycle sales improve accessibility. The Global Dual-Sport Motorcycle Market gains momentum from stronger retail penetration across developed and emerging economies. Financing options attract first-time buyers and support middle-income consumers. It reduces entry barriers and increases brand loyalty. Retailers emphasize after-sales support to improve customer experience. Companies expand footprints through multi-brand showrooms and partnerships with local distributors. Online sales platforms extend market presence beyond traditional outlets. Distribution expansion creates a stable foundation for consistent global adoption.

Market Trends

Shift Toward Lightweight and Compact Motorcycle Models for Diverse Terrains

The Global Dual-Sport Motorcycle Market sees rising interest in compact models that suit both urban and rural roads. Consumers prefer lightweight motorcycles for easy handling and fuel savings. It drives design changes, where brands focus on reducing weight without sacrificing strength. Dual-purpose models appeal to commuters who balance efficiency with adventure rides. Increasing sales reflect demand for simplicity combined with durability. Lightweight frames also reduce maintenance costs, enhancing user trust. The industry adapts by introducing motorcycles that target both entry-level and experienced riders. This trend highlights a strategic move toward broader accessibility.

Increased Customization and Personalization Options for Consumer Segments

Riders seek motorcycles that align with personal identity, fueling customization demand. The Global Dual-Sport Motorcycle Market responds by offering factory-level personalization and aftermarket solutions. It includes adjustable seats, luggage carriers, and navigation systems. Younger consumers adopt motorcycles as lifestyle statements, while older riders value practical customization. Dealers and service providers capitalize on this by promoting tailored packages. Digital platforms showcase modular kits that make customization easier. Brands strengthen consumer loyalty by delivering flexible design options. The focus on individuality continues to grow as motorcycles evolve beyond transportation tools.

- For instance, Triumph offers over 50 genuine factory accessories for the 2024 Tiger 900 Rally Pro, including adjustable heated seats (with up to 0.78 inches of seat height adjustability), hand-guards, and accessory navigation systems, all documented in Triumph’s official accessory catalogs and product brochures.

Integration of Smart Connectivity Features for Rider Safety and Experience

Smart connectivity enhances the value proposition of modern motorcycles. The Global Dual-Sport Motorcycle Market adapts with GPS systems, Bluetooth-enabled helmets, and ride-tracking apps. It makes navigation, performance monitoring, and safety alerts seamless for riders. Manufacturers integrate these technologies to capture younger, tech-savvy audiences. It helps riders stay connected while managing performance metrics. Safety improves through real-time monitoring of engine health and tire pressure. Brands market connected motorcycles as premium, future-ready products. Digital adoption signals an era where motorcycles merge technology with performance.

Expansion of Electric Dual-Sport Motorcycles With Long-Range Capabilities

Electric motorcycles become a vital trend as environmental awareness grows. The Global Dual-Sport Motorcycle Market features models offering better range and charging efficiency. It encourages adoption among urban riders seeking sustainability with performance. Advances in battery technology improve reliability in long-distance touring. Companies invest in hybrid solutions bridging fuel and electric designs. This innovation appeals to eco-conscious consumers in both developed and emerging regions. Charging infrastructure development supports widespread electric adoption. Electric motorcycles transition from niche offerings to mainstream demand drivers.

- For instance, Zero Motorcycles’ DSR/X adventure bike is officially listed with a Z-Force 17.3 kWh lithium-ion battery, supporting a city range of up to 179 miles per charge, backed by the company’s published technical documentation.

Market Challenges Analysis

High Cost of Ownership and Limited Affordability Across Middle-Income Groups

Affordability challenges hinder expansion within the Global Dual-Sport Motorcycle Market. It involves high upfront costs and significant maintenance expenses compared to regular motorcycles. Middle-income consumers often hesitate despite interest in versatile designs. Financing solutions help but remain uneven across regions. Repair and replacement costs also discourage ownership among first-time buyers. Premium features like advanced suspension and connectivity systems raise prices further. Emerging markets face affordability gaps that restrict adoption speed. Cost constraints make price-sensitive buyers reluctant to shift from conventional motorcycles.

Infrastructural Limitations and Market Awareness Gaps in Emerging Regions

The Global Dual-Sport Motorcycle Market encounters obstacles linked to road infrastructure and awareness gaps. Many regions lack off-road trails or safe riding environments, limiting appeal. It restricts adoption where dual-sport motorcycles cannot be used to their full potential. Awareness of benefits remains low in developing economies, slowing demand growth. Limited dealerships and servicing points worsen the issue. Riders face challenges in accessing spare parts or specialized mechanics. Infrastructure gaps reduce the practicality of ownership in several markets. Low consumer knowledge about dual-sport versatility continues to slow penetration rates.

Market Opportunities

Expansion Into Emerging Economies Through Strategic Partnerships and Local Manufacturing

The Global Dual-Sport Motorcycle Market has strong opportunities in emerging economies where recreational biking culture is growing. Local partnerships support affordable manufacturing and regional distribution. It helps reduce costs and aligns products with local consumer needs. Expanding urbanization and rising disposable incomes enhance purchasing ability. Manufacturers that invest in localized models strengthen competitive advantage. Collaboration with tourism operators broadens exposure to new consumer bases. Regional demand for adventure sports increases opportunities for both global and regional brands. Emerging markets offer a long-term growth path for industry leaders.

Growing Demand for Premium Features Among Enthusiast Riders and Professionals

Premium features attract a distinct consumer base in the Global Dual-Sport Motorcycle Market. It includes advanced braking systems, smart connectivity, and superior suspension technology. Professional riders and enthusiasts prioritize these upgrades for enhanced performance. High-income groups and corporate buyers invest in premium motorcycles as lifestyle products. Expanding luxury retail networks increase exposure of high-end motorcycles. Tourism operators and adventure clubs also invest in advanced models for group activities. The trend aligns with global demand for durable, reliable, and technologically advanced machines. Premium adoption secures steady revenue for manufacturers in this market.

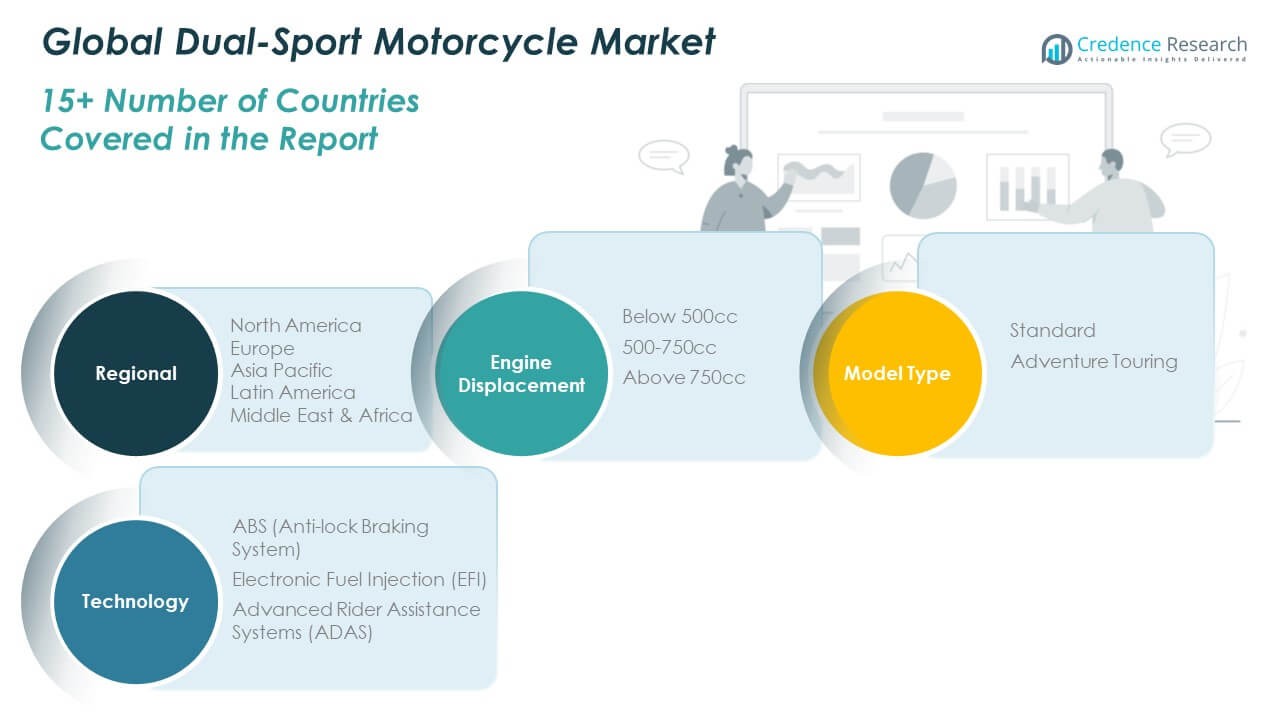

Market Segmentation Analysis:

The Global Dual-Sport Motorcycle Market is segmented

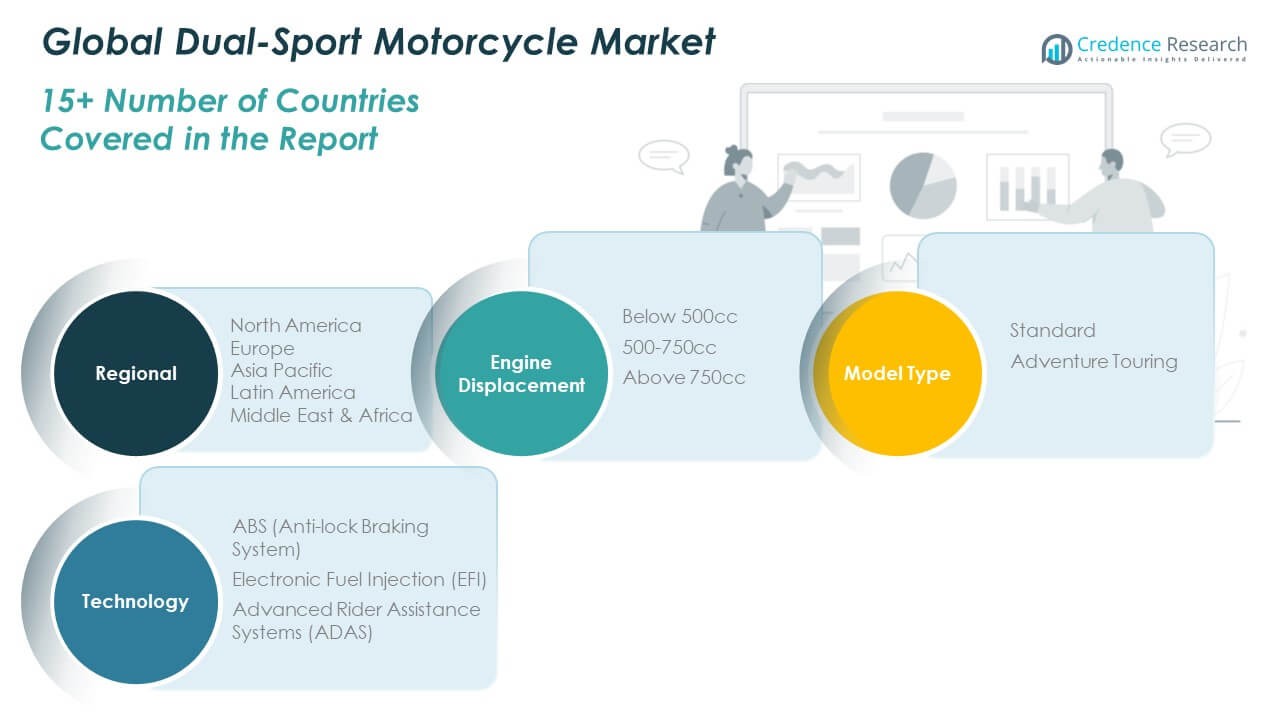

By engine displacement into below 500cc, 500–750cc, and above 750cc. The below 500cc category appeals to entry-level riders due to affordability and ease of handling, making it popular in Asia Pacific and Latin America. The 500–750cc segment balances performance with comfort, attracting mid-range buyers seeking reliable dual-purpose motorcycles. Above 750cc motorcycles dominate premium segments, favored in North America and Europe for long-distance touring and adventure riding. Each displacement tier caters to distinct rider preferences, supporting market diversification across income levels and geographies.

- For instance, in September 2023, BMW Motorrad unveiled the R 1300 GS, featuring a new 1,300cc boxer engine producing 145 horsepower at 7,750 rpm, establishing a benchmark for performance in the large touring and adventure motorcycle segment.

By model type, the market divides into standard and adventure touring motorcycles. Standard models are designed for urban commuting with occasional off-road use, appealing to daily riders seeking practicality. Adventure touring motorcycles provide advanced suspension, high ground clearance, and durability suited for rugged terrains. It remains the fastest-growing category, driven by adventure tourism and cross-country demand. The combination of versatility and performance makes adventure touring a major contributor to future growth.

- For example, the Triumph Tiger 900 Rally Pro 2023 is equipped with a Showa rear suspension unit that offers manual preload and rebound damping adjustment and 230 mm (9.05 inches) of wheel travel, specifically engineered for off-road durability. This makes adventure touring a standout category due to versatility and superior performance specifications.

By technology, segmentation includes ABS, electronic fuel injection (EFI), and advanced rider assistance systems (ADAS). ABS adoption strengthens safety standards across regions, while EFI improves fuel efficiency and engine reliability. ADAS integration represents a premium feature, gaining traction in developed markets where riders prioritize advanced safety and connectivity. It underlines the industry’s focus on innovation and rider protection. Across all segments, the Global Dual-Sport Motorcycle Market reflects a balance of affordability, performance, and technological advancement.

Segmentation:

By Engine Displacement

- Below 500cc

- 500–750cc

- Above 750cc

By Model Type

- Standard

- Adventure Touring

By Technology

- ABS (Anti-lock Braking System)

- Electronic Fuel Injection (EFI)

- Advanced Rider Assistance Systems (ADAS)

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis:

North America

The North America Global Dual-Sport Motorcycle Market size was valued at USD 339.70 million in 2018 to USD 586.79 million in 2024 and is anticipated to reach USD 1,379.07 million by 2032, at a CAGR of 10.5% during the forecast period. North America holds 28.07% of the 2024 global market share, supported by a strong motorcycle culture and advanced retail networks. The U.S. leads with high consumer spending power and strong adoption of adventure touring. It benefits from extensive off-road trails, well-established tourism, and organized events promoting dual-sport riding. Canada shows rising adoption due to growing interest in outdoor recreation and improved infrastructure. Mexico is developing through expanding middle-class demand and increased access to affordable motorcycles. The region’s manufacturers emphasize performance, safety, and advanced technology integration. North America remains a crucial hub for premium motorcycles, attracting both enthusiasts and professionals.

Europe

The Europe Global Dual-Sport Motorcycle Market size was valued at USD 221.80 million in 2018 to USD 367.93 million in 2024 and is anticipated to reach USD 782.76 million by 2032, at a CAGR of 9.1% during the forecast period. Europe contributes 17.60% of the 2024 market share, led by Germany, the UK, France, and Italy. It benefits from a mature motorcycle market and a strong tradition of touring. Riders in Europe value advanced technologies, fuel efficiency, and customization options. Tourism across scenic routes such as the Alps and Mediterranean regions sustains consistent demand. Electric motorcycle adoption is increasing due to strict EU emission regulations. The market supports premium segments as high-income groups invest in luxury models. Brands like BMW and Ducati strengthen the European presence. It positions Europe as a leading innovator in the dual-sport segment.

Asia Pacific

The Asia Pacific Global Dual-Sport Motorcycle Market size was valued at USD 520.86 million in 2018 to USD 947.98 million in 2024 and is anticipated to reach USD 2,353.67 million by 2032, at a CAGR of 11.3% during the forecast period. Asia Pacific dominates with 45.36% of the 2024 market share, driven by China, India, and Japan. Rising disposable incomes and rapid urbanization support growing adoption across middle-class populations. It reflects strong demand for motorcycles suited for daily commuting and recreational use. India and Southeast Asia show robust growth as dual-sport motorcycles become popular among youth. Japan leads in technological innovation, while Australia contributes with adventure touring demand. Expanding retail networks and affordable financing options boost accessibility. The region also witnesses strong growth in electric dual-sport motorcycles. Asia Pacific stands as the largest growth engine for the industry.

Latin America

The Latin America Global Dual-Sport Motorcycle Market size was valued at USD 55.06 million in 2018 to USD 95.42 million in 2024 and is anticipated to reach USD 197.09 million by 2032, at a CAGR of 8.7% during the forecast period. Latin America accounts for 4.56% of the 2024 global market share, led by Brazil and Argentina. Adventure tourism culture plays a significant role in supporting motorcycle adoption. It gains momentum as middle-income groups increase recreational spending. Brazil leads with a strong rider community and presence of regional distributors. Argentina shows rising interest in motorcycles for both leisure and mobility. Infrastructure development, though uneven, improves market potential across urban centers. Financing programs expand accessibility for younger consumers. Latin America remains a growing market with notable opportunities for manufacturers.

Middle East

The Middle East Global Dual-Sport Motorcycle Market size was valued at USD 33.63 million in 2018 to USD 53.99 million in 2024 and is anticipated to reach USD 106.78 million by 2032, at a CAGR of 8.1% during the forecast period. The region captures 2.58% of the 2024 global market share, with GCC countries leading adoption. Rising adventure tourism and interest in motorsports support demand growth. It is reinforced by expanding retail networks in countries like UAE and Saudi Arabia. Israel shows interest in advanced motorcycles, aligning with technological innovation. Turkey contributes with its growing youth rider base and expanding middle-class demand. Infrastructure investments improve accessibility for adventure touring. Manufacturers focus on premium models to cater to high-income consumers. The Middle East positions itself as a niche but profitable region for dual-sport motorcycles.

Africa

The Africa Global Dual-Sport Motorcycle Market size was valued at USD 19.91 million in 2018 to USD 38.34 million in 2024 and is anticipated to reach USD 72.69 million by 2032, at a CAGR of 7.5% during the forecast period. Africa represents 1.84% of the 2024 global market share, with South Africa leading adoption. It benefits from rising interest in outdoor sports and recreational riding. Egypt contributes with increasing urban demand and improving mobility infrastructure. Other African nations show gradual uptake supported by affordable models. Limited awareness and high costs restrict rapid growth, but opportunities exist in tourism-driven markets. Riders in urban centers show stronger demand for versatile motorcycles. Manufacturers entering the region focus on affordable models and distribution partnerships. Africa remains an emerging market with long-term potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Honda Motor Co.

- Kawasaki Motors

- KTM Sportmotorcycle

- Suzuki Motor Corporation

- Yamaha Motor Corporation

- Ducati

- Erik Buell Racing

Competitive Analysis:

The Global Dual-Sport Motorcycle Market features strong competition among leading global and regional manufacturers. Honda, Yamaha, Suzuki, Kawasaki, and KTM dominate with extensive product portfolios, advanced technologies, and established dealer networks. European brands such as BMW and Ducati strengthen the premium segment through innovation and performance-focused models. It remains influenced by product differentiation, pricing strategies, and technological integration such as ABS, EFI, and rider assistance systems. Emerging players target affordability and localized designs to capture demand in Asia Pacific and Latin America. Strategic moves including product launches, mergers, and distribution partnerships shape competitive positioning. Companies invest heavily in research and development to improve safety, efficiency, and connectivity features. Market leaders build brand loyalty through after-sales services and financing support. The industry reflects a balance of established dominance and new entrants leveraging innovation to gain share in this fast-expanding segment.

Recent Developments:

- In May 2025, Honda released updated versions of its CRF300L and Rally dual-sport motorcycles, introducing key upgrades such as new LED lighting, improved suspension, and a revised cooling system for better durability and comfort. For instance, the new CRF300L is now available in dealerships with an upgraded rear shock mount and increased ground clearance, allowing for better handling on rough trails.

Report Coverage:

The research report offers an in-depth analysis based on Engine Displacement, Model Type and Technology. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Dual-Sport Motorcycle Market will expand steadily with strong adoption across developed and emerging economies.

- Technological innovations such as ABS, EFI, and rider assistance systems will define future product competitiveness.

- Growth in electric and hybrid motorcycle models will open new opportunities for sustainability-focused consumers.

- Premium motorcycle demand will intensify in Europe and North America, driven by high-income enthusiasts.

- Asia Pacific will remain the largest growth hub due to its rising middle-class population and urban expansion.

- Adventure tourism and recreational activities will continue to fuel consumer interest in versatile motorcycles.

- Strategic collaborations with local distributors will improve access in Latin America, Africa, and the Middle East.

- Expanding financing options and online retail networks will lower entry barriers for new buyers.

- Manufacturers will focus on weight reduction, durability, and customization to capture wider consumer bases.

- Competitive intensity will rise as established brands and new entrants compete for global positioning.