Market Overview

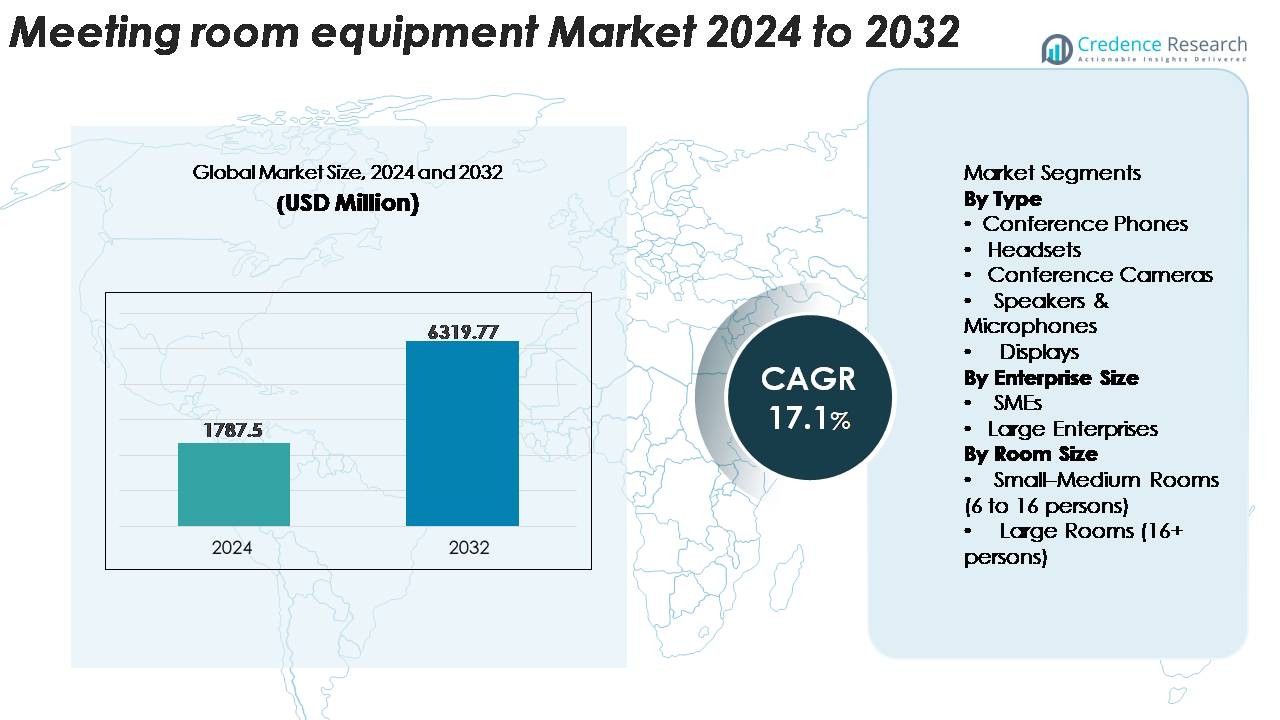

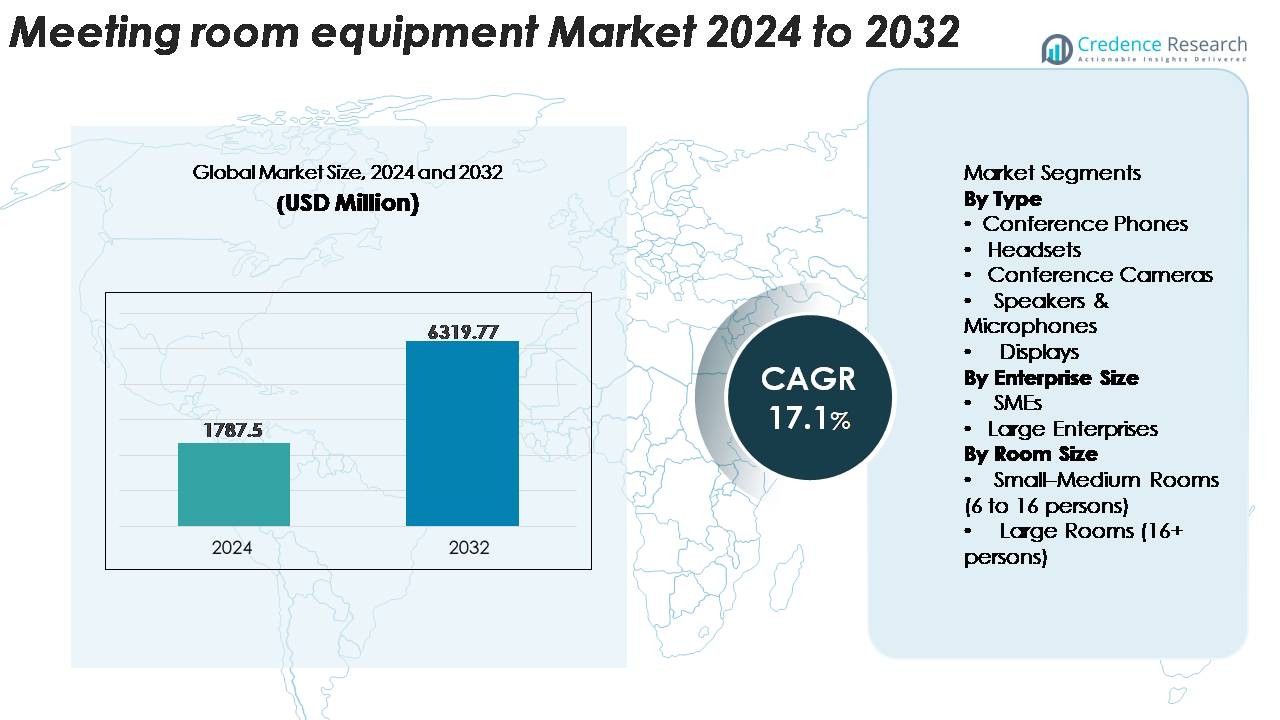

The Meeting Room Equipment Market was valued at USD 1,787.5 million in 2024 and is projected to reach USD 6,319.77 million by 2032, registering a CAGR of 17.1% over the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Meeting Room Equipment Market Size 2024 |

USD 1,787.5 Million |

| Meeting Room Equipment Market, CAGR |

17.1% |

| Meeting Room Equipment Market Size 2032 |

USD 6,319.77 Million |

The meeting room equipment market is shaped by a competitive group of technology and communication leaders, including Polycom (Plantronics, Inc.), ZTE Corporation, Adobe Systems Incorporated, Cisco Systems, Inc., Zoom Video Communications, Inc., Huawei Technologies Co., Ltd., LogMeIn, Inc., Alphabet Inc. (Google), and Microsoft Corporation. These companies compete through advanced video conferencing systems, AI-enabled collaboration tools, unified communication platforms, and cloud-managed devices that strengthen enterprise productivity. North America remains the leading region, capturing 32–34% market share, supported by strong hybrid-work adoption, rapid digital transformation, and high deployment of Teams Rooms, Zoom Rooms, and Google Meet-certified hardware across corporate environments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The meeting room equipment market was valued at USD 1,787.5 million in 2024 and is projected to reach USD 6,319.77 million by 2032, registering a CAGR of 17.1% during the forecast period.

- Demand is driven by the rapid expansion of hybrid work environments, prompting enterprises to upgrade conference rooms with AI-enabled cameras, advanced audio systems, and unified communication–certified hardware to support seamless collaboration across distributed teams.

- Market trends highlight rising adoption of all-in-one video bars, cloud-managed devices, and smart room technologies equipped with sensors, automation, and data analytics to optimize room utilization and user experience.

- Competition intensifies as leading players such as Cisco, Microsoft, Zoom, Google, Poly, and Huawei innovate aggressively with integrated collaboration suites; however, high deployment costs and interoperability challenges remain key restraints for SMEs and emerging markets.

- Regionally, North America leads with 32–34% share, followed by Europe at 26–28%, while APAC accounts for 28–30% and expands fastest; by segment, conference cameras hold the dominant type share, and large enterprises contribute the highest spending.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

Conference cameras represent the dominant type segment, holding the largest share of the meeting room equipment market as organizations prioritize high-resolution video collaboration for hybrid and distributed workforces. Demand is reinforced by the adoption of AI-enhanced framing, noise suppression, and multi-stream capabilities that improve meeting equity and user experience. Conference phones and speakers & microphones continue to gain traction as enterprises upgrade audio clarity for large and acoustically challenging environments, while displays benefit from the shift toward interactive whiteboards and touchscreen-enabled collaboration suites. Headsets remain essential for individual conferencing but command a smaller portion of room-level investments.

- For instance, Logitech’s Rally Bar integrates a 4K sensor with a 15× total zoom range (5× optical + digital enhancement) and uses onboard AI to process up to 30 video streams per second for automated speaker tracking.

By Enterprise Size

Large enterprises account for the highest share of meeting room equipment spending, driven by extensive multi-site collaboration needs, large conferencing infrastructures, and continuous modernization of boardrooms, training halls, and executive spaces. Their investment cycles increasingly prioritize unified communication (UC) integration, security-certified devices, and scalable cloud-native meeting platforms that support global connectivity. SMEs remain a fast-growing segment as hybrid work adoption expands and low-maintenance, plug-and-play hardware becomes more accessible. Bundled conferencing kits and subscription-based device management models further accelerate SME adoption, although overall market contribution remains led by large enterprises.

- For instance, Cisco’s Webex Room Kit Pro powers enterprise boardrooms with a quad-camera array capable of capturing video at 60 frames per second and integrates with up to 3 external 4K displays to manage large-room visual workflows.

By Room Size

Small–medium rooms (6 to 16 persons) make up the largest share of deployments, supported by the widespread conversion of standard meeting spaces into hybrid-ready collaboration rooms. These environments favor compact all-in-one video bars, auto-tracking cameras, and wireless presentation systems that balance performance with cost efficiency. Large rooms (16+ persons) contribute significantly but remain a smaller segment due to higher installation complexity and fewer available large-format spaces. Demand in this category is driven by multi-camera setups, ceiling-array microphones, and ultra-wide or multi-display configurations tailored for boardrooms, auditoriums, and training centers.

Key Growth Drivers

Expansion of Hybrid and Flexible Work Models

The transition toward hybrid workplaces continues to be the most significant driver of meeting room equipment adoption as organizations redesign their collaboration infrastructure to support distributed teams. Companies are increasingly prioritizing seamless video and audio experiences to ensure equal participation for remote and in-room attendees. This shift fuels demand for intelligent collaboration tools such as AI-enhanced cameras, noise-cancelling audio systems, high-fidelity microphones, and unified communication (UC)–integrated conferencing hardware. Employers seek to standardize conference rooms across office locations, ensuring hardware compatibility with Microsoft Teams, Zoom, Google Meet, and other UC platforms. The proliferation of huddle rooms and mid-sized collaboration spaces further amplifies the need for compact, all-in-one conferencing solutions. As enterprises compete on digital productivity and employee experience, investments in meeting room modernization become essential, ensuring improved decision-making, streamlined communication, and reduced operational inefficiencies. These factors collectively strengthen long-term demand for advanced meeting room equipment ecosystems.

- For instance, Microsoft’s Surface Hub 2S uses a 4K+ (3840 × 2560) PixelSense display and a 90-degree field-of-view 4K camera capable of capturing 30 frames per second, enabling remote participants to view meeting content and presenters with high clarity.

Rising Adoption of AI-Driven Collaboration and Automation

Artificial intelligence is becoming central to next-generation meeting environments, driving widespread upgrading of meeting room hardware. AI-enabled features such as auto-framing, speaker tracking, voice recognition, echo-cancellation, and automated lighting and environmental adjustments create frictionless meeting experiences. Organizations are increasingly integrating AI-powered management platforms that allow IT teams to remotely monitor device health, apply firmware updates, track usage patterns, and optimize room utilization. Intelligent scheduling panels and occupancy sensors enhance workplace analytics, enabling data-driven decisions about space allocation and technology investments. The emergence of multi-camera systems and spatial audio technologies also improves engagement and reduces meeting fatigue. As AI-driven features become standard expectations for professional collaboration, enterprises across sectors including finance, healthcare, education, and technology allocate larger budgets to future-ready meeting room ecosystems. The growing ecosystem of AI-capable devices positions the market for strong, sustained growth.

- For instance, the Logitech Rally Bar Mini uses an onboard AI Viewfinder module powered by a 4K imaging sensor that processes 30 video frames per second to deliver precise auto-framing and speaker tracking.

Increasing Standardization on Unified Communication and Cloud Platforms

The accelerated convergence of hardware and cloud-based unified communication platforms serves as a strong market catalyst. Enterprises increasingly require meeting room equipment that seamlessly integrates with Zoom Rooms, Microsoft Teams Rooms, Google Meet hardware, and cloud PBX systems. This standardization drives uniform device procurement, reduces interoperability issues, and ensures consistent user experiences across geographically distributed offices. Growth is further supported by ongoing cloud migration initiatives that encourage organizations to replace legacy conference systems with scalable, centrally managed solutions. Hardware-as-a-service and subscription-based device licensing models increase affordability, enabling businesses to upgrade equipment without high upfront costs. Interoperability certification programs also stimulate demand for fully compatible displays, cameras, controllers, and audio systems. As cloud-native collaboration becomes the backbone of modern communication, enterprises prioritize secure, compliant, and future-proof integrated meeting room solutions boosting adoption across organizations of all sizes.

Key Trends & Opportunities

Surge in Demand for All-in-One Collaboration Bars and Smart Meeting Bundles

A major trend reshaping the market is the rapid adoption of all-in-one video bars and bundled room kits designed for simplified installation and easy scalability. These integrated systems combine ultra-high-definition cameras, beamforming microphones, stereo speakers, and built-in compute units into a single device. Businesses prefer these solutions because they reduce cabling complexity, accelerate deployment, and lower maintenance requirements while delivering enterprise-grade performance. Vendors are increasingly introducing preconfigured kits for small, medium, and large rooms, enabling standardized rollout across corporate campuses. The opportunity expands as resellers and integrators offer bundled packages with displays, controllers, room schedulers, and cloud management features. This trend strongly benefits SMEs and organizations undergoing rapid meeting-room expansions, as they can deploy high-quality conferencing setups without needing specialized AV support. The growing preference for modular, plug-and-play systems will continue driving hardware innovation and market expansion.

· For example, the Poly Studio X50 integrates a 4K-capable camera with AI-driven auto-framing and a beamforming microphone array rated for pickup up to 25 feet (about 7.6 meters). The all-in-one bar includes stereo speakers engineered for meeting-room clarity and operates natively without the need for an external PC.

Growth of Smart Rooms with IoT, Sensors, and Automation Ecosystems

The evolution toward intelligent, connected workplaces presents substantial opportunities for meeting room equipment vendors. Sensors integrated into room systems including occupancy detectors, environmental sensors, and usage analytics modules enable automated room scheduling, dynamic lighting control, touchless operation, and environmental optimization. IoT-enabled devices also allow facility and IT managers to monitor room performance in real time, enabling predictive maintenance and reducing downtime. Smart whiteboards, wireless presentation solutions, and digital collaboration tools further enhance productivity, bridging the gap between physical and virtual meetings. As organizations pursue workplace digitalization strategies, demand increases for interconnected systems that support automation, energy efficiency, and data-driven space planning. These innovations not only streamline meeting workflows but also improve user adoption and enhance employee experience. The trend toward IoT-augmented meeting environments offers strong opportunities for vendors specializing in hardware, software, sensors, and analytics platforms.

- For instance, Crestron offers various occupancy sensors, such as the GLS-OIR-C-CN model, which uses passive infrared (PIR) technology for occupancy detection in areas up to 2,000 square feet (approximately 185 square meters).

Increasing Demand from Education, Healthcare, and Government Sectors

Beyond corporate offices, significant growth opportunities emerge from institutional sectors that are accelerating their digital transformation initiatives. Universities, training institutes, and smart classrooms are rapidly deploying advanced meeting room equipment to support hybrid learning, remote teaching, and campus-wide collaboration. Healthcare organizations invest in teleconsultation suites and multidisciplinary conference rooms equipped with high-definition cameras and secure communication platforms. Meanwhile, government agencies and public institutions upgrade meeting spaces to improve administrative efficiency and support remote participation in policy and coordination meetings. Procurement in these sectors is driven by long-term modernization budgets, compliance mandates, and a focus on secure, reliable communication infrastructure. As institutions shift toward permanent hybrid engagement models, demand for robust, integrated meeting room solutions is expected to expand significantly, creating sustained opportunities for vendors.

Key Challenges

High Deployment Costs and Infrastructure Constraints

Despite strong market momentum, budget constraints and high installation costs remain significant barriers to adoption, especially for SMEs and public-sector organizations. Comprehensive meeting room upgrades often involve not only hardware procurement but also acoustic treatment, network readiness, room redesign, and professional installation services. Larger rooms require complex AV architectures, including ceiling microphone arrays, multi-camera systems, DSP units, and control processors substantially raising investment requirements. Additionally, outdated buildings may lack the wiring, power distribution, or network bandwidth necessary to support modern video conferencing setups. These cost and infrastructure challenges slow down large-scale deployment and prevent organizations from fully standardizing rooms across all locations.

Interoperability Issues and Device Management Complexity

Maintaining compatibility across diverse collaboration platforms and multi-vendor hardware ecosystems continues to pose challenges, particularly for enterprises operating across global offices. Different rooms often use equipment from various manufacturers, creating inconsistencies in performance and user experience. Firmware updates, device monitoring, and troubleshooting become complex when IT teams must manage equipment remotely or across hybrid networks. Interoperability issues between UC platforms, such as Teams and Zoom, further complicate deployment strategies and may require additional licensing or hardware. Cybersecurity concerns also arise as more meeting room devices connect to corporate networks. These management complexities increase operational burden and hinder seamless meeting room standardization.

Regional Analysis

North America

North America holds the largest share of the meeting room equipment market, accounting for 32–34% of global revenue, driven by rapid hybrid-work adoption and strong penetration of unified communication platforms such as Zoom Rooms, Microsoft Teams Rooms, and Google Meet hardware. Large enterprises across the U.S. and Canada continue to modernize boardrooms, huddle spaces, and training centers with AI-enabled cameras, advanced audio systems, and all-in-one collaboration bars. Strong investments in digital transformation, high replacement cycles, and widespread corporate standardization further reinforce the region’s leadership position in smart meeting infrastructure.

Europe

Europe captures 26–28% of the global market, supported by stringent enterprise communication standards, strong adoption of remote collaboration, and government-backed digital workplace initiatives. Demand is particularly high in Germany, the U.K., France, and the Nordics, where organizations invest in acoustic-optimized conferencing rooms, multi-camera setups, and interactive displays. The shift toward sustainable, energy-efficient meeting environments also drives adoption of low-power AV systems and sensor-enabled smart rooms. Growth is further accelerated by the modernization of public-sector institutions, universities, and pan-European enterprises seeking standardized cloud-integrated meeting room architectures.

Asia-Pacific (APAC)

Asia-Pacific is the fastest-growing region, contributing 28–30% of the market and expanding rapidly due to large-scale office expansions, digitization initiatives, and a surge in SME participation. China, Japan, South Korea, and India drive major deployments across corporate campuses, co-working hubs, education centers, and government facilities. Adoption of AI-powered collaboration devices, wireless presentation tools, and multi-display configurations is accelerating as enterprises prioritize productivity and hybrid collaboration. Increasing investment from global AV manufacturers and the rise of local hardware suppliers further strengthen market penetration, positioning APAC as a long-term growth engine.

Latin America

Latin America accounts for 6–8% of global demand, supported by gradual digital workplace transformation and growing hybrid meeting adoption in Brazil, Mexico, Colombia, and Chile. Enterprises increasingly deploy budget-friendly conference cameras, USB-based audio solutions, and all-in-one collaboration bars to enhance remote collaboration. The region benefits from the expansion of multinational companies and rising investment in telecommunications infrastructure. However, cost sensitivity and uneven technology maturity across countries limit faster adoption. Despite these constraints, demand continues to rise as organizations modernize meeting spaces to improve operational efficiency and connectivity.

Middle East & Africa (MEA)

The Middle East & Africa region holds 4–5% of the global market, driven by strong enterprise modernization in the UAE, Saudi Arabia, and South Africa. Large investments in government digitization, smart city programs, and multinational corporate expansion support increased deployment of professional-grade meeting room equipment. Enterprises prioritize advanced audio systems, PTZ cameras, and large-format displays to support high-stakes conference environments. Growth in the educational, healthcare, and public sectors also contributes to demand. However, varying infrastructure readiness and budget constraints across emerging markets keep the region’s overall share relatively smaller.

Market Segmentations:

By Type

- Conference Phones

- Headsets

- Conference Cameras

- Speakers & Microphones

- Displays

By Enterprise Size

By Room Size

- Small–Medium Rooms (6 to 16 persons)

- Large Rooms (16+ persons)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the meeting room equipment market is characterized by strong participation from global AV, IT, and unified communication technology providers that focus on advanced collaboration ecosystems and seamless platform integration. Leading vendors such as Logitech, Poly (HP), Cisco, Crestron, Barco, Sony, Samsung, and Lenovo compete through innovation in AI-driven video bars, PTZ cameras, beamforming microphones, touch-enabled displays, and cloud-managed control systems. Companies emphasize interoperability with major UC platforms, including Microsoft Teams Rooms, Zoom Rooms, and Google Meet hardware, to strengthen enterprise adoption. Strategic partnerships with software providers, frequent firmware upgrades, and product portfolio expansion into all-in-one room kits further intensify competition. Many vendors are also investing in sustainability, energy-efficient components, and remote device management tools to meet enterprise IT requirements. At the same time, regional players and emerging manufacturers offer cost-effective conferencing solutions, increasing price competitiveness. Overall, the market remains dynamic, innovation-driven, and strongly influenced by global digital workplace modernization trends.

Key Player Analysis

- Polycom (Plantronics, Inc.)

- ZTE Corporation

- Adobe Systems Incorporated

- Cisco Systems, Inc.

- Zoom Video Communications, Inc.

- Huawei Technologies Co., Ltd.

- LogMeIn, Inc.

- Alphabet, Inc. (Google)

- Microsoft Corporation

Recent Developments

- In October 2025, Zoom expanded its hardware certification program to include accessories for frontline workers, starting with a partnership with Jabra. This initiative is an enhancement to the company’s “Zoom Rooms” hardware ecosystem. More information is available from Zoom.

- In September 2025, Cisco announced extended interoperability for its RoomOS devices, enabling meeting-room equipment to support native connections with Zoom, Google Meet and Microsoft Teams.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Enterprise size, Room size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Hybrid and remote collaboration will continue to drive sustained investment in advanced meeting room equipment across enterprises of all sizes.

- AI-enabled features such as auto-framing, noise cancellation, and multi-participant recognition will become standard in next-generation conferencing systems.

- All-in-one video bars and preconfigured room bundles will gain broader adoption due to simplified installation and lower maintenance needs.

- Cloud-managed device ecosystems will expand, enabling remote monitoring, automated updates, and predictive maintenance for IT teams.

- Interactive displays, digital whiteboards, and touch-enabled collaboration tools will see increased integration in modern meeting spaces.

- IoT sensors and room analytics platforms will enhance space utilization, scheduling efficiency, and energy management.

- Large enterprises will continue leading spending, while SMEs accelerate adoption through subscription-based hardware-as-a-service models.

- Multi-camera setups and spatial audio technologies will redefine immersive meeting experiences for high-end conference rooms.

- Education, healthcare, and government sectors will increase deployments to support hybrid instruction, telehealth, and administrative collaboration.

- Sustainability-driven procurement will boost demand for energy-efficient, durable, and low-emission meeting room devices.

Market Segmentation Analysis:

Market Segmentation Analysis: