Market Overview:

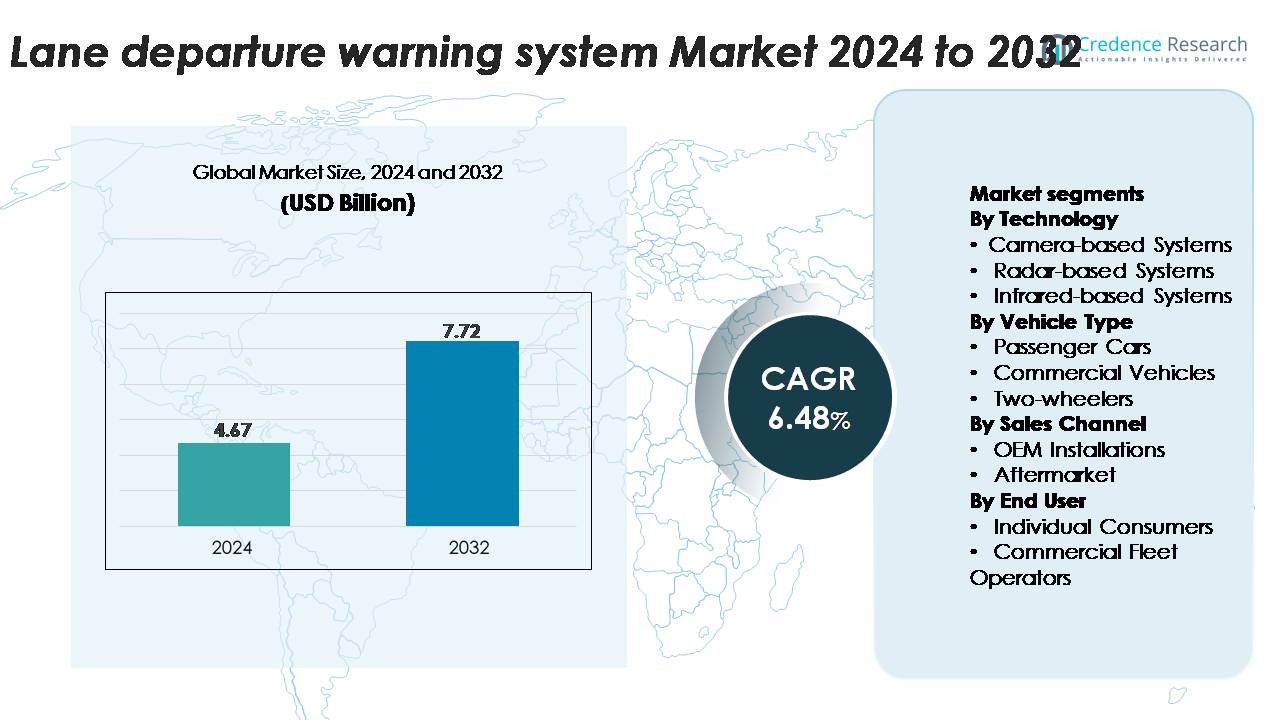

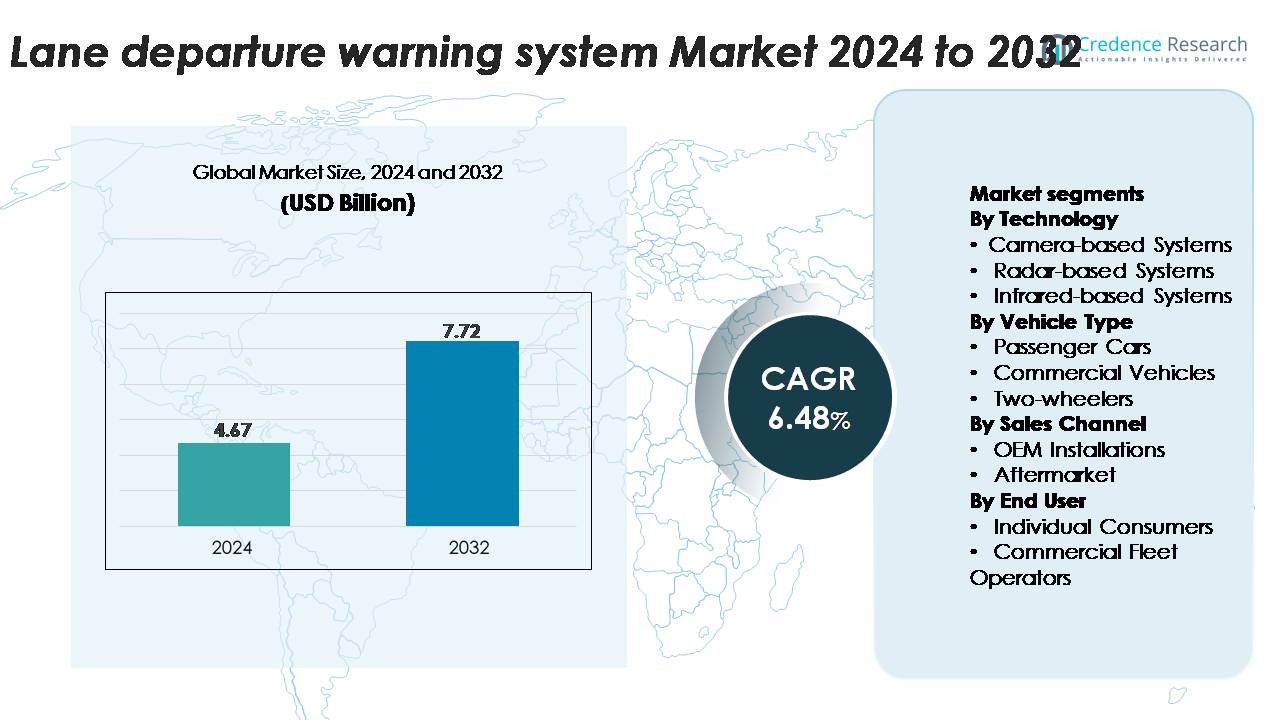

The global Lane Departure Warning System (LDWS) Market was valued at USD 4.67 billion in 2024 and is projected to reach USD 7.72 billion by 2032, registering a CAGR of 6.48% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Lane Departure Warning System (LDWS) Market Size 2024 |

USD 4.67 Billion |

| Lane Departure Warning System (LDWS) Market, CAGR |

6.48% |

| Lane Departure Warning System (LDWS) Market Size 2032 |

USD 7.72 Billion |

The lane departure warning system market is shaped by strong participation from leading ADAS and automotive electronics companies such as Bosch GmbH, Continental AG, Denso Corporation, ZF Friedrichshafen, Mobileye, Aptiv, Magna International, Valeo, Hella, Visteon Corporation, Panasonic Automotive, Hyundai Mobis, Autoliv Inc., TRW Automotive, Gentex Corporation, Hitachi Automotive Systems, Mando Corporation, NVIDIA Corporation, and Autotalks. These players compete through advancements in camera technology, AI-based lane detection, and sensor-fusion platforms integrated into OEM safety suites. North America leads the global market with approximately 32% share, driven by stringent safety regulations and high ADAS penetration, followed closely by Europe at 28% with strong regulatory enforcement and mature automotive manufacturing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The global lane departure warning system market was valued at USD 4.67 billion in 2024 and is projected to reach USD 7.72 billion by 2032, registering a CAGR of 6.48% over the forecast period.

- Market growth is driven by mandatory ADAS regulations, rising integration of camera-based LDWS currently the dominant technology segment with the largest share—and increasing consumer demand for safety-equipped vehicles across mid-range and premium categories.

- Key trends include AI-enhanced lane detection, sensor-fusion platforms, and expanding OEM adoption supported by declining sensor costs, with aftermarket retrofitting gaining momentum in aging vehicle fleets.

- Competitive intensity remains high, with players such as Bosch, Continental, Denso, ZF Friedrichshafen, Mobileye, Aptiv, and Valeo focusing on improved lane-recognition accuracy, low-light performance, and scalable ADAS architectures; however, system calibration challenges and performance limitations in poor road conditions restrain wider adoption.

- Regionally, North America leads with 32%, followed by Europe at 28% and Asia-Pacific at 27%, while passenger cars remain the largest vehicle-type segment, supporting sustained LDWS penetration worldwide.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Technology

Camera-based systems represent the dominant technology segment in lane departure warning systems due to their precision in lane recognition, lower cost, and compatibility with advanced driver assistance platforms. These systems lead adoption because they accurately interpret road markings, support multifunctional ADAS features, and integrate easily with onboard processors. Radar- and infrared-based systems gain traction in adverse-weather scenarios, but their uptake remains lower because of higher sensor costs and limited relevance to standard lane-keeping applications. As vehicle manufacturers prioritize scalable, software-driven ADAS architectures, camera-based LDWS continues to hold the largest share across global deployments.

- For instance, Mobileye’s camera-based LDW module uses an 8-megapixel forward camera processed by the EyeQ5 High SoC, delivering 16 TOPS enabling high-definition lane detection at distances exceeding 150 meters even at highway speeds.

By Vehicle Type

Passenger cars account for the largest share of LDWS adoption, driven by rising regulatory mandates, increasing incorporation of ADAS in mid-range models, and strong consumer preference for safety-enhancing vehicle technologies. Automakers are equipping sedans, SUVs, and crossovers with standard or optional LDWS features to meet safety ratings and differentiate product offerings. Commercial vehicles show steady growth as fleet operators seek technologies that reduce operational risk and improve driver compliance. Two-wheelers remain an emerging niche, with adoption primarily concentrated in premium motorcycles. Overall, passenger cars remain the dominant segment due to high production volume and faster technology integration.

- For instance, Hyundai Mobis develops and supplies camera and radar sensors for its Advanced Driver Assistance Systems (ADAS), including Lane Departure Warning (LDW) and Lane Keeping Assist (LKA), to Hyundai and Kia vehicles.

By Sales Channel

OEM installations dominate the LDWS market as manufacturers integrate these systems directly into new vehicles to comply with evolving safety standards and enhance competitive positioning. Factory-fitted LDWS ensures optimal calibration, seamless ADAS integration, and higher reliability, making it the preferred choice for both automakers and buyers. The aftermarket segment is expanding gradually as vehicle owners retrofit older models with ADAS components, although integration complexities and compatibility issues limit penetration. Continued regulatory pressure and ADAS standardization across vehicle segments reinforce OEM installations as the leading contributor to market share.

Key Growth Drivers

Rising Regulatory Mandates for Vehicle Safety Compliance

Growing regulatory pressure is one of the strongest contributors to LDWS adoption worldwide. Governments in North America, Europe, and parts of Asia have implemented mandatory ADAS requirements for new vehicles, pushing OEMs to integrate lane departure technologies as standard equipment. Safety bodies such as Euro NCAP increasingly reward higher ratings to vehicles equipped with LDWS, influencing automaker design priorities and consumer purchasing decisions. This regulatory momentum compels manufacturers to accelerate ADAS integration across mass-market and premium vehicle lines. The push for Vision Zero initiatives and national road safety programs further amplifies the demand for technologically advanced warning systems. In emerging markets, regulatory harmonization is encouraging automakers to standardize LDWS across global platforms. As safety norms become more stringent and enforcement tightens, regulatory adoption remains a powerful catalyst that drives consistent growth across both OEM and commercial fleet segments.

- For instance, Bosch’s third-generation MPC3 mono-camera, which was designed to enhance existing safety functions, uses a ~2.6-megapixel CMOS sensor with a typical passenger vehicle detection range of up to 210 meters. It utilizes an innovative system-on-chip with a Bosch microprocessor that employs an algorithmic multipath approach combining classic image-processing algorithms with AI methods, enabling precise lane-edge recognition under low-contrast road conditions.

Increasing Consumer Preference for ADAS-Enabled Vehicles

Consumer awareness of road safety benefits is rapidly expanding, leading to strong demand for vehicles equipped with advanced driver assistance features, including LDWS. Buyers increasingly prioritize collision-prevention technologies, especially in mid-range vehicles where ADAS availability was previously limited. Automakers are responding by integrating LDWS into broader driver-assistance suites, enhancing the perceived value and safety credentials of new models. The rise of digital dashboards and in-vehicle sensors supports seamless user experience, making LDWS more intuitive for drivers. Additionally, insurance companies in several regions are incentivizing ADAS-equipped vehicles with lower premiums, encouraging wider adoption. As vehicle shoppers evaluate safety performance as a key buying criterion, LDWS becomes an essential feature contributing to overall driver confidence and reduced accident risk. This consumer-driven shift accelerates adoption across both passenger cars and commercial fleets, reinforcing steady market expansion.

- For instance, Aptiv’s latest Gen 6 camera module targeted at high-volume mid-segment passenger cars uses an 8-megapixel image sensor paired with a vision processor delivering 22 TOPS, enabling lane boundary detection at highway speeds with processing latencies under 20 milliseconds.

Expansion of Connected and Autonomous Vehicle Architectures

The shift toward connected and semi-autonomous mobility significantly influences the adoption of lane departure warning systems. LDWS functions as a foundational component within Level 1 and Level 2 automation frameworks, supporting real-time lane tracking, adaptive cruise control, and lane-keeping assist. Advancements in sensor fusion, AI-driven image processing, and onboard computing enable LDWS to deliver more accurate lane recognition across diverse road conditions. Automakers invest heavily in scalable ADAS platforms that integrate multiple sensors—including cameras, radar, and ultrasonic modules—to enhance predictive safety capabilities. Fleet operators adopting telematics-based monitoring also rely on LDWS to reduce driver fatigue-related incidents and improve operational efficiency. As the industry moves closer to higher automation levels, LDWS becomes indispensable for redundancy and system reliability. This technological evolution reinforces its role as a critical enabler of next-generation vehicle intelligence and road safety.

Key Trends & Opportunities:

Integration of AI-Enhanced Lane Detection and Sensor Fusion

AI-driven algorithms are transforming LDWS accuracy and performance by enabling real-time lane recognition under conditions that traditionally challenged optical systems, such as faded markings, poor lighting, and adverse weather. Manufacturers increasingly deploy deep learning models and sensor fusion strategies that combine camera data with radar or LiDAR inputs to create robust lane detection capabilities. This integration opens new opportunities for enhanced driver assistance and seamless transitions to lane-keeping automation. The emergence of domain controllers and centralized vehicle computing platforms further supports high-speed data processing, allowing LDWS to operate with greater precision. As AI capabilities continue to advance, suppliers have significant opportunity to differentiate systems through software innovation, over-the-air updates, and improved predictive safety features.

- For instance, ZF’s latest ProAI-based ADAS stack supports up to 66 TOPS of compute and processes inputs from a 120-degree 8-megapixel front camera paired with 77-GHz radars having a detection range of 150 meters, enabling robust AI-powered lane interpretation.

Growing Adoption of ADAS in Mid-Range and Economy Vehicles

A major market opportunity is the rapid democratization of advanced driver assistance technologies in mid-range and entry-level vehicles. Automakers are reducing sensor costs, optimizing software architectures, and leveraging economies of scale to integrate LDWS more affordably. This shift expands adoption beyond premium models, opening substantial growth potential in high-volume vehicle categories. Governments promoting mass-market safety enhancements further accelerate this trend, especially in Asia-Pacific and Latin America. As LDWS becomes a standard expectation among mainstream buyers, suppliers gain opportunities to scale production, diversify product portfolios, and collaborate with OEMs on integrated ADAS bundles. The long-term trajectory indicates rising adoption across all vehicle price points.

- For instance, Continental’s MFC500 mono-camera part of a modular, scalable, and interlinked platform for all vehicle architectures features a high image resolution that ranges from one to eight megapixels, a wide field of view of up to 125 degrees, and integrates leading-edge technologies such as machine learning and neural networks for advanced ADAS functions and Highly Automated Driving.

Expansion of Aftermarket Solutions for Older Vehicle Fleets

The aftermarket presents a growing opportunity as vehicle owners and fleet operators seek cost-effective safety upgrades for older models. Improved sensor miniaturization, plug-and-play camera systems, and simplified installation kits make retrofitting more practical. Commercial fleets increasingly adopt these systems to reduce liability, prevent accidents, and improve driver monitoring. Technology firms are introducing aftermarket LDWS units with smartphone integration, cloud analytics, and driver behavior insights, offering additional value. As road safety programs promote ADAS benefits, the aftermarket segment is positioned for accelerated expansion, especially in markets with large aging vehicle populations.

Key Challenges:

Performance Limitations in Poor Road Marking and Adverse Weather

Despite technological progress, LDWS performance still suffers in environments with inconsistent road markings, heavy rainfall, snow, fog, or low-light conditions. Camera-based systems—which dominate the market—struggle to detect lanes accurately without clear visual cues. Regions with poorly maintained road networks experience higher false warnings or system deactivation, reducing driver trust. While radar and sensor fusion can mitigate some limitations, these systems are costlier and less frequently implemented in mainstream vehicles. Adverse weather reliability remains a critical challenge as global safety regulations tighten. Overcoming this requires more resilient algorithms, enhanced sensor calibration, and greater standardization of road marking quality.

High Integration Costs and Compatibility Issues in Aftermarket Installations

Although aftermarket LDWS solutions are expanding, installation complexity and cost remain major barriers. Retrofitting often requires precise camera alignment, specialized calibration tools, and integration with existing vehicle electronics, leading to higher service expenses. Many older vehicles lack necessary interfaces or digital architectures, limiting compatibility. Commercial fleets face additional downtime costs during installation, reducing appeal despite long-term benefits. For suppliers, designing universally compatible aftermarket systems while maintaining accuracy presents technical constraints. Unless costs decrease and installation becomes more standardized, aftermarket adoption will continue to lag behind OEM integration, posing a challenge to broader market penetration.

Regional Analysis:

North America

North America holds a strong position with approximately 32% market share, driven by advanced ADAS regulations, high consumer adoption, and strong integration of safety technologies across premium and mid-range vehicles. The U.S. dominates regional demand due to NHTSA guidelines, five-star safety rating requirements, and early deployment of camera-based LDWS in passenger and commercial fleets. OEMs such as Ford, GM, and Tesla integrate LDWS as standard or optional features, strengthening penetration. Fleet modernization initiatives and rising insurance incentives further accelerate uptake. Canada’s growing focus on road safety contributes to steady regional expansion.

Europe

Europe accounts for roughly 28% market share, supported by stringent Euro NCAP protocols and widespread OEM adoption of ADAS across all vehicle categories. Germany, France, and the U.K. lead deployments as manufacturers integrate LDWS into broader safety suites to comply with EU General Safety Regulation guidelines. The region benefits from well-maintained road infrastructure, enabling high-accuracy camera-based lane detection. Commercial fleets increasingly equip LDWS to meet corporate safety standards and reduce liability. Strong consumer awareness, high vehicle electrification, and rapid adoption of semi-autonomous functions reinforce Europe’s position as a mature LDWS market.

Asia-Pacific

Asia-Pacific represents the fastest-growing region with an estimated 27% market share, driven by soaring vehicle production, rising safety awareness, and rapid ADAS penetration in China, Japan, and South Korea. Chinese OEMs integrate LDWS into mass-market models to meet evolving safety norms and competitiveness requirements. Japan’s established automotive technologies and emphasis on elderly driver safety contribute to consistent demand. India and Southeast Asia show increasing adoption as mid-range vehicles begin incorporating lane-departure features. Expanding regulatory alignment, cost-effective sensor manufacturing, and strong government road-safety initiatives position Asia-Pacific for continued high growth.

Latin America

Latin America holds around 7% market share, with adoption concentrated in Brazil, Mexico, and Argentina. Growing availability of ADAS in mid-range passenger cars and rising imports of technologically advanced models support market expansion. Regulatory adoption remains gradual, but fleet operators increasingly adopt LDWS to reduce accident rates and insurance exposure. Economic variability and cost sensitivity limit penetration of high-end sensor systems; however, aftermarket LDWS installations are emerging as a feasible alternative for older fleets. As regional safety standards improve and OEM production stabilizes, LDWS adoption is expected to gain momentum across the region.

Middle East & Africa

The Middle East & Africa region captures approximately 6% market share, driven by rising demand for premium vehicles, expanding commercial fleets, and growing awareness of driver safety technologies. Gulf countries such as the UAE and Saudi Arabia lead adoption due to strong purchasing power and increasing regulatory emphasis on road safety. Commercial transport operators implement LDWS to reduce fatigue-related accidents on long-distance routes. In Africa, adoption remains limited but gradually improving with growing imports of ADAS-equipped vehicles. Infrastructure challenges and lower consumer affordability restrain growth, but long-term prospects strengthen as safety-focused policies evolve.

Market Segmentations:

By Technology

- Camera-based Systems

- Radar-based Systems

- Infrared-based Systems

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two-wheelers

By Sales Channel

- OEM Installations

- Aftermarket

By End User

- Individual Consumers

- Commercial Fleet Operators

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the lane departure warning system market is characterized by strong participation from global automotive technology suppliers, sensor manufacturers, and integrated ADAS solution providers. Leading companies focus on advancing camera modules, AI-driven image processing, and sensor fusion capabilities to enhance lane-detection accuracy and enable seamless integration with broader driver-assistance platforms. Established Tier-1 suppliers collaborate closely with OEMs to develop modular LDWS packages that meet regional safety regulations and evolving vehicle design requirements. Competitive differentiation increasingly centers on software algorithms, low-light performance, and reliability in adverse weather conditions. Companies also invest in scalable architectures that support Level 2 and Level 3 automation features, strengthening long-term positioning. Emerging players target aftermarket opportunities with retrofittable LDWS units optimized for older vehicle fleets. Continuous innovation, strategic partnerships, and expanding automotive electronics production facilities shape a competitive environment driven by technological leadership and regulatory compliance.

Key Player Analysis:

- Gentex Corporation

- Mobileye

- ZF Friedrichshafen

- Aptiv

- Panasonic Automotive

- Autoliv Inc.

- Hella

- Hyundai Mobis

- Denso Corporation

- Mando Corporation

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Recent Developments:

- In November 2025, Panasonic Automotive Systems Co., Ltd. joined the Open Invention Network (OIN), a strategic move demonstrating its commitment to supporting the development of open source technologies in the automotive industry. While not specifically focused on lane departure warning systems, this partnership underscores Panasonic Automotive’s broader commitment to advancing software-defined vehicle technologies and supporting the development of advanced in-vehicle software required for next-generation ADAS applications.

- In October 2025, Aptiv announcedits most advanced radar platform yet Generation 8 (Gen 8) radars designed to meet the evolving needs of future advanced driver assistance systems (ADAS). Engineered for hands-free driving in complex urban environments, Aptiv’s Gen 8 radars offer superior perception and cost efficiency through both front-facing and corner radar units, providing all-weather reliability and 4D perception capabilities.

- In October 2025, Mobileye announced a significant expansion of its India footprint through a strategic collaboration with VVDN Technologies Pvt. Ltd., a leading Indian Tier 1 engineering and manufacturing services company. Under this Memorandum of Understanding (MoU), the two companies will work together to localize key ADAS solutions, including systems built on the EyeQ™ family of chips and associated sensors, to support Indian automakers. This partnership aims to leverage Mobileye’s global product roadmap and advanced driver assistance technologies with VVDN’s deep local engineering and manufacturing capabilities, enabling faster time-to-market and customization for Indian automotive manufacturers and their export-ready platforms.

Report Coverage:

The research report offers an in-depth analysis based on Technology, Vehicle type, Sales channel, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- LDWS will increasingly integrate AI-driven lane recognition to improve accuracy in low-visibility and complex road conditions.

- Automakers will expand LDWS adoption across mid-range and entry-level vehicles as ADAS becomes a standard safety feature.

- Sensor-fusion architectures combining cameras, radar, and LiDAR will enhance system reliability and support higher automation levels.

- Over-the-air software updates will allow continuous LDWS performance improvements and system recalibration without service visits.

- Commercial fleets will adopt LDWS more aggressively to reduce accident rates and meet corporate safety compliance targets.

- Regulatory bodies worldwide will tighten safety mandates, accelerating OEM integration across all new vehicle platforms.

- Aftermarket LDWS solutions will gain traction as technology becomes easier to install and more cost-effective.

- Integration with advanced cockpit electronics and centralized domain controllers will streamline processing and reduce latency.

- Emerging markets will see rapid growth as local regulations evolve and ADAS-enabled vehicles become more accessible.

- Collaborative ecosystems between automotive OEMs, semiconductor firms, and ADAS software providers will drive next-generation LDWS innovations.

Market Segmentation Analysis:

Market Segmentation Analysis: