Market Overview:

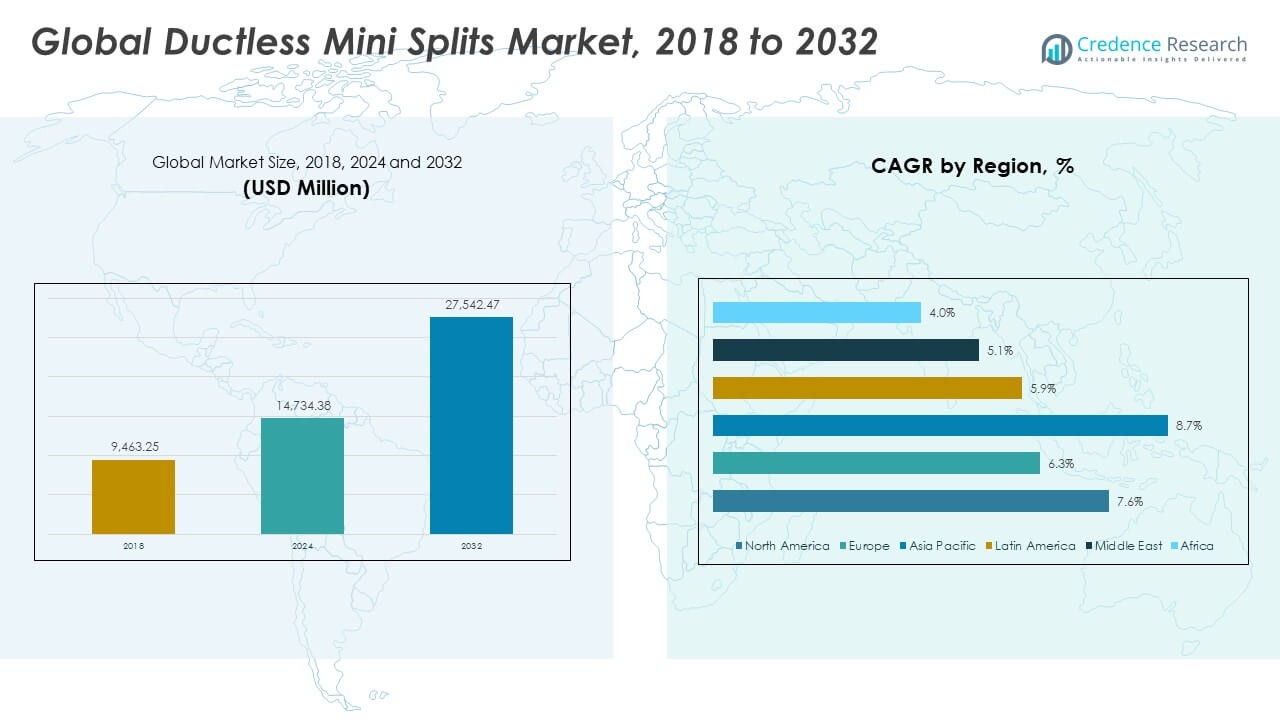

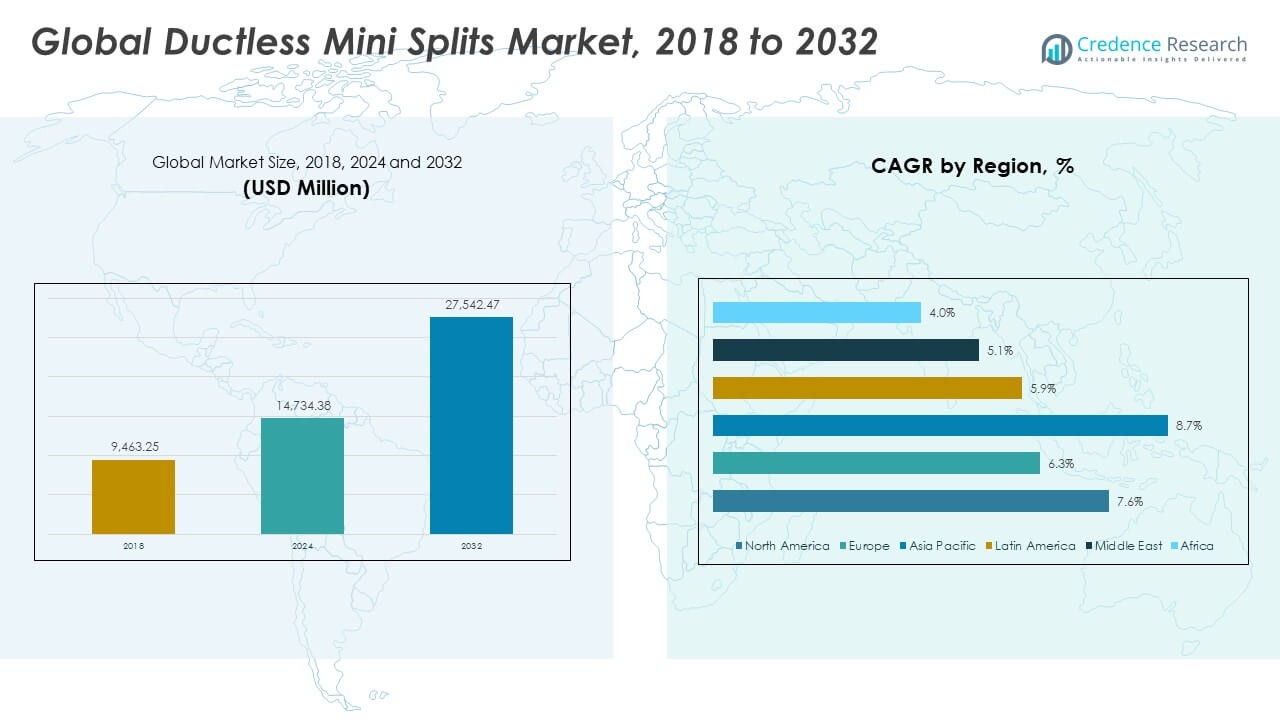

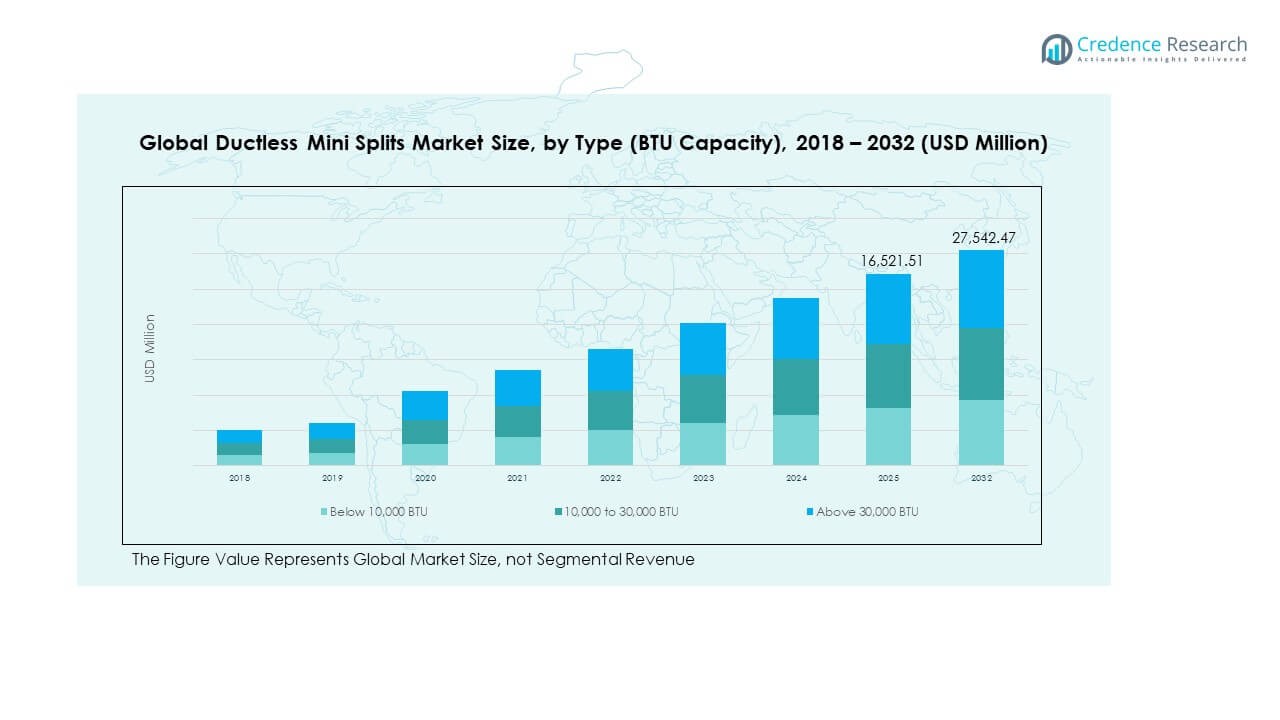

The Global Ductless Mini Splits Market size was valued at USD 9,463.25 million in 2018 to USD 14,734.38 million in 2024 and is anticipated to reach USD 27,542.47 million by 2032, at a CAGR of 7.57% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ductless Mini Splits Market Size 2024 |

USD 14,734.38 Million |

| Ductless Mini Splits Market, CAGR |

7.57% |

| Ductless Mini Splits Market Size 2032 |

USD 27,542.47 Million |

The market growth is driven by rising demand for energy-efficient climate control systems across residential and commercial sectors. Consumers seek cost savings and comfort through inverter-based and smart-enabled models. Government initiatives promoting eco-friendly appliances accelerate adoption, while technological innovations in design and connectivity improve product appeal. Growing urban housing projects and the need for flexible installations further strengthen demand. Businesses also turn to ductless systems for reliable performance, reduced emissions, and compliance with environmental standards, creating momentum for sustained expansion.

Regional growth reflects diverse drivers across geographies. North America leads with strong adoption in residential retrofitting and light commercial applications. Asia Pacific is emerging rapidly due to urbanization, middle-class expansion, and government-led energy initiatives in markets like China, Japan, and India. Europe maintains steady growth with strict energy regulations and widespread replacement demand. Latin America shows rising adoption in urban centers, while the Middle East benefits from extreme climate needs. Africa, though smaller, is gradually advancing with urban infrastructure projects and increasing awareness of energy-efficient cooling.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Ductless Mini Splits Market was valued at USD 9,463.25 million in 2018, reached USD 14,734.38 million in 2024, and is projected to attain USD 27,542.47 million by 2032, growing at a CAGR of 7.57%.

- North America leads with 43.67% share in 2024 due to high residential retrofitting and commercial adoption, while Asia Pacific follows at 30.35% with rapid urbanization, and Europe holds 17.44% supported by strict energy regulations.

- Asia Pacific is the fastest-growing region with 30.35% share in 2024, driven by rising middle-class income, government incentives for energy efficiency, and expanding distribution in China, India, and Southeast Asia.

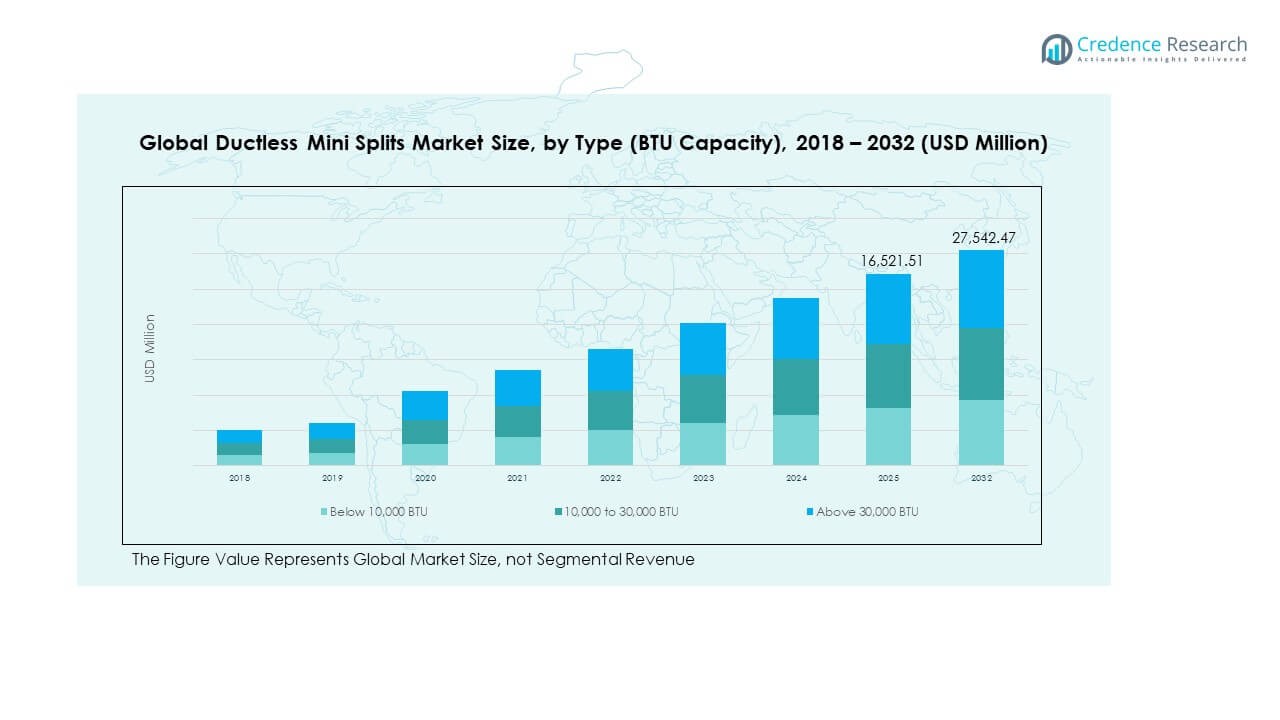

- The 10,000 to 30,000 BTU segment captures 52% share in 2024, reflecting balanced demand across households and light commercial spaces requiring mid-range capacity.

- Below 10,000 BTU holds 28% share, appealing to compact residential spaces, while above 30,000 BTU accounts for 20% share, serving industrial and large commercial applications.

Market Drivers

Rising Demand for Energy-Efficient Climate Control Solutions

The Global Ductless Mini Splits Market is expanding due to the strong push for energy efficiency. Consumers prefer systems that reduce electricity bills while maintaining comfort in homes and offices. Governments across regions encourage adoption through incentives and regulations on energy-efficient appliances. Manufacturers integrate inverter technology to provide consistent performance and lower operational costs. Businesses focus on reducing energy footprints, boosting installations in commercial facilities. The rising costs of conventional HVAC systems drive preference for ductless solutions. Consumers see long-term savings and reliable temperature control as key benefits. This combination supports steady adoption worldwide.

- For example, Daikin’s OTERRA R32 residential mini split offers a published SEER2 rating of up to 21, as listed in official product specifications, reflecting its high efficiency compared to traditional models. This positions the unit among Daikin’s most energy-efficient ductless solutions.

Urbanization and Growth in Residential Construction Projects

The rise of urban housing projects drives demand for compact and flexible air conditioning systems. Developers adopt ductless mini splits due to their ease of installation in apartments and smaller spaces. The Global Ductless Mini Splits Market benefits from the trend of increasing urban populations seeking modern living standards. It provides customized climate control for diverse room layouts. Construction companies favor systems that save space while reducing maintenance complexity. Growing disposable incomes enhance consumer spending on premium cooling solutions. Renovation projects in older homes also generate significant replacement demand. Rising urbanization continues to strengthen market growth potential.

Technological Integration with Smart Home Systems

Integration with IoT and smart home platforms boosts product appeal across consumer groups. Users operate ductless mini splits via smartphones, voice assistants, and automated schedules. The Global Ductless Mini Splits Market leverages this shift to attract younger, tech-driven buyers. It improves user convenience and energy optimization through real-time monitoring. Remote operation aligns with lifestyle changes where flexibility and control are essential. Manufacturers highlight connectivity features to differentiate products in competitive markets. Upgrades in Wi-Fi modules and sensors enhance efficiency and comfort. The focus on intelligent climate management strengthens consumer adoption trends.

Government Support and Environmental Regulations

Strict environmental policies promote adoption of eco-friendly appliances across multiple economies. Authorities enforce standards to reduce greenhouse gas emissions from residential and commercial cooling systems. The Global Ductless Mini Splits Market gains traction due to these policy shifts. It aligns with sustainability goals through the use of low-emission refrigerants and efficient compressors. Tax benefits and subsidies in certain regions encourage households and businesses to switch. Green building certifications drive contractors to adopt energy-efficient cooling solutions. Increased awareness of climate impact among consumers supports eco-conscious purchases. These regulatory and cultural drivers create long-term demand stability.

- For example, LG’s ARTCOOL Mirror models use R32 refrigerant with a global warming potential (GWP) of 675, confirmed through official product literature. The range also carries Eurovent certification, verifying its performance and efficiency standards in the European market.

Market Trends

Adoption of Multi-Zone Cooling Systems for Large Spaces

The demand for multi-zone systems is growing across residential and commercial projects. Consumers want climate control tailored for different rooms without installing multiple units. The Global Ductless Mini Splits Market responds by introducing advanced multi-zone designs. It allows multiple indoor units to connect to one outdoor unit, reducing costs and improving space efficiency. Businesses in retail, hospitality, and healthcare embrace such systems to optimize comfort. Growing awareness of zonal energy savings supports adoption. Manufacturers promote these solutions as sustainable and cost-efficient. The trend aligns with the expansion of urban housing and commercial projects.

- For instance, Daikin’s VRV LIFE system officially supports connecting up to 9 indoor units to a single outdoor unit, delivering zoning flexibility well-suited for large residential and light commercial projects verified by Daikin’s official technical guides and 2025 product literature.

Customization of Indoor Unit Designs for Aesthetic Appeal

Consumers increasingly value the design and aesthetics of indoor air conditioning units. Companies introduce slim, wall-mounted, ceiling cassette, and floor-mounted options to match interiors. The Global Ductless Mini Splits Market sees this shift as a major trend in customer appeal. It offers buyers a wide range of visually appealing designs without compromising functionality. Architects and interior designers recommend ductless systems for modern layouts. Enhanced design flexibility creates opportunities in premium housing projects. Compact and stylish units attract urban buyers seeking modern aesthetics. This trend improves market competitiveness across high-demand regions.

Increased Role of Replacement Demand in Mature Markets

Replacement of outdated HVAC systems is a major contributor to new sales in developed economies. Consumers prefer energy-efficient ductless models over expensive central air upgrades. The Global Ductless Mini Splits Market benefits from this cycle of replacement. It positions itself as a cost-effective solution for aging residential and commercial infrastructure. Businesses look to reduce operational costs by upgrading to ductless systems. Strict energy laws also encourage replacement of conventional units. The availability of easy-install retrofitting options accelerates replacement adoption. This trend reinforces consistent growth in mature regional markets.

Focus on Low-GWP Refrigerants for Environmental Sustainability

Manufacturers prioritize refrigerants with low Global Warming Potential (GWP) to comply with regulations. Transition toward alternatives like R-32 highlights environmental responsibility and product innovation. The Global Ductless Mini Splits Market aligns with this global transition. It demonstrates commitment to sustainability while addressing consumer demand for eco-friendly solutions. Manufacturers invest in R&D to ensure efficient cooling without environmental harm. Low-GWP refrigerants gain traction in both developed and emerging regions. Market players highlight compliance with environmental laws as a competitive advantage. This trend strengthens alignment with climate-conscious policies and consumer preferences.

- For example, Panasonic’s 2025 European catalogue confirms that its split and multi-split series now use R32 refrigerant with a GWP of 675, compared to 2088 for R410A. This shift delivers a 68% reduction in GWP, aligning with the company’s sustainability focus in Europe.

Market Challenges Analysis

High Upfront Costs and Installation Barriers

High initial purchase costs remain a major challenge for broader adoption. Many price-sensitive consumers delay switching despite long-term energy savings. The Global Ductless Mini Splits Market faces hurdles in reaching lower-income households. It must compete with traditional window and split ACs that remain cheaper. Installation costs also increase in retrofitting projects where wiring and setup are complex. Contractors require technical training to ensure proper installation, limiting widespread acceptance. Lack of awareness in rural areas further delays demand growth. These barriers slow the market expansion pace in key regions.

Technical Limitations and Lack of Skilled Workforce

Technical limitations restrict adoption in large industrial applications where central systems dominate. The Global Ductless Mini Splits Market struggles to capture demand in heavy commercial sectors. It requires a trained workforce for maintenance and troubleshooting, which is not always available. Shortage of skilled technicians limits market reach in developing economies. Consumers face downtime and higher service costs without adequate support. Compatibility challenges in integrating ductless systems with older electrical frameworks add to the issue. Limited distribution in some regions also affects adoption. These combined challenges highlight operational and structural constraints.

Market Opportunities

Growing Adoption in Developing Economies and Urban Expansions

Developing nations present strong growth opportunities with rising disposable incomes and urban infrastructure projects. The Global Ductless Mini Splits Market benefits from expanding middle-class populations seeking comfort and efficiency. It becomes an attractive option for households upgrading from basic air conditioners. Urban housing projects, retail expansion, and hospitality growth support wider installations. Compact design and flexible installation suit diverse living spaces. Energy-conscious governments provide incentives for efficient systems. Expanding retail channels enhance product accessibility. These dynamics create a significant growth path in emerging economies.

Product Innovation and Integration with Sustainable Practices

Product innovation enhances opportunities for market penetration and consumer satisfaction. The Global Ductless Mini Splits Market benefits from advanced inverter technology and smart integration. It offers better performance, cost savings, and reduced emissions. Manufacturers invest in eco-friendly refrigerants to meet sustainability targets. Expansion of hybrid systems for dual heating and cooling broadens applications. Smart connectivity appeals to technology-driven consumers, raising adoption rates. Partnerships with builders and green developers improve market exposure. These opportunities align with global energy transition goals and long-term consumer demand.

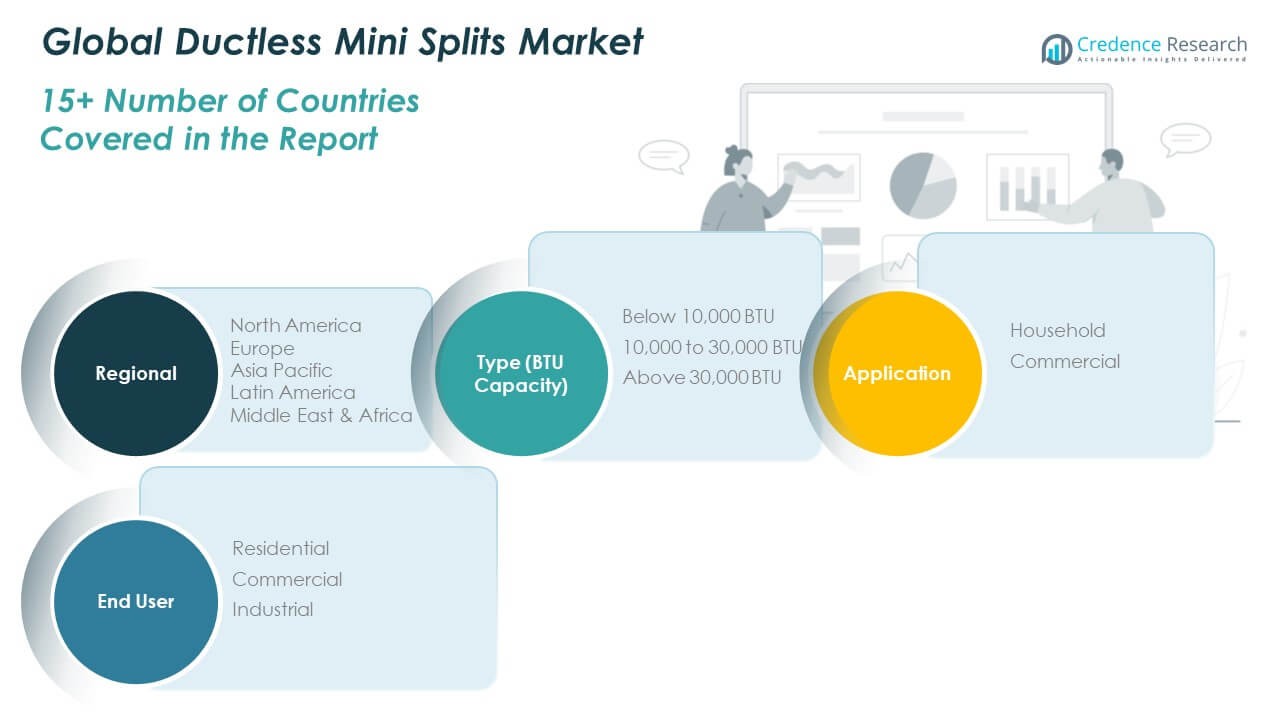

Market Segmentation Analysis:

The Global Ductless Mini Splits Market shows strong growth across

By capacity-based segments. Units below 10,000 BTU attract households with smaller living spaces, offering affordability and efficiency. The 10,000 to 30,000 BTU category dominates due to balanced performance, making it suitable for apartments, mid-sized homes, and light commercial uses. Above 30,000 BTU units serve large residential properties and industrial spaces where higher cooling and heating demands exist. It highlights how varied capacity ranges address diverse user requirements, ensuring broad market penetration.

- For instance, Mitsubishi’s 30,000 BTU P-Series single-zone mini split achieves a 21.9 SEER2 energy efficiency rating and offers a maximum cooling capacity of 31,000 BTU/h in light commercial installations, according to official product specifications from HVAC wholesalers.

By application, the household segment drives most demand, supported by urbanization, rising disposable incomes, and consumer preference for efficient home climate control. The commercial segment follows with adoption in offices, retail, and hospitality sectors seeking reliable multi-zone cooling.

- For example, Della’s 12,000 BTU Vario Series mini split carries a 19 SEER2 efficiency rating and is officially specified to cool spaces up to 550 square feet, making it suitable for reliable household use.

By end user, residential buyers hold the largest share, reflecting strong household installation rates worldwide. Commercial end users show consistent demand from business infrastructure, while industrial facilities adopt high-capacity systems for operational efficiency. This balanced segmentation underpins steady expansion across regions.

Segmentation:

By Type (BTU Capacity)

- Below 10,000 BTU

- 10,000 to 30,000 BTU

- Above 30,000 BTU

By Application

By End User

- Residential

- Commercial

- Industrial

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis:

North America

The North America Global Ductless Mini Splits Market size was valued at USD 4,175.51 million in 2018 to USD 6,434.49 million in 2024 and is anticipated to reach USD 12,060.82 million by 2032, at a CAGR of 7.6% during the forecast period. North America holds 43.67% share of the market in 2024, supported by strong adoption across residential and light commercial sectors. The U.S. dominates the region, driven by energy-efficient retrofitting projects and rising replacement demand for central systems. It benefits from high awareness of energy-saving appliances and government-led sustainability initiatives. Canada supports growth with increasing residential installations and regulatory focus on eco-friendly refrigerants. Mexico contributes through rising urbanization and demand for cost-effective cooling in new housing. It maintains steady growth due to availability of multi-zone systems and advanced inverter technology. Strategic partnerships and robust retail networks further strengthen regional penetration.

Europe

The Europe Global Ductless Mini Splits Market size was valued at USD 1,746.54 million in 2018 to USD 2,568.68 million in 2024 and is anticipated to reach USD 4,360.87 million by 2032, at a CAGR of 6.3% during the forecast period. Europe accounts for 17.44% share of the market in 2024, supported by regulatory frameworks encouraging energy-efficient cooling. Germany, the UK, and France lead adoption due to replacement demand in older infrastructure. Italy and Spain contribute with demand for compact solutions suited to urban apartments. It experiences steady growth from strict EU environmental standards, which favor low-GWP refrigerants. High adoption of smart home integration drives demand among premium consumers. Renovation of historic buildings requires flexible systems, strengthening appeal for ductless technology. Regional manufacturers emphasize innovation and eco-compliance as competitive strategies.

Asia Pacific

The Asia Pacific Global Ductless Mini Splits Market size was valued at USD 2,719.22 million in 2018 to USD 4,471.60 million in 2024 and is anticipated to reach USD 9,119.88 million by 2032, at a CAGR of 8.7% during the forecast period. Asia Pacific holds 30.35% share of the market in 2024, making it the second-largest region. China dominates with large-scale adoption driven by rapid urbanization and rising middle-class income. Japan and South Korea contribute with high penetration of advanced inverter systems. India shows strong momentum with increasing urban housing and smart city projects. It benefits from government policies encouraging energy-efficient appliances. Australia supports growth with rising adoption in residential renovations. Expanding distribution channels across Southeast Asia strengthen regional accessibility. Continuous technological innovations in design and efficiency ensure Asia Pacific remains highly competitive.

Latin America

The Latin America Global Ductless Mini Splits Market size was valued at USD 446.99 million in 2018 to USD 687.32 million in 2024 and is anticipated to reach USD 1,137.15 million by 2032, at a CAGR of 5.9% during the forecast period. Latin America contributes 4.67% share of the market in 2024, with Brazil leading adoption. It benefits from rising urban housing projects and consumer focus on affordable cooling solutions. Argentina contributes to regional expansion with demand in residential and small commercial spaces. Mexico’s growing influence through cross-border trade also aids accessibility. It faces challenges such as economic fluctuations and low awareness in rural areas. However, product affordability and flexible installation options attract urban customers. Regional players adopt partnerships to expand retail reach and improve availability.

Middle East

The Middle East Global Ductless Mini Splits Market size was valued at USD 249.31 million in 2018 to USD 352.72 million in 2024 and is anticipated to reach USD 549.16 million by 2032, at a CAGR of 5.1% during the forecast period. The Middle East holds 2.39% share of the market in 2024, led by demand from GCC countries. It benefits from extreme climatic conditions that drive steady cooling requirements. Saudi Arabia and the UAE dominate adoption in both residential and hospitality sectors. Israel contributes through demand for smart, energy-efficient technologies. It gains momentum from rising construction activities across urban hubs. Growth is supported by regional expansion strategies of global manufacturers. Despite moderate growth compared to Asia Pacific, it offers consistent demand potential.

Africa

The Africa Global Ductless Mini Splits Market size was valued at USD 125.68 million in 2018 to USD 219.57 million in 2024 and is anticipated to reach USD 314.59 million by 2032, at a CAGR of 4.0% during the forecast period. Africa contributes 1.49% share of the market in 2024, making it the smallest regional segment. South Africa leads with demand supported by urban residential and commercial projects. Egypt demonstrates growing adoption in urban housing and hospitality sectors. It faces challenges from affordability issues and limited consumer awareness. The market benefits from increasing infrastructure investments across major cities. Rising demand for energy-efficient cooling aligns with government modernization goals. International manufacturers enter through partnerships to expand local distribution networks. Despite slower growth, it holds long-term potential as urbanization accelerates.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Carrier Global Corporation

- Mitsubishi Electric Corporation

- Daikin Industries, Ltd.

- LG Electronics Inc.

- Panasonic Corporation

- Samsung Electronics Co., Ltd.

- Fujitsu General Limited

- Midea Group Co., Ltd.

- Johnson Controls International plc

- Blue Star Limited

Competitive Analysis:

The Global Ductless Mini Splits Market features intense competition among global and regional players focusing on innovation, energy efficiency, and smart integration. Leading companies such as Daikin Industries, Mitsubishi Electric, LG Electronics, Panasonic, Samsung, Fujitsu General, and Carrier Global dominate with extensive product portfolios and advanced inverter technologies. It strengthens competitiveness through R&D investments aimed at reducing emissions and improving performance. Midea Group and Johnson Controls expand their presence by offering cost-effective solutions for emerging markets. Blue Star Limited leverages strong distribution in South Asia to capture rising demand. Strategic partnerships, mergers, and acquisitions remain common to expand reach and consolidate market position. Players also prioritize the use of eco-friendly refrigerants and compliance with regulatory standards to meet global sustainability goals. Competitive intensity pushes manufacturers to differentiate through design, smart connectivity, and after-sales service, driving innovation across all regions.

Recent Developments:

- In June 2025, LG Electronics completed the acquisition of OSO, a leading European provider of stainless steel hot water solutions. This deal bolstered LG’s HVAC portfolio, enabling the integration of advanced heat pump technologies and expanding the company’s footprint in the European market with high-performance water heating and air conditioning packages.

- In April 2025, Mitsubishi Electric Trane HVAC US (METUS) introduced a new line of all-climate ductless and ducted mini-split systems featuring low global warming potential (GWP) refrigerants. This new collection emphasizes ultra-high efficiency and environmental sustainability, targeting both residential and commercial markets in the United States.

- In March 2025, Panasonic Canada announced a strategic national partnership with EMCO HVAC, significantly expanding the distribution of Panasonic’s next-generation heat pump and ductless mini split products across Canada. This collaboration aims to improve market access for Panasonic’s energy-efficient residential solutions.

- In May 2024, Daikin announced a strategic capital and business partnership with Miura Co., Ltd., involving mutual investments and a focus on integrated solutions for air conditioning and heat, including industrial ductless systems.

Report Coverage:

The research report offers an in-depth analysis based on Type (BTU Capacity), Application and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Ductless Mini Splits Market will continue to benefit from rising demand for energy-efficient climate control systems.

- Growing adoption of inverter and smart-enabled models will drive stronger penetration in residential and commercial spaces.

- Expansion of urban housing projects worldwide will sustain demand for compact and flexible cooling solutions.

- Replacement demand in mature economies will create stable revenue streams for manufacturers.

- Integration with IoT and smart home platforms will strengthen consumer appeal across technology-driven regions.

- Rising focus on sustainability will accelerate the use of eco-friendly refrigerants and low-emission technologies.

- Emerging economies in Asia Pacific, Latin America, and Africa will present untapped opportunities through expanding middle-class populations.

- Strategic partnerships, mergers, and acquisitions will shape competitive landscapes and expand global reach.

- Regional regulatory policies will influence innovation and adoption of energy-compliant products.

- Continuous product differentiation through design aesthetics and multi-zone capabilities will enhance brand competitiveness.