Market Overview

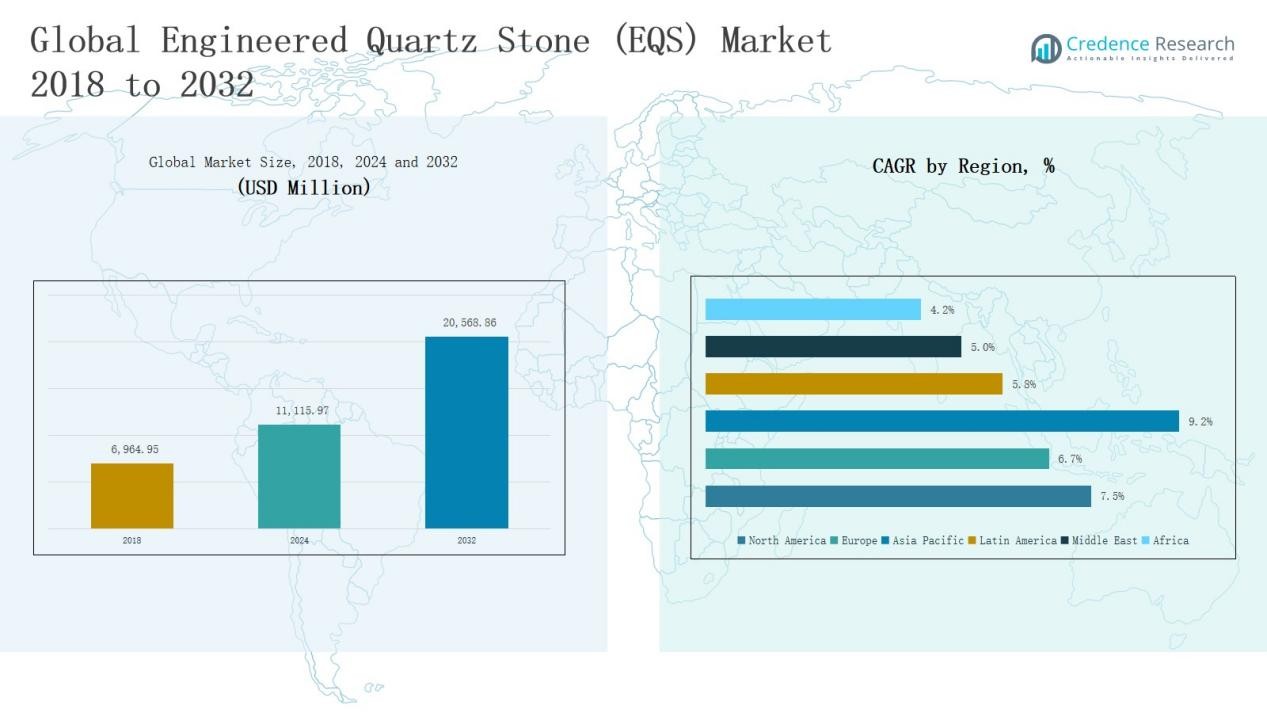

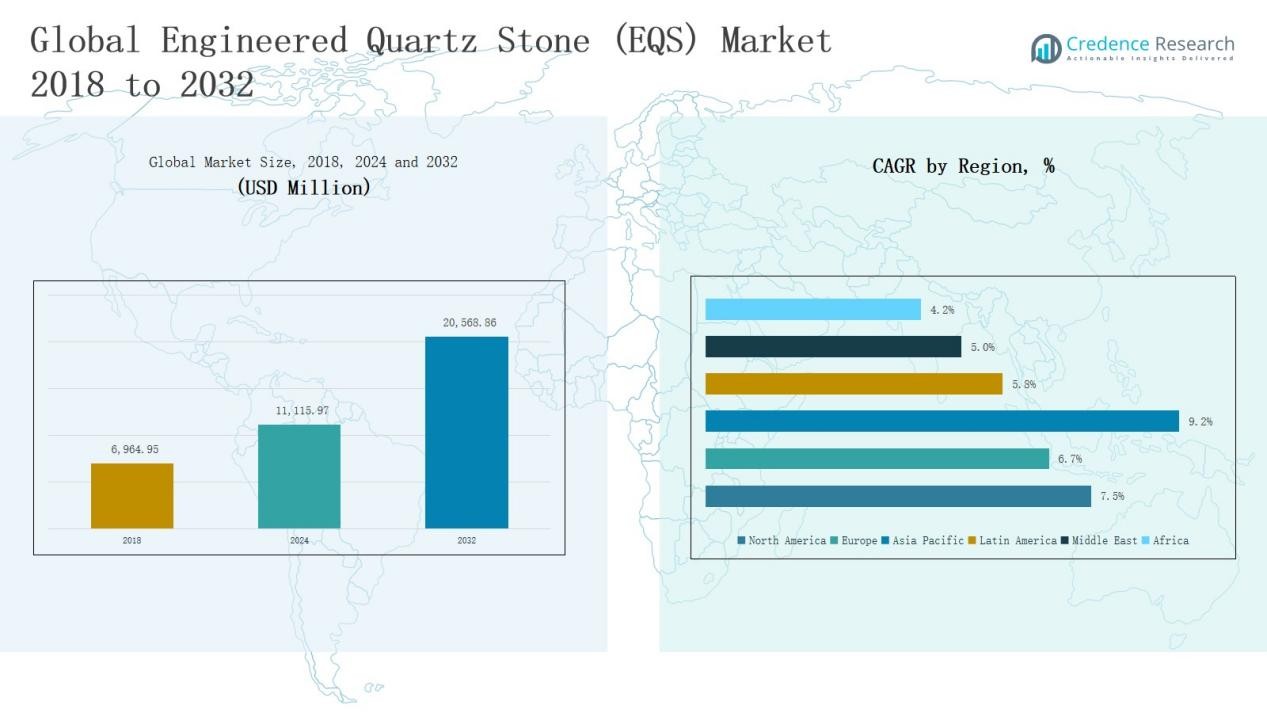

Engineered Quartz Stone (EQS) Market size was valued at USD 6,964.95 million in 2018, reached USD 11,115.97 million in 2024, and is anticipated to reach USD 20,568.86 million by 2032, growing at a CAGR of 7.45% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Engineered Quartz Stone (EQS) Market Size 2024 |

USD 11,115.97 Million |

| Engineered Quartz Stone (EQS) Market, CAGR |

7.45% |

| Engineered Quartz Stone (EQS) Market Size 2032 |

USD 20,568.86 Million |

The Engineered Quartz Stone (EQS) Market is shaped by global leaders such as Cosentino S.A., Caesarstone Ltd., Cambria Company LLC, Hanwha Solutions (HanStone), Vicostone, RAK Ceramics, Compac S.A., Levantina Group, and Stone Italiana S.p.A. These companies maintain a competitive edge through strong product portfolios, innovative designs, and eco-friendly solutions, including recycled and silica-free quartz surfaces. Strategic partnerships with architects and contractors, along with expanding digital retail presence, further strengthen their market positions. North America emerged as the leading region in 2024, commanding a 43.7% market share, driven by robust remodeling activity, premium housing projects, and strong consumer preference for durable, low-maintenance quartz surfaces.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Engineered Quartz Stone (EQS) Market grew from USD 6,964.95 million in 2018 to USD 11,115.97 million in 2024, and is expected to reach USD 20,568.86 million by 2032.

- Kitchen countertops dominated with over 55% revenue share in 2024, driven by durability, stain resistance, and preference in residential and commercial construction projects.

- Distributors and dealers led distribution with around 48% share in 2024, supported by strong contractor networks and wide product offerings across global markets.

- North America held 43.7% share in 2024, valued at USD 4,811.05 million, driven by remodeling activity, premium housing demand, and expanding commercial construction projects.

- Leading players such as Cosentino, Caesarstone, Cambria, Hanwha Solutions, Vicostone, RAK Ceramics, Compac, Levantina, and Stone Italiana focus on innovation, eco-friendly solutions, and strategic partnerships.

Market Segment Insights

By Application

Kitchen countertops dominated the Engineered Quartz Stone market in 2024, accounting for over 55% of revenue share. Their popularity stems from durability, stain resistance, and a wide range of design options, making them the preferred choice in residential and commercial projects. Bathroom vanities followed as the second largest sub-segment with rising adoption in premium housing. Flooring, wall cladding, and other applications are growing steadily, supported by modern architecture trends and consumer preference for low-maintenance surfaces.

- For instance, Caesarstone introduced its Pebbles Collection in 2022, featuring neutral-toned quartz slabs tailored for kitchen and bathroom applications.

By Distribution Channel

Distributors and dealers held the largest share of the EQS market in 2024, representing around 48% of global revenue. Their extensive networks, ability to offer variety, and strong relationships with contractors drive sales dominance. Direct sales followed closely, driven by premium brand strategies and large-scale project contracts. Home improvement retailers are witnessing steady growth, supported by do-it-yourself renovations and rising urban home upgrades, while the “others” category benefits from niche channels such as online platforms.

- For instance, Lowe’s introduced enhanced digital tools to support online-to-store purchases, catering to both urban upgraders and small contractors through its retail platform.

Key Growth Drivers

Rising Demand for Premium Kitchen Countertops

Engineered quartz stone is witnessing strong demand in kitchen countertops, driven by consumer preference for aesthetics, durability, and low maintenance. Its resistance to stains, scratches, and bacteria makes it more appealing compared to natural stone. Growing disposable incomes and rapid urbanization, especially in emerging economies, further support market expansion. Residential renovation and remodeling projects in North America and Europe continue to boost adoption, while premium housing projects in Asia-Pacific increase demand for high-quality quartz-based surfaces.

- For instance, Wilsonart introduced a new collection of quartz designs at KBIS 2025, featuring ten innovative designs inspired by natural stone, including Icelandic Mist and Emerald Brook.

Expansion of Residential and Commercial Construction

The steady rise in global residential and commercial construction projects strongly fuels EQS adoption. Builders and architects increasingly specify engineered quartz for countertops, flooring, and wall cladding due to its durability and design flexibility. Commercial spaces such as hotels, restaurants, and retail outlets prefer quartz for its cost-effectiveness and long-term performance. Urban infrastructure investments and government-backed housing schemes in developing nations are further driving market penetration, ensuring sustained demand across both developed and emerging markets.

- For instance, Cosentino launched its Silestone Ethereal collection in recent years, offering innovative colors and sustainable manufacturing using its HybriQ+ technology, designed to meet both eco-conscious housing and premium hospitality projects.

Growing Preference for Sustainable and Eco-Friendly Materials

Sustainability is becoming a decisive factor in material selection across construction and interior design sectors. Engineered quartz stone, often manufactured with recycled materials and minimal environmental impact, aligns well with green building practices. Growing certifications such as LEED and BREEAM encourage developers to integrate eco-friendly solutions. Manufacturers are also innovating silica-free and low-emission quartz surfaces to meet regulatory requirements. Rising consumer awareness about environmental responsibility continues to position engineered quartz as a preferred sustainable alternative to natural stone.

Key Trends & Opportunities

Increasing Penetration of Smart Retail and Online Sales

Digital transformation in the building materials sector creates new opportunities for EQS distribution. Online platforms and smart retail solutions allow customers to compare designs, customize orders, and access a wider variety of surface options. Homeowners and contractors increasingly rely on e-commerce channels to purchase engineered quartz for renovations and smaller projects. This trend benefits smaller brands by improving visibility and competitiveness. Online retail is expected to play a stronger role in complementing traditional distributors and home improvement stores.

- For instance, Caesarstone Ltd. integrated its product offerings with Home Depot’s online platform, providing U.S. customers seamless access to customizable quartz surfaces.

Product Innovation and Customization Opportunities

Manufacturers are actively investing in new designs, textures, and finishes to meet evolving consumer preferences. Advancements in digital printing and manufacturing techniques allow greater customization of engineered quartz stone surfaces. Customers now demand unique colors and patterns, including natural marble and granite-like appearances. This innovation supports differentiation and brand loyalty, especially in premium markets. Companies offering tailored solutions for residential and commercial projects gain competitive advantage, making product innovation and customization a major growth opportunity.

- For instance, Cambria Quartz launched the Inverness collection featuring deeply textured veining, catering to customers seeking bold, natural-stone aesthetics for kitchen and commercial interiors.

Key Challenges

High Production and Installation Costs

Despite its benefits, engineered quartz stone remains more expensive compared to traditional materials such as laminate or ceramic tiles. High production costs, driven by raw material and energy requirements, often limit adoption in cost-sensitive markets. Installation also requires skilled labor, which adds to the overall expense. These factors restrict penetration in low- to mid-income housing projects. Manufacturers face the challenge of balancing premium quality with affordability to expand customer base while sustaining profitability.

Competition from Alternative Surface Materials

EQS faces significant competition from natural stone, solid surfaces, and emerging eco-friendly substitutes. Granite and marble still appeal to consumers due to their natural aesthetics and established presence in luxury projects. Meanwhile, materials like sintered stone and recycled composites are gaining market attention for sustainability. Price competition and shifting consumer preferences intensify the challenge for EQS manufacturers. Maintaining differentiation through design innovation and marketing is crucial to address the threat of substitute materials.

Health and Environmental Concerns from Silica Dust

A growing challenge for the EQS market is the health risk associated with crystalline silica dust released during cutting and fabrication. Exposure can lead to serious respiratory issues such as silicosis, prompting stricter workplace safety regulations. Regulatory agencies in Australia, the U.S., and Europe are already enforcing tighter rules, leading some regions to consider restrictions on silica-based quartz surfaces. Manufacturers are under pressure to develop safer, silica-free alternatives while ensuring compliance with evolving health and environmental standards.

Regional Analysis

North America

North America led the Engineered Quartz Stone market with a 43.7% share in 2024, valued at USD 4,811.05 million, rising from USD 3,046.05 million in 2018 and projected to reach USD 8,926.99 million by 2032, at a CAGR of 7.5%. Growth is driven by strong remodeling and renovation activity, particularly in the U.S. housing sector. Premium kitchen countertops and bathroom vanities dominate demand, supported by consumer preference for durable, aesthetic, and low-maintenance materials. Expanding commercial construction also strengthens the region’s leadership position in global EQS adoption.

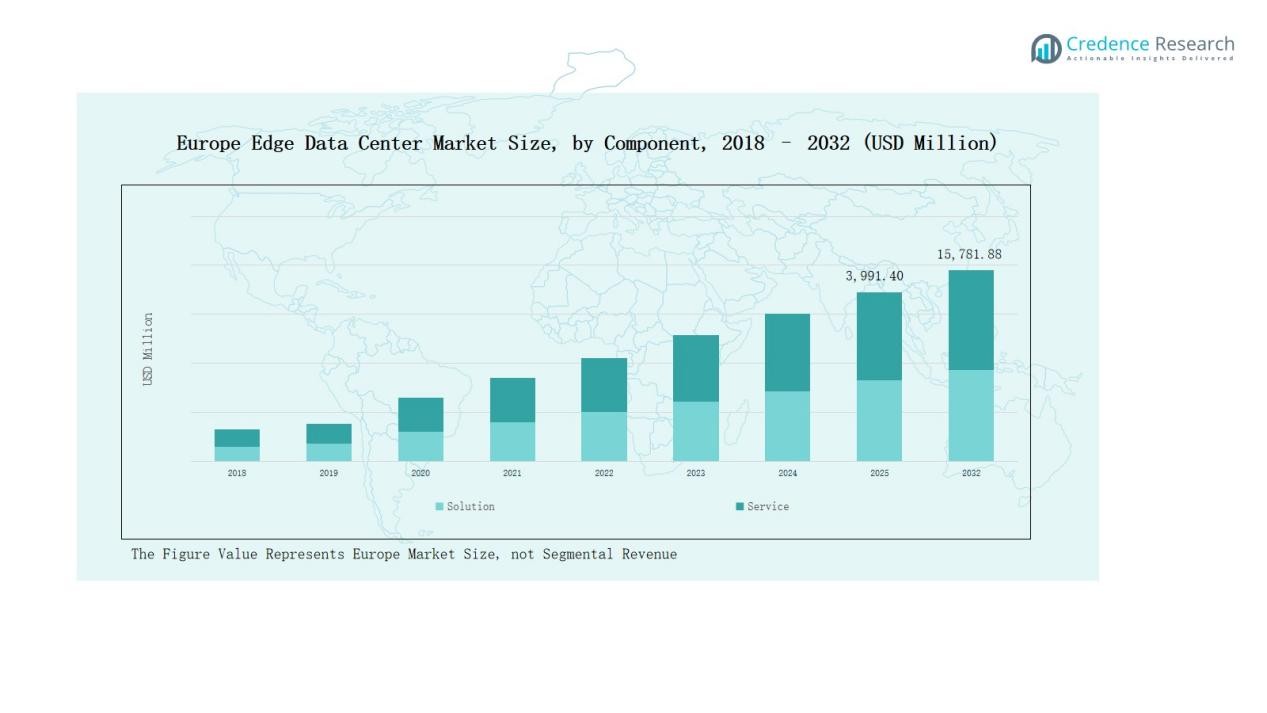

Europe

Europe accounted for a 28.3% market share in 2024, reaching USD 3,148.36 million, up from USD 2,043.91 million in 2018, and is anticipated to hit USD 5,496.59 million by 2032 at a CAGR of 6.7%. Demand is fueled by sustainable building initiatives, advanced architectural designs, and rising adoption of eco-friendly quartz products. Germany, the UK, and France remain key contributors due to robust residential upgrades and commercial projects. Increasing consumer focus on premium surfaces and compliance with EU green building standards enhances long-term growth across the region.

Asia Pacific

Asia Pacific emerged as the fastest-growing region with a 19.8% market share in 2024, valued at USD 2,206.30 million, compared to USD 1,270.02 million in 2018, and expected to reach USD 4,651.03 million by 2032 at a CAGR of 9.2%. Rapid urbanization, rising disposable incomes, and large-scale housing developments in China and India drive growth. Japan, South Korea, and Australia add momentum through premium residential projects and modern interiors. Expanding infrastructure and increased consumer preference for durable, low-maintenance surfaces continue to make Asia Pacific the most dynamic market.

Latin America

Latin America captured a 4.6% share of the EQS market in 2024, with revenues of USD 507.41 million, growing from USD 322.02 million in 2018, and projected to reach USD 828.65 million by 2032, at a CAGR of 5.8%. Growth is supported by rising urban housing demand in Brazil and Argentina, coupled with modernization of commercial infrastructure. The adoption of quartz stone is increasing in premium housing and hospitality projects. However, slower economic growth and higher product costs limit wider adoption, though expansion of distribution networks improves accessibility.

Middle East

The Middle East accounted for a 2.4% market share in 2024, with revenues of USD 263.63 million, up from USD 181.95 million in 2018, and forecast to reach USD 405.55 million by 2032, registering a CAGR of 5.0%. Strong investments in luxury residential projects and hospitality infrastructure, particularly in GCC countries, drive demand. Engineered quartz stone is favored for high-end countertops and flooring in modern construction. However, limited awareness and reliance on imports constrain broader adoption, although rising government-backed smart city projects provide opportunities for steady growth.

Africa

Africa represented a 1.6% share in 2024, valued at USD 179.22 million, compared with USD 101.01 million in 2018, and is set to reach USD 260.05 million by 2032, at a CAGR of 4.2%. Market growth is driven by increasing urbanization and construction projects in South Africa and Egypt. Adoption remains modest due to high product costs and limited awareness, but gradual improvements in distribution and retail infrastructure support expansion. Growing middle-class housing demand and infrastructure modernization present long-term potential for engineered quartz stone adoption.

Market Segmentations:

By Application

- Kitchen Countertops

- Bathroom Vanities

- Flooring

- Wall Cladding

- Others

By Distribution Channel

- Direct Sales

- Distributors/Dealers

- Home Improvement Retailers

- Others

By Region

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The Engineered Quartz Stone (EQS) market is moderately consolidated, with global leaders and regional specialists competing on product quality, design variety, and sustainability. Key players such as Cosentino S.A., Caesarstone Ltd., Cambria Company LLC, Hanwha Solutions (HanStone), Vicostone, RAK Ceramics, and Compac S.A. dominate through extensive product portfolios and strong brand recognition. These companies focus on innovation in patterns, colors, and eco-friendly formulations, including silica-free and recycled material-based surfaces, to meet rising sustainability standards. Strategic partnerships with architects, contractors, and distributors enhance market penetration, while investment in digital showrooms and e-commerce strengthens customer outreach. Regional players like Stone Italiana S.p.A. and Levantina Group cater to localized demand, offering tailored solutions at competitive pricing. The competitive environment is further shaped by mergers, acquisitions, and capacity expansions aimed at strengthening global presence. Continuous R&D, premium branding, and compliance with environmental regulations remain critical differentiators for sustaining leadership in this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Cosentino S.A.

- Caesarstone Ltd.

- Compac S.A.

- Cambria Company LLC

- Hanwha Solutions (HanStone)

- Vicostone

- RAK Ceramics

- Q Holdings PLC (Quartzforms)

- Levantina Group

- Stone Italiana S.p.A.

Recent Developments

- In May 2025, LOTTE Chemical partnered with EKO Stone to distribute Radianz Quartz in the U.S. Midwest.

- In July 2024, UMI Stone signed an exclusive distribution deal with Vicostone for the U.S. East Coast.

- In March 2025, Specta unveiled its Pastel Poise quartz collection featuring soft pastel shades.

- In August 2025, Wilsonart introduced new Quartz & Solid Surface designs with bold colorways.

Report Coverage

The research report offers an in-depth analysis based on Application, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for engineered quartz stone will increase with rising home renovation projects worldwide.

- Kitchen countertops will remain the largest application due to durability and premium appeal.

- Bathroom vanities and flooring will witness steady growth driven by luxury housing demand.

- Asia Pacific will continue as the fastest-growing region with large-scale urbanization and housing projects.

- North America and Europe will sustain dominance through remodeling activity and eco-friendly adoption.

- Manufacturers will focus on eco-friendly, recycled, and silica-free engineered quartz surfaces.

- Digital showrooms and online retail platforms will expand distribution and customer accessibility.

- Strategic partnerships with architects and contractors will strengthen brand positioning.

- Product innovation in textures, finishes, and customization will shape competitive advantage.

- Compliance with environmental and workplace safety regulations will influence production strategies globally.