Market Overview

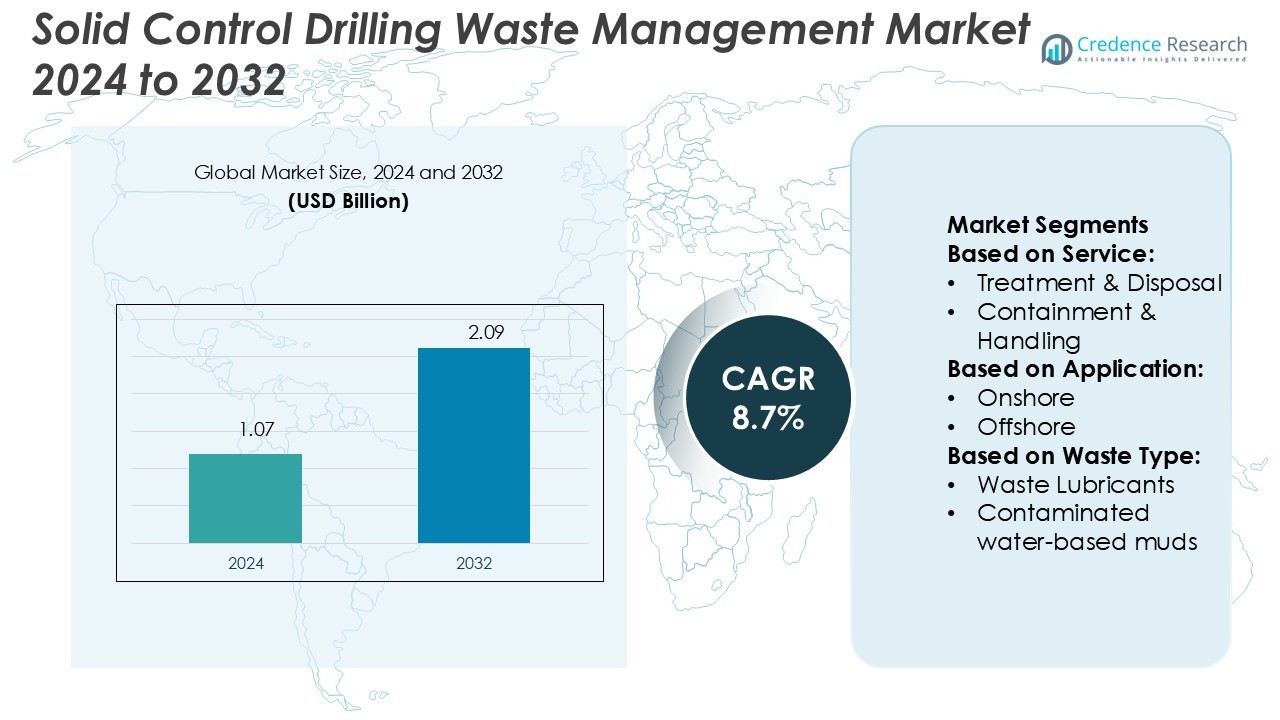

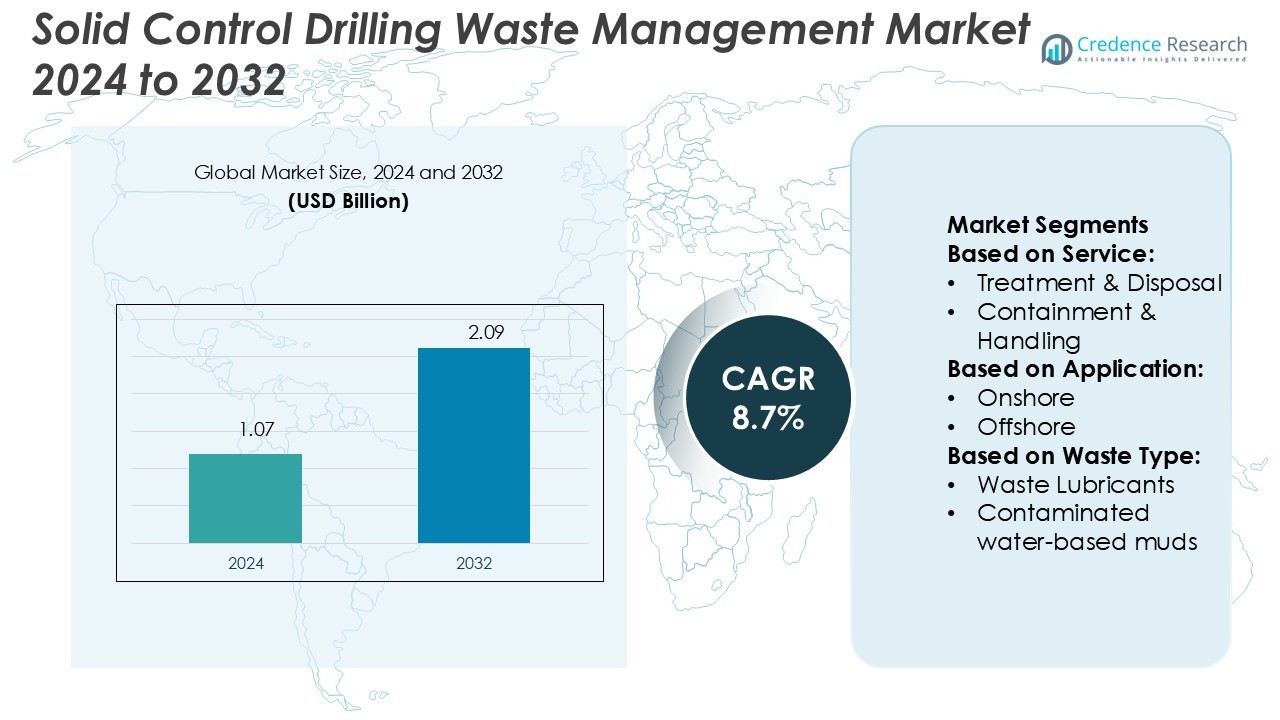

Solid Control Drilling Waste Management Market size was valued USD 1.07 billion in 2024 and is anticipated to reach USD 2.09 billion by 2032, at a CAGR of 8.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Solid Control Drilling Waste Management Market Size 2024 |

USD 1.07 Billion |

| Solid Control Drilling Waste Management Market, CAGR |

8.7% |

| Solid Control Drilling Waste Management Market Size 2032 |

USD 2.09 Billion |

The solid control drilling waste management market is shaped by leading players such as GN Solids Control, Halliburton, Newpark Resources Inc., Baker Hughes, Derrick Equipment Company, NOV Inc., Augean Plc, CLEAN HARBORS, INC., Imdex Limited, and Geminor. These companies focus on advanced solids separation, waste recycling, and integrated treatment solutions to meet rising regulatory and environmental demands. Large-scale operators leverage global networks and technology portfolios, while niche players target specialized services and regional markets. North America leads the global market with a 38% share in 2024, supported by extensive shale gas exploration, offshore drilling in the Gulf of Mexico, and strict compliance frameworks that drive high adoption of waste management technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The solid control drilling waste management market size was valued at USD 1.07 billion in 2024 and is projected to reach USD 2.09 billion by 2032, growing at a CAGR of 8.7%.

- Rising environmental regulations and the need for safe disposal of contaminated oil-based muds, which hold a 46% segment share, are driving demand for advanced waste treatment technologies.

- Market trends highlight growing adoption of digital monitoring systems, automation, and recycling-focused solutions, with players enhancing efficiency and sustainability in operations.

- Competitive analysis shows strong participation from GN Solids Control, Halliburton, Baker Hughes, and others, with large operators leveraging global presence while niche firms focus on specialized regional services.

- North America leads with a 38% share in 2024, driven by shale gas exploration and offshore projects, while Europe follows with 22%, supported by strict sustainability frameworks and offshore drilling activities in the North Sea.

Market Segmentation Analysis:

By Service

The treatment and disposal segment dominates the solid control drilling waste management market, holding 42% share in 2024. This dominance stems from rising regulatory compliance for safe disposal of drilling fluids and cuttings. Companies focus on advanced thermal and bioremediation methods to reduce hazardous impact and meet strict environmental standards. Growing offshore exploration projects, coupled with sustainability commitments by major oilfield operators, further accelerate demand for effective treatment solutions, positioning this segment as the key revenue contributor within service offerings.

- For instance, GN Solids Control developed the GNTDU-35A thermal desorption unit, which is engineered to process 3.5–5 tons of drilling cuttings per hour. It operates with a burner system that enables recovery of base oil for reuse and reduces the oil-on-cuttings (OOC) content to below 0.3%, aligning with international environmental standards.

By Application

Onshore operations account for the largest share, representing 58% of the market in 2024. High drilling activity in shale gas and conventional oil fields drives this dominance. Onshore exploration sites generate significant waste volumes, requiring efficient containment, handling, and disposal solutions. Lower costs of onshore projects compared to offshore also encourage investments, boosting adoption of solids control and waste treatment services. Increasing land-based exploration in North America, the Middle East, and Asia Pacific continues to strengthen onshore demand, sustaining its lead across the global market.

- For instance, Baker Hughes’ Centrilift® FLEXPump™ ESPs in general are routinely run at depths well over 10,000 feet, and the FLEXPump system is built to handle the mechanical and thermal stresses of such applications.

By Waste Type

Contaminated oil-based muds dominate the waste type segment with 46% share in 2024. These muds require complex treatment methods due to high hydrocarbon content and environmental risks. Operators increasingly invest in advanced recovery and recycling technologies to minimize disposal costs and maximize reuse of base oils. Rising offshore drilling activities, where oil-based muds are commonly used for stability in high-pressure wells, drive demand for their effective management. Stringent global environmental policies reinforce the need for specialized treatment solutions, ensuring this segment maintains its strong position.

Key Growth Drivers

Stringent Environmental Regulations

Tightening environmental regulations serve as a primary driver for the solid control drilling waste management market. Governments and regulatory bodies enforce strict guidelines for drilling waste treatment and disposal, compelling operators to adopt advanced solutions. Compliance with waste discharge standards and reduced environmental footprint has become a priority for oil and gas companies. This regulatory pressure fuels investment in technologies such as thermal desorption, bioremediation, and advanced solids control, supporting safer operations and strengthening the market’s growth trajectory worldwide.

- For instance, Newpark’s Dura-Base® Advanced Composite Mat System has been deployed in environmentally sensitive regions, supporting compressive loads up to 600 psi while preventing soil contamination from drilling fluids.

Increasing Oil and Gas Exploration Activities

The expansion of oil and gas exploration projects, both onshore and offshore, significantly boosts demand for waste management services. High drilling volumes generate large quantities of contaminated muds, lubricants, and chemicals, requiring efficient containment and treatment systems. Offshore exploration, particularly in deep-water fields, amplifies waste complexity and disposal requirements. The surge in shale gas development in North America and expanding exploration efforts in the Middle East and Asia Pacific further support the adoption of specialized solid control systems, driving consistent market growth.

- For instance, Baker Hughes provides specialized drilling fluid systems for deepwater projects, which are designed to maintain wellbore stability at water depths exceeding 8,000 feet.

Focus on Sustainability and Cost Efficiency

Operators are increasingly prioritizing sustainable drilling practices and cost-effective waste management solutions. Recycling of drilling fluids and recovery of valuable hydrocarbons from waste streams reduce both environmental impact and operational expenses. Technologies enabling reuse of oil-based muds and advanced containment systems deliver measurable efficiency gains. Energy companies invest in eco-friendly solutions to align with corporate sustainability goals while lowering costs associated with waste transport and disposal. This focus positions sustainability as both a compliance necessity and a growth accelerator for the industry.

Key Trends & Opportunities

Adoption of Digital Monitoring Systems

Digitalization is transforming drilling waste management with the integration of real-time monitoring and automation. Operators deploy IoT-enabled sensors and data analytics platforms to track waste generation, fluid properties, and treatment efficiency. These systems enhance operational accuracy, reduce downtime, and optimize resource utilization. Automated solids control equipment and predictive analytics also support cost savings while improving compliance with regulations. The adoption of smart waste management systems creates new opportunities for service providers to offer technology-driven solutions in both established and emerging markets.

- For instance, Derrick’s FLC 500 series of shale shakers, when equipped with Pyramid® screens, maintains separation efficiency in compliance with API RP 13C standards.

Expansion of Offshore Deep-Water Projects

The steady growth of offshore deep-water drilling projects opens opportunities for specialized waste management solutions. Harsh conditions and complex well designs in these environments demand robust containment and treatment technologies. Oil-based muds, widely used in deep-water operations, generate high-value waste streams requiring advanced recovery systems. Investments in offshore exploration across regions like West Africa, the Gulf of Mexico, and Asia Pacific increase the need for efficient solid control equipment. Service providers delivering reliable, portable, and compliant solutions gain a competitive edge in this growing segment.

- For instance, NOV’s Brandt™ VSM 300 shale shaker has been deployed extensively in offshore operations, capable of processing high fluid volumes and achieving efficient solids removal.

Key Challenges

High Operational and Capital Costs

Solid control drilling waste management solutions involve significant capital investment and operational expenditure. Advanced treatment technologies, such as thermal desorption and high-speed centrifuges, require substantial upfront costs and skilled labor. Small and mid-sized operators often find these expenses challenging, limiting adoption rates in cost-sensitive markets. Additionally, ongoing maintenance, logistics, and disposal costs further strain budgets. The high financial burden of deploying advanced systems remains a major challenge, particularly in regions with low oil prices or limited regulatory enforcement.

Complexity of Waste Treatment Processes

Managing drilling waste, especially contaminated oil-based muds, involves highly complex treatment processes. Hydrocarbon recovery, waste segregation, and compliance with diverse regional regulations add operational challenges. Variability in waste composition across drilling sites complicates the standardization of solutions. Service providers must constantly adapt technologies to meet site-specific requirements while ensuring efficiency and environmental safety. This complexity not only increases operational risks but also requires specialized expertise and infrastructure, creating barriers for widespread adoption in the global market.

Regional Analysis

North America

North America leads the solid control drilling waste management market with 38% share in 2024. The region’s dominance is supported by extensive shale gas exploration, deep-water offshore projects in the Gulf of Mexico, and stringent environmental regulations enforced by agencies such as the EPA. Oilfield operators increasingly adopt advanced solids control and treatment systems to comply with zero-discharge policies. The presence of established service providers and high technological adoption rates further strengthen the regional market. Investments in eco-friendly drilling solutions and ongoing exploration activities sustain North America’s leadership position throughout the forecast period.

Europe

Europe accounts for 22% share of the solid control drilling waste management market in 2024, driven by strict environmental policies and sustainability targets. Countries such as Norway and the UK, with strong offshore oil and gas activities, lead demand for advanced waste treatment solutions. The European Union’s focus on circular economy practices promotes recycling and recovery of drilling fluids, creating opportunities for innovative service providers. Increasing investments in offshore exploration in the North Sea and the Arctic further boost the regional market, positioning Europe as a key hub for sustainable drilling waste management practices.

Asia Pacific

Asia Pacific holds 21% share in the solid control drilling waste management market in 2024, supported by growing exploration and production activities in China, India, Australia, and Southeast Asia. Rising energy demand and increasing offshore drilling projects in regions like the South China Sea drive demand for effective waste management. Governments across the region emphasize stricter compliance measures, fueling investments in solids control equipment and treatment technologies. The region also presents growth opportunities for cost-efficient solutions tailored for emerging markets, making Asia Pacific one of the fastest-growing regions in this industry.

Latin America

Latin America captures 7% share of the solid control drilling waste management market in 2024. Brazil, Mexico, and Venezuela are the key contributors, driven by offshore deep-water drilling projects and rising exploration in unconventional reserves. Regulatory frameworks in Brazil and Mexico encourage adoption of advanced treatment systems to limit environmental impact. Growing interest in cost-efficient solutions further boosts demand across the region. Although economic volatility and political challenges can impact project execution, continued investments in offshore exploration ensure Latin America’s steady role in the global market landscape.

Middle East & Africa

The Middle East & Africa region represents 12% share of the market in 2024, supported by extensive oil and gas drilling operations. Countries such as Saudi Arabia, UAE, and Nigeria drive demand for solids control services, particularly for large-scale onshore and offshore projects. Growing offshore exploration in West Africa and rising adoption of advanced waste treatment technologies in the Gulf region strengthen the market presence. However, cost sensitivity and varying regulatory enforcement levels pose challenges. Despite these constraints, the region’s expanding oilfield operations ensure steady growth opportunities for service providers.

Market Segmentations:

By Service:

- Treatment & Disposal

- Containment & Handling

By Application:

By Waste Type:

- Waste Lubricants

- Contaminated water-based muds

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The solid control drilling waste management market features strong competition among key players such as GN Solids Control, Halliburton, Newpark Resources Inc., Baker Hughes, Derrick Equipment Company, NOV Inc., Augean Plc, CLEAN HARBORS, INC., Imdex Limited, and Geminor. The solid control drilling waste management market is highly competitive, driven by technological innovation, regulatory compliance, and increasing demand for sustainable solutions. Companies focus on developing advanced solids separation systems, efficient fluid recycling technologies, and eco-friendly treatment methods to reduce environmental impact and operational costs. The market emphasizes integrated service offerings that combine containment, handling, treatment, and disposal solutions tailored to both onshore and offshore drilling projects. Strategic partnerships, regional expansions, and investments in digital monitoring systems further enhance competitiveness, enabling service providers to meet rising global exploration activities and strict waste management standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GN Solids Control

- Halliburton

- Newpark Resources Inc.

- Baker Hughes

- Derrick Equipment Company

- NOV Inc.

- Augean Plc

- CLEAN HARBORS, INC.

- Imdex Limited

- Geminor

Recent Developments

- In May 2025, TWMA has secured a drilling waste management contract from BP for operations in the UK North Sea. Under the agreement, TWMA will utilize its advanced technologies, including the RotoMill system, to process drilling waste directly at the well site. This approach enhances operational efficiency while supporting bp’s commitment to sustainable offshore practices.

- In January 2025, SLB has secured multiple drilling contracts to support Shell’s deep and ultra-deep-water operations across key global regions, including the UK North Sea, Trinidad and Tobago, and the Gulf of Mexico. This collaboration will harness SLB’s advanced AI-powered digital drilling technologies and deep-water expertise to deliver efficient, cost-effective well development, aligning with Shell’s focus on capital-efficient energy production.

- In 2024, Schlumberger announced the launch of the RigSPEC Total Solids Monitor. The aim of this machine is to offer real-time solids monitoring and control to augment drilling efficiency.

- In December 2023, GN Solids America rolled out a tailored drilling waste management equipment solution, specifically crafted for its Europe region. This innovative system seamlessly integrates essential components, ensuring efficient management of drilling waste. With this strategic move, GN Solids America aims to bolster its presence in the European market and sharpen its competitive advantage in the region.

Report Coverage

The research report offers an in-depth analysis based on Service, Application, Waste Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising global oil and gas exploration activities.

- Offshore deep-water projects will drive demand for advanced waste management systems.

- Adoption of digital monitoring and automation will improve efficiency in solids control.

- Recycling and reuse of drilling fluids will gain importance as cost-saving strategies.

- Stricter environmental regulations will push operators toward eco-friendly treatment solutions.

- Service providers will expand regional presence to capture emerging market opportunities.

- Technological innovation in thermal and biological treatment methods will enhance market potential.

- Integrated service offerings will dominate, combining containment, treatment, and disposal solutions.

- Strategic partnerships and acquisitions will shape the competitive landscape.

- Sustainability and zero-discharge goals will remain key drivers for long-term growth.