Market Overview

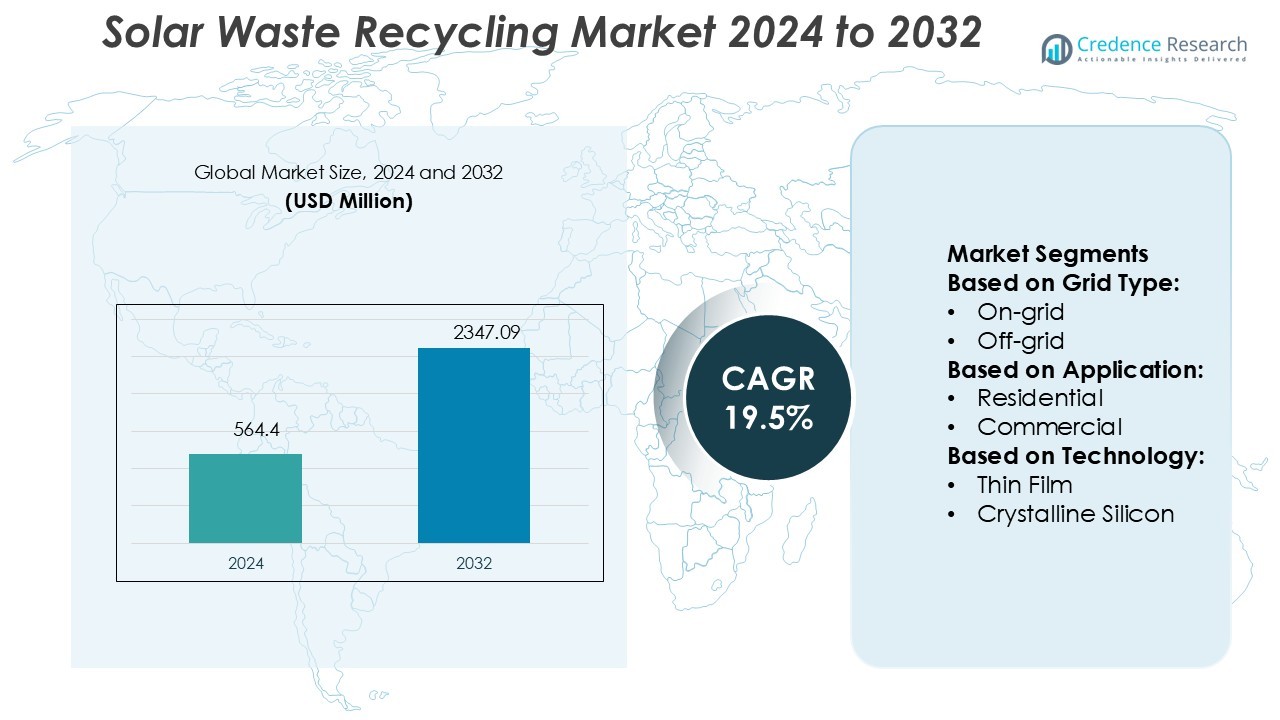

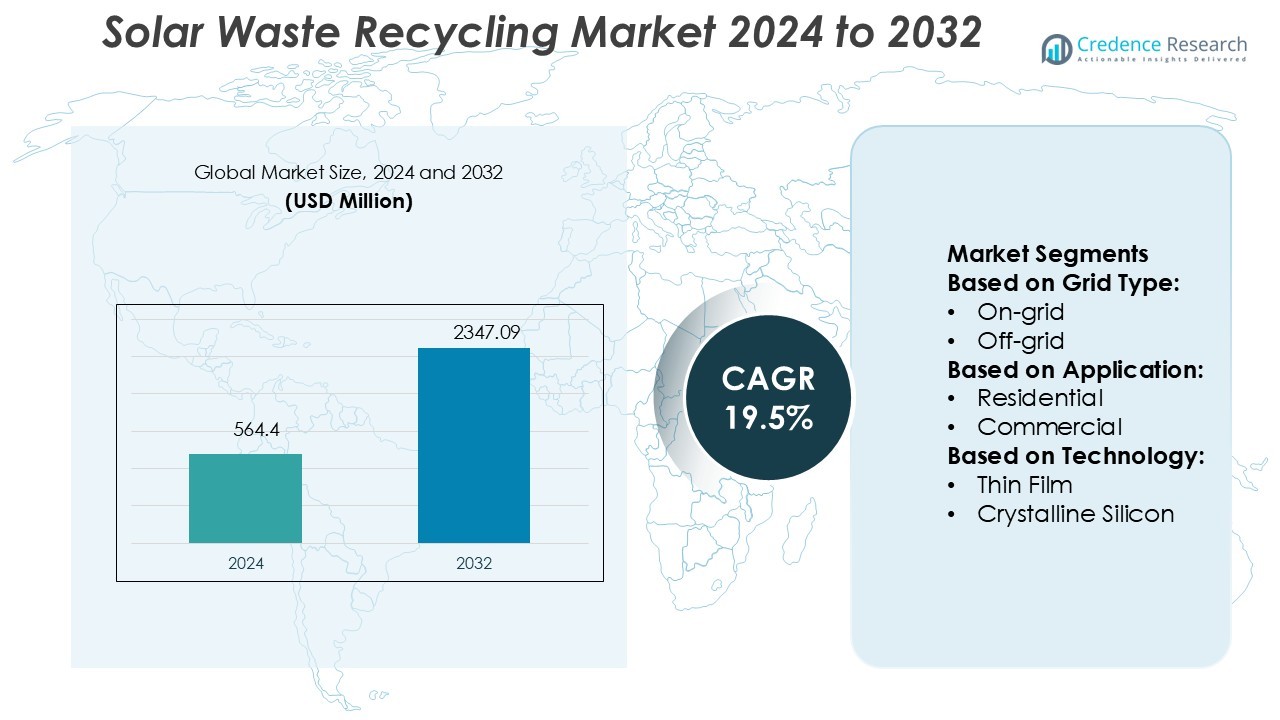

Solar Waste Recycling Market size was valued USD 564.4 million in 2024 and is anticipated to reach USD 2347.09 million by 2032, at a CAGR of 19.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Solar Waste Recycling Market Size 2024 |

USD 564.4 Million |

| Solar Waste Recycling Market, CAGR |

19.5% |

| Solar Waste Recycling Market Size 2032 |

USD 2347.09 Million |

The Solar Waste Recycling Market is driven by leading players including ROSI, Recycle Solar Technologies Limited, The Retrofit Companies, Inc.s, Veolia, Solarcycle, Inc, First Solar Inc., Rinovasol, SILCONTEL LTD, HAMADA CO., LTD, and Reiling GmbH & Co. KG. These companies focus on advanced material recovery, automation, and sustainable recycling practices to address the rising volume of end-of-life solar panels. Their strategies emphasize closed-loop processes, partnerships with solar manufacturers, and expansion of recycling infrastructure. North America leads the market with a 37% share, supported by strong regulatory frameworks, rapid solar adoption, and investment in large-scale recycling plants. The region’s dominance is further reinforced by collaboration between industry participants and government initiatives promoting circular economy models. This leadership, combined with continuous innovation from top companies, positions the region at the forefront of sustainable solar waste management.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Solar Waste Recycling Market size was valued at USD 564.4 million in 2024 and is projected to reach USD 2347.09 million by 2032, growing at a CAGR of 19.5%.

- Rising volumes of end-of-life solar panels and strict environmental regulations drive strong demand for advanced recycling solutions.

- Automation, closed-loop processes, and innovation in material recovery mark key trends as companies expand capabilities and partnerships.

- High costs of recycling technologies and limited infrastructure in emerging regions restrain faster adoption of large-scale operations.

- North America leads with 37% share, supported by regulatory support and large-scale recycling plants, while Europe follows closely with significant adoption of sustainable waste management. Asia-Pacific is the fastest-growing region, driven by rapid solar expansion and government-backed initiatives. Segment analysis shows crystalline silicon panels dominating waste volume, holding 65% share, while thin-film panels account for 25%, reflecting technology-specific recycling opportunities.

Market Segmentation Analysis:

By Grid Type

The Solar Waste Recycling Market is divided into on-grid and off-grid segments. The on-grid sub-segment holds the dominant market share, driven by the growing integration of solar power into existing electricity grids, facilitating efficient energy distribution and recycling. This segment benefits from governmental policies promoting renewable energy integration, enabling seamless energy storage and redistribution. The off-grid segment, although smaller, is gaining traction due to increasing adoption in remote areas where grid access is limited, further pushing the demand for decentralized solar solutions.

- For instance, ROSI established a state-of-the-art facility in Saint-Honoré, France, with the capacity to recycle 3,000 tonnes of photovoltaic modules annually, enabling direct recovery of silicon, silver, and copper from on-grid solar arrays that reach end-of-life.

By Application

The market is categorized by residential, commercial, and industrial applications, with the residential segment commanding the largest market share. Residential solar systems are widely adopted due to increasing consumer awareness and incentives for sustainable energy solutions. This segment is driven by the rising demand for energy independence and eco-friendly energy solutions. Commercial and industrial sectors also exhibit significant growth as companies and manufacturers pursue sustainability goals, with solar waste recycling becoming an integral part of their corporate social responsibility initiatives, especially in regions with stringent environmental regulations.

- For instance, solar panel recycling facilities often use high-capacity equipment to recover valuable materials like glass, which can make up more than 70% of a panel’s weight. Efficient recovery of materials from end-of-life installations helps reduce landfill waste.

By Technology

The Solar Waste Recycling Market is further segmented by technology into thin film, crystalline silicon, and others, with crystalline silicon holding the dominant market share. Crystalline silicon is favored due to its higher efficiency and widespread use in commercial and residential solar systems. The thin film technology segment is gaining traction due to its cost-effectiveness and flexibility in applications. Innovations in recycling technologies for both segments are enhancing performance and sustainability, reducing overall recycling costs, and promoting the circular economy within the solar industry.

Key Growth Drivers

Rising Solar Installations and Aging Panels

The rapid expansion of solar power installations and the natural aging of panels are driving demand for recycling solutions. Millions of panels installed two decades ago are reaching end-of-life, creating a consistent waste stream. Recycling provides valuable raw materials such as glass, aluminum, and silicon that can be reused in new panels. This not only reduces landfill waste but also strengthens the supply chain for solar manufacturing, making solar waste recycling a crucial component of the renewable energy ecosystem.

- For instance, Veolia’s photovoltaic recycling line in Rousset, France, processes 1,800 tonnes of end-of-life crystalline silicon panels per year, with a targeted scale-up to 4,000 tonnes annually.

Government Policies and Sustainability Mandates

Strict environmental regulations and circular economy initiatives are fueling growth in the solar waste recycling market. Governments worldwide are implementing extended producer responsibility (EPR) programs and recycling mandates for photovoltaic manufacturers. These policies ensure accountability for waste management, encouraging companies to adopt advanced recycling practices. Incentives, subsidies, and carbon reduction goals further strengthen the adoption of sustainable disposal methods, positioning recycling as an essential compliance requirement and a driver of market expansion.

- For instance, Solarcycle claims its proprietary process can extract up to 95 % of the value from a retired panel — recovering silver, silicon, copper, aluminum, and glass.

Economic Value from Recovered Materials

The recovery of high-value materials from end-of-life solar panels significantly drives the market. Materials such as silver, silicon, and aluminum command strong resale value, improving profitability for recycling operators. Efficient recovery technologies help achieve higher material yields, making recycling economically viable. As raw material prices rise, recycling reduces reliance on virgin resources and ensures stable supply for solar manufacturing. This economic advantage aligns with sustainability goals, creating dual benefits for both industry stakeholders and environmental conservation.

Key Trends & Opportunities

Technological Advancements in Recycling Processes

Emerging recycling technologies, such as thermal and chemical separation, are improving material recovery efficiency. These innovations enable higher purity yields of silicon and precious metals, making recycling more profitable. Companies investing in R&D are gaining competitive advantages by reducing operational costs and achieving higher throughput rates. This trend enhances circularity and opens opportunities for partnerships between recyclers and solar manufacturers.

- For instance, First Solar’s “high-value recycling” program achieved an average 95 % global material recovery rate in 2023, retrieving glass, aluminum, steel, laminate, and semiconductor material.

Growing Private Investments and Partnerships

Private sector investment in recycling infrastructure is rising, with collaborations forming between recyclers, solar developers, and governments. Strategic partnerships foster innovation and scale recycling capacity to meet growing waste volumes. This investment climate creates opportunities for expansion into underserved regions, especially in Asia-Pacific and Africa. By aligning business models with sustainability goals, companies unlock long-term growth in recycling services.

- For instance, Rinovasol employs a refurbishment process that achieves a re-use rate exceeding 95 % of solar modules, by repairing, reconditioning, or repowering panels instead of full recycling.

Key Challenges

High Cost of Recycling Infrastructure

Establishing solar waste recycling facilities requires significant capital investment, which restricts entry for small and mid-sized players. The costs include advanced processing technologies, compliance systems, and logistics networks for waste collection. Without strong subsidies or economies of scale, recycling operations face profitability challenges, especially in early adoption regions.

Complexity of Material Separation

Solar panels contain multiple layered materials bonded with adhesives, making efficient separation technically difficult. Recovering high-purity silicon, silver, and other valuable metals demands advanced processes, which increase costs and reduce operational efficiency. The complexity of handling diverse panel designs adds another layer of challenge, slowing widespread adoption of recycling solutions.

Regional Analysis

North America

North America leads the Solar Waste Recycling Market with a 36% share in 2024. The region’s dominance is supported by early solar adoption, strong regulatory frameworks, and government-driven recycling mandates. The United States drives the majority of demand with a well-established solar infrastructure and growing end-of-life panel volumes. Canada also contributes, focusing on circular economy policies and sustainable energy goals. Rising investments in advanced recycling technologies and strong private-public partnerships strengthen the region’s leadership. The market benefits from established collection networks and large-scale recyclers focusing on material recovery efficiency and economic reuse of valuable resources.

Europe

Europe accounts for 30% of the Solar Waste Recycling Market in 2024, supported by strict environmental regulations and the Waste Electrical and Electronic Equipment (WEEE) directive. Countries like Germany, France, and the UK emphasize sustainability goals, driving structured recycling frameworks for solar waste. The European Union enforces producer responsibility, ensuring manufacturers actively participate in recycling processes. High solar penetration and ambitious renewable targets create a consistent flow of decommissioned panels. Investments in chemical and mechanical recycling innovations further improve recovery rates. With its regulatory leadership, Europe continues to be a critical hub for developing efficient recycling models.

Asia-Pacific

Asia-Pacific holds a 25% share of the Solar Waste Recycling Market in 2024, driven by rapid solar deployment and rising end-of-life panels. China leads the region with its extensive solar manufacturing base and recycling capacity, supported by government policies encouraging waste management. Japan and India also contribute significantly, investing in sustainable recycling technologies to reduce environmental impact. Growing renewable adoption in Southeast Asian countries further adds to waste volumes. The region’s strong manufacturing ecosystem, combined with cost-effective recycling processes, positions Asia-Pacific as a fast-growing market with high potential for scaling recycling infrastructure.

Latin America

Latin America accounts for 5% of the Solar Waste Recycling Market in 2024, with growth led by Brazil, Mexico, and Chile. Expanding solar power projects and rising demand for clean energy are generating steady recycling opportunities. Brazil’s government-backed renewable initiatives and Mexico’s industrial adoption drive early demand for panel recycling. Chile’s large-scale solar farms in the Atacama Desert also contribute to long-term waste generation. While recycling infrastructure is still developing, partnerships with global players are helping establish processing facilities. Policy alignment and sustainable energy incentives are expected to drive further growth across Latin American countries.

Middle East & Africa

The Middle East & Africa region represents 4% of the Solar Waste Recycling Market in 2024. Countries such as the UAE and Saudi Arabia are expanding solar installations as part of diversification strategies away from fossil fuels. South Africa leads the African market with renewable investments supported by policy frameworks. The growing number of large-scale solar projects in desert regions is expected to generate considerable panel waste in coming years. Limited recycling infrastructure remains a challenge, but ongoing investments and partnerships are gradually strengthening capabilities. Sustainability goals and green energy commitments are fostering long-term growth opportunities.

Market Segmentations:

By Grid Type:

By Application:

By Technology:

- Thin Film

- Crystalline Silicon

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Solar Waste Recycling Market features strong competition among key players such as ROSI, Recycle Solar Technologies Limited, The Retrofit Companies, Inc.s, Veolia, Solarcycle, Inc, First Solar Inc., Rinovasol, SILCONTEL LTD, HAMADA CO., LTD, and Reiling GmbH & Co. KG. The Solar Waste Recycling Market is shaped by growing demand for efficient recovery of materials from decommissioned solar panels. Companies in the sector emphasize advanced recycling methods to extract high-value components such as silicon, glass, and rare metals. Increasing focus on sustainability, circular economy practices, and compliance with regulatory frameworks drives investments in new recycling plants and automated dismantling systems. Market participants also prioritize research and development to enhance recovery rates, reduce processing costs, and improve environmental performance. Strategic collaborations with solar manufacturers and government agencies further support large-scale adoption of eco-friendly recycling solutions. Rising solar installations worldwide and the need for responsible end-of-life panel management continue to accelerate competitive innovation and global expansion in this industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ROSI

- Recycle Solar Technologies Limited

- The Retrofit Companies, Inc.s

- Veolia

- Solarcycle, Inc

- First Solar Inc.

- Rinovasol

- SILCONTEL LTD

- HAMADA CO., LTD

- Reiling GmbH & Co. KG

Recent Developments

- In May 2025, SeGo Innovations launched the world’s first origami solar cell design, which opened new possibilities for solar energy usage. This technology enables individuals to create solar power remotely with a portable design.

- In October 2024, SOLARCYCLE announced plans to establish a 5 GW solar panel recycling facility in Georgia, which is set to become the largest in the U.S. This facility is engineered to process up to 10 million solar panels annually, addressing a significant portion of the anticipated 25-30% of solar modules projected to reach their end-of-life by 2030.

- In February 2024, Veolia announced plans to launch more than 40 solar projects on its selected non-hazardous restored landfills, aiming for a total installed capacity of 300 MW. These photovoltaic panels would cover approximately 400 hectares, generating enough electricity to power 130,000 households.

- In January 2024, Microsoft signed an eight-year deal with the largest US solar manufacturer, Qcells, to supply the company with enough solar panels to add 12 gigawatts of solar electricity to the US grid.

Report Coverage

The research report offers an in-depth analysis based on Grid Type, Application, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising volumes of decommissioned solar panels worldwide.

- Companies will focus on improving recovery rates of silicon, glass, and rare metals.

- Automated recycling technologies will gain adoption to boost efficiency and reduce labor costs.

- Strategic collaborations will increase between recyclers, solar manufacturers, and governments.

- Regulatory policies will push the adoption of sustainable recycling practices in major markets.

- Investment in large-scale recycling plants will strengthen global processing capacity.

- Circular economy initiatives will drive innovation in closed-loop recycling solutions.

- Research and development will accelerate to lower costs and improve material purity.

- Demand for eco-friendly solutions will encourage partnerships across renewable energy sectors.

- Emerging regions will witness new opportunities as solar installations grow rapidly.