Market Overview:

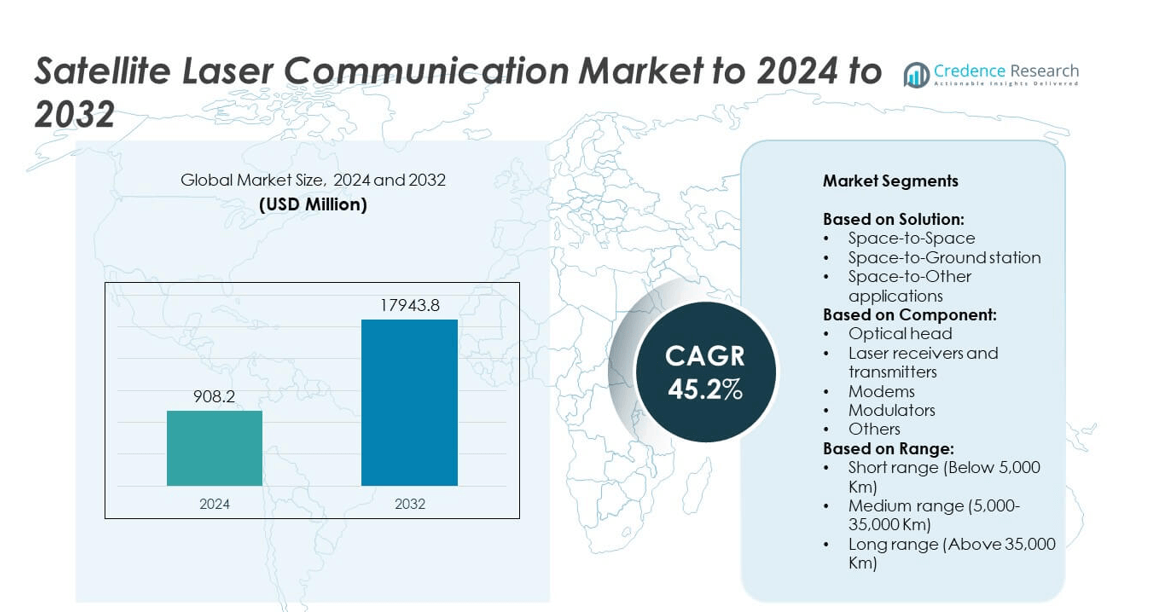

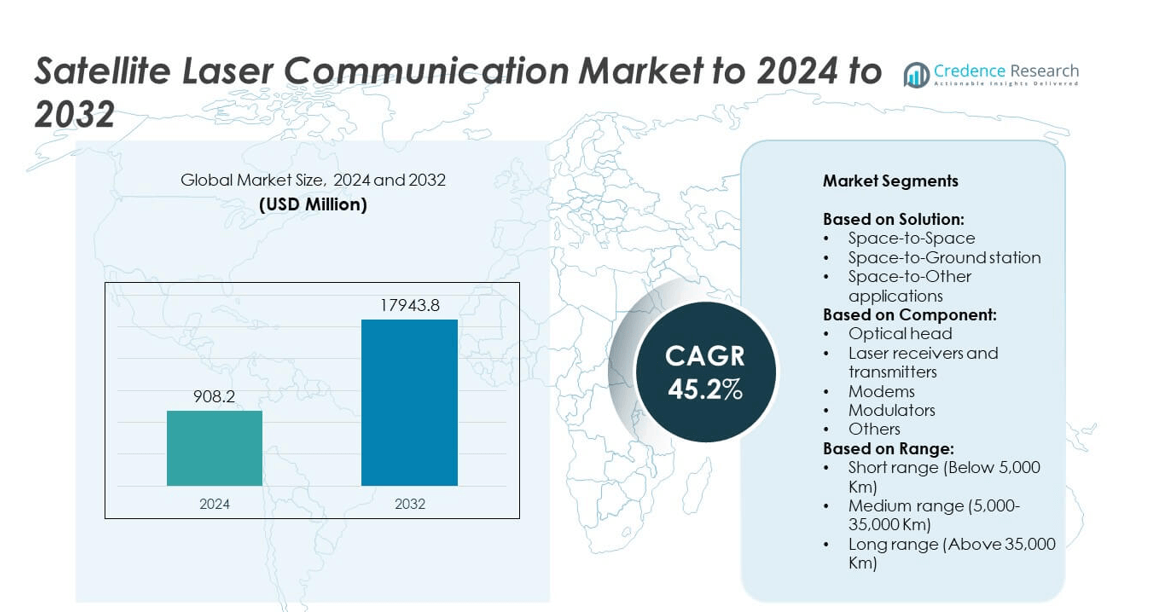

Satellite Laser Communication Market size was valued USD 908.2 Million in 2024 and is anticipated to reach USD 17943.8 Million by 2032, at a CAGR of 45.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Satellite Laser Communication Market Size 2024 |

USD 908.2 Million |

| Satellite Laser Communication Market, CAGR |

45.2% |

| Satellite Laser Communication Market Size 2032 |

USD 17943.8 Million |

The satellite laser communication market is driven by leading players such as Ball Aerospace, TESAT Spacecom, Thales Alenia Space, SpaceX, Mynaric AG, Hyperion Technologies, and BridgeComm, which are advancing optical terminals and inter-satellite communication systems. These companies focus on enhancing bandwidth, improving secure data transfer, and supporting large-scale satellite constellations for both commercial and defense applications. Regionally, North America dominated the market in 2024 with a 38% share, supported by strong investments from government agencies and private operators. Europe followed with 29%, driven by ESA-led projects, while Asia Pacific accounted for 22% owing to rising programs in China, Japan, and India.

Market Insights

- The satellite laser communication market was valued at USD 908.2 million in 2024 and is projected to reach USD 17943.8 million by 2032, growing at a CAGR of 45.2%.

- Rising demand for high-speed, secure, and jam-resistant data transfer across defense, commercial broadband, and deep-space missions is fueling strong adoption of optical systems.

- A key trend is the integration of laser communication with 5G and future networks, enabling global connectivity while inter-satellite links in LEO constellations strengthen broadband coverage.

- The market is highly competitive with major players focusing on miniaturized optical terminals, R&D partnerships, and hybrid RF-optical solutions to address technical and cost-related barriers.

- North America led with 38% share in 2024, followed by Europe at 29% and Asia Pacific at 22%, while Latin America and the Middle East & Africa accounted for 6% and 5% respectively; space-to-ground station solutions dominated with 47% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Solution

The satellite laser communication market by solution is led by the space-to-ground station segment, which accounted for nearly 47% share in 2024. This dominance is driven by the growing demand for high-speed data transfer between satellites and terrestrial networks, essential for Earth observation, defense, and commercial communication services. Space-to-space links are also gaining traction for inter-satellite connectivity in mega-constellations, while space-to-other applications, including aircraft and maritime connectivity, are expanding steadily. The surge in government and private investment in satellite-to-ground laser terminals strongly fuels the adoption of this segment.

- For instance, Airbus’s EDRS (SpaceDataHighway) is a laser communication data relay service that offers transfer rates of up to 1.8 Gbit/s and is capable of relaying up to 40 terabytes per day. A typical link session, lasting around 18 minutes, can download approximately 230 GB of data.

By Component

The optical head segment emerged as the dominant component, holding around 39% share in 2024. Optical heads are critical in managing high-precision pointing, acquisition, and tracking, ensuring reliable communication links. Laser receivers and transmitters follow closely, supported by demand for advanced payload integration in low Earth orbit satellites. Modems and modulators are also vital, enabling seamless conversion and data encoding processes. The optical head’s dominance is primarily driven by the rising need for compact, efficient, and durable solutions to meet bandwidth-intensive applications across defense, space exploration, and commercial communication.

- For instance, Mynaric announced in June 2025 that it had delivered more than 100 CONDOR Mk3 optical communications terminals to customers, including for the Space Development Agency’s Tranche 1 program. In parallel, Mynaric is developing the next-generation CONDOR Mk3.1 terminal, which is being designed to support data rates of up to 100 Gbit/s for future satellite constellations.

By Range

The medium-range segment, covering 5,000–35,000 km, dominated the market with a 44% share in 2024. This range supports critical satellite operations, including data relays between low Earth orbit (LEO) and geostationary Earth orbit (GEO) satellites, offering flexibility and reduced latency. The segment benefits from its compatibility with both Earth observation and broadband service missions. Short-range systems cater to inter-satellite links in LEO constellations, while long-range solutions above 35,000 km serve deep-space exploration. The dominance of the medium-range category is fueled by increasing broadband coverage demand and enhanced Earth-to-orbit communications.

Market Overview

Rising Demand for High-Speed Data Transmission

The increasing need for secure, high-capacity data transfer is the key growth driver for the satellite laser communication market. Conventional radio-frequency systems are reaching their bandwidth limits, while laser systems provide faster transmission and reduced latency. Governments and private players are investing in mega-constellations and Earth observation projects, pushing adoption further. This demand is particularly strong in defense, where secure, jam-resistant communication is vital. As data-driven services expand, laser communication becomes indispensable for real-time applications, positioning this driver as the most influential factor in market growth.

- For instance, Airbus / Space Data Highway (EDRS) has supported more than 80,000 successful laser links and relayed over 2.5 petabytes of space data through its infrastructure.

Expansion of Satellite Constellations

The rapid deployment of low Earth orbit (LEO) and medium Earth orbit (MEO) satellite constellations drives the market significantly. Operators like SpaceX and OneWeb are scaling networks that require reliable inter-satellite and ground links. Laser communication enables higher bandwidth, reduced congestion, and interoperability within these constellations. The scalability of optical systems also lowers long-term operational costs compared to traditional RF solutions. As satellite networks become essential for broadband connectivity in remote areas, the expansion of constellations directly fuels market demand and technology adoption.

- For instance, According to a statement from a SpaceX engineer in early 2024, Starlink’s mesh network used over 9,000 inter-satellite laser links to achieve a data capacity of more than 42 petabytes per day. A later 2024 progress report from Starlink indicated that the network had grown to more than 13,000 bidirectional laser links, increasing the constellation’s overall data capacity. The number of active lasers and the network’s total capacity continue to evolve as SpaceX launches more satellites.

Government and Defense Investments

Government and defense agencies are increasingly funding laser communication projects to strengthen secure space-based networks. Laser systems provide higher security against signal interception, making them crucial for military operations and intelligence applications. Programs in the United States, Europe, and Asia-Pacific are accelerating adoption through large-scale research and demonstration missions. These investments are not limited to defense but extend to weather monitoring, navigation, and disaster management. The public sector’s role in driving innovation and establishing infrastructure creates a steady demand, ensuring sustained growth for the market.

Key Trends & Opportunities

Integration with 5G and Future Networks

A major trend is the integration of satellite laser communication with terrestrial 5G and future 6G networks. The seamless connectivity between satellites and ground-based systems enhances global broadband coverage, particularly in underserved regions. Laser links provide the high capacity needed to backhaul data for dense 5G infrastructures. This opportunity positions laser systems as an enabler of hybrid networks, bridging terrestrial and satellite ecosystems. The move toward ubiquitous global connectivity ensures continued investments and partnerships between telecom operators and satellite service providers.

- For instance, In May 2019, Telesat, in partnership with Vodafone and the University of Surrey, successfully demonstrated 5G backhaul connectivity over a Low Earth Orbit (LEO) satellite. During the test, a low round-trip latency of 18–40 ms was achieved. The demonstration confirmed the capability of the network to support real-time applications such as video chatting, web browsing, and streaming of high-resolution video, including up to 8K, along with the transfer of 4K video.

Growing Role in Space Exploration

Another key opportunity lies in space exploration missions, where laser systems are being adopted for deep-space communication. Agencies such as NASA and ESA are increasingly testing optical links for missions to the Moon and Mars. Unlike RF, laser links handle high data volumes, essential for transmitting scientific images and telemetry across vast distances. The ability to maintain long-range secure communication positions laser systems as a cornerstone of future interplanetary exploration. This trend strengthens the market by expanding its relevance beyond commercial and defense domains.

- For instance, NASA’s LLCD (Lunar Laser Communication Demonstration) achieved downlink rates of 622 Mbps and uplink rates of 20 Mbps from lunar orbit to Earth.

Key Challenges

High Development and Deployment Costs

A key challenge for the satellite laser communication market is the high initial cost of development, testing, and deployment. Optical terminals require advanced precision engineering and expensive ground infrastructure, making adoption difficult for small-scale operators. Additionally, integration with existing RF systems adds complexity and increases expenses. While costs are expected to decline with scaling, current pricing remains a barrier to widespread adoption. This challenge limits accessibility for startups and emerging markets, slowing overall commercialization and global deployment.

Atmospheric and Weather Interference

Another major challenge is the impact of atmospheric conditions on laser signals. Cloud cover, rain, and turbulence can disrupt transmission between satellites and ground stations, reducing reliability. Unlike RF waves, optical beams are more susceptible to scattering and absorption, creating operational hurdles in regions with unstable climates. Solutions such as hybrid RF-optical systems are being explored, but they increase costs and complexity. Overcoming weather-related interference remains a critical technical barrier that the industry must address to achieve consistent global coverage.

Regional Analysis

North America

North America led the satellite laser communication market in 2024 with a 38% share. The region benefits from strong investments by NASA, the U.S. Department of Defense, and commercial players like SpaceX and Amazon’s Kuiper project. Demand for secure, high-capacity communication drives adoption in defense, broadband connectivity, and Earth observation programs. Canada is also contributing through collaborations with international space agencies. The focus on integrating optical links with growing satellite constellations further strengthens regional dominance. Strategic partnerships between technology firms and government organizations ensure North America maintains its leadership throughout the forecast period.

Europe

Europe accounted for 29% of the market share in 2024, supported by initiatives from the European Space Agency and countries like Germany, France, and the UK. The region focuses heavily on inter-satellite communication for broadband expansion and defense applications. Projects such as the European Data Relay System and public-private partnerships have accelerated adoption. European firms are developing advanced optical terminals and investing in miniaturized systems for commercial use. The growing push for digital sovereignty and secure networks enhances demand. Europe’s strong R&D ecosystem and government support position it as a key hub for innovation in this market.

Asia Pacific

Asia Pacific held a 22% market share in 2024, with rapid growth driven by China, Japan, and India. These countries are expanding satellite programs for defense, space exploration, and broadband connectivity. China’s advancements in inter-satellite laser communication and Japan’s space-based optical tests are key growth drivers. India’s focus on cost-efficient satellite launches also supports adoption. The region benefits from rising demand for global broadband coverage and increasing private sector involvement in space technology. Growing collaboration with global players further accelerates Asia Pacific’s role, making it one of the fastest-growing markets in the forecast period.

Latin America

Latin America captured a 6% share of the satellite laser communication market in 2024. The region is witnessing gradual adoption as countries like Brazil and Mexico expand satellite-based services for communication and monitoring. Government initiatives supporting space infrastructure development contribute to market growth. Although adoption is currently slower compared to larger regions, international collaborations and partnerships with satellite operators are creating opportunities. The rising need for rural broadband connectivity and disaster management solutions drives interest. With increasing private and public sector investments, Latin America is expected to enhance its presence in the global market over time.

Middle East and Africa

The Middle East and Africa accounted for a 5% market share in 2024, driven by satellite-based communication programs in countries such as the UAE, Israel, and South Africa. The region is adopting laser communication for defense, oil and gas monitoring, and secure communication needs. The UAE’s growing role in space technology, including Mars missions, highlights its commitment to advanced communication infrastructure. Africa is focusing on broadband expansion for underserved areas, opening opportunities for satellite-based solutions. While adoption is at an early stage, regional investments and international partnerships are steadily supporting future growth in this emerging market.

Market Segmentations:

By Solution:

- Space-to-Space

- Space-to-Ground station

- Space-to-Other applications

By Component:

- Optical head

- Laser receivers and transmitters

- Modems

- Modulators

- Others

By Range:

- Short range (Below 5,000 Km)

- Medium range (5,000-35,000 Km)

- Long range (Above 35,000 Km)

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The satellite laser communication market is shaped by leading companies such as Ball Aerospace & Technologies (Ball Corporation), Hyperion Technologies, Thales Alenia Space (Thales and Leonardo), BridgeComm, Inc., TESAT Spacecom (Airbus), SpaceX (Starlink), Optical Physics Company, ATLAS Space Operations, Inc., General Atomics, ODYSSEUS Space, Fibertek, Hensoldt, Mynaric AG, and Space Micro. These players focus on advancing optical terminals, improving transmission efficiency, and enhancing interoperability across satellite constellations. The market is characterized by strong collaborations between defense agencies, space organizations, and private operators, aiming to boost secure and high-speed communication networks. Investment in research and development remains intense, with companies working to miniaturize systems, lower costs, and expand deployment in commercial and defense missions. The competitive environment is further shaped by partnerships for global broadband connectivity, adoption of hybrid RF-optical systems, and demand for robust space-to-ground links. This dynamic landscape ensures continuous innovation and positions the market for strong long-term growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ball Aerospace & Technologies (Ball Corporation)

- Hyperion Technologies

- Thales Alenia Space (Thales and Leonardo)

- BridgeComm, Inc.

- TESAT Spacecom (Airbus)

- SpaceX (Starlink)

- Optical Physics Company

- ATLAS Space Operations, Inc.

- General Atomics

- ODYSSEUS Space

- Fibertek

- Hensoldt

- Mynaric AG

- Space Micro

Recent Developments

- In 2025, SpaceX and Starlink are developing technology to enable mobile phones to connect directly to Starlink satellites within two years.

- In 2024, Tesat-Spacecom GmbH & Co. KG demonstrated its laser communication terminal technology in a successful test with SpaceX Starlink satellites for the SDA, reported by Photonics Spectra.

- In 2023, Mynaric delivered CONDOR Mk3 terminals to Loft Federal, a subsidiary of Loft Orbital, for the SDA’s NExT program

Report Coverage

The research report offers an in-depth analysis based on Solution, Component, Range and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly with rising adoption in satellite constellations.

- Space-to-ground communication will remain the dominant solution throughout the forecast period.

- Governments will continue funding laser-based secure communication programs.

- Defense applications will drive strong demand for jam-resistant communication systems.

- Integration with 5G and future networks will create new growth opportunities.

- Space exploration missions will increasingly rely on laser communication for deep-space links.

- Medium-range systems will retain the largest market share due to flexible applications.

- Technological innovations will reduce costs and improve reliability over time.

- Weather-related challenges will encourage hybrid RF-optical communication solutions.

- Asia Pacific will emerge as the fastest-growing region with large-scale satellite projects.