Market Overview:

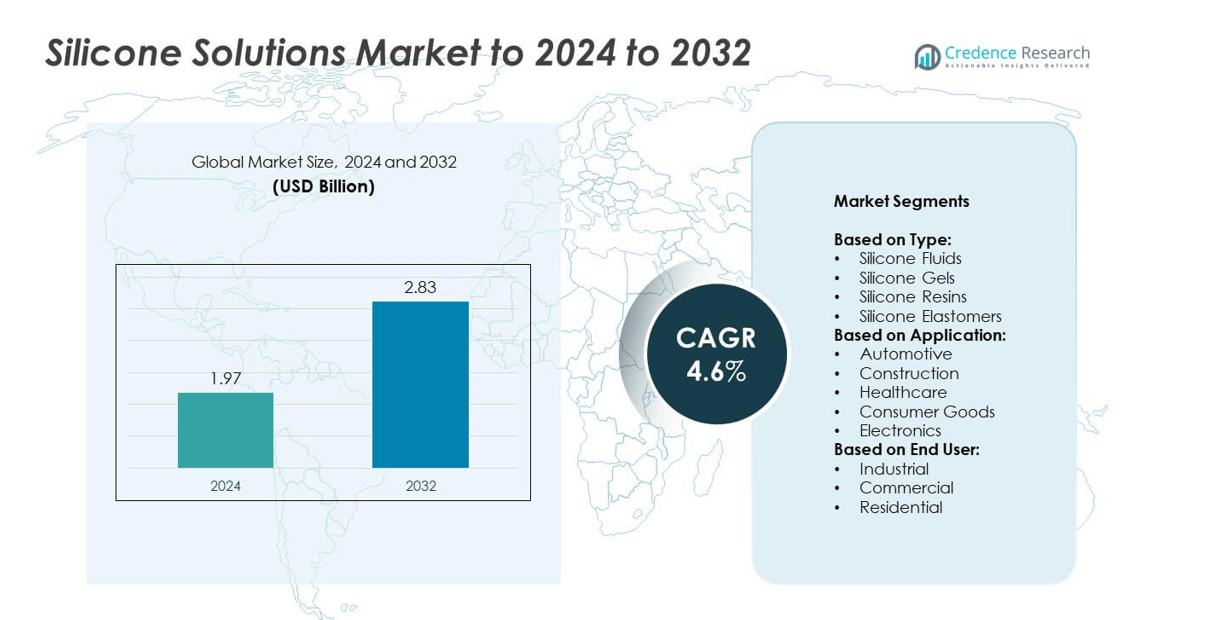

Silicone Solutions market size was valued at USD 1.97 Billion in 2024 and is anticipated to reach USD 2.83 Billion by 2032, at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Silicone Solutions Market Size 2024 |

USD 1.97 Billion |

| Silicone Solutions Market, CAGR |

4.6% |

| Silicone Solutions Market Size 2032 |

USD 2.83 Billion |

The Silicone Solutions market is driven by leading players including Kraton Corporation, Wacker Chemie AG, Evonik Industries AG, Huntsman Corporation, SABIC, ShinEtsu Chemical, KCC Corporation, DowSil, Elkem ASA, Mitsui Chemicals, SiVance LLC, Momentive Performance Materials, BASF SE, Polysiloxanes, and China National Chemical Corporation. These companies compete through product innovation, sustainability initiatives, and expansion into high-growth sectors such as automotive, healthcare, and construction. Regionally, Asia Pacific dominated the market in 2024 with a 34% share, supported by rapid industrialization and infrastructure development. North America followed with 32%, fueled by advanced manufacturing and strong demand in healthcare and automotive applications. Europe accounted for 27%, driven by strict regulatory standards and emphasis on sustainable formulations, while Latin America and the Middle East & Africa together represented smaller but emerging markets.

Market Insights

- The Silicone Solutions market was valued at USD 1.97 Billion in 2024 and is projected to reach USD 2.83 Billion by 2032, growing at a CAGR of 4.6%.

- Rising demand from automotive, healthcare, construction, and electronics sectors drives growth, with silicone elastomers holding over 40% share in 2024 due to their durability and versatility.

- Sustainability trends and technological advancements in electronics are shaping the market, with bio-based formulations and thermal management applications offering strong growth opportunities.

- The market is highly competitive, with global players focusing on innovation, cost-efficient production, and regional expansion to maintain leadership positions.

- Asia Pacific led with 34% share in 2024, followed by North America at 32% and Europe at 27%, while Latin America and the Middle East & Africa captured smaller shares but are emerging as growth regions supported by construction and infrastructure projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Silicone elastomers accounted for the largest share of the Silicone Solutions market in 2024, driven by their durability, flexibility, and resistance to extreme temperatures. These properties make them highly valuable in automotive seals, medical implants, and electronics encapsulation. Growing demand in healthcare and automotive sectors continues to strengthen their dominance. While silicone fluids and gels serve niche roles in cosmetics, lubricants, and personal care, and silicone resins support coatings and adhesives, elastomers remain the preferred choice across industries, holding over 40% market share due to broad applicability and consistent innovation.

- For instance, Elkem expanded Roussillon silicone intermediates capacity to 100,000 metric tons per year in 2023.

By Application

The automotive sector held the leading share of the market in 2024, exceeding 35%. Silicone-based solutions are vital in gaskets, seals, lubricants, and thermal management systems, supporting electric vehicle expansion and stricter emission norms. Their heat resistance and stability enhance vehicle safety and performance. Construction also shows significant adoption, particularly in sealants and adhesives, while healthcare applications are expanding with medical-grade silicones in implants and prosthetics. However, automotive remains dominant, driven by rising EV production, lightweight materials demand, and continuous R&D investments in advanced silicone formulations.

- For instance, Dow’s DOWSIL™ TC-2035 adhesive is specified for continuous operation at 200 °C in EV power modules.

By End User

Industrial end users represented the dominant segment in 2024, capturing more than 45% of the market. This dominance stems from the widespread use of silicone solutions in manufacturing, automotive, electronics, and energy sectors where performance reliability and thermal stability are critical. Commercial applications, including healthcare facilities and retail construction, also show growth due to rising demand for durable materials. Residential use is expanding slowly through sealants, adhesives, and consumer goods. Still, industrial adoption drives the market forward, powered by large-scale manufacturing investments, automation expansion, and stringent quality standards across global industries.

Market Overview

Rising Demand in Automotive Industry

The automotive industry stands as the key growth driver for the Silicone Solutions market. Increasing production of electric vehicles requires advanced materials that can withstand high temperatures and provide long-term durability. Silicone elastomers and fluids play a crucial role in sealing, insulation, and thermal management systems, enhancing vehicle safety and efficiency. Stringent emission standards and the push for lightweight components further boost adoption. With over one-third of demand coming from automotive applications, this sector is expected to continue driving significant growth during the forecast period.

- For instance, Shin-Etsu Chemical developed a silicone rubber (KE-5641-U) for EV high-voltage cable insulation with a dielectric breakdown strength of 40 kV/mm, up from 26 kV/mm in their previous product.

Expansion of Healthcare Applications

Healthcare is another major growth driver, fueled by the biocompatibility and flexibility of silicone materials. Silicone gels, elastomers, and fluids are increasingly used in implants, prosthetics, tubing, and wound care products. Rising healthcare spending, aging populations, and demand for advanced medical devices are driving growth. Regulatory approvals for silicone-based implants and their proven safety profile further support adoption. The need for durable, non-reactive materials in critical medical procedures positions healthcare as a major growth pillar for the silicone solutions industry.

- For instance, the Solventum™ Medical Silicone Tape 2480 uses a hi-tack silicone adhesive layer of approximately 4 mils (~101.6 µm) and is designed for adhesive performance on sensitive skin for up to 7 days.

Growth in Construction and Infrastructure

The global construction sector is driving strong demand for silicone sealants, adhesives, and coatings. Silicone resins and elastomers are widely applied in glazing, waterproofing, and insulation due to their weather resistance and durability. Rapid urbanization, infrastructure projects, and green building initiatives are fueling consumption, particularly in Asia-Pacific. The energy efficiency advantages of silicone-based construction products align with sustainable building trends. Expanding investments in residential and commercial construction solidify this segment as a key growth driver, ensuring long-term demand for silicone solutions across multiple geographies.

Key Trends & Opportunities

Innovation in Sustainable Formulations

Sustainability is a key trend in the Silicone Solutions market, with rising demand for eco-friendly and energy-efficient materials. Companies are investing in bio-based silicones and low-VOC formulations to align with green building codes and regulatory requirements. This creates opportunities for manufacturers to capture environmentally conscious customers, especially in Europe and North America. The growing shift toward recyclable and sustainable silicone products also helps firms strengthen brand positioning while meeting strict compliance standards. Innovation in sustainable solutions offers both differentiation and long-term growth opportunities.

- For instance, KCC Silicone introduced SeraSilk PDA 90 in late 2024 as a microplastic-free cosmetic ingredient

Technological Advancements in Electronics

Electronics is emerging as a major opportunity for silicone solutions, with rising demand for thermal management and protective materials. Silicone gels and elastomers are increasingly used in encapsulation, insulation, and flexible electronic components. The expansion of 5G networks, miniaturization of devices, and adoption of renewable energy systems fuel this demand. Growth in semiconductor and consumer electronics manufacturing also opens significant opportunities for specialized silicone products. Companies focusing on high-performance silicone materials for electronics can capture a growing share of this expanding market segment.

- For instance, Wevo launched WEVOSIL 22105 FL, a silicone potting compound with thermal conductivity of 1.5 W/m·K and density 2.61 g/cm³.

Key Challenges

High Production Costs

One of the key challenges facing the Silicone Solutions market is the high production cost of silicone materials. Raw materials such as silicon metal are energy-intensive to produce, leading to fluctuating input prices. This impacts profitability and restricts adoption in cost-sensitive markets like consumer goods. Smaller manufacturers often struggle to compete due to these cost pressures, creating barriers to entry. Balancing performance quality with affordability remains a challenge for producers, requiring innovation in cost-efficient production methods to maintain competitiveness in the global market.

Regulatory and Environmental Compliance

Strict regulatory frameworks and environmental concerns present another major challenge for the market. Governments are imposing tighter rules on chemical usage, emissions, and product safety. Compliance with REACH, RoHS, and similar standards increases costs and complexity for manufacturers. Environmental scrutiny of silicone disposal and recycling adds further pressure. Companies face the challenge of developing compliant, sustainable products without compromising performance or significantly raising costs. Failure to adapt to these evolving regulations may restrict market access, especially in developed regions like Europe and North America.

Regional Analysis

North America

North America held a 32% share of the Silicone Solutions market in 2024, driven by strong demand from automotive, healthcare, and electronics sectors. The United States remains the key contributor, supported by advanced manufacturing and research capabilities. Growth is further supported by the rapid expansion of electric vehicles and increasing investments in medical devices using silicone materials. The region also benefits from stringent energy-efficiency regulations, boosting silicone adoption in construction applications. Canada and Mexico contribute through rising infrastructure projects and industrial uses, consolidating North America’s position as a leading market for silicone solutions.

Europe

Europe accounted for 27% of the Silicone Solutions market in 2024, supported by sustainability initiatives and strict regulatory frameworks such as REACH. Countries like Germany, France, and the United Kingdom lead demand, especially in automotive, construction, and personal care applications. The region is experiencing strong growth in green building projects, boosting the use of silicone resins and sealants. Healthcare adoption is also increasing, driven by advanced medical technologies and rising demand for safe, durable materials. Europe’s focus on innovation and eco-friendly formulations positions it as a significant growth hub within the global silicone solutions industry.

Asia Pacific

Asia Pacific dominated the Silicone Solutions market with a 34% share in 2024, emerging as the fastest-growing region. China, Japan, South Korea, and India drive demand, fueled by industrial expansion, construction booms, and electronics manufacturing. The region benefits from high infrastructure investments, rising urbanization, and growing healthcare applications of silicone solutions. Rapid adoption in consumer goods and packaging also supports growth. China remains the largest contributor, followed by Japan’s advanced electronics sector and India’s construction-driven demand. With supportive government policies and increasing foreign investments, Asia Pacific continues to lead in both consumption and production capacities.

Latin America

Latin America captured 4% of the Silicone Solutions market in 2024, with Brazil and Mexico as leading contributors. The region shows growing demand in construction, automotive, and healthcare applications, supported by rising industrial activities. Silicone resins and sealants are gaining traction in infrastructure projects, particularly in urban developments. Automotive adoption is supported by increasing vehicle production in Brazil and Mexico. Healthcare expansion and consumer goods also contribute, though growth is moderate compared to developed markets. Despite challenges such as economic fluctuations, Latin America offers emerging opportunities for silicone solutions manufacturers targeting industrial and commercial segments.

Middle East and Africa

The Middle East and Africa region held a 3% share of the Silicone Solutions market in 2024. Demand is primarily concentrated in construction and infrastructure development, especially in Gulf countries such as the UAE and Saudi Arabia. Silicone sealants and coatings are widely used in large-scale building projects and energy facilities. Healthcare and consumer goods are smaller but expanding segments. Africa shows gradual adoption, led by South Africa’s industrial activities. Although the market share is relatively small, increasing investments in smart cities and energy projects create long-term opportunities for silicone solution providers in this region.

Market Segmentations:

By Type:

- Silicone Fluids

- Silicone Gels

- Silicone Resins

- Silicone Elastomers

By Application:

- Automotive

- Construction

- Healthcare

- Consumer Goods

- Electronics

By End User:

- Industrial

- Commercial

- Residential

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The Silicone Solutions market is shaped by key players such as Kraton Corporation, Wacker Chemie AG, Evonik Industries AG, Huntsman Corporation, SABIC, ShinEtsu Chemical, KCC Corporation, DowSil, Elkem ASA, Mitsui Chemicals, SiVance LLC, Momentive Performance Materials, BASF SE, Polysiloxanes, and China National Chemical Corporation. These companies compete through product innovation, strategic partnerships, and regional expansions to strengthen their market presence. The competitive environment is defined by continuous investment in sustainable and high-performance silicone formulations to meet regulatory demands and customer expectations. Firms focus on developing specialized applications in automotive, healthcare, construction, and electronics to secure long-term growth. Intense competition also drives advancements in manufacturing technologies, aiming to reduce production costs and enhance product efficiency. Market players are expanding into emerging regions with strong industrial bases, ensuring a wider global footprint. This dynamic landscape reflects a balance between innovation, sustainability, and regional penetration to maintain leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kraton Corporation

- Wacker Chemie AG

- Evonik Industries AG

- Huntsman Corporation

- SABIC

- ShinEtsu Chemical

- KCC Corporation

- DowSil

- Elkem ASA

- Mitsui Chemicals

- SiVance LLC

- Momentive Performance Materials

- BASF SE

- Polysiloxanes

- China National Chemical Corporation

Recent Developments

- In 2024, KCC Corporation acquired Momentive Performance Materials Group, a move that expanded its advanced silicones and specialty applications portfolio.

- In 2023, Huntsman Corporation Launched new products, including intumescent polyurethane coatings for fire protection and a new polyether amine.

- In 2022, Elkem ASA opened a facility in South Carolina focused on high-purity medical silicones

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising adoption across automotive, healthcare, and construction sectors.

- Demand for silicone elastomers will grow due to their durability and heat resistance.

- Healthcare will drive innovation with increasing use in implants, prosthetics, and medical devices.

- Construction projects will boost demand for silicone resins, sealants, and adhesives.

- Electronics will see higher adoption of silicone gels and fluids for insulation and protection.

- Sustainability trends will push companies toward eco-friendly and bio-based silicone formulations.

- Asia Pacific will remain the fastest-growing region with strong industrial growth.

- North America and Europe will lead in advanced applications and regulatory-driven demand.

- High production costs will encourage innovation in cost-efficient manufacturing processes.

- Strategic partnerships and R&D investments will shape competitive advantages among leading players.