Market Overview:

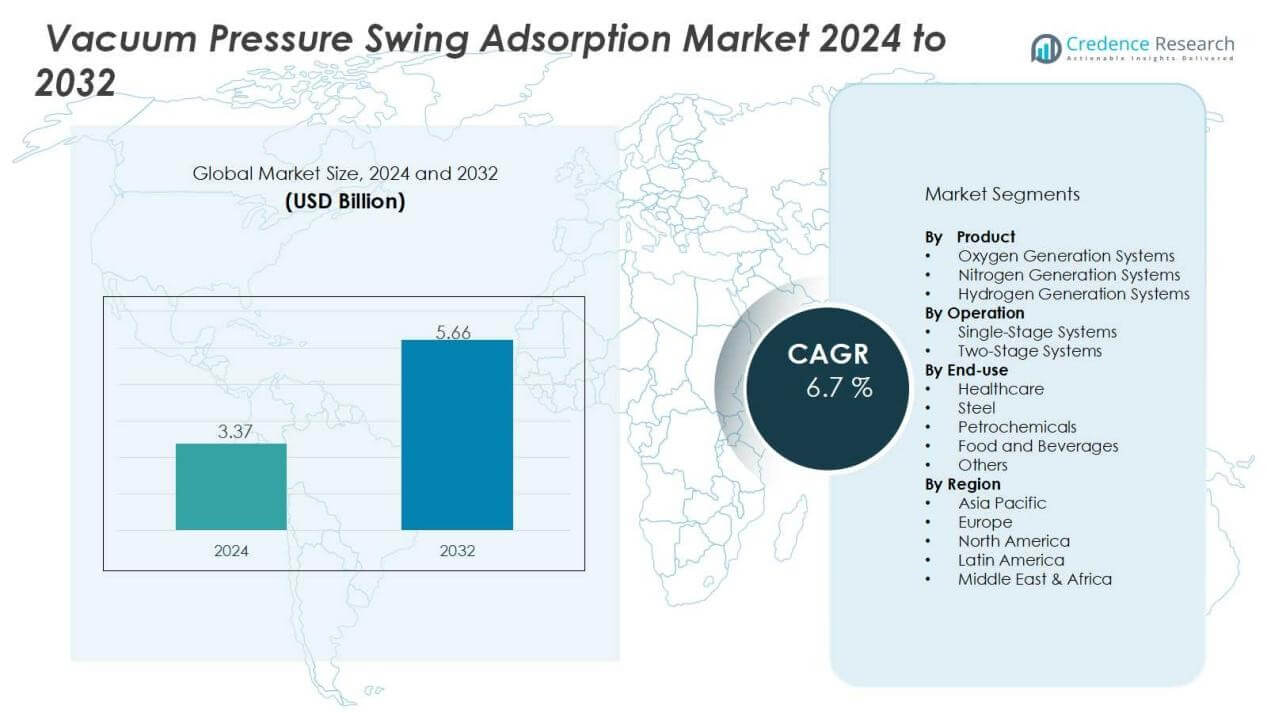

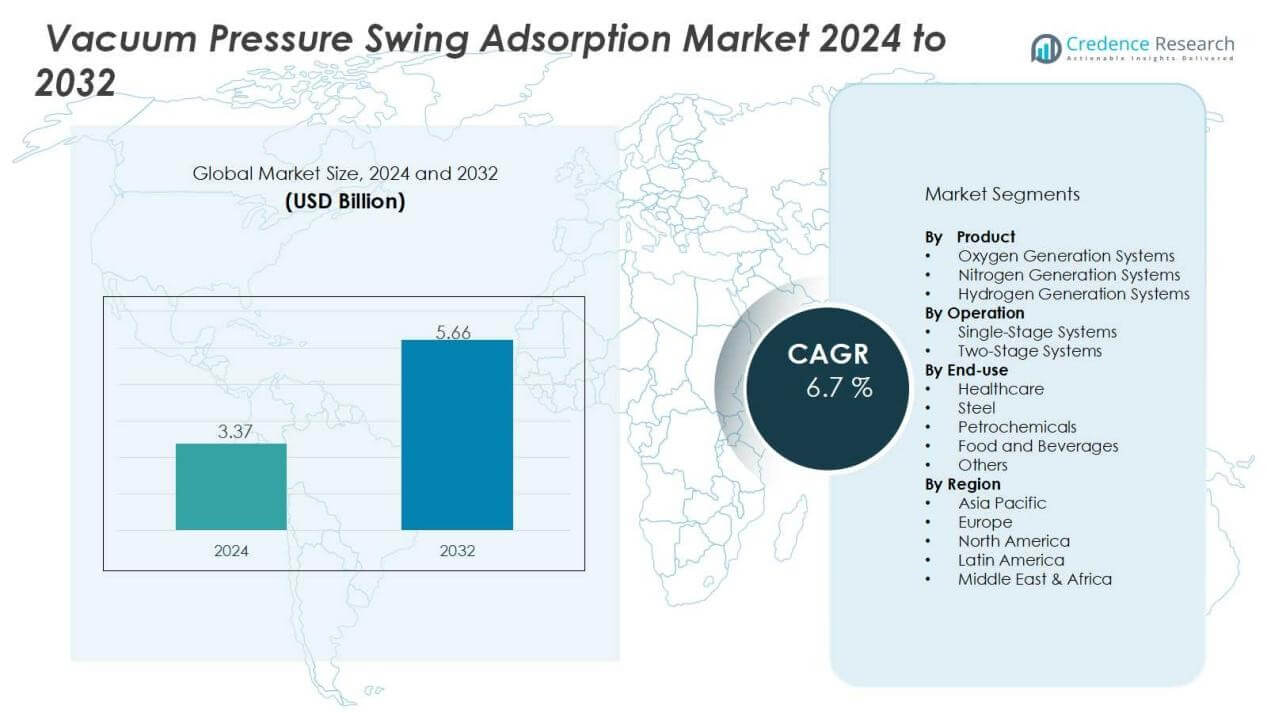

The vacuum pressure swing adsorption market size was valued at USD 3.37 billion in 2024 and is anticipated to reach USD 5.66 billion by 2032, at a CAGR of 6.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vacuum Pressure Swing Adsorption Market Size 2024 |

USD 3.37 Billion |

| Vacuum Pressure Swing Adsorption Market, CAGR |

6.7% |

| Vacuum Pressure Swing Adsorption Market Size 2032 |

USD 5.66 Billion |

Key drivers include growing applications in medical oxygen generation, steel production, and petrochemical processing. Rising healthcare investments, particularly in emerging economies, are boosting the need for on-site oxygen plants. Additionally, industries are focusing on reducing dependency on bulk gas supplies, favoring VPSA systems due to their operational efficiency and reliability. Environmental concerns and the adoption of cleaner production processes also support the integration of VPSA technology in multiple end-use sectors.

Regionally, Asia-Pacific dominates the VPSA market, led by China and India, where healthcare expansion and industrial growth are accelerating adoption. North America and Europe follow, supported by strong healthcare infrastructure and ongoing technological innovations. Meanwhile, Latin America and the Middle East & Africa are witnessing gradual uptake, driven by infrastructure development and rising healthcare demand.

Market Insights:

Market Insights:

- The vacuum pressure swing adsorption market was valued at USD 3.37 billion in 2024 and is projected to reach USD 5.66 billion by 2032, at a CAGR of 6.7%.

- Healthcare facilities drive strong demand for VPSA systems due to their reliability, cost efficiency, and ability to deliver on-site oxygen.

- Industrial applications in steel and petrochemical sectors expand adoption, as VPSA ensures stable gas supply and reduces operational costs.

- Energy efficiency is a key advantage, with VPSA systems consuming less power compared to traditional cryogenic methods.

- Environmental regulations support VPSA adoption, as it enables cleaner gas generation with reduced reliance on fossil-fuel-intensive supply chains.

- High capital investment and maintenance requirements remain challenges, limiting adoption in cost-sensitive regions and small enterprises.

- Asia-Pacific led with 42% market share in 2024, followed by North America at 28% and Europe at 21%, while Latin America and Middle East & Africa showed gradual uptake with 6% and 3% shares respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for On-Site Oxygen Generation in Healthcare Facilities:

The vacuum pressure swing adsorption market is strongly supported by the growing demand for oxygen generation systems in hospitals and clinics. Healthcare providers prefer VPSA systems for their reliability, cost efficiency, and ability to supply oxygen on demand. Governments are promoting localized oxygen generation to reduce supply chain risks and improve emergency preparedness. This trend gained significant momentum after global health crises exposed vulnerabilities in centralized oxygen supply networks.

- For Instance, Atlas Copco manufactures OGV+ VPSA oxygen generators designed for continuous hospital operation, with certain models capable of meeting oxygen demands above 100 kg/h for use in advanced surgical and intensive care units.

Expanding Applications Across Industrial Sectors Including Steel and Petrochemicals:

Industrial adoption is another key driver shaping the vacuum pressure swing adsorption market. Steel manufacturers use VPSA systems for oxygen enrichment during blast furnace operations, while petrochemical plants benefit from nitrogen generation. The technology offers stable performance in high-demand environments, making it attractive for industries requiring continuous gas supply. Its ability to cut operational costs compared to bulk deliveries strengthens its role in large-scale production processes.

- For instance, Anshan Baode Iron and Steel Co., Ltd. installed a VPSA oxygen plant in September 2018 that supplies 7,500 Nm³/h of 80% pure oxygen (equivalent to 6,000 Nm³/h of pure oxygen) to its blast furnace

Strong Push Toward Energy-Efficient and Cost-Effective Gas Separation Solutions:

Energy efficiency remains a critical factor driving the vacuum pressure swing adsorption market forward. Companies are under pressure to reduce operational costs and comply with sustainability goals. VPSA technology provides lower energy consumption compared to traditional cryogenic methods, making it more appealing for industries seeking long-term savings. The reduced dependency on external gas suppliers further increases its value proposition for small and medium enterprises.

Growing Emphasis on Environmental Compliance and Cleaner Production Methods:

The vacuum pressure swing adsorption market benefits from stricter environmental standards and industrial regulations. Companies are under increasing pressure to reduce emissions and adopt greener practices in production. VPSA systems align well with these goals by enabling efficient gas generation without heavy reliance on fossil-fuel-intensive supply chains. It supports sustainable development strategies while meeting the operational needs of diverse industries.

Market Trends:

Growing Preference for Decentralized Gas Generation Solutions Across Healthcare and Industries:

The vacuum pressure swing adsorption market is witnessing a shift toward decentralized gas generation systems. Hospitals, clinics, and small industries favor VPSA units for their ability to deliver reliable oxygen and nitrogen on-site. It reduces reliance on bulk supply chains and minimizes risks associated with transport delays. The flexibility of VPSA systems makes them suitable for remote or underdeveloped regions with limited infrastructure. Industrial sectors such as steel, petrochemicals, and food processing are also integrating VPSA systems to meet operational efficiency targets. Government initiatives promoting localized healthcare solutions further accelerate adoption across multiple regions.

- For Instance, INOX Air Products announced a massive ₹2,000 crore investment to build eight large-scale Air Separation Units (ASUs) across India by 2024 to increase its liquid medical oxygen production capacity.

Advancements in Technology and Rising Integration with Sustainability Goals:

The vacuum pressure swing adsorption market is influenced by continuous improvements in system design and adsorbent materials. Modern VPSA units are engineered to optimize cycle efficiency, reduce energy consumption, and improve long-term reliability. It aligns with global sustainability efforts, as companies focus on lowering emissions and operating costs. Integration with renewable energy-based facilities further enhances the appeal of VPSA solutions. Industries under pressure to comply with stricter environmental regulations adopt VPSA technology to support clean production goals. The trend toward digital monitoring and automation also enhances system performance and strengthens its role in industrial applications.

- For Instance, Linde signed 59 new long-term agreements to build, own, and operate 64 on-site plants using its ECOVAR® technology, stating these projects would “rapidly contribute” to growth.

Market Challenges Analysis:

High Capital Investment and Operational Limitations Restricting Adoption:

The vacuum pressure swing adsorption market faces challenges due to high upfront costs for installation and infrastructure. Small and medium enterprises often struggle to allocate resources for such capital-intensive systems. It requires specialized components, skilled labor, and consistent maintenance, which increase overall expenses. Some industries continue to rely on traditional bulk supply models because of lower initial investment. Limited flexibility in handling fluctuating demand also creates barriers for widespread use. These factors slow adoption in regions where cost sensitivity is high and technical expertise is limited.

Competition from Alternative Gas Separation Technologies and Supply Models:

The vacuum pressure swing adsorption market encounters strong competition from cryogenic separation and membrane-based technologies. These alternatives offer advantages in specific applications such as large-scale industrial gas production. It also competes with bulk gas suppliers that provide convenient delivery without heavy investments. In certain industries, reliability concerns limit the confidence in VPSA systems compared to established methods. Regulatory complexities and varying compliance standards across regions further challenge consistent adoption. Such competitive and regulatory pressures hinder the pace of market penetration despite growing awareness of VPSA benefits.

Market Opportunities:

Expanding Role of VPSA Systems in Emerging Healthcare and Industrial Markets:

The vacuum pressure swing adsorption market presents strong opportunities in emerging economies with expanding healthcare infrastructure. Hospitals and clinics in developing regions increasingly require reliable on-site oxygen solutions to meet patient needs. It allows healthcare facilities to overcome supply shortages and reduce reliance on external suppliers. Industrial sectors such as metallurgy, petrochemicals, and food processing also open new growth avenues. Rising investments in manufacturing hubs across Asia-Pacific and Latin America strengthen demand for scalable VPSA systems. Growing awareness of cost savings and operational independence further accelerates adoption.

Rising Integration of VPSA Technology into Sustainable and Energy-Efficient Solutions:

The vacuum pressure swing adsorption market benefits from rising global focus on sustainability and energy efficiency. Companies look for gas generation technologies that minimize energy consumption and support environmental compliance. It offers significant advantages over cryogenic methods by reducing energy costs and lowering carbon footprints. Opportunities are growing in sectors seeking to align operations with green initiatives and net-zero targets. Integration of VPSA into renewable-powered plants and decentralized facilities strengthens its long-term relevance. Demand from industries under regulatory pressure to adopt cleaner technologies ensures consistent market growth potential.

Market Segmentation Analysis:

By Product:

The vacuum pressure swing adsorption market by product is segmented into oxygen generation systems, nitrogen generation systems, and hydrogen generation systems. Oxygen systems dominate due to strong demand from hospitals, clinics, and emergency care centers. It ensures a reliable medical-grade supply, reducing reliance on bulk cylinder deliveries. Nitrogen systems are widely adopted in petrochemicals, food packaging, and electronics industries. Hydrogen systems are gaining momentum in refining and clean energy applications, where continuous and cost-effective supply is critical. Each product category supports specific industrial and healthcare requirements, creating diverse growth opportunities.

- For Instance, AirSep, now known as CAIRE Inc., is a manufacturer providing VPSA oxygen generators for gold leaching with typical purity of 93% ±3%. The company has installed various VPSA systems for gold mining globally, with capacities ranging from 2,000 to 120,000 SCFH.

By Operation:

The vacuum pressure swing adsorption market by operation is divided into single-stage and two-stage systems. Single-stage systems remain preferred for smaller facilities seeking low-cost solutions with reliable performance. Two-stage systems capture increasing interest from industries that require higher purity and efficiency levels. It offers improved gas separation, meeting the needs of demanding processes such as metallurgy and petrochemicals. Growing awareness of energy efficiency further strengthens demand for advanced two-stage systems. Both segments contribute to meeting the varied scale of industrial and medical applications.

- For instance, Linde’s two-bed VPSA plant installed at Weyerhaeuser Canada’s Kamloops pulp mill produces 41 tonnes per day of 90% pure oxygen, enabling continuous operation in high-consistency oxygen delignification.

By End-Use:

The vacuum pressure swing adsorption market by end-use includes healthcare, steel, petrochemicals, food and beverages, and others. Healthcare leads adoption, driven by rising investments in medical infrastructure and demand for localized oxygen generation. Steel and petrochemical sectors deploy VPSA units to support high-volume, continuous operations. It is also gaining traction in food and beverage industries for nitrogen-based preservation processes. Smaller end-use categories such as chemicals and electronics show steady growth with specialized applications. This broad adoption base ensures consistent demand across multiple industries.

Segmentations:

By Product:

- Oxygen Generation Systems

- Nitrogen Generation Systems

- Hydrogen Generation Systems

By Operation:

- Single-Stage Systems

- Two-Stage Systems

By End-Use:

- Healthcare

- Steel

- Petrochemicals

- Food and Beverages

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific:

Asia-Pacific accounted for 42% market share in 2024, making it the leading regional market. The vacuum pressure swing adsorption market in this region benefits from strong healthcare expansion in China and India. It is supported by government programs encouraging localized oxygen generation to strengthen hospital infrastructure. Rapid industrialization further drives demand in steel, petrochemical, and manufacturing sectors. Rising investments in industrial hubs and energy projects accelerate technology adoption. Regional players also contribute to growth through cost-effective and scalable VPSA solutions.

North America and Europe:

North America captured 28% market share in 2024, while Europe held 21% share in the same year. The vacuum pressure swing adsorption market in these regions is driven by strong healthcare systems and advanced industrial facilities. It benefits from widespread demand for on-site oxygen generation across hospitals and specialized clinics. Industries adopt VPSA systems to meet energy efficiency goals and comply with sustainability standards. Strong presence of technology providers and R&D centers ensures continuous innovation. Both regions also emphasize environmental compliance, further boosting adoption.

Latin America and Middle East & Africa:

Latin America held 6% market share in 2024, while the Middle East & Africa accounted for 3%. The vacuum pressure swing adsorption market in these regions is developing gradually with rising healthcare investments. It is increasingly used in hospitals to reduce dependency on bulk oxygen deliveries. Expanding industrial activity in mining, energy, and chemicals also contributes to growth. Governments encourage adoption of decentralized gas generation solutions to strengthen infrastructure. While adoption remains limited compared to larger regions, steady growth potential is visible in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- AirSep

- Precision Medical

- NOVAIR USA

- Air Products and Chemicals

- Adsorption Research

- Valmet

- PKU Pioneer

- NES Company

- Chenrui Air Separation Technology

- Linde

- CAIRE

- Praxair Technology

Competitive Analysis:

The vacuum pressure swing adsorption market is shaped by strong competition among global and regional players. Key companies include AirSep, Precision Medical, NOVAIR USA, Air Products and Chemicals, Adsorption Research, Valmet, PKU Pioneer, and NES Company. These firms focus on advancing system efficiency, improving adsorbent materials, and expanding product portfolios to meet diverse industry needs. It strengthens their market presence through partnerships with healthcare providers, steel manufacturers, and petrochemical operators. Many players invest in R&D to deliver energy-efficient solutions that align with sustainability goals. Competitive strategies also include regional expansion, mergers, and collaborations to enhance customer reach. Strong brand reputation and technological innovation remain critical factors influencing market leadership.

Recent Developments:

- In September 2025, Air Products successfully completed the first fill of NASA’s world’s largest liquid hydrogen sphere at Kennedy Space Center, supplying 730,000 gallons of liquid hydrogen for the Artemis Moon program.

- In September 2025, Valmet and Körber entered a joint venture agreement for the FactoryPal digital shop floor solution, with Valmet holding the majority share to advance AI-powered operational excellence for tissue machine producers.

Report Coverage:

The research report offers an in-depth analysis based on Product, Operation, End-Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The vacuum pressure swing adsorption market will continue to gain traction in healthcare through growing adoption of on-site oxygen generation systems.

- It will see rising demand from steel and petrochemical industries that require continuous gas supply for large-scale operations.

- Energy-efficient VPSA systems will remain attractive as industries prioritize solutions that reduce power consumption and operating costs.

- Integration with renewable-powered plants will expand opportunities for VPSA technology in decentralized and sustainable gas generation.

- The market will benefit from stricter environmental regulations that push industries to adopt cleaner and compliant production methods.

- Technological advancements in adsorbent materials and system design will enhance efficiency, reliability, and scalability of VPSA systems.

- Developing economies will emerge as major growth hubs, supported by rapid industrialization and expanding healthcare infrastructure.

- Competition with cryogenic and membrane-based separation methods will continue, requiring VPSA providers to focus on differentiation through cost and efficiency.

- Partnerships between technology developers and local suppliers will help strengthen distribution networks and market reach in underserved regions.

- Long-term growth will be supported by rising awareness of operational independence, cost savings, and sustainability benefits offered by VPSA technology.

Market Insights:

Market Insights: