Market Overview

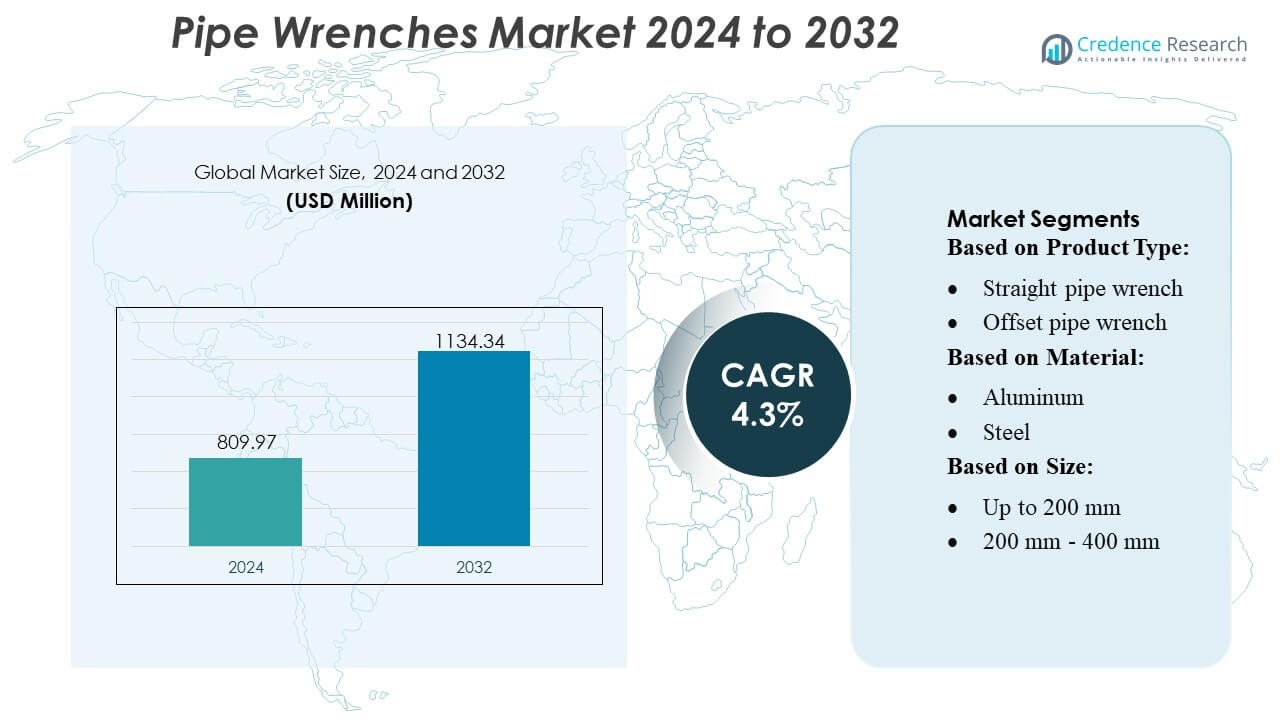

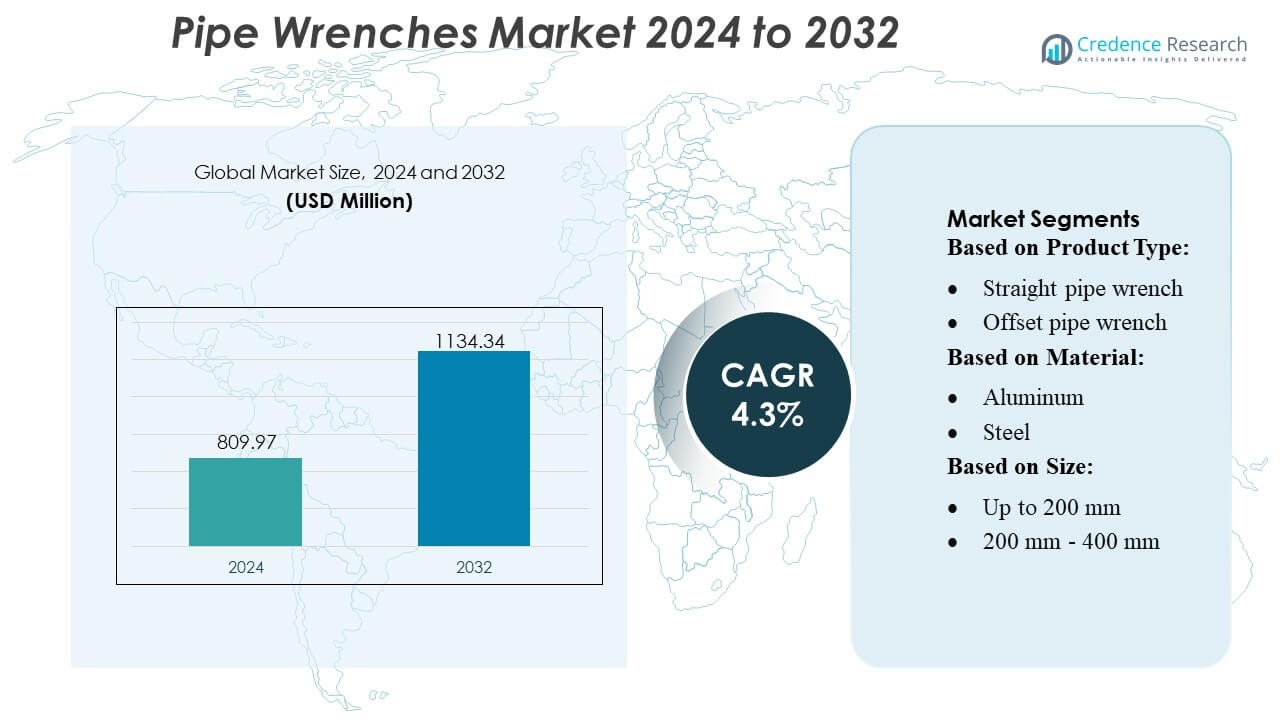

Pipe Wrenches Market size was valued USD 809.97 million in 2024 and is anticipated to reach USD 1134.34 million by 2032, at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pipe Wrenches Market Size 2024 |

USD 809.97 Million |

| Pipe Wrenches Market, CAGR |

4.3% |

| Pipe Wrenches Market Size 2032 |

USD 1134.34 Million |

The Pipe Wrenches Market is supported by a competitive group of global tool manufacturers, industrial equipment suppliers, and material innovators that continue to enhance product durability, torque efficiency, and ergonomic performance. Leading companies focus on expanding portfolios of lightweight, corrosion-resistant, and precision-engineered wrenches to serve plumbing, HVAC, construction, and industrial maintenance applications. Strategic priorities include strengthening distribution networks, accelerating product innovation, and leveraging e-commerce growth to reach professional and DIY users. North America leads the global market with an exact 38% share, driven by advanced infrastructure, high tool adoption rates, and consistent investment in maintenance and repair activities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Pipe Wrenches Market was valued at USD 809.97 million in 2024 and is projected to reach USD 1134.34 million by 2032, registering a 3% CAGR during the forecast period.

- Demand grows steadily due to strong drivers such as plumbing modernization, industrial maintenance needs, and rising adoption of ergonomic and lightweight wrench designs across professional applications.

- Key trends include the shift toward aluminum and composite materials, increased online procurement, and rising preference for precision-engineered jaws and multi-functional wrench models.

- The competitive landscape strengthens as manufacturers enhance durability, torque performance, and distribution capabilities while competing against powered tightening tools in heavy-duty environments.

- Regionally, North America holds 38% of the market, while the 200 mm–400 mm size segment leads product demand; expanding construction activity in Asia-Pacific continues to support long-term global growth.

Market Segmentation Analysis:

By Product Type

Straight pipe wrenches dominate the market with the largest share due to their widespread use in plumbing, mechanical maintenance, and industrial installations. Their high gripping strength, compatibility with various pipe diameters, and robust construction drive strong preference among technicians and contractors. Offset and end pipe wrenches gain traction in confined spaces, while chain and strap wrenches serve applications requiring non-marring surfaces or irregular shapes. Growth in oil & gas maintenance and municipal water infrastructure upgrades further strengthens demand for durable straight pipe wrenches across global end-use sectors.

- For instance, CCS Insight robust 46.8 million second-hand mobile devices were sold globally in Q4 2023 within the organized secondary market (excluding peer-to-peer sales). This represented a 2.9% increase from the previous year, highlighting the market’s resilience and continued growth.

By Material

Steel pipe wrenches hold the dominant market share, supported by superior durability, high torque resistance, and suitability for heavy-duty industrial environments. Their long service life and reliability in high-pressure pipeline operations make them the preferred choice across construction, petrochemical, and utility sectors. Aluminum wrenches gain adoption among professionals seeking lightweight alternatives for overhead or repetitive tasks, while plastic and composite variants expand in applications requiring corrosion resistance. Increasing focus on ergonomic handling and material advancement continues to elevate demand for structured steel-based wrench designs.

- For instance, Gazelle is a well-known company in the reCommerce space for consumer electronics, providing trade-in services and selling certified pre-owned devices. Gazelle had successfully processed over 2 million used devices from more than 1 million customers.

By Size

The 200 mm–400 mm size segment accounts for the largest market share, driven by its versatility in residential plumbing, HVAC servicing, and general mechanical repair. This mid-range category balances grip capacity with maneuverability, making it suitable for technicians performing frequent installations and maintenance tasks. Smaller wrenches under 200 mm support precision work in compact spaces, whereas larger sizes above 600 mm address heavy-duty industrial pipelines. Expanding construction activity, rising utility network maintenance, and the need for adaptable tools continue to reinforce demand for mid-sized pipe wrenches globally.

Key Growth Drivers

Rising Plumbing and Infrastructure Modernization

Expansion of residential, commercial, and municipal infrastructure drives strong demand for pipe wrenches as plumbing, drainage, and pipeline systems undergo continuous upgrades. Contractors prefer high-torque, durable tools that support frequent installation and repair tasks across water supply, HVAC, and wastewater networks. Growth in renovation activities and adoption of standardized pipe fittings further accelerates product usage. Increasing investments in urban water management and smart city development continue to reinforce market momentum, positioning pipe wrenches as essential tools for maintenance-intensive environments.

- For instance, the Amazon Renewed program, which sells certified refurbished electronics, is supported by its Amazon Renewed Guarantee, a minimum 90-day warranty that strengthens consumer trust in refurbished devices.

Industrial Expansion and Maintenance Demand

Growth across oil & gas, petrochemical, manufacturing, and power generation sectors fuels the requirement for heavy-duty pipe wrenches capable of handling high-pressure pipelines and large-diameter connections. Facilities rely on these tools for routine maintenance, shutdown operations, and safety inspections to ensure operational continuity. Rising industrial automation and the global push toward reducing downtime encourage adoption of precision-engineered wrenches with improved grip strength and torque performance. Upgrades in mechanical workshops and field-service operations strengthen long-term demand across industrial maintenance applications.

- For instance, Piaggio’s Vespa Elettrica a flagship electric scooter uses a lithium‑ion battery pack with 4.2 kWh energy and delivers a peak motor power of 4 kW (continuous 3.6 kW), with a torque output of 200 Nm.

Shift Toward Ergonomic and Lightweight Tools

Increasing workforce efficiency requirements and technician fatigue concerns drive the shift toward lightweight, ergonomic, and user-friendly pipe wrench designs. Manufacturers enhance comfort through improved handle geometry, reduced tool weight, and vibration-minimizing features. Aluminum and composite materials gain traction as professionals seek tools that enable longer usage without compromising gripping capability. Demand for portable toolkits among HVAC, plumbing, and service technicians also accelerates this transition. This focus on usability and worker safety supports rapid adoption of modernized wrench designs across global markets.

Key Trends & Opportunities

Adoption of Advanced Materials and Precision Engineering

A growing trend toward high-performance materials such as aluminum alloys, hardened steel, and composites enhances durability, corrosion resistance, and grip accuracy. Manufacturers invest in precision machining to improve jaw alignment and torque consistency, supporting professional-grade applications. Opportunities emerge for reinforced wrenches designed for extreme working conditions, including offshore, chemical-processing, and heavy mechanical environments. This evolution toward advanced construction materials helps differentiate brands and aligns with industry needs for long-lasting, reliable tools.

- For instance, Hyundai Creta Electric scheduled for 2025 launch offers two liquid‑cooled lithium‑ion battery pack options: a 51.4 kWh pack and a 42 kWh pack.

Growth of Multi-Functional and Adjustable Wrench Designs

The market witnesses rising demand for adjustable, multi-functional, and compact wrench models that streamline toolkits and improve operational flexibility. Technicians increasingly prefer tools that can accommodate multiple pipe diameters and complex geometries, reducing the need for multiple specialty wrenches. Innovations in quick-adjust mechanisms, modular jaws, and dual-purpose handles present strong opportunities for manufacturers. This trend aligns with the growing focus on field productivity and cost-efficient servicing across plumbing, industrial, and mechanical applications.

- For instance, the Volkswagen Group emphasizes its multi-continent production network for its electric vehicle portfolio, producing Battery Electric Vehicles (BEVs) at 18 sites across its global production network as of year-end 2023.

Expansion of E-Commerce and Professional Tool Distribution

Digital platforms strengthen product visibility and offer technicians wider access to specialized wrench types, driving heightened online procurement. Professional tool retailers and OEM-branded e-commerce portals expand offerings of premium, ergonomic, and task-specific wrenches. Growing adoption of subscription-based maintenance tool kits and online customization options presents new opportunities. Enhanced digital logistics and rapid delivery capabilities further support the shift toward online channels, accelerating market penetration across small contractors and DIY consumers.

Key Challenges

Operational Limitations in Extreme Industrial Environments

Pipe wrenches face challenges in high-temperature, corrosive, or high-torque environments where repeated usage accelerates wear, jaw deformation, and slippage risks. Heavy-duty industrial applications often demand specialized tools or powered alternatives, limiting the suitability of conventional manual wrenches. Industries such as chemical processing, offshore drilling, and mining require enhanced materials and coatings to address durability issues. Manufacturers must continuously improve mechanical strength and corrosion resistance to maintain competitiveness in demanding operational settings.

Rising Competition from Powered and Automated Tools

The increasing adoption of power-driven pipe tools, hydraulic torque systems, and automated tightening solutions presents a major challenge for traditional pipe wrench usage. These advanced systems offer higher precision, better torque control, and reduced operator fatigue, making them preferred for large-scale industrial installations. As industrial facilities aim for faster turnaround times and safer maintenance practices, manual wrenches risk declining relevance in high-performance environments. Companies must innovate with hybrid or enhanced manual designs to compete effectively against automated alternatives.

Regional Analysis

North America

North America holds the largest share of the global pipe wrenches market at approximately 38%, supported by strong construction activity, extensive plumbing maintenance requirements, and advanced industrial infrastructure. The region benefits from high professional tool adoption rates across HVAC, oil & gas, and utilities, where durable and high-torque wrenches remain essential. Continuous investment in pipeline modernization, residential remodeling, and municipal water system upgrades strengthens demand. Established tool manufacturers and widespread distribution networks further reinforce market penetration, while growing interest in ergonomic, lightweight, and precision-engineered tools supports steady long-term growth.

Europe

Europe accounts for around 27% of the global market, driven by stringent safety standards, rising industrial maintenance needs, and sustained investment in commercial and residential infrastructure upgrades. Demand remains strong across Germany, the U.K., France, and Nordic countries where HVAC expansion, plumbing refurbishment, and renewable energy projects require reliable hand tools. The region’s focus on lightweight materials, corrosion-resistant alloys, and sustainability-oriented manufacturing enhances product innovation. Replacement cycles driven by regulatory compliance and the presence of established mechanical service industries further contribute to Europe’s stable demand for premium pipe wrenches.

Asia-Pacific

Asia-Pacific represents roughly 24% of the global market and continues to expand rapidly due to large-scale construction activity, fast-growing urbanization, and rising industrial output across China, India, and Southeast Asia. Infrastructure expansion projects, including water distribution networks, oil & gas pipelines, and industrial facilities, significantly boost tool consumption. The region’s growing technician workforce and increasing adoption of professional-grade tools support long-term market momentum. Local manufacturing capabilities and competitive pricing enhance accessibility, while modernization of utilities and strong growth in residential plumbing services drive sustained demand across varied applications.

Latin America

Latin America captures about 7% of the global pipe wrenches market, supported by ongoing urban development, expansion of residential housing, and gradual modernization of water and sanitation infrastructure. Demand grows steadily in Brazil, Mexico, Argentina, and Chile as plumbing maintenance activities rise alongside industrial construction. Economic fluctuations and import dependency pose challenges, yet increasing interest in durable, mid-range tools sustains market activity. Investments in oil & gas fields, mining operations, and utility networks create opportunities for heavy-duty wrench categories, contributing to stable long-term market prospects across the region.

Middle East & Africa

The Middle East & Africa region holds nearly 4% of the global market, with demand primarily driven by oil & gas operations, industrial construction, and ongoing expansion of commercial infrastructure. Countries such as the UAE, Saudi Arabia, and South Africa rely heavily on high-strength, corrosion-resistant wrenches suited for harsh environments. Water pipeline development projects and increased maintenance of energy assets further support consumption. Although market growth is moderated by uneven economic conditions, rising investment in utilities, refineries, and urban infrastructure continues to create consistent demand for durable and high-performance pipe wrenches.

Market Segmentations:

By Product Type:

- Straight pipe wrench

- Offset pipe wrench

By Material:

By Size:

- Up to 200 mm

- 200 mm – 400 mm

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Pipe Wrenches Market features a diverse mix of global manufacturers and industrial suppliers, including Metline Industries, RPM International Inc., Tata Steel, Georg Fischer, Merck KGaA, Eastman Chemical Company, Saint-Gobain, Popular Pipes Group of Companies, Aliaxis, and Mueller Industries. the Pipe Wrenches Market is defined by a mix of established global tool manufacturers and emerging regional producers that compete through innovation, material advancements, and distribution strength. Companies focus on enhancing torque efficiency, jaw precision, and ergonomic handling to support demanding applications across plumbing, HVAC, industrial maintenance, and construction sectors. Investments in lightweight alloys, corrosion-resistant finishes, and precision-engineered components reflect the industry’s shift toward higher performance and user comfort. Expanding e-commerce channels, professional tool partnerships, and after-sales service networks further intensify competition. As infrastructure modernization and industrial expansion accelerate worldwide, manufacturers emphasize product reliability, extended lifespan, and versatile designs to strengthen market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Metline Industries

- RPM International Inc.

- Tata Steel

- Georg Fischer

- Merck KGaA

- Eastman Chemical Company

- Saint-Gobain

- Popular Pipes Group of Companies

- Aliaxis

- Mueller Industries

Recent Developments

- In October 2025, Georg Fischer (GF) has acquired the VAG Group for CHF, strengthening its Flow Solutions platform, particularly in the infrastructure sector.

- In June 2025, Prysmian completed the acquisition of Channell Commercial Corporation, a U.S. manufacturer of thermoplastic enclosures and fiber management, for a base price of subject to adjustments, a move strengthening Prysmian’s Digital Solutions and support for broadband/telecom networks with Channell’s U.S. manufacturing and products like vaults and enclosures.

- In March 2025, Baker Hughes and Petrobras have partnered on a technology development program to create stress-corrosion-resistant flexible pipes with a 30-year lifespan.

- In May 2024, Westlake Pipe & Fittings announced a significant expansion in Wichita Falls, TX, adding a 190,000-sq-ft plant for molecular-oriented PVC (PVCO) pipes, a stronger, more durable alternative to standard PVC, enhancing their portfolio for water infrastructure with reduced material use and better performance.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, Size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady demand driven by ongoing plumbing and infrastructure modernization.

- Manufacturers will increasingly adopt lightweight aluminum and composite materials to enhance user comfort.

- Digital sales channels will expand further as technicians shift toward online tool procurement.

- Precision-engineered jaws and improved torque mechanisms will gain prominence in professional applications.

- Industrial maintenance operations will continue to drive adoption of heavy-duty wrench variants.

- Multi-functional and adjustable wrench designs will attract users seeking versatile toolkits.

- Growing construction activity in emerging economies will strengthen global market penetration.

- Sustainability-focused manufacturing and recyclable materials will gain more industry attention.

- Ergonomic improvements will remain a priority to reduce fatigue during prolonged field use.

- Product differentiation will increasingly rely on durability, performance consistency, and brand reliability.