Market Overview

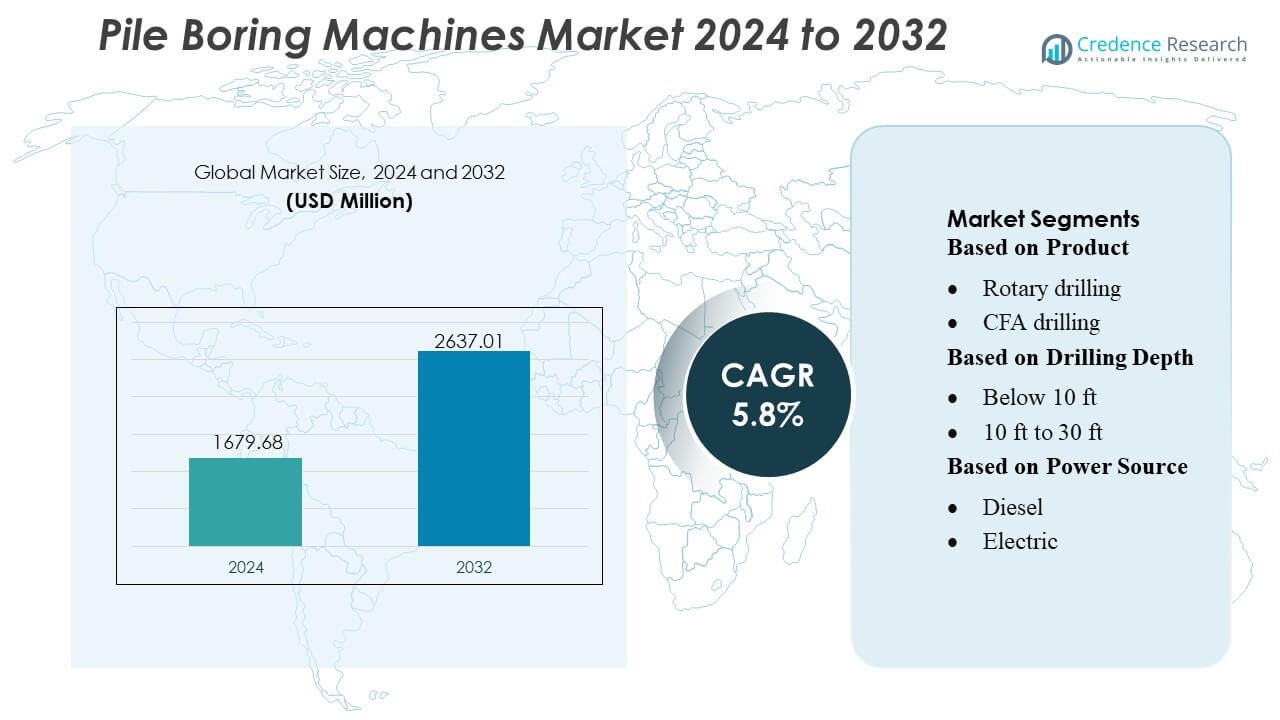

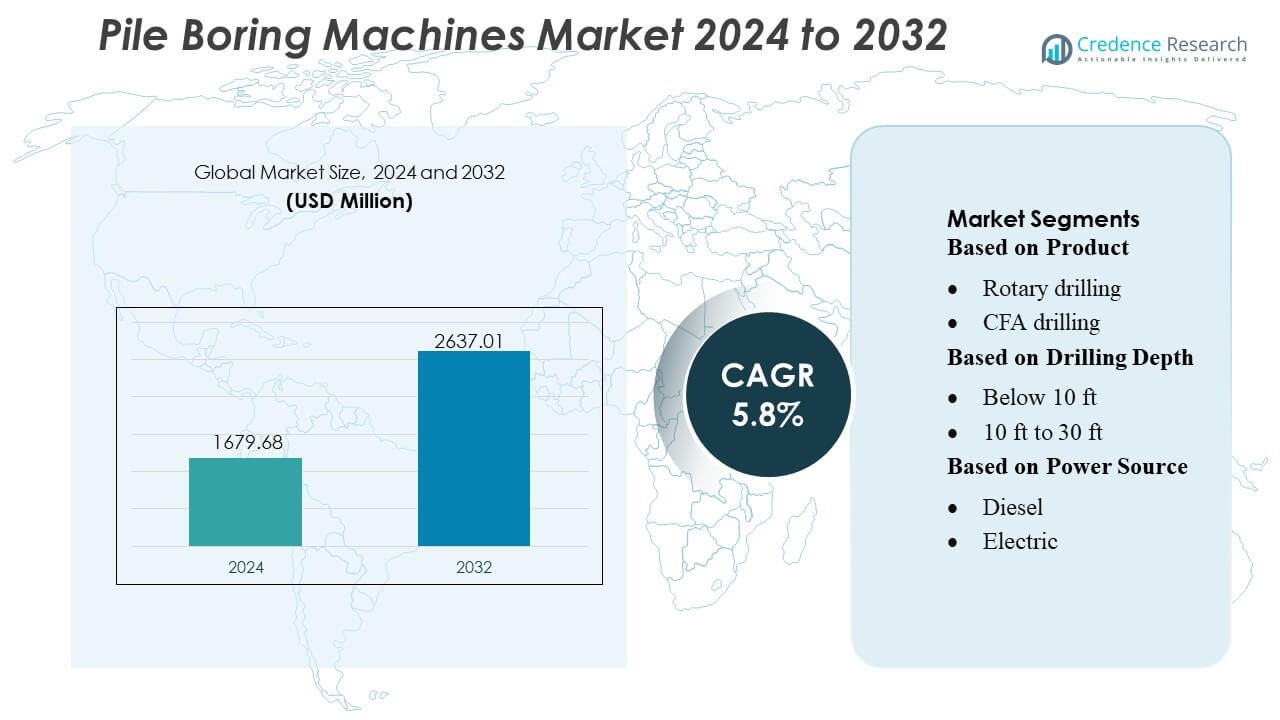

Pile Boring Machines Market size was valued USD 1679.68 million in 2024 and is anticipated to reach USD 2637.01 million by 2032, at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pile Boring Machines Market Size 2024 |

USD 1679.68 Million |

| Pile Boring Machines Market, CAGR |

5.8% |

| Pile Boring Machines Market Size 2032 |

USD 2637.01 Million |

The Pile Boring Machines Market features a competitive environment shaped by global manufacturers that prioritize high-torque drilling systems, automation, and durable components to support large-scale infrastructure and high-rise development. Companies focus on expanding product portfolios that improve drilling precision, enhance fuel efficiency, and reduce vibration to meet diverse soil and depth requirements. Technological integration, including telematics and real-time monitoring, strengthens equipment reliability and job-site productivity. North America leads the global market with an exact 38% share, supported by strong construction activity, advanced machinery adoption, and sustained investment in transportation, commercial, and energy-related foundation projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Pile Boring Machines Market reached USD 1679.68 million in 2024 and is projected to hit USD 2637.01 million by 2032 at a 5.8% CAGR, reflecting steady demand across infrastructure and commercial construction.

- Market growth is driven by rising investments in high-rise buildings, transportation corridors, and deeper foundation requirements, strengthening adoption of rotary and CFA drilling systems with strong segment preference toward the 10 ft to 30 ft depth range.

- Advanced technologies such as automation, telematics, and real-time monitoring elevate equipment efficiency and reinforce the competitive landscape as manufacturers enhance durability and drilling accuracy.

- Key restraints include high equipment acquisition costs, complex maintenance needs, and operational challenges in urban zones with noise, emission, and vibration restrictions.

- Regionally, North America leads with a 38% share, followed by Europe and Asia-Pacific, supported by strong construction activity and growing demand for high-capacity, fuel-efficient piling equipment across diverse soil conditions.

Market Segmentation Analysis:

By Product

The product landscape of the Pile Boring Machines Market is led by rotary drilling, capturing the dominant share due to its versatility across infrastructure, commercial, and deep-foundation projects. Its ability to handle various soil conditions and deliver high torque output strengthens adoption in large bridge, metro, and high-rise construction. Demand accelerates as contractors prioritize equipment that supports faster penetration rates, reduced vibration, and compatibility with large-diameter piles. CFA drilling and micro piling follow, supported by urban redevelopment and low-noise site requirements, while hydraulic pile driving and Kelly drilling maintain niche roles in specialized geotechnical applications.

- For instance, Revlon established a 62,000-square-foot innovation center in Kenilworth, New Jersey, relocating its research and development operations to the Northeast Science and Technology (NEST) Center.

By Drilling Depth

The 10 ft to 30 ft depth segment holds the highest market share, driven by its widespread relevance in mid-depth foundation works for industrial facilities, housing projects, and transport infrastructure. Contractors prefer machines optimized for this range because they balance operational efficiency, fuel consumption, and equipment maneuverability, especially in congested urban sites. Growing global investments in road expansions, utility networks, and modular construction further increase demand. Below 10 ft machines remain essential for light civil works, while above 30 ft equipment gains traction in mega-projects requiring deep load-bearing foundations.

- For instance, Johnson & Johnson’s consumer health division revealed 16 new skincare research studies at the 2021 American Academy of Dermatology Virtual Meeting. The presentations, which included 3 oral publications and 13 poster presentations, highlighted targeted innovation in various aspects of skin health, including for women, cancer patients, and multicultural populations.

By Power Source

Diesel-powered machines dominate the market with the largest share, supported by their high power output, suitability for continuous heavy-duty cycles, and reliability in remote or off-grid construction zones. Their strong penetration in developing economies, where electrification of job sites remains limited, reinforces segment leadership. Demand persists across large infrastructure programs, including highways, ports, and mining-related piling tasks. Electric and hydraulic power sources are expanding steadily as contractors adopt lower-emission and precision-controlled alternatives, while hybrid solutions and other emerging technologies gain interest in projects prioritizing sustainability and reduced operating noise.

Key Growth Drivers

- Surge in Global Infrastructure Development

Large-scale infrastructure programs accelerate demand for pile boring machines as governments expand transportation corridors, smart cities, and energy facilities. Growing investments in bridges, metro systems, and industrial zones increase the need for high-capacity equipment capable of delivering deeper and more precise foundations. Contractors prefer machines that support faster cycle times, larger pile diameters, and reduced downtime, strengthening procurement across both developed and emerging economies. The transition toward resilient and climate-ready infrastructure further reinforces sustained equipment adoption.

- For instance, FOREO LUNA 4 cleansing device integrates 16 T-Sonic pulsation intensities and ultra-hygienic silicone touchpoints. It offers up to 600 uses per full charge, improving both cleansing precision and user longevity.

- Growing Urbanization and High-Rise Construction

Rapid urbanization increases the construction of high-rise residential towers, commercial buildings, and mixed-use complexes, driving demand for advanced piling equipment that can operate efficiently in restricted urban footprints. Machines with compact designs, low-vibration systems, and enhanced drilling accuracy gain strong preference. The need for deeper load-bearing foundations in seismic or unstable soil zones accelerates adoption of rotary and CFA drilling systems. Continuous redevelopment of aging urban infrastructure further amplifies the requirement for reliable and high-performance pile boring technologies.

- For instance, L’Oréal’s new North America Research & Innovation Center spans 250,000 sq ft and houses a 26,000 sq ft modular lab, on-site mini factory, and capacity for daily user testing with up to 400 consumers.

- Advancements in Drilling Technology and Automation

Technological advancements significantly boost market growth as manufacturers integrate automation, telematics, and real-time monitoring systems into modern pile boring machines. Features such as automated drilling control, torque optimization, and predictive maintenance improve productivity and reduce operational errors. High-efficiency hydraulic systems, reduced-emission engines, and modular attachment designs enhance machine versatility across diverse soil conditions. Contractors embrace these innovations to improve safety, reduce fuel consumption, and optimize project timelines, supporting rapid technological adoption across global job sites.

Key Trends & Opportunities

- Rising Adoption of Low-Emission and Electric Piling Equipment

Sustainability-focused regulations and green construction initiatives drive strong interest in electric and hybrid pile boring machines. Contractors increasingly evaluate low-noise, low-emission alternatives for metro corridors, urban redevelopment zones, and environmentally sensitive projects. Battery-powered systems and energy-efficient hydraulic drives create opportunities for manufacturers to tap into emerging eco-friendly equipment portfolios. As cities tighten emission norms, demand grows for machines that can comply with Tier 4 and Stage V standards while maintaining drilling power and operational reliability.

- For instance, Krones has deployed remote service over more than 20,000 machines worldwide via the CENTERSIGHT / Device Insight platform, enabling remote diagnostics and legally compliant access logging.

- Expansion of Smart Job-Site Integration

The integration of digital technologies—such as GPS-based positioning, IoT-enabled performance tracking, and automated depth logging—creates opportunities for enhanced job-site efficiency. These tools help contractors monitor productivity, optimize drilling parameters, and reduce human error. Increasing adoption of BIM-linked drilling data and remote diagnostics enables better project planning and faster troubleshooting. As large contractors prioritize connected equipment ecosystems, demand rises for pile boring machines that seamlessly integrate with digital construction workflows.

- For instance, PackSys Global is known for building modular machines and configurable lines. The Mini 300 is a specific tube production line offered by the company. The Mini 300 line has a “remarkable production capacity of 300 tubes per minute” for small-diameter laminate tubes.

- Growth in Underground Utility and Renewable Energy Projects

Expanding underground utilities, such as water pipelines, grid modernization, and fiber networks, generates new applications for compact and mid-depth pile boring machines. Wind farms, solar parks, and substation installations also require stable foundations, creating opportunities for specialized drilling systems. Rising investment in renewable energy infrastructure strengthens the market for machines capable of operating in mixed terrains and remote locations, particularly in Asia-Pacific, Europe, and North America.

Key Challenges

- High Equipment Costs and Maintenance Burden

Pile boring machines require substantial capital investment, which limits adoption among small and mid-sized contractors. High maintenance needs—especially for engines, hydraulic systems, and wear-intensive drill components—further increase ownership costs. Unpredictable construction cycles and fluctuating raw material prices strain financial planning for equipment fleets. These cost pressures often push contractors toward rentals rather than new equipment purchases, constraining market expansion.

- Operational Constraints in Urban and Sensitive Environments

Urban construction zones impose strict limitations related to noise, vibration, emissions, and space availability, creating operational challenges for traditional piling machines. Regulatory restrictions and community-impact concerns can delay or restrict drilling activities. Soil variability under dense cityscapes further complicates performance predictability, necessitating specialized attachments and advanced controls. Contractors face productivity losses when navigating these constraints, increasing demand for specialized low-vibration, compact, and environmentally compliant machines while challenging legacy equipment deployment.

Regional Analysis

North America

North America holds the leading position in the Pile Boring Machines Market with around 38% market share, supported by extensive investments in transportation upgrades, energy infrastructure, and commercial construction across the U.S. and Canada. Strong adoption of advanced rotary and CFA drilling systems reflects the region’s focus on high-efficiency equipment and strict compliance with emission and safety regulations. Manufacturers benefit from high procurement capacity among large contractors, while redevelopment of aging bridges, rail corridors, and utility networks strengthens long-term demand. Technological integration—such as telematics and automated drilling controls—further accelerates market expansion across major metropolitan construction zones.

Europe

Europe accounts for approximately 27% market share, driven by stringent sustainability regulations, rapid urban redevelopment, and expansion of underground utility networks. Countries across Western and Northern Europe prioritize low-emission and low-noise pile boring machines to align with environmental standards and urban construction requirements. The region’s strong engineering expertise supports adoption of advanced hydraulic and electric-powered systems in large civil works, including tunnels, metro lines, and renewable-energy foundations. Growth is reinforced by public investments in smart infrastructure and cross-border transport corridors, which create consistent demand for high-precision, noise-controlled piling technologies in densely populated environments.

Asia-Pacific

Asia-Pacific represents about 24% of the global market, driven by rapid urbanization, mega-infrastructure development, and large-scale residential and industrial construction across China, India, Japan, and Southeast Asia. High demand for deep foundations in high-rise structures, port expansions, and transportation megaprojects boosts adoption of rotary and Kelly drilling systems. Infrastructure initiatives such as economic corridors, metro networks, and renewable-energy installations further stimulate procurement. Competitive pricing, a strong contractor ecosystem, and increasing availability of high-capacity diesel and hydraulic machines position the region as the fastest-growing market, supported by rising foreign investments and government-backed construction programs.

Latin America

Latin America holds nearly 7% market share, supported by infrastructure modernization efforts across Brazil, Mexico, Chile, and Colombia. Rising investments in mining operations, road connectivity, and industrial facilities drive the need for durable and high-torque pile boring machines capable of operating in challenging terrain. Governments’ focus on improving logistics networks and port infrastructure enhances adoption of mid-depth and deep drilling systems. Market growth is steady but constrained by economic fluctuations and varying construction budgets. Nonetheless, expanding urban populations and increasing public-private partnerships create opportunities for contractors to deploy advanced piling technologies in key development zones.

Middle East & Africa

The Middle East & Africa region accounts for around 4% market share, supported by significant foundation requirements for large commercial complexes, energy facilities, and transportation infrastructure. In the Middle East, high-rise towers, smart cities, and industrial free zones drive consistent demand for high-capacity rotary and CFA machines. Africa experiences gradual growth through road, bridge, and utilities development fueled by international investments. Harsh soil conditions, remote project locations, and high equipment import costs challenge faster penetration, yet rising interest in durable, diesel-powered, and hybrid systems supports future market expansion across strategic construction corridors.

Market Segmentations:

By Product

- Rotary drilling

- CFA drilling

By Drilling Depth

- Below 10 ft

- 10 ft to 30 ft

By Power Source

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Pile Boring Machines players such as HEUFT Systemtechnik GmbH, Keyence Corporation, Anritsu Corporation, Körber AG, Cognex Corporation, Ishida Co., Ltd., Mettler-Toledo International Inc., ANTERAS VISION, ACG Group, and Omron Corporation. the Pile Boring Machines Market is shaped by manufacturers focusing on advanced drilling efficiency, precision control, and equipment durability to meet the demands of modern infrastructure and high-rise construction projects. Companies emphasize innovations in high-torque rotary systems, automated depth control, low-vibration mechanisms, and energy-efficient powertrains that improve operational accuracy and reduce downtime. The market also benefits from the growing integration of telematics, real-time diagnostics, and safety-enhancing features that support productivity in complex soil conditions and dense urban environments. Competitive differentiation increasingly centers on product reliability, customization options, and after-sales service networks that enable contractors to optimize performance and extend equipment life cycles.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- HEUFT Systemtechnik GmbH

- Keyence Corporation

- Anritsu Corporation

- Körber AG

- Cognex Corporation

- Ishida Co., Ltd.

- Mettler-Toledo International Inc.

- ANTERAS VISION

- ACG Group

- Omron Corporation

Recent Developments

- In November 2024, Mindray introduced innovative upgrades to its A7 and A5 anesthesia systems under the A series anesthesia, incorporating cutting-edge technologies to empower anesthesiologists in delivering precise anesthesia, ultimately enhancing patient safety and operational efficiency during the perioperative phase.

- In September 2024, Okuma America Corporation launched CNC horizontal machining centers – the MA-4000H. The MA-4000H features one of the largest machining areas and has spindle power and speed for maximum efficiency and productivity.

- In May 2024, Walker’s Shortbread launched the world’s first interactive shortbread vending machine at Edinburgh Airport, partnering with World Duty Free (Avolta), allowing passengers to take a quiz to find their perfect shortbread for any occasion, offering a unique, sensory Scottish experience.

- In April 2024, Dispension Industries Inc. announced the launch of the contour top SmartServ. This is a specialized vending machine designed for selling beer and ready-to-drink (RTD) alcoholic beverages.

Report Coverage

The research report offers an in-depth analysis based on Product, Drilling Depth, Power Source and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness rising adoption of automated and digitally controlled piling systems to improve drilling accuracy and productivity.

- Demand for low-emission and hybrid powertrain machines will increase as sustainability regulations tighten across major construction regions.

- Compact and low-noise pile boring machines will gain strong traction in urban and restricted-space projects.

- Infrastructure modernization programs will continue to drive procurement of high-capacity rotary and CFA drilling equipment.

- Manufacturers will expand integration of telematics, predictive maintenance, and real-time performance monitoring.

- Growth in renewable energy and utility expansion projects will create new opportunities for specialized piling systems.

- Advances in high-strength materials and wear-resistant components will extend machine lifespan and reduce operating costs.

- Emerging Asian and African markets will experience accelerated adoption due to increasing investments in transport and industrial construction.

- Rental fleet expansion will intensify as contractors seek flexible access to advanced piling technologies.

- Industry collaboration between equipment OEMs and software providers will strengthen development of smart, connected piling solutions.