Market Overview

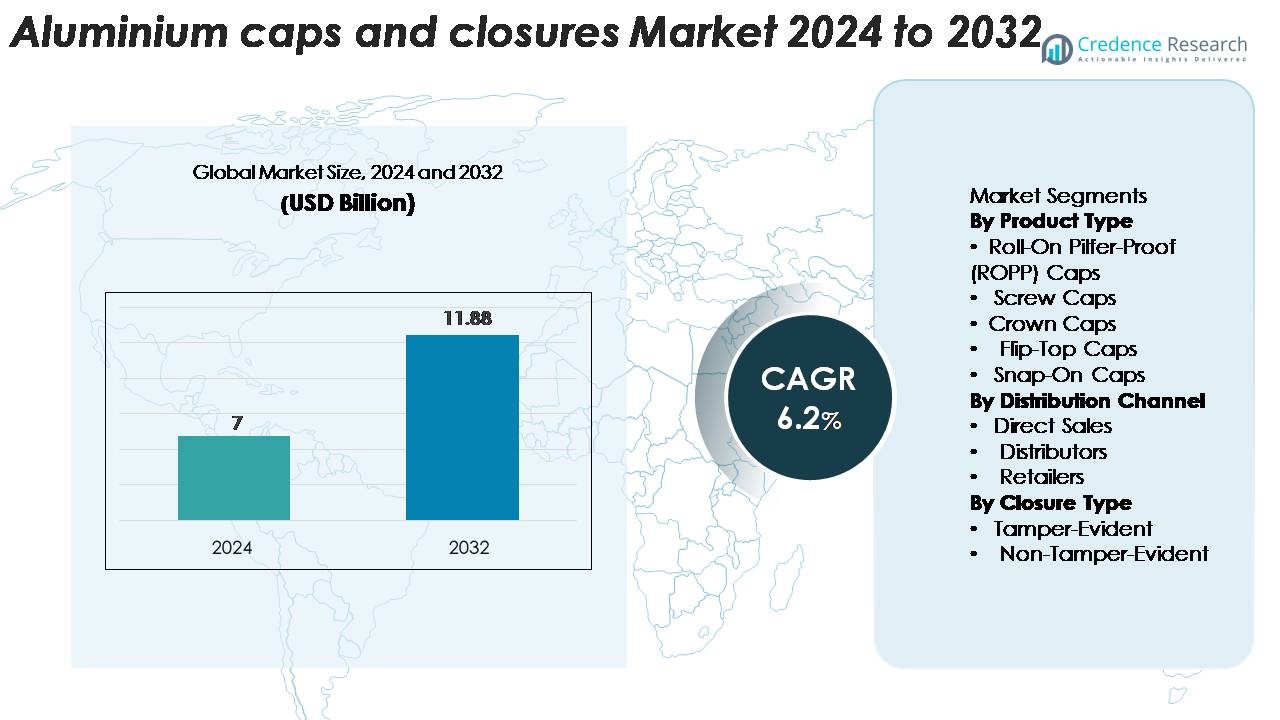

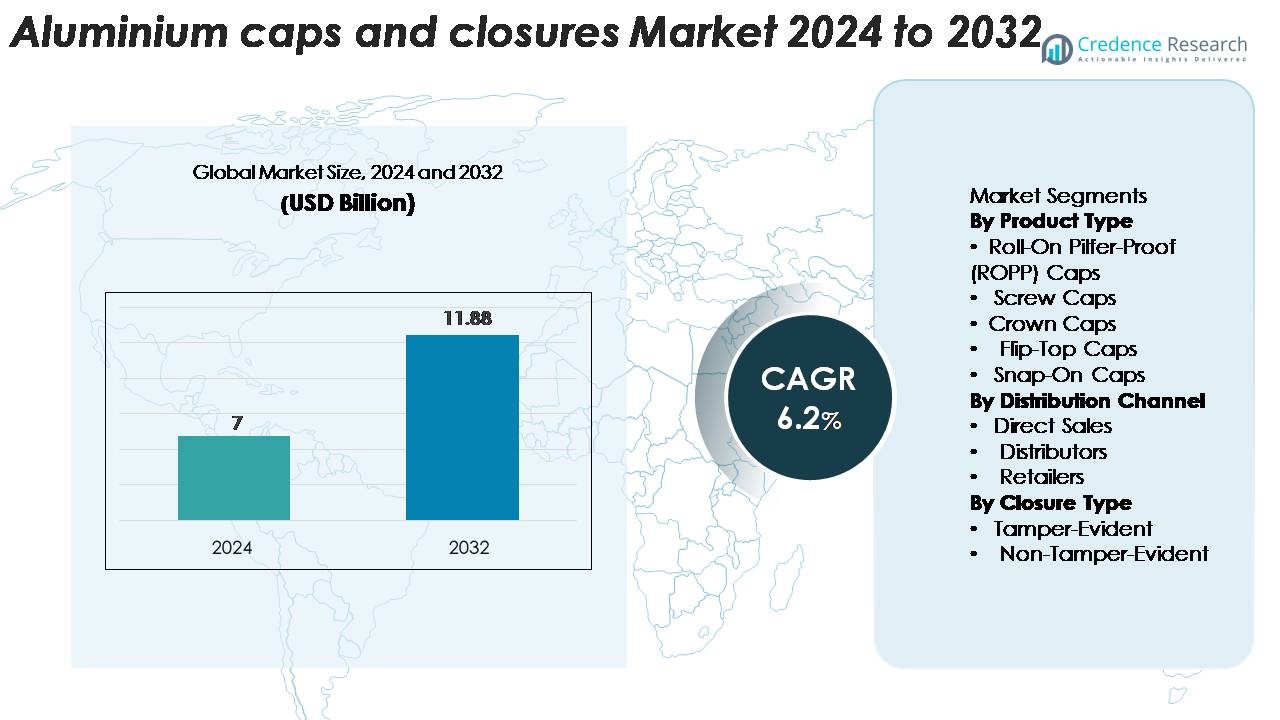

The aluminium caps and closures market was valued at USD 7 billion in 2024 and is projected to reach USD 11.88 billion by 2032, expanding at a CAGR of 6.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aluminium Caps and Closures Market Size 2024 |

USD 7 Billion |

| Aluminium Caps and Closures Market, CAGR |

6.2% |

| Aluminium Caps and Closures Market Size 2032 |

USD 11.88 Billion |

The aluminium caps and closures market is shaped by leading players such as Crown Holdings, Silgan Holdings, Guala Closures Group, Amcor, Closure Systems International, and Bericap, each competing through innovations in tamper-evident designs, lightweight alloys, and premium decorative finishes. These companies serve major beverage, pharmaceutical, food, and cosmetics brands through extensive global manufacturing networks and long-term supply partnerships. North America leads the market with a 32% share, driven by strong bottled water, spirits, and healthcare demand, while Asia-Pacific follows closely with 30%, supported by expanding beverage production and healthcare infrastructure. Europe accounts for nearly 28%, anchored by its advanced recycling ecosystem and high adoption of sustainable aluminium packaging.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The aluminium caps and closures market was valued at USD 7 billion in 2024 and is expected to reach USD 11.88 billion by 2032, registering a CAGR of 6.2%.

- Market growth is driven by rising demand from the beverages and pharmaceutical sectors, with ROPP caps holding the largest share at around 38%, supported by strong adoption in spirits, wine, and medicinal packaging.

- Key trends include the shift toward recyclable aluminium solutions, premium decorative closures, and advanced tamper-evident technologies that enhance product safety and consumer trust.

- The competitive landscape features major players such as Crown Holdings, Guala Closures Group, Silgan Holdings, and Bericap, all investing in automation, lightweight alloys, and design customization to maintain market leadership.

- Regionally, North America leads with 32%, followed by Asia-Pacific at 30% and Europe at 28%, while Latin America and the Middle East & Africa collectively account for the remaining share, supported by expanding beverage and healthcare markets.

Market Segmentation Analysis:

By Product Type:

Roll-On Pilfer-Proof (ROPP) caps dominate the aluminium caps and closures market with an estimated 38% share, driven by their strong adoption in spirits, wine, pharmaceuticals, and premium beverages. Their tamper-evident sealing, compatibility with high-speed bottling lines, and ability to maintain product integrity make them the preferred choice for manufacturers. Screw caps follow closely, supported by rising usage in edible oils and household products. Crown caps remain relevant in carbonated drinks, while flip-top and snap-on caps gain traction in personal care and convenience-driven packaging formats.

- For instance, Bapco Closures’ snap-on cap systems are manufactured using high-precision injection molding processes, a standard industry method for producing high-value, precise closures, enabling consistent hinge performance for personal care packaging

By Distribution Channel:

Direct sales account for the largest share at approximately 45%, supported by long-term supply contracts between closure manufacturers and beverage, pharmaceutical, and food processing companies. This channel ensures consistent quality, bulk pricing advantages, and uninterrupted supply for high-volume production lines. Distributors play a crucial role for medium-scale FMCG and regional bottlers, offering flexible order quantities and local availability. Retailers hold a smaller share, largely catering to small businesses and craft beverage producers that procure limited volumes.

- For instance, Crown Holdings directly supplies aluminium closures to major beverage clients using its fully automated production lines capable of manufacturing up to 5 billion closures annually across its global plants, ensuring contract stability and high-volume fulfilment.

By Closure Type:

Tamper-evident closures lead the segment with around 62% market share, driven by stringent regulatory requirements in beverages, pharmaceuticals, and packaged foods. Their ability to provide visible proof of product safety, prevent adulteration, and build consumer trust fuels strong adoption across global markets. Industries such as alcohol, carbonated beverages, and over-the-counter medicines increasingly mandate tamper-evident aluminium caps for compliance and brand protection. Non-tamper-evident closures serve applications where ease of opening, frequent use, and cost efficiency are prioritized, particularly in household and personal care products.

Key Growth Drivers

Rising Consumption of Packaged Beverages

The rapid expansion of the global packaged beverage industry significantly drives demand for aluminium caps and closures. Growth in carbonated drinks, alcoholic beverages, bottled water, ready-to-drink teas, and functional beverages has accelerated the need for high-performance closure solutions. Aluminium ROPP and crown caps remain preferred due to their superior sealing, tamper-evidence, recyclability, and compatibility with high-speed filling lines. Premium beverage categories, including craft spirits, wine, and energy drinks, increasingly adopt aluminium closures to enhance product safety and aesthetics. In emerging markets, rising disposable incomes and urbanization are boosting per-capita beverage consumption, which expands large-scale procurement of aluminium caps by bottlers. Additionally, beverage manufacturers prioritize sustainability, and aluminium’s infinite recyclability strengthens its adoption over plastic alternatives. Together, these factors create consistent, long-term growth momentum for aluminium closure manufacturers.

- For instance, Closure Systems International (CSI) supplies more than 50 billion closures annually to beverage manufacturers, including major operations in India, Brazil, and Southeast Asia, matching the rising beverage output in these regions.

Strong Adoption in Pharmaceuticals and Healthcare Packaging

Pharmaceutical companies rely heavily on aluminium closures due to their sterility, compatibility with sensitive formulations, and strong tamper-evident properties. Aluminium caps are widely used for vials, syrups, injectables, and OTC medicines, supporting strict regulatory compliance across global markets. The growth of chronic diseases, expansion of vaccine production, and rising output of liquid formulations contribute to sustained demand from pharmaceutical fillers. Aluminium closures also offer superior barrier protection against moisture, oxygen, and contamination—critical for maintaining drug stability during transport and storage. Moreover, governments and regulatory agencies increasingly enforce tamper-evident packaging guidelines, leading to widespread adoption of aluminium seals and flip-off caps. As healthcare infrastructure expands in Asia-Pacific, Latin America, and Africa, pharmaceutical manufacturing capacity increases, resulting in strong procurement of aluminium caps for high-volume packaging applications.

- For instance, West Pharmaceutical Services’ Flip-Off® CCS seals undergo 100% camera-based visual inspection and meet ISO 8362-7 specifications, ensuring tamper-evident performance for vaccine and biologic packaging.

Sustainability Push and Shift Toward Recyclable Packaging

Increasing global emphasis on sustainability is accelerating the transition from plastic closures to aluminium alternatives. Aluminium’s recyclability—where nearly 75% of all aluminium ever produced remains in circulation—positions it as a preferred material for brands pursuing circular economy goals. Growing regulatory pressure, including bans on single-use plastics and extended producer responsibility schemes, encourages manufacturers to adopt aluminium caps that offer both high performance and environmental advantages. Beverage brands, particularly in premium segments, highlight aluminium closures as part of their eco-friendly packaging strategies. The lightweight nature of aluminium also supports carbon-reduction goals in logistics and transportation. As consumers prioritize sustainable packaging, manufacturers invest in new alloy grades, downgauged profiles, and energy-efficient production processes to strengthen the competitive appeal of aluminium caps. This shift creates strong long-term growth opportunities across beverages, cosmetics, pharmaceuticals, and household products.

Key Trends & Opportunities

Growth of Premiumization and Enhanced Aesthetic Packaging

Premiumization across alcohol, cosmetics, and specialty beverages is creating strong demand for aluminium closures with enhanced visual appeal, intricate embossing, and high-quality printing. Brands increasingly use customized aluminium caps to differentiate products on crowded retail shelves. Advances in surface treatment technologies, digital printing, and multi-color lacquering allow manufacturers to offer sophisticated designs and brand storytelling elements through closures. Luxury spirits, craft beverages, and boutique skincare brands particularly favor aluminium caps for their durability and premium tactile feel. As consumer preferences shift toward high-end and giftable packaging, aluminium closure producers have a significant opportunity to expand portfolios with value-added decorative options, including matte finishes, anodized coatings, and engraved designs. This trend supports higher margins and strengthens collaborations between closure manufacturers and brand owners seeking innovative packaging aesthetics.

- For instance, Amcor utilizes anodized aluminium technologies that deliver surface hardness levels of up to 500 HV (Vickers Hardness), ensuring scratch-resistant finishes for premium cosmetic closures.

Technological Advancements in Tamper-Evident and Smart Closures

Innovation in tamper-evident mechanisms and digital-enabled packaging presents major opportunities for aluminium closure manufacturers. Technologies such as laser-scored bands, breakaway seals, and enhanced pilfer-proof mechanisms strengthen consumer trust and regulatory compliance across pharmaceuticals and beverages. At the same time, the industry is exploring integration of smart features such as QR codes, NFC tags, and authentication markers directly onto aluminium caps. These features enable supply chain traceability, anti-counterfeiting measures, and customer engagement through digital content. High-growth segments like premium alcohol, nutraceuticals, and specialty foods benefit significantly from such advanced closures. Manufacturers investing in automated production, precision molding, and improved alloy compositions are well-positioned to capture emerging demand for intelligent and safety-enhanced closures. The rise of connected packaging further amplifies long-term growth potential.

- For instance, Closure Systems International (CSI) operates high-speed molding lines capable of producing over 50 billiontamper-evident and other closures annually across its various global sites, supporting safety-critical applications in beverages, healthcare, and other industries.

Expansion of E-Commerce and Small-Format Packaging

The global rise of e-commerce has reshaped packaging demand, increasing the need for durable, leak-proof, and tamper-evident aluminium closures suitable for long-distance shipping. Products such as cosmetics, household cleaners, and specialty foods increasingly require closures that maintain integrity under transportation stress. Aluminium caps are gaining traction in small-format, travel-size, and subscription-based packaging formats popular in online retail. These caps provide stability, compatibility with diverse bottle materials, and high resistance to deformation. As e-commerce penetration grows, there is a growing opportunity for manufacturers to design impact-resistant, lightweight closures optimized for fulfilment centers and direct-to-consumer models. This trend also encourages development of resealable and user-friendly aluminium closure formats.

Key Challenges

High Raw Material Costs and Price Volatility

Aluminium caps and closures manufacturers face significant challenges due to fluctuations in aluminium prices, which are influenced by energy costs, mining output, and geopolitical instability. Aluminium production is energy-intensive, and rising electricity prices directly impact operational costs, making it difficult for closure manufacturers to maintain pricing stability. Smaller converters are particularly affected, as they lack the procurement leverage of large packaging companies. Volatility disrupts long-term supply contracts with beverage and pharmaceutical fillers, while cost-sensitive customers may shift toward plastic alternatives in certain segments. Managing cost inflation while maintaining product quality and sustainability commitments remains a critical challenge for the industry. Manufacturers increasingly rely on recycled aluminium, efficiency upgrades, and strategic sourcing to mitigate these risks, but volatility continues to pressure profit margins.

Competition from Plastic Closures in Cost-Sensitive Markets

Although aluminium offers superior durability, recyclability, and visual appeal, plastic closures remain strong competitors, especially in cost-sensitive markets such as mass beverages, household chemicals, and low-value FMCG products. Plastic caps are cheaper, easier to mold into complex shapes, and widely used across segments that prioritize cost efficiency over premium performance. Innovations in lightweight plastic closures and improved recyclability further strengthen their market position. For manufacturers of aluminium caps, competing purely on price becomes challenging, especially in regions with limited recycling infrastructure. To maintain market relevance, aluminium closure producers must focus on premium applications, sustainability value propositions, advanced tamper-evidence features, and high-impact design differentiation.

Regional Analysis

North America

North America holds around 32% of the aluminium caps and closures market, driven by strong demand from the beverages, pharmaceuticals, and personal care industries. The region benefits from advanced manufacturing capabilities, stringent safety regulations, and high adoption of tamper-evident and premium closure formats. The U.S. leads consumption due to its large bottled water, spirits, and nutraceutical markets, while Canada contributes steady demand from the healthcare and craft beverage sectors. Sustainability initiatives and high recycling rates further support aluminium closure adoption, as brands prioritize recyclable packaging materials to meet environmental compliance and consumer expectations.

Europe

Europe accounts for roughly 28% of global market share, supported by mature beverage, cosmetics, and pharmaceutical industries that widely adopt aluminium closures for quality, safety, and sustainability. The region’s strong emphasis on circular economy principles drives demand for recyclable aluminium caps across both premium and mainstream product lines. Germany, Italy, France, and the U.K. are key contributors, with extensive bottling operations and advanced recycling systems. Premium wine and spirits brands continue to shift toward ROPP and decorative aluminium caps to enhance product differentiation. Regulatory alignment across the EU accelerates standardization of tamper-evident packaging formats.

Asia-Pacific

Asia-Pacific represents approximately 30% of the market and is the fastest-growing region, driven by rapid urbanization, rising disposable incomes, and expanding beverage and pharmaceutical production. China and India dominate regional demand, supported by large-scale bottling facilities, growing consumption of packaged drinks, and increasing investment in healthcare infrastructure. Japan and South Korea contribute through high-quality cosmetic and personal care packaging. The region also benefits from strong manufacturing capabilities and cost-efficient aluminium processing. As sustainability awareness grows, brands increasingly adopt aluminium closures as recyclable alternatives, accelerating market penetration across both premium and mass-market segments.

Latin America

Latin America holds nearly 6% of the market, supported by growth in the alcoholic beverages, carbonated drinks, and household product segments. Countries such as Brazil, Mexico, and Argentina are major contributors due to their expanding beverage industries and rising demand for tamper-evident packaging. Regional bottlers increasingly adopt aluminium closures for enhanced product safety and compliance with evolving quality standards. While price sensitivity remains a challenge, the shift toward sustainable packaging is creating new demand for aluminium alternatives to plastic caps. Investments in local manufacturing and growing export activities further support market expansion.

Middle East & Africa

The Middle East & Africa region accounts for around 4% of the market, driven by expanding bottled water, juices, and pharmaceutical segments. The Gulf countries, particularly the UAE and Saudi Arabia, lead adoption due to rising consumption of packaged beverages and strong investments in healthcare supply chains. African markets, including South Africa and Nigeria, show increasing demand driven by urbanization and the growth of small-scale beverage producers. However, limited recycling infrastructure and higher import dependence challenge market growth. Nonetheless, rising focus on food safety, tamper-evident closures, and premium beverage packaging continues to create steady opportunities.

Market Segmentations

By Product Type

- Roll-On Pilfer-Proof (ROPP) Caps

- Screw Caps

- Crown Caps

- Flip-Top Caps

- Snap-On Caps

By Distribution Channel

- Direct Sales

- Distributors

- Retailers

By Closure Type

- Tamper-Evident

- Non-Tamper-Evident

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the aluminium caps and closures market is characterized by a mix of global packaging leaders and specialized regional manufacturers competing on product quality, innovation, and sustainability. Key players focus on expanding their portfolios of ROPP caps, crown caps, tamper-evident closures, and premium decorative variants to meet the diverse needs of beverage, pharmaceutical, food, and personal care sectors. Companies increasingly invest in advanced printing, embossing, and laser-scoring technologies to enhance product differentiation and brand appeal. Strategic priorities include improving recyclability, reducing material usage through downgauging, and strengthening supply chains to support high-volume bottling operations. Partnerships with beverage and pharmaceutical companies, along with regional capacity expansions, remain central to maintaining competitive advantage. Additionally, manufacturers adopt automation and energy-efficient production systems to improve cost competitiveness amid fluctuating aluminium prices. The industry continues to consolidate, with mergers and acquisitions enabling broader geographic reach and enhanced technological capabilities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Amcor Limited

- Bapco Closures

- Cap & Seal Pvt. Ltd.

- Crown Holdings Inc.

- G. Finneran Associates, Inc.

- Nippon Closures Co., Ltd.

- Phoenix Closures, Inc.

- Silgan Holdings Inc.

Recent Developments

- In September 2025, Amcor showcased its latest beverage closure designs at Drinktec 2025 in Munich, highlighting flat and sports caps for returnable glass and PET bottles.

- In July 2025, Amcor introduced its Secure Flip 26 mm tamper-evident sports cap for children’s drinks in Austria, combining ergonomic design and enhanced recyclability.

- In July 2023, Crown expanded its Aluminium Stewardship Initiative (ASI) certifications to its Asia-Pacific closures operations (Thailand), reinforcing its responsible sourcing credentials.

Report Coverage

The research report offers an in-depth analysis based on Product type, Distribution channel, Closure type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding as beverage, pharmaceutical, and personal care industries increase their reliance on secure and lightweight aluminium closures.

- Demand for tamper-evident and safety-enhanced closure designs will rise across regulated sectors.

- Sustainability initiatives will accelerate the shift toward recyclable aluminium solutions over plastic alternatives.

- Premiumization in spirits, cosmetics, and specialty beverages will boost adoption of decorative and custom-designed aluminium caps.

- Advancements in digital printing and laser-etching technologies will enable greater branding flexibility.

- Manufacturers will invest in automation and energy-efficient production systems to improve cost competitiveness.

- Lightweight alloy development will support downgauging efforts without compromising performance.

- Smart closure technologies, including QR codes and authentication markers, will gain traction in anti-counterfeiting applications.

- Emerging markets will drive growth through increasing packaged beverage consumption and expanding pharmaceutical infrastructure.

- Global players will focus on strategic partnerships and capacity expansions to strengthen regional supply networks.