Market Overview

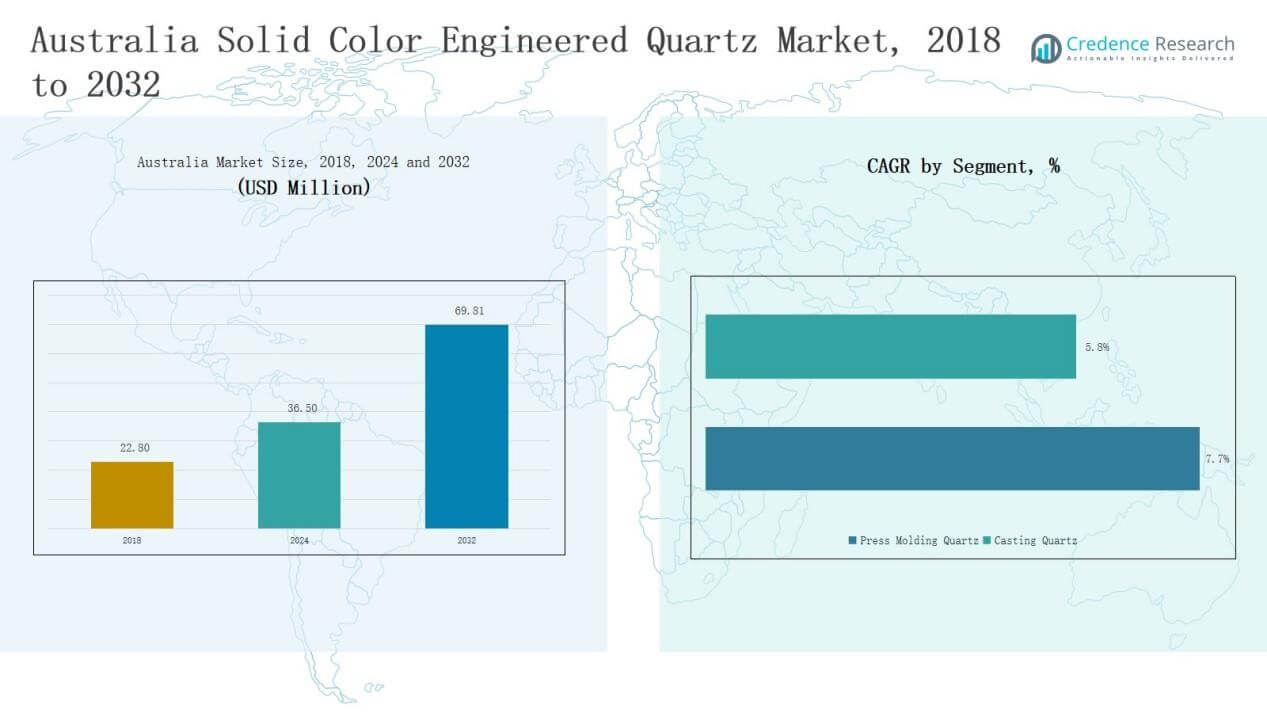

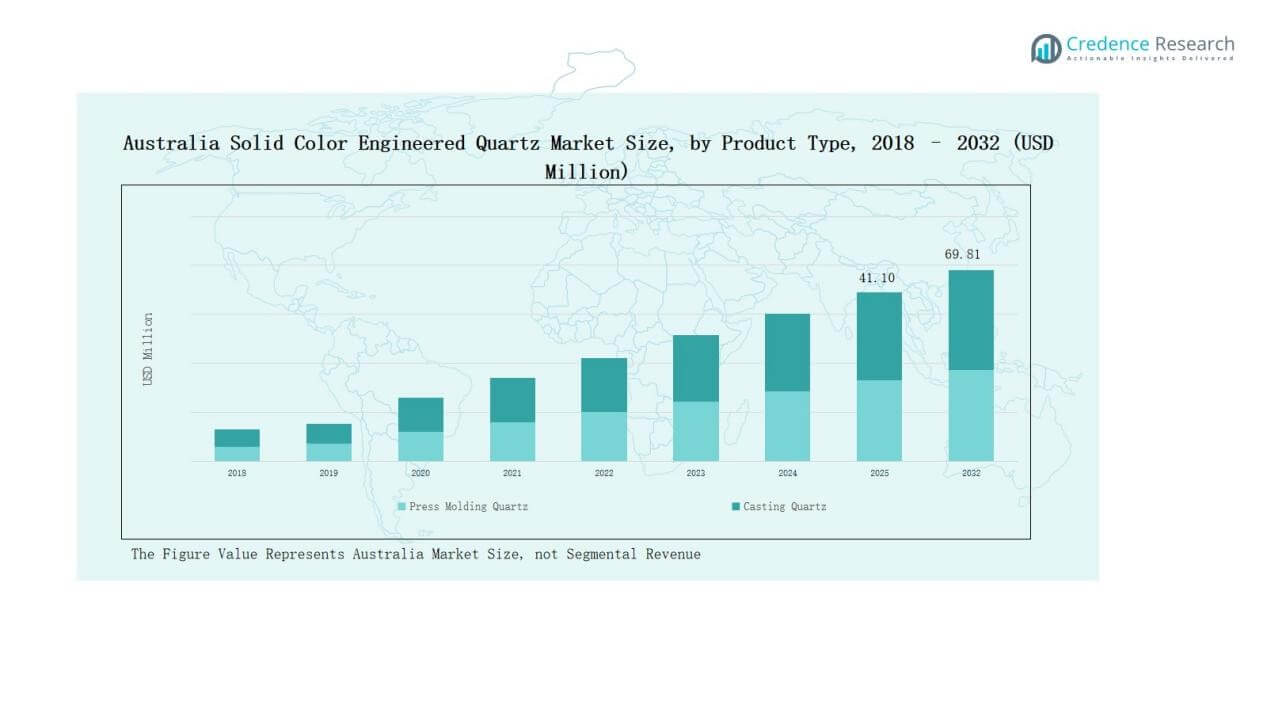

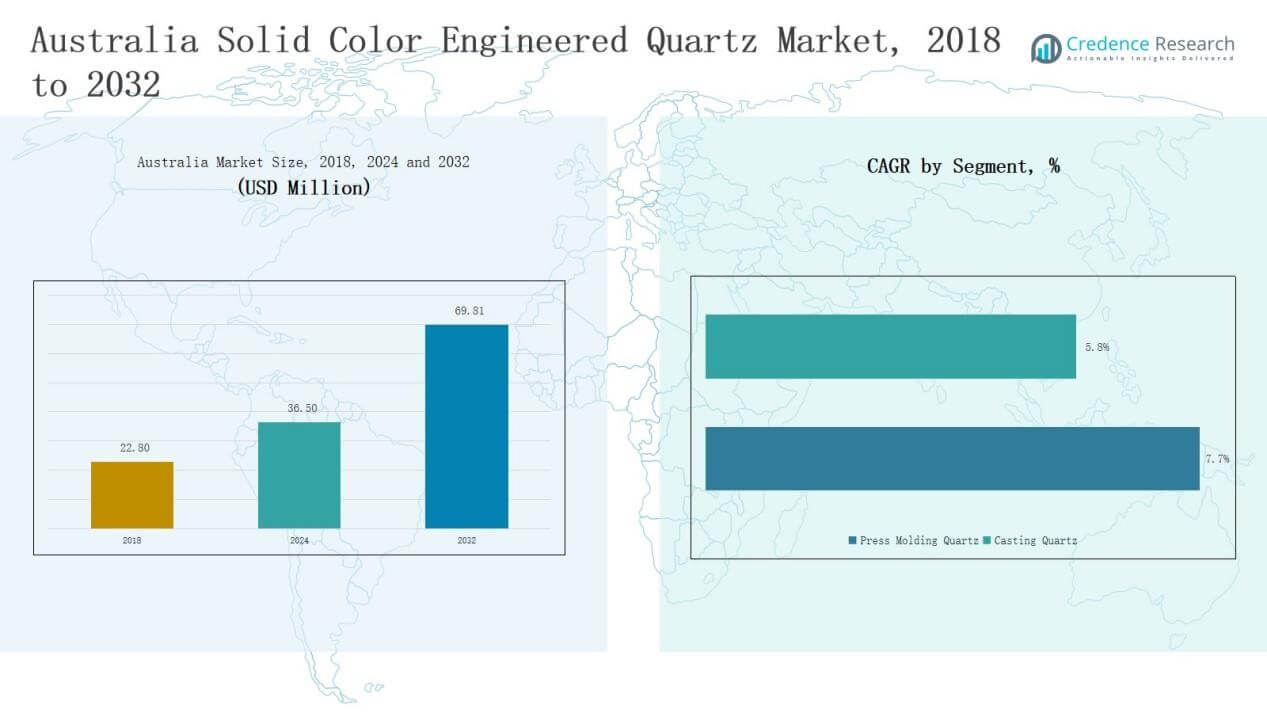

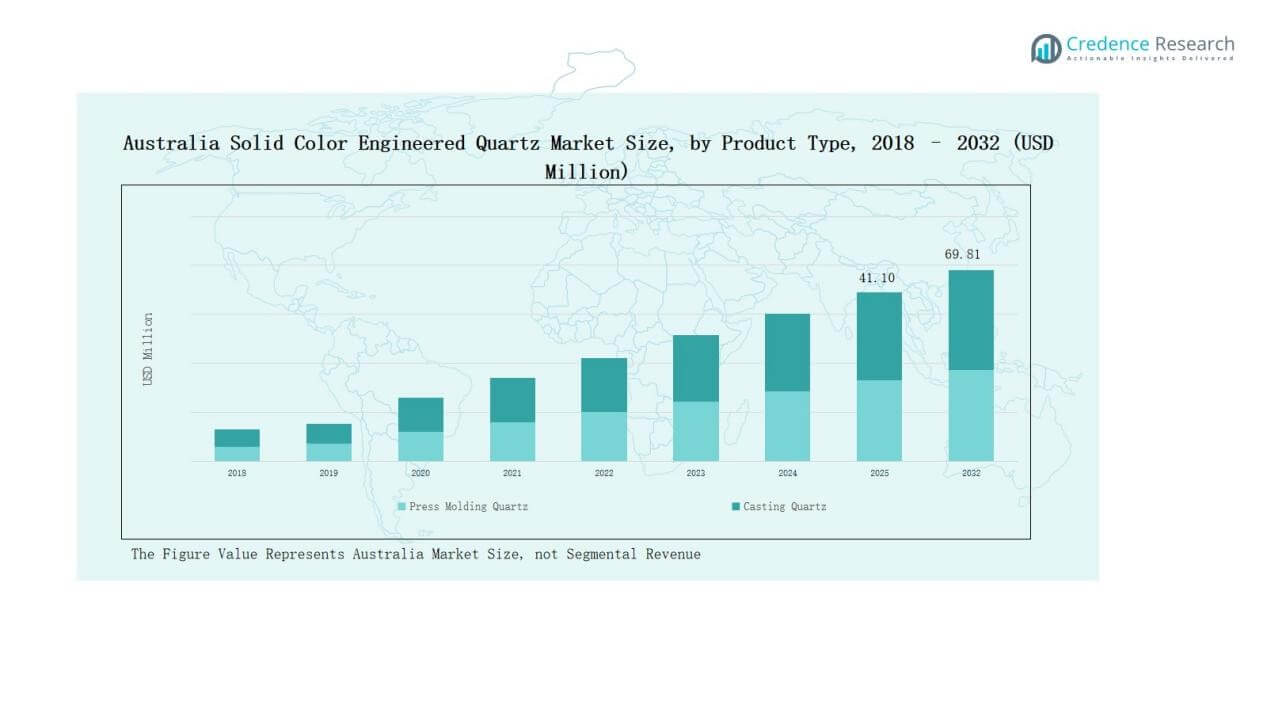

The Australia Solid Color Engineered Quartz Market size was valued at USD 22.80 million in 2018, reached USD 36.50 million in 2024, and is anticipated to reach USD 69.81 million by 2032, growing at a CAGR of 7.86% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Solid Color Engineered Quartz Market Size 2024 |

USD 36.50 Million |

| Australia Solid Color Engineered Quartz Market, CAGR |

7.86% |

| Australia Solid Color Engineered Quartz Market Size 2032 |

USD 69.81 Million |

The Australia Solid Color Engineered Quartz Market is led by prominent players such as Caesarstone, Cosentino, Smartstone, Quantum Quartz, Silestone Australia, HanStone Quartz Australia, WK Marble & Granite, Essa Stone, Laminex Australia, and Lapitec Australia. These companies strengthen their positions through extensive product portfolios, sustainable production practices, and strong distribution networks tailored to both residential and commercial applications. Innovation in premium finishes and customization remains a key differentiator. Regionally, New South Wales held the largest share at 28% in 2024, driven by robust residential renovations, premium interior demand, and growing adoption across hospitality projects.

Market Insights

Market Insights

- The Australia Solid Color Engineered Quartz Market grew from USD 22.80 million in 2018 to USD 36.50 million in 2024 and is projected to reach USD 69.81 million by 2032, at 7.86% CAGR.

- Top players include Caesarstone, Cosentino, Smartstone, Quantum Quartz, Silestone Australia, HanStone Quartz Australia, WK Marble & Granite, Essa Stone, Laminex Australia, and Lapitec Australia, focusing on sustainability and premium finishes.

- By product type, press molding quartz dominated with 63% share in 2024, favored for durability, consistent finish, and resistance to stains, while casting quartz held the remaining share.

- By application, countertops led with 46% share in 2024, supported by rising home renovations, followed by flooring, walls, door jambs, and smaller institutional uses across Australia.

- By end user, the residential sector dominated with 71% share in 2024, while the commercial segment contributed 29%, led by hospitality, office, and retail projects demanding stylish, long-lasting surfaces.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product Type

Press molding quartz dominated the Australia Solid Color Engineered Quartz Market with 63% share in 2024, driven by its superior durability, consistent finish, and versatility across large-scale applications. Its ability to deliver uniform texture and high resistance to stains made it the preferred option in both residential and commercial projects. Casting quartz accounted for the remaining share, supported by flexibility in design and cost-effectiveness. Rising consumer preference for premium quality finishes continues to strengthen the adoption of press molding quartz.

For instance, Caesarstone announced the expansion of its press molding quartz surface offerings specifically tailored for high-traffic commercial interiors, emphasizing easy maintenance and uniform color quality.

By Application

Countertops led the market with 46% share in 2024, reflecting their widespread use in modern kitchens and bathrooms across Australia. Demand was supported by rising home renovation projects and consumer preference for stylish, low-maintenance surfaces. Flooring followed with strong adoption in high-traffic spaces, while walls and door jambs captured smaller shares. The others segment, including institutional uses, contributed modestly. The superior durability, stain resistance, and easy maintenance of quartz positioned countertops as the leading application in the market.

By End User

The residential sector held 71% share in 2024, making it the largest end-user segment in the Australia Solid Color Engineered Quartz Market. Strong demand was fueled by urban housing expansion, home improvement projects, and rising consumer investment in premium interiors. Homeowners preferred quartz for its long lifespan, stain resistance, and ability to replicate natural stone with enhanced performance. The commercial segment accounted for the remaining share, supported by demand from hospitality, retail, and office projects requiring durable, aesthetic surface solutions.

For instance, Caesarstone introduced its Pebbles Collection in Australia, offering softer neutral tones tailored for modern residential kitchens and bathrooms.

Key Growth Drivers

Rising Demand for Residential Renovations

The Australia Solid Color Engineered Quartz Market is expanding with increasing home renovation and remodeling activities. Homeowners prefer quartz for its durability, stain resistance, and premium aesthetic appeal in kitchens and bathrooms. Its ability to replicate natural stone while offering low maintenance makes it a popular choice in modern homes. Rising disposable incomes and urban housing development further drive residential adoption. This demand positions solid color engineered quartz as a reliable surface material for both contemporary and luxury interiors.

For instance, Cosentino expanded its Silestone solid-color quartz ranges with HybriQ+ technology, offering enhanced sustainability features tailored to homeowners prioritizing both style and environmental responsibility.

Growing Commercial Infrastructure Projects

Rapid development in commercial infrastructure, including offices, retail outlets, and hospitality projects, is fueling quartz demand in Australia. Commercial spaces require long-lasting, hygienic, and visually appealing surfaces, and quartz meets these requirements effectively. Its non-porous nature ensures resistance to stains and bacteria, making it ideal for high-traffic environments. Strong growth in the hospitality and retail industries supports adoption, while architects and designers increasingly recommend quartz for its versatility. This commercial expansion continues to strengthen market opportunities and broaden usage scope.

For instance, Quantum Quartz by WK Stone has been widely specified in Australian office fit-outs, reflecting rising demand for long-lasting and sustainable benchtops and wall surfaces across commercial projects.

Preference for Sustainable and Eco-Friendly Materials

Sustainability is emerging as a major driver in the Australia Solid Color Engineered Quartz Market. Consumers and developers are shifting toward eco-friendly products that align with green building standards. Engineered quartz offers sustainable benefits by utilizing recycled materials and reducing the need for natural stone quarrying. Its durability also ensures reduced lifecycle costs, aligning with environmentally responsible construction practices. With increasing awareness of green certifications, quartz is gaining prominence as a sustainable alternative, appealing to both residential and commercial users.

Key Trends & Opportunities

Increasing Demand for Customization

Customization is becoming a strong trend in Australia, with buyers seeking unique finishes, colors, and textures for their quartz surfaces. Manufacturers are responding with expanded product ranges featuring matte, glossy, and marble-like designs. Digital fabrication technologies are enabling precise customization, helping to attract design-focused consumers. This trend creates an opportunity for companies to differentiate and capture higher-margin sales. It positions solid color engineered quartz as not only a durable material but also a key design element in premium interiors.

For instance, Cosentino introduced Dekton and Silestone ranges with innovative finishes such as Velvet Texture, allowing customers to choose surfaces with low sheen for modern interiors.

Expansion in Non-Residential Applications

Beyond residential use, quartz adoption is rising in institutional and public infrastructure projects such as hospitals, schools, and government facilities. Its hygiene benefits, long life, and ease of cleaning make it suitable for these high-traffic environments. Government investments in modern infrastructure across Australia create significant opportunities for quartz suppliers. Expanding applications diversify demand and reduce dependency on the residential sector. This broadening of use cases enhances market stability and opens growth avenues in previously underpenetrated sectors.

For instance, Jyothi Quartz Surfaces have been increasingly specified in healthcare facilities for their non-porous, antibacterial properties that help reduce hospital-acquired infections and support easier maintenance in high-traffic environments.

Key Challenges

High Initial Cost of Quartz Surfaces

Despite its durability and long-term benefits, quartz remains more expensive than alternatives such as laminates and tiles. This cost barrier limits adoption among budget-conscious buyers in both residential and commercial sectors. While premium buyers accept the higher price, affordability remains a challenge for middle-income groups. Manufacturers face pressure to balance pricing with quality while developing cost-effective product lines. Without addressing this challenge, quartz adoption may slow down in regions with lower disposable incomes and price-sensitive markets.

Competition from Substitute Materials

The Australia Solid Color Engineered Quartz Market faces strong competition from granite, marble, laminates, and ceramic surfaces. Natural stones continue to appeal to consumers seeking authenticity and luxury, while laminates and ceramics attract buyers with lower prices. This competitive environment forces quartz producers to constantly innovate and emphasize unique value propositions like uniformity, hygiene, and sustainability. Without strong differentiation, quartz risks losing potential customers to these substitute materials, particularly in projects where cost or natural aesthetics dominate decisions.

Supply Chain and Raw Material Vulnerability

The industry relies on imported raw materials, making it vulnerable to fluctuations in global supply chains. Rising transportation costs, energy prices, and environmental regulations in production hubs create challenges for manufacturers in Australia. Supply delays or shortages can disrupt project timelines and increase overall costs for both producers and consumers. Companies are under pressure to secure local sourcing alternatives or invest in recycling processes to reduce dependency. These vulnerabilities highlight a critical challenge that may impact consistent market growth.

Regional Analysis

Regional Analysis

New South Wales

New South Wales led the Australia Solid Color Engineered Quartz Market with 28% share in 2024, supported by strong adoption in residential renovations and commercial projects. High-income households in Sydney favored quartz for kitchens and bathrooms due to its premium appearance and durability. Demand from the hospitality sector also contributed with installations in hotels and restaurants. The state’s ongoing housing developments created consistent opportunities for suppliers. It continues to strengthen its position with consumer preference for stylish, low-maintenance surfaces.

Victoria

Victoria accounted for 24% share in 2024, driven by robust urban housing projects and a thriving construction sector. The Australia Solid Color Engineered Quartz Market in Victoria benefits from strong demand in Melbourne, where modern housing designs emphasize quartz finishes. Renovation activities supported by rising disposable incomes further increased adoption. Commercial projects in retail and hospitality also used quartz for durability and design flexibility. It remains one of the fastest-growing regions, supported by consumer preference for sustainable and premium-quality materials.

Queensland

Queensland represented 18% share in 2024, with growth supported by rising residential construction and tourism-related projects. The Australia Solid Color Engineered Quartz Market in Queensland benefits from high adoption in coastal properties, where resistance to stains and humidity is valued. Consumers in Brisbane and the Gold Coast preferred quartz for modern home interiors. Hospitality developments, including hotels and resorts, also fueled demand. It continues to grow steadily, supported by lifestyle-driven investments in both residential and commercial projects.

Western Australia

Western Australia held 15% share in 2024, supported by demand from urban centers such as Perth. The Australia Solid Color Engineered Quartz Market in the region is influenced by consumer preference for durable and premium interior materials. Residential buyers favored quartz for kitchens and bathrooms, while commercial adoption increased in offices and retail outlets. Mining-driven economic activity contributed indirectly by supporting disposable incomes. It shows consistent growth with developers integrating quartz surfaces in modern housing projects.

South Australia

South Australia captured 9% share in 2024, with adoption mainly in residential upgrades and selective commercial installations. The Australia Solid Color Engineered Quartz Market in this region benefited from government-supported housing projects and consumer demand for cost-efficient premium surfaces. Local distributors strengthened availability across urban and semi-urban areas. Renovation projects in Adelaide supported sales, particularly for countertops and flooring. It continues to expand gradually with increasing consumer awareness of quartz’s long-term performance benefits.

Rest of Australia

The Rest of Australia accounted for 6% share in 2024, covering Tasmania, Northern Territory, and the Australian Capital Territory. Demand was smaller but steadily rising, supported by niche residential and public projects. The Australia Solid Color Engineered Quartz Market in this segment benefited from government infrastructure spending and small-scale renovation activity. Consumers valued quartz for its durability, non-porous structure, and low maintenance. It shows potential for growth as awareness increases and distribution networks strengthen in underserved areas.

Market Segmentations:

Market Segmentations:

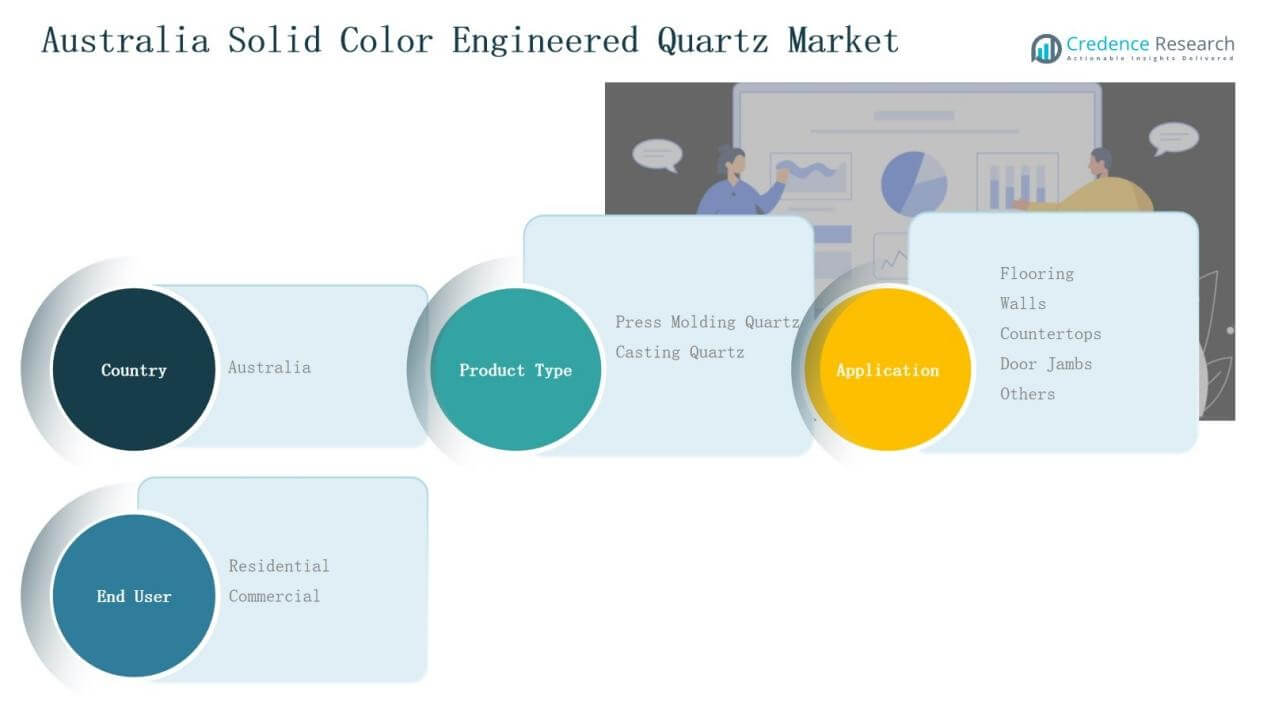

By Product Type

- Press Molding Quartz

- Casting Quartz

By Application

- Flooring

- Walls

- Countertops

- Door Jambs

- Others

By End User

By Region

- New South Wales

- Victoria

- Queensland

- Western Australia

- South Australia

- Reat of Australia

Competitive Landscape

The Australia Solid Color Engineered Quartz Market is highly competitive, with both global and domestic players focusing on innovation, design variety, and sustainability to strengthen their positions. Leading companies such as Caesarstone, Cosentino, Smartstone, Quantum Quartz, Silestone Australia, HanStone Quartz Australia, WK Marble & Granite, Essa Stone, Laminex Australia, and Lapitec Australia dominate the market through wide product portfolios, extensive distribution networks, and strong brand recognition. These companies emphasize premium finishes, eco-friendly production, and customized offerings to cater to rising consumer demand for stylish, low-maintenance surfaces. Strategic initiatives, including product launches, partnerships, and localized marketing, further enhance their competitive edge. Domestic players leverage strong regional presence and tailored designs, while international companies focus on advanced fabrication technologies and sustainable manufacturing practices. The market remains dynamic, with players competing on product quality, pricing strategies, and customer engagement, positioning solid color engineered quartz as a preferred surface material across Australia’s residential and commercial sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Caesarstone

- Cosentino

- Smartstone

- Quantum Quartz

- Silestone Australia

- HanStone Quartz Australia

- WK Marble & Granite

- Essa Stone

- Laminex Australia

- Lapitec Australia

Recent Developments

- In December 2023, Caesarstone announced the Australian ban on engineered stone slabs containing crystalline silica, effective July 2024.

- In March 2022, Smartstone launched the Ibrido range, a low-silica hybrid engineered surface with advanced print technology.

- In May 2024, WK Stone partnered with Eight Homes to offer Quantum Zero, a recycled surface as a safe alternative to high-silica engineered stone.

Report Coverage

The research report offers an in-depth analysis based on Type, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for solid color engineered quartz will rise with increasing home renovation projects across Australia.

- Commercial adoption will grow, supported by hospitality, retail, and office space developments.

- Sustainable and eco-friendly quartz products will gain stronger acceptance among environmentally conscious consumers.

- Customized finishes and marble-look designs will drive product differentiation and appeal.

- Local manufacturing capacity will expand to reduce reliance on imported raw materials.

- Competition will intensify, pushing companies to innovate in durability and design quality.

- Public infrastructure investments will create opportunities for quartz use in institutional buildings.

- Wider distribution networks will improve accessibility in both metropolitan and regional areas.

- Digital fabrication technologies will enable precision cutting and cost-efficient customization.

- Strategic collaborations and acquisitions will support market consolidation and long-term growth.

Market Insights

Market Insights Regional Analysis

Regional Analysis Market Segmentations:

Market Segmentations: