Market Overview

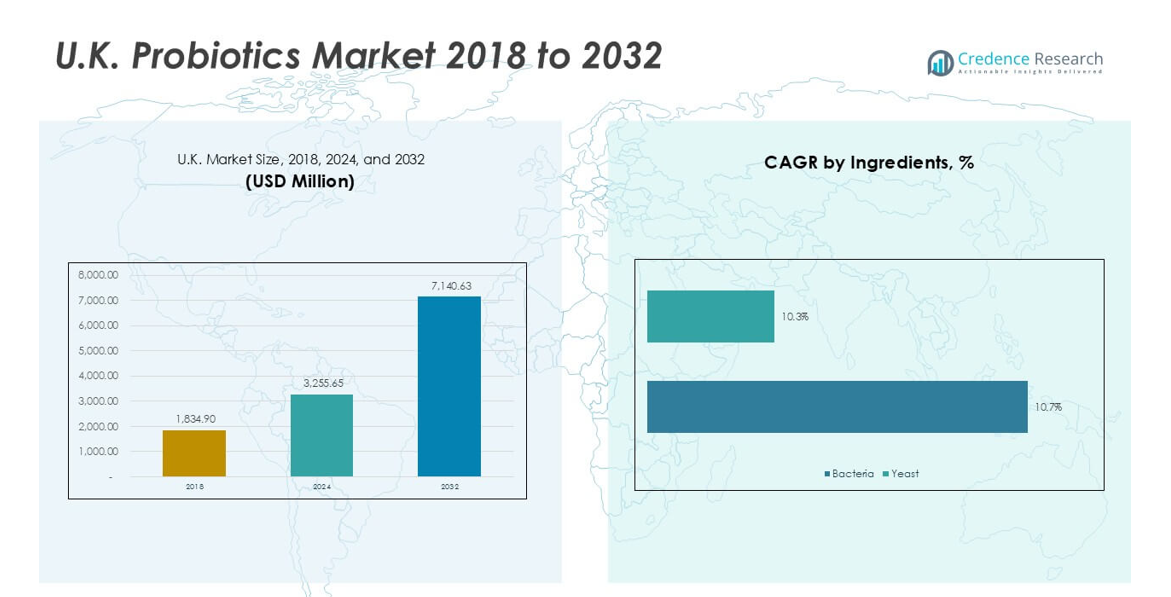

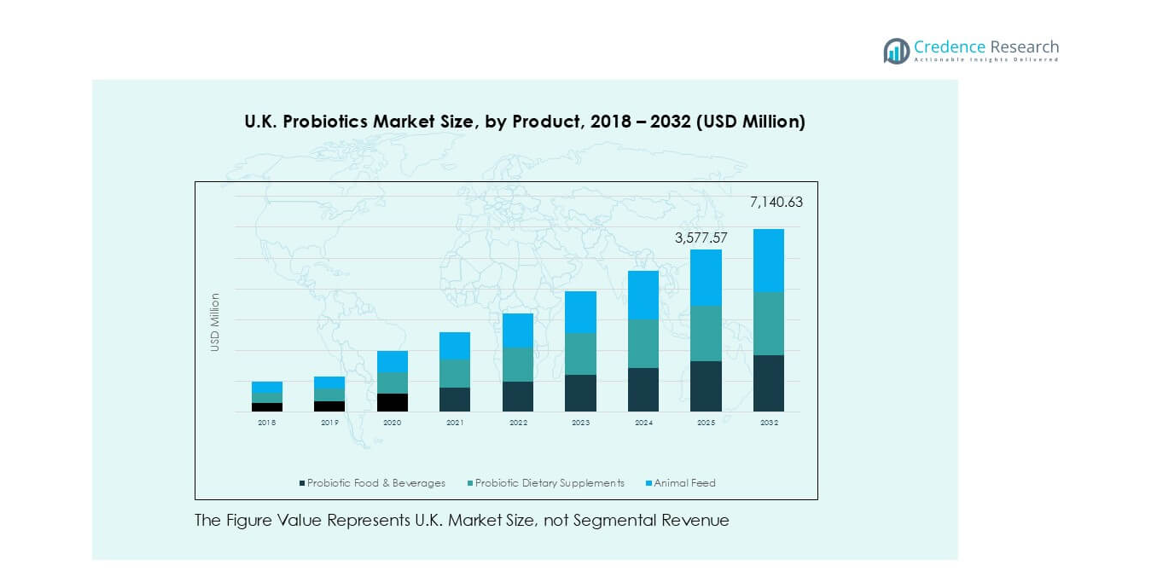

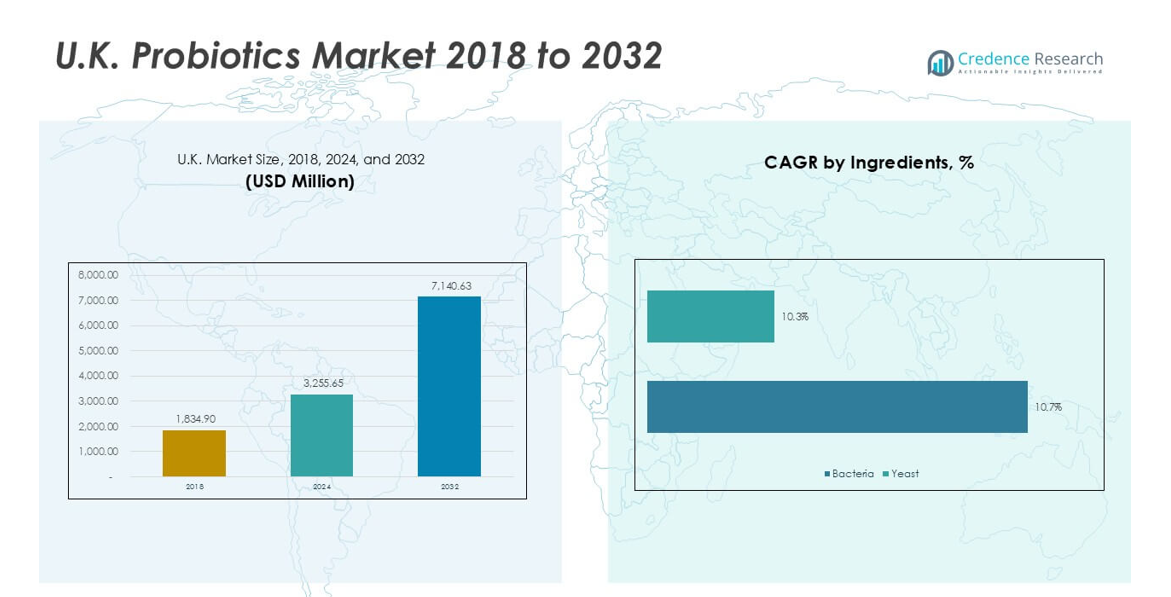

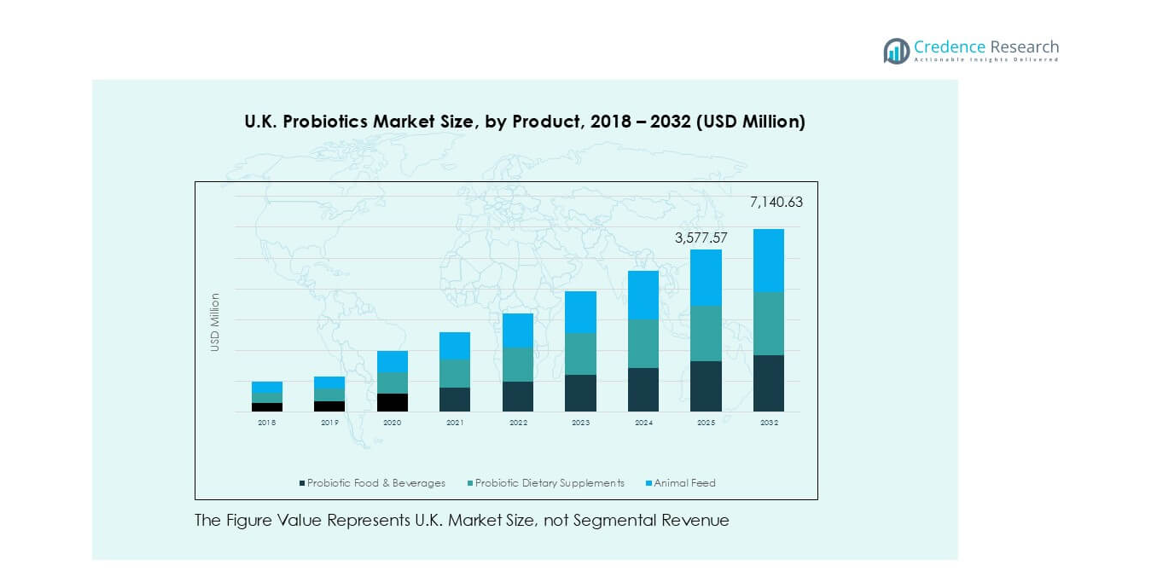

The U.K. Probiotics market size was valued at USD 1,834.90 million in 2018, increasing to USD 3,255.65 million in 2024, and is anticipated to reach USD 7,140.63 million by 2032, at a CAGR of 10.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.K. Probiotics Market Size 2024 |

USD 3,255.65 million |

| U.K. Probiotics Market, CAGR |

10.5% |

| U.K. Probiotics Market Size 2032 |

USD 7,140.63 million |

The U.K. probiotics market is led by global players such as Nestlé S.A., Danone S.A., Yakult Honsha Co., Ltd., Kerry Group, and DuPont Nutrition & Biosciences, alongside regional specialists like OptiBac Probiotics Ltd. and Symprove Ltd. These companies dominate through wide product portfolios, strong R&D investment, and extensive retail networks. England emerged as the leading region in 2024, accounting for 65% of the market share, supported by high consumer awareness and strong distribution infrastructure. Scotland held 15% share, followed by Wales at 12%, while Northern Ireland contributed 8%, reflecting more localized growth within the overall U.K. market.

Market Insights

- The U.K. probiotics market was valued at USD 3,255.65 million in 2024 and is expected to reach USD 7,140.63 million by 2032, expanding at a CAGR of 10.5%.

- Growing demand for functional foods and dietary supplements is driving market growth, supported by rising awareness of digestive and immune health benefits.

- Key trends include innovation in probiotic product formats such as fortified cereals, beverages, and infant nutrition, alongside expanding online distribution channels.

- Competition is strong with players like Nestlé, Danone, Yakult, Kerry Group, OptiBac Probiotics, and Symprove focusing on R&D, partnerships, and targeted consumer solutions.

- Regionally, England leads with 65% share, followed by Scotland at 15%, Wales at 12%, and Northern Ireland at 8%. By segment, probiotic food and beverages dominate, with dairy products holding the largest share, while Lactobacillus remains the leading bacterial strain across applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

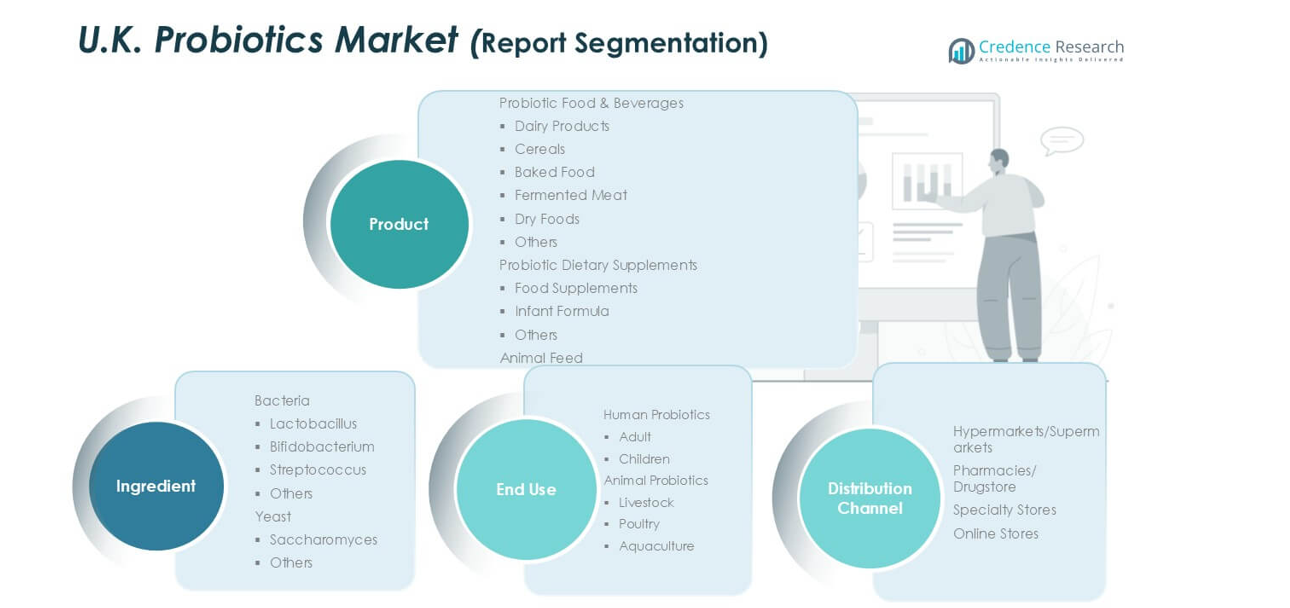

Market Segmentation Analysis:

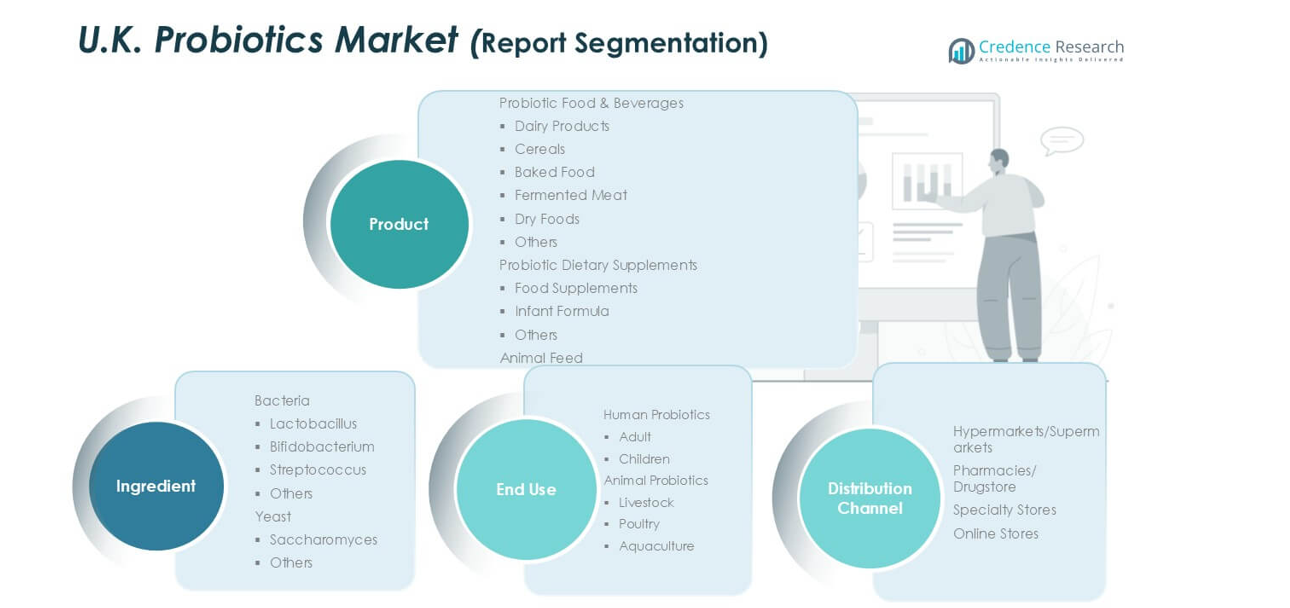

By Product

The U.K. probiotics market by product is dominated by probiotic food and beverages, accounting for the largest share in 2024. Within this, dairy products such as yogurt and fermented milk led due to their established consumer acceptance and high nutritional value. Cereals, baked food, and fermented meat are gaining traction as functional food trends expand, while dry foods and other niche categories are emerging. Probiotic dietary supplements, especially food supplements, continue to rise as consumers seek convenient formats. Animal feed also represents a growing sub-segment driven by livestock health improvement.

- For instance, Danone’s Activia and Actimel brands sold over 2.5 billion probiotic yogurt and drink units globally in 2022, with the U.K. among its top five markets.

By Ingredient

Bacterial strains form the backbone of the probiotics market, with Lactobacillus dominating the segment share in the U.K. in 2024. Its effectiveness in improving gut health, immunity, and digestion has secured widespread use in food, supplements, and dairy products. Bifidobacterium also maintains a strong presence in infant formula and digestive health solutions, while Streptococcus and other strains add diversity. Yeast-based probiotics, led by Saccharomyces, are expanding as alternatives for gut balance and resistance to antibiotics, though their market share remains smaller compared to bacterial probiotics.

- For instance, Yakult Honsha produced 40 million bottles daily worldwide in 2022, each containing Lactobacillus casei Shirota, with strong sales in U.K. retail chains.

By End User

Human probiotics represent the largest end-user segment in the U.K. market, with adults holding the dominant share in 2024. Rising consumer awareness of preventive healthcare, demand for functional food, and lifestyle-related digestive disorders are key drivers for adult probiotics. Children’s probiotics, particularly through infant formulas, also show steady growth, reflecting parental focus on early-stage gut health. Animal probiotics contribute a smaller yet vital share, with livestock leading usage for improved growth performance and immunity, followed by poultry and aquaculture applications in sustainable farming and animal welfare.

Market Overview

Rising Demand for Functional Foods and Beverages

The growing consumer shift toward functional and health-focused foods is a major driver of the U.K. probiotics market. Consumers are increasingly linking digestive health with overall wellness, leading to greater demand for products like yogurt, fermented milk, and fortified beverages. Dairy-based probiotic foods continue to dominate, while cereals, baked goods, and ready-to-drink probiotic beverages expand accessibility. Awareness campaigns and endorsements by nutritionists are also fueling adoption among both adults and children. The emphasis on preventive healthcare, combined with lifestyle changes and increasing cases of gastrointestinal issues, has accelerated probiotic intake. Manufacturers are responding with innovative formulations and flavor options that meet consumer preferences while maintaining health benefits. This focus on wellness, convenience, and daily dietary integration is ensuring that probiotic food and beverage products remain the core growth engine within the U.K. market.

- For instance, Danone’s Activia brand sold over 2.5 billion probiotic yogurts and drinks globally in 2022, with strong distribution in U.K. supermarkets.

Expanding Application in Infant and Child Nutrition

Infant nutrition has emerged as one of the most promising segments in the U.K. probiotics market, largely driven by parental focus on immunity and gut health during early childhood. Probiotic-enriched infant formula and supplements containing strains such as Bifidobacterium have gained strong adoption due to their proven benefits in reducing colic, improving digestion, and supporting immune development. Rising awareness among parents, reinforced by pediatric recommendations, has expanded demand for safe and clinically validated products. The introduction of child-specific probiotic formats, such as chewables and gummies, has further improved accessibility. With increasing numbers of working parents and a preference for convenient yet effective nutritional solutions, probiotics for children are becoming mainstream. Regulatory approval of probiotic strains for infant use has strengthened consumer confidence, ensuring this sub-segment continues to expand its market share in the coming years as a reliable and essential part of early-stage nutrition.

- For instance, Danone’s Aptamil infant formula, which contains the probiotic Bifidobacterium breve M-16V, is a widely available brand in the U.K.

Animal Feed Sector Growth and Livestock Health Focus

The U.K. animal feed probiotics market is gaining momentum as farmers and producers focus on sustainable practices and antibiotic alternatives. Livestock probiotics, particularly for cattle and poultry, are being adopted to enhance feed efficiency, boost immunity, and improve overall productivity. Growing consumer demand for antibiotic-free meat and dairy products has encouraged the use of probiotics as a natural growth promoter in animal nutrition. This trend aligns with regulatory efforts to reduce antibiotic usage in farming, making probiotics an attractive and compliant alternative. Aquaculture also benefits from probiotic integration, as it helps in disease prevention and improves water quality, ensuring healthier yields. The rising importance of animal welfare and sustainable farming practices further supports this segment. As livestock producers increasingly recognize the long-term economic and health benefits of probiotics, the animal feed sector is expected to play a significant role in expanding the U.K. probiotics market footprint.

Key Trends & Opportunities

Innovation in Probiotic Product Formats

One of the notable trends in the U.K. probiotics market is the rapid diversification of product formats. Beyond traditional dairy items, probiotics are being introduced into cereals, baked products, snack bars, and even beverages such as juices and kombucha. This expansion has been made possible by advancements in strain stability and encapsulation technologies, which allow probiotics to be incorporated into non-refrigerated and shelf-stable products. The demand for convenience foods has created opportunities for manufacturers to integrate probiotics into daily-consumed products, enhancing adoption across age groups. Additionally, personalized nutrition solutions, such as supplements tailored to individual microbiome needs, are gaining traction. This innovation-driven shift is reshaping consumer engagement, making probiotics more accessible and appealing to wider demographics. Companies that focus on unique, convenient, and science-backed formats are likely to capture new market share in the evolving U.K. probiotics landscape.

- For instance, Chr. Hansen developed probiotic microencapsulation technology capable of maintaining Lactobacillus acidophilus viability for over 12 months in dry snack applications, enabling its adoption in U.K. functional foods.

Digital Retail Expansion and Online Probiotic Sales

E-commerce is emerging as a significant opportunity for probiotic brands in the U.K., as consumers increasingly shift to online platforms for healthcare and nutritional products. Online retail offers a wider range of products, price comparisons, and home delivery convenience, which has accelerated probiotic supplement sales. Pharmacies and specialty online stores are expanding their probiotic offerings, while major e-commerce platforms are making probiotics more accessible nationwide. Subscription-based models for dietary supplements and probiotic-infused beverages are also growing, enabling steady consumer retention. Digital channels further allow brands to educate customers about probiotic benefits, leveraging targeted advertising and influencer marketing to drive awareness. With tech-savvy younger consumers and parents forming a major customer base, online sales are expected to remain a strong growth channel. This shift also allows smaller and innovative brands to compete alongside established players, intensifying competition and expanding consumer choice.

Key Challenges

Regulatory Complexity and Product Standardization

The U.K. probiotics market faces challenges related to regulatory frameworks, particularly concerning strain-specific approvals, labeling, and health claims. Probiotics are categorized variably as food, supplements, or pharmaceutical products, leading to inconsistencies in market entry requirements. The lack of uniform standards complicates product positioning, while strict rules on marketing health benefits limit brand communication. Companies must invest significantly in clinical trials to prove efficacy, which increases costs and delays product launches. Regulatory scrutiny is essential for consumer safety, but it also restricts innovation and slows time-to-market. Smaller firms face greater difficulties in meeting compliance requirements, creating barriers to entry. These complexities highlight the need for clearer, harmonized guidelines that can balance consumer safety with industry growth. Until such frameworks are standardized, regulatory hurdles will remain a significant challenge to both established and emerging probiotic players in the U.K. market.

High Costs of Production and Strain Development

Probiotic product development involves substantial costs due to research, testing, and maintaining strain viability throughout production and distribution. Ensuring that probiotics remain active in different product formats, such as baked goods or beverages, requires advanced encapsulation and preservation technologies, which increase expenses. Clinical validation of strains for specific health benefits further adds to R&D costs, creating barriers for new entrants. Rising production costs also impact retail prices, limiting consumer adoption in price-sensitive segments. For animal feed applications, cost competitiveness against conventional additives remains a hurdle. Additionally, maintaining cold chain logistics for probiotic foods like dairy products adds to supply chain complexity and expenses. While consumer demand is strong, profitability remains a challenge for manufacturers, especially smaller players with limited scale. Managing cost-efficiency while ensuring quality and efficacy is essential for the sustainable growth of the U.K. probiotics industry.

Regional Analysis

England

England dominated the U.K. probiotics market in 2024, holding nearly 65% share. The region benefits from strong consumer awareness of functional foods, high urbanization, and widespread retail penetration of probiotic-rich dairy and supplements. Demand is supported by growing adoption of preventive healthcare practices and increasing gastrointestinal health issues among adults. England’s large population, combined with innovation in product formats such as yogurt drinks and dietary supplements, ensures continued growth. With well-established distribution networks through supermarkets, pharmacies, and online channels, the region remains the leading hub for probiotic consumption in the U.K.

Scotland

Scotland accounted for around 15% share of the U.K. probiotics market in 2024. Rising interest in wellness diets and functional beverages has driven growth, supported by expanding retail presence in urban areas like Glasgow and Edinburgh. Scottish consumers are increasingly adopting probiotic dairy and dietary supplements to address digestive and immune health concerns. The market is also benefiting from research collaborations in nutrition and healthcare sectors that promote probiotics’ benefits. While smaller in size compared to England, Scotland demonstrates strong growth potential due to increasing health awareness and growing demand for premium, locally sourced probiotic products.

Wales

Wales represented nearly 12% share of the probiotics market in the U.K. in 2024. The region is witnessing rising demand for probiotic dairy products and supplements as consumer focus on preventive healthcare strengthens. Supermarkets and pharmacies remain the primary distribution channels, with online sales gradually expanding reach. Rural consumers are adopting probiotics at a slower pace compared to urban counterparts, yet overall growth is supported by awareness programs highlighting gut health benefits. With expanding product availability and consumer education, Wales is steadily strengthening its role in the national probiotics market landscape.

Northern Ireland

Northern Ireland held close to 8% share of the U.K. probiotics market in 2024. Probiotic food and beverage products, particularly yogurt and fortified drinks, are leading the segment, with dietary supplements also gaining traction. The region’s smaller population limits overall market size, but growing consumer awareness and rising adoption in urban centers are boosting demand. Local healthcare initiatives focusing on digestive health and immunity have supported market penetration. With increased access to e-commerce platforms and expanding retail options, Northern Ireland shows steady growth, although its share remains smaller compared to England, Scotland, and Wales.

Market Segmentations:

By Product

- Probiotic Food & Beverages

-

-

- Dairy Products

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

- Others

- Probiotic Dietary Supplements

-

-

- Food Supplements

- Infant Formula

- Others

By Ingredient

-

-

- Lactobacillus

- Bifidobacterium

- Streptococcus

- Others

By End User

-

-

- Livestock

- Poultry

- Aquaculture

By Distribution Channel

- Hypermarkets/Supermarkets

- Pharmacies/Drugstore

- Specialty Stores

- Online Stores

By Geography

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The U.K. probiotics market is highly competitive, shaped by the presence of global leaders and specialized domestic players. Multinational companies such as Nestlé S.A., Danone S.A., Yakult Honsha Co., Ltd., and Kerry Group dominate with strong brand recognition, extensive product portfolios, and established distribution networks across supermarkets, pharmacies, and online platforms. DuPont Nutrition & Biosciences and Archer Daniels Midland Company leverage advanced R&D capabilities to expand strain diversity and product applications. Local companies, including OptiBac Probiotics Ltd. and Symprove Ltd., strengthen the market through targeted formulations and consumer trust in region-specific brands. Niche players like Winclove Probiotics and Probi are enhancing market presence through partnerships and innovative dietary supplements. The competitive landscape is also shaped by growing investment in clinical trials, regulatory compliance, and expansion into infant and animal nutrition. With rising consumer awareness and increasing demand for functional foods, competition continues to intensify, driving innovation and differentiation across the U.K. market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2024, Probi launched clinically-supported probiotic solution for metabolic health.

- In August 2024, AB-Biotics launched probiotic solutions Gyntima Menopause (complex probiotic made of Lacotobacillus crispatus KABP™ Lactobacillus plantarum KABP™ 051 (CECT 7481), and Lactococcus lactis KABP™ 021 (CECT 7483). It helps to regulate estrogen level by reactivating it through β-glucuronidase (GUS) activity in women suffering from perimenopausal symptoms.

- In August 2024, ZBiotics announced the completion of venture series A (amounting to USD 12 million) in order to support the commercialization of genetically engineered probiotics.

- In February 2024, AB Biotics SA (Netherlands) expands its presence in Asia, partnering with Wonderlab for their globally marketed product, AB-LIFE. The collaboration introduces Shape100, a probiotic blend focusing on cardiometabolic health, to the Chinese market. This strategic move aims to address cholesterol-related concerns through evidence-based solutions.

- In November 2023, Nestlé (Switzerland) launched N3 milk, a breakthrough in nutritional innovation. Incorporating prebiotic fibers and reduced lactose, it enriches gut health and boasts over 15% fewer calories. Tailored for diverse dietary needs, N3 supports bone health, muscle growth, and immunity.

- In April 2022, Symrise, a r producer of cosmetic ingredients, launched SymFerment, a cutting-edge ingredient designed to enhance skin care with its moisturizing and smoothing properties. Developed in collaboration with Probi, a leading manufacturer of probiotics for the healthcare and food industries, SymFerment represents a significant advancement in sustainable cosmetic technology.

Report Coverage

The research report offers an in-depth analysis based on Product, Ingredient, End User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The U.K. probiotics market will continue to grow steadily with strong consumer demand.

- Functional foods and beverages will remain the largest segment in product adoption.

- Dairy-based probiotics will dominate but new product formats will gain traction.

- Dietary supplements, especially for children and infants, will see rising consumption.

- Probiotic applications in animal feed will expand with focus on antibiotic alternatives.

- Online sales channels will grow faster than traditional retail outlets.

- Innovation in strain development and delivery formats will drive product diversification.

- Regulatory clarity will play a key role in shaping competitive strategies.

- Local players will strengthen market presence with targeted consumer solutions.

- England will remain the leading region while Scotland and Wales show increasing growth potential.