Market Overview:

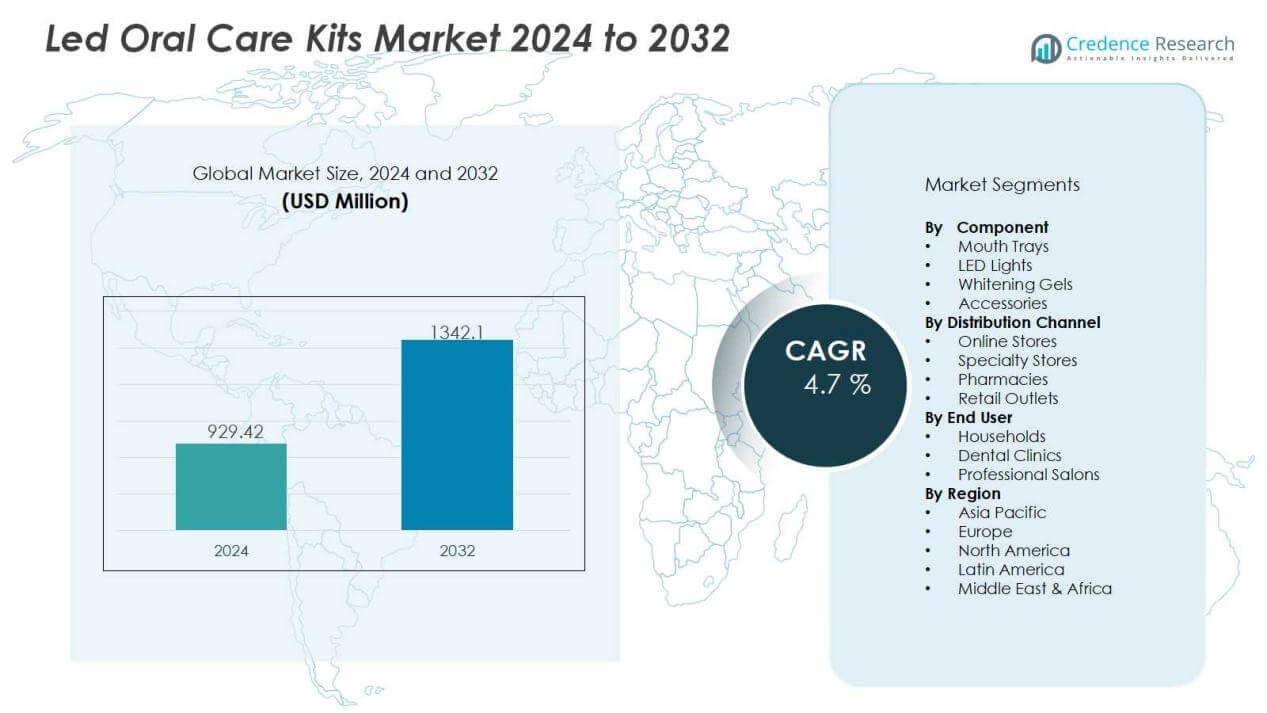

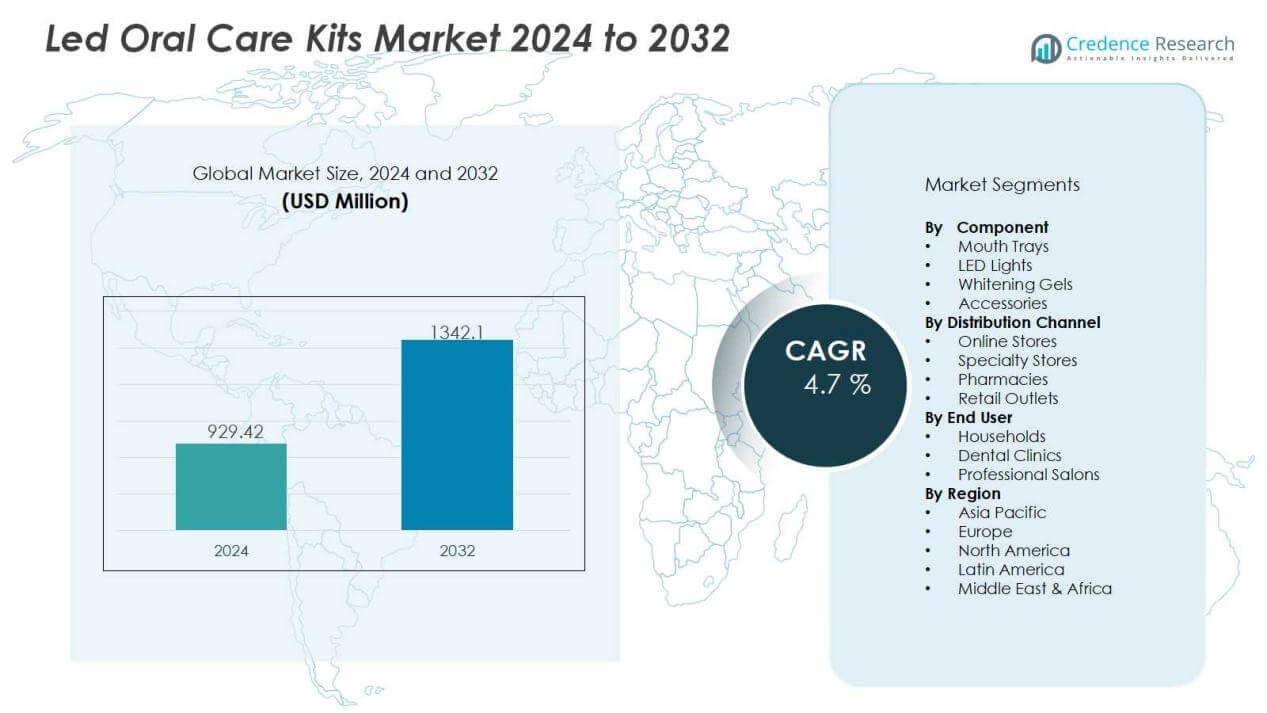

The Led Oral Care Kits Market size was valued at USD 929.42 million in 2024 and is anticipated to reach USD 1342.1 million by 2032, at a CAGR of 4.7 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Led Oral Care Kits Market Size 2024 |

USD 929.42 Million |

| Led Oral Care Kits Market, CAGR |

4.7 % |

| Led Oral Care Kits Market Size 2032 |

USD 1342.1 Million |

Key drivers shaping the market include heightened focus on personal grooming, growing influence of social media on cosmetic trends, and rising demand for non-invasive dental solutions. Technological advancements in LED-based whitening systems, combined with user-friendly designs and rechargeable features, are enhancing product appeal. Increasing disposable income, paired with consumer willingness to spend on preventive and cosmetic oral care, further accelerates adoption across both developed and emerging economies.

Regionally, North America leads the market due to high consumer awareness, strong distribution networks, and early adoption of innovative products. Europe follows, supported by demand for premium oral care solutions and strong emphasis on dental health. Asia-Pacific is the fastest-growing region, driven by rapid urbanization, increasing middle-class spending, and rising penetration of e-commerce platforms, which expand product accessibility and visibility.

Market Insights:

Market Insights:

- The LED oral care kits market was valued at USD 929.42 million in 2024 and is projected to reach USD 1342.1 million by 2032 at a CAGR of 4.7%.

- Rising focus on personal grooming and growing consumer interest in dental aesthetics are fueling demand for at-home whitening solutions.

- Technological innovations such as rechargeable devices, adjustable LED modes, and smartphone integration are enhancing product appeal.

- Increasing disposable income and willingness to invest in preventive oral care are driving adoption across both urban and semi-urban areas.

- North America led with 41% share in 2024, supported by strong consumer awareness, advanced dental infrastructure, and established brands.

- Europe accounted for 27% share in 2024, with high demand for premium oral care solutions and strong regulatory frameworks ensuring trust.

- Asia-Pacific held 22% share in 2024 and is the fastest-growing region, driven by urbanization, rising e-commerce penetration, and increasing middle-class spending.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Focus on Dental Aesthetics and At-Home Whitening Solutions:

The LED oral care kits market is expanding due to increasing consumer interest in dental aesthetics. A growing number of individuals prefer convenient at-home whitening solutions over expensive clinic treatments. It allows users to achieve visible results without professional intervention, saving both time and cost. Social media influence and the popularity of cosmetic dentistry trends further strengthen demand across diverse demographics.

- For Instance, In February 2023, Colgate launched its Optic White ComfortFit LED Whitening Kit, which includes a whitening pen and a flexible LED light that plugs into a smartphone. When used as directed for 10 minutes a day over 10 days, the company states the kit is clinically tested to whiten teeth by up to 6 shades.

Technological Advancements and Product Innovation Driving Adoption:

Continuous innovation in LED-based whitening systems enhances efficiency, safety, and ease of use. Products now include features such as rechargeable devices, adjustable light settings, and integration with smartphone apps. The LED oral care kits market benefits from these improvements by appealing to tech-savvy consumers seeking advanced solutions. It creates strong differentiation compared to traditional oral hygiene products, making adoption rates higher among younger age groups.

- For instance, Philips Zoom WhiteSpeed uses advanced blue LED light technology and is clinically proven to whiten teeth up to eight shades in just 45 minutes per in-office session, offering adjustable intensity settings for patient comfort.

Increasing Disposable Income and Willingness to Spend on Oral Care:

Rising disposable income levels support greater consumer spending on preventive and cosmetic dental products. Many households are prioritizing oral care as part of broader wellness and self-care trends. The LED oral care kits market is supported by consumers seeking affordable yet premium-quality alternatives to professional whitening treatments. It shows strong traction in both urban and semi-urban areas, where awareness of cosmetic care is expanding.

- commerce Growth and Expanding Accessibility Across Regions:

Online platforms play a major role in driving product visibility and accessibility. E-commerce channels enable brands to reach diverse consumer bases with tailored marketing and promotional campaigns. The LED oral care kits market benefits from rising online product reviews and influencer-driven endorsements that boost credibility. It ensures growing availability across global markets, including emerging economies where offline distribution remains limited.

Market Trends:

Integration of Smart Features and Growing Focus on Personalized Oral Care:

The LED oral care kits market is witnessing strong demand for products with smart connectivity and customization features. Consumers prefer kits that integrate mobile apps, provide usage tracking, and offer adjustable light intensity for personalized results. It is driving innovation toward safer, user-friendly, and more interactive designs that improve the overall whitening experience. Manufacturers are expanding portfolios with peroxide-free gels and ergonomic trays to address sensitivity concerns. The trend reflects broader consumer interest in personal health monitoring and tailored cosmetic solutions. Growing investment in research and development supports continuous improvements that differentiate premium products from mass-market offerings.

- For instance, Oral-B’s iO Series 9 features advanced 3D teeth tracking technology that monitors 16 distinct zones in the mouth, compared to the 6 zones tracked by standard models, providing comprehensive real-time brushing guidance through its smartphone app.

Sustainability Initiatives and Influence of Digital Marketing Channels:

Eco-friendly packaging and sustainable product designs are becoming vital in strengthening brand reputation and consumer trust. The LED oral care kits market benefits from rising demand for reusable trays, rechargeable devices, and reduced plastic usage. It aligns with increasing awareness of environmental impact among younger demographics who drive adoption. Digital marketing, influencer endorsements, and online reviews are shaping purchasing behavior across regions. E-commerce platforms serve as key channels to promote new product launches and build global reach. Brands are leveraging social media trends to connect with beauty-conscious consumers, ensuring long-term visibility and stronger engagement.

- For instance, SURI introduced sustainable electric toothbrushes with plant-based brush heads made from corn starch and castor oil, achieving 33,000 sonic vibrations per minute while maintaining a 40-day battery life.

Market Challenges Analysis:

Concerns Over Safety, Efficacy, and Consumer Trust:

The LED oral care kits market faces challenges linked to consumer doubts about long-term safety and efficacy. Many users question whether at-home kits deliver results comparable to professional treatments. It creates hesitation among first-time buyers, particularly in markets with limited regulatory oversight. Sensitivity issues, improper usage, and unverified claims by smaller brands further undermine trust. Growing awareness of potential enamel damage also makes some consumers cautious. Regulatory authorities are still developing clear standards, which slows adoption in certain regions.

High Competition, Price Pressure, and Limited Awareness in Emerging Markets:

Strong competition from both established oral care brands and new entrants drives significant price pressure. Companies must balance affordability with innovation, which can strain profitability. The LED oral care kits market also faces limited consumer awareness in developing economies where dental aesthetics is not a top priority. It restricts growth outside urban centers, where disposable incomes and lifestyle trends are still evolving. Counterfeit and low-quality products sold through online platforms further complicate market expansion. Educating consumers and building brand trust remain critical challenges for sustained growth.

Market Opportunities:

Rising Consumer Shift Toward At-Home Oral Care and Personal Aesthetics:

The LED oral care kits market holds strong opportunities driven by increasing demand for convenient and affordable dental care solutions. Consumers prefer at-home kits that combine effectiveness with ease of use, reducing the need for clinic visits. It benefits from growing awareness of oral aesthetics influenced by digital media, lifestyle changes, and celebrity endorsements. Expanding consumer focus on self-care and preventive health further supports adoption. Rising penetration across younger demographics creates space for premium product innovations. The trend also encourages cross-selling opportunities with complementary oral hygiene products.

Expansion Through E-Commerce Channels and Emerging Market Growth:

Digital platforms present significant opportunities to reach broader audiences through tailored marketing campaigns and influencer partnerships. Online reviews and direct-to-consumer models enhance brand credibility and visibility. The LED oral care kits market is well positioned to expand into emerging economies where rising disposable income and urbanization are fueling demand for advanced oral care. It creates strong potential in Asia-Pacific, Latin America, and the Middle East where offline distribution remains limited. Partnerships with dental professionals and clinics can further validate product efficacy and build trust. Widening global access ensures sustained long-term growth potential.

Market Segmentation Analysis:

By Component:

The LED oral care kits market is segmented into mouth trays, LED lights, whitening gels, and accessories. Mouth trays and LED lights dominate due to their central role in whitening performance. It benefits from technological upgrades such as wireless devices, ergonomic tray designs, and reusable components. Whitening gels hold steady demand, driven by consumer preference for safe, peroxide-free options. Accessories including storage cases and charging devices support value-added sales. Strong emphasis on durability and effectiveness is shaping consumer preferences across this segment.

- For instance, GLO Science launched their patented wireless teeth whitening system featuring a control module with LED lights and heating elements that can be inductively charged and controlled via Bluetooth, incorporating over 25 issued patents for their proprietary technology.

By Distribution Channel:

The market is divided into online stores, specialty stores, pharmacies, and retail outlets. Online stores hold a leading share due to rising e-commerce adoption and influencer-led marketing campaigns. It leverages consumer reliance on product reviews and digital promotions for purchasing decisions. Specialty stores and pharmacies contribute significantly by ensuring product credibility and professional endorsements. Retail outlets remain relevant in mature markets where offline presence strengthens brand familiarity. Expanding omnichannel strategies are enhancing accessibility and consumer engagement.

- For instance, Amazon unveiled Vision-Assisted Package Retrieval (VAPR) technology in 2024, which projects green and red lights onto packages for delivery drivers and achieved a 67% reduction in perceived physical and mental effort while saving more than 30 minutes per route.

By End User:

End users include households, dental clinics, and professional salons. Households dominate due to the rising popularity of at-home whitening kits. The LED oral care kits market benefits from consumer preference for cost-effective and convenient oral care solutions. Clinics and salons represent a growing segment, offering LED whitening as part of cosmetic packages. It shows strong potential in urban regions where demand for professional yet affordable treatments is high. Expanding self-care trends and lifestyle shifts will continue to drive household adoption.

Segmentations:

By Component:

- Mouth Trays

- LED Lights

- Whitening Gels

- Accessories

By Distribution Channel:

- Online Stores

- Specialty Stores

- Pharmacies

- Retail Outlets

By End User

- Households

- Dental Clinics

- Professional Salons

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America:

North America held 41% share of the LED oral care kits market in 2024, supported by high consumer awareness and advanced product adoption. The region benefits from established dental care infrastructure and strong marketing strategies by leading brands. It has a mature customer base that prioritizes both aesthetics and preventive oral health. Demand is fueled by higher disposable incomes and widespread access to e-commerce platforms. Product innovation, such as wireless designs and mobile app integration, strengthens market leadership. Regulatory clarity and trusted brands further reinforce consumer confidence across the United States and Canada.

Europe:

Europe accounted for 27% share of the LED oral care kits market in 2024, driven by rising demand for premium oral care products. Strong emphasis on wellness, sustainability, and eco-friendly packaging is shaping consumer choices. It benefits from growing adoption of advanced whitening kits in countries such as Germany, France, and the United Kingdom. Regulatory frameworks ensure product safety and build higher consumer trust in this region. Distribution through pharmacies, specialty stores, and online platforms enhances accessibility. Expanding partnerships with dental professionals also support credibility and adoption of advanced kits.

Asia-Pacific:

Asia-Pacific contributed 22% share of the LED oral care kits market in 2024, with rapid growth expected through the forecast period. Expanding urbanization, rising disposable incomes, and growing beauty-conscious populations drive adoption across this region. It is experiencing strong demand in markets such as China, Japan, South Korea, and India. E-commerce penetration and digital campaigns are helping brands build recognition and reach wider audiences. Local players are entering the market with competitive pricing, supporting accessibility to middle-income groups. Strategic investments in marketing and regional manufacturing facilities are likely to strengthen future growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Colgate-Palmolive

- Auraglow

- Glo Science

- MySmile

- Bright White Smiles

- Starlite Smile

- Snow Cosmetics LLC

- Active Wow

- ShYn

- P&G

Competitive Analysis:

The LED oral care kits market is highly competitive, shaped by global and regional players offering diverse product portfolios. Leading companies include Colgate-Palmolive, Auraglow, Glo Science, MySmile, Bright White Smiles, and Starlite Smile, each focusing on innovation and branding to strengthen their positions. It is characterized by continuous product differentiation, with firms integrating advanced LED technology, peroxide-free gels, and ergonomic designs to meet evolving consumer needs. Strong emphasis on safety, convenience, and affordability drives brand loyalty in both premium and mass-market segments. Companies leverage e-commerce platforms, influencer marketing, and strategic partnerships with dental professionals to expand reach and credibility. The market also faces price competition, pushing players to balance product quality with affordability while maintaining margins. Sustainability initiatives and eco-friendly packaging are becoming essential strategies for long-term growth. The competitive landscape is expected to remain dynamic, with innovation and consumer engagement defining leadership.

Recent Developments:

- In March 2025, Colgate-Palmolive announced the acquisition of Care TopCo Pty Ltd, the owner of Prime100 pet food brand, to expand its Hill’s Pet Nutrition division.

- In March 2025, Aspen Dental announced a nationwide partnership with Glo Science, bringing GLO’s professional whitening system to over 1,000 dental offices and broadening access to in-office whitening treatments.

Report Coverage:

The research report offers an in-depth analysis based on Component, Distribution Channel, End User and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The LED oral care kits market will continue to expand as consumer demand for cosmetic oral care strengthens.

- Technological advancements such as smart connectivity and customizable LED light modes will drive innovation.

- Growing focus on non-invasive and pain-free whitening solutions will increase adoption among diverse age groups.

- Brands will invest in product differentiation through sustainable packaging and eco-friendly materials to attract conscious consumers.

- E-commerce platforms will remain a key growth driver by widening accessibility and enabling targeted digital campaigns.

- Rising influence of social media and celebrity endorsements will boost awareness and accelerate market penetration.

- Emerging markets in Asia-Pacific, Latin America, and the Middle East will present significant expansion opportunities.

- Strategic collaborations with dental professionals and clinics will enhance product credibility and consumer trust.

- Affordability and premiumization strategies will coexist, catering to both mass-market and luxury-oriented segments.

- Continuous improvement in safety features and regulatory compliance will strengthen long-term consumer confidence.

Market Insights:

Market Insights: