Market Overview

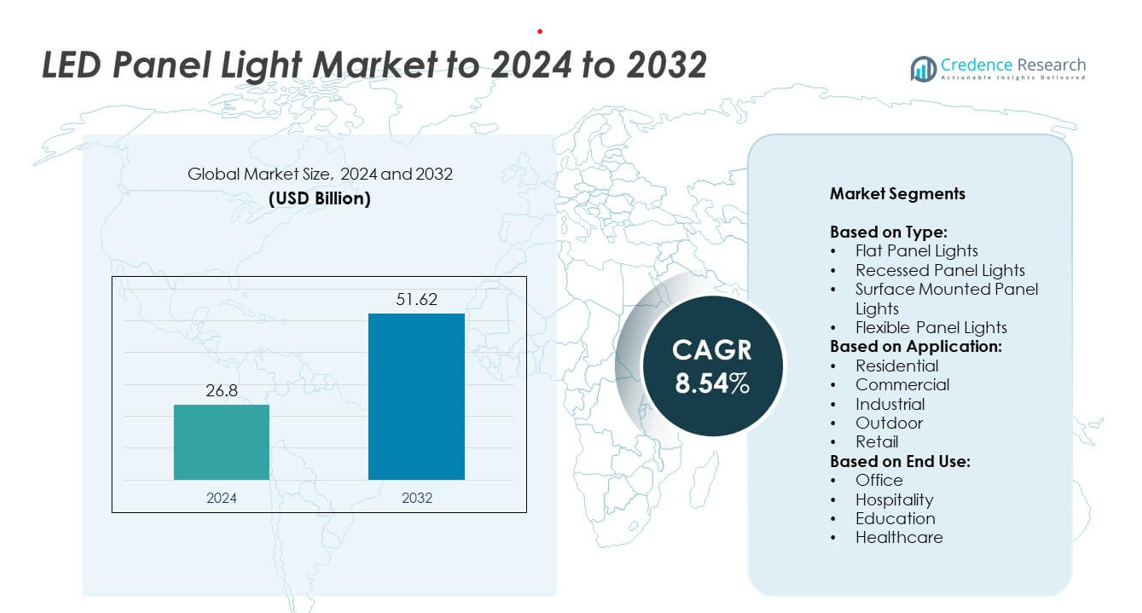

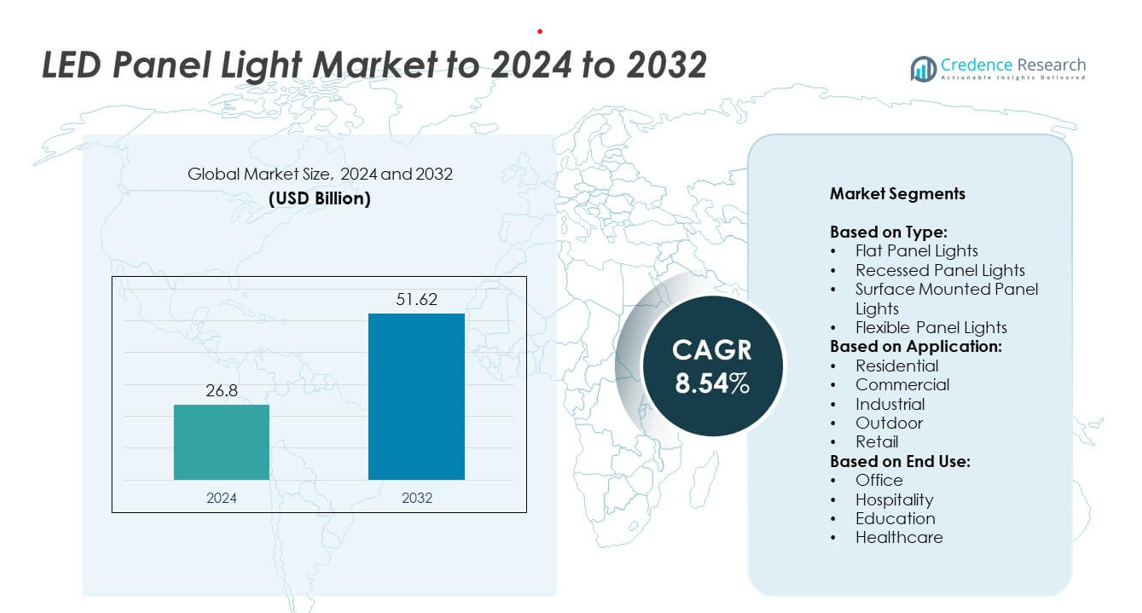

The LED Panel Light Market size was valued at USD 26.8 billion in 2024 and is anticipated to reach USD 51.62 billion by 2032, at a CAGR of 8.54% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| LED Panel Light Market Size 2024 |

USD 26.8 billion |

| LED Panel Light Market, CAGR |

8.54% |

| LED Panel Light Market Size 2032 |

USD 51.62 billion |

The LED panel light market is shaped by key players such as Cree, Toshiba, Zumtobel Group, LG Electronics, Hubbell Lighting, Samsung Electronics, Dialight, Everlight Electronics, Osram, Acuity Brands, Philips Lighting, Nichia Corporation, GE Lighting, Panasonic, and Signify. These companies compete through innovations in smart-enabled panels, sustainable designs, and energy-efficient solutions to strengthen their global presence. Asia Pacific emerged as the leading region in 2024 with a 30% market share, supported by rapid urbanization, infrastructure development, and government-led energy efficiency programs. North America followed with 32% share, driven by retrofitting projects and smart city initiatives, while Europe accounted for 27% owing to strict sustainability regulations and green building standards.

Market Insights

- The LED panel light market was valued at USD 26.8 billion in 2024 and is projected to reach USD 51.62 billion by 2032, growing at a CAGR of 8.54%.

- Rising demand for energy-efficient lighting solutions and supportive government initiatives are fueling market growth across residential, commercial, and industrial sectors.

- Smart-enabled LED panel lights and sustainable designs are emerging as key trends, creating opportunities in offices, hospitality, healthcare, and retail applications.

- The market is highly competitive, with global and regional players focusing on innovation, cost efficiency, and sustainable product development to maintain leadership positions.

- Asia Pacific led with a 30% share in 2024, followed by North America at 32% and Europe at 27%, while Latin America accounted for 6% and the Middle East & Africa held 5%, reflecting strong regional diversity in adoption patterns.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Flat panel lights held the largest share in the LED panel light market in 2024, accounting for over 40% of revenue. Their dominance is driven by slim design, high energy efficiency, and widespread adoption in modern offices and commercial spaces. Recessed panel lights also gained traction due to aesthetic appeal in false ceilings, while surface-mounted lights found use in areas lacking ceiling depth. Flexible panel lights, though smaller in share, are expanding with demand for creative architectural lighting solutions, particularly in high-end retail and hospitality sectors.

- For instance, Cree Lighting’s CR Series 2×2 architectural LED troffers achieve a high luminous efficacy, delivering up to 137 lumens per watt, a metric of their energy efficiency and performance in commercial installations.

By Application

The commercial segment dominated the market with over 45% share in 2024, supported by large-scale adoption in offices, malls, and retail complexes. Growing focus on energy-efficient infrastructure and compliance with green building standards accelerated adoption. Industrial facilities followed closely, leveraging LED panels for uniform lighting and reduced operational costs. Residential adoption rose steadily due to urban housing projects, while outdoor and retail applications gained demand for enhanced visibility, aesthetics, and branding. Commercial expansion remains the primary driver, aided by corporate sustainability initiatives.

- For instance, in a lighting project, Zumtobel Group installed a photovoltaic system in Dornbirn with a total output of 1,250 kWp, which contributes to the company’s own energy consumption. In a separate pilot project for the Werd Administrative Centre, the company achieved electricity savings of more than 80% by switching from fluorescent to LED lighting.

By End Use

Offices accounted for the leading share of more than 35% in 2024, reflecting the high demand for uniform, glare-free lighting that enhances employee productivity. Hospitality followed as hotels and restaurants increasingly adopted LED panels to create modern, energy-saving ambiances. The education sector also contributed significantly, with schools and universities upgrading infrastructure to eco-friendly lighting systems. Healthcare facilities are emerging adopters, with LED panels offering both operational efficiency and compliance with health and safety standards. The office segment remains dominant, driven by workplace modernization and efficiency goals

Key Growth Drivers

Rising Demand for Energy Efficiency

The growing need for energy-efficient solutions remains the primary driver of the LED panel light market. Governments across regions enforce strict energy regulations, prompting businesses and households to replace conventional lighting with LEDs. LED panel lights reduce electricity consumption by nearly 50%, making them cost-effective and environmentally sustainable. Their long operational life further minimizes replacement and maintenance costs, increasing preference across sectors. Rising awareness about carbon footprint reduction and energy savings ensures energy efficiency remains the most significant growth driver in this market.

- For instance, the deployment of energy-efficient LED panel systems by Signify (Philips Lighting) has been shown to reduce the energy consumption of lighting by up to 65 % compared to older fluorescent installations, contributing to significant operational savings.

Supportive Government Policies and Incentives

Government initiatives promoting sustainable infrastructure strongly support the adoption of LED panel lights. Subsidies, tax rebates, and public lighting programs accelerate market penetration across developing and developed economies. Programs like smart city projects and green building certifications encourage widespread installation of efficient lighting solutions in offices, retail spaces, and public infrastructure. Mandatory energy labeling and minimum performance standards also create demand consistency. These supportive measures align with global sustainability goals, ensuring consistent market growth and fostering innovation in LED panel light technologies.

- For instance, the USA’s commercial buildings energy-efficiency tax deduction (179D) was updated by the Inflation Reduction Act of 2022 and now offers a tiered deduction structure. The maximum deduction, which is adjusted for inflation annually, can be up to $5.81 per square foot for the 2025 tax year for projects that achieve maximum energy savings and meet prevailing wage and apprenticeship requirements.

Expanding Commercial and Industrial Infrastructure

The expansion of commercial and industrial infrastructure serves as a critical growth factor. Offices, retail complexes, healthcare centers, and educational institutions increasingly require efficient and durable lighting solutions. LED panel lights, with their uniform distribution and modern designs, meet these demands effectively. Large-scale adoption in new construction projects and renovation activities contributes to steady demand. Industrial facilities also prefer LED panels due to reduced energy costs and low maintenance requirements. This widespread infrastructure growth ensures consistent opportunities for manufacturers and suppliers of LED panel lights.

Key Trends & Opportunities

Integration of Smart Lighting Solutions

The integration of smart technology with LED panel lights is a significant market trend. Smart-enabled panels allow users to control brightness, color temperature, and energy use through mobile apps or IoT platforms. Offices, educational institutions, and hospitality spaces increasingly adopt these systems to enhance flexibility and reduce costs. Integration with building management systems further supports energy optimization. As smart city initiatives expand globally, smart-enabled LED panels present lucrative opportunities, driving adoption among both commercial and residential customers seeking technologically advanced lighting solutions.

- For instance, LEDVANCE’s product literature and sustainability reports confirm that LED products offer significant life cycle cost savings. In a published LCA for one of their LED lamps, the “use phase” was shown to account for over 95% of the total energy consumption, making long-term energy savings the largest cost advantage over conventional lighting. The company also publishes case studies and guarantee conditions highlighting the long lifespan of its LED products, including fixtures lasting up to 75,000 hours, which significantly reduces the maintenance and replacement expenses common with fluorescent lights.

Focus on Sustainable Materials and Designs

Sustainability is emerging as a vital opportunity in the LED panel light market. Manufacturers increasingly invest in eco-friendly materials, recyclable components, and low-carbon production processes to meet regulatory compliance. Demand for thin, lightweight, and modular designs is growing, as consumers and businesses prioritize aesthetics alongside sustainability. Green building certifications and environmental labeling standards further encourage adoption. Companies that innovate with sustainable product offerings gain a competitive edge while addressing global concerns about resource conservation. This trend fosters long-term growth and industry transformation toward greener practices.

- For instance, lighting experts and manufacturers often state that a Color Rendering Index (CRI) below 80 is considered poor and results in inaccurate color representation.

Key Challenges

High Initial Installation Costs

Despite long-term energy and maintenance savings, the high upfront cost of LED panel lights presents a key challenge. Price-sensitive consumers, especially in emerging economies, often delay adoption due to limited budgets. Small businesses and households may prefer cheaper conventional alternatives, slowing widespread penetration. Although government subsidies help, cost concerns remain a barrier for many potential buyers. Manufacturers face the task of balancing affordability with quality to overcome this challenge. Achieving cost competitiveness without compromising performance is vital for broader acceptance across global markets.

Intense Market Competition

The LED panel light market faces stiff competition with numerous global and regional players. Price wars are common, driven by the entry of low-cost manufacturers from emerging markets. This reduces profit margins for established companies and limits investment capacity for innovation. Counterfeit products also flood markets, damaging consumer trust and affecting brand value. Companies need to differentiate through technology integration, superior design, and sustainability to maintain competitive positions. Intense competition continues to pose a challenge, especially in price-sensitive regions where brand loyalty is limited.

Regional Analysis

North America

North America accounted for 32% of the LED panel light market share in 2024, driven by strong adoption across commercial offices, educational institutions, and healthcare facilities. Energy efficiency regulations and government incentives have accelerated replacement of conventional lighting systems with LED panels. The United States leads the region, supported by widespread smart building initiatives and sustainability-driven retrofitting projects. Canada also contributes significantly through adoption in residential and industrial sectors. Rising investments in smart city infrastructure and corporate sustainability programs ensure continued growth, making North America one of the most mature regional markets.

Europe

Europe held a 27% market share in 2024, supported by stringent EU energy efficiency directives and sustainability regulations. Countries like Germany, the UK, and France lead adoption, driven by green building standards and demand for eco-friendly lighting. The region shows strong penetration in commercial and hospitality spaces, where uniform lighting and energy savings remain critical. Renovation projects in aging infrastructure further stimulate demand for LED panels. The focus on reducing carbon emissions and achieving climate goals positions Europe as a steady growth region, with manufacturers investing in recyclable materials and smart-enabled lighting solutions.

Asia Pacific

Asia Pacific dominated with a 30% share in 2024, reflecting rapid urbanization, industrial expansion, and government-led energy-saving programs. China leads the market with large-scale manufacturing, smart city projects, and infrastructure investments. India and Southeast Asia are emerging growth hubs, fueled by increasing residential adoption and modernization of retail and office spaces. Japan and South Korea contribute with advanced smart lighting solutions and innovation-led demand. Strong government subsidies and large construction activities continue to drive adoption. With rising demand across commercial, residential, and industrial sectors, Asia Pacific remains the fastest-growing regional market for LED panel lights.

Latin America

Latin America captured 6% of the market share in 2024, supported by growing commercial and retail infrastructure. Brazil and Mexico lead adoption, driven by modernization efforts in offices and shopping complexes. Government energy efficiency campaigns and gradual smart city projects are encouraging the shift from traditional lighting to LED panels. Residential adoption remains slower due to cost barriers, but demand is gradually rising with urban housing expansion. Opportunities are expected to increase with the development of industrial facilities and hospitality projects. The region’s growth outlook remains moderate but promising with supportive sustainability measures.

Middle East and Africa

The Middle East and Africa accounted for 5% of the market share in 2024, driven by infrastructure development in commercial, retail, and hospitality sectors. Gulf countries, including the UAE and Saudi Arabia, lead adoption, supported by smart city investments and sustainability initiatives. Africa is showing gradual progress with government-led electrification programs and rising demand for cost-efficient lighting. The hospitality and retail sectors remain major consumers, particularly in tourism-driven economies. Although market penetration is lower compared to other regions, increasing investments in modern infrastructure and renewable energy programs provide long-term opportunities for growth.

Market Segmentations:

By Type:

- Flat Panel Lights

- Recessed Panel Lights

- Surface Mounted Panel Lights

- Flexible Panel Lights

By Application:

- Residential

- Commercial

- Industrial

- Outdoor

- Retail

By End Use:

- Office

- Hospitality

- Education

- Healthcare

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

Cree, Toshiba, Zumtobel Group, LG Electronics, Hubbell Lighting, Samsung Electronics, Dialight, Everlight Electronics, Osram, Acuity Brands, Philips Lighting, Nichia Corporation, GE Lighting, Panasonic, and Signify dominate the competitive landscape of the LED panel light market. The market features intense rivalry, with players focusing on technological advancements, sustainable designs, and energy-efficient solutions to maintain leadership. Companies are investing heavily in smart-enabled panel lights, eco-friendly materials, and modular designs to cater to evolving customer needs. Expansion into emerging markets, supported by smart city initiatives and infrastructure projects, continues to provide growth opportunities. Strategic collaborations, acquisitions, and partnerships are common approaches used to strengthen distribution networks and enhance innovation capabilities. Price competitiveness is a key challenge, pushing manufacturers to balance affordability with performance. Continuous emphasis on product reliability, regulatory compliance, and customized solutions positions leading players to sustain growth in an increasingly competitive global landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cree

- Toshiba

- Zumtobel Group

- LG Electronics

- Hubbell Lighting

- Samsung Electronics

- Dialight

- Everlight Electronics

- Osram

- Acuity Brands

- Philips Lighting

- Nichia Corporation

- GE Lighting

- Panasonic

- Signify

Recent Developments

- In 2024, Acuity Brands, Inc. Launched new panel and troffer-style products (like the FRAME and Wafer) featuring switchable color temperature and adjustable lumen output technology, simplifying inventory and installation for contractors.

- In 2024, ams OSRAM Showcased the new generation of the OSLON™ Pure family of LEDs, targeting professional indoor and retail lighting applications. Highlighted its portfolio of spectral and ambient light sensors for building management, enabling their panel light partners to offer superior color and brightness control.

- In 2023, Signify Continued to integrate Human-Centric Lighting (HCL) features into its professional panel lighting, such as color and intensity tuning to support natural rhythms (circadian lighting).

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The LED panel light market will continue expanding with strong demand across commercial sectors.

- Smart-enabled LED panels will see rapid adoption in offices, schools, and hospitality spaces.

- Sustainability and eco-friendly designs will remain central to product innovation.

- Asia Pacific will sustain its position as the fastest-growing regional market.

- North America and Europe will focus on retrofitting projects and smart city integration.

- Price competition will intensify, pushing manufacturers to innovate in quality and efficiency.

- Healthcare and education sectors will increase demand for uniform and safe lighting.

- Government regulations on energy efficiency will accelerate replacement of conventional lighting.

- Flexible and modular LED panels will gain traction in retail and architectural applications.

- Long-term opportunities will arise from rapid urbanization and infrastructure development worldwide.