Market Overview

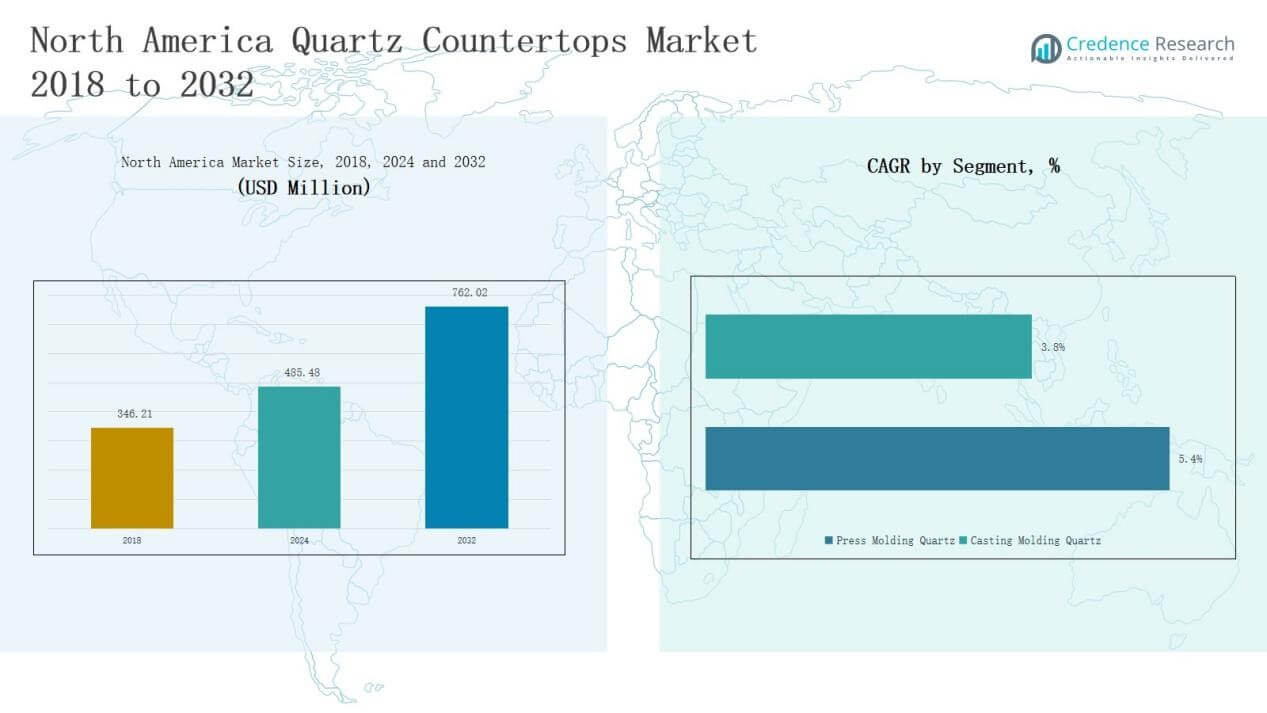

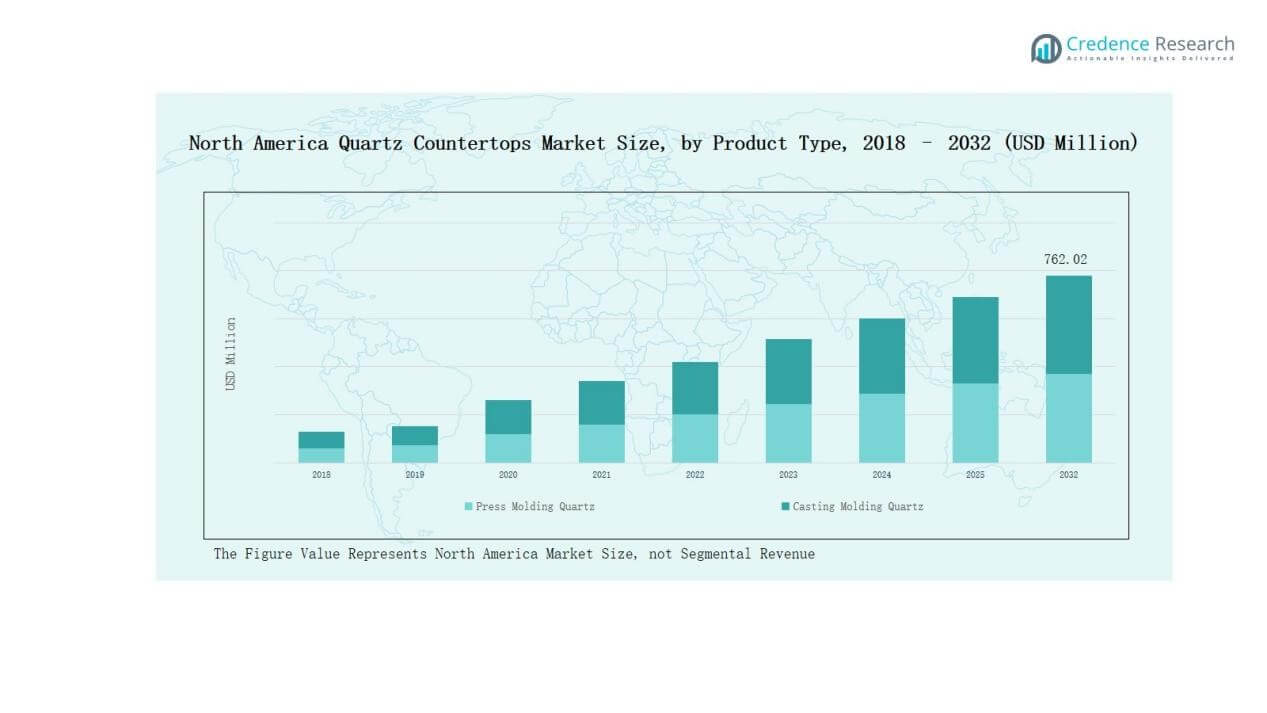

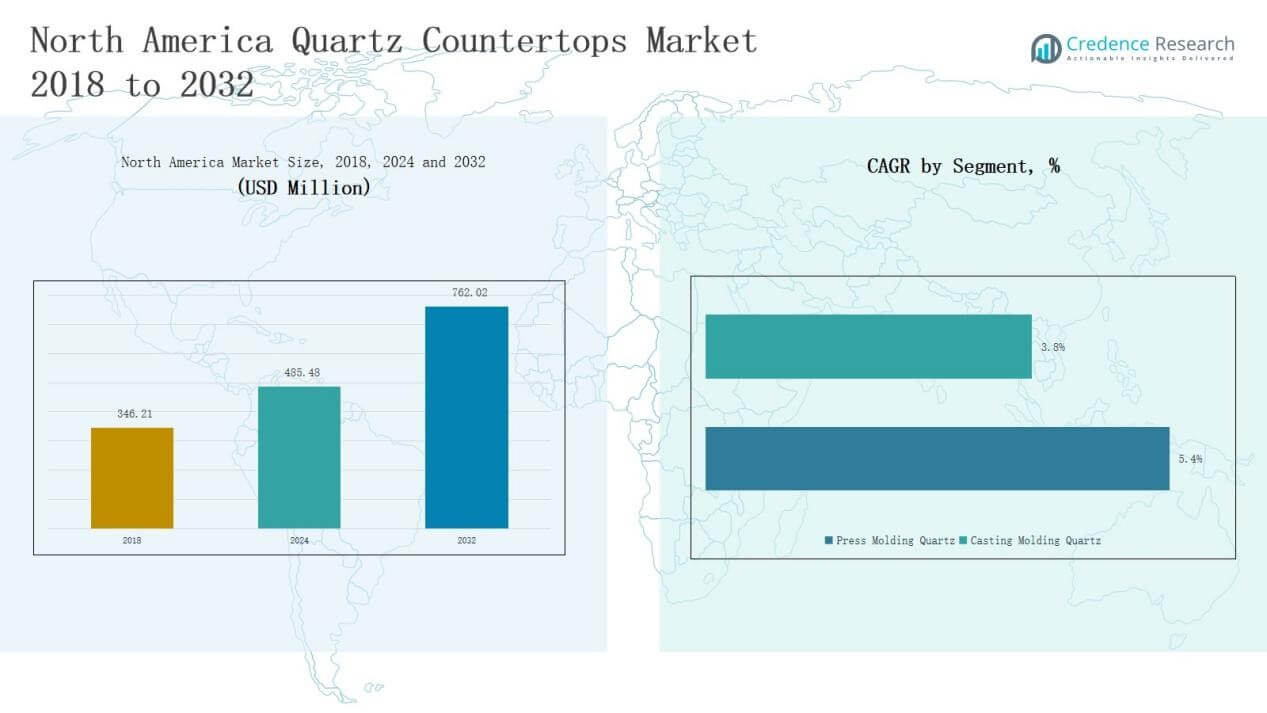

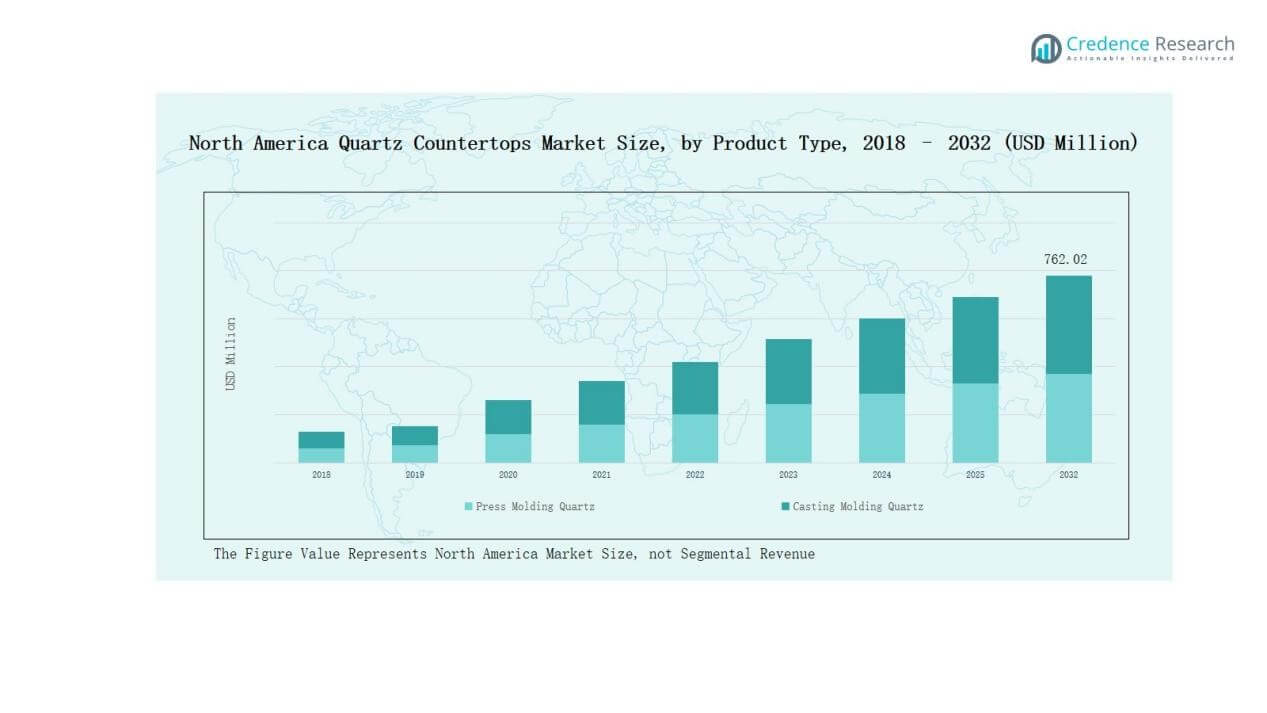

The North America Quartz Countertops Market size was valued at USD 346.21 million in 2018, reached USD 485.48 million in 2024, and is anticipated to reach USD 762.02 million by 2032, at a CAGR of 5.40% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Quartz Countertops Market Size 2024 |

USD 485.48 Million |

| North America Quartz Countertops Market, CAGR |

5.40% |

| North America Quartz Countertops Market Size 2032 |

USD 762.02 Million |

The North America Quartz Countertops Market is highly competitive, with key players such as Cambria, MSI Surfaces, Caesarstone, Silestone (Cosentino), Daltile ONE Quartz, LX Hausys Viatera, Corian Quartz (DuPont), Vicostone USA, Wilsonart Quartz, and Meta Surfaces driving market growth through product innovation, advanced fabrication technologies, and strong distribution partnerships. These companies focus on expanding portfolios with premium finishes, sustainable surfaces, and customized designs to meet rising consumer demand across residential and commercial sectors. Regionally, the United States led the market with 68% share in 2024, supported by robust remodeling activities, established supply networks, and higher adoption of premium countertops in both households and commercial spaces.

Market Insights

Market Insights

- The North America Quartz Countertops Market grew from USD 346.21 million in 2018 to USD 485.48 million in 2024 and is projected to reach USD 762.02 million by 2032 at 5.40% CAGR.

- Press molding quartz led by product type with 62% share in 2024, supported by durability, uniform finish, and strong adoption in both residential and commercial projects.

- The residential segment dominated applications with 70% share in 2024, driven by rising remodeling activities, preference for stylish kitchens, and demand for low-maintenance surfaces.

- The United States held the largest regional share of 68% in 2024, fueled by strong remodeling trends, established supply networks, and widespread use of premium countertops.

- Canada accounted for 19% and Mexico 13% in 2024, supported by urban development, housing projects, and increasing adoption in both residential and commercial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product Type

Press molding quartz dominated the North America Quartz Countertops Market with nearly 62% share in 2024. Its strength, uniform finish, and low maintenance needs make it a preferred choice in both residential and commercial projects. Builders and homeowners favor press molding quartz for its durability and aesthetic consistency, driving steady adoption. Casting molding quartz, though smaller in share, is gaining traction due to design flexibility and ability to replicate natural stone textures at competitive prices.

For instance, Corian Quartz introduced casting-based patterns that incorporate multi-tonal depth, meeting customer preferences for natural stone-inspired textures.

By Application

The residential segment accounted for about 70% share in 2024, making it the leading application in the North America Quartz Countertops Market. Rising home renovation projects, growing demand for stylish kitchen and bathroom surfaces, and preference for low-maintenance materials support its dominance. The commercial segment, holding the remaining share, benefits from adoption in hotels, restaurants, and offices where durability and premium aesthetics are key. This trend positions quartz as a strong alternative to granite and marble.

For instance, Caesarstone launched its Pebbles Collection featuring nature-inspired hues, which has been widely adopted in residential remodeling projects across the U.S.

Key Growth Drivers

Rising Residential Remodeling Activities

Home renovation and remodeling projects strongly boost demand for quartz countertops in North America. Growing consumer preference for stylish, durable, and low-maintenance surfaces makes quartz a leading choice in kitchens and bathrooms. Rising disposable incomes and higher spending on home interiors further support adoption. Developers and homeowners are replacing natural stone and laminates with quartz to achieve modern finishes, fueling market expansion across urban and suburban households.

Superior Material Properties of Quartz

Quartz countertops offer superior durability, stain resistance, and design uniformity compared to alternatives like granite or marble. These properties align well with consumer demand for low-maintenance and aesthetically appealing surfaces. Manufacturers highlight features such as scratch resistance and antibacterial surfaces, which further enhance adoption. The combination of functionality and aesthetics creates sustained demand in both residential and commercial sectors, solidifying quartz’s competitive advantage over other countertop materials in North America.

For instance, Caesarstone introduced its Mineral™ collection, engineered with a blend of natural minerals and recycled materials to deliver enhanced hardness and reduced silica content, highlighting both performance and sustainability.

Expansion of Distribution and Retail Networks

Wider retail presence and online distribution channels have made quartz countertops more accessible to consumers. Large home improvement retailers, specialty stores, and e-commerce platforms play an important role in expanding reach. Leading manufacturers partner with distributors to enhance availability and showcase diverse product portfolios. Improved accessibility, coupled with competitive pricing and promotional campaigns, strengthens market penetration. This expansion ensures consumers across various income segments can access quartz countertops, supporting steady demand growth.

For instance, LOTTE Chemical and Kalacatta Stone strengthened U.S. distribution of Belenco Quartz through a new partnership to boost market reach and availability.

Key Trends & Opportunities

Key Trends & Opportunities

Growing Demand for Sustainable Surfaces

Eco-friendly and recycled quartz countertops are gaining traction in the North America market. Manufacturers increasingly integrate recycled glass and industrial byproducts into production to reduce environmental impact. This trend aligns with rising consumer awareness about sustainability and stricter green building regulations. Companies offering eco-certified products are likely to capture premium demand from environmentally conscious buyers, creating a strong opportunity to differentiate offerings in a competitive market landscape.

For instance, IceStone produces countertops using recycled glass, Portland cement, and non-toxic pigments, creating surfaces with minimal environmental footprint while ensuring aesthetic appeal.

Customization and Premium Aesthetics

Consumers increasingly demand customized countertops with unique colors, textures, and edge profiles. Advanced digital fabrication technologies allow manufacturers to deliver personalized products at scale. The rising popularity of marble-look and matte-finish quartz in high-end projects creates growth opportunities. Luxury residential projects and modern commercial spaces prioritize premium aesthetics alongside performance, driving demand for innovative designs. Customization provides manufacturers a pathway to expand their customer base and strengthen brand positioning in the region.

For instance, Caesarstone introduced its Pebbles Collection featuring unique soft textures and earthy tones, designed to bring a natural aesthetic to custom kitchen and bathroom designs.

Key Challenges

High Production and Installation Costs

Quartz countertops are often more expensive to produce and install compared to laminate or tile alternatives. High raw material and fabrication costs can limit affordability, particularly among price-sensitive buyers. This price gap slows adoption in mid-income households, where cost remains a critical factor. Manufacturers face challenges in balancing quality with competitive pricing while maintaining margins, especially amid rising energy and labor costs in North America.

Supply Chain and Raw Material Constraints

The quartz industry depends on steady supply of natural quartz and resins, which face global sourcing challenges. Disruptions in raw material availability, logistical delays, or higher import costs create uncertainties in the supply chain. Such constraints may lead to fluctuations in product availability and pricing, impacting distributors and retailers. Manufacturers need to build resilient supply networks and diversify sourcing strategies to reduce dependence on limited suppliers and global volatility.

Competition from Alternative Materials

Quartz competes with a wide range of countertop materials, including granite, solid surfaces, porcelain, and emerging sintered stones. Each alternative offers unique selling points such as natural aesthetics, heat resistance, or lower cost. Growing innovations in ceramics and engineered stone segments increase competitive pressure. To sustain growth, quartz manufacturers must consistently innovate and highlight value propositions, ensuring the product remains differentiated and attractive in a market with multiple material choices.

Regional Analysis

United States

The United States held the largest share of the North America Quartz Countertops Market with 68% in 2024. Strong residential remodeling activity and rising demand for premium kitchen and bathroom surfaces drive its dominance. Homeowners prefer quartz for its durability, design consistency, and low maintenance compared to granite or marble. The presence of established manufacturers and large-scale distribution networks supports steady adoption. Commercial usage in hospitality, retail, and office spaces further strengthens market growth. It is expected to remain the leading region during the forecast period.

Canada

Canada accounted for 19% share in 2024, supported by increasing investments in housing projects and renovations. Rising disposable income and growing urban development encourage the use of quartz countertops in both new constructions and remodeling activities. Canadian consumers favor quartz for its eco-friendly features and modern aesthetics. Import dependency is notable, but local distributors ensure product availability across major cities. Commercial demand from hotels, restaurants, and retail outlets also contributes to market expansion. It is projected to maintain a stable growth path with rising consumer awareness.

Mexico

Mexico represented 13% share in 2024, with growth fueled by rising urbanization and expanding middle-class income levels. Increasing adoption of modern interiors in residential construction supports quartz demand. Developers and contractors favor quartz countertops for their affordability and premium appearance. While the market is still developing compared to the U.S. and Canada, rising investments in commercial projects such as offices and hospitality spaces enhance prospects. Local distribution partnerships improve accessibility and drive awareness of quartz products. It is emerging as a promising contributor to regional market growth.

Market Segmentations:

Market Segmentations:

By Product Type

- Press Molding Quartz

- Casting Molding Quartz

By Application

- Residential

- Commercial

- Others

By Region

Competitive Landscape

The North America Quartz Countertops Market features intense competition with a strong presence of regional and global manufacturers. Leading companies such as Cambria, MSI Surfaces, Caesarstone, Silestone (Cosentino), Daltile ONE Quartz, LX Hausys Viatera, Corian Quartz (DuPont), Vicostone USA, Wilsonart Quartz, and Meta Surfaces dominate the competitive landscape. These players focus on expanding product portfolios with innovative colors, textures, and finishes to meet evolving consumer preferences in residential and commercial projects. Strategic partnerships with distributors, retailers, and home improvement chains strengthen their market reach. Companies invest in digital fabrication and advanced design technologies to improve customization capabilities and capture premium demand. Sustainability initiatives, including eco-friendly production and recycled content, are gaining traction as differentiation strategies. Price competition remains significant, but brand recognition and strong distribution networks provide an edge to established leaders. The market is expected to see continued consolidation through acquisitions and partnerships, enhancing competitive positioning across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Cambria

- MSI Surfaces

- Caesarstone

- Silestone (Cosentino)

- Daltile ONE Quartz

- LX Hausys Viatera

- Corian Quartz (DuPont)

- Vicostone USA

- Wilsonart Quartz

- Meta Surfaces

Recent Developments

- In August 2024, Vadara Quartz Surfaces launched four new distribution partnerships across the U.S. East Coast.

- In April 2024, Corian® Design by DuPont unveiled six new aesthetics in its Corian® Quartz collection.

- In July 2024, Cutting Edge Countertops acquired L.E. Smith Company to strengthen its hard surface portfolio.

- In February 2025, Arcasurfaces introduced 12 new additions to its PentalQuartz® collection (e.g. Bianco Sol, Carrara Vario).

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for quartz countertops will rise with increasing home renovation and remodeling projects.

- Residential applications will continue to dominate supported by preference for durable and stylish surfaces.

- Commercial adoption will expand as hotels, restaurants, and offices invest in premium interiors.

- Sustainability initiatives will gain momentum with growth in recycled and eco-friendly quartz offerings.

- Customization will become a key driver as consumers seek unique colors, textures, and edge designs.

- Digital fabrication technologies will improve design precision and support wider adoption in premium projects.

- Distribution networks will strengthen through partnerships with large retailers and online platforms.

- Competition from alternative materials like porcelain and sintered stone will challenge market expansion.

- Leading companies will focus on acquisitions and collaborations to consolidate regional presence.

- Mexico will emerge as a promising growth hub alongside the established U.S. and Canadian markets.

Market Insights

Market Insights Key Trends & Opportunities

Key Trends & Opportunities Market Segmentations:

Market Segmentations: