Market Overview

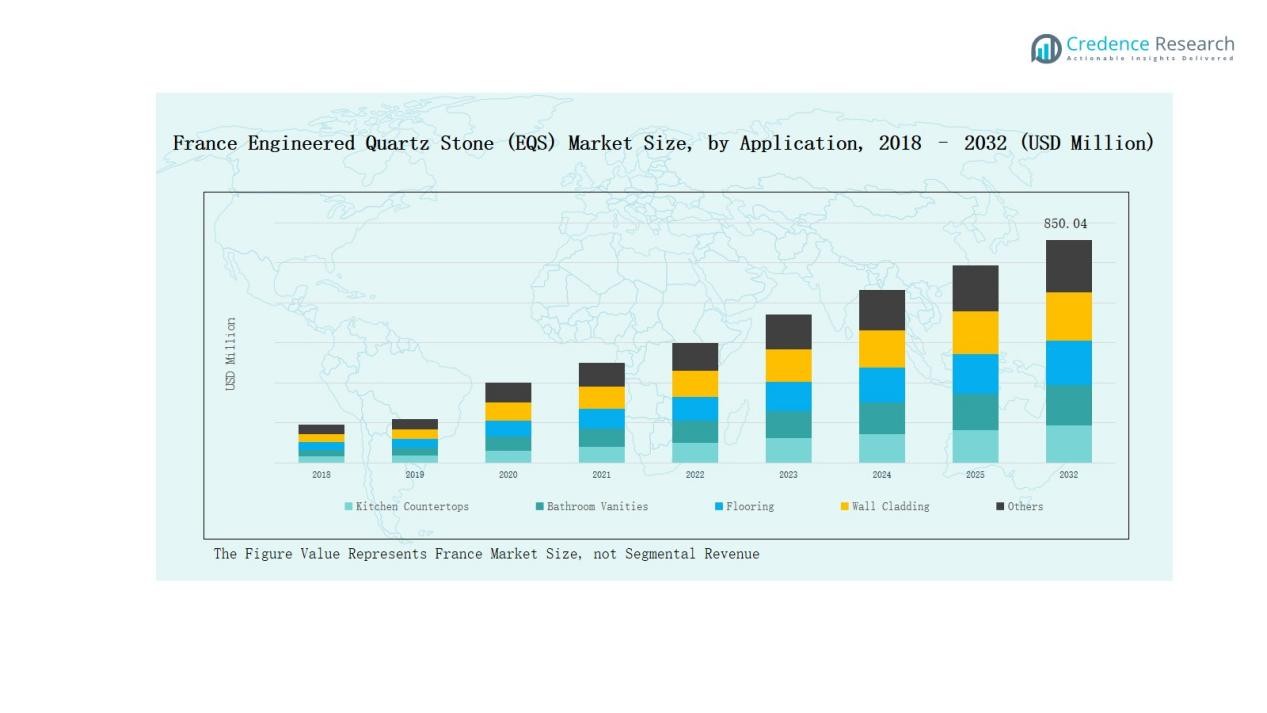

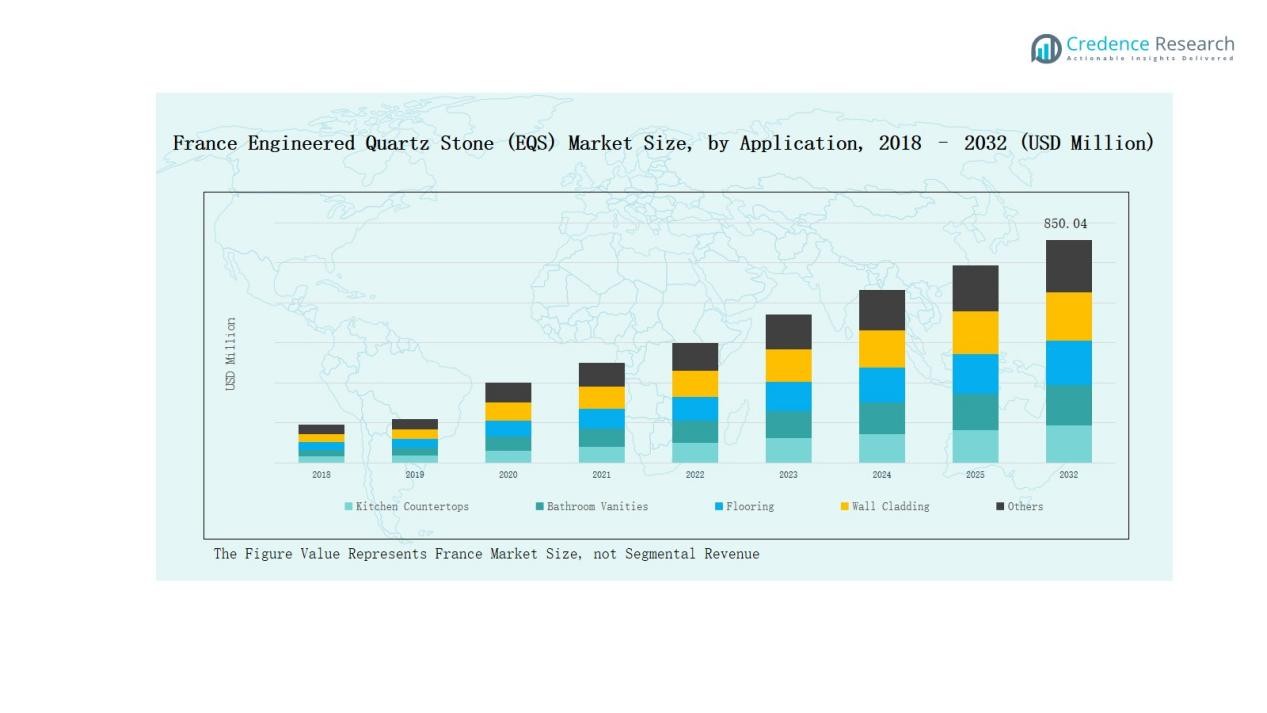

The France Engineered Quartz Stone (EQS) Market size was valued at USD 336.02 million in 2018, reached USD 504.39 million in 2024, and is anticipated to reach USD 850.04 million by 2032, at a CAGR of 6.28% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Engineered Quartz Stone (EQS) Market Size 2024 |

USD 504.39 Million |

| France Engineered Quartz Stone (EQS) Market, CAGR |

6.28% |

| France Engineered Quartz Stone (EQS) Market Size 2032 |

USD 850.04 Million |

The France Engineered Quartz Stone (EQS) Market is shaped by prominent players including Cosentino, Caesarstone, COMPAC France, Quarella France, Lapitec France, Silestone France, Technistone France, Wilsonart, Breton, and Stone Italiana France. These companies strengthen their market positions through extensive product portfolios, sustainable manufacturing practices, and strong distribution networks. Innovation in design and eco-friendly production has enabled them to capture both residential and commercial demand. Northern France emerged as the leading region with 36% share in 2024, supported by high urbanization, luxury housing projects, and large-scale commercial developments that drive consistent adoption of engineered quartz surfaces.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The France Engineered Quartz Stone (EQS) Market grew from USD 336.02 million in 2018 to USD 504.39 million in 2024 and will reach USD 850.04 million by 2032.

- Kitchen countertops led with 48% share in 2024, followed by bathroom vanities at 23%, while flooring and wall cladding jointly accounted for 21%.

- Distributors and dealers dominated distribution with 41% share, direct sales captured 28%, and home improvement retailers held 19%, with others contributing 12%.

- Northern France commanded 36% share in 2024, driven by urbanization, luxury housing, and strong commercial construction projects supported by extensive distribution networks.

- Leading players include Cosentino, Caesarstone, COMPAC France, Quarella France, Lapitec France, Silestone France, Technistone France, Wilsonart, Breton, and Stone Italiana France.

Market Segment Insights

By Application

Kitchen countertops dominated the France Engineered Quartz Stone (EQS) Market with nearly 48% share in 2024. Their leadership stems from strong demand in residential renovations and premium housing projects. Consumers prefer quartz for stain resistance, durability, and modern aesthetics compared to natural stone. Bathroom vanities followed with around 23% share, driven by growing bathroom remodeling activities. Flooring and wall cladding applications jointly held about 21%, while other uses contributed 8%, reflecting niche adoption in furniture and design elements.

- For instance, Caesarstone introduced its Porcelain and Mineral Surfaces ranges in Europe, highlighting their use in modern kitchen countertops and expanded surface options.

By Distribution Channel

Distributors and dealers led the France EQS market with 41% share in 2024, supported by extensive networks that ensure product reach across urban and semi-urban areas. Direct sales accounted for nearly 28%, backed by strong partnerships with builders and contractors managing large-scale projects. Home improvement retailers captured around 19%, reflecting rising do-it-yourself trends and retail availability. The remaining 12% share came from other channels, including specialty outlets and online platforms, which are gradually expanding through digital sales strategies.

- For instance, Point.P, a subsidiary of Saint-Gobain Distribution Bâtiment France, enhanced its direct sales channel by collaborating with large construction contractors to supply energy-efficient equipment for housing renovation projects.

Key Drivers

Rising Residential Renovation and Remodeling

The France Engineered Quartz Stone (EQS) Market benefits significantly from strong demand in home renovation projects. Rising disposable income and preference for modern interiors drive the adoption of quartz for kitchen countertops and bathroom vanities. Consumers increasingly value durability, ease of maintenance, and design versatility, which positions quartz as a preferred alternative to natural stone. Large-scale urban housing upgrades and government incentives for energy-efficient renovations further support demand, creating consistent growth across residential applications and boosting market expansion.

- For instance, Caesarstone maintains a strong presence in France with its durable quartz surfaces, favored for kitchen countertops and bathroom vanities, supported by a 25-year product warranty ensuring long-term customer confidence.

Expanding Commercial Infrastructure Projects

Commercial real estate growth across France strongly supports EQS demand. Hotels, offices, and retail complexes increasingly adopt engineered quartz due to its aesthetic appeal, cost efficiency, and sustainability. Architects and contractors recommend quartz surfaces for high-traffic areas given their durability and long lifecycle. Major investments in urban development and foreign capital inflows are boosting demand for premium building materials. These factors ensure that commercial spaces remain a significant contributor, reinforcing quartz adoption beyond traditional residential applications.

Shift Toward Sustainable Building Materials

Sustainability is emerging as a vital growth driver in the French market. Engineered quartz incorporates recycled content, reduces water consumption during production, and supports green building certifications. Rising consumer awareness about eco-friendly materials, alongside government emphasis on carbon reduction, is pushing demand for sustainable surface solutions. Manufacturers are also adopting advanced processes that reduce emissions and improve energy efficiency. These practices align with France’s environmental regulations, positioning EQS as a material of choice for both environmentally conscious consumers and corporate buyers.

- For instance, the French government mandates that all new public buildings contain at least 50% wood or other sustainable materials, which has driven major projects like Bordeaux’s timber towers for low-carbon construction.

Key Trends & Opportunities

Adoption of Innovative Design and Finishes

The market is witnessing a surge in demand for advanced finishes and colors. French consumers increasingly prefer products that replicate natural stone aesthetics while offering enhanced durability. Manufacturers are focusing on matte, textured, and large-format slabs to cater to evolving design preferences. This trend provides opportunities for players to differentiate portfolios and expand into premium segments. The shift toward customization and luxury finishes highlights the role of innovation as a critical growth enabler in the French EQS industry.

- For instance, the EQS SUV offers a range of sophisticated exterior paint options, such as metallic, non-metallic, and MANUFAKTUR finishes, broadening consumer choice for personalized elegance.

Expansion of E-Commerce and Online Retail Channels

The rise of online retail is creating new opportunities for engineered quartz distribution. Home improvement platforms and e-commerce channels are enabling wider accessibility, especially for smaller contractors and individual buyers. Digital tools, including virtual design visualization, are enhancing customer engagement and driving sales. As consumer behavior shifts toward convenience and research-based purchasing, online availability is strengthening. This trend opens the path for players to tap into new customer segments and complement existing dealer-driven distribution networks.

- Form instance, Home Depot enhanced its e-commerce experience for countertop surfaces by integrating digital visualization with online quartz ordering, enabling faster selection for DIY renovators and small-scale contractors.

Key Challenges

High Competition and Price Pressures

The France EQS market faces strong competition from both domestic and international brands. Intense rivalry often leads to pricing pressures, which can erode margins for smaller players. Customers are increasingly sensitive to cost differences between engineered quartz and alternative materials such as granite, marble, or ceramics. While premium buyers value design and durability, mass-market consumers often prioritize affordability. This dynamic creates challenges for manufacturers to balance quality, innovation, and cost competitiveness in an already crowded marketplace.

Supply Chain Disruptions and Raw Material Costs

Volatility in the supply of raw materials such as quartz aggregates and resins creates uncertainty in production planning. Rising transportation costs and global supply chain disruptions also contribute to fluctuating prices. Manufacturers in France often rely on imports for key inputs, making them vulnerable to international trade restrictions and currency fluctuations. These challenges increase operational costs, which are difficult to fully pass on to customers, thereby impacting profitability and long-term stability for market participants.

Environmental Regulations and Compliance Costs

Strict environmental regulations in France add pressure on engineered quartz manufacturers. Compliance with carbon emission limits, waste management norms, and workplace safety standards requires continuous investment in technology and infrastructure. Small and mid-sized companies often struggle to keep up with these requirements, raising entry barriers and limiting their competitiveness. While sustainability drives long-term demand, the short-term cost burden of compliance poses significant challenges. This dynamic forces players to innovate processes while managing financial pressures effectively.

Regional Analysis

Northern France

Northern France held the leading position in the France Engineered Quartz Stone (EQS) Market with 36% share in 2024. Strong urbanization and luxury residential projects in cities such as Paris drive consumption of premium quartz surfaces. High demand for kitchen countertops and bathroom vanities reflects the region’s focus on modern interior aesthetics and low-maintenance materials. Developers and contractors prefer engineered quartz for large-scale commercial and retail projects due to its durability. It benefits from established distribution networks and strong presence of international brands.

Western France

Western France accounted for 24% share in 2024, supported by steady growth in residential remodeling and coastal urban development. Consumers in this region prefer quartz for flooring and wall cladding applications, which aligns with sustainable building trends. The presence of mid-sized construction projects and lifestyle-focused renovations supports demand. Dealers and distributors remain key channels, ensuring availability in both urban and semi-urban markets. It shows consistent adoption driven by increasing preference for durable and versatile surface solutions.

Southern France

Southern France captured 22% share in 2024, fueled by growth in tourism-related infrastructure such as hotels and resorts. The hospitality sector heavily uses quartz in lobbies, kitchens, and bathrooms for its aesthetic appeal and long lifecycle. Rising investments in luxury housing along the Mediterranean coast further push adoption. Homeowners also favor quartz due to its resistance to stains and moisture, making it suitable for high-use areas. It continues to benefit from alignment with design-focused consumer demand and upscale construction activity.

Eastern France

Eastern France represented 18% share in 2024, driven by industrial development and rising adoption in commercial spaces. The region shows increasing demand for quartz in office and retail projects due to its strength and design versatility. Bathroom vanities and kitchen countertops remain core applications, while flooring is gradually expanding. Distributors play a critical role in expanding product accessibility across regional cities. It reflects steady growth, supported by a mix of residential upgrades and ongoing commercial infrastructure development.

Market Segmentations:

By Application

- Kitchen Countertops

- Bathroom Vanities

- Flooring

- Wall Cladding

- Others

By Distribution Channel

- Direct Sales

- Distributors/Dealers

- Home Improvement Retailers

- Others

By Region

- North France

- Western France

- Southern France

- Eastern France

Competitive Landscape

The France Engineered Quartz Stone (EQS) Market is highly competitive, with both international and domestic players shaping its structure. Leading companies such as Cosentino, Caesarstone, COMPAC France, Quarella France, Lapitec France, Silestone France, Technistone France, Wilsonart, Breton, and Stone Italiana France dominate through extensive product portfolios, established dealer networks, and strategic partnerships with architects and contractors. These players focus on offering a wide range of designs, sustainable manufacturing practices, and advanced customization options to meet evolving consumer demand. Competition is fueled by rising investments in eco-friendly production and innovative finishes, enabling differentiation in a crowded market. While premium players capture strong market share with luxury offerings, smaller regional firms compete through cost-effective solutions and localized distribution. Strategic emphasis on sustainability, digital presence, and product innovation defines competitive positioning. The market continues to witness new product launches and collaborations, which intensify rivalry while expanding adoption across residential and commercial applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Cosentino

- Caesarstone

- COMPAC France

- Quarella France

- Lapitec France

- Silestone France

- Technistone France

- Wilsonart

- Breton

- Stone Italiana France

Recent Developments

- In May 2024, Caesarstone launched new engineered quartz surface collections featuring recycled content, expanding its sustainable product line.

- In April 2025, Stone Plus Enterprises entered a strategic partnership with Raj Kesari Rocks to expand into engineered quartz surfaces.

- In September 2025, Caesarstone introduced a silica-free quartz surface line named Icon, eliminating nearly all crystalline silica in its new formulations.

Report Coverage

The research report offers an in-depth analysis based on Application, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow steadily with rising residential renovation and remodeling activities across major cities.

- Kitchen countertops will remain the dominant application, supported by strong consumer preference for durability.

- Bathroom vanities will expand further, driven by premium housing and modern interior design trends.

- Commercial projects such as hotels and offices will increase adoption due to long lifecycle performance.

- Sustainable and recycled quartz products will gain traction under stricter environmental regulations.

- Northern France will continue leading the market, supported by urbanization and large-scale construction.

- Online retail platforms and digital visualization tools will enhance consumer engagement and sales.

- Product innovation in finishes, colors, and textures will drive demand for premium offerings.

- Strategic partnerships between manufacturers and builders will strengthen distribution efficiency.

- Competition among international and domestic players will intensify, encouraging cost efficiency and innovation.