Market Overview:

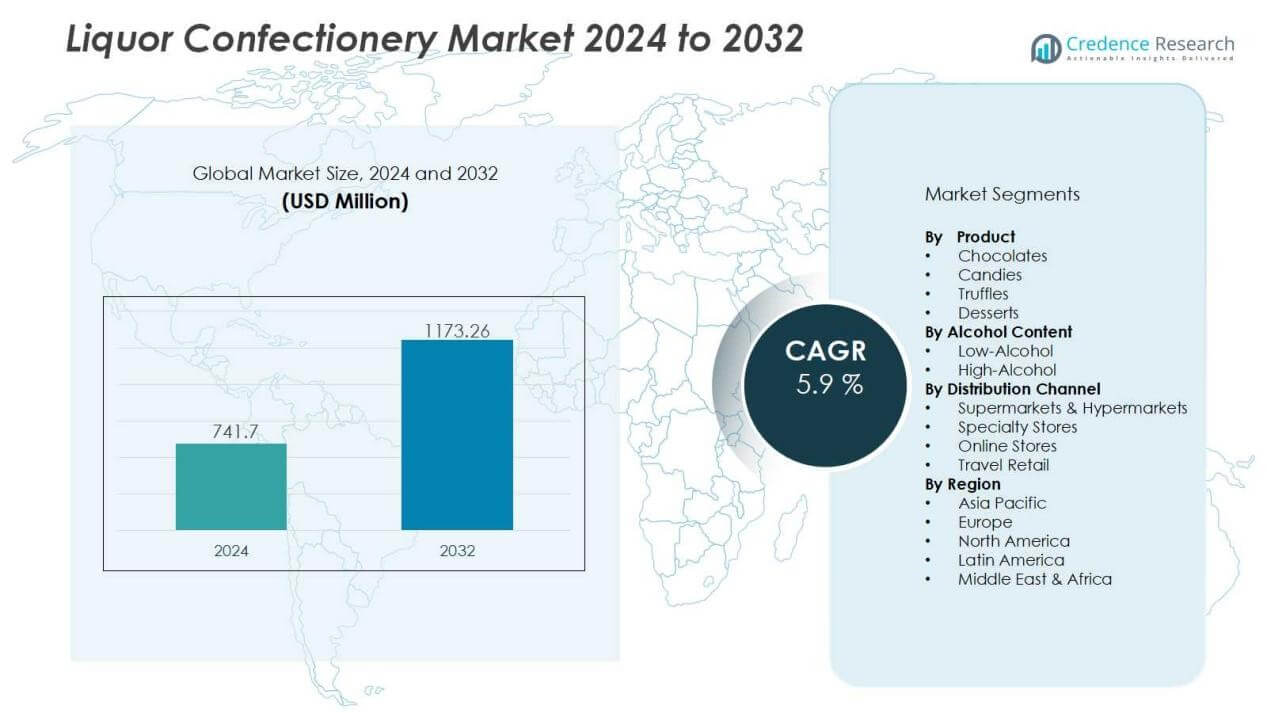

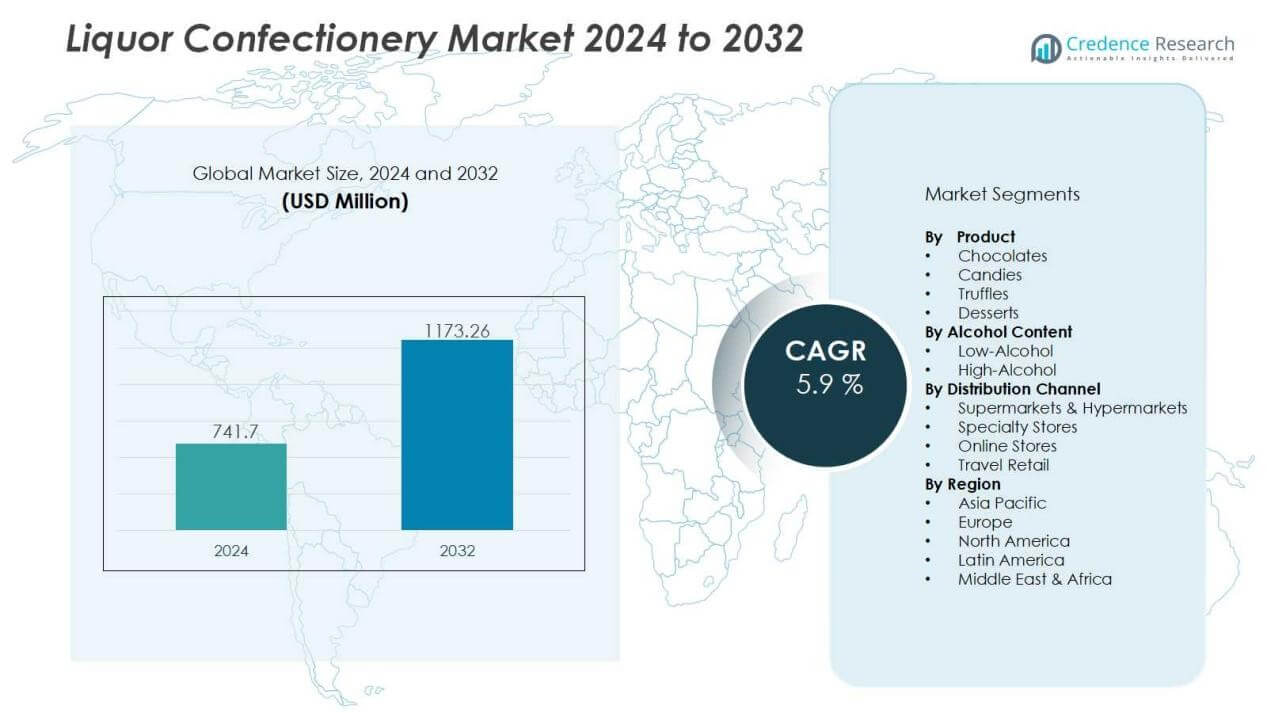

The liquor confectionery market size was valued at USD 741.7 million in 2024 and is anticipated to reach USD 1173.26 million by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Liquor Confectionery Market Size 2024 |

USD 741.7 Million |

| Liquor Confectionery Market, CAGR |

5.9% |

| Liquor Confectionery Market Size 2032 |

USD 1173.26 Million |

Key drivers include increasing consumer interest in unique flavor experiences and alcohol-infused products. Premiumization trends in chocolates and candies have encouraged manufacturers to launch innovative offerings that blend confectionery with spirits. Additionally, gifting culture, festive consumption, and greater acceptance of alcohol-based products in mainstream retail channels are boosting demand. The market is also benefiting from brand collaborations between confectionery producers and liquor companies, which enhance product visibility and consumer engagement.

Regionally, Europe dominates the liquor confectionery market due to strong cultural acceptance and high per capita confectionery consumption. North America follows closely, driven by demand for premium chocolates and innovative indulgent products. The Asia Pacific market is witnessing rapid growth, supported by rising disposable incomes, urbanization, and evolving consumer lifestyles. Latin America and the Middle East & Africa present emerging opportunities, driven by expanding retail networks and increasing adoption of western confectionery trends.

Market Insights:

Market Insights:

- The liquor confectionery market was valued at USD 741.7 million in 2024 and is projected to reach USD 1173.26 million by 2032 at a CAGR of 5.9%.

- Rising demand for premium indulgence drives growth, with consumers seeking unique taste profiles combining spirits and confectionery.

- Collaborations between liquor companies and confectionery brands enhance visibility and accelerate acceptance of alcohol-infused sweets in mainstream markets.

- Younger consumers, especially Millennials and Gen Z, favor experiential products, boosting adoption of liquor-based chocolates and candies.

- Retail expansion in supermarkets, specialty stores, and travel retail, supported by rapid e-commerce growth, strengthens global accessibility.

- Challenges include regulatory restrictions, cultural sensitivities, health concerns, and price pressures that influence consumer choices and limit growth.

- Europe led with 41% market share in 2024, followed by North America at 28%, while Asia Pacific recorded 21% and remains the fastest-growing region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Premium and Indulgent Confectionery Experiences:

The liquor confectionery market benefits from increasing consumer appetite for premium indulgence. Shoppers seek unique taste profiles that combine spirits with chocolates or candies. Premiumization trends drive innovation in packaging, product quality, and exclusivity. It allows brands to position products as lifestyle-driven luxuries. Gifting occasions and festive consumption further enhance demand for these products.

- For instance, for the 2025 holiday season, Ferrero introduced a line of new products, including Ferrero Rocher chocolate squares, Marshmallow Butterfinger, and CRUNCH White.

Expanding Collaborations Between Liquor and Confectionery Brands:

Strategic partnerships between liquor manufacturers and confectionery producers shape the market. Such collaborations create innovative products that blend established spirits with traditional sweets. It strengthens brand visibility while appealing to diverse consumer groups. Joint ventures also expand distribution across luxury retail and travel outlets. These partnerships help accelerate acceptance of alcohol-infused treats in mainstream markets.

- For instance, Kahlúa’s partnership with Cardi B’s Whipshots® for their Chocolate Sips launch introduced two distinct flavor variations—Smooth Chocolate and White Chocolate—in late 2024. While a Kahlúa press release stated that the Smooth Chocolate and White Chocolate flavors received scores of 93 and 94 points respectively at the 2024 New York International Spirits Competition (NYISC)

Growing Acceptance of Alcohol-Based Confectionery Among Younger Consumers:

Younger demographics drive strong adoption of liquor confectionery products due to their novelty. Millennials and Gen Z value experiential consumption, making them receptive to alcohol-infused sweets. It reflects evolving lifestyles where taste exploration ranks higher than conventional choices. Social media further amplifies product discovery and brand engagement. Rising urbanization and disposable incomes reinforce this trend across global markets.

Increasing Role of Retail Expansion and Online Distribution Channels:

The liquor confectionery market benefits from wider retail presence in supermarkets, specialty shops, and duty-free stores. Global travel retail hubs offer premium positioning to attract tourists and gift buyers. It also thrives on the rapid growth of e-commerce platforms, providing global reach and convenience. Online channels allow niche brands to connect directly with consumers. Expanding accessibility ensures steady growth across diverse regions and demographics.

Market Trends:

Innovation in Flavor Combinations and Premium Product Development:

The liquor confectionery market is experiencing a wave of innovation focused on flavor diversity and premium positioning. Manufacturers are blending popular spirits such as whiskey, rum, and liqueurs with chocolates, truffles, and candies to create unique indulgent experiences. It reflects the growing demand for products that deliver sophistication and novelty in everyday consumption. Premium packaging and limited-edition releases further reinforce exclusivity and appeal to affluent consumers. Seasonal launches around holidays and gifting occasions provide momentum to sales. Brands are also experimenting with low-sugar and clean-label formulations to align with evolving consumer preferences for healthier indulgence.

- For Instance, Crown Royal has released a Limited Edition Chocolate Flavored Canadian Whisky. This release combines premium Canadian whisky with notes of chocolate, caramel, and vanilla to create a velvety, dessert-like flavor profile. While this is a seasonal and limited release, it is being distributed nationwide across the U.S. for a suggested retail price of $26.99

Expansion of Global Distribution and Influence of Lifestyle Trends:

The liquor confectionery market continues to expand its presence across global retail channels, including supermarkets, specialty shops, and duty-free outlets. It benefits from rising international travel and consumer preference for gifting premium alcohol-infused sweets. Online platforms also play a key role in extending reach to new demographics and niche markets. Growing influence of lifestyle trends that prioritize experiential consumption supports the adoption of alcohol-based confectionery products. Social media campaigns and influencer partnerships amplify visibility among younger audiences. Regional markets in Asia Pacific and Latin America are emerging as growth hotspots due to increasing disposable incomes and evolving consumer tastes.

- For instance, in September 2023, Kweichow Moutai partnered with Mars’ Dove brand to launch alcohol-infused chocolates across 1 500 duty-free and specialty retail outlets in China, with each piece containing 2% Moutai baijiu by weight.

Market Challenges Analysis:

Regulatory Restrictions and Cultural Sensitivities Across Markets:

The liquor confectionery market faces hurdles from varying regulatory frameworks that govern alcohol-infused products. Many countries impose strict labeling requirements, age restrictions, and advertising limitations, which reduce market accessibility. Cultural sensitivities in regions with low alcohol tolerance also restrict consumption. It challenges manufacturers to balance innovation with compliance to avoid market entry barriers. Duty-free sales remain important but depend heavily on international travel patterns. Fluctuations in tourism and trade policies further add uncertainty to sales strategies.

Health Concerns and Price Sensitivity Among Consumers:

Health-conscious consumers present another challenge by limiting the appeal of alcohol-infused confectionery. Concerns about sugar content, calorie intake, and alcohol presence influence purchase decisions. It forces companies to invest in reformulation and alternative ingredients to sustain demand. High pricing of premium liquor-based sweets restricts affordability among price-sensitive buyers. Competition from regular confectionery and non-alcoholic indulgent options also pressures market share. Rising costs of raw materials and supply chain disruptions add financial strain to producers.

Market Opportunities:

Rising Demand for Premium Gifting and Experiential Products:

The liquor confectionery market holds strong opportunities in the premium gifting segment. Consumers increasingly value products that combine indulgence with exclusivity, creating space for luxury packaging and limited editions. Seasonal demand around holidays, weddings, and corporate gifting reinforces this trend. It allows brands to expand product portfolios tailored to celebratory occasions. Collaborations between liquor companies and confectionery manufacturers can enhance product appeal. Growing interest in experiential consumption ensures continued demand for innovative alcohol-infused sweets.

Expansion Through Emerging Markets and Digital Channels:

Emerging economies present significant growth opportunities due to rising disposable incomes and evolving consumer tastes. The liquor confectionery market can strengthen its presence by targeting urban populations in Asia Pacific, Latin America, and the Middle East. It also benefits from the rapid adoption of e-commerce, which offers wider reach and convenience. Online platforms allow niche brands to scale quickly while engaging directly with younger demographics. Travel retail expansion further boosts exposure among international buyers. Health-focused innovations, such as low-sugar or natural ingredient variants, can capture demand from wellness-oriented consumers.

Market Segmentation Analysis:

By Product:

The liquor confectionery market by product is led by chocolates, which remain the most popular choice due to widespread acceptance and premium positioning. It benefits from strong demand in gifting and seasonal consumption. Candies and gums infused with alcohol are also gaining traction, particularly among younger consumers who prefer novelty items. Truffles and specialty desserts represent a niche but growing category, supported by luxury branding and gourmet retail expansion.

- For Instance, Lindt & Sprüngli, a major Swiss chocolatier, leverages a distribution network that includes subsidiaries, independent distributors, and its own stores to sell products in over 120 countries.

By Alcohol Content:

The market by alcohol content is divided into low-alcohol and high-alcohol offerings. Low-alcohol products dominate due to broader consumer acceptance and fewer regulatory barriers. It appeals to health-conscious buyers and regions with stricter rules on alcohol consumption. High-alcohol confectionery serves a premium audience, especially in Europe and North America, where demand for bold flavors and indulgent experiences is strong.

- For Instances, At ISM & ProSweets 2025, Smith & Sinclair showcased its ‘Eat Your Drink’ cocktail gummy line, which includes a deconstructed Whiskey & Ginger flavor with a maximum of 5% alcohol by volume and 36 calories per piece.

By Distribution Channel:

The liquor confectionery market thrives across multiple distribution channels. Supermarkets and hypermarkets account for the largest share, supported by wide product availability and consumer trust. Specialty stores offer premium and exclusive selections, targeting high-income groups. Online channels are rapidly growing, providing global reach and direct consumer engagement. Travel retail remains significant, with duty-free outlets positioning these products as premium gifts for international travelers.

Segmentations:

By Product:

- Chocolates

- Candies

- Truffles

- Desserts

By Alcohol Content:

By Distribution Channel:

- Supermarkets & Hypermarkets

- Specialty Stores

- Online Stores

- Travel Retail

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Europe:

Europe accounted for 41% market share in 2024, making it the leading region. The liquor confectionery market thrives here due to cultural acceptance of alcohol-infused sweets and high confectionery consumption levels. It benefits from established brands, luxury gifting traditions, and strong retail networks. Seasonal demand during Christmas, Easter, and other festivals supports consistent sales growth. Duty-free stores across major airports further expand premium product accessibility. Innovation in flavors and collaborations with liquor brands strengthen the regional position.

North America:

North America held 28% market share in 2024, supported by demand for indulgent and innovative confectionery. The liquor confectionery market in this region benefits from rising interest in premium chocolates and gifting trends. It also gains traction through online retail and strong specialty store presence. Millennials and Gen Z consumers drive growth through their preference for experiential products. Seasonal promotions during Halloween, Thanksgiving, and Valentine’s Day boost demand. Collaborations between U.S. confectionery firms and global liquor brands enhance consumer engagement.

Asia Pacific:

Asia Pacific recorded 21% market share in 2024, positioning it as a high-growth region. The liquor confectionery market benefits from rising disposable incomes, urbanization, and evolving consumer preferences in countries like China, Japan, and India. It is supported by increasing adoption of western lifestyles and gifting traditions. Travel retail in hubs such as Singapore and Hong Kong further accelerates exposure. Latin America and the Middle East & Africa contribute steadily, backed by growing retail expansion and rising urban middle-class populations. Manufacturers view these regions as untapped markets for future product development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Chocolaterie Abtey

- Neuhaus

- Mars, Incorporated

- The Hershey Company

- Brookside

- Ferrero

- Mondelēz International

- Toms Gruppen

- Liqueur Fills

- MoreWines

Competitive Analysis:

The liquor confectionery market is highly competitive, shaped by global and regional players focusing on innovation, premiumization, and consumer engagement. Leading companies include Chocolaterie Abtey, Neuhaus, Mars, Incorporated, The Hershey Company, Brookside, Ferrero, and Mondelēz International. It is characterized by continuous product development, with brands blending high-quality spirits and confectionery to create distinctive offerings. Luxury chocolate makers emphasize exclusivity and craftsmanship, while multinational corporations leverage scale, strong distribution networks, and brand recognition to capture broad consumer bases. Partnerships between liquor brands and confectionery producers strengthen product differentiation and expand visibility in global retail. Online platforms, travel retail, and specialty stores serve as key battlegrounds for premium positioning. Market competition is further intensified by seasonal launches, festive packaging, and the growing influence of social media-driven promotions. Companies investing in healthier formulations, sustainable sourcing, and eco-friendly packaging are gaining competitive advantage and strengthening long-term consumer loyalty.

Recent Developments:

- In August 2025, Hershey’s Reese’s and Oreo brands collaborated on a new product line, launching Reese’s Oreo Cup and Oreo Reese’s Cookie.

- In June 2025, Mondelēz International joined the 100+ Accelerator initiative to advance sustainable innovation at scale.

Report Coverage:

The research report offers an in-depth analysis based on Product, Alcohol Content, Distribution Channel and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Premiumization will continue to shape product development, with brands focusing on luxury packaging and exclusive editions.

- Collaborations between global liquor companies and confectionery producers will expand, creating innovative and cross-branded offerings.

- Health-conscious reformulations, including low-sugar and natural ingredient options, will gain importance in broadening consumer appeal.

- Digital commerce will strengthen its role, enabling brands to reach younger demographics and niche buyers directly.

- Travel retail will remain a critical growth driver, with airports and duty-free outlets promoting premium gifting options.

- Consumer demand for seasonal and festive launches will create consistent sales opportunities across global markets.

- Asia Pacific and Latin America will emerge as dynamic regions, driven by rising disposable incomes and changing lifestyles.

- Social media campaigns and influencer collaborations will enhance visibility and accelerate adoption among younger consumers.

- Sustainable sourcing and eco-friendly packaging will become essential, reflecting rising demand for responsible consumption.

- Innovation in flavor combinations with premium spirits will continue to attract adventurous buyers and strengthen brand differentiation.

Market Insights:

Market Insights: