Market Overview

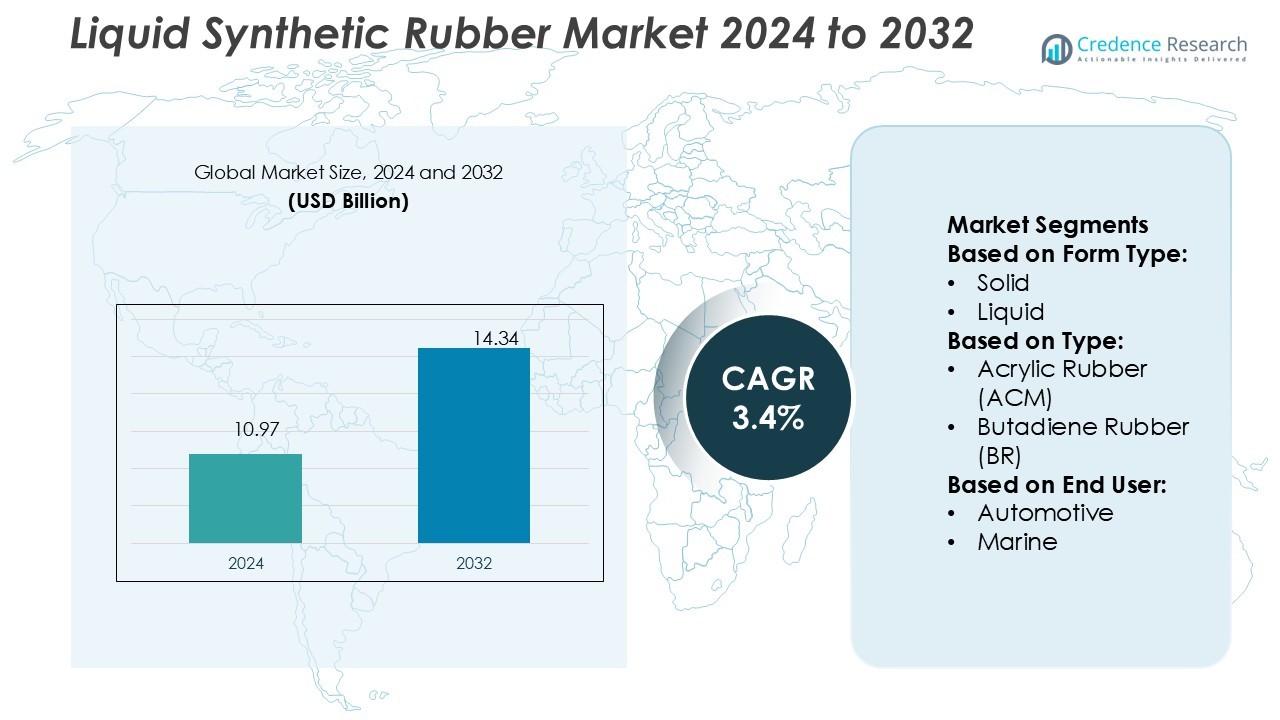

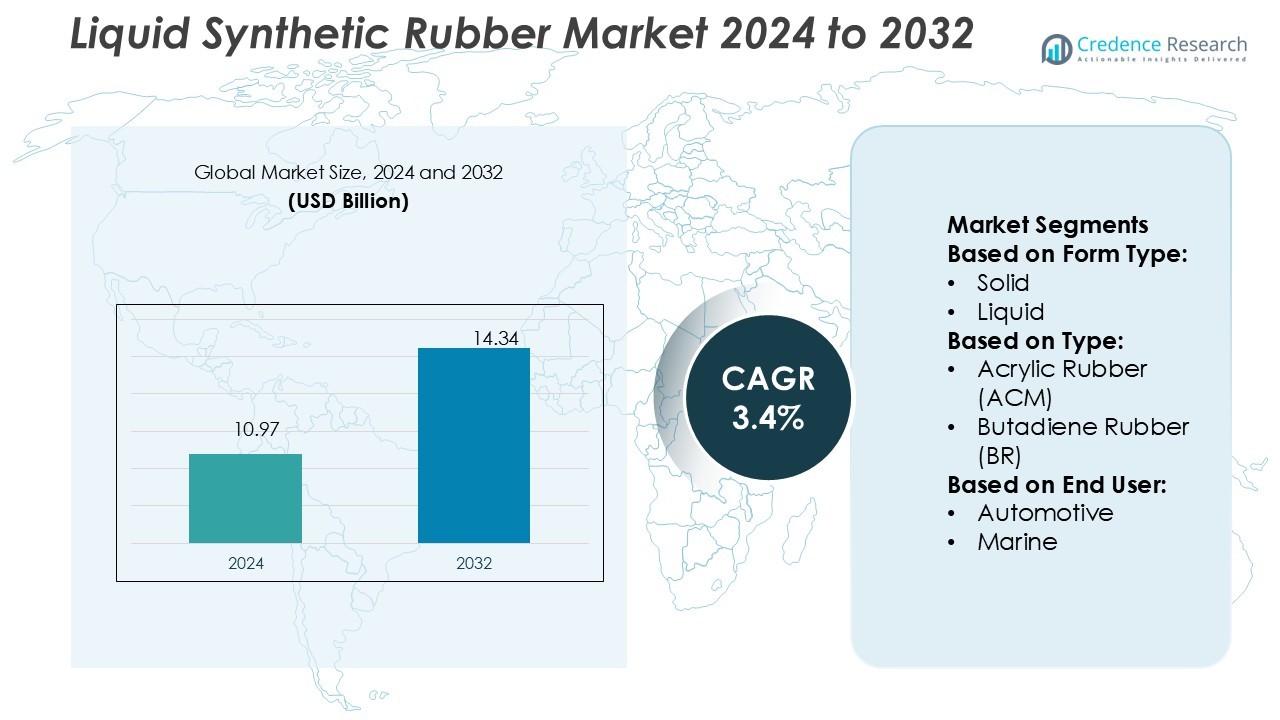

Liquid Synthetic Rubber Market size was valued USD 10.97 billion in 2024 and is anticipated to reach USD 14.34 billion by 2032, at a CAGR of 3.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Liquid Synthetic Rubber Market Size 2024 |

USD 10.97 Billion |

| Liquid Synthetic Rubber Market, CAGR |

3.4% |

| Liquid Synthetic Rubber Market Size 2032 |

USD 14.34 Billion |

The liquid synthetic rubber market is driven by leading players such as Asahi Kasei, ENEOS Corporation, Evonik Industries AG, JSR Corporation, Kumho Petrochemical, Kuraray Co., Ltd, Nippon Soda Co., Ltd, Puyang Linshi Chemical New Material Co., Ltd, Royal Adhesives & Sealants, and Sinopec. These companies emphasize R&D, sustainable product development, and capacity expansions to strengthen their competitive positions across automotive, construction, and industrial applications. Asia-Pacific leads the global market with a 42% share in 2024, supported by rapid industrialization, strong automotive production, and expanding infrastructure development, making it the most dominant and fastest-growing regional hub.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The liquid synthetic rubber market size was valued at USD 10.97 billion in 2024 and is projected to reach USD 14.34 billion by 2032, growing at a CAGR of 3.4%.

- Market growth is driven by rising demand from the automotive sector, particularly in tire manufacturing, where liquid form holds 61% share due to its superior processability and performance.

- Key players such as Asahi Kasei, Kumho Petrochemical, Sinopec, and Evonik Industries focus on R&D, capacity expansions, and sustainable product development to gain competitive advantage.

- Market restraints include volatility in raw material prices and stringent environmental regulations, which increase production costs and limit formulation flexibility.

- Asia-Pacific leads with 42% share in 2024, driven by strong industrialization and automotive output, followed by North America at 24% and Europe at 21%, while transportation remains the dominant end-use segment with 47% share globally.

Market Segmentation Analysis:

By Form Type

The liquid synthetic rubber market by form type is segmented into solid and liquid. The liquid form dominates the market, holding 61% share in 2024, due to its superior processability and compatibility with different polymers. Its high demand in tire manufacturing, adhesives, and sealants drives growth. The liquid form also offers enhanced viscosity control and ease of blending, making it essential for automotive and industrial applications. The rising shift toward lightweight materials in transportation and construction further fuels adoption, while the solid form continues to serve niche applications with limited growth.

- For instance, Kumho Petrochemical’s SOL-5270H solution styrene butadiene rubber (SSBR) is produced via anionic solution polymerization and offers improved filler dispersibility and cold flexibility. The grade is shelf-stable for 2 years at 35 °C and is used in tire treads to enhance braking performance.

By Type

Among types, Styrene Butadiene Rubber (SBR) leads the market with 32% share in 2024, owing to its strong demand in tire manufacturing, adhesives, and footwear. SBR provides excellent abrasion resistance, durability, and cost-effectiveness, making it the preferred choice for large-scale applications. The rapid expansion of automotive production, particularly in Asia-Pacific, reinforces its dominance. Butadiene Rubber (BR) and Nitrile Rubber (NBR) also show strong growth due to their applications in industrial goods and oil-resistant products. Meanwhile, specialty rubbers like EPDM and FKM gain traction in high-performance sectors such as aerospace and medical devices.

- For instance, Puyang Linshi produces IR-550 polyisoprene latex with no branching or microgels, achieving particle sizes of 0.15 µm and molecular weights around 1.2 million g/mol, making it functionally similar to natural rubber latex in sensitive film applications.

By End User

The transportation sector dominates the market with a 47% share in 2024, supported mainly by the automotive industry. Demand is driven by the extensive use of liquid synthetic rubber in tires, seals, and adhesives, which improve fuel efficiency and durability. Automotive manufacturers increasingly prefer synthetic rubber for lightweighting and performance enhancement. Marine and aerospace also adopt these materials for their resistance to extreme temperatures and chemicals. Beyond transportation, building and construction is a growing end user, using synthetic rubber for insulation, sealants, and coatings, while medical and textile applications are expanding steadily.

Key Growth Drivers

Rising Demand from Automotive Sector

The automotive sector is the largest consumer of liquid synthetic rubber, especially for tire manufacturing. Growing global vehicle production and the demand for high-performance, fuel-efficient tires are driving usage. Liquid synthetic rubber enhances abrasion resistance, grip, and rolling resistance, improving both safety and efficiency. Electric vehicle adoption further accelerates demand, as manufacturers seek advanced materials to balance weight and durability. This trend positions the automotive sector as a primary driver of market growth during the forecast period.

- For instance, Kuraray’s GS-L-BR silane-modified liquid butadiene rubber reduces mixing torque and improves silica dispersion in tire compounds, achieving viscosities of 7 Pa·s at 38 °C for GS-L-BR-114, and enhancing adhesion forces when 17 % of LIR-403 is added (adhesion to aluminum improves to 800 N) in structural adhesive tests.

Expansion of Adhesives and Sealants Industry

Liquid synthetic rubber is increasingly adopted in adhesives and sealants due to its superior bonding strength and flexibility. Rising demand across construction, packaging, and industrial applications supports market growth. Its ability to provide strong adhesion under dynamic conditions makes it ideal for high-stress environments. With global infrastructure investments and consumer demand for durable packaging materials, the adhesives and sealants sector significantly contributes to liquid synthetic rubber consumption. This expansion strengthens its role as a key growth driver across multiple industries.

- For instance, Evonik’s densified fumed silica grade AEROSIL® R 972 V has a tamped density of approximately 90 g/L. This grade is used as a reinforcing filler in various rubber and silicone applications to enhance mechanical properties like strength and durability.

Technological Advancements in Rubber Production

Advancements in polymerization technology and production processes are enhancing the performance and efficiency of liquid synthetic rubber. Innovations in catalysts and formulation techniques enable manufacturers to develop customized grades for specific end-use industries. These improvements not only reduce production costs but also increase product quality, durability, and application versatility. Companies are investing in R&D to develop bio-based alternatives, aligning with sustainability goals. Technological innovation thus emerges as a key driver, ensuring higher adoption across industries such as automotive, construction, and medical.

Key Trends & Opportunities

Shift Toward Sustainable Rubber Solutions

Growing environmental concerns and regulatory pressures are pushing the market toward eco-friendly alternatives. Manufacturers are investing in bio-based liquid synthetic rubber derived from renewable feedstocks to reduce reliance on petrochemicals. This shift aligns with global sustainability targets and appeals to end users seeking green solutions. Adoption of eco-friendly materials provides a significant opportunity for differentiation and long-term growth. Companies embracing sustainable innovation can capture emerging demand while complying with strict environmental standards.

- For instance, Nippon Soda recently developed 1,2-SBS (styrene-butadiene-styrene block copolymer) with increased 1,2-vinyl content to improve crosslinking reactivity and dielectric performance, targeting advanced electronics and elastomer applications.

Rising Demand from Emerging Economies

Asia-Pacific and Latin America present strong growth opportunities for the liquid synthetic rubber market. Rapid urbanization, increasing automotive production, and expanding infrastructure projects fuel demand in these regions. Government investments in transportation and construction sectors further boost consumption. Additionally, growing middle-class populations with higher purchasing power drive demand for consumer goods using synthetic rubber. Emerging economies are expected to serve as the fastest-growing markets, offering manufacturers opportunities to expand operations and establish strategic partnerships to strengthen their global presence.

- For instance, Dynasol has launched new SBS grades “Calprene 420X” and “Calprene 480” optimized for roofing membranes, where Calprene 480 provides higher temperature reactivity and improved aging stability in modified asphalt blends.

Key Challenges

Volatility in Raw Material Prices

Liquid synthetic rubber production depends heavily on petrochemical feedstocks such as butadiene and styrene. Price fluctuations of these raw materials, driven by crude oil market instability, directly impact production costs. Manufacturers face margin pressures when raw material costs surge without parallel increases in product prices. This volatility creates uncertainty in supply chains and discourages long-term investment planning. As a result, managing cost efficiency and exploring alternative raw materials remain critical challenges for market participants.

Stringent Environmental Regulations

The synthetic rubber industry faces tightening regulations regarding emissions, waste management, and the use of petrochemical-based feedstocks. Compliance with these regulations requires substantial investments in cleaner technologies and process modifications, increasing production costs. Regulatory restrictions on certain chemicals also limit formulation flexibility. Non-compliance can result in fines, reputational risks, and restricted access to markets. For manufacturers, balancing regulatory compliance with cost-effectiveness remains a major challenge, pushing them to accelerate the adoption of sustainable production practices.

Regional Analysis

North America

North America holds 24% share of the liquid synthetic rubber market in 2024, driven by strong demand from the automotive and construction sectors. The United States leads the region, supported by established tire manufacturers and high investment in infrastructure projects. Rising adoption of adhesives and sealants in building applications further supports growth. The push toward electric vehicle production also fuels demand for high-performance synthetic rubber materials. Regulatory emphasis on energy efficiency and sustainable manufacturing practices creates opportunities for bio-based alternatives, making North America a stable yet innovation-driven regional market.

Europe

Europe accounts for 21% share of the liquid synthetic rubber market in 2024, supported by advanced automotive and aerospace industries. Germany, France, and the U.K. dominate the regional demand due to their robust automotive manufacturing base. Strict EU environmental regulations encourage the use of high-performance and sustainable synthetic rubber variants. The construction sector also contributes significantly, with demand for adhesives, coatings, and sealants. Additionally, growing focus on fuel efficiency and reduced emissions enhances the adoption of synthetic rubber in tire production. Europe’s commitment to sustainability ensures steady long-term growth despite regulatory challenges.

Asia-Pacific

Asia-Pacific dominates the liquid synthetic rubber market with 42% share in 2024, making it the largest regional market. China, India, and Japan lead demand, driven by rapid industrialization, expanding automotive production, and infrastructure development. High consumption of tires in both commercial and passenger vehicles strongly supports market growth. The region’s packaging and construction industries also utilize synthetic rubber extensively. Low production costs and growing investments in manufacturing facilities make Asia-Pacific a global hub for supply. Rising middle-class populations and urbanization further fuel consumption, positioning Asia-Pacific as the fastest-growing region during the forecast period.

Latin America

Latin America holds 7% share of the liquid synthetic rubber market in 2024, with Brazil and Mexico leading demand. The region’s growing automotive sector and infrastructure development projects contribute to rising consumption of synthetic rubber for tires, adhesives, and sealants. Economic recovery and increased foreign investments are boosting industrial growth, further supporting demand. However, reliance on imports for raw materials creates supply chain challenges. The region shows potential for expansion, particularly in the construction and packaging sectors, as governments emphasize modernization of transport systems and energy-efficient infrastructure projects.

Middle East & Africa

The Middle East & Africa region accounts for 6% share of the liquid synthetic rubber market in 2024. Growth is driven by rising demand in construction, oil and gas, and automotive applications. Countries such as Saudi Arabia, the UAE, and South Africa are leading consumers due to infrastructure projects and industrial expansion. Increasing use of adhesives and sealants in building projects strengthens demand. However, market growth faces challenges from limited local manufacturing capacity and reliance on imports. Still, ongoing investments in industrialization and diversification initiatives present opportunities for future expansion in the region.

Market Segmentations:

By Form Type:

By Type:

- Acrylic Rubber (ACM)

- Butadiene Rubber (BR)

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the liquid synthetic rubber market features key players including Royal Adhesives & Sealants, Kumho Petrochemical, Puyang Linshi Chemical New Material Co., Ltd, Kuraray Co., Ltd, JSR Corporation, Sinopec, Evonik Industries AG, ENEOS Corporation, Nippon Soda Co., Ltd, and Asahi Kasei. The liquid synthetic rubber market is characterized by strong innovation, strategic capacity expansions, and a focus on sustainability. Companies are investing in advanced polymerization technologies and R&D to develop high-performance and eco-friendly grades, addressing rising demand from automotive, construction, and industrial applications. Market participants are also pursuing mergers, acquisitions, and partnerships to strengthen distribution networks and expand their geographic reach. With growing emphasis on lightweight materials and energy-efficient solutions, competition is intensifying across both established and emerging markets. Sustainability-focused initiatives and cost optimization remain central strategies shaping future competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2024, Bridgestone researchers in Akron got a grant from the U.S. Department of Energy for a pilot project. This project will focus on making synthetic rubber by using plant-based ethanol.

- In March 2024, ARLANXEO presented sustainable and innovative synthetic rubber solutions at the India Rubber Expo 2024. This aligned with their commitment of offering high class products and services in India and by large in Asia Pacific region.

- In July 2023, Shin-etsu Chemical Co. Ltd announced an investment plan of worth nearly USD 640 million to improve its silicones portfolio. The investment was planned in order to mitigate the demand for the silicone products sold by the company. The company planned to expand its eco-friendly products portfolio in order to achieve the goal of carbon neutrality.

- In May 2023, Idemitsu Kosan, Kumho Petrochemical, and Sumitomo Corporation have signed an MOU to collaborate on the development of sustainable polymers and chemicals in Asia. Idemitsu will produce bio-SM using the mass balance method, while Kumho Petrochemical will create bio-SSBR (Solution Styrene Butadiene Rubber) for high-functional tires.

Report Coverage

The research report offers an in-depth analysis based on Form Type, Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising demand from the automotive sector.

- Adoption in tire manufacturing will grow due to focus on fuel efficiency.

- Bio-based synthetic rubber will gain traction with stricter sustainability regulations.

- Technological advancements will improve performance and cost efficiency of products.

- Emerging economies will drive consumption through rapid industrialization and urbanization.

- Construction and infrastructure projects will create new opportunities for adhesives and sealants.

- Electric vehicle production will boost demand for high-performance rubber grades.

- Strategic partnerships and capacity expansions will shape competitive strategies.

- Fluctuating raw material prices will influence production and pricing trends.

- Sustainability-driven innovations will define long-term market positioning and growth.