Market Overview

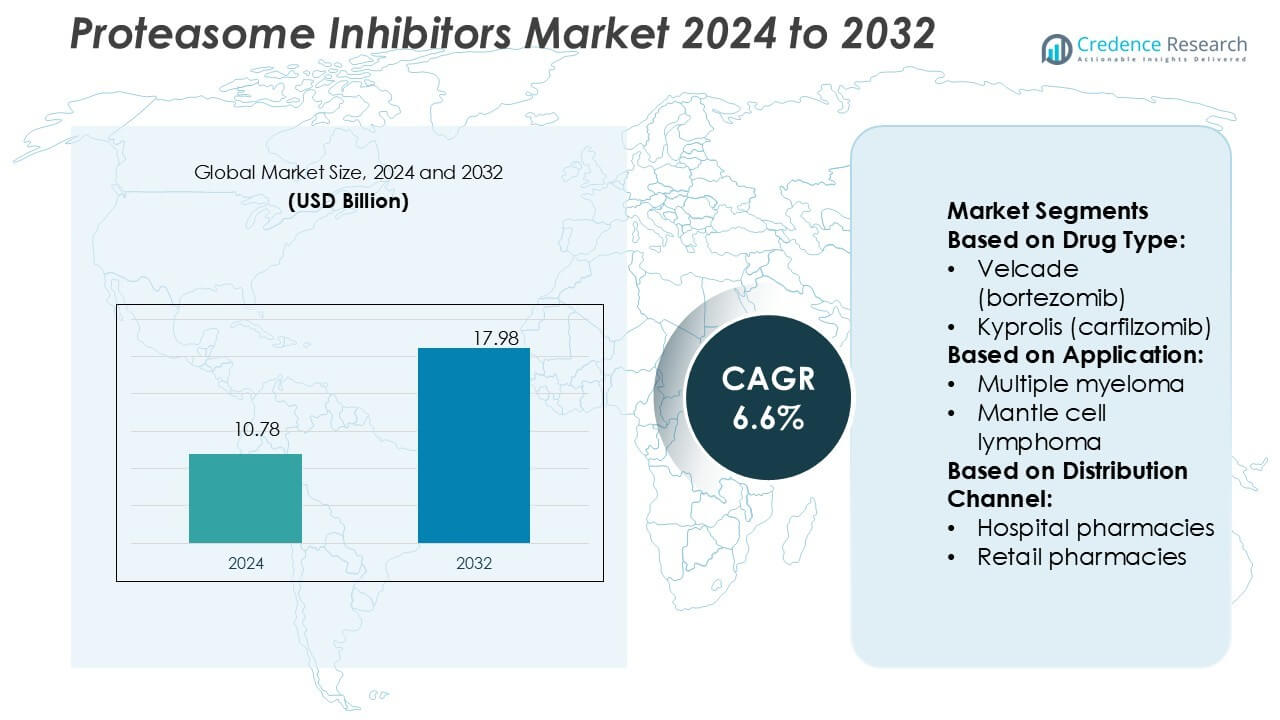

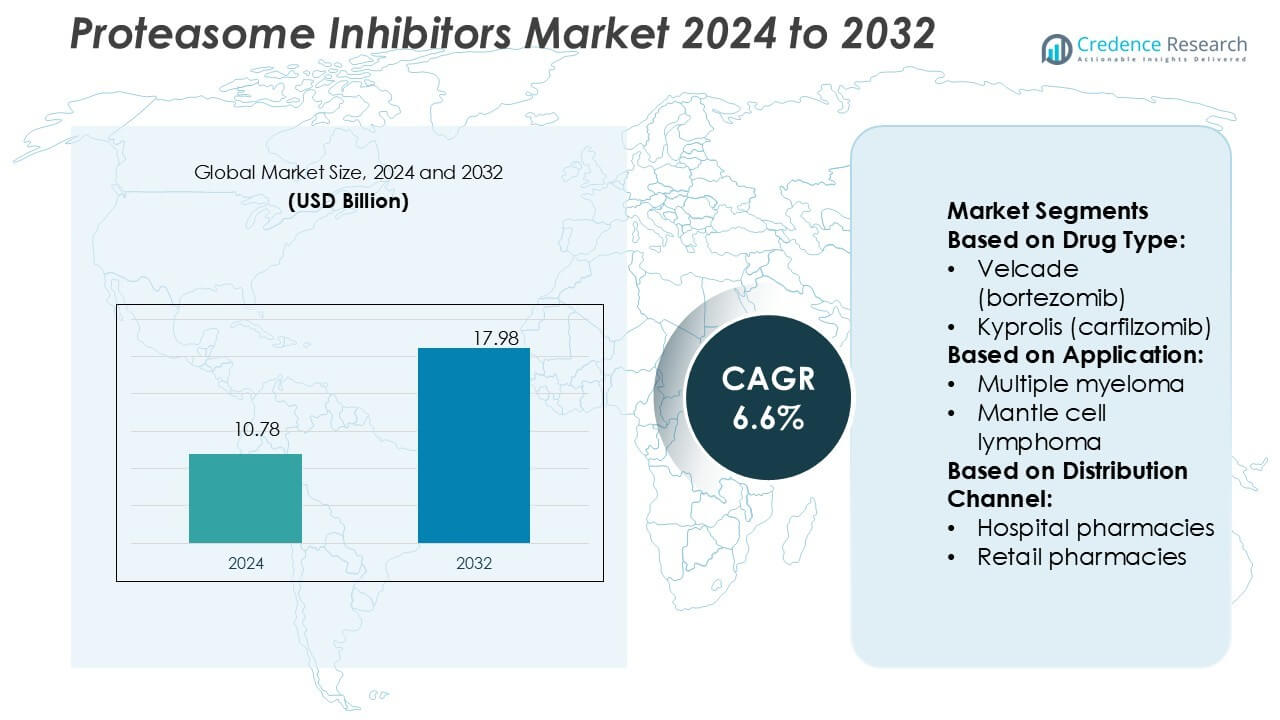

Proteasome Inhibitors Market size was valued USD 10.78 billion in 2024 and is anticipated to reach USD 17.98 billion by 2032, at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Proteasome Inhibitors Market Size 2024 |

USD 10.78 Billion |

| Proteasome Inhibitors Market, CAGR |

6.6% |

| Proteasome Inhibitors Market Size 2032 |

USD 17.98 Billion |

The proteasome inhibitors market features strong competition among leading players such as Fresenius Kabi, Amgen, Camber Pharmaceuticals, Aurobindo Pharma, Gland Pharma, Apotex, Bristol Myers Squibb, Baxter International, Amneal Pharmaceuticals, and Dr. Reddy’s Laboratories. These companies focus on expanding product portfolios, advancing clinical trials, and strengthening distribution networks to secure competitive positions. Innovative therapies from established leaders, combined with the entry of generics, enhance both accessibility and affordability of treatment. North America leads the global market with a 38% share in 2024, supported by advanced healthcare infrastructure, high adoption of novel oncology therapies, and favorable reimbursement frameworks.

Market Insights

Market Insights

- The proteasome inhibitors market was valued at USD 10.78 billion in 2024 and is projected to reach USD 17.98 billion by 2032, growing at a CAGR of 6.6%.

- Rising prevalence of multiple myeloma and mantle cell lymphoma, along with growing demand for advanced oncology treatments, is driving strong market growth.

- A key trend is the adoption of oral formulations and combination therapies, offering better compliance and improved patient outcomes.

- Competition is intense, with major players focusing on product innovation, clinical trial expansion, and generics to enhance affordability and accessibility.

- North America leads with a 38% share in 2024, followed by Europe at 28% and Asia-Pacific at 24%, while hospital pharmacies remain the dominant distribution channel, strengthening access to advanced therapies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Drug Type

Branded drugs dominate the proteasome inhibitors market, holding nearly 72% share in 2024. Velcade (bortezomib) leads this category due to its established efficacy in multiple myeloma treatment, followed by Kyprolis (carfilzomib) and Ninlaro (ixazomib). Their widespread use stems from strong clinical outcomes, extended survival rates, and continued physician preference. The introduction of generics has created cost-effective options, but branded drugs maintain leadership through patent protections, expanded indications, and ongoing clinical research. Increased patient access programs and strong distribution networks further support the branded segment’s dominance.

- For instance, Fresenius Kabi undertook a multi-stage expansion of its Melrose Park, Illinois facility, representing an investment of over $250 million. The project, completed in phases, included the addition of five new automated aseptic filling lines, one of which was for cytotoxic products.

By Application

Multiple myeloma represents the largest application segment, accounting for 82% of the market share in 2024. The dominance is driven by the rising prevalence of the disease and the effectiveness of proteasome inhibitors as first-line therapy. Continuous innovation in treatment regimens, including drug combinations, enhances patient response rates and extends progression-free survival. Mantle cell lymphoma, though smaller in volume, shows growth potential as targeted therapy adoption increases. Expanding diagnostic capabilities and early detection programs are expected to strengthen demand in both application areas.

- For instance, Amgen’s ENDEAVOR trial data showed that patients receiving Kyprolis (carfilzomib) plus dexamethasone achieved median progression-free survival of 18.7 months, compared to 9.4 months in the Velcade plus dexamethasone arm.

By Distribution Channel

Hospital pharmacies dominate the distribution channel, holding 61% market share in 2024. Their leadership is supported by the need for specialized administration of proteasome inhibitors, most of which require infusion under medical supervision. Hospital settings also ensure strict compliance, dosage monitoring, and immediate management of side effects. Retail pharmacies and e-commerce platforms are gradually gaining ground, supported by the availability of oral formulations such as Ninlaro. However, the critical nature of cancer treatment keeps hospital pharmacies as the preferred channel, especially in developed markets with advanced healthcare infrastructure.

Key Growth Drivers

Rising Prevalence of Hematologic Malignancies

The growing incidence of hematologic cancers, particularly multiple myeloma and mantle cell lymphoma, drives demand for proteasome inhibitors. Rising global cancer rates, supported by aging populations and lifestyle factors, expand the patient pool. Healthcare systems prioritize advanced treatment options, boosting adoption of targeted therapies like bortezomib, carfilzomib, and ixazomib. Increasing diagnosis rates and improved access to oncology care further accelerate market expansion, making this one of the strongest drivers behind sustained growth in the proteasome inhibitors market.

- For instance, Aurobindo’s biosimilars pipeline, managed by its subsidiary CuraTeQ Biologics, consists of 14 molecules (primarily in oncology and immunology). Aurobindo is also expanding its portfolio of complex generics, including injectables, peptides, and other specialty products, with a robust pipeline in development.

Expanding Clinical Research and Pipeline Development

Continuous investments in clinical research enhance the market outlook for proteasome inhibitors. Leading pharmaceutical firms are conducting trials to expand therapeutic indications and improve safety profiles. Novel formulations, combination therapies, and next-generation inhibitors aim to provide better efficacy with reduced side effects. Strategic collaborations among academic institutes and drug manufacturers accelerate innovation pipelines. These R&D advancements support regulatory approvals and create opportunities for broader patient adoption, strengthening the market’s growth trajectory.

- For instance, Gland Pharma’s in-house complex injectable pipeline includes 19 products, of which 9 ANDAs have been filed and 6 launched, and it also holds a co-development pipeline of 15 products (6 in 505(b)(2) and 9 ANDAs), reflecting its capacity to progress multiple complex formulations in parallel.

Increasing Healthcare Spending and Accessibility

Rising healthcare expenditure, particularly in emerging economies, plays a vital role in market growth. Governments and private insurers are increasing funding for cancer therapies, ensuring broader patient access to costly treatments. Hospital expansions, improved oncology infrastructure, and reimbursement support in key markets such as the U.S., Europe, and Asia-Pacific enhance adoption rates. Pharmaceutical companies are also focusing on generic versions, which provide cost-effective alternatives and expand treatment reach, further fueling the global proteasome inhibitors market.

Key Trends & Opportunities

Shift Toward Oral Formulations and Patient-Centric Therapies

Patient demand for more convenient treatment options fuels innovation in oral proteasome inhibitors. Ixazomib, the first oral drug in this class, highlights the industry’s shift toward patient-centric therapies. Oral formulations reduce hospital visits, enhance compliance, and improve quality of life. Pharmaceutical firms are investing in similar developments, presenting opportunities for expanding outpatient care models and meeting evolving patient preferences.

- For instance, Bristol Myers Squibb commits up to $674 million in milestone funds to its collaboration with VantAI to generate generative AI-designed molecular glues, linking computational design to real-world therapeutic advances.

Emerging Opportunities in Combination Therapies

Combination regimens integrating proteasome inhibitors with immunomodulators, monoclonal antibodies, and CAR-T therapies are gaining strong traction. These approaches improve response rates and extend survival outcomes compared to monotherapy. Ongoing clinical trials across multiple cancer subtypes highlight untapped opportunities for market expansion. This trend aligns with precision medicine strategies, offering tailored treatments for diverse patient populations.

- For instance, Amneal’s collaboration with Apiject expands its blow-fill-seal (BFS) platform capacity to produce 250 to 300 million units annually, with scaling potential beyond 400 million units.

Key Challenges

High Treatment Costs and Reimbursement Barriers

Proteasome inhibitors remain expensive, creating challenges for healthcare systems and patients. In many regions, limited reimbursement and high out-of-pocket expenses restrict access. This is particularly problematic in low- and middle-income countries where affordability strongly influences adoption. Even in developed markets, cost-effectiveness assessments by payers may delay approvals or limit coverage, restraining overall market penetration.

Adverse Effects and Drug Resistance

Toxicities such as peripheral neuropathy, gastrointestinal issues, and cardiovascular complications present major barriers to long-term use. Patients may discontinue therapy due to intolerable side effects, reducing treatment effectiveness. Furthermore, resistance to proteasome inhibitors over time limits therapeutic outcomes and drives demand for new drug classes. Addressing these safety and efficacy concerns remains a critical challenge for manufacturers and clinicians.

Regional Analysis

North America

North America dominates the proteasome inhibitors market with a 38% share in 2024. The region benefits from strong healthcare infrastructure, high adoption of innovative therapies, and significant investments in oncology research. Rising incidence of multiple myeloma and mantle cell lymphoma fuels demand for advanced treatment options. The U.S. leads regional growth, supported by favorable reimbursement policies and regulatory approvals from the FDA. Pharmaceutical companies actively conduct clinical trials, further driving availability of novel drugs. Robust partnerships between research institutes and industry players strengthen market expansion, keeping North America at the forefront of proteasome inhibitor adoption.

Europe

Europe accounts for 28% of the global proteasome inhibitors market in 2024. The region’s growth is supported by an aging population, high cancer prevalence, and government-backed healthcare systems. Germany, France, and the UK lead adoption due to advanced oncology facilities and strong R&D pipelines. European Medicines Agency (EMA) approvals for newer therapies improve patient access, enhancing market penetration. Increasing clinical research collaborations with universities and biotech firms also contribute to drug innovation. Patient awareness programs and hospital-based distribution channels further strengthen uptake. These factors collectively position Europe as the second-largest regional contributor to proteasome inhibitor demand.

Asia-Pacific

Asia-Pacific captures 24% of the proteasome inhibitors market share in 2024, showing the fastest growth potential. Rising cancer incidence, expanding healthcare infrastructure, and increasing access to novel therapies drive regional adoption. Countries such as China, Japan, and India are emerging as high-demand centers due to rising healthcare spending. Supportive government policies for clinical trials and drug approvals also accelerate expansion. Local pharmaceutical firms are forming alliances with global players to improve drug availability. Growing awareness of multiple myeloma treatment options among physicians and patients boosts market prospects. This dynamic growth is making Asia-Pacific a critical market for future opportunities.

Latin America

Latin America holds 6% of the global proteasome inhibitors market share in 2024. Growth in the region is driven by increasing diagnosis rates of hematologic cancers and gradual improvements in healthcare access. Brazil and Mexico lead market expansion, supported by rising investments in oncology treatment centers. Government healthcare reforms and international partnerships contribute to better drug availability. However, challenges such as affordability and limited reimbursement coverage restrict broader access. Despite these hurdles, growing awareness campaigns and ongoing clinical trials in urban hospitals create opportunities for market expansion. The region continues to attract interest from global pharmaceutical companies.

Middle East & Africa

The Middle East & Africa region represents 4% of the proteasome inhibitors market share in 2024. Growth remains modest due to limited access to advanced oncology drugs and economic constraints. However, countries like Saudi Arabia, UAE, and South Africa show rising adoption, supported by investments in specialized cancer centers. International pharmaceutical companies are expanding distribution networks, improving patient access to innovative therapies. Government health initiatives and increasing collaborations with global research institutes enhance treatment availability. While affordability challenges persist, the region shows steady demand growth, particularly in urban areas with stronger healthcare infrastructure and better treatment access.

Market Segmentations:

By Drug Type:

- Velcade (bortezomib)

- Kyprolis (carfilzomib)

By Application:

- Multiple myeloma

- Mantle cell lymphoma

By Distribution Channel:

- Hospital pharmacies

- Retail pharmacies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the proteasome inhibitors market players such as Fresenius Kabi, Amgen, Camber Pharmaceuticals, Aurobindo Pharma, Gland Pharma, Apotex, Bristol Myers Squibb, Baxter International, Amneal Pharmaceuticals, and Dr. Reddy’s Laboratories. The proteasome inhibitors market is shaped by strong innovation, strategic collaborations, and expanding global access. Companies are investing heavily in research and development to introduce advanced therapies targeting multiple myeloma and mantle cell lymphoma. Regulatory approvals and ongoing clinical trials strengthen the pipeline, ensuring a steady flow of novel treatments. Generic manufacturers contribute to affordability, improving patient access in cost-sensitive regions. Partnerships with research institutes, healthcare providers, and distributors enhance market penetration and ensure wider adoption. Continuous efforts to balance innovation with affordability highlight the competitive dynamics, driving growth and sustaining market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fresenius Kabi

- Amgen

- Camber Pharmaceuticals

- Aurobindo Pharma

- Gland Pharma

- Apotex

- Bristol Myers Squibb

- Baxter International

- Amneal Pharmaceuticals

- Reddy’s Laboratories

Recent Developments

- In March 2025, IFF and Kemira announced the formation of Alpha Bio, a joint venture to scale production of sustainable biobased materials using enzymatic technology. The news outlines their commitment to replacing fossil-based polymers with enzyme-enabled biopolymers derived from plant sugars. The aim is to meet growing demand for biodegradable, high-performance materials.

- In October 2024, HLB Group acquired Genofocus, a producer of specialty enzymes for customized industrial applications. The company obtained a 26.48 percent stake in Genofocus and secured management control.

- In September 2024, Amneal Pharmaceuticals and Shilpa Medicare received U.S. FDA approval for BORUZU, a ready-to-use intravenous (IV) bortezomib formulation. BORUZU is used in oncology and simplifies the preparation process during administration.

- In April 2023, Specialty Enzymes and Probiotics announced the release of patent-pending Pepzyme Pro, a dietary ingredient with powerful protease enzymes and a symbiotic (5 probiotic strains and a prebiotic) suitable for vegans and vegetarians.

Report Coverage

The research report offers an in-depth analysis based on Drug Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The proteasome inhibitors market will expand with rising multiple myeloma cases worldwide.

- Research and development will drive the launch of next-generation inhibitors with improved safety.

- Oral formulations will gain preference due to better patient compliance and convenience.

- Emerging economies will witness higher adoption with expanding healthcare infrastructure.

- Regulatory approvals will accelerate market penetration for novel therapies.

- Combination therapies will become a standard approach to enhance treatment outcomes.

- Biosimilars and generics will increase accessibility in cost-sensitive markets.

- Collaborations between pharmaceutical companies and research institutes will boost innovation.

- Hospital pharmacies will remain the leading distribution channel for advanced therapies.

- Growing awareness and early diagnosis will support higher treatment adoption rates.

Market Insights

Market Insights