Market Overview:

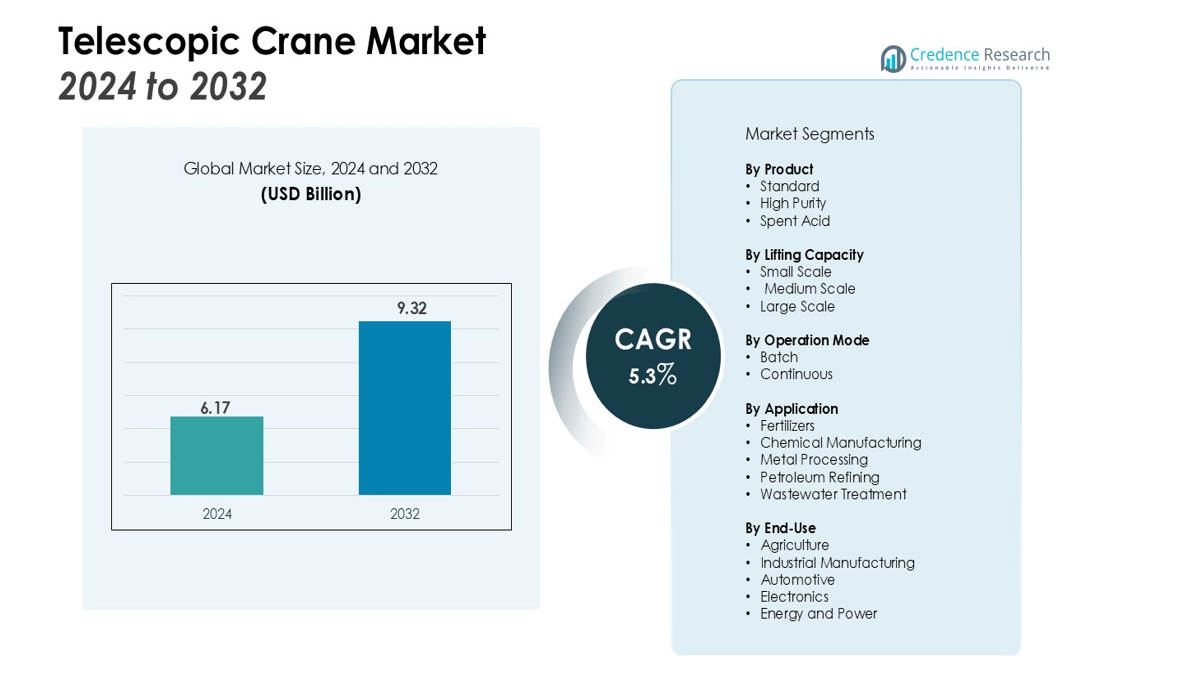

The Telescopic Crane Market size was valued at USD 6.17 billion in 2024 and is anticipated to reach USD 9.32 billion by 2032, at a CAGR of 5.3% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Telescopic Crane Market Size 2025 |

USD 6.17 billion |

| Telescopic Crane Market, CAGR |

5.3% |

| Telescopic Crane Market Size 2032 |

USD 9.32 billion |

Market growth is driven by rapid urbanization, smart city development, and the increasing need for advanced lifting equipment with higher load capacities and better maneuverability. The shift toward electric and hybrid cranes highlights the industry’s commitment to sustainability and compliance with stringent emission regulations. Integration of automation and telematics enhances operational safety and efficiency, making telescopic cranes a strategic choice for contractors and industrial operators.

Regionally, Asia-Pacific holds the largest share due to robust infrastructure development in China, India, and Southeast Asia. North America shows stable demand, supported by oil and gas activities and industrial maintenance projects. Europe demonstrates growth through modernization of transport and energy infrastructure, while Middle East & Africa and Latin America represent emerging markets where increased construction and industrialization are creating new opportunities for telescopic crane adoption.

Market Insights:

- The Telescopic Crane Market was valued at USD 6.17 billion in 2024 and is projected to reach USD 9.32 billion by 2032, reflecting a CAGR of 3% during 2024–2032.

- Rapid urbanization and smart city development drive consistent demand for advanced lifting solutions with greater mobility and load capacity.

- Adoption of electric and hybrid models strengthens sustainability efforts, ensuring compliance with emission standards and lowering operational costs.

- Integration of automation, telematics, and remote monitoring improves safety, enhances control, and reduces downtime in heavy-duty operations.

- Industrial diversification beyond construction, including mining, oil and gas, and renewable energy projects, supports steady application growth.

- Asia-Pacific leads the market due to large-scale infrastructure investment in China, India, and Southeast Asia, while North America shows stable demand from oil, gas, and industrial maintenance projects.

- Europe experiences growth through modernization of transport and energy infrastructure, whereas Middle East & Africa and Latin America represent emerging opportunities backed by rising construction and industrialization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Infrastructure Development and Urbanization Driving Equipment Demand

Global investment in infrastructure expansion strongly supports the demand for Telescopic Crane. Large-scale projects in transportation, energy, and urban development require heavy lifting solutions that offer mobility and efficiency. It provides contractors with versatile lifting capacity, making it a preferred choice for both developed and emerging markets. Rapid population growth and smart city projects further create sustained demand for advanced lifting equipment.

- For instance, Liebherr’s LTM 1100-5.3 mobile crane is equipped with a powerful telescopic boom that extends to a length of 62 meters, making it highly effective for large-scale construction projects.

Shift Toward Sustainability and Energy-Efficient Machinery

The construction sector faces strict emission regulations, creating a clear push for energy-efficient lifting equipment. Telescopic Crane manufacturers are introducing electric and hybrid models that lower emissions while delivering consistent performance. It improves cost efficiency for operators through reduced fuel usage and lower maintenance costs. Environmental goals across regions accelerate the transition toward cleaner equipment solutions.

- For instance, Zoomlion’s ZTC250N-EV, the first pure electric truck crane, operates at a sound level not exceeding 65 decibels, making it suitable for use in urban areas with strict noise regulations.

Integration of Advanced Technology and Safety Features

Automation, telematics, and remote monitoring strengthen the operational appeal of Telescopic Crane. Enhanced safety systems reduce workplace risks while improving operational precision. It allows operators to manage heavy loads with greater accuracy and lower downtime. Advanced control features, including stability management, make cranes more reliable in high-intensity construction environments.

Expanding Industrial Applications Beyond Construction

Industrial sectors such as mining, oil and gas, and energy increasingly adopt Telescopic Crane. The equipment supports heavy-duty operations in remote or complex environments with high lifting demands. It offers flexible mobility, making it suitable for both onshore and offshore applications. Growing investment in renewable energy projects, including wind and solar, further expands the market’s application base.

Market Trends:

Adoption of Electrification and Hybrid Power Solutions Across Global Markets

The growing focus on sustainability drives the adoption of electric and hybrid models within the Telescopic Crane segment. Manufacturers introduce battery-powered and hybrid variants to reduce emissions while meeting regulatory standards. It improves operational efficiency by cutting fuel expenses and lowering noise levels at worksites. Government initiatives promoting clean energy in construction further accelerate this trend. Contractors also prioritize energy-efficient machines to strengthen their environmental commitments. The integration of alternative power solutions highlights a long-term industry transition toward cleaner and smarter lifting equipment.

- For instance, Konecranes’ Ecolifting Hybrid Retrofit for its Rubber-Tired Gantry (RTG) cranes reduces annual CO2 equivalent emissions from a baseline of 284 tonnes to 111 tonnes for a conventional diesel model.

Integration of Digitalization and Telematics to Enhance Operational Control

Digital solutions reshape equipment management, making telematics and automation standard features in the Telescopic Crane market. Real-time monitoring provides insights into machine performance, fuel use, and maintenance schedules. It improves productivity by minimizing downtime and extending equipment lifespan. Safety enhancements such as stability control and remote operation gain prominence across construction and industrial projects. Contractors benefit from data-driven decision-making that improves site planning and asset utilization. The trend toward intelligent lifting systems positions digitalization as a defining factor in competitive differentiation.

- For instance, as part of its digitalization and equipment management strategy, SENNEBOGEN offers a specialized long-term coolant that pushes the required service interval to 4,000 operating hours, enhancing machine availability.

Market Challenges Analysis:

Environmental Concerns and Stringent Regulatory Frameworks Impacting Production

The production and handling of Sulfuric Acid face challenges linked to strict environmental and safety regulations. Compliance with emission standards and waste management rules increases operational costs for producers. It requires continuous investment in advanced technologies such as scrubbers and neutralization systems to limit environmental impact. Government agencies enforce rigorous monitoring to reduce risks related to air and water pollution. Rising community concerns about industrial safety further pressure companies to maintain higher operational standards. These regulatory demands create barriers for smaller players with limited resources.

Volatility in Raw Material Costs and Supply Chain Disruptions Affecting Stability

Sulfur prices, a key input in Sulfuric Acid production, remain highly volatile due to fluctuations in global energy markets. Supply chain disruptions, driven by geopolitical tensions or logistical bottlenecks, affect the consistent availability of raw materials. It creates uncertainty in pricing, reducing profitability for manufacturers and end users. Transportation challenges further increase the cost burden, particularly in emerging regions with limited infrastructure. Market participants must balance production efficiency with sourcing stability to remain competitive. Ongoing volatility in raw material supply continues to challenge long-term planning and cost management.

Market Opportunities:

Rising Agricultural Needs and Fertilizer Production Supporting Market Growth

Global population expansion and higher food demand continue to drive fertilizer consumption, directly boosting the use of Sulfuric Acid. It remains critical for phosphate fertilizer manufacturing, which supports soil health and improves crop yields. Emerging economies with large agricultural sectors invest in fertilizer capacity, creating sustained demand. Government programs promoting food security strengthen market opportunities for producers. Technological improvements in fertilizer plants also enhance efficiency and increase acid usage. This agricultural reliance provides a strong, long-term growth channel for the market.

Expanding Role in Energy Storage and Industrial Innovation Enhancing Market Potential

The shift toward clean energy solutions expands the scope of Sulfuric Acid across new industrial domains. It supports mineral processing for batteries, which are vital for electric vehicles and renewable power storage. Growing adoption of solar and wind projects further increases the requirement for refined metals, driving chemical demand. Industrial applications in wastewater treatment and chemical processing also expand its relevance. Recycling and sustainable mining practices increasingly rely on efficient acid use. These evolving applications secure fresh opportunities and reinforce the long-term resilience of the market.

Market Segmentation Analysis:

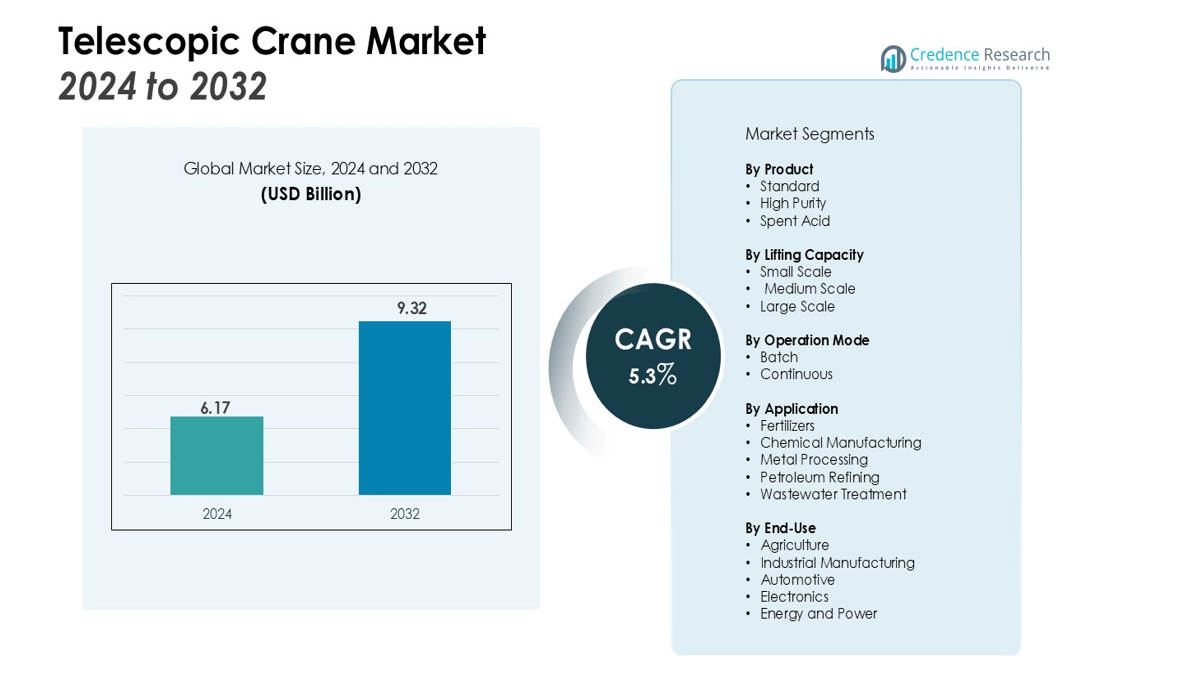

By Product

Sulfuric Acid is segmented by product into standard, high purity, and spent acid categories. Standard acid dominates demand due to its extensive use in fertilizers and industrial chemicals. It supports large-scale phosphate fertilizer production, making it essential for agriculture. High purity grades cater to electronics and specialty chemical industries where quality and precision are critical. Spent acid finds applications in recycling and regeneration, supporting cost efficiency for end users.

- For instance, in April 2025, BASF announced a major investment in a new production facility in Germany, a technological initiative to produce semiconductor-grade sulfuric acid to meet the growing demand from European chip manufacturers.

By Lifting Capacity

Market segmentation by lifting capacity reflects small, medium, and large-scale production facilities. Small facilities serve localized agricultural needs and niche chemical manufacturing. Medium-scale operations provide balanced supply for regional demand while maintaining operational flexibility. Large plants dominate global output, securing reliable supply for industries with high-volume requirements. It strengthens production capacity and ensures consistent availability for both agriculture and industrial sectors.

- For instance, the Sadara Chemical Company’s complex includes 26 integrated world-scale manufacturing plants. This large-scale operation is capable of producing over 3 million tons of high-value chemicals and plastics each year.

By Operation Mode

Segmentation by operation mode includes batch and continuous production methods. Batch mode serves smaller plants focused on specialized end-use applications. Continuous mode dominates global capacity due to its efficiency, scalability, and cost advantage. It allows manufacturers to meet consistent industrial and agricultural demand with minimal interruptions. Continuous production also supports sustainability initiatives by integrating advanced emission control systems. This operational structure remains vital for long-term market stability.

Segmentations:

By Product

- Standard

- High Purity

- Spent Acid

By Lifting Capacity

- Small Scale

- Medium Scale

- Large Scale

By Operation Mode

By Application

- Fertilizers

- Chemical Manufacturing

- Metal Processing

- Petroleum Refining

- Wastewater Treatment

By End-Use

- Agriculture

- Industrial Manufacturing

- Automotive

- Electronics

- Energy and Power

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Strong Market Presence Across Asia-Pacific Supported by Fertilizer and Industrial Demand

Asia-Pacific accounts for 45% share of the global Sulfuric Acid market, making it the leading region. China and India drive demand through extensive fertilizer production and growing chemical industries. Agricultural reliance on phosphate fertilizers continues to expand consumption levels across the region. It also benefits from rapid industrialization, where chemical processing and metal refining require consistent supply. Governments in Southeast Asia are investing in capacity expansion to meet rising domestic demand. Infrastructure development and large-scale industrial projects further reinforce the region’s leading position.

Stable Growth in North America Driven by Industrial and Environmental Applications

North America holds 20% share of the Sulfuric Acid market, supported by industrial and environmental applications. The United States leads demand with strong use in fertilizers, metal refining, and wastewater treatment. It also plays a crucial role in pollution control technologies that rely on acid. Investments in electric vehicles and renewable energy projects create new opportunities. Regulatory frameworks encourage the use of advanced production methods, sustaining demand across industries. This stability highlights the region’s long-term importance for global supply and application diversity.

Expanding Opportunities in Europe, Latin America, and Middle East & Africa

Europe represents 18% share of the Sulfuric Acid market, driven by fertilizer use, chemical manufacturing, and energy transition projects. Latin America holds 10% share, led by agricultural expansion in Brazil and mining activities in Chile. It remains essential for meeting fertilizer needs across large farming economies. Middle East & Africa contribute 7% share, supported by mining, oil refining, and infrastructure development. Governments in these regions are promoting industrial expansion that strengthens acid consumption. Collectively, these regions demonstrate rising demand and growing strategic importance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Manitex International, Inc.

- Sany Group Co., Ltd.

- Tadano Ltd.

- Xuzhou Construction Machinery Group Co., Ltd. (XCMG)

- Furukawa UNIC Corporation

- The Manitowoc Company, Inc.

- Kobelco Construction Machinery Co., Ltd.

- Hitachi Sumitomo Heavy Industries Construction Crane Co., Ltd.

- Terex Corporation

- Liebherr-International AG

Competitive Analysis:

The Sulfuric Acid market is highly competitive, with global and regional players focusing on scale, efficiency, and integration. Leading companies emphasize expanding production capacity, securing raw material supply, and improving cost structures. It drives investments in advanced technologies such as emission control systems and energy-efficient production methods to meet regulatory requirements. Firms with vertically integrated operations gain an advantage by controlling feedstock and distribution networks. Strategic partnerships, mergers, and acquisitions strengthen market positions while enhancing geographic reach. Regional producers compete by offering localized supply and specialized grades tailored to niche applications. Continuous innovation in recycling and regeneration processes also provides a competitive edge, allowing companies to balance sustainability with profitability. The landscape remains dynamic, with competition shaped by raw material volatility, regulatory pressures, and growing demand from agriculture, chemical, and energy sectors.

Recent Developments:

- In April 2025, UNIC Cranes Europe, a dealer for Furukawa UNIC, launched the UM445 lithium-ion battery-powered mini spider crane at the Bauma 2025 trade fair.

- In September 2025, Kobelco announced an expanded collaboration with Trimble, enabling certified Kobelco dealers in North America to offer Trimble Earthworks 2D grade control systems directly to customers for pre-installation on excavators.

Report Coverage:

The research report offers an in-depth analysis based on Product, Lifting Capacity, Operation Mode, Application, End-Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for Sulfuric Acid will remain strong due to its critical role in fertilizer production.

- Agricultural expansion in emerging economies will sustain high consumption levels across phosphate-based fertilizers.

- Industrial growth in chemicals, mining, and refining will drive steady utilization of the acid.

- It will gain prominence in clean energy applications, including battery production for electric vehicles.

- Growing adoption of renewable energy infrastructure will increase demand for refined metals supported by the acid.

- Companies will invest in advanced emission control technologies to meet strict environmental regulations.

- Recycling and regeneration practices will expand, supporting sustainability and resource efficiency in production.

- Regional diversification will strengthen, with Asia-Pacific retaining dominance and Latin America showing rapid growth.

- Strategic collaborations and capacity expansions will shape competition among global and regional producers.

- Long-term opportunities will align with global trends in agriculture, energy transition, and industrial modernization.