Market Overview

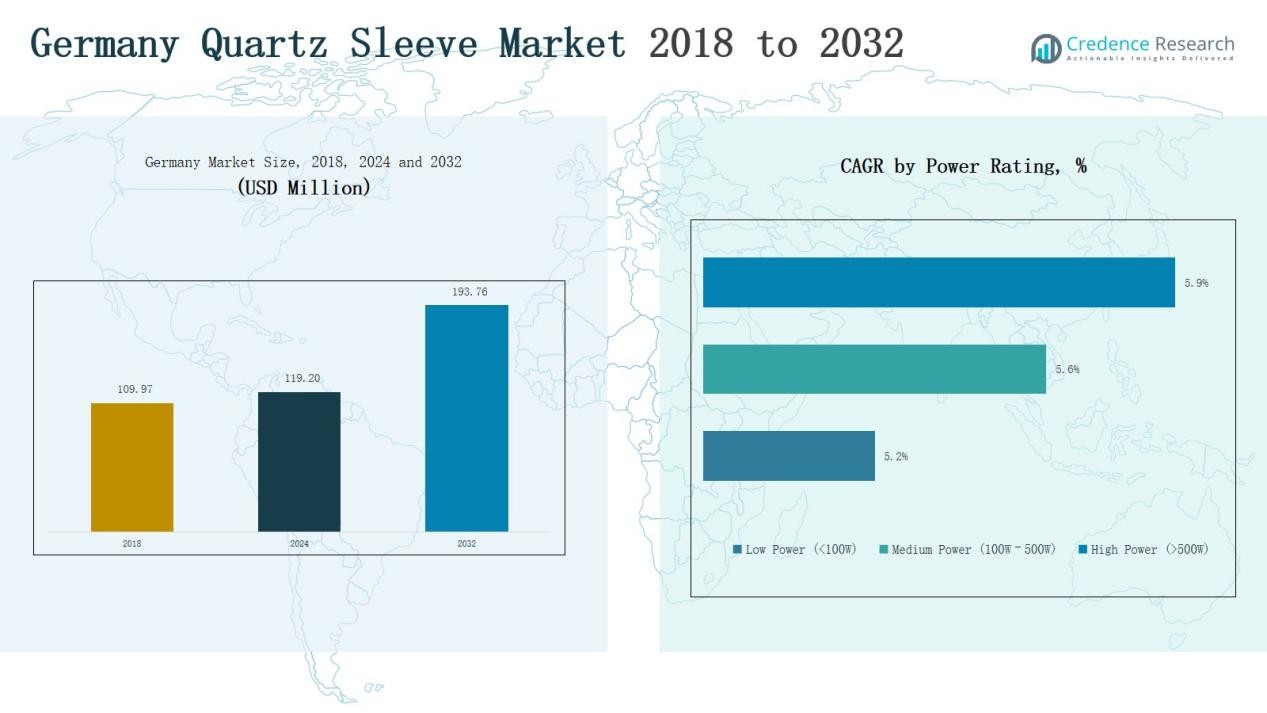

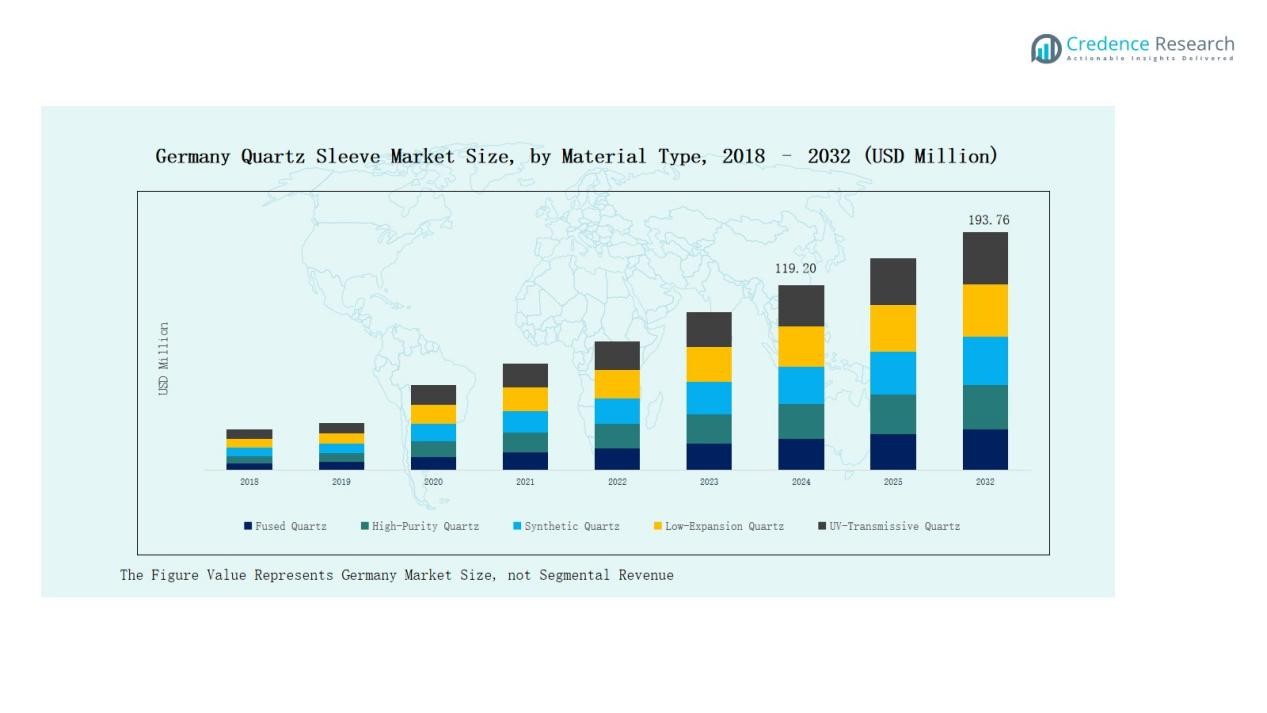

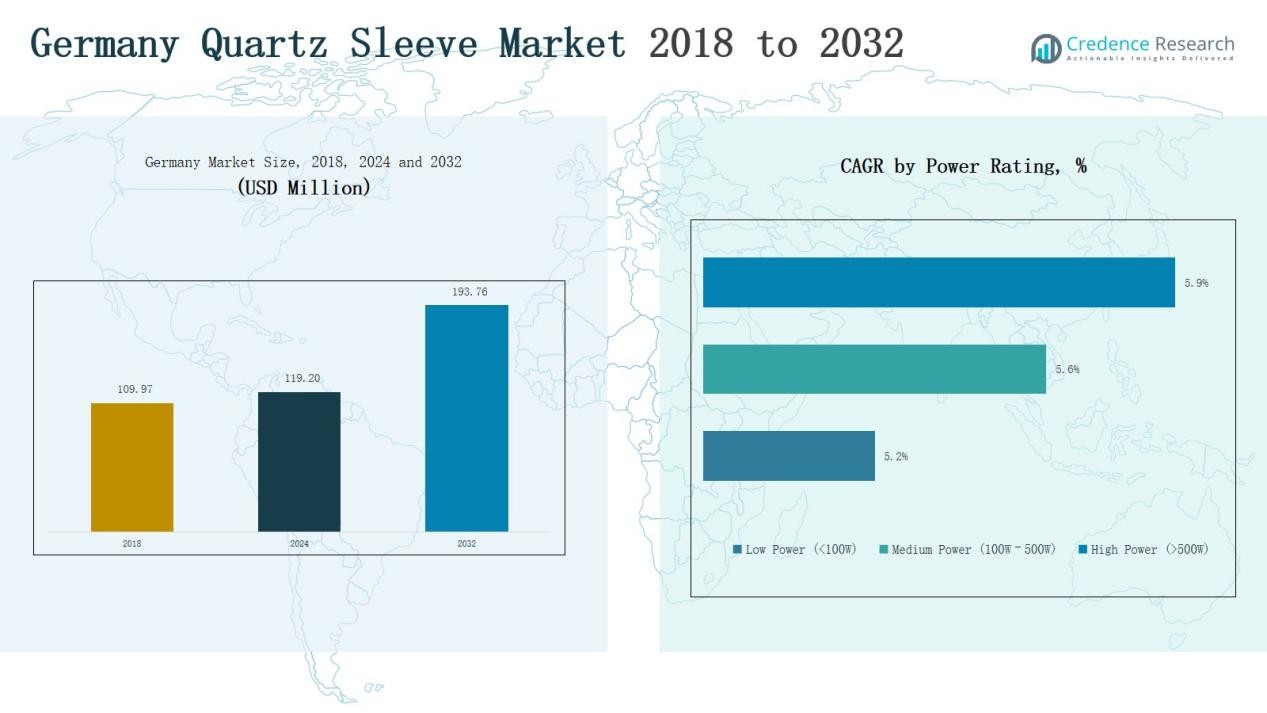

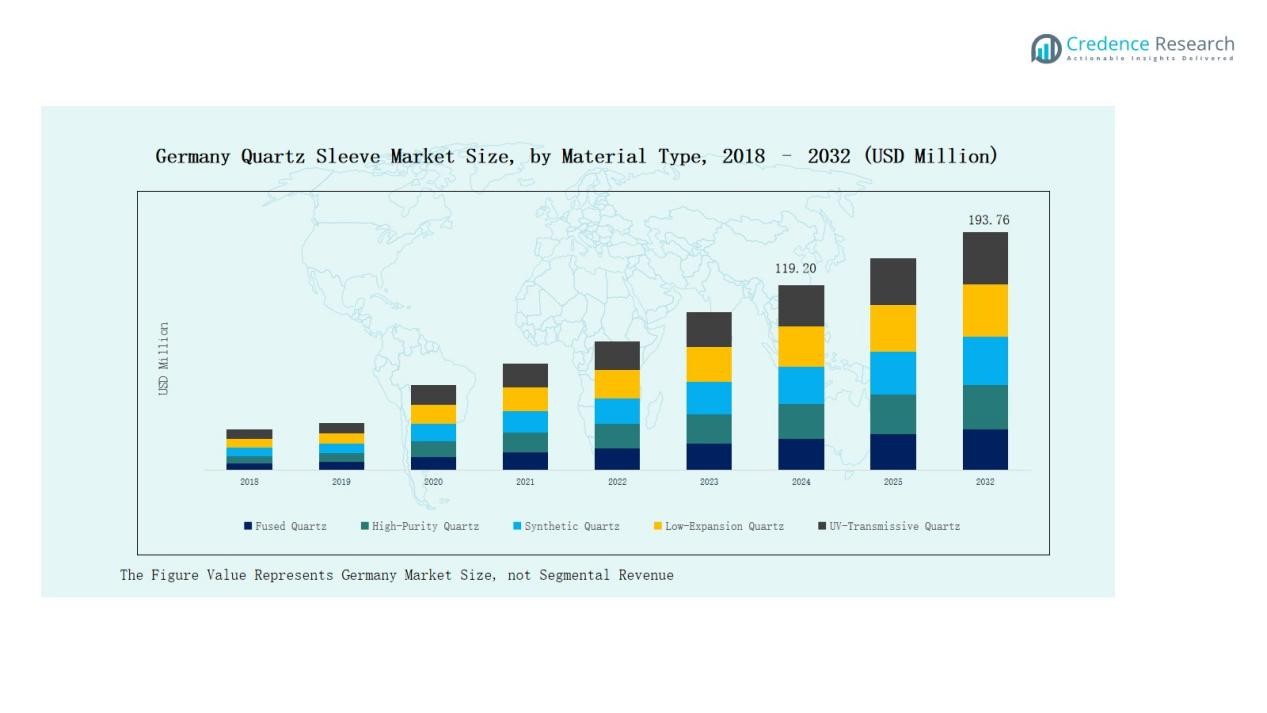

The Germany Quartz Sleeve Market size was valued at USD 109.97 million in 2018, reached USD 119.20 million in 2024, and is anticipated to reach USD 193.76 million by 2032, at a CAGR of 6.26% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Quartz Sleeve Market Size 2024 |

USD 119.20 Million |

| Germany Quartz Sleeve Market, CAGR |

6.26% |

| Germany Quartz Sleeve Market Size 2032 |

USD 193.76 Million |

The Germany Quartz Sleeve Market is characterized by strong competition among global and domestic players focusing on quality, innovation, and customized solutions. Key companies include Heraeus Quarzglas GmbH & Co. KG, Raesch Quarz (Germany) GmbH, WONIK Quartz Europe (WQE), QCS – Quarzglas Komponenten und Service GmbH, GVB GmbH – Solutions in Glass, semiQuarz, OSRAM Pre-Materials – Quartz Division, and Herbert Arnold GmbH & Co. KG (Arnold Gruppe). These players drive growth through advancements in high-purity materials, sustainable manufacturing, and application-specific solutions across water treatment, semiconductors, and pharmaceuticals. Southern Germany led the market in 2024 with a 31% share, supported by advanced manufacturing clusters, semiconductor facilities, and robust demand from food and beverage industries, cementing its position as the most dominant regional hub.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Germany Quartz Sleeve Market was valued at USD 109.97 million in 2018, reached USD 119.20 million in 2024, and will reach USD 193.76 million by 2032 at a CAGR of 6.26%.

- Leading companies include Heraeus Quarzglas GmbH & Co. KG, Raesch Quarz (Germany) GmbH, WONIK Quartz Europe, QCS Quarzglas Komponenten und Service GmbH, GVB GmbH, semiQuarz, OSRAM Pre-Materials, and Herbert Arnold GmbH & Co. KG.

- By material type, fused quartz held the largest share of 39% in 2024, driven by its thermal stability, high purity, and rising use in water treatment and semiconductors.

- By application, UV water disinfection led with 44% share in 2024, supported by strict regulations, municipal water treatment projects, and growing installation of advanced UV lamp systems.

- Southern Germany dominated with 31% share in 2024, benefiting from advanced semiconductor clusters, robust food and beverage demand, and strong industrial activity in Bavaria and Baden-Württemberg.

Market Segment Insights

By Material Type

Fused quartz dominated the Germany quartz sleeve market in 2024 with a 39% share. Its superior thermal stability, high purity, and resistance to UV degradation make it the preferred choice for water treatment and semiconductor industries. Demand is further supported by Germany’s strong base of advanced manufacturing and research facilities. High-purity quartz followed, gaining traction in pharmaceutical and electronics applications, driven by growing requirements for contamination-free environments and the expansion of precision component manufacturing.

- For instance, QSIL GmbH introduced specialty quartz components tailored for UV water purification systems, enhancing durability and operational efficiency for municipal and industrial users.

By Application

UV water disinfection led the market with a 44% share in 2024, fueled by Germany’s strict water quality regulations and widespread adoption of UV purification systems. Rising municipal investments in water treatment plants and the integration of advanced UV lamps further supported growth. UV air disinfection also recorded notable adoption in healthcare and public spaces, boosted by rising awareness of air hygiene standards post-pandemic. Surface disinfection and chemical processing provided niche opportunities, catering to food safety and industrial needs.

- For instance, Heraeus Conamic announced the expansion of its fused silica production capacity in Germany to meet growing demand from semiconductor and photonics industries.

By End-User

Water treatment emerged as the leading end-user segment with a 36% market share in 2024. The dominance stems from Germany’s advanced municipal infrastructure and stringent policies on clean water standards. The food and beverage industry followed, leveraging quartz sleeves in UV-based sterilization systems to ensure product safety and compliance with EU regulations. Pharmaceutical companies also contributed significant demand, utilizing high-purity sleeves in sterile processing environments, while semiconductor manufacturers adopted them for high-performance UV curing and precision applications.

Key Growth Drivers

Rising Demand for UV Disinfection Systems

Germany’s strict water quality regulations and focus on sustainable sanitation practices drive the adoption of UV disinfection systems. Quartz sleeves are essential for protecting UV lamps and ensuring efficient performance. Increasing municipal investments in water treatment plants and growing adoption in residential applications reinforce demand. Additionally, public awareness of waterborne diseases and the government’s initiatives toward eco-friendly disinfection methods further accelerate market growth, making UV water disinfection the largest application segment in the German quartz sleeve market.

- For instance, the Witten drinking-water plant near Berlin swapped chlorine dioxide for two Wedeco Quadron 1200 UV systems to meet stricter microbial limits.

Expansion of Semiconductor and Electronics Manufacturing

The robust semiconductor and electronics sector in Germany significantly contributes to quartz sleeve demand. These sleeves are used in high-purity and UV processes, critical for chip fabrication and precision instruments. Increasing investments in microelectronics, coupled with EU-backed initiatives to strengthen regional chip production, enhance market prospects. Germany’s position as a hub for innovation and advanced manufacturing ensures continuous utilization of high-purity quartz materials, driving both volume growth and technological upgrades across multiple end-user industries.

- For instance, GlobalFoundries partnered with Robert Bosch GmbH and other companies under the EU’s Important Project of Common European Interest (IPCEI) framework, enhancing regional semiconductor manufacturing routes that depend on quartz glass-based systems for lithography and etching

Growing Adoption in Food and Pharmaceutical Industries

Food safety and pharmaceutical compliance standards drive quartz sleeve use in sterilization and disinfection processes. The food and beverage sector leverages UV quartz sleeve systems for packaging, processing, and microbial control. Similarly, pharmaceutical companies depend on high-purity quartz sleeves for contamination-free sterile production. Rising consumer expectations for safety, paired with EU regulations for hygiene and product integrity, strengthen demand. This trend highlights the role of quartz sleeves as vital components in ensuring reliability and efficiency across regulated industries.

Key Trends & Opportunities

Integration of Advanced UV-C and LED Technologies

The integration of advanced UV-C and UV-LED systems presents new opportunities for quartz sleeves. These sleeves must adapt to higher efficiency lamps with extended lifespans. Manufacturers are innovating materials that maximize UV transmission and thermal resistance, enabling compatibility with emerging disinfection systems. This trend aligns with Germany’s push for sustainable, energy-efficient solutions. It positions quartz sleeve suppliers to benefit from long-term replacement cycles and new product development in healthcare, municipal, and consumer applications across the country.

- For instance, Signify expanded its Philips UV-C disinfection portfolio with new UV-C chambers designed for healthcare settings, where enhanced quartz sleeves were adopted to improve optical efficiency and withstand higher lamp operating conditions.

Rising Focus on Sustainable Manufacturing Practices

Sustainability is emerging as a key opportunity in the Germany quartz sleeve market. Companies are adopting eco-friendly processes to reduce carbon emissions and improve material efficiency. Demand for recyclable, durable quartz sleeves is gaining momentum, particularly in industries adopting green procurement policies. Furthermore, Germany’s strong emphasis on environmental compliance supports suppliers investing in circular economy practices. This shift enhances brand positioning and offers new opportunities for differentiation, enabling companies to strengthen competitiveness while meeting sustainability-focused customer expectations.

- For instance, Saint-Gobain’s low-carbon ORAÉ® glass uses renewable electricity and high recycled cullet. An EPD shows 64% pre-consumer cullet content for a representative product. This transparency aligns with German green procurement needs.

Key Challenges

High Production and Processing Costs

Quartz sleeve manufacturing requires high-purity raw materials and precise processing techniques, leading to elevated production costs. Advanced melting, shaping, and polishing processes increase capital requirements, which limits entry for smaller firms. Rising energy costs in Germany further exacerbate the challenge, pressuring margins. These cost factors make quartz sleeves relatively expensive compared to substitutes, creating resistance among cost-sensitive end users. Companies must adopt technological innovations and efficiency improvements to balance product quality with affordability in this competitive market.

Competition from Low-Cost Imports

German manufacturers face significant competition from low-cost imports, particularly from Asian producers with scale-driven pricing advantages. While domestic players emphasize quality, consistency, and compliance with EU regulations, cheaper imports appeal to price-sensitive buyers. This dynamic intensifies competition and challenges margins for local firms. Additionally, fluctuations in global trade policies and tariffs further complicate supply chains. To remain competitive, German suppliers must enhance value propositions by offering customized solutions, faster delivery, and superior after-sales support.

Dependence on End-User Investments

Quartz sleeve demand is closely tied to capital spending in sectors such as water treatment, semiconductors, and pharmaceuticals. Delays in municipal projects or budget constraints in industrial sectors directly impact market growth. Economic downturns, inflationary pressures, or shifts in government funding priorities can slow adoption. Such dependence on end-user investment cycles introduces uncertainty, making long-term forecasting complex. Market players must diversify customer bases and strengthen aftermarket services to mitigate risks linked to cyclical investments and project delays.

Regional Analysis

Southern Germany

Southern Germany held a 31% share in the Germany Quartz Sleeve Market in 2024. Strong industrial activity in Bavaria and Baden-Württemberg supports high adoption of quartz sleeves across water treatment, electronics, and pharmaceuticals. The presence of leading semiconductor facilities and advanced manufacturing clusters ensures steady demand for high-purity and fused quartz products. Food and beverage companies in this region also integrate UV systems to meet strict safety standards. Continuous investment in clean technologies strengthens its market leadership.

Western Germany

Western Germany accounted for a 28% share in 2024. The region benefits from a strong chemical processing and industrial base in North Rhine-Westphalia. Municipal water treatment projects supported by large urban populations continue to drive demand for quartz sleeves. Pharmaceutical companies in Frankfurt further expand usage, especially in sterile production processes. The market here reflects steady demand across multiple applications, supported by strong infrastructure and government emphasis on sanitation compliance.

Northern Germany

Northern Germany represented a 22% share in the Germany Quartz Sleeve Market during 2024. The region demonstrates rising demand due to extensive port activities and industrial processing hubs. Investments in municipal water facilities, particularly in Hamburg and Bremen, boost adoption of UV water disinfection solutions. Semiconductor and electronics demand remains moderate but growing, supported by smaller specialized facilities. Food and beverage processing units also create stable opportunities for quartz sleeves, reinforcing the region’s balanced contribution.

Eastern Germany

Eastern Germany captured a 19% share in 2024. The region is steadily advancing through infrastructure modernization and healthcare projects, particularly in Saxony and Thuringia. Smaller pharmaceutical and electronics hubs are emerging, encouraging higher use of high-purity quartz sleeves. Municipal initiatives in water purification create steady opportunities, while rising adoption in food safety strengthens demand. Though the market share remains lower compared to other regions, continued investment and industrial upgrades support long-term growth potential for quartz sleeves.

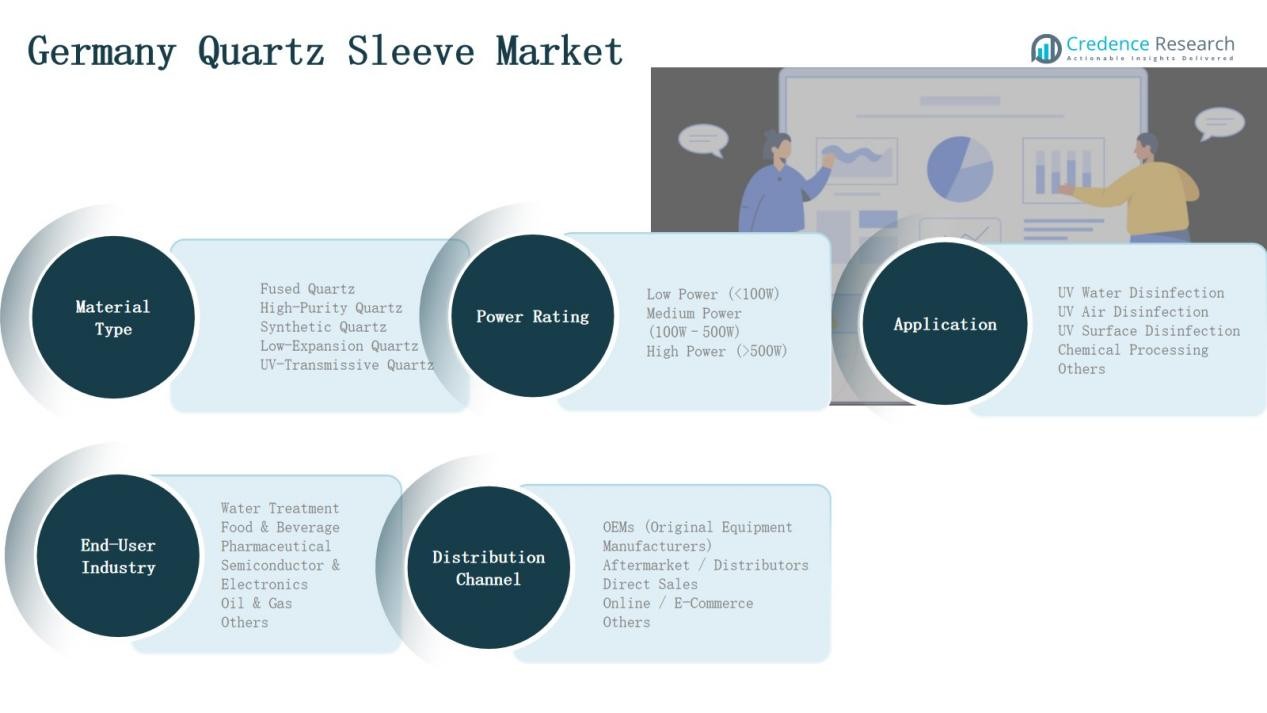

Market Segmentations:

By Material Type

- Fused Quartz

- High-Purity Quartz

- Synthetic Quartz

- Low-Expansion Quartz

- UV-Transmissive Quartz

By Application

- UV Water Disinfection

- UV Air Disinfection

- UV Surface Disinfection

- Chemical Processing

- Others

By End-User

- Water Treatment

- Food & Beverage

- Pharmaceutical

- Semiconductor & Electronics

- Oil & Gas

- Others

By Power Rating

- Low Power (<100W)

- Medium Power (100W–500W)

- High Power (>500W)

By Distribution Channel

- OEMs (Original Equipment Manufacturers)

- Aftermarket / Distributors

- Direct Sales

- Online / E-Commerce

- Others

By Region

- Southern Germany

- Western Germany

- Northern Germany

- Eastern Germany

Competitive Landscape

The Germany Quartz Sleeve Market features a mix of global leaders and specialized domestic players competing on quality, innovation, and customization. Heraeus Quarzglas GmbH & Co. KG holds a leading position, supported by advanced R&D and a broad product portfolio catering to water treatment, semiconductors, and pharmaceuticals. Raesch Quarz (Germany) GmbH and WONIK Quartz Europe (WQE) strengthen competition through precision-engineered products and established client networks. QCS – Quarzglas Komponenten und Service GmbH and GVB GmbH – Solutions in Glass focus on tailored solutions, serving both industrial and municipal applications. SemiQuarz and Herbert Arnold GmbH & Co. KG emphasize engineering expertise and niche offerings, while OSRAM Pre-Materials leverages its quartz division for UV lighting applications. Intense rivalry pushes companies to invest in high-purity materials, sustainable processes, and after-sales service. Strategic partnerships, technology upgrades, and regional expansion remain central to strengthening market share and meeting Germany’s demand for advanced quartz sleeve solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In June 2024, Wacker broke ground on a new production site in Karlovy Vary, Czech Republic, to increase its capacity for silicone specialties.

- In December 2024, SCHOTT announced acquisition of QSIL GmbH / Quarzschmelze Ilmenau, expanding its quartz glass capabilities.

- In January 2025, Heraeus merged its Conamic and Comvance units to form a new high-performance materials business, consolidating its materials technologies.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Application, End User, Power Rating, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will expand with rising investments in UV water disinfection projects across municipalities.

- Semiconductor manufacturing growth will drive adoption of high-purity quartz sleeves.

- Food and beverage companies will increase usage to ensure product safety and regulatory compliance.

- Pharmaceutical demand will rise due to sterile production requirements and hygiene standards.

- Energy-efficient UV-LED systems will create new opportunities for advanced quartz sleeve designs.

- Online distribution channels will gain traction, improving accessibility for smaller buyers.

- Sustainability initiatives will push suppliers to adopt eco-friendly manufacturing processes.

- Competition will intensify as low-cost imports challenge domestic producers.

- Regional industrial modernization will stimulate adoption in Eastern and Northern Germany.

- Customized solutions and aftermarket services will become key strategies for market differentiation.