Market Overview

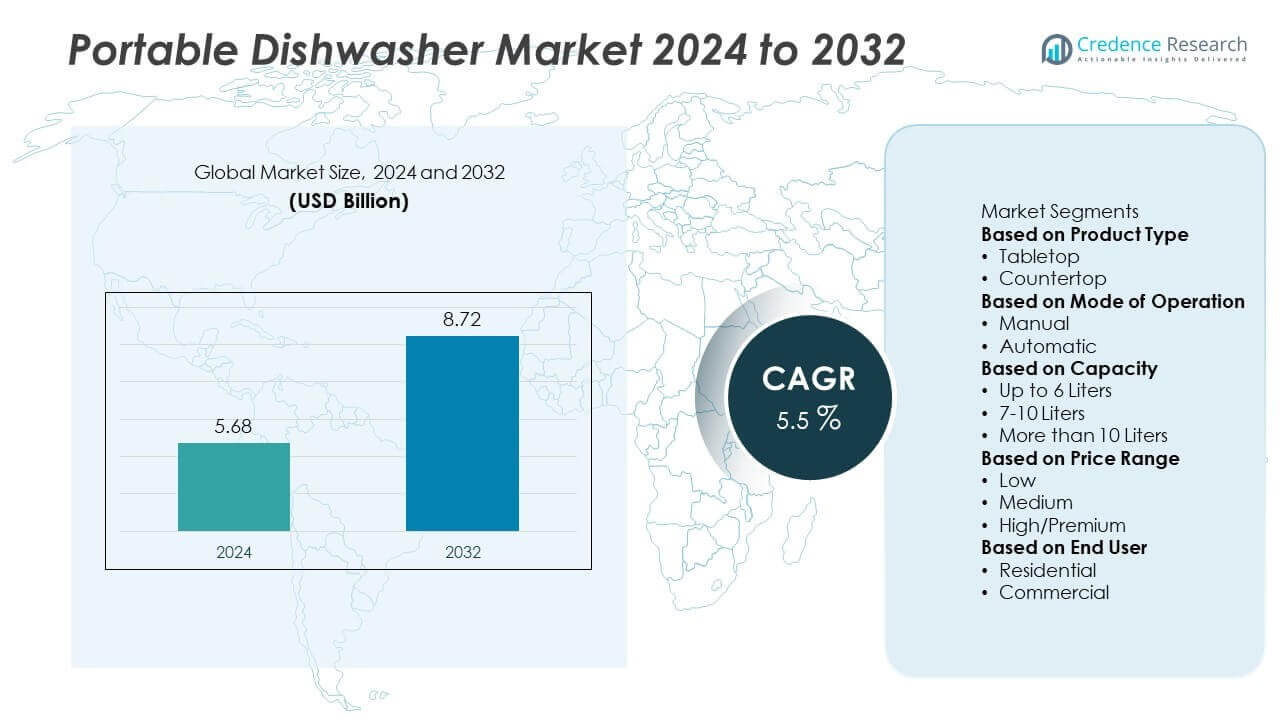

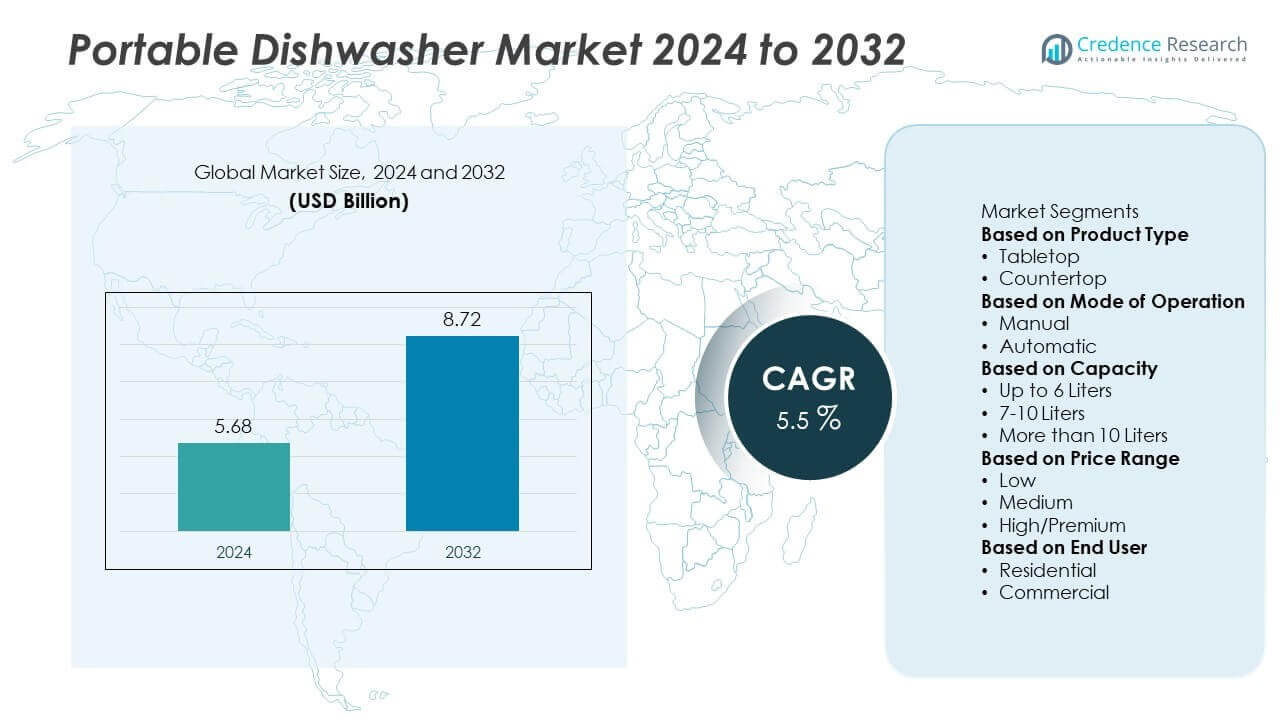

The Portable Dishwasher Market was valued at USD 5.68 billion in 2024. It is projected to reach USD 8.72 billion by 2032, growing at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Portable Dishwasher Market Size 2024 |

USD 5.68 Billion |

| Portable Dishwasher Market, CAGR |

5.5% |

| Portable Dishwasher Market Size 2032 |

USD 8.72 Billion |

The portable dishwasher market is driven by top players including Champion Industries, Haier Inc., KitchenAid, IFB Appliances, Electrolux AB, Danby, GE Appliances, Baumatic Ltd., Fisher & Paykel Appliances Ltd., and Fagor Industrial. These companies lead through innovation in compact, automated, and energy-efficient models while expanding their presence via online retail and regional distribution networks. North America emerged as the leading region in 2024 with over 35% share, supported by high consumer awareness and strong adoption of smart appliances. Europe followed with 30% share, driven by eco-regulations and demand for sustainable products, while Asia-Pacific accounted for 25% share, positioning itself as the fastest-growing market due to rising urbanization and expanding middle-class households.

Market Insights

Market Insights

- The portable dishwasher market was valued at USD 5.68 billion in 2024 and is projected to reach USD 8.72 billion by 2032, growing at a CAGR of 5.5% during 2024–2032.

- Growing demand for convenience, compact designs, and automation drives adoption, with automatic models capturing nearly 65% share and tabletop dishwashers leading product type with over 55% share.

- Smart features such as IoT connectivity, energy-saving cycles, and eco-friendly designs are shaping market trends, with mid-capacity units (7–10 liters segment) holding 50% share due to suitability for family households.

- The competitive landscape is moderately consolidated with key players including Haier Inc., KitchenAid, IFB Appliances, Electrolux AB, GE Appliances, and Danby focusing on innovation, online retail expansion, and sustainability-focused designs.

- North America held over 35% share in 2024, followed by Europe at 30% and Asia-Pacific at 25%, with Asia-Pacific emerging as the fastest-growing regional market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The tabletop segment dominated the portable dishwasher market in 2024, accounting for over 55% share. Its leadership is driven by compact size, affordability, and suitability for small households and apartments where kitchen space is limited. Rising adoption among urban consumers and renters boosts demand, as tabletop units require minimal installation. Countertop models hold a smaller but growing share, supported by improved aesthetics and advanced features like energy-saving modes. However, tabletop dishwashers remain preferred due to ease of placement, lower water consumption, and strong distribution through online retail platforms.

- For instance, Danby’s DDW631SDB model, a six-place-setting tabletop dishwasher, operates at 54 dB and consumes approximately 11.7 liters of water per normal wash cycle, making it highly efficient for small households.

By Mode of Operation

Automatic portable dishwashers led the market in 2024 with nearly 65% share, reflecting consumers’ preference for convenience and efficiency. Growth is driven by rising demand for smart appliances that offer preset wash cycles, energy optimization, and water-saving technologies. Urban households increasingly adopt automatic models to save time, particularly in regions with higher disposable incomes. Manual units maintain presence in cost-sensitive markets, but lack of advanced features limits growth. Automatic dishwashers dominate due to integration of IoT-enabled controls, expanding their appeal across tech-savvy and working-class consumers.

- For instance, the Haier HDC1804TW portable countertop dishwasher features three wash cycles, a 47 dBA quiet package, and is suitable for smaller urban kitchens with limited space.

By Capacity

The 7–10 liters segment accounted for the largest share in 2024, holding around 50% of the market. This capacity range balances affordability with sufficient load size for medium households, making it the most practical choice. Rising urban population density and the need for efficient water usage drive segment dominance. Up to 6-liter models appeal to single users and compact apartments but capture a smaller share. Larger units above 10 liters are growing in premium households. However, mid-capacity dishwashers remain dominant due to strong demand among families seeking efficient yet space-saving solutions.

Key Growth Drivers

Rising Urbanization and Space Constraints

Urban households with limited kitchen space are driving demand for portable dishwashers. Compact units, especially tabletop models, fit well in small apartments where traditional built-in dishwashers are impractical. Rising rental housing and nuclear family structures add to adoption, as consumers seek flexible appliances that require minimal installation. Growing middle-class incomes in emerging markets also expand affordability, strengthening overall market penetration.

- For instance, the IFB Neptune VX dishwasher has a 12-place setting capacity and consumes 9 liters of water per cycle, which is efficient for daily use. This model has a width of approximately 59.6 cm.

Increasing Preference for Convenience and Automation

Consumers increasingly prioritize time-saving and hassle-free solutions in daily chores. Automatic portable dishwashers, with preset wash cycles, energy-saving features, and water optimization, address these needs effectively. The rise of dual-income households further supports this trend, as busy lifestyles encourage adoption of smart kitchen appliances. Manufacturers are introducing IoT-enabled and voice-controlled models, enhancing convenience and attracting tech-savvy buyers. This demand for automation is a strong growth engine.

- For instance, the KitchenAid KDTM604KPS model offers 44 dBA ultra-quiet operation along with a ProWash cycle that uses sensors to automatically adjust wash time and water temperature based on soil levels.

Rising Focus on Water and Energy Efficiency

Environmental concerns and rising utility costs are pushing consumers toward eco-friendly dishwashers. Modern portable dishwashers use less water compared to manual washing, appealing to households conscious about sustainability. Regulatory standards promoting energy-efficient appliances also boost adoption across developed regions. Manufacturers are innovating with low-water-use models and energy-saving modes, making these units more appealing. The focus on reducing environmental footprints ensures consistent growth momentum in this segment.

Key Trends & Opportunities

Adoption of Smart and Connected Appliances

Integration of IoT, AI, and smartphone connectivity is transforming the portable dishwasher market. Consumers can now control and monitor wash cycles remotely, while predictive maintenance and customized settings enhance user experience. Smart features not only improve convenience but also align with broader smart home adoption, creating new revenue opportunities for manufacturers.

- For instance, Haier has introduced several Wi-Fi–enabled dishwashers under its high-end Casarte brand, which can be controlled via a smartphone app to monitor the cycle status and start a wash remotely. Some of its full-size models, such as the double-drawer dishwasher, offer features like voice commands and real-time process display, while other Haier smart dishwashers can use sensors to automatically determine the appropriate water usage for a given load.

Growth in Online Retail and E-Commerce Distribution

Online platforms are emerging as a major sales channel for portable dishwashers. E-commerce offers consumers access to a wider variety of models, transparent pricing, and promotional discounts. Rising digital adoption in developing economies enhances market reach, creating strong opportunities for brands to expand customer bases beyond traditional retail.

- For instance, Electrolux AB distributes its ESF6010BW portable dishwasher across multiple e-commerce platforms, with an eight-place-setting capacity and water use rated at 8.8 liters per standard eco wash cycle, demonstrating strong traction through online sales channels.

Key Challenges

High Initial Cost and Limited Awareness

Despite growing demand, portable dishwashers remain relatively expensive compared to traditional manual washing. In cost-sensitive regions, this price barrier restricts penetration. Additionally, limited consumer awareness about product benefits slows adoption, particularly in developing economies where dishwashing remains labor-intensive.

Durability and Maintenance Concerns

Many consumers perceive portable dishwashers as less durable than built-in models. Issues related to water leakage, limited load capacity, and frequent maintenance discourage adoption. These concerns create hesitation among first-time buyers and reduce repeat purchases, restraining faster market growth.

Regional Analysis

North America

North America held over 35% share of the portable dishwasher market in 2024, driven by high consumer adoption of compact and automated kitchen appliances. Strong demand stems from rising urban housing, nuclear families, and preference for convenience-focused solutions. The U.S. dominates the region, supported by advanced distribution networks and strong presence of leading appliance brands. Growing integration of IoT-enabled and energy-efficient models also fuels adoption. Canada contributes steadily, with increasing disposable incomes and sustainability-focused consumers driving sales. The region benefits from higher awareness of water and energy conservation, boosting market growth across residential households.

Europe

Europe accounted for around 30% share of the market in 2024, supported by advanced appliance penetration and environmental regulations. Countries such as Germany, the U.K., and France drive growth through strong awareness of water-saving and energy-efficient products. Compact housing across major cities enhances adoption of tabletop and mid-capacity dishwashers. EU policies promoting eco-friendly appliances create strong incentives for households to switch from manual washing. Additionally, rising online retail distribution provides greater accessibility to diverse product ranges. Europe remains a mature market where sustainability-driven innovations and automated models play a key role in maintaining steady demand.

Asia-Pacific

Asia-Pacific captured over 25% share in 2024 and represents the fastest-growing market for portable dishwashers. Rising urbanization, expanding middle-class incomes, and growing adoption of modern kitchen appliances drive strong demand. China leads the region with significant sales of affordable tabletop units, while Japan and South Korea showcase high adoption of smart and compact models. India is emerging as a promising market with increasing awareness of water-saving appliances. E-commerce growth further boosts accessibility, while regional manufacturers introduce budget-friendly options to attract first-time buyers. Asia-Pacific’s expansion is fueled by both affordability and consumer preference for convenient lifestyle solutions.

Latin America

Latin America held about 6% share of the market in 2024, with Brazil and Mexico serving as primary growth hubs. Increasing urban population and a shift toward modern appliances are driving demand, especially in middle-income households. Limited awareness and affordability challenges restrain faster penetration, but rising exposure through online retail and global brands is improving adoption. Demand for compact and low-capacity dishwashers is growing in metropolitan areas where space constraints prevail. Manufacturers are targeting cost-sensitive consumers with energy-efficient and budget-friendly options, helping the region build a steady but smaller role in the global market.

Middle East & Africa

The Middle East & Africa region accounted for around 4% share of the portable dishwasher market in 2024. Growth is led by the Gulf countries, where rising disposable incomes and preference for modern lifestyle appliances fuel adoption. Compact dishwashers are increasingly popular among younger households and urban residents. Africa remains a developing market with lower penetration due to affordability concerns and limited product awareness. However, expanding retail infrastructure and rising internet access are opening new opportunities. Energy- and water-saving models are gaining traction, particularly in areas facing resource constraints, supporting long-term market potential in the region.

Market Segmentations:

By Product Type

By Mode of Operation

By Capacity

- Up to 6 Liters

- 7-10 Liters

- More than 10 Liters

By Price Range

By End User

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the portable dishwasher market is shaped by leading players such as Champion Industries, Haier Inc., KitchenAid, IFB Appliances, Electrolux AB, Danby, GE Appliances, Baumatic Ltd., Fisher & Paykel Appliances Ltd., and Fagor Industrial. These companies compete through product innovation, smart technology integration, and expansion into new regional markets. Many focus on developing compact, energy-efficient, and water-saving models to attract eco-conscious consumers. Strategic partnerships with online retailers and investments in e-commerce platforms are further strengthening their market presence. Global brands dominate in North America and Europe, while regional manufacturers are capturing growth in Asia-Pacific and Latin America with affordable product lines. Continuous innovation in design, automation, and IoT-enabled features is a major differentiator, as brands aim to expand consumer bases across both premium and cost-sensitive markets. The market remains moderately consolidated, with competition intensifying as manufacturers prioritize sustainability and user convenience.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Electrolux Professional reported a top repairability rating for its NeoBlue Touch undercounter unit, reflecting efficiency features relevant to compact installations.

- In September 2024, KitchenAid announced its 360° Max Jets third-rack dishwasher platform, a tech update that spread across its lineup and informed compact offerings.

- In 2024, GE Appliances showcased its portfolio at KBIS 2024, including the 24-inch GPT225 portable dishwasher with sanitize cycle.

- In 2024, Champion Industries published guidance on selecting commercial dishwashers, noting space and mobility factors that align with portable needs.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Mode of Operation, Capacity, Price Range, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising adoption of compact household appliances.

- Automatic models will continue to dominate due to convenience and time-saving features.

- Smart and IoT-enabled dishwashers will gain higher demand among tech-savvy consumers.

- Energy- and water-efficient designs will remain central to product innovation.

- Tabletop dishwashers will sustain leadership as urban housing drives compact solutions.

- Online retail channels will strengthen distribution and improve global consumer access.

- Asia-Pacific will record the fastest growth, supported by urbanization and rising incomes.

- Europe will sustain demand driven by strict eco-regulations and sustainability awareness.

- Partnerships between manufacturers and e-commerce platforms will enhance market reach.

- Competition will intensify as global brands and regional players introduce affordable models.

Market Insights

Market Insights