Market Overview

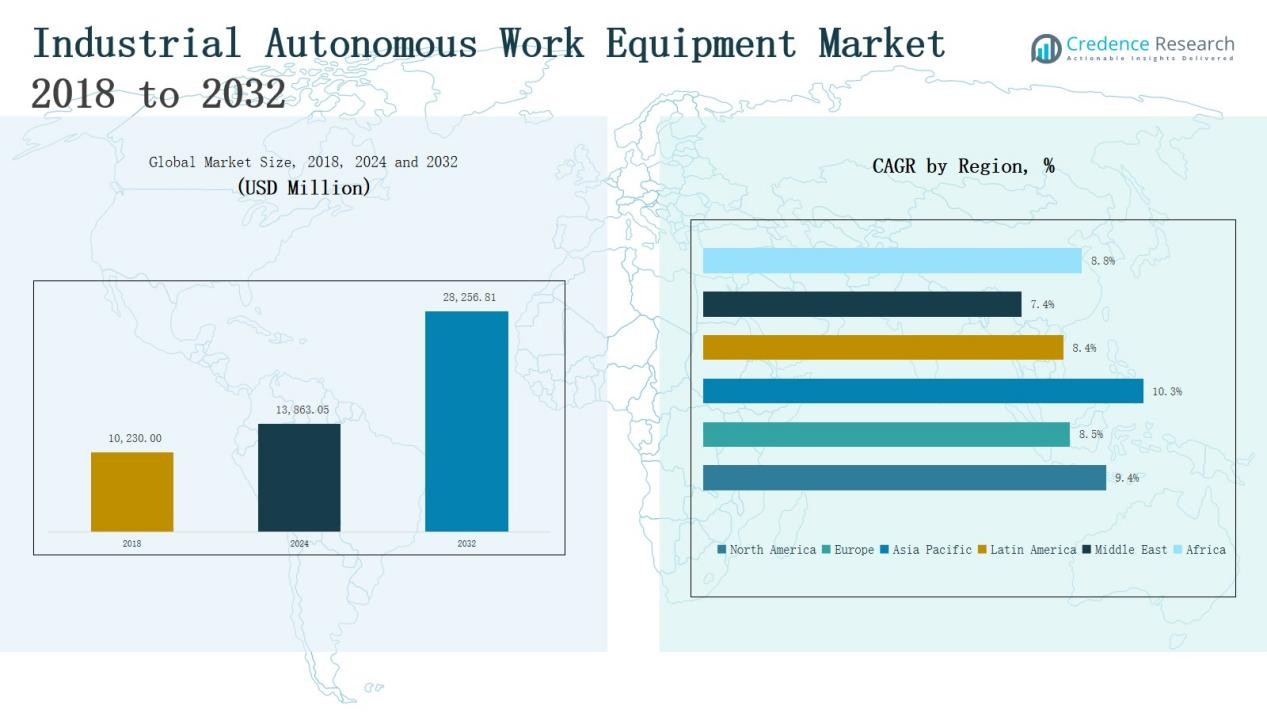

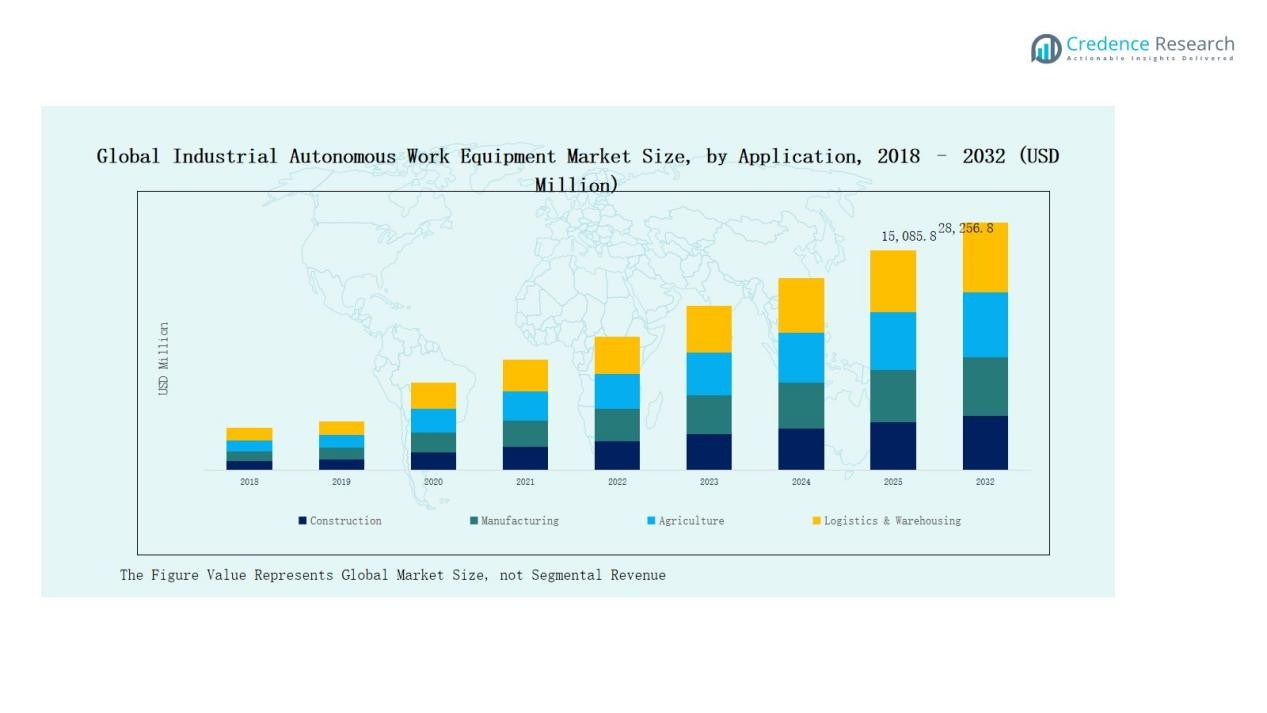

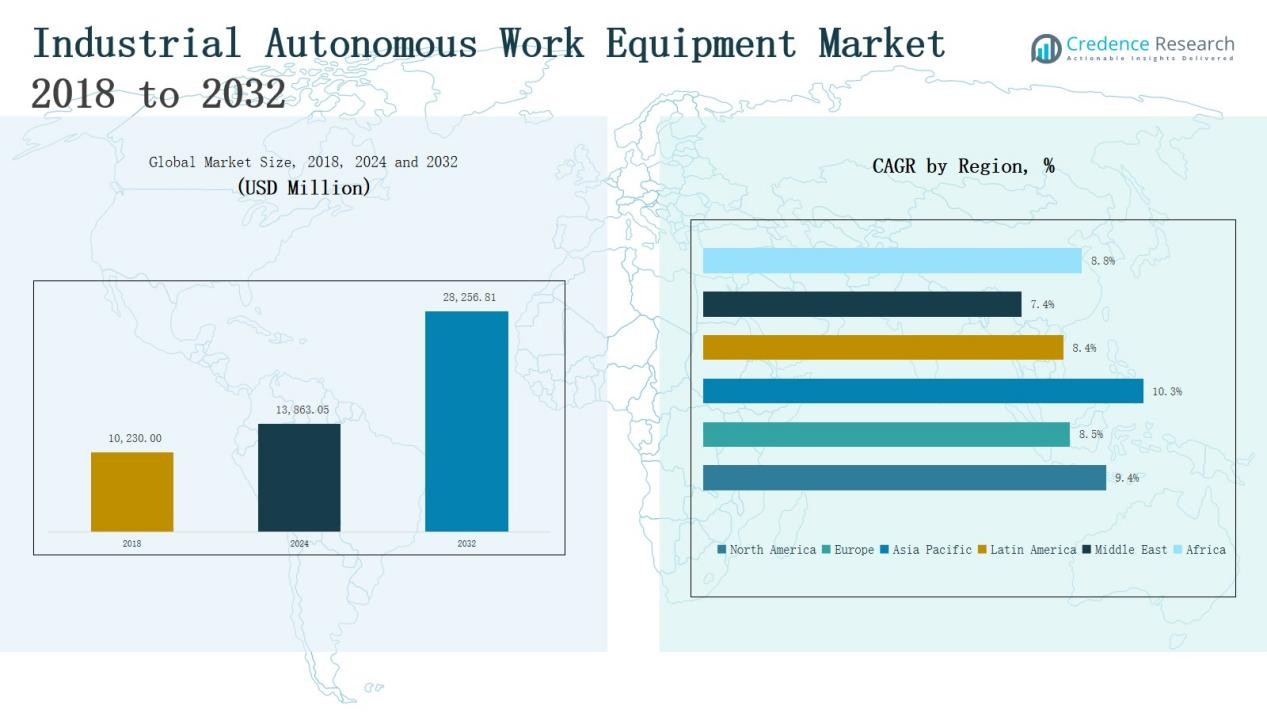

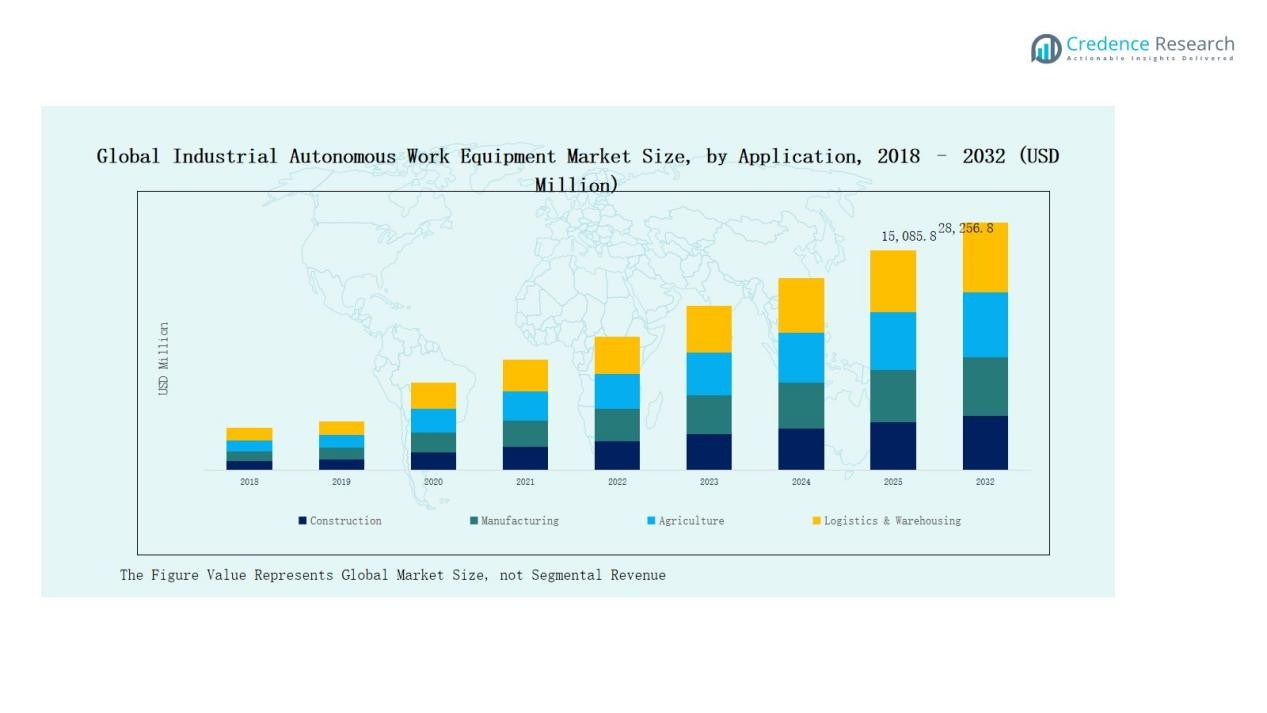

Industrial Autonomous Work Equipment Market size was valued at USD 10,230.00 million in 2018, reached USD 13,863.05 million in 2024, and is anticipated to reach USD 28,256.81 million by 2032, at a CAGR of 9.38% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Autonomous Work Equipment Market Size 2024 |

USD 13,863.05 Million |

| Industrial Autonomous Work Equipment Market, CAGR |

9.38% |

| Industrial Autonomous Work Equipment Market Size 2032 |

USD 28,256.81 Million |

The Industrial Autonomous Work Equipment Market is highly competitive, with top players such as Caterpillar, Komatsu, Hitachi Construction Machinery, Volvo Construction Equipment, Deere & Co., Liebherr Group, ABB Robotics, KUKA Robotics, Fanuc Corporation, Universal Robots, Teradyne, Honeywell Intelligrated, and Vecna Robotics driving innovation and market growth. These companies focus on integrating AI, sensors, and automation technologies to enhance efficiency and safety across construction, agriculture, manufacturing, and logistics applications. Regionally, Asia Pacific led the market in 2024 with a 37.9% share, supported by rapid industrialization, agricultural modernization, and large-scale investments in robotics and smart infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Industrial Autonomous Work Equipment Market grew from USD 10,230.00 million in 2018 to USD 13,863.05 million in 2024 and will reach USD 28,256.81 million by 2032.

- Autonomous construction equipment led by excavators, dozers, and haul trucks dominated in 2024 with a 38% share, fueled by smart city projects and infrastructure upgrades.

- Construction was the largest application segment in 2024 with a 36% share, supported by large-scale infrastructure, road building, and mining operations that reduce reliance on manual labor.

- Artificial Intelligence (AI) dominated technology adoption with a 40% share in 2024, enhancing predictive maintenance, navigation, and real-time decision-making across multiple industrial applications.

- Asia Pacific led globally with a 37.9% share in 2024, supported by rapid industrialization, agricultural mechanization, e-commerce growth, and government investments in robotics and smart infrastructure.

Market Segment Insights

By Equipment Type

Autonomous construction equipment dominated the Industrial Autonomous Work Equipment Market in 2024 with a 38% share. Excavators, dozers, and haul trucks drive adoption as construction firms seek improved safety and reduced labor dependency. Increasing smart city projects and infrastructure upgrades fuel demand, while integration of GPS, telematics, and AI-based monitoring enhances operational efficiency. Agricultural equipment follows closely, supported by rising mechanization and food demand, while industrial robots and material handling systems expand with manufacturing automation and e-commerce logistics growth.

- For instance, Caterpillar introduced an autonomous mining truck platform equipped with advanced telematics and terrain monitoring features to improve productivity in large-scale earthmoving projects.

By Application

Construction accounted for the largest share at 36% in 2024, driven by large-scale infrastructure projects and urbanization initiatives. Autonomous equipment supports efficiency in earthmoving, road building, and mining operations, reducing reliance on manual labor. Manufacturing followed, with 28% share, supported by Industry 4.0 adoption and demand for collaborative robots in assembly and production lines. Agriculture and logistics also gained momentum, with precision farming technologies and automated warehousing systems enabling productivity gains, cost efficiency, and reduced operational downtime across sectors.

- For instance, ABB introduced its GoFa 10 and GoFa 12 cobots designed for electronics assembly and precision handling applications. Agriculture and logistics also gained traction with automation technologies.

By Technology

Artificial Intelligence (AI) led the market with a 40% share in 2024, enabling predictive maintenance, autonomous navigation, and smart decision-making. AI integration across construction, agriculture, and manufacturing enhances productivity and lowers operational risks. Machine learning contributes by optimizing equipment performance through real-time analytics, while lidar and sensors strengthen safety and object detection. Computer vision supports precision in material handling and robotic arms. Together, these technologies underpin the shift toward fully autonomous, connected, and adaptive industrial ecosystems worldwide.

Key Growth Drivers

Rising Infrastructure Development and Construction Demand

The rapid growth of urbanization and smart city initiatives drives strong adoption of autonomous construction equipment. Governments worldwide are investing heavily in infrastructure modernization, including road networks, rail systems, and energy facilities. Autonomous excavators, dozers, and haul trucks improve productivity, reduce project timelines, and enhance worker safety in hazardous environments. Increasing reliance on automated heavy machinery helps address skilled labor shortages while lowering costs, making construction the leading application segment within the Industrial Autonomous Work Equipment Market.

- For instance, Built Robotics has retrofitted construction vehicles like dozers and excavators with autonomous technologies and has completed 6,000 hours of autonomous operation across 10 construction projects, thereby boosting efficiency and safety on site

Advancements in Robotics and AI Integration

The integration of robotics, artificial intelligence, and machine learning fuels growth by enabling smarter, more adaptive autonomous systems. Robotic arms, collaborative robots, and guided vehicles increasingly support precision, real-time decision-making, and predictive maintenance. These technologies enhance efficiency, accuracy, and operational safety across manufacturing and logistics sectors. AI-driven automation reduces downtime, optimizes supply chains, and lowers human error. Industries are investing in robotics-driven solutions to achieve operational resilience, ensuring consistent market expansion as adoption spreads across both developed and emerging economies.

- For instance, DHL leverages AI-based predictive algorithms to optimize routes and manage warehouse workloads, achieving a 25% reduction in delivery times and a 95% accuracy in demand forecasting, enhancing supply chain resilience and operational efficiency.

Growing Demand for Agricultural Automation

The need to meet rising global food demand and counter agricultural labor shortages accelerates adoption of autonomous tractors, harvesters, and sprayers. Precision farming technologies integrated with GPS, sensors, and AI enable accurate seeding, spraying, and harvesting, improving crop yields and resource efficiency. Farmers benefit from reduced input costs, higher productivity, and minimized environmental impact. Emerging economies, especially in Asia-Pacific and Latin America, are increasingly adopting automated agricultural equipment, making this a critical growth driver for the Industrial Autonomous Work Equipment Market.

Key Trends & Opportunities

Expansion of Autonomous Material Handling Systems

The surge of e-commerce and global trade creates rising demand for automated material handling solutions. Autonomous guided vehicles, forklifts, and pallet trucks streamline warehousing and distribution operations, reducing dependency on manual labor. These solutions increase speed, accuracy, and efficiency in logistics while minimizing safety risks. Companies are investing in smart warehouses, integrated with AI and IoT-enabled systems, to achieve real-time inventory tracking and order fulfillment. This trend presents lucrative opportunities for technology providers in the Industrial Autonomous Work Equipment Market.

- For instance, Daifuku Co., Ltd. leads with advanced automated storage and retrieval systems that optimize space and enable real-time inventory management in e-commerce warehouses

Regional Growth in Asia-Pacific

Asia-Pacific emerges as the fastest-growing regional market, driven by rapid industrialization, infrastructure development, and agricultural modernization. China, India, and Japan lead adoption through significant investments in construction, manufacturing, and robotics-driven automation. Rising government support for smart manufacturing and mechanized farming further accelerates demand. Expanding e-commerce and logistics hubs across Southeast Asia also create strong opportunities for autonomous material handling systems. With rising middle-class populations and technology adoption, Asia-Pacific offers substantial growth potential for global players in the Industrial Autonomous Work Equipment Market.

- For instance, Japan’s Kawasaki Heavy Industries announced pilot deployments of its autonomous construction machinery at large urban development projects in Tokyo, enhancing productivity while reducing operator shortages.

Key Challenges

High Initial Investment and Integration Costs

The adoption of autonomous equipment requires significant capital expenditure, including machinery upgrades, AI software, sensors, and integration with existing infrastructure. Small and medium enterprises often face financial barriers, limiting large-scale deployment. Maintenance and training costs add to the financial burden, particularly in price-sensitive markets. While cost savings materialize over time, the initial outlay slows adoption rates in developing economies. Addressing affordability through financing models and scalable solutions remains a key challenge for market expansion.

Workforce Resistance and Skill Gaps

The shift toward autonomous work equipment raises concerns over job displacement and workforce restructuring. Many industries face resistance from workers fearing job losses due to automation. Additionally, the operation and maintenance of advanced autonomous systems require specialized technical skills, which are scarce in many regions. Companies must invest in workforce reskilling programs and promote human-machine collaboration to reduce resistance. Bridging this skill gap is critical to ensuring sustainable adoption and wider acceptance of autonomous equipment in industrial operations.

Regulatory and Safety Compliance

Ensuring the safe deployment of autonomous equipment in industrial environments remains a significant challenge. Regulatory frameworks across countries are still evolving, with varying standards for safety, liability, and data usage. Accidents or malfunctions involving autonomous machinery can raise liability concerns and damage trust in automation. Manufacturers must adhere to stringent compliance standards, including cybersecurity safeguards for connected equipment. Establishing unified global regulations and ensuring safety certifications will be critical to overcoming these barriers in the Industrial Autonomous Work Equipment Market.

Regional Analysis

North America

The North America Industrial Autonomous Work Equipment Market was valued at USD 2,908.39 million in 2018, reached USD 2,933.48 million in 2024, and is expected to hit USD 5,965.35 million by 2032, expanding at a CAGR of 9.4%. The region held a 21.2% share in 2024, driven by strong adoption in construction, mining, and logistics sectors. The U.S. leads with advanced automation infrastructure, robust R&D investments, and early regulatory frameworks supporting autonomous technologies. Demand for AI-enabled construction equipment and collaborative robots positions North America as a consistent revenue-generating region.

Europe

The Europe Industrial Autonomous Work Equipment Market was USD 2,485.89 million in 2018, increased to USD 3,226.94 million in 2024, and is projected to reach USD 6,181.25 million by 2032, recording a CAGR of 8.5%. Europe accounted for 23.3% of global share in 2024, supported by strong industrial robotics adoption and automation in automotive and manufacturing hubs. Countries such as Germany, France, and Italy drive growth through Industry 4.0 initiatives and sustainability-driven smart construction projects. Regulatory support for automation and advanced manufacturing technologies sustains Europe’s competitive position in the global market.

Asia Pacific

The Asia Pacific Industrial Autonomous Work Equipment Market was valued at USD 3,764.64 million in 2018, rose to USD 5,251.96 million in 2024, and is forecast to reach USD 11,419.45 million by 2032, growing at a CAGR of 10.3%. With a 37.9% share in 2024, Asia Pacific dominates the global market, led by China, Japan, and India. Rapid industrialization, expanding agricultural mechanization, and smart manufacturing initiatives boost demand for autonomous equipment. E-commerce growth and large-scale warehousing further drive material handling automation. Government investments in robotics and infrastructure reinforce Asia Pacific’s role as the fastest-growing regional market.

Latin America

The Latin America Industrial Autonomous Work Equipment Market stood at USD 654.72 million in 2018, reached USD 878.78 million in 2024, and is anticipated to touch USD 1,663.48 million by 2032, advancing at a CAGR of 8.4%. The region captured a 6.3% share in 2024, driven by expanding construction projects, mining activities, and agricultural automation in Brazil and Argentina. Growing focus on smart farming practices and logistics modernization supports adoption. Although investment constraints limit faster growth, increasing partnerships with global automation providers present opportunities for scaling autonomous equipment usage across key industries.

Middle East

The Middle East Industrial Autonomous Work Equipment Market was valued at USD 286.44 million in 2018, increased to USD 354.80 million in 2024, and is estimated to reach USD 624.63 million by 2032, growing at a CAGR of 7.4%. Holding a 2.6% share in 2024, growth is supported by construction megaprojects in GCC countries and rising demand for automation in oil, gas, and logistics operations. Saudi Arabia and the UAE lead adoption through smart infrastructure and mining projects. Investments in robotics for industrial efficiency are expected to drive gradual expansion despite regional volatility.

Africa

The Africa Industrial Autonomous Work Equipment Market was USD 129.92 million in 2018, surged to USD 1,217.09 million in 2024, and is expected to reach USD 2,402.66 million by 2032, registering a CAGR of 8.8%. With a 8.8% global share in 2024, Africa shows strong momentum fueled by urbanization, mining expansion, and agricultural mechanization. South Africa and Egypt are leading adopters, while infrastructure projects across sub-Saharan Africa increase reliance on autonomous machinery. Rising foreign investments and government-backed modernization programs strengthen adoption, though challenges in financing and skills development remain.

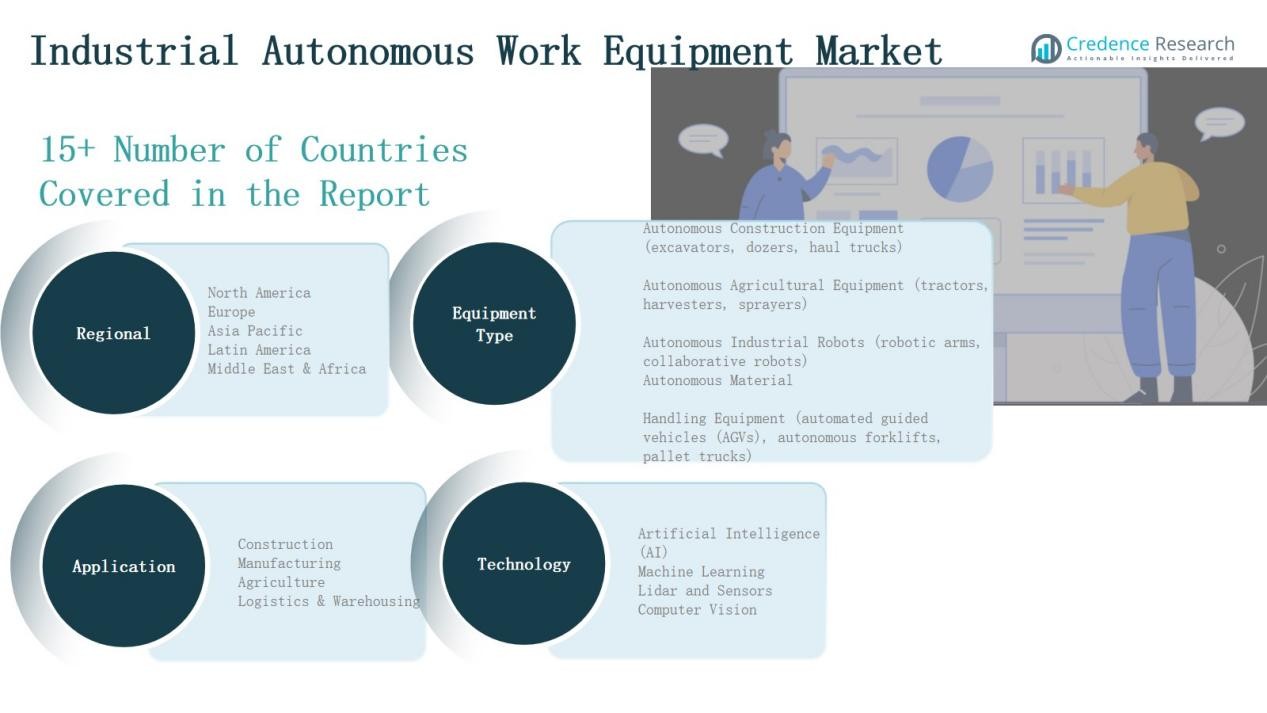

Market Segmentations:

By Equipment Type

- Autonomous Construction Equipment (excavators, dozers, haul trucks)

- Autonomous Agricultural Equipment (tractors, harvesters, sprayers)

- Autonomous Industrial Robots (robotic arms, collaborative robots)

- Autonomous Material Handling Equipment (AGVs, autonomous forklifts, pallet trucks)

By Application

- Construction

- Manufacturing

- Agriculture

- Logistics & Warehousing

By Technology

- Artificial Intelligence (AI)

- Machine Learning

- Lidar and Sensors

- Computer Vision

By Region

- North America(U.S., Canada, Mexico)

- Europe(UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific(China, Japan, South Korea, India, Australia, Southeast Asia, Rest of APAC)

- Latin America(Brazil, Argentina, Rest of Latin America)

- Middle East(GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa(South Africa, Egypt, Rest of Africa)

Competitive Landscape

The Industrial Autonomous Work Equipment Market features a mix of global heavy equipment manufacturers, robotics firms, and automation technology providers competing to expand market presence. Leading players such as Komatsu, Hitachi Construction Machinery, Volvo Construction Equipment, Deere & Co., and Liebherr Group dominate the construction and agricultural equipment segments with advanced autonomous machinery integrated with AI, sensors, and telematics. Robotics leaders including ABB Robotics, KUKA Robotics, Fanuc Corporation, Universal Robots, and Teradyne strengthen the manufacturing segment with collaborative robots and industrial automation systems. Logistics-focused companies such as Honeywell Intelligrated and Vecna Robotics enhance market dynamics with autonomous material handling solutions. Competition centers on innovation, strategic partnerships, and regional expansion, with firms investing heavily in AI-driven navigation, predictive maintenance, and energy-efficient designs. Mergers, acquisitions, and alliances with technology firms further shape the market, as companies aim to provide end-to-end autonomous solutions across construction, agriculture, manufacturing, and logistics applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Deere & Co.

- Universal Robots

- Teradyne

- Vecna Robotics

- Komatsu

- Hitachi Construction Machinery

- Volvo Construction Equipment

- ABB Robotics

- KUKA Robotics

- John Deere

- Fanuc Corporation

- Honeywell Intelligrated

- Liebherr Group

Recent Developments

- In August 2025, Komatsu and Pronto launched an autonomy solution for quarry-size trucks in North America.

- In January 2025, John Deere revealed new autonomous machines along with its second-generation autonomy kit at CES 2025.

- In September 2025, Forterra and Hiab signed a strategic partnership to advance autonomy in load handling solutions.

- In September 2025, TIER IV, Komatsu, and Earthbrain formed a partnership to develop autonomous construction technology.

Report Coverage

The research report offers an in-depth analysis based on Equipment Type, Application, Technology and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI-powered autonomous machinery will expand across construction, agriculture, and logistics.

- Collaborative robots will gain traction in manufacturing for precision-driven and flexible operations.

- Autonomous material handling systems will strengthen warehousing and e-commerce supply chains.

- Governments will support automation through incentives, policies, and smart infrastructure investments.

- Energy-efficient and sustainable autonomous equipment will see higher demand across industries.

- Integration of IoT, 5G, and cloud platforms will enhance remote equipment management.

- Emerging economies will accelerate adoption with growing focus on industrial modernization.

- Partnerships between equipment manufacturers and tech firms will drive product innovation.

- Workforce reskilling initiatives will become essential to support long-term adoption.

- Safety standards and regulatory frameworks will evolve to ensure reliable global deployment.