Market Overview

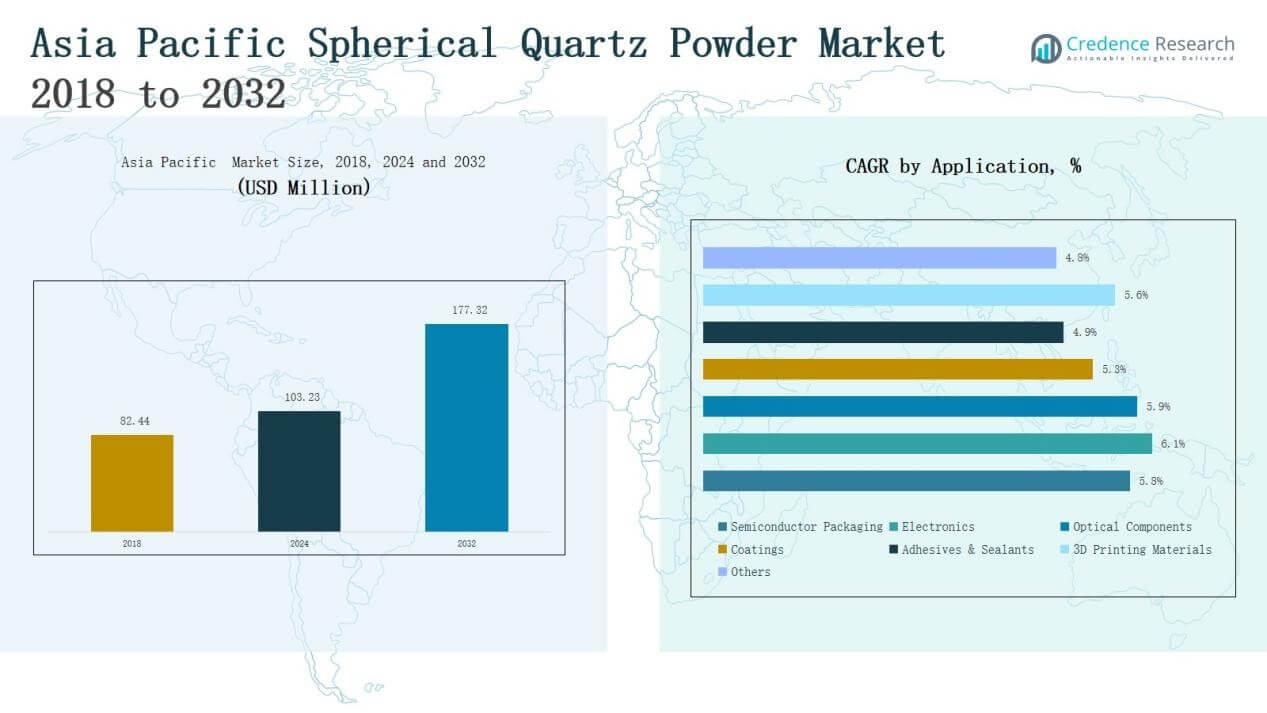

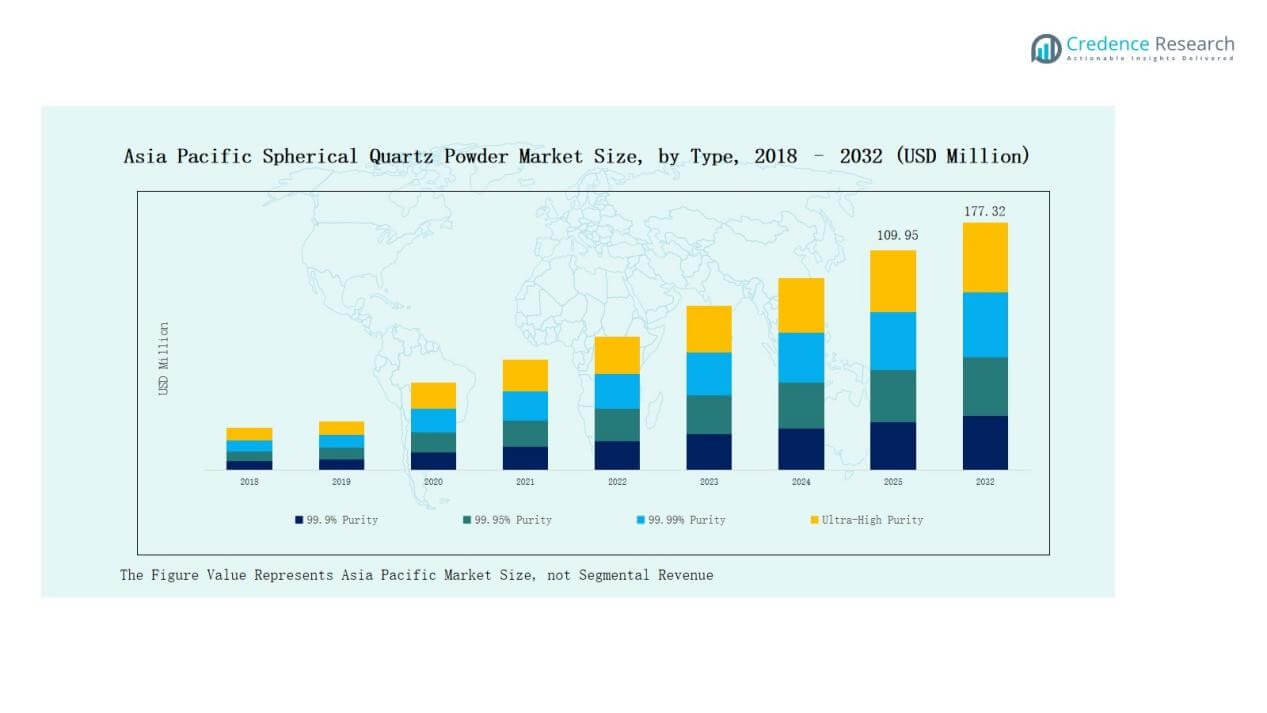

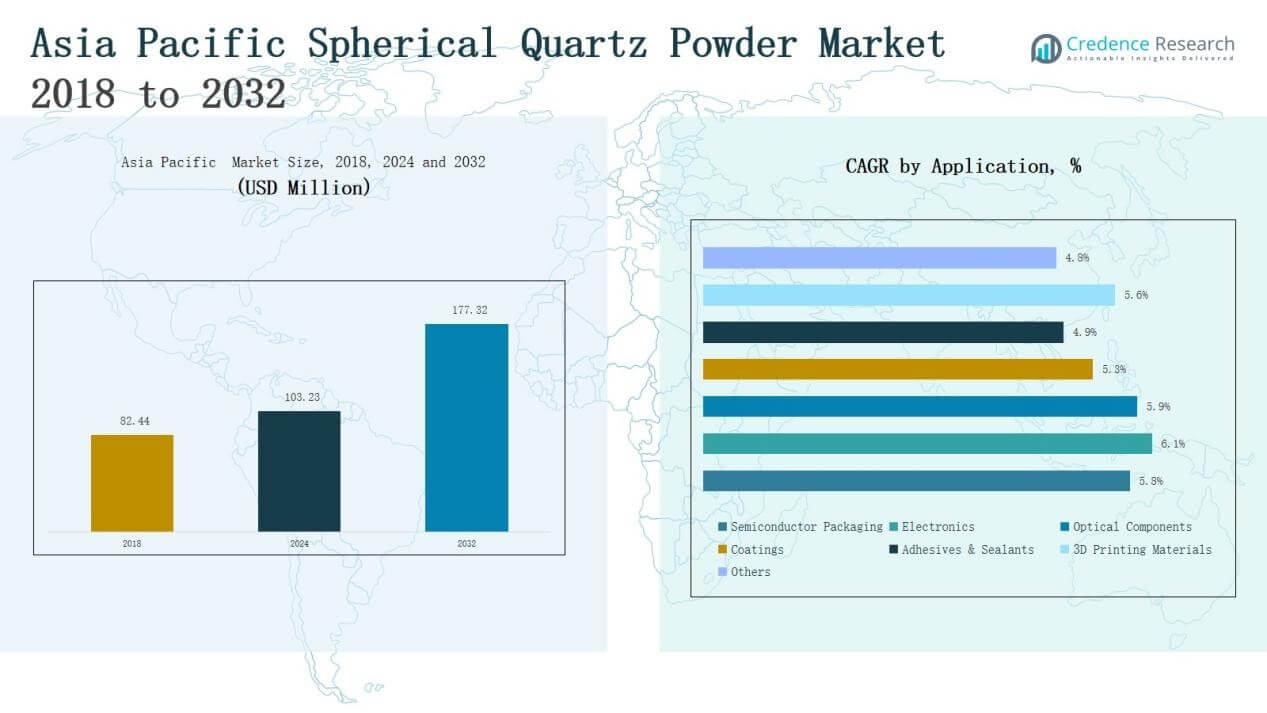

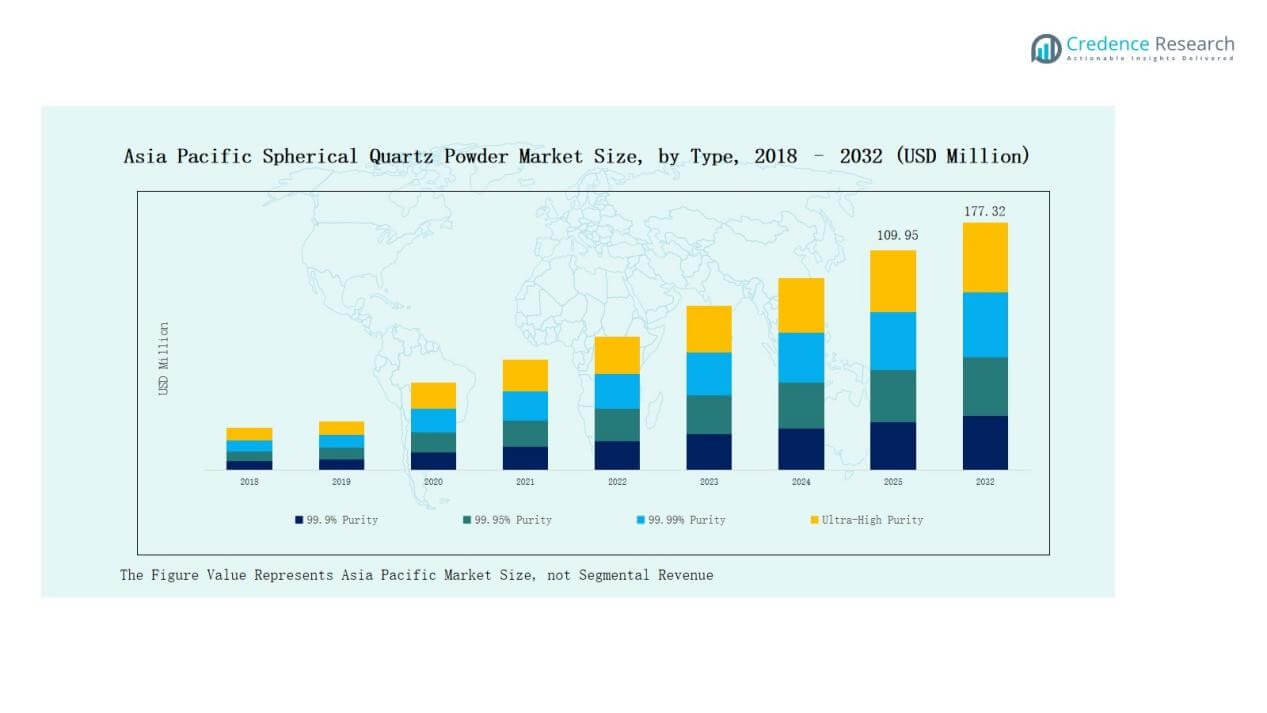

Asia Pacific Spherical Quartz Powder Market size was valued at USD 82.44 million in 2018, reached USD 103.23 million in 2024, and is anticipated to reach USD 177.32 million by 2032, at a CAGR of 5.62% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asia Pacific Spherical Quartz Powder Market Size 2024 |

USD 103.23 Million |

| Asia Pacific Spherical Quartz Powder Market, CAGR |

5.62% |

| Asia Pacific Spherical Quartz Powder Market Size 2032 |

USD 177.32 Million |

The Asia Pacific Spherical Quartz Powder Market is shaped by strong competition among established global and regional players, including SINOENERGY GROUP, ALPA Powder Technology, Shin-Etsu Chemical, Tatsumori, Denka, Sibelco, FUSO Chemical, Admatechs, and Nippon Chemical. These companies focus on high-purity quartz solutions to serve the semiconductor, electronics, and advanced material industries. Chinese producers dominate in capacity and cost-efficiency, while Japanese and South Korean firms emphasize ultra-high purity for advanced chip applications. Among regions, China leads the market with a 42% share in 2024, driven by its vast semiconductor manufacturing base, government-backed self-sufficiency initiatives, and expanding electronics exports. This leadership reinforces China’s position as the central hub for both production and consumption in the regional market.

Market Insights

Market Insights

- The Asia Pacific Spherical Quartz Powder Market reached USD 103.23 million in 2024 and is projected to reach USD 177.32 million by 2032, growing at 5.62%.

- The 99.99% purity type led the market with 38% share in 2024, supported by demand from semiconductor manufacturing and adoption of 5G and AI-powered devices.

- Semiconductor packaging was the top application, holding 41% share in 2024, driven by rapid expansion of the semiconductor supply chain across China, South Korea, and Taiwan.

- The semiconductor and electronics industry dominated end-use with 52% share in 2024, supported by strong regional manufacturing hubs and government-backed self-sufficiency initiatives.

- China commanded the largest share at 42% in 2024, driven by its semiconductor dominance, government support, EV expansion, and growing investments in quartz refining technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Type

The 99.99% purity segment dominates the Asia Pacific Spherical Quartz Powder Market, accounting for over 38% of revenue share in 2024. Its dominance stems from widespread use in semiconductor manufacturing, where ultra-clean raw materials are critical for advanced chip production. The demand is further supported by the rising adoption of 5G networks and AI-powered devices, which require higher performance chips. Increasing investment in high-end electronics across China, Japan, and South Korea strengthens the growth of this segment.

For instance, Tokuyama Corporation announced the expansion of its electronic materials segment in Japan, highlighting spherical silica products tailored for semiconductor applications.

By Application

Semiconductor packaging is the leading application segment, holding about 41% of the market share in 2024. Growth is driven by rapid expansion of the semiconductor supply chain in Asia Pacific, particularly in China, South Korea, and Taiwan. High dielectric strength and thermal resistance of spherical quartz powder make it indispensable for IC packaging. Rising demand for smartphones, consumer electronics, and EV chips continues to propel its adoption. Advanced wafer-level packaging technologies further reinforce the segment’s market leadership.

For instance, Samsung Electronics expanded its advanced packaging line in Cheonan, Korea, to support growing demand for high-density chips in consumer electronics and automotive applications.

By End-Use Industry

The semiconductor and electronics industry dominates end-use, contributing nearly 52% of total revenue in 2024. The segment benefits from Asia Pacific’s position as a global hub for electronics production and semiconductor fabrication. Demand for quartz powder in photolithography, encapsulation, and integrated circuit applications is rising steadily. Government-backed investments in semiconductor self-sufficiency, particularly in China and India, also strengthen market momentum. Growing consumer electronics penetration and increased R&D in microelectronics sustain the leading share of this end-use segment.

Key Growth Drivers

Key Growth Drivers

Expanding Semiconductor Manufacturing in Asia Pacific

The Asia Pacific Spherical Quartz Powder Market benefits strongly from the region’s rapid semiconductor industry growth. China, Japan, South Korea, and Taiwan account for the largest share of global chip production. High-purity quartz powder is crucial for wafer fabrication, encapsulation, and integrated circuit packaging. Government-backed investments and incentives to achieve semiconductor self-sufficiency, particularly in China and India, further accelerate demand. Increasing consumption of consumer electronics and automotive semiconductors reinforces the segment’s long-term growth potential across the regional supply chain.

For instance, in 2023, TSMC ramped up production at its Fab 18 in Tainan, Taiwan, dedicated to 5-nanometer chips, with a monthly output capacity exceeding 120,000 wafers, directly driving demand for ultra-pure quartz materials used in photolithography and etching processes.

Rising Adoption of Advanced Electronics and 5G Devices

The market experiences significant growth due to the adoption of 5G-enabled devices and advanced electronics. Quartz powder provides exceptional dielectric strength and heat resistance, supporting high-performance electronic components. With Asia Pacific driving global smartphone and smart device production, demand for reliable raw materials has increased. Investments in AI, IoT, and high-speed data centers require durable semiconductor packaging solutions. This surge in digital infrastructure and next-generation communication systems is a primary driver for sustained market expansion across multiple economies.

Increasing Penetration of Electric Vehicles (EVs)

The rise of electric vehicles in Asia Pacific creates notable demand for spherical quartz powder. EV batteries, sensors, and power electronics rely heavily on semiconductor packaging and electronic materials, where quartz powder plays a vital role. Countries like China, Japan, and South Korea lead EV adoption, driving supply chain expansion. Supportive government policies promoting clean energy mobility further accelerate adoption. The increasing use of EV chips, battery management systems, and high-performance power electronics boosts the need for high-purity quartz.

For instance, China sold 12.866 million new-energy vehicles in 2024, equal to 40.9% of all auto sales, which accelerates power semiconductor demand.

Key Trends & Opportunities

Emergence of 3D Printing Applications

3D printing materials represent a growing opportunity within the Asia Pacific Spherical Quartz Powder Market. High-purity quartz is increasingly adopted for producing precision components in medical, aerospace, and electronics industries. The powder’s thermal stability and chemical resistance make it suitable for additive manufacturing of complex geometries. Rapid industrialization and demand for customized parts in China, Japan, and Southeast Asia reinforce the trend. Growing investments in research and material innovation provide new opportunities to expand beyond conventional semiconductor applications.

For instance, in October 2018, GE Aviation (now GE Aerospace) announced the production of its 30,000th 3D-printed fuel nozzle tip. These nozzles were created using metal additive manufacturing, specifically laser or electron beam powder bed fusion.

Sustainability and Eco-Friendly Manufacturing Practices

A key trend is the growing adoption of sustainable production methods in quartz powder processing. Manufacturers across Asia Pacific focus on reducing carbon emissions, improving recycling, and adopting cleaner refining technologies. With governments enforcing stricter environmental regulations, eco-friendly solutions gain greater market acceptance. Green procurement policies among semiconductor and electronics companies further strengthen adoption. Companies investing in circular economy practices and energy-efficient production gain competitive advantages. This shift toward sustainability not only meets compliance but also enhances brand credibility.

For instance, in 2023, AGC Inc. in Japan achieved a successful demonstration test of hydrogen-fueled glass production at its Kansai Plant, a technology that aligns with its overall strategy to develop innovative glass melting methods to significantly reduce CO₂ emissions.

Key Challenges

High Production Costs of Ultra-High Purity Quartz Powder

Producing ultra-high purity quartz powder involves complex refining and processing, leading to elevated costs. These costs impact the ability of smaller manufacturers to compete with established global players. Limited availability of natural quartz deposits with required quality adds to challenges. High production expenses often translate into premium pricing, restricting widespread adoption in cost-sensitive industries. Balancing quality, affordability, and scaling production remains a key challenge that slows penetration into emerging applications outside semiconductors and advanced electronics.

Geopolitical and Supply Chain Vulnerabilities

The Asia Pacific Spherical Quartz Powder Market faces risks from geopolitical tensions and supply chain disruptions. Heavy reliance on cross-border trade for raw quartz materials exposes manufacturers to fluctuations in pricing and availability. Disruptions caused by trade restrictions, tariffs, or political instability can delay production schedules. Semiconductor industries in particular are vulnerable to delays in securing critical raw materials. These uncertainties compel companies to invest in local sourcing, vertical integration, or strategic reserves, yet challenges persist in ensuring stable supply chains.

Intense Competition and Pricing Pressures

The market experiences growing competition among regional and international players, creating pricing press ures. Large-scale producers from China dominate supply with competitive pricing, impacting profit margins for smaller firms. Continuous technological advancements push companies to upgrade capabilities, adding to cost burdens. Customers demand high-quality materials at lower costs, particularly in mass semiconductor production. This combination of strong competition and price sensitivity poses a challenge for companies seeking to balance innovation, profitability, and market share growth across Asia Pacific.

Regional Analysis

China

China dominates the Asia Pacific Spherical Quartz Powder Market with a 42% share in 2024. It benefits from its position as the global hub for semiconductor and electronics manufacturing. Strong government support for domestic semiconductor production boosts demand for high-purity quartz materials. The country’s rapid expansion of electric vehicles and renewable energy sectors further contributes to consumption. It continues to attract investment in quartz refining technologies, ensuring consistent supply for downstream industries. China’s leadership in electronics exports reinforces its position as the leading market.

Japan

Japan holds a 17% share and remains a critical market due to its advanced semiconductor and automotive industries. The country’s strong R&D ecosystem encourages innovation in quartz-based applications. High-quality standards drive the need for ultra-pure quartz powder in chip packaging and optical components. Demand is supported by leading domestic companies specializing in electronics and materials technology. Growth is reinforced by continuous investment in 5G infrastructure and high-end electronics. Japan maintains a stable presence with consistent adoption across industrial and technological applications.

South Korea

South Korea accounts for a 14% share supported by its globally competitive semiconductor sector. Companies in the country prioritize quartz powder for IC packaging, wafer fabrication, and microelectronics. Strong ties with global technology companies ensure steady demand for high-purity grades. The rise of consumer electronics, combined with government-backed digital strategies, strengthens its position. It also benefits from growth in display technologies, where quartz powder plays a vital role. South Korea’s strong export-oriented semiconductor industry sustains the segment’s share in the region.

India

India represents 9% of the regional market, driven by emerging electronics manufacturing and government initiatives like “Make in India.” The push toward semiconductor self-reliance boosts domestic demand for spherical quartz powder. Rapid growth in the automotive and telecommunications sectors creates new opportunities. It faces challenges in scaling production to meet ultra-high purity requirements, but foreign partnerships are helping bridge this gap. Expansion of EV production and digitalization trends support ongoing consumption. India is positioned as a growing market within the regional landscape.

Australia

Australia captures a 7% share, primarily due to its role in supplying raw quartz resources. Its mining industry provides high-quality quartz used in downstream powder processing across Asia Pacific. Domestic consumption remains modest, but export activities strengthen its relevance. Investments in refining technologies improve the value chain for local producers. Demand for advanced materials in defense and aerospace industries also supports growth. Australia’s focus on mineral resource development ensures its continued role in the regional market.

Southeast Asia

Southeast Asia holds a 6% share, supported by expanding electronics assembly and industrial manufacturing. Countries such as Malaysia, Vietnam, and Singapore attract foreign investments in semiconductor packaging and electronics supply chains. Demand for adhesives, coatings, and optical applications is also rising. It benefits from growing infrastructure for high-tech manufacturing and supportive trade policies. Increasing consumer electronics penetration drives demand for advanced materials. Southeast Asia continues to emerge as a competitive manufacturing hub in the regional quartz powder market.

Rest of Asia Pacific

The Rest of Asia Pacific contributes 5% share, encompassing smaller but growing markets. Demand is largely driven by industrial manufacturing and telecommunications applications. Countries in this segment focus on improving local electronics production capacity. Growth opportunities lie in niche applications such as 3D printing and specialty coatings. While scale remains limited, expanding industrial bases create steady adoption. It maintains relevance by serving specialized needs within the broader regional landscape.

Market Segmentations:

Market Segmentations:

By Type

- 9% Purity

- 95% Purity

- 99% Purity

- Ultra-High Purity

By Application

- Semiconductor Packaging

- Electronics

- Optical Components

- Coatings

- Adhesives & Sealants

- 3D Printing Materials

- Others

By End-Use Industry

- Semiconductor & Electronics

- Automotive

- Aerospace

- Telecommunications

- Industrial Manufacturing

- Others

By Region

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Competitive Landscape

The Asia Pacific Spherical Quartz Powder Market is characterized by strong competition among global and regional manufacturers focusing on high-purity materials. Key players such as SINOENERGY GROUP, ALPA Powder Technology, Shin-Etsu Chemical, Tatsumori, and Denka lead with extensive product portfolios and established supply chains. Japanese and South Korean companies emphasize ultra-high-purity grades for advanced semiconductor applications, while Chinese producers dominate mid- to high-purity segments with cost advantages and large-scale capacity. International firms like Sibelco and FUSO Chemical strengthen their presence through partnerships and technology upgrades. Companies are investing in refining technologies, sustainability practices, and vertical integration to enhance competitiveness. Intense competition drives continuous innovation, with firms targeting electronics, EVs, and optical components as key growth sectors. Market players focus on balancing quality and pricing to secure long-term contracts with semiconductor manufacturers, positioning themselves strategically in one of the world’s most dynamic high-tech material markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- SINOENERGY GROUP

- ALPA Powder Technology

- Sinonine

- Micron

- Denka

- Tatsumori

- Shin-Etsu Chemical

- Tanki New Materials

- Tongrun Nano Technology

- NOVORAY

- Admatechs

- FUSO Chemical

- Sibelco

- Nippon Chemical

- Pacific Quartz

Recent Developments

- In February 2025, Novoray disclosed plans for a 300 million yuan investment in its spherical silica project to expand production capacity.

- In August 2024, Denka introduced its SNECTON low-dielectric-loss spherical silica variant in its quarterly report, targeting semiconductor sealing applications.

- In 2024, Sibelco was cited in industry reports as a top global high-purity quartz supplier, recognized alongside Pacific Quartz among major HPQ / quartz suppliers.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End User Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise with expanding semiconductor fabrication across China, Japan, and South Korea.

- High-purity grades will gain preference due to increasing use in advanced electronics.

- EV adoption will strengthen quartz powder demand for power electronics and battery systems.

- Optical component applications will expand with growing investment in telecommunications networks.

- 3D printing materials will emerge as a niche growth driver in aerospace and healthcare.

- Sustainability initiatives will encourage adoption of eco-friendly refining and production processes.

- Regional governments will support domestic production capacity to reduce import reliance.

- Strategic collaborations between local producers and global technology firms will accelerate innovation.

- Industrial manufacturing and coatings sectors will continue to create steady demand.

- Market competition will intensify, pushing firms to focus on quality differentiation and integration.

Market Insights

Market Insights Key Growth Drivers

Key Growth Drivers Market Segmentations:

Market Segmentations: