Market Overview

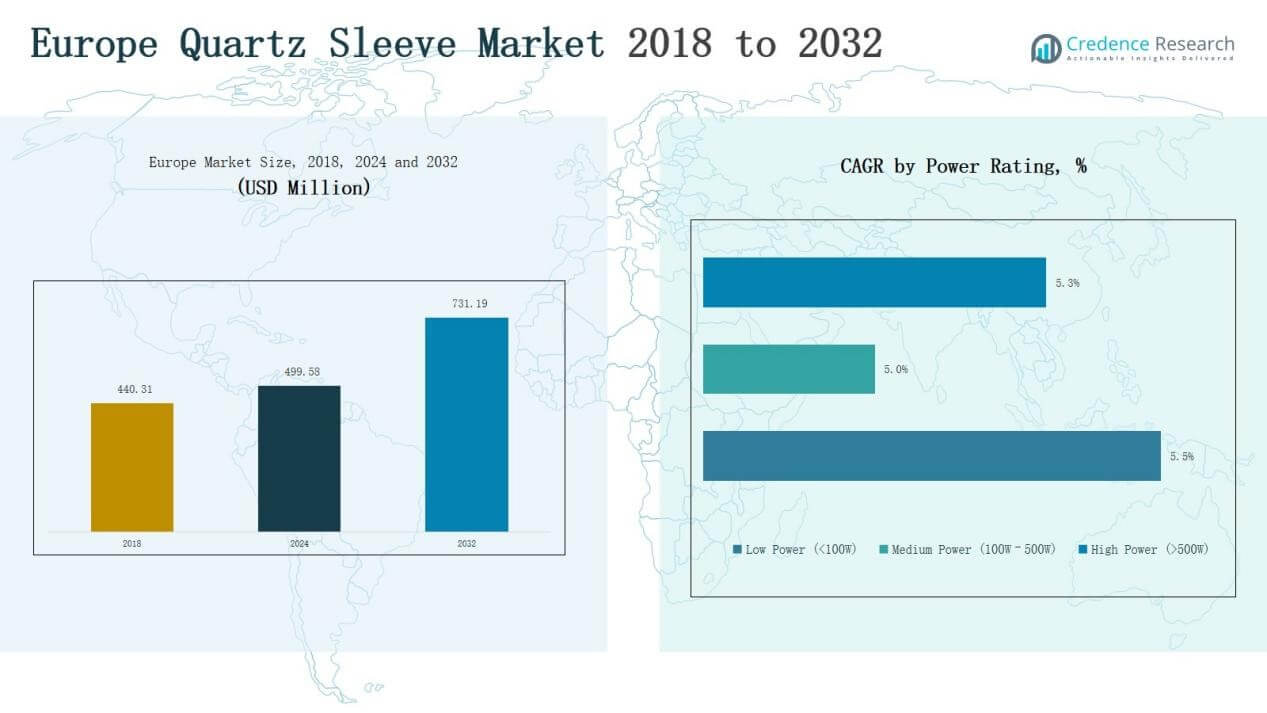

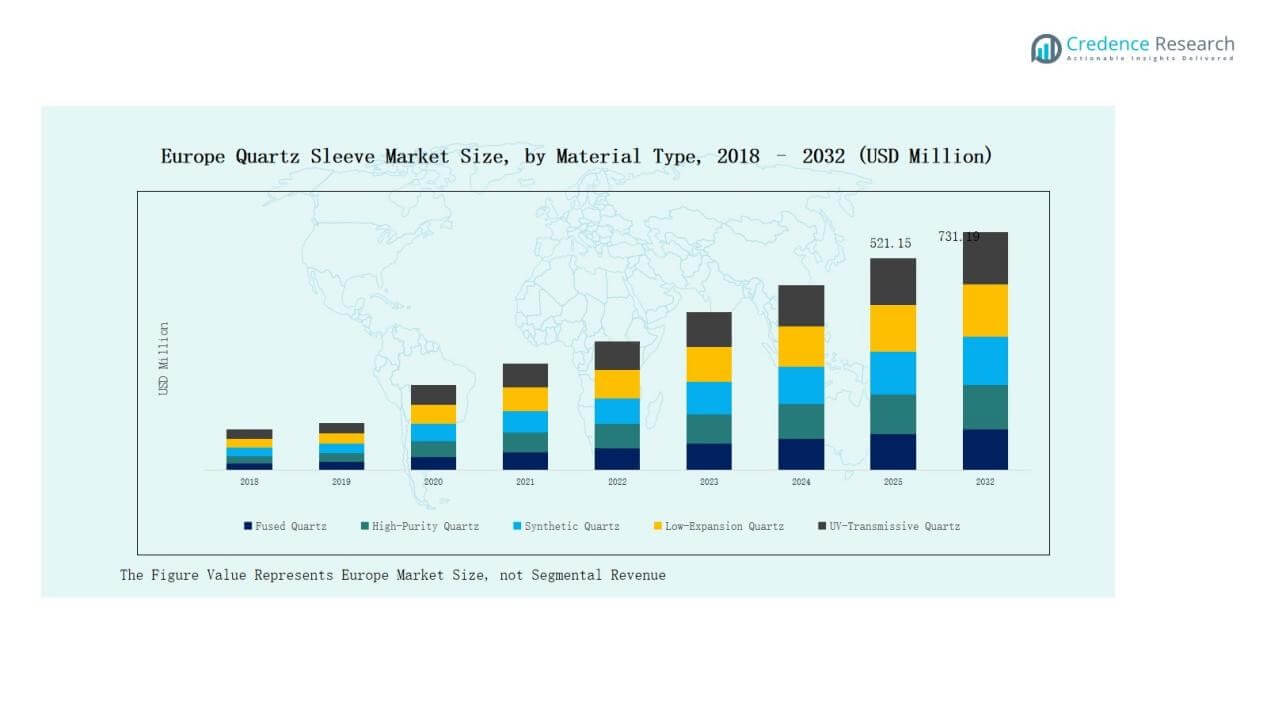

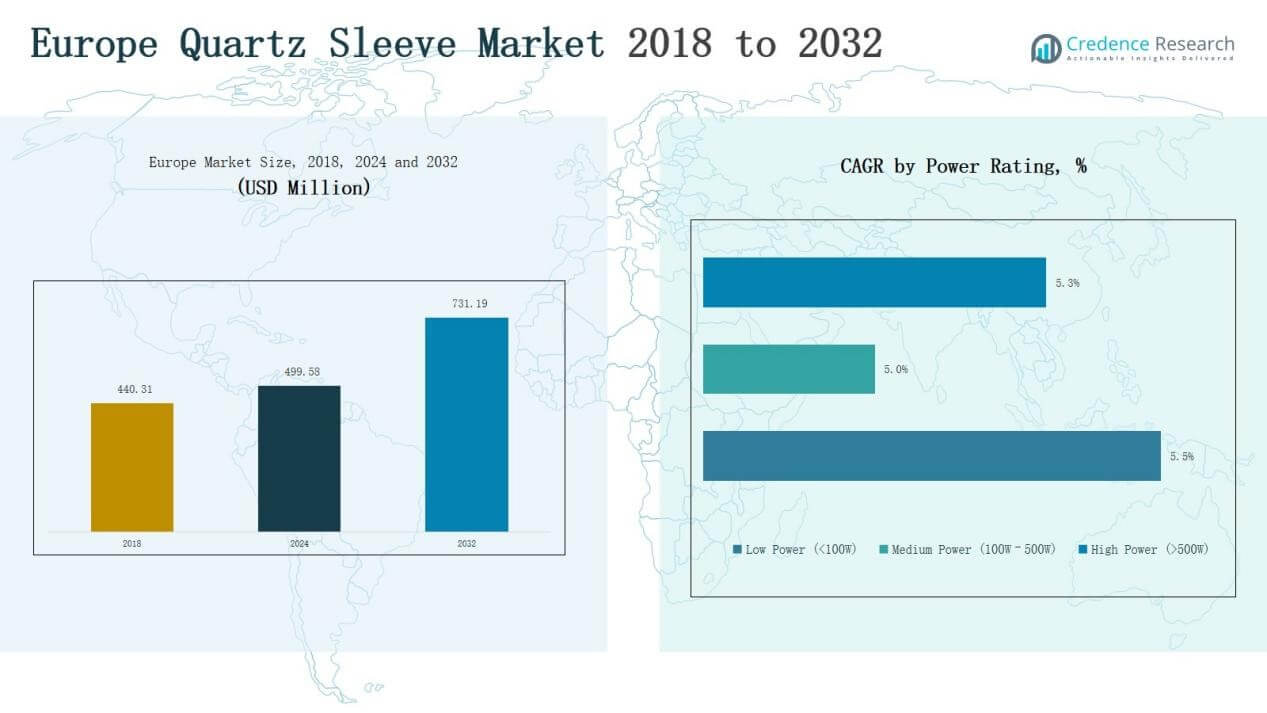

Europe Spherical Quartz Powder Market size was valued at USD 34.65 million in 2018, reached USD 40.13 million in 2024, and is anticipated to reach USD 60.24 million by 2032, at a CAGR of 5.14% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Spherical Quartz Powder Market Size 2024 |

USD 40.13 Million |

| Europe Spherical Quartz Powder Market, CAGR |

5.14% |

| Europe Spherical Quartz Powder Market Size 2032 |

USD 60.24 Million |

The Europe Spherical Quartz Powder Market is characterized by the presence of established global and regional players focusing on purity, innovation, and supply reliability. Key companies include SINOENERGY GROUP, ALPA Powder Technology, Sinonine, Micron, Denka, Tatsumori, Shin-Etsu Chemical, Tanki New Materials, Tongrun Nano Technology, NOVORAY, Admatechs, FUSO Chemical, Sibelco, Nippon Chemical, and Pacific Quartz. These players compete by expanding high-purity product portfolios, investing in R&D, and strengthening distribution networks to serve semiconductor and electronics industries. Germany leads the regional market with a 28% share in 2024, driven by its robust semiconductor base, strong R&D capabilities, and advanced automotive and aerospace sectors. This leadership position underscores Germany’s central role in shaping Europe’s spherical quartz powder demand.

Market Insights

Market Insights

- The Europe Spherical Quartz Powder Market grew from USD 34.65 million in 2018 to USD 40.13 million in 2024 and will reach USD 60.24 million by 2032.

- The 99.99% purity type dominates with 42% share in 2024, driven by semiconductor fabrication and rising demand for ultra-high purity grades in advanced electronics and optics.

- By application, semiconductor packaging leads with 48% share in 2024, supported by its role in IC manufacturing, while electronics and optical components provide additional growth opportunities.

- By end-use, the semiconductor and electronics industry holds 55% share in 2024, followed by automotive and aerospace adopting quartz powders in advanced systems and composites.

- Germany leads the regional market with 28% share in 2024, while France (16%), UK (14%), Italy (12%), Spain (10%), Russia (9%), and Rest of Europe (11%) contribute significantly.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Type

In the Europe Spherical Quartz Powder Market, the 99.99% purity segment holds the dominant share of around 42% in 2024. Demand is driven by its critical use in semiconductor fabrication, where high purity levels ensure minimal contamination and improved device performance. Ultra-high purity grades are also gaining traction, supported by growing adoption in advanced electronics and optical industries. The rising need for reliable raw materials in next-generation chip manufacturing strengthens growth across high-purity segments.

For instance, HPQ Silicon signed an agreement with PyroGenesis Canada Inc. to commercialize high-purity quartz-based materials for electronic and photovoltaic applications.

By Application

The semiconductor packaging segment leads with nearly 48% market share in 2024, reflecting its importance in integrated circuit (IC) manufacturing. Spherical quartz powder offers superior flowability and thermal stability, making it vital for encapsulants and mold compounds. Electronics and optical components also contribute significantly, supported by demand for lightweight, durable, and heat-resistant materials. Expanding 3D printing applications further diversify usage, although semiconductor packaging remains the core driver of market revenues.

For instance, Denka Company introduced high-purity silica-based materials for optical fiber applications, aiming to enhance signal transmission efficiency and durability.

By End-Use Industry

The semiconductor and electronics industry dominates with a share of about 55% in 2024, supported by Europe’s growing chip production and R&D investments. The material’s ability to enhance heat dissipation and maintain purity makes it indispensable in this sector. Automotive and aerospace industries follow, integrating quartz powders in advanced electronic systems and composites. Telecommunications and industrial manufacturing sectors also provide steady demand, though semiconductor and electronics remain the largest and fastest-growing end-use industry.

Key Growth Drivers

Rising Demand from Semiconductor Industry

The semiconductor industry drives the largest demand for spherical quartz powder in Europe. High-purity grades, particularly 99.99%, are critical for encapsulants, wafer-level packaging, and advanced chip production. Expanding investments in European semiconductor manufacturing, supported by EU funding programs, are accelerating adoption. As chip designs become more complex and require better thermal and dielectric properties, demand for quartz powder continues to strengthen. This steady growth positions the semiconductor sector as the primary engine for the market.

For instance, STMicroelectronics announced additional investments of €730 million in its Catania, Italy facility for silicon carbide and next-generation semiconductor production, further increasing the consumption of specialty quartz powders for packaging and fabrication processes.

Expanding Applications in Electronics and Optics

Electronics and optical components create significant growth opportunities for quartz powders in Europe. The material’s ability to provide superior transparency, durability, and thermal stability makes it suitable for lenses, sensors, and specialized coatings. Rising consumer electronics penetration, coupled with the adoption of optical devices in healthcare and communication, has supported steady demand. Furthermore, innovations in high-performance electronics and optoelectronics encourage the use of ultra-high purity quartz. These applications expand the market beyond semiconductor packaging.

For instance, SCHOTT expanded its optical materials portfolio with radiation-resistant quartz-based glasses for cameras and sensors used in space exploration and defense optics, enhancing durability in extreme environments.

Strong Push for Advanced Materials in Automotive and Aerospace

The European automotive and aerospace industries increasingly rely on advanced materials, including spherical quartz powder. Lightweight composites and heat-resistant materials are essential for modern vehicles and aircraft. Quartz powders offer improved insulation and stability, enabling use in electronic systems, sensors, and structural applications. With Europe’s emphasis on electric vehicles, autonomous systems, and aerospace innovation, demand for high-quality powders is expected to rise. This sector acts as a key growth driver, diversifying the market beyond semiconductors.

Key Trends & Opportunities

Key Trends & Opportunities

Growing Role of 3D Printing Materials

3D printing is emerging as a transformative opportunity for spherical quartz powder in Europe. The powder’s high purity and uniform particle size make it well-suited for additive manufacturing, especially in producing precision components for electronics and medical devices. As industries adopt 3D printing for cost-effective prototyping and production, the demand for advanced raw materials grows. This trend opens new revenue channels and diversifies the application base, strengthening the overall market outlook.

For instance, 3D Systems collaborated with the U.S. Air Force to develop printable high-temperature materials for aerospace components, highlighting the increasing requirement for ultra-pure powders suited for critical 3D printing applications.

Shift Toward Ultra-High Purity Grades

Europe is witnessing a steady shift toward ultra-high purity quartz powders, driven by the rising complexity of semiconductors and optical devices. With contamination-free materials becoming critical for next-generation chips and photonics, suppliers are prioritizing advanced refining and purification processes. This trend reflects a long-term opportunity for manufacturers to supply specialized, high-value powders. By catering to demanding applications in electronics and optics, companies can enhance their competitive positioning in the European market.

For instance, Heraeus and Momentive Quartz have enhanced their high purity quartz production capacities in Europe to support the expanding semiconductor and renewable energy industries, emphasizing improved thermal stability and chemical purity in their products.

Key Challenges

High Production and Processing Costs

Producing spherical quartz powder, especially at ultra-high purity levels, requires advanced technology and stringent processes. These increase overall production costs, which often transfer to end-users. The reliance on specialized equipment and energy-intensive methods further adds to expenses. For smaller manufacturers, competing with established global players becomes difficult. Cost barriers limit broader adoption across price-sensitive industries, challenging overall market growth despite increasing demand from high-value applications.

Limited Raw Material Availability

The availability of high-purity quartz reserves is limited, particularly within Europe. Manufacturers often depend on imports from Asia and other regions, leading to supply risks. Fluctuations in raw material availability affect production stability and pricing structures. This dependency creates challenges for European companies aiming for self-sufficiency in strategic industries such as semiconductors. Ensuring a reliable and sustainable raw material supply remains a critical hurdle for long-term market expansion.

Intense Competition from Asian Producers

European manufacturers face stiff competition from Asian producers, particularly China, which dominates global capacity. Chinese companies often leverage cost efficiency and scale advantages, making it difficult for European suppliers to match pricing. While Europe emphasizes quality and ultra-high purity, competing with low-cost imports pressures margins. This competitive imbalance could restrict the growth of regional players and force them to focus on niche high-value markets rather than volume-based expansion.

Regional Analysis

Germany

Germany leads the Europe Spherical Quartz Powder Market with a 28% share in 2024. Its strong semiconductor and electronics base drives the demand for high-purity quartz powders. The country benefits from advanced R&D capabilities and government programs supporting chip self-sufficiency. Growing investments in automotive electronics and aerospace applications further strengthen consumption. Local companies emphasize ultra-high purity grades to meet the requirements of precision industries. With industrial innovation and a robust supply chain, it remains the dominant regional market.

France

France accounts for 16% of the market share, supported by its expanding aerospace and telecommunications industries. Strong demand for optical components and coatings contributes to steady consumption. French manufacturers prioritize quality and sustainability, focusing on applications in defense and aviation. Semiconductor packaging also supports growth as the nation invests in digital and industrial transformation. It is expected to benefit from ongoing collaborations between public institutions and private companies. This focus ensures consistent growth across diverse applications.

UK

The UK holds 14% of the Europe Spherical Quartz Powder Market, driven by its advanced electronics and industrial manufacturing sectors. Strong adoption of high-performance materials in defense, telecommunications, and automotive industries creates steady demand. Local investments in 3D printing and next-generation electronics boost the use of spherical quartz powders. The UK’s emphasis on R&D fosters innovation in ultra-high purity grades. It is expected to remain a stable consumer market with a focus on technology-driven applications.

Italy

Italy represents 12% of the market share, with demand led by automotive and industrial applications. Growing use of spherical quartz powders in adhesives, sealants, and coatings supports expansion. The nation’s manufacturing base and investments in electric mobility strengthen consumption. Semiconductor and electronics demand remains modest but shows gradual improvement. It benefits from rising adoption of advanced materials in production and processing industries. Italy continues to evolve as a significant secondary market in the region.

Spain

Spain contributes 10% of the market share, driven by industrial and automotive manufacturing. Strong adoption in coatings and electronics fuels demand for quartz powders. It is also expanding its role in renewable energy and advanced materials, supporting new applications. Growing focus on domestic production capabilities adds resilience to the supply chain. Semiconductor packaging demand remains limited but rising slowly. Spain’s balanced industrial base ensures steady contribution to regional growth.

Russia

Russia accounts for 9% of the Europe Spherical Quartz Powder Market, with demand supported by industrial and aerospace sectors. Domestic companies rely on imports for high-purity grades, creating supply challenges. Strong defense-related applications sustain market presence. Semiconductor packaging adoption is limited, but electronic and optical components show rising demand. It faces geopolitical and trade constraints that influence supply stability. Despite these challenges, Russia maintains a role in the regional landscape.

Rest of Europe

The Rest of Europe holds 11% of the market share, covering smaller economies with emerging applications. Demand is led by semiconductor packaging and electronics in countries like the Netherlands and Poland. Adoption in 3D printing and telecommunications further drives interest in quartz powders. Companies focus on imports to meet requirements for high-purity and ultra-high purity grades. It is steadily expanding as new industries adopt advanced materials. This group contributes consistently to regional growth.

Market Segmentations:

Market Segmentations:

By Type

- 9% Purity

- 95% Purity

- 99% Purity

- Ultra-High Purity

By Application

- Semiconductor Packaging

- Electronics

- Optical Components

- Coatings

- Adhesives & Sealants

- 3D Printing Materials

- Others

By End-Use Industry

- Semiconductor & Electronics

- Automotive

- Aerospace

- Telecommunications

- Industrial Manufacturing

- Others

By Region

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The Europe Spherical Quartz Powder Market is highly competitive, with global and regional players focusing on purity, innovation, and supply reliability. Leading companies such as SINOENERGY GROUP, ALPA Powder Technology, Denka, Shin-Etsu Chemical, Admatechs, FUSO Chemical, and Sibelco dominate through strong production capacities and advanced refining processes. Japanese and South Korean firms emphasize ultra-high purity powders tailored for semiconductor packaging and optical applications, while European players highlight sustainable sourcing and localized customer support. Chinese producers continue to strengthen their presence by offering cost advantages, challenging regional suppliers. Strategic partnerships, R&D investments, and expansion into high-purity product lines remain central growth strategies. Recent developments focus on addressing rising demand from semiconductor and electronics industries, which require contamination-free materials. With growing competition, companies increasingly differentiate through quality certifications, advanced distribution networks, and customer-focused innovations, shaping the market toward greater consolidation and technology-driven rivalry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- SINOENERGY GROUP

- ALPA Powder Technology

- Sinonine

- Micron

- Denka

- Tatsumori

- Shin-Etsu Chemical

- Tanki New Materials

- Tongrun Nano Technology

- NOVORAY

- Admatechs

- FUSO Chemical

- Sibelco

- Nippon Chemical

- Pacific Quartz

Recent Developments

- In January 2025, Imerys acquired Chemviron’s European diatomite and perlite business to strengthen its mineral portfolio.

- In February 2024, the European Commission launched a €500 million public-private partnership to accelerate advanced materials development across Europe.

- In January 2025, PQ completed the acquisition of Sibelco’s specialty silicate business in Lödöse, Sweden.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for ultra-high purity grades will rise with advanced semiconductor production.

- Electronics and optical component applications will continue to expand steadily.

- Automotive and aerospace sectors will adopt quartz powders for advanced systems.

- 3D printing materials will emerge as a significant growth opportunity.

- European suppliers will invest in refining technology to compete with Asian producers.

- Sustainability practices will influence procurement and production strategies.

- Strategic partnerships will increase to secure raw material supply.

- Industrial manufacturing applications will diversify product usage across sectors.

- Government initiatives to boost semiconductor capacity will support long-term demand.

- Market competition will intensify, driving innovation in purity and performance.

Market Insights

Market Insights Key Trends & Opportunities

Key Trends & Opportunities Market Segmentations:

Market Segmentations: