Market Overview

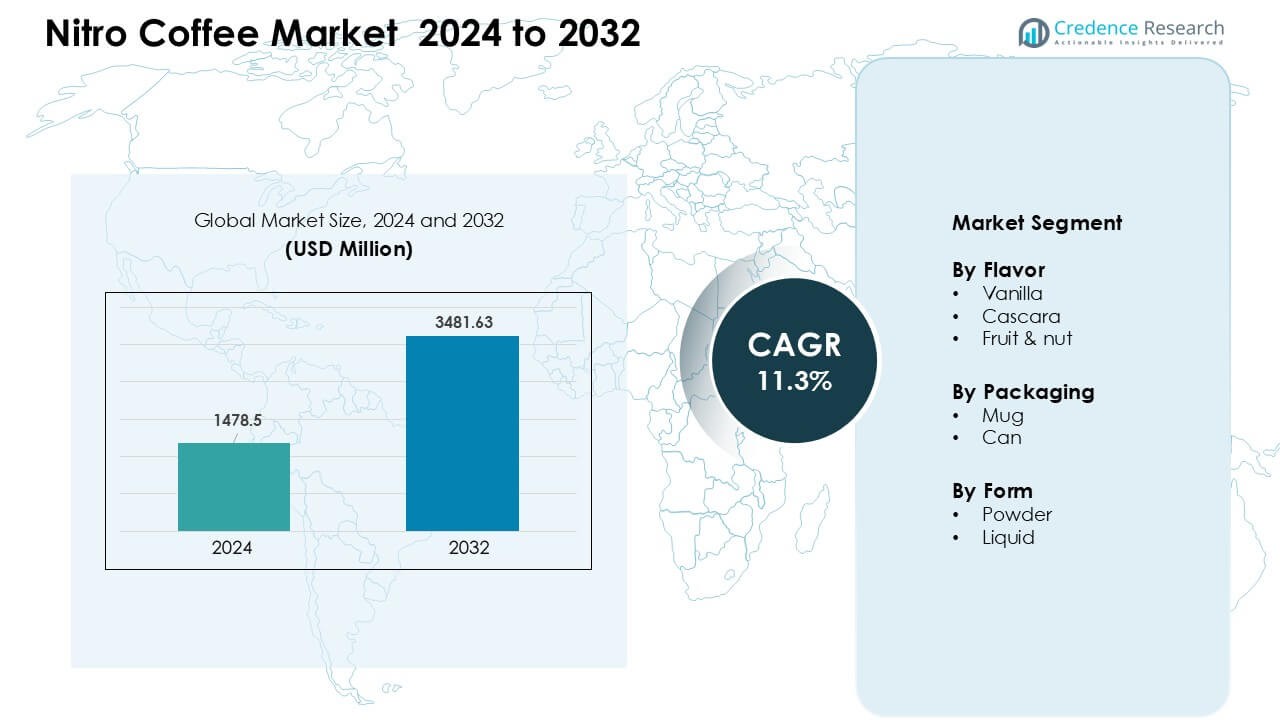

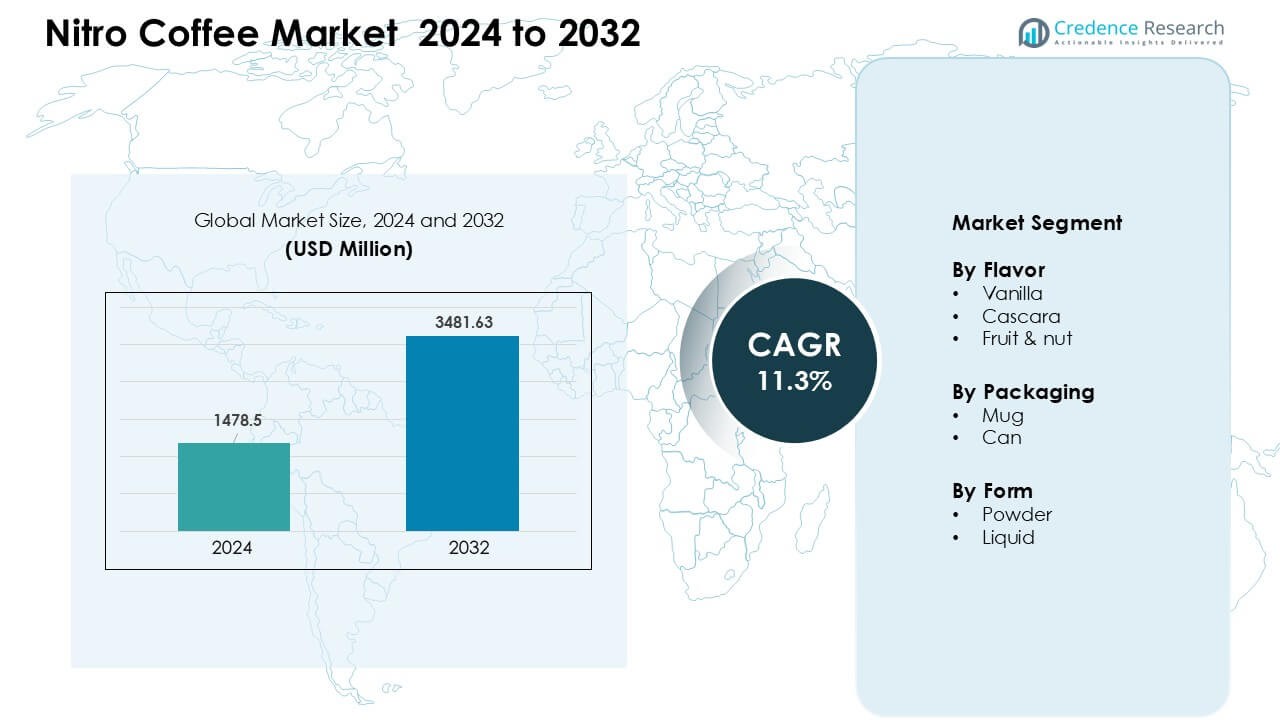

Nitro Coffee Market was valued at USD 1478.5 million in 2024 and is anticipated to reach USD 3481.63 million by 2032, growing at a CAGR of 11.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Nitro Coffee Market Size 2024 |

USD 1478.5 Million |

| Nitro Coffee Market, CAGR |

11.3% |

| Nitro Coffee Market Size 2032 |

USD 3481.63 Million |

The Nitro Coffee Market features strong competition from leading brands such as Rise Brewing Co, Nitro Beverage Co., Left Hand Brewing Co., Quivr, Monster Energy Company, Lucky Jack Coffee, Caveman Coffee Co., PepsiCo Inc., Starbucks Corporation, and Bona Fide Nitro Coffee and Tea. These companies drive growth through expanded ready-to-drink portfolios, nitrogen-stable can technology, and cleaner ingredient profiles that appeal to health-focused buyers. Many brands strengthen reach through retail partnerships and café collaborations, while social media marketing boosts visibility among younger consumers. North America leads the global market with about 42% share, supported by mature café culture and high adoption of premium cold coffee beverages.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Nitro Coffee Market was valued at USD 1478.5 million in 2024 and is projected to reach USD 3481.63 million by 2032, growing at a CAGR of 11.3% during the forecast period.

- Demand grew as consumers shifted toward ready-to-drink cold beverages, with vanilla flavor holding about 46% share and cans leading packaging with nearly 71% share.

- Trends centered on flavored nitro variants, nitrogen-stable cans, and clean-label formulations that appealed to younger buyers seeking smoother, dairy-free options.

- Competition intensified as major brands expanded retail presence; players focused on innovation in flavors, packaging, and distribution to strengthen market reach.

- North America led with about 42% share, followed by Europe at 28%, Asia-Pacific at 22%, Latin America at 5%, and Middle East & Africa at 3%, supported by strong café culture and growing demand for premium cold coffee.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Flavor

Vanilla led the Nitro Coffee Market in 2024 with about 46% share. The flavor gained strong traction due to wide consumer acceptance and its smooth taste profile, which pairs well with nitrogen infusion. Brands pushed vanilla-based variants in ready-to-drink lines, boosting visibility across retail and cafés. Cascara and fruit & nut flavors grew at a steady pace as younger buyers explored bolder options. Rising interest in flavored functional beverages further supported the demand shift toward specialty blends.

- For instance, The Starbucks Nitro Cold Brew Vanilla canned product is a ready-to-drink coffee that is indeed nitrogen-infused for a creamy texture.

By Packaging

Cans dominated the market in 2024 with nearly 71% share. Their lead came from longer shelf stability, easy distribution, and strong adoption in ready-to-drink coffee formats. Retail chains and online platforms favored canned nitro coffee because the packaging supported consistent pressure retention, which is crucial for maintaining texture. Mugs held a smaller share and stayed more common in cafés offering fresh nitro pours. Growth in on-the-go consumption pushed brands to expand canned products across global markets.

- For instance, La Colombe’s Draft Latte is sold in 9 fl oz cans with nitrogen pressurization to maintain creaminess and texture, enabling consistent quality in retail and online channels.

By Form

Liquid nitro coffee held the dominant share in 2024 with about 64%. The format remained popular due to its smooth mouthfeel, quick consumption, and high suitability for cafés and ready-to-drink lines. Manufacturers expanded cold-chain distribution to maintain product quality, which strengthened liquid sales. Powder forms grew slowly as homebrewing trends increased, offering longer shelf life and easier storage. Interest in convenient café-style beverages supported innovation in both formats.

Key Growth Drivers

Growing Demand for Ready-to-Drink Cold Coffee

Demand for ready-to-drink cold beverages continues to rise as busy consumers look for quick, premium options. Nitro coffee benefits from this shift because the drink offers a creamy texture without added dairy and fits well with on-the-go habits. Retail chains expanded cold brew shelves, which increased exposure for nitro formats. Younger buyers prefer chilled coffee over traditional hot drinks, and this trend strengthened the category’s reach across convenience stores and cafés. Brands also introduced flavored nitro lines to widen appeal among new users. The growing link between cold coffee and lifestyle beverages supports long-term market expansion.

- For instance, Stumptown Coffee Roasters’ Nitro Cold Brew in 10.3 fl oz cans combines ready-to-drink convenience with nitrogen infusion, supporting growth in retail channels and on-the-go consumption among younger buyers.

Rise of Specialty Coffee Culture Worldwide

Specialty coffee culture expanded across major cities, and nitro coffee gained traction as a premium craft option. Cafés promoted nitrogen-infused blends as smoother and richer, which helped attract curious consumers. Baristas used nitro taps to highlight product uniqueness, driving more foot traffic and higher customer engagement. Social media visibility increased interest as videos showcasing cascading foam spread widely. Roasters introduced single-origin nitro variants to tap into premium preferences. Growing awareness of quality-focused brewing strengthened demand for nitro coffee within artisanal and modern café chains, supporting steady global growth.

- For instance, La Colombe’s Draft Latte, served in cafés and retail outlets, uses nitrogen infusion to create a cascading foam effect that enhances visual appeal and premium experience, driving higher engagement on social media.

Innovation in Flavors and Packaging Formats

Continuous product innovation boosted nitro coffee acceptance across retail and foodservice. Companies launched new flavored options, which broadened the drink’s consumer base beyond traditional cold brew users. Packaging upgrades such as pressure-stable cans improved shelf life and preserved the signature creamy texture. Producers also invested in sustainable packaging to meet rising eco-friendly expectations. The entry of new brands accelerated innovation, as companies competed through differentiated tastes and convenient distribution. Such advancements made nitro coffee more accessible and appealing across markets.

Key Trends & Opportunities

Expansion of RTD Coffee in Retail and E-commerce

Retail expansion and online availability created new opportunities for nitro coffee brands. Supermarkets increased shelf space for cold brew and nitro beverages as demand for chilled drinks surged. E-commerce platforms offered wider flavor choices and subscription models, drawing repeat customers. Digital ads and influencer-driven promotions improved product visibility. This push toward multi-channel distribution helped brands reach consumers who prefer home delivery or bulk buying. The trend also encouraged companies to release travel-friendly packaging, boosting convenience and widening reach across regions.

- For instance, Starbucks Ready-to-Drink Nitro Cold Brew Vanilla Latte is available in 9.6 fl oz cans across supermarkets, convenience stores, and online platforms with subscription options, increasing accessibility for home consumption.

Growing Focus on Functional and Clean-Label Beverages

Consumers showed rising interest in clean-label coffee options with fewer additives. Nitro coffee fit this preference because the drink relies on nitrogen for texture rather than cream or sweeteners. Brands promoted low-calorie and dairy-free attributes, strengthening appeal among health-conscious buyers. Some producers added functional elements such as antioxidants or natural flavor infusions to target wellness-focused users. The combination of clean labels and premium experience created a strong opportunity for nitro variants in both retail and cafés.

- For Instance, Califia Farms Nitro Cold Brews are plant-based, using almond or oat milk, and are certified vegan and dairy-free.

Key Challenges

High Production and Cold-Chain Distribution Costs

Nitro coffee requires specialized equipment, consistent pressure control, and cold storage across the supply chain. These needs raise production costs compared to regular cold brew or traditional coffee formats. Smaller brands often struggle to manage nitrogen infusion systems and chilled distribution, which limits market entry. Retailers also expect stable shelf life and consistent foam quality, adding pressure on manufacturers to maintain high standards. These operational challenges slow expansion in regions with weak cold-chain infrastructure.

Limited Consumer Awareness in Emerging Markets

Awareness of nitro coffee remains low outside major urban centers and developed markets. Many consumers are unfamiliar with nitrogen-infused beverages, which reduces trial rates. Cafés in emerging economies often avoid nitro systems due to high equipment costs and limited demand. Marketing efforts must focus on education to explain the product’s texture and taste benefits. Slow adoption in these regions restricts overall market penetration despite rising interest in cold coffee formats.

Regional Analysis

North America

North America held the dominant share of about 42% in the Nitro Coffee Market in 2024. Strong café culture, high acceptance of premium cold beverages, and wide availability of ready-to-drink nitro cans supported leadership. Major brands expanded distribution through supermarkets, convenience stores, and online platforms, increasing consumer reach. Younger buyers drove demand through preference for chilled, smooth-texture coffee. The region also benefited from strong adoption of specialty brewing equipment in cafés, which boosted fresh nitro tap sales. Innovation in flavors and packaging continued to strengthen North America’s leading position.

Europe

Europe accounted for nearly 28% share in 2024, supported by rising specialty coffee culture across major countries. Demand increased as consumers sought premium cold brews with clean-label profiles. Café chains introduced nitro taps to attract younger customers and widen their beverage portfolios. Ready-to-drink formats gained momentum through retail and online channels, especially in the UK, Germany, and the Nordics. The region’s growing interest in healthier, low-sugar drinks also lifted nitro coffee adoption. Expanding artisanal café networks further strengthened Europe’s market position.

Asia-Pacific

Asia-Pacific held about 22% share in 2024, driven by rapid urbanization and rising café penetration in countries such as Japan, South Korea, China, and Australia. Younger consumers embraced nitro coffee as a trendy premium beverage, often influenced by social media and global café chains. Retailers expanded cold brew sections, which increased the presence of canned nitro formats. Local brands introduced unique flavor profiles to match regional tastes, supporting faster trial and adoption. Growth in specialty coffee shops and rising disposable incomes positioned Asia-Pacific as a fast-growing regional market.

Latin America

Latin America captured nearly 5% share in 2024, with gradual adoption centered in urban café hubs. Countries such as Brazil, Mexico, and Colombia saw early demand due to a strong coffee culture and rising interest in cold brew variations. Nitro taps appeared in select specialty cafés targeting younger consumers seeking premium experiences. Retail presence remained limited but expanded slowly through imported ready-to-drink products. Growing tourism and exposure to global beverage trends supported awareness. Market growth remained moderate due to limited cold-chain distribution.

Middle East & Africa

The Middle East & Africa region accounted for around 3% share in 2024, marked by early-stage adoption and concentrated demand in premium café chains. Urban centers such as Dubai, Riyadh, and Johannesburg showed growing interest in cold brew and nitro-infused beverages. Café culture expansion, tourism growth, and rising disposable incomes supported initial traction. Ready-to-drink nitro formats remained niche due to limited distribution networks and higher pricing. Brands focused on educating consumers about flavor and texture benefits to improve awareness in the region.

Market Segmentations:

By Flavor

- Vanilla

- Cascara

- Fruit & nut

By Packaging

By Form

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Nitro Coffee Market features established beverage companies and fast-growing specialty brands competing through flavor innovation, packaging upgrades, and broader retail placement. Key players such as Rise Brewing Co, Nitro Beverage Co., Left Hand Brewing Co., Quivr, Monster Energy Company, Lucky Jack Coffee, Caveman Coffee Co., PepsiCo Inc., Starbucks Corporation, and Bona Fide Nitro Coffee and Tea focus on expanding ready-to-drink nitro lines to strengthen visibility across supermarkets, cafés, and online platforms. Companies invest in nitrogen-stable can technology to preserve texture and extend shelf life, which helps improve product consistency. Many brands also highlight clean-label ingredients to match growing demand for low-calorie and dairy-free cold beverages. Partnerships with café chains and distributors support wider adoption, while social media-driven marketing boosts engagement with younger buyers. Innovation in flavors and sustainable packaging remains central to shaping competitive strategies in this expanding market.

Key Player Analysis

- Rise Brewing Co

- Nitro Beverage Co.

- Left Hand Brewing Co.

- Quivr

- Monster Energy Company

- Lucky Jack Coffee

- Caveman Coffee Co.

- PepsiCo Inc.

- Starbucks Corporation

- Bona Fide Nitro Coffee and Tea

Recent Developments

- In December 2023, Left Hand launched a new beer Belgian White Nitro a nitro-infused brew with a smooth, crisp profile (4.8% ABV) combining orange peel and coriander.

- In June 2023, Lucky Jack Coffee was acquired by private-label manufacturer Magnum Coffee Roastery.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Flavor, Packaging, Form and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Nitro coffee will gain wider global adoption as cold brew demand rises.

- Ready-to-drink variants will expand across retail and online channels.

- Flavor innovation will increase as brands target broader consumer groups.

- Sustainable and recyclable packaging will become a core focus for producers.

- Café chains will install more nitro taps to attract younger customers.

- Clean-label and low-calorie formulations will strengthen buyer interest.

- Premium single-origin nitro products will grow within specialty coffee segments.

- Companies will expand distribution networks to improve cold-chain efficiency.

- Marketing will rely more on digital engagement and influencer partnerships.

- Emerging markets will show faster adoption as café culture continues to expand.

Market Segmentation Analysis:

Market Segmentation Analysis: