Market Overview

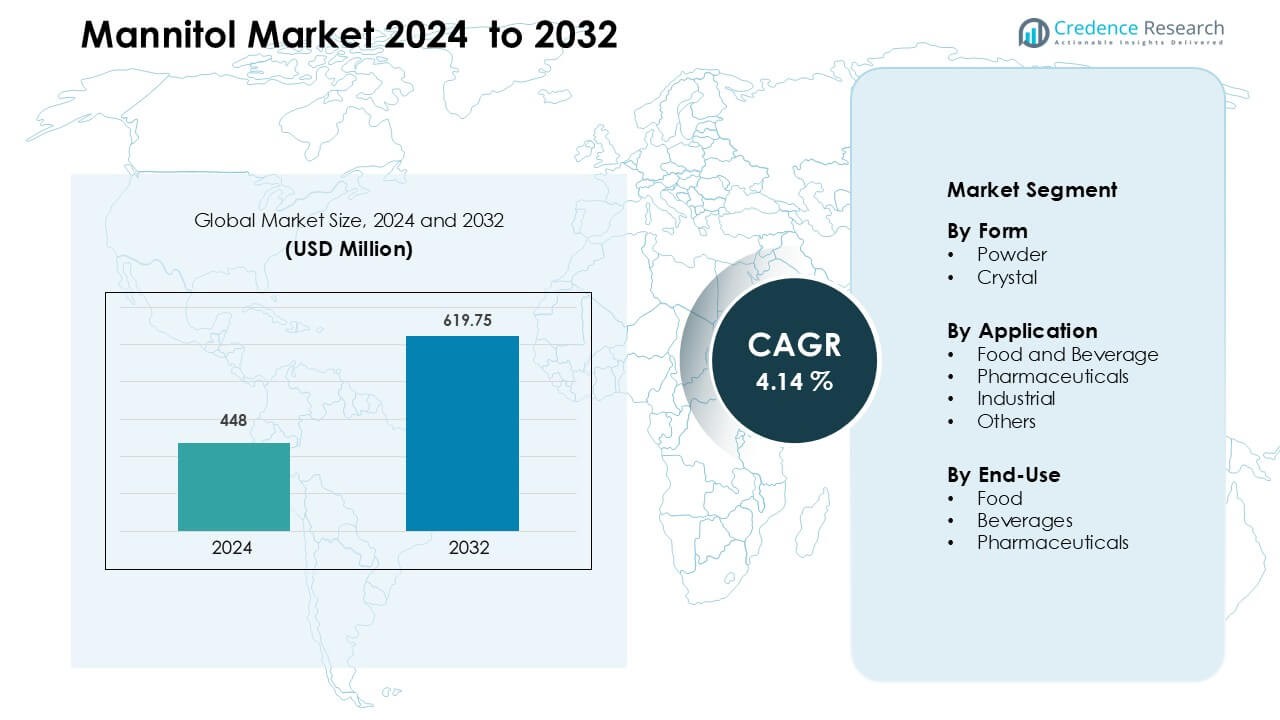

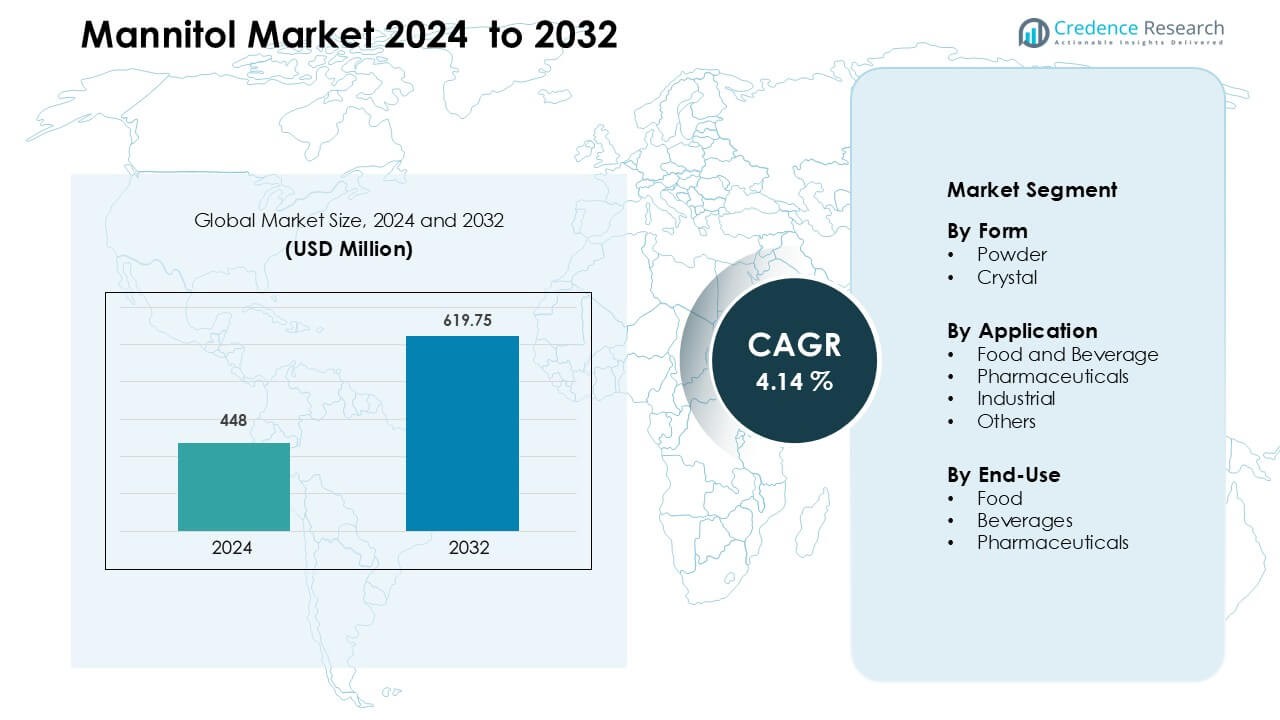

Mannitol Market was valued at USD 448 million in 2024 and is anticipated to reach USD 619.75 million by 2032, growing at a CAGR of 4.14 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mannitol Market Size 2024 |

USD 448 Million |

| Mannitol Market, CAGR |

4.14% |

| Mannitol Market Size 2032 |

USD 619.75 Million |

The Mannitol Market is shaped by major companies such as Merck KGaA, Qingdao Mingyue Seaweed Group Co., Singsino Group Ltd., Cargill, Rongde Seaweed Co., Moga International, Roquette Frères, Shijiazhuang Huaxu Pharmaceutical Co., SPI Pharma, and Ingredion. These players compete by expanding pharma-grade and food-grade mannitol portfolios, improving production efficiency, and strengthening global supply networks. North America leads the market with about 34% share in 2024, supported by strong demand for sugar-free foods, advanced pharmaceutical manufacturing, and growing adoption of low-calorie polyols across functional nutrition and oral-care applications.

Market Insights

- The Mannitol Market was valued at USD 448 million in 2024 and is projected to reach USD 619.75 million by 2032, growing at a CAGR of of 4.14 % during the forecast period.

- Demand grows as mannitol use increases in pharmaceuticals, which hold the largest segment share at about 48% due to its role in tablets, injectables, and freeze-drying applications.

- Key trends include rising sugar-free product launches, clean-label adoption, and investments in high-purity mannitol for biologics, confectionery, and functional foods.

- Leading playersMerck KGaA, Roquette Frères, Cargill, SPI Pharma, and others—compete through capacity expansion, improved crystallization technologies, and high-grade product portfolios.

- North America leads with nearly 34% market share, followed by Europe at 29% and Asia-Pacific at 28%, driven by strong pharma production, diabetic-friendly food demand, and expanding industrial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Form

Powder mannitol dominates this segment with about 62% share in 2024. Manufacturers prefer the powder form because it offers high solubility, easy blending, and stable performance in food, pharma, and industrial uses. Growth accelerates as producers expand low-calorie sweetener lines and demand rises for uniform particle size in tablet compression. Crystal mannitol grows at a steady pace due to strong use in confectionery, chewable tablets, and freeze-drying applications where hardness and controlled crystallization improve product texture.

- For instance, Roquette’s PEARLITOL 200 GT powder exhibits a bulk density of 0.625 g/cm³ and tapped density of 0.826 g/cm³, enabling direct compression at high drug loads (20–25%) without any capping.

By Application

Pharmaceuticals lead this segment with nearly 48% share in 2024. Drug makers rely on mannitol as an excipient for tablets, capsules, and lyophilized drugs because it improves stability and flow properties. Demand increases with rising production of injectable formulations and expansion of chronic disease treatments. Food and beverage applications grow as brands add mannitol to sugar-free candies, chewing gums, and bakery mixes. Industrial use expands through applications in plastics, resins, and surfactants that require consistent moisture control.

- For instance, Roquette’s PEARLITOL 150 SD grade designed for highly sensitive APIs maintains reducing sugar levels below 300 ppm, ensuring stability in direct compression tablet formulations.

By End-Use

Pharmaceuticals remain the leading end-use category with around 50% share in 2024. Drug manufacturers prefer mannitol because it enhances tablet hardness, supports controlled release, and improves freeze-drying performance. Growth strengthens as biopharma expands biologics and parenteral products that rely on mannitol as a bulking agent. Food and beverage end-users adopt mannitol for sugar reduction and improved mouthfeel in low-calorie items. Rising awareness of clean-label sugar substitutes further supports broader adoption across packaged foods and functional drinks.

Key Growth Drivers

Rising Demand for Low-Calorie Sweeteners

Global demand for low-calorie sweeteners continues to rise as consumers shift toward healthier dietary habits. Mannitol benefits from this shift because it offers sweetness with fewer calories, making it suitable for diabetic-friendly and weight-management products. Food manufacturers use mannitol in sugar-free confectionery, baked goods, and chewing gums where reduced sugar content improves product positioning in health-conscious markets. Regulatory support for polyols in clean-label and low-GI formulations also boosts adoption. Growth strengthens as brands expand no-sugar and reduced-sugar product lines, driven by rising lifestyle diseases and growing preference for natural sugar substitutes across mature and emerging regions.

- For instance, Roquette uses the brand name PEARLITOL for its mannitol range, with designations like PEARLITOL 25C, 50C, 100SD, 160C, and 200SD, where the number typically relates to the mean particle size in microns (e.g., PEARLITOL 50C has a mean particle size of approximately 50 µm).

Expanding Pharmaceutical Applications

Mannitol sees strong growth in pharmaceutical applications due to its role as a stable and safe excipient. Drug makers use mannitol in oral solid doses, chewable tablets, and freeze-dried injectables because it improves product stability, compressibility, and mouthfeel. Rising production of biologics and injectable formulations further boosts mannitol usage as a bulking and cryoprotective agent. Demand increases as chronic diseases grow worldwide and manufacturers launch more controlled-release and patient-friendly dosage forms. Regulatory approvals for mannitol-based excipients support consistent adoption, while R&D efforts expand its role in advanced drug delivery systems and combination therapies.

- For instance, SPI Pharma’s Mannogem XL (a spray-dried direct-compression mannitol) shows 25% higher tablet hardness and 38% faster disintegration, while enabling 50% higher drug loading and 200% better friability at low compression force, which helps in developing patient‑friendly chewables or orally disintegrating tablets.

Growth in Industrial and Specialty Applications

Industrial applications of mannitol gain momentum due to its functional value in plastics, resins, agrochemicals, and surfactants. Manufacturers prefer mannitol for moisture control, chemical stability, and its compatibility with specialty formulations. Adoption increases in fermentation processes, specialty coatings, and chemical synthesis where mannitol offers reliable performance and safe handling properties. Rising investments in green chemistry and bio-based materials also support wider industrial use. The expansion of chemical and polymer production in Asia-Pacific strengthens demand, especially in sectors needing stable polyols with defined purity grades. These factors create sustained growth across industrial and specialty application segments.

Key Trend & Opportunity

Growth of Clean-Label and Natural Ingredient Adoption

Companies across food and pharmaceutical sectors increasingly shift toward clean-label and natural ingredients. Mannitol fits well within this shift due to its natural occurrence in fruits and vegetables and its favorable safety profile. Brands use mannitol to create products free from artificial additives while maintaining sweetness, texture, and stability. Demand rises as consumers seek transparent labeling and reduced sugar intake. The clean-label movement also opens opportunities for manufacturers to introduce plant-derived mannitol through advanced extraction technologies. This trend strengthens market expansion across premium, organic, and wellness-oriented product segments in global markets.

- For instance, Roquette’s cosmetic-grade mannitol (Beauté by Roquette® PO 260) is derived from corn/wheat starch, labeled with a natural origin index (ISO 16128) of 1, indicating 100% natural carbon atoms.

Expansion of Sugar-Free and Functional Food Categories

The growth of sugar-free snacks, fortified beverages, and functional foods creates major opportunities for mannitol adoption. Producers rely on mannitol to deliver sweetness without spiking blood glucose levels, supporting product claims related to diabetes management and metabolic health. Functional food manufacturers use mannitol to enhance texture in high-fiber, protein-rich, and nutraceutical products. Increasing investments in product innovation across protein bars, sugar-free confectionery, and ready-to-eat mixes further boost demand. As consumers seek healthier indulgence options, mannitol helps companies create products that balance taste, functionality, and regulatory compliance across diverse categories.

- For instance, Cargill’s C☆Mannidex™ mannitol is used in sugar‑free chewing gum to provide bulk and reduce stickiness, thanks to its very low hygroscopicity.

Advances in Manufacturing Technologies

Advances in fermentation and catalytic hydrogenation technologies improve mannitol yield, purity, and cost efficiency. Producers adopt continuous processing and bio-fermentation to reduce production costs and improve sustainability. These innovations expand availability of high-grade mannitol for pharmaceutical and food applications. The shift toward bio-based feedstocks offers opportunities to strengthen environmental credentials and meet global sustainability expectations. Companies exploring integrated production lines and automated quality control systems enhance consistency, enabling expansion into premium application areas. This technological evolution supports long-term market growth and encourages broader industrial adoption.

Key Challenge

High Production Costs and Complex Manufacturing

Mannitol production involves complex processes such as catalytic hydrogenation or specialized fermentation, which require significant investment and operational expertise. These steps increase manufacturing costs compared with conventional sweeteners. Producers also face cost fluctuations arising from feedstock availability, energy consumption, and purification requirements. Scaling bio-based production requires technical precision and advanced equipment, which can pose barriers for new entrants. High production costs limit competitive pricing, especially in cost-sensitive food and industrial markets. These constraints challenge small and mid-size manufacturers as they compete with larger players that benefit from advanced processing infrastructure.

Regulatory and Safety Compliance Constraints

Strict regulatory standards for food and pharmaceutical applications challenge producers to maintain consistent quality and safety. Mannitol must meet purity, stability, and functional performance criteria across global markets, increasing testing and certification efforts. Variations in regional regulations for polyols complicate product approvals and market entry. Pharmaceutical-grade mannitol demands rigorous compliance with pharmacopeial standards, often requiring high-cost quality assurance systems. Any deviation in excipient quality can disrupt production schedules or lead to product recalls. These regulatory challenges raise operational costs and require continuous monitoring to meet evolving global requirements.

Regional Analysis

North America

North America leads the Mannitol Market with around 34% share in 2024. Growth strengthens as food and pharmaceutical companies expand sugar-free confectionery, oral-care products, and solid-dose formulations. The U.S. drives demand due to strong diabetic-friendly product launches and the presence of major drug manufacturers using mannitol as an excipient. Rising consumer preference for low-calorie ingredients supports wider adoption across bakery mixes and functional nutrition. Investments in advanced manufacturing and strict quality standards further boost adoption, keeping the region at the forefront of innovation and high-grade mannitol consumption.

Europe

Europe accounts for nearly 29% share of the Mannitol Market in 2024. The region benefits from strong regulatory support for polyols in sugar-reduced and clean-label products. Demand grows in Germany, France, and the U.K. as confectionery makers expand no-sugar product lines and pharmaceutical producers use mannitol for tablets and lyophilized drugs. The region’s focus on sustainability encourages adoption of bio-based polyols. Rising investments in specialty chemicals and nutraceutical formulations also contribute to market growth, positioning Europe as a steady and high-value consumer of both food-grade and pharma-grade mannitol.

Asia-Pacific

Asia-Pacific holds the largest growth potential and captures about 28% market share in 2024. China, India, and Japan drive consumption through expanding pharmaceutical production, strong sugar-free confectionery demand, and rising health-focused dietary trends. Manufacturers benefit from cost-efficient raw materials and large-scale polyol production facilities. Adoption increases as regional consumers shift toward low-calorie snacks and diabetic-friendly foods. The booming biopharma sector accelerates use of mannitol in freeze-dried injectables and solid-dose drugs. Rapid industrialization also supports industrial-grade mannitol applications across chemicals and specialty formulations.

Latin America

Latin America represents roughly 5% share in 2024, supported by growing demand for reduced-sugar confectionery and rising diabetic population. Brazil and Mexico lead adoption as food companies introduce sugar-free candies, chewing gums, and beverages. The pharmaceutical sector shows steady use of mannitol as an excipient in generics and OTC formulations. Although industrial applications remain smaller, investments in chemical and resin production gradually expand usage. Improved import channels and rising health-conscious consumer behavior support moderate but consistent growth across the region.

Middle East & Africa

Middle East & Africa hold about 4% share of the Mannitol Market in 2024. The market expands as food manufacturers increase sugar-reduced products to meet rising lifestyle-disease concerns. Gulf countries drive demand for pharma-grade mannitol used in oral and injectable formulations. Growth remains supported by expanding healthcare infrastructure and the import reliance of local drug producers. Adoption in industrial applications grows slowly but gains traction as chemical and coating industries develop. Rising urbanization and gradual improvement in food processing capabilities contribute to steady long-term demand.

Market Segmentations:

By Form

By Application

- Food and Beverage

- Pharmaceuticals

- Industrial

- Others

By End-Use

- Food

- Beverages

- Pharmaceuticals

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Mannitol Market features strong competition among global and regional manufacturers that focus on high-purity grades, cost efficiency, and application-specific performance. Companies such as Merck KGaA, Qingdao Mingyue Seaweed Group Co., Singsino Group Ltd., Cargill, Rongde Seaweed Co., Moga International, Roquette Frères, Shijiazhuang Huaxu Pharmaceutical Co., SPI Pharma, and Ingredion strengthen their market position by expanding food-grade and pharma-grade portfolios. Producers invest in advanced crystallization, fermentation, and hydrogenation technologies to improve quality and reduce production costs. Partnerships with pharmaceutical companies and food manufacturers support long-term supply agreements. Many suppliers also focus on sustainable and bio-based production routes to meet rising clean-label and regulatory demands. Continuous R&D in excipients, lyophilized drug formulations, sugar-free confectionery, and industrial applications further intensifies competition.

Key Player Analysis

- Merck KGaA

- Qingdao Mingyue Seaweed Group Co.

- Singsino Group Ltd.

- Cargill, Incorporated

- Rongde Seaweed Co., Ltd.

- Moga International Ltd.

- Roquette Frères

- Shijiazhuang Huaxu Pharmaceutical Co., Ltd.

- SPI Pharma

- Ingredion

Recent Developments

- In 2024, Qingdao Mingyue Seaweed Group Co.: A major review on value-added utilization of seaweed processing streams highlighted Qingdao Mingyue as an industrial seaweed processor whose kelp lines generate streams rich in mannitol and sodium alginate. This recognition underscores the company’s role in integrated biorefinery concepts, where mannitol recovered from kelp waste contributes to the Mannitol Market’s marine-based supply.

- In December 2023, Merck KGaA: Merck released a technical white paper on Parteck M mannitol that shows how near-infrared spectroscopy can monitor low-dose API blend uniformity in solid oral dosage manufacturing. This supports wider use of Merck’s directly compressible mannitol excipient in high-control pharmaceutical processes and aligns with rising demand for robust process analytical technologies in the Mannitol Market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Form, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Mannitol Market will grow steadily as demand rises for sugar-free and low-calorie products.

- Pharmaceutical adoption will increase as drug makers expand lyophilized and solid-dose formulations.

- Advances in fermentation and hydrogenation technologies will improve production efficiency.

- Bio-based mannitol will gain traction as companies shift toward sustainable ingredient sourcing.

- Use in functional foods and nutraceuticals will expand with rising health-focused consumption.

- Industrial applications will grow as manufacturers integrate mannitol into coatings, chemicals, and specialty materials.

- Emerging markets in Asia-Pacific will see rapid uptake due to growing pharma and food processing sectors.

- Companies will strengthen supply chains to support consistent quality and regulatory compliance.

- Product innovation will rise as brands develop new sugar-free confectionery and oral-care lines.

- Competition will intensify as global producers invest in capacity expansion and high-purity grade development.