Market overview

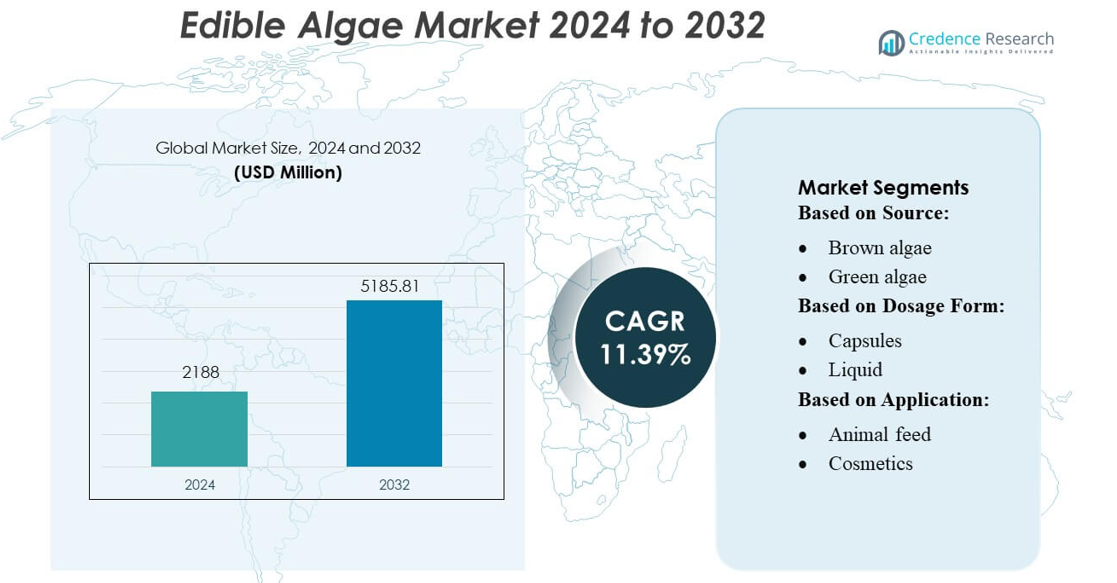

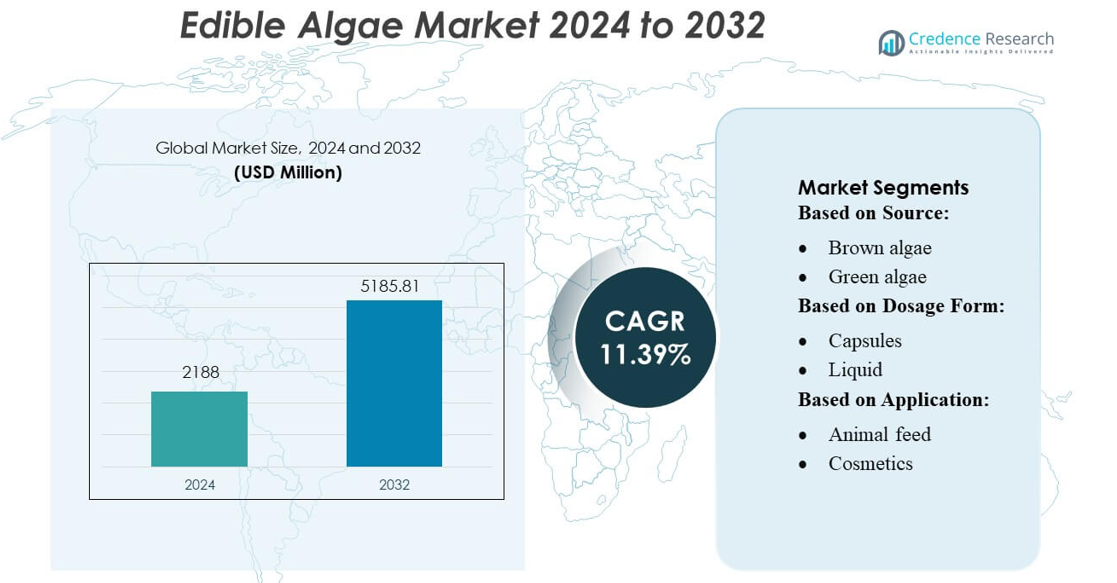

Edible Algae Market size was valued USD 2188 million in 2024 and is anticipated to reach USD 5185.81 million by 2032, at a CAGR of 11.39% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Edible Algae Market Size 2024 |

USD 2188 million |

| Edible Algae Market, CAGR |

11.39% |

| Edible Algae Market Size 2032 |

USD 5185.81 million |

The edible algae market features strong participation from leading global nutraceutical and functional food manufacturers that continue to invest in high-quality spirulina, chlorella, and seaweed-based products. These companies compete through advances in cultivation efficiency, purity standards, product diversification, and sustainability-driven production models. Asia-Pacific remains the dominant regional market, holding over 35% market share, supported by extensive seaweed cultivation, established consumer familiarity, and large-scale microalgae production infrastructure. The region’s integration of algae into traditional diets, combined with growing demand for fortified foods and supplements, reinforces its leadership while influencing product development strategies across global competitors.

Market Insights

- The Edible Algae Market was valued at USD 2,188 million in 2024 and is projected to reach USD 5,185.81 million by 2032, advancing at a robust CAGR of 11.39%, supported by rising demand for nutrient-rich, plant-based ingredients across global food and supplement categories.

- Market growth is driven by expanding consumption of spirulina and chlorella, which together account for a dominant over 45% share owing to their high protein density, natural pigments, and strong adoption in dietary supplements and functional beverages.

- Key trends include increased investment in advanced photobioreactor systems, clean-label algae formulations, and the integration of algae into mainstream snacks, protein drinks, and fortified foods.

- Competitive activity intensifies as manufacturers focus on purity enhancement, sensory improvement, sustainability certifications, and strategic partnerships to strengthen global distribution and reduce production constraints.

- Asia-Pacific leads the regional landscape with over 35% share, driven by large-scale seaweed cultivation and established consumer familiarity, while North America and Europe show rising uptake in premium algae-based supplements and fortified foods.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Source

The edible algae market remains dominated by seaweed, accounting for over 40% of total market share due to its extensive use in food, nutraceuticals, and hydrocolloid extraction. Its high content of dietary fiber, iodine, and bioactive compounds drives widespread adoption across Asian and increasingly Western food industries. Microalgae—especially spirulina and chlorella—continue to gain traction as premium nutrient-dense ingredients, supported by rising demand for plant-based proteins and natural colorants. Brown and red algae maintain steady growth, driven by applications in thickeners, antioxidants, and functional foods.

- For instance, Prairie Naturals produces organic spirulina (Spirulina platensis) powder that contains about 60 g of protein per 100 g, underscoring the high-protein value that microalgae bring to the market.

By Dosage Form

The powder form leads this segment with over 50% market share, supported by its versatility in dietary supplements, beverages, protein formulations, and functional foods. Powdered spirulina and chlorella remain central to product innovation because they blend seamlessly into smoothies, snack bars, and fortified foods. Capsules register strong adoption in the nutraceutical sector, driven by consumer preference for convenient and precise dosing. Liquid formats, though smaller in share, gain momentum in ready-to-drink wellness beverages and concentrated extracts. Overall, demand is propelled by clean-label formulations and incorporation flexibility.

- For instance, FEBICO (Far East Bio-Tec Co., Ltd.) is a major microalgae producer that operates a 140,000 m² site in Pingtung County, southern Taiwan, which features over 60 microalgae culture ponds.

By Application

Dietary supplements dominate the application segment with around 45% market share, fueled by the global shift toward preventive health and the rising popularity of natural superfoods. Spirulina and chlorella-based supplements lead due to their high protein, chlorophyll, iron, and antioxidant content. The food and beverage category expands rapidly as manufacturers incorporate algae into snacks, protein drinks, bakery items, and fortified cereals. Cosmetics also show steady growth, benefiting from algae’s anti-aging, hydrating, and antioxidant properties. Animal feed applications advance as producers seek sustainable, nutrient-dense alternatives to conventional feed ingredients.

Key Growth Drivers

Rising Demand for Plant-Based Nutrition

The edible algae market grows strongly as consumers increasingly shift toward plant-based, nutrient-dense food sources. Algae—particularly spirulina, chlorella, and seaweed—deliver high protein levels, essential amino acids, and bioactive compounds that support immunity and metabolic health. Their naturally rich micronutrient profile, including B vitamins, iron, and antioxidants, positions them as valuable ingredients for functional foods and supplements. This sustained preference for clean-label, vegan, and sustainable alternatives accelerates algae adoption across dietary supplements, beverages, and fortified foods.

- For instance, Cyanotech Corporation, leveraging its 96-acre microalgae facility on the Kona Coast, uses a patented Ocean-Chill Drying system fed by deep ocean water drawn from 2,000 feet depth, which preserves nutrient bioactivity in its Hawaiian Spirulina Pacifica®.

Expansion of Functional Food & Beverage Applications

Functional food manufacturers increasingly incorporate algae due to its versatile nutritional properties, natural pigmentation, and thickening capability. Algae-derived proteins, omega-3 fatty acids, and polysaccharides are widely used in protein drinks, snacks, and plant-based formulations, driving market momentum. Growing consumer interest in foods that offer targeted health benefits—such as immunity, energy, and digestive support—supports this trend. Additionally, algae’s ability to enhance texture, stability, and shelf life without synthetic additives strengthens its position as a preferred natural ingredient.

- For instance, Vimergy LLC uses oil derived from Schizochytrium microalgae to deliver 1,360 mg of algae oil per three-capsule serving, which contains 163 mg of EPA and 326 mg of DHA, as part of its vegan Omega-3 product.

Sustainability and Low Environmental Footprint

The market benefits from the rising emphasis on sustainable food production, as algae offer a low-resource, high-yield alternative to traditional agriculture. Algae cultivation requires minimal land, no freshwater for many species, and absorbs significant amounts of CO₂, making it a superior option for climate-resilient food systems. Governments and industry stakeholders increasingly support algae farming through subsidies, R&D programs, and aquaculture expansion initiatives. These environmental and regulatory advantages promote large-scale algae integration across human nutrition, animal feed, and industrial applications.

Key Trends & Opportunities

Growth of Algae-Infused Foods and Alternative Proteins

Manufacturers are capitalizing on the rising popularity of algae-enriched foods such as snacks, protein bars, breakfast cereals, and bakery items. Algae’s high protein content and natural functional properties make it an attractive alternative protein source for sports nutrition and plant-based product lines. Emerging food technologies enable improved flavor masking and odor reduction, expanding its acceptance in mainstream categories. As demand for novel, nutrient-rich ingredients accelerates, algae-based proteins offer strong opportunities for product diversification and premium functional formulations.

- For instance, ENERGYbits® produces microalgae “bits” grown in triple-filtered spring mountain water, each tablet boasting 60% protein, over 40 vitamins/minerals, and just one calorie.

Technological Advancements in Algae Cultivation & Processing

The industry increasingly benefits from innovations such as photobioreactors, precision farming, and controlled-environment cultivation systems that enhance biomass yield and nutrient density. Improved drying, extraction, and cell-wall disruption technologies allow manufacturers to deliver higher-purity proteins, pigments, and bioactive compounds with better sensory characteristics. These advancements lower production costs, boost scalability, and expand the viability of algae for high-volume food, beverage, and nutraceutical applications. Enhanced traceability and contamination control further strengthen market confidence and premium product positioning.

- For instance, NOW Foods uses mechanically broken cell-wall technology for its Chlorella 500 mg tablets, ensuring that the microalgae’s tough cell wall is disrupted to facilitate digestibility and maximize absorption.

Expanding Applications in Cosmetics and Animal Nutrition

Growing interest in natural and marine-derived cosmetics presents new revenue opportunities for edible algae producers. Algae bioactives—such as fucoidans, chlorophyll, and carotenoids—support anti-aging, moisturizing, and antioxidant formulations. In the animal feed sector, algae provide sustainable alternatives to fishmeal and synthetic additives, offering superior digestibility and nutrient density. The rising adoption of algae-based feed for aquaculture, livestock, and pets expands the market’s cross-industry potential. These applications create stable, long-term demand beyond traditional food sectors.

Key Challenges

High Production Costs and Complex Processing Requirements

Despite growing adoption, algae production remains cost-intensive due to specialized cultivation technologies, strict environmental control, and energy-demanding drying and extraction processes. Microalgae, in particular, require sophisticated harvesting and purification methods that elevate overall production expenses. These high costs limit affordability and slow mainstream penetration, especially in price-sensitive markets. Manufacturers must continue investing in automation, energy-efficient systems, and optimized biomass processing to reduce unit costs and achieve competitive scalability.

Sensory Limitations and Limited Consumer Awareness

Algae ingredients often face barriers related to taste, color, and odor, which can restrict their incorporation into widely accepted food categories. Although food technology improvements mitigate these issues, consumer perception still influences product adoption, especially among those unfamiliar with algae-based foods. Limited understanding of algae’s nutritional benefits further slows demand in some regions. To overcome this challenge, companies must invest in consumer education, flavor-neutral product development, and strategic marketing to enhance acceptance across mainstream food and beverage segments.

Regional Analysis

North America

North America holds around 28% market share, driven by strong demand for plant-based nutrition, functional foods, and clean-label supplements. The U.S. leads consumption of spirulina- and chlorella-based products, supported by widespread adoption in protein drinks, dietary supplements, and fortified snacks. Rising interest in sustainable food sources and marine biotechnology encourages greater investment in microalgae cultivation systems. The presence of major nutraceutical brands and innovative algae-processing companies further accelerates product diversification. Regulatory support for natural colorants and eco-friendly ingredients strengthens market growth, enabling algae to penetrate mainstream food and beverage applications across the region.

Europe

Europe accounts for approximately 30% market share, making it a leading region due to its advanced food innovation ecosystem and strict preference for sustainable, natural ingredients. Countries such as Germany, France, and the U.K. drive significant consumption of seaweed, spirulina, and chlorella in functional foods, vegan products, and high-value supplements. Strong regulatory alignment with clean-label trends and carbon-neutral food production enhances algae cultivation initiatives. Extensive use of seaweed in traditional cuisines across Nordic nations supports diversification. The region’s growing demand for algae-based cosmetics and nutraceuticals further fuels expansion in both industrial and consumer markets.

Asia-Pacific

Asia-Pacific dominates the edible algae market with over 35% market share, supported by long-standing culinary use of seaweed in China, Japan, and South Korea. Large-scale aquaculture infrastructure, low production costs, and abundant raw material availability strengthen regional competitiveness. Rising urban health consciousness boosts adoption of spirulina, chlorella, and seaweed extracts in supplements, beverages, and fortified foods. Governments actively promote seaweed farming as part of coastal economic programs, driving capacity expansion. Rapid growth in algae-based snacks, beverages, and wellness products positions Asia-Pacific as the fastest-growing hub for both traditional and value-added algae applications.

Latin America

Latin America captures around 4% market share, showing steady expansion driven by rising awareness of nutrient-rich superfoods and growing interest in sustainable agriculture. Countries such as Brazil and Chile invest in microalgae cultivation for use in supplements, functional beverages, and animal feed. Increasing demand for natural colorants and protein alternatives also supports algae integration in food manufacturing. Although production infrastructure remains limited compared to Asia, emerging biotechnology startups and research partnerships strengthen market viability. Expanding retail availability of spirulina powders and capsules further boosts consumer adoption across health-conscious urban populations.

Middle East & Africa

The Middle East & Africa region holds about 3% market share, with growth driven primarily by rising interest in nutrient-dense supplements and sustainable protein sources. Countries such as the UAE and South Africa are witnessing increased adoption of spirulina and chlorella in health foods, beverages, and wellness products. Limited local production capacity leads to high reliance on imports, but new investments in desert-based microalgae farms offer long-term potential. Growing demand for algae-based animal feed in aquaculture-rich African markets supports additional expansion. As awareness of algae’s health benefits increases, the region steadily integrates edible algae into retail and nutraceutical sectors.

Market Segmentations:

By Source:

By Dosage Form:

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The edible algae market features a moderately consolidated competitive landscape, with leading participants such as Prairie Naturals, Far East Bio-Tec Co. Ltd., Cyanotech Corporation, Vimergy LLC, ENERGY Bit Inc., NOW Foods, Corbion, Earthrise Nutritional, Rainbow Light, and E.I.D-Parry Limited. The edible algae market remains highly dynamic, supported by continuous advancements in cultivation technologies, product innovation, and expanding applications across food, nutraceutical, and cosmetic segments. Companies increasingly focus on enhancing algae purity, nutrient density, and sensory appeal through optimized photobioreactor systems, controlled-environment farming, and improved extraction techniques. The competitive environment emphasizes clean-label positioning, sustainability, and regulatory compliance, driving manufacturers to adopt eco-efficient production methods and secure certifications such as organic, non-GMO, and allergen-free. Strategic initiatives including capacity expansion, cross-industry partnerships, and geographic diversification strengthen global market presence. Additionally, rising investments in R&D for algae-based proteins, natural pigments, and functional ingredients support continuous product differentiation, enabling companies to meet accelerating consumer demand for plant-based, nutrient-rich innovations.Top of Form

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, Pacific Bio (Ayr, Australia) opened a macro-algal wastewater treatment facility using their proprietary RegenAqua technology. It extracts nutrients from municipal wastewater utilizing sunlight and native algae in a chemical-free process, yielding valuable by-products such as liquid fertilizers (marketed as PlantJuice) and materials for paper or biofuels.

- In April 2025, MiAlgae planned to construct an algal oil production facility in Grangemouth, Scotland. The biotech startup uses whisky industry by-products to produce microalgae, which serves as a sustainable and cost-effective source of omega-3s compared to fish-derived alternatives.

- In June 2024, Brevel, Ltd., a company specializing in microalgae protein, inaugurated its first commercial facility. Spanning 27,000 square feet (approximately 2,500 square meters), this new plant is equipped to produce substantial quantities of microalgae protein powder, catering to the rapidly growing global alternative protein market

Report Coverage

The research report offers an in-depth analysis based on Source, Dosage Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as consumers increasingly adopt algae-based foods and supplements for natural, plant-derived nutrition.

- Advancements in large-scale photobioreactor and aquaculture systems will improve efficiency and reduce production costs.

- Algae-derived proteins will gain wider acceptance in sports nutrition, functional beverages, and plant-based food formulations.

- Producers will strengthen sustainability claims as algae farming continues to demonstrate low land use, minimal water demand, and strong carbon absorption.

- Demand for natural pigments such as phycocyanin will rise due to clean-label and artificial-colorant replacement trends.

- Algae-enriched snacks, cereals, and fortified bakery products will become more common in mainstream retail channels.

- Cosmetic and personal care applications will grow as manufacturers leverage algae’s antioxidant and anti-aging properties.

- Increasing investment in R&D will accelerate development of improved strains with higher nutrient density and better sensory profiles.

- Regulatory support for novel food ingredients will boost market penetration across developed and emerging regions.

- Strategic collaborations among food companies, biotechnology firms, and aquaculture operators will drive innovation and global supply chain expansion.