Market Overview

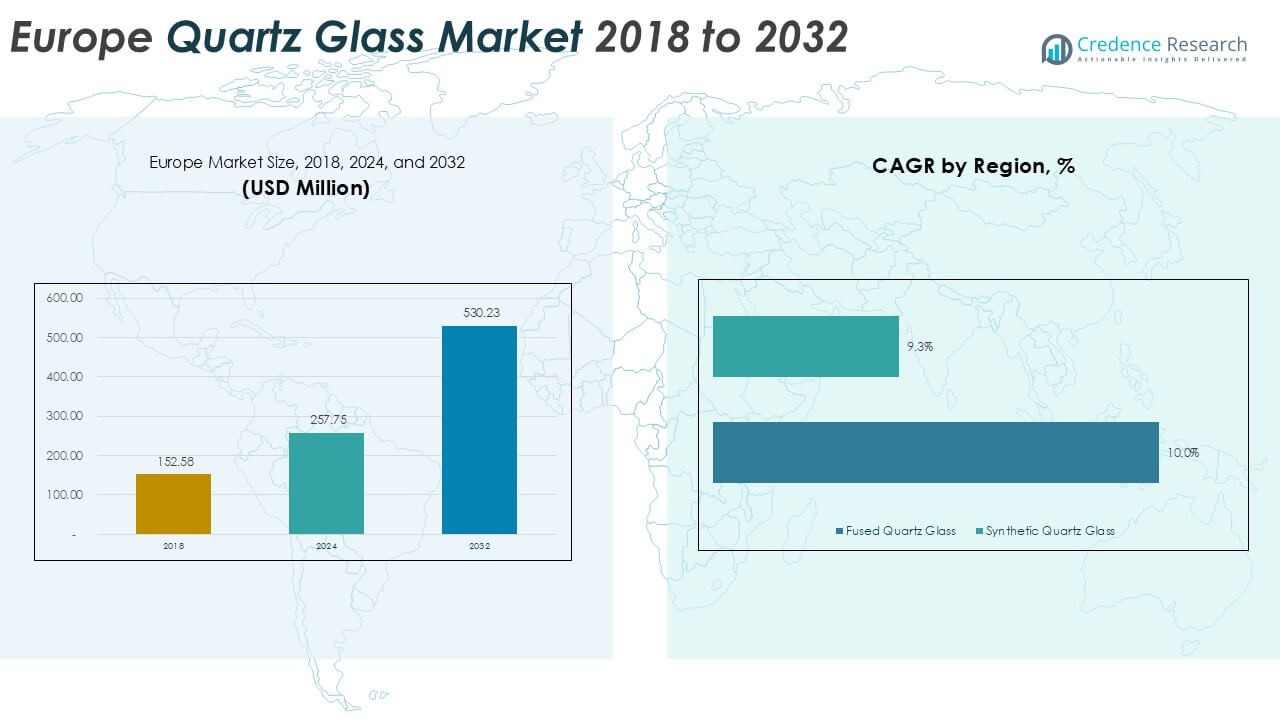

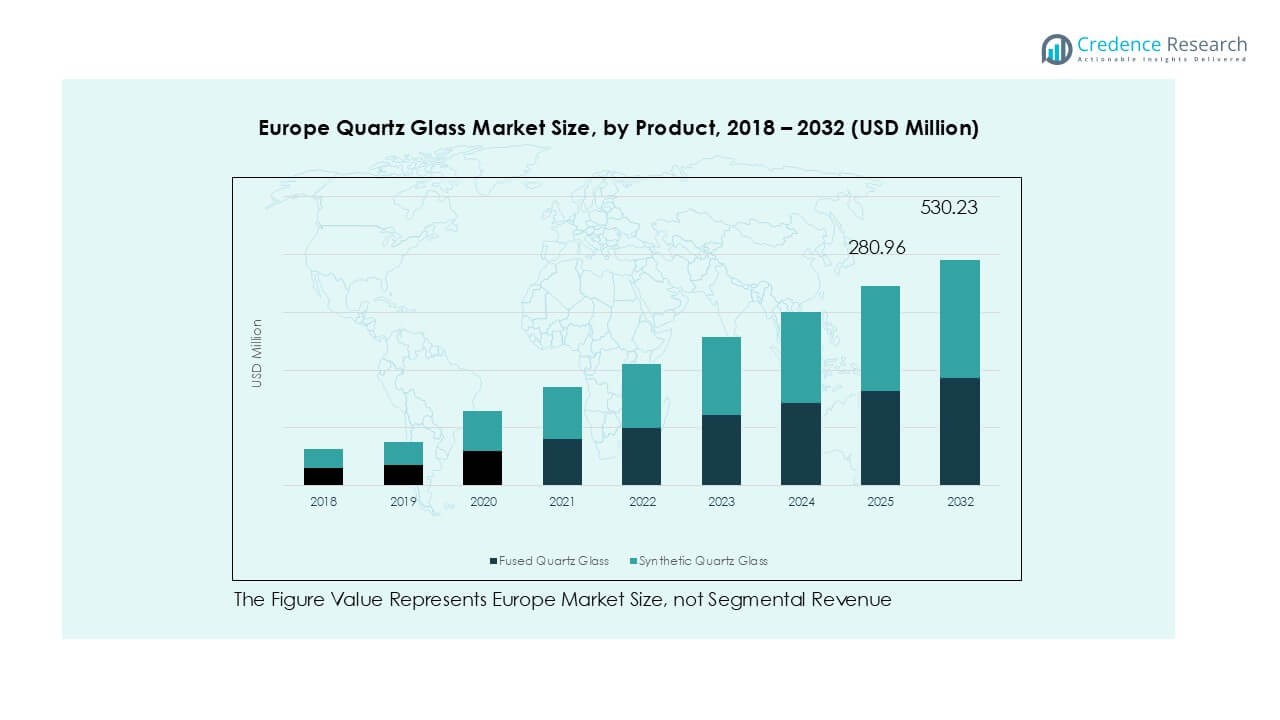

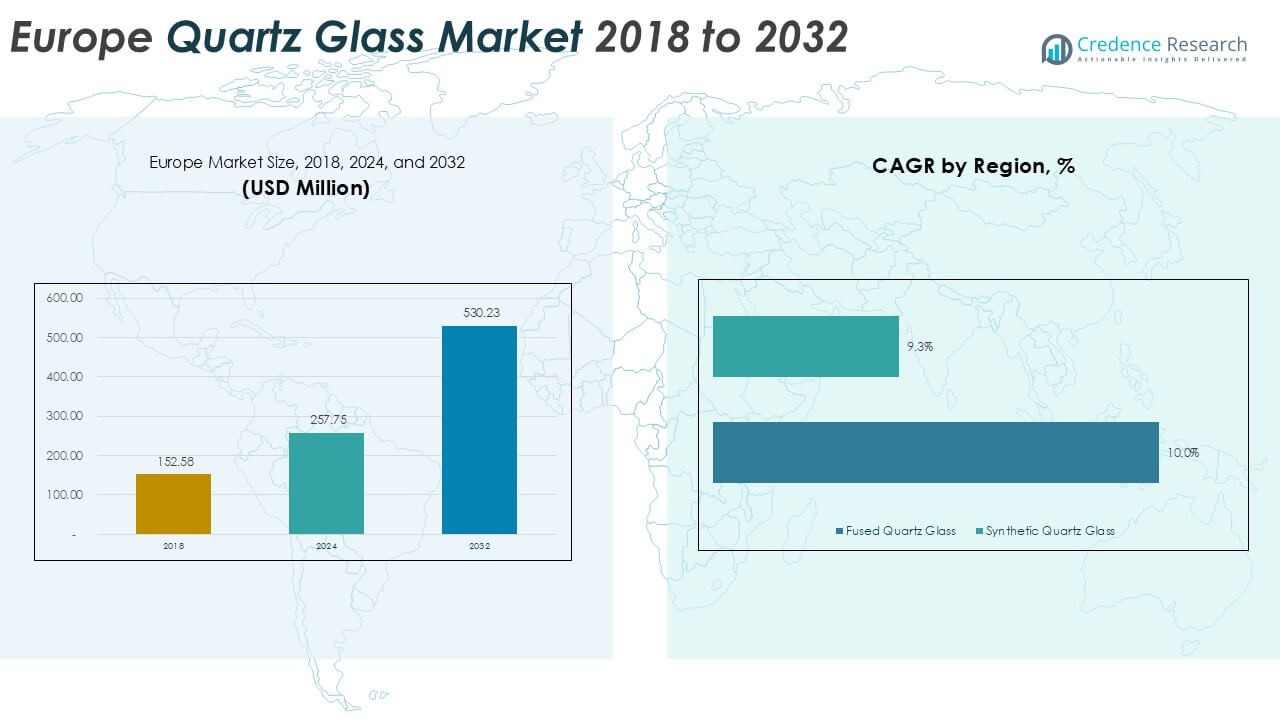

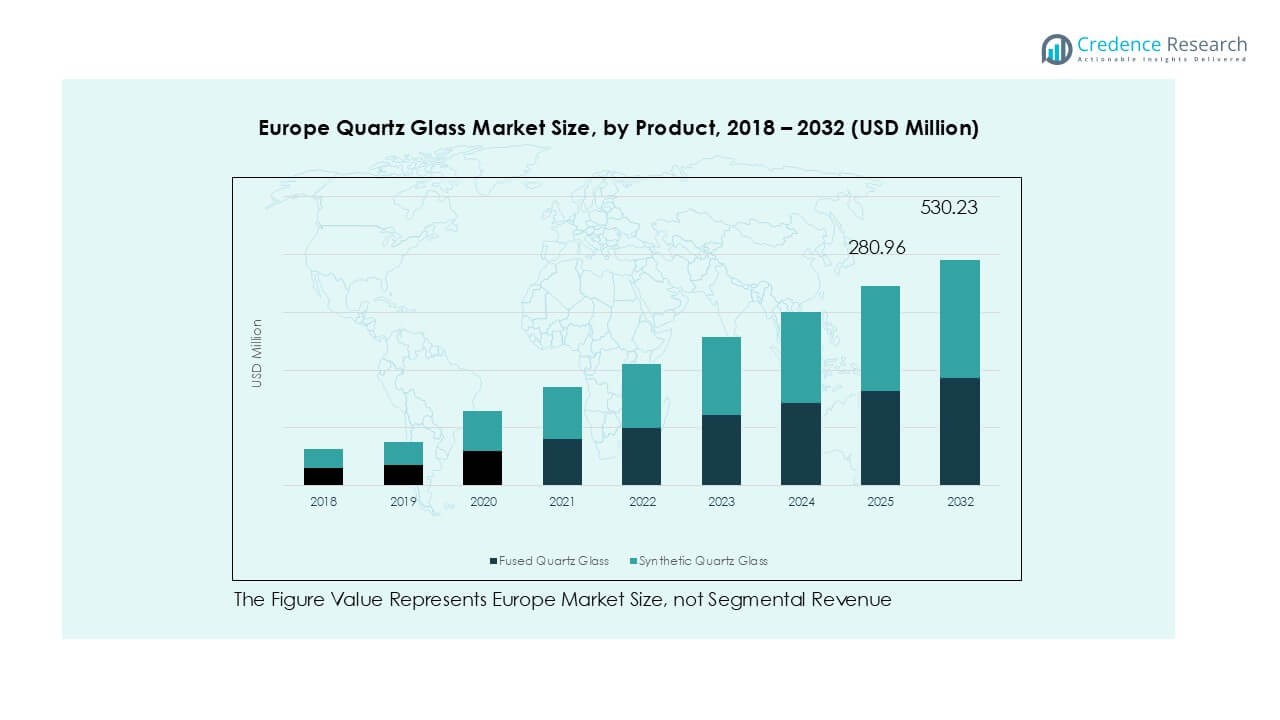

Europe Quartz Glass market size was valued at USD 152.58 million in 2018, expanded to USD 257.75 million in 2024, and is anticipated to reach USD 530.23 million by 2032, at a CAGR of 9.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Quartz Glass Market Size 2024 |

USD 257.75 Million |

| Europe Quartz Glass Market, CAGR |

9.5% |

| Europe Quartz Glass Market Size 2032 |

USD 530.23 Million |

The Europe quartz glass market is led by prominent players such as Saint-Gobain S.A., Heraeus Holding, proQuarz GmbH, WONIK Group, and Raesch Quarz, which hold strong positions through advanced product portfolios and strategic collaborations in semiconductors, solar, and photonics sectors. These companies emphasize high-purity fused and synthetic quartz glass to meet stringent industrial standards, particularly in electronics and renewable energy. On the regional front, Germany accounted for 28% of the market share in 2024, driven by its robust semiconductor and optics industries, followed by the UK with 14% and France with 12%, reflecting their investments in photonics, medical devices, and renewable energy applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe Quartz Glass market was valued at USD 257.75 million in 2024 and is projected to reach USD 530.23 million by 2032, growing at a CAGR of 9.5%.

- Strong demand from the semiconductors and electronics segment (48% share) drives growth, supported by EU’s Chips Act and rising investment in advanced fabrication plants across Germany and France.

- Key trends include the rising adoption of synthetic quartz glass for EUV lithography and growing opportunities in photonics and medical devices, supported by EU-funded research initiatives.

- The competitive landscape is led by Saint-Gobain, Heraeus Holding, proQuarz GmbH, and WONIK Group, while regional specialists such as Raesch Quarz and Quartz Solutions strengthen niche supply with customized offerings.

- Germany held 28% share of the market in 2024, followed by the UK at 14% and France at 12%, while quartz tubes dominated forms (45% share), highlighting the regional and product-level growth concentration.

Market Segmentation Analysis:

By Product

Fused quartz glass dominated the Europe quartz glass market in 2024, accounting for over 62% share. Its wide adoption stems from high thermal stability, superior optical transmission, and cost efficiency compared to synthetic quartz. The material is extensively used in semiconductors, photomasks, and laboratory equipment, driving large-scale consumption. Growth in precision electronics and expansion of photonics research across Germany, France, and the UK further reinforce demand. Synthetic quartz glass continues to expand steadily, supported by its superior purity and reliability for applications in advanced optics, EUV lithography, and specialized medical devices.

- For instance, Heraeus produces fused quartz tubes in Germany for use in semiconductor diffusion processes involving 300 mm wafers. These tubes are manufactured to very tight dimensional tolerances to meet the stringent demands of high-precision semiconductor fabrication.

By Application

The semiconductors and electronics segment held the leading position with over 48% share in 2024. Rising investments in chip fabrication and microelectronics across Europe fuel strong demand for quartz components used in photomasks, diffusion tubes, and etching chambers. Growing government support for semiconductor independence, including EU’s Chips Act, strengthens regional capacity. Solar energy applications are expanding rapidly as quartz glass enables high-efficiency photovoltaic cells. Optics, photonics, and medical segments also show steady growth, driven by laser optics, diagnostic devices, and laboratory equipment requiring high-purity quartz substrates.

- For instance, ASML’s EUV lithography systems manufactured in the Netherlands require ultra-pure synthetic quartz photomask blanks with flatness ≤15 nm over 150 mm, driving supplier demand in the region.

By Form

Quartz tubes emerged as the dominant form, representing more than 45% share in 2024. Their prevalence comes from widespread use in semiconductor furnaces, UV lamps, and photovoltaic cell production. Quartz tubes offer high heat resistance, transparency, and purity, making them indispensable in advanced manufacturing. Quartz rods and plates follow, gaining traction in optical components, lab instrumentation, and photonic devices. Increasing R&D in photonics and laboratory automation across European research institutes also drives demand for plates and sheets. Rising innovation in medical laser applications further supports the growth of specialty quartz forms.

Key Growth Drivers

Expanding Semiconductor and Electronics Industry

The semiconductor and electronics sector is the largest consumer of quartz glass in Europe, driving substantial demand. Quartz glass is vital for semiconductor manufacturing equipment, including diffusion tubes, photomasks, and etching chambers, where high purity and heat resistance are essential. The EU’s strategic initiatives, such as the Chips Act, aim to enhance Europe’s semiconductor production capacity and reduce dependence on imports. These programs are fostering new fabrication plants and expanding existing facilities across Germany, France, and the Netherlands. As production scales, the need for fused and synthetic quartz glass rises significantly. Furthermore, the rapid development of advanced nodes and EUV lithography processes relies heavily on synthetic quartz due to its exceptional optical and structural properties. The semiconductor industry’s acceleration, fueled by increasing demand for microelectronics, sensors, and communication devices, ensures quartz glass will remain a critical material supporting Europe’s industrial and technological competitiveness.

- For instance, GlobalFoundries and STMicroelectronics announced in 2023 a €7.4 billion joint fab in Crolla’s, France, which will rely on high-purity fused quartz components for 300 mm wafer processing.

Growth in Renewable Energy and Solar Installations

Europe’s strong focus on renewable energy adoption, particularly solar power, is creating a robust demand for quartz glass. Quartz glass plays a crucial role in photovoltaic manufacturing, where its high optical transmission and resistance to thermal stress support the production of solar cells and modules. Countries such as Germany, Spain, and Italy are expanding solar installations to meet the EU’s 2030 climate targets. With the region targeting at least 45% renewable energy share by 2030, solar PV projects are accelerating rapidly. Quartz glass is extensively used in tubes and sheets for silicon wafer production and protective covers for solar applications. Additionally, the development of concentrated solar power (CSP) systems further increases quartz glass consumption, particularly for high-temperature-resistant components. As Europe invests in energy transition, quartz glass becomes indispensable in enabling efficiency and durability for solar technologies. This sectoral push firmly positions renewable energy growth as a long-term driver of the market.

- For instance, Germany added 14.6 GW of solar capacity in 2023, all requiring quartz crucibles and tubes for silicon wafer production.

Expanding Applications in Optics, Photonics, and Medical Devices

Quartz glass is witnessing increasing demand across optics, photonics, and medical device applications, contributing significantly to market expansion. In optics and photonics, quartz glass is used in laser optics, lenses, and fiber optics due to its superior transparency and low thermal expansion. Research institutes and industries in Germany, Switzerland, and the UK are accelerating investments in photonics for communication, defense, and biomedical applications. Simultaneously, the medical sector increasingly utilizes quartz glass for laboratory equipment, diagnostic systems, and laser-based surgical instruments. The material’s chemical inertness and biocompatibility make it well-suited for medical laboratories and healthcare devices. With Europe’s healthcare sector adopting advanced imaging and diagnostic technologies, quartz glass demand in medical applications continues to rise. Additionally, the growing focus on photonic research and EU funding for advanced optics and laser projects further enhances opportunities. This broad application base beyond semiconductors ensures quartz glass remains integral to Europe’s innovation-driven industries.

Key Trends and Opportunities

Advancement in High-Purity Synthetic Quartz Glass

A major trend in the European quartz glass market is the rising demand for high-purity synthetic quartz. As semiconductor manufacturing transitions to EUV lithography and smaller nanometer nodes, synthetic quartz glass becomes indispensable for optics, masks, and precision equipment. Companies are investing in refining production technologies to deliver defect-free, ultra-pure quartz glass that meets stringent requirements. This trend is not limited to semiconductors; optics and photonics applications are also benefiting from improved material purity. Growing R&D collaborations between European universities, research institutes, and industrial players are accelerating material innovation. This technological shift creates opportunities for regional manufacturers to enhance competitiveness against Asian suppliers.

- For instance, Shin-Etsu Chemical provides photomask blank alternatives, but EUV lithography tools, like those manufactured by ASML, require reflective photomasks. These EUV masks are built on low thermal expansion material (LTEM) substrates, coated with a multilayer of molybdenum and silicon to reflect the 13.5 nm light.

Opportunities in Photonics and Laser Applications

The European Union identifies photonics as a key enabling technology, which opens significant opportunities for quartz glass. Quartz glass is essential in high-power laser systems, optical fibers, and precision optics, which support industries ranging from defense to telecommunications. With strong research investments under Horizon Europe and Photonics21 initiatives, Europe is building leadership in photonics innovation. Demand for quartz-based laser optics and optical substrates is growing rapidly, particularly for biomedical imaging, laser machining, and quantum communication. As industries adopt advanced optical technologies, the opportunity for quartz glass suppliers to serve diverse sectors such as healthcare, aerospace, and automotive expands, ensuring long-term growth prospects.

Key Challenges

High Production Costs and Energy-Intensive Processing

One of the major challenges in the Europe quartz glass market is the high cost associated with production. Manufacturing quartz glass requires extreme purity raw materials and energy-intensive melting processes at very high temperatures. This significantly increases operational costs, particularly with Europe’s rising electricity and natural gas prices. The reliance on specialized facilities and complex refining technologies also limits scalability, raising entry barriers for new players. Furthermore, the cost competitiveness of Asian suppliers adds pricing pressure on European producers. Balancing energy efficiency, cost control, and product quality remains a key challenge to sustaining profitability.

Raw Material Supply Constraints

The quartz glass industry depends on high-quality silica sand and other critical inputs, which are subject to supply constraints. Limited availability of ultra-pure raw materials in Europe leads to dependence on imports from countries with abundant reserves, increasing vulnerability to price volatility and supply disruptions. Geopolitical tensions and trade restrictions can further impact raw material sourcing. Additionally, stricter EU mining and environmental regulations limit domestic extraction, compounding supply risks. These constraints create challenges in maintaining consistent production while meeting rising demand from semiconductors, solar energy, and photonics. Developing sustainable sourcing strategies and recycling technologies is becoming essential for the industry.

Regional Analysis

Germany

Germany led the Europe quartz glass market in 2024, accounting for 28% share. The country’s dominance is supported by its strong semiconductor and electronics industry, particularly with leading fabrication facilities and R&D centers. Germany’s renewable energy push, especially solar, also drives quartz glass demand for photovoltaic applications. The presence of advanced photonics and optics research hubs further boosts adoption. Strategic initiatives under the EU Chips Act and Horizon Europe programs strengthen domestic manufacturing and innovation capacity. Germany’s industrial base, coupled with government funding for clean energy and advanced materials, ensures sustained leadership in quartz glass consumption.

UK

The UK held nearly 14% share of the Europe quartz glass market in 2024. Demand is largely fueled by the country’s growing investments in photonics, laser technology, and medical devices. Universities and research institutes, particularly in Cambridge and Oxford clusters, contribute significantly to optics and laboratory applications. The healthcare sector’s focus on advanced diagnostics also supports quartz glass adoption. Although semiconductor manufacturing is relatively limited compared to Germany, the UK’s research-driven photonics ecosystem offers strong opportunities. Increasing renewable energy deployment, particularly offshore solar and smart energy systems, further enhances demand for quartz tubes and plates across key industries.

France

France accounted for 12% share in the Europe quartz glass market in 2024. The country benefits from expanding semiconductor activity, supported by national strategies to attract fabrication investments under the EU framework. France’s well-established aerospace and optics industries also drive demand for high-purity quartz components in precision instruments and laser technologies. Strong solar energy deployment, particularly in southern regions, reinforces quartz glass usage in photovoltaic applications. In addition, France’s advanced healthcare infrastructure encourages adoption in laboratory equipment and diagnostic tools. With government-backed investments in photonics and optics research, France is poised to expand its role in high-tech applications.

Italy

Italy represented about 9% share of the Europe quartz glass market in 2024. The country’s solar energy expansion and steady semiconductor equipment demand underpin market growth. Italy’s manufacturing sector integrates quartz glass in electronics, optics, and laboratory applications, supported by regional industrial clusters. The adoption of photovoltaic installations in central and southern Italy contributes to rising demand for quartz tubes and sheets. Furthermore, Italy’s medical technology industry increasingly incorporates quartz-based diagnostic and imaging devices. Investments in renewable energy and government incentives for energy efficiency continue to create opportunities, ensuring Italy’s stable role in the regional quartz glass landscape.

Spain

Spain contributed nearly 8% share to the Europe quartz glass market in 2024. The country’s strong focus on solar energy is the primary growth driver, with quartz glass widely used in photovoltaic modules. Spain’s rapid expansion of solar farms under EU renewable targets makes quartz an essential material. Beyond energy, Spain also sees demand in medical and laboratory sectors, supported by its growing biotech and research ecosystem. Semiconductor applications remain modest but show steady growth due to rising electronics demand. With favorable climate policies and renewable adoption, Spain is positioned as a fast-growing market within the region.

Russia

Russia held about 11% share in the Europe quartz glass market in 2024. The country’s demand is largely supported by semiconductor, electronics, and defense-related optics industries. Russia’s growing investments in photonics and laser technologies drive the need for quartz glass in high-precision applications. Solar energy expansion, although gradual, is adding to demand for quartz tubes and sheets. Despite geopolitical tensions and trade restrictions, Russia continues to develop domestic quartz processing to reduce reliance on imports. The country’s focus on technological independence ensures steady consumption, but supply chain constraints and limited access to advanced raw materials pose ongoing challenges.

Rest of Europe

The Rest of Europe, including Nordic nations, Eastern Europe, and Benelux, represented around 18% share in 2024. Demand is distributed across renewable energy, semiconductors, and photonics industries. Countries such as the Netherlands and Belgium are strengthening their role in semiconductor R&D, boosting demand for synthetic quartz. The Nordic region is seeing strong adoption of renewable energy, particularly solar and emerging photonics applications. Eastern Europe is gradually expanding manufacturing capacities, supported by EU investment programs. Collectively, these regions offer steady growth potential, ensuring the rest of Europe remains an important contributor to quartz glass demand across diverse industries.

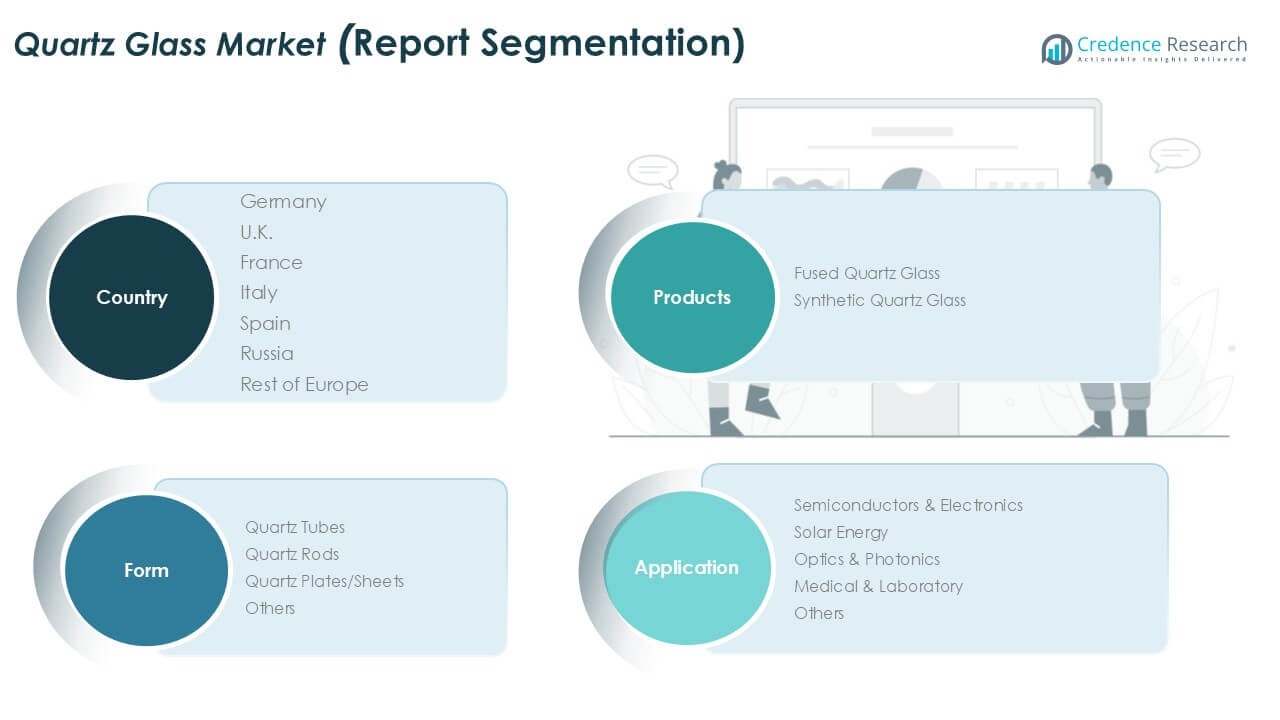

Market Segmentations:

By Product

- Fused Quartz Glass

- Synthetic Quartz Glass

By Application

- Semiconductors & Electronics

- Solar Energy

- Optics & Photonics

- Medical & Laboratory

- Others

By Form

- Quartz Tubes

- Quartz Rods

- Quartz Plates/Sheets

- Others

By Geography

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The Europe quartz glass market is moderately consolidated, with a mix of established global players and specialized regional manufacturers. Leading companies such as Saint-Gobain S.A., Heraeus Holding, proQuarz GmbH, WONIK Group, and Raesch Quarz dominate the market through their strong product portfolios and extensive distribution networks. These firms emphasize high-purity quartz for semiconductors, solar energy, and photonics applications, aligning with Europe’s industrial and renewable energy strategies. Regional players including Quartz Solutions, SUNG RIM Europe GmbH, and Precision Electronic Glass enhance competitiveness by offering niche solutions and customized components. Companies actively pursue strategies such as R&D investment, capacity expansion, and collaborations with semiconductor and optics firms to strengthen their presence. Recent developments highlight innovation in synthetic quartz for EUV lithography and advanced optical applications, reflecting market focus on technology-driven growth. The competitive environment remains dynamic, shaped by technological advancements, supply chain optimization, and increasing demand from semiconductor and renewable sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- proQuarz GmbH

- Saint-Gobain S.A.

- Heraeus Holding

- Quartz Solutions

- Precision Electronic Glass

- WONIK Group

- Raesch Quarz

- S & S Optical Company, Inc.

- SUNG RIM Europe GmbH

- Swift Glass

- Sandfire Scientific

- Other Key Players

Recent Developments

- In July 2025, QSIL inaugurated (opened) an expansion building at its ceramics site in Auma-Weidatal for the metallization process. While this is not directly quartz glass, it is part of its high-performance materials / production footprint.

- In March 2025, Heraeus (Heraeus Covantics) launches a new quartz manufacturing plant in Shenyang, China.The facility cost is ~600 million yuan (≈ USD 83.6 million). It focuses on high-purity and ultra-high-purity synthetic quartz products.

- In January 2025, Heraeus Covantics is formed (reorganization). Heraeus combined its high-performance materials units, Heraeus Conamic and Heraeus Comvance, into a new operating company under the name.

- In December 2024 / January 2025, QSIL GmbH Quarzschmelze Ilmenau is acquired by SCHOTT AG. Effective early 2025, SCHOTT acquired the quartz glass production facility in Ilmenau, Germany, including about 275 employees. The acquisition is seen as strategic for SCHOTT to bolster its semiconductor materials portfolio and ensure supply chain resilience.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Form and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Europe quartz glass market is set to expand steadily with strong growth prospects across industries.

- Rising semiconductor demand will remain the primary driver, supported by EU initiatives to boost local chip production.

- Solar energy expansion will accelerate quartz glass use in photovoltaic and CSP applications.

- Synthetic quartz glass will gain momentum due to its purity and suitability for EUV lithography.

- Leading companies will focus on R&D and partnerships to meet advanced optical and photonics requirements.

- High production costs and energy intensity will push firms toward efficiency and recycling innovations.

- Germany will maintain its dominance with 28% share, followed by the UK and France.

- Quartz tubes will continue leading with more than 45% share, driven by semiconductor and solar uses.

- Healthcare and laboratory applications will create new demand channels for quartz-based precision instruments.

- Regional diversification and investment in advanced materials will shape future competitiveness in the market.