Market Overview

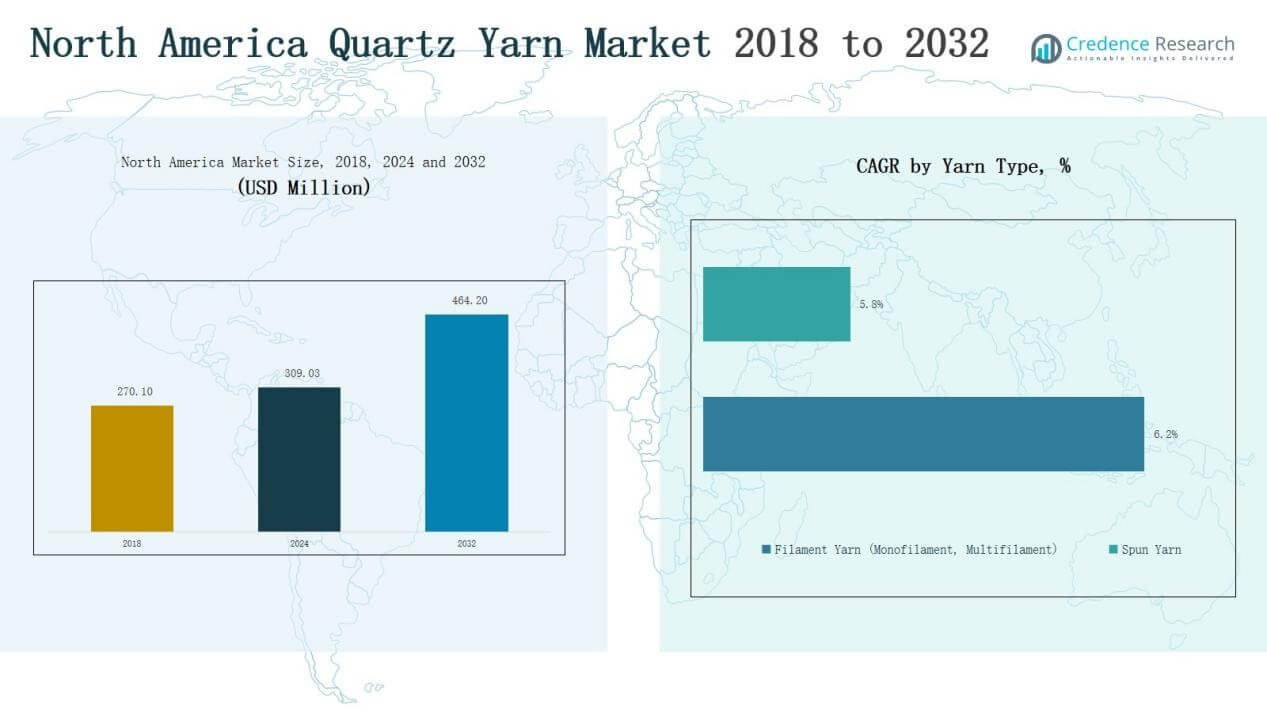

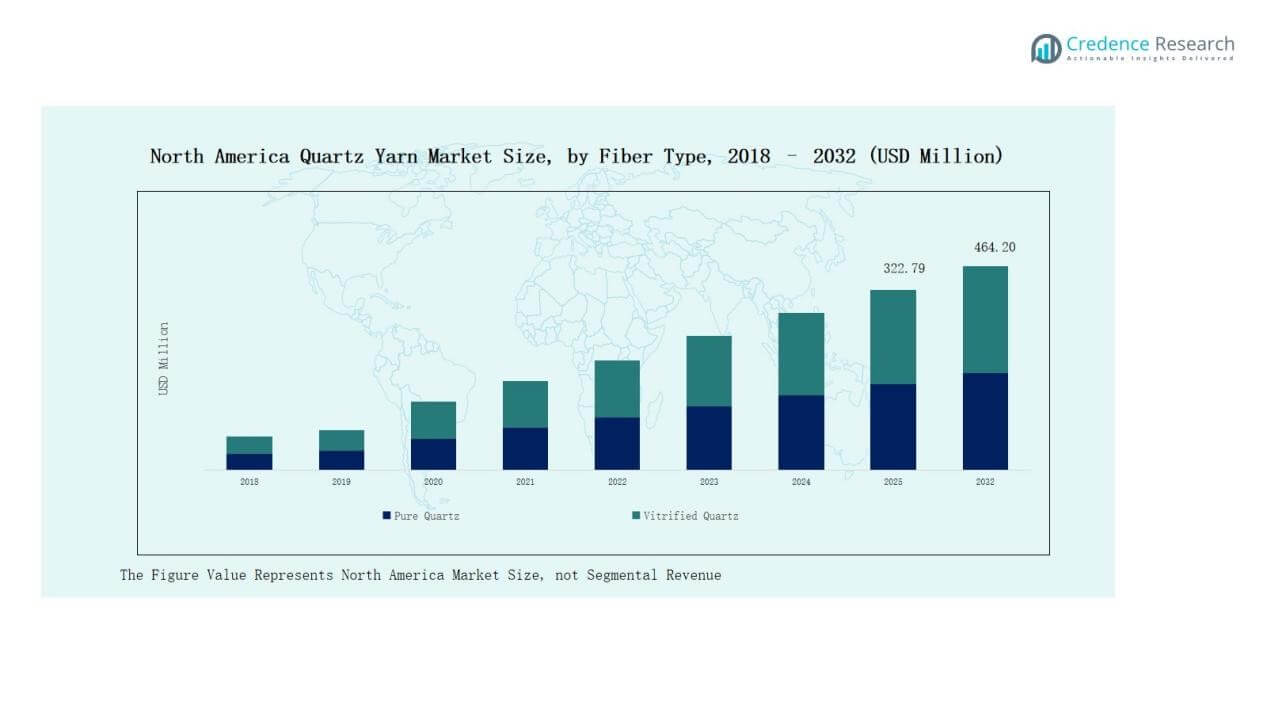

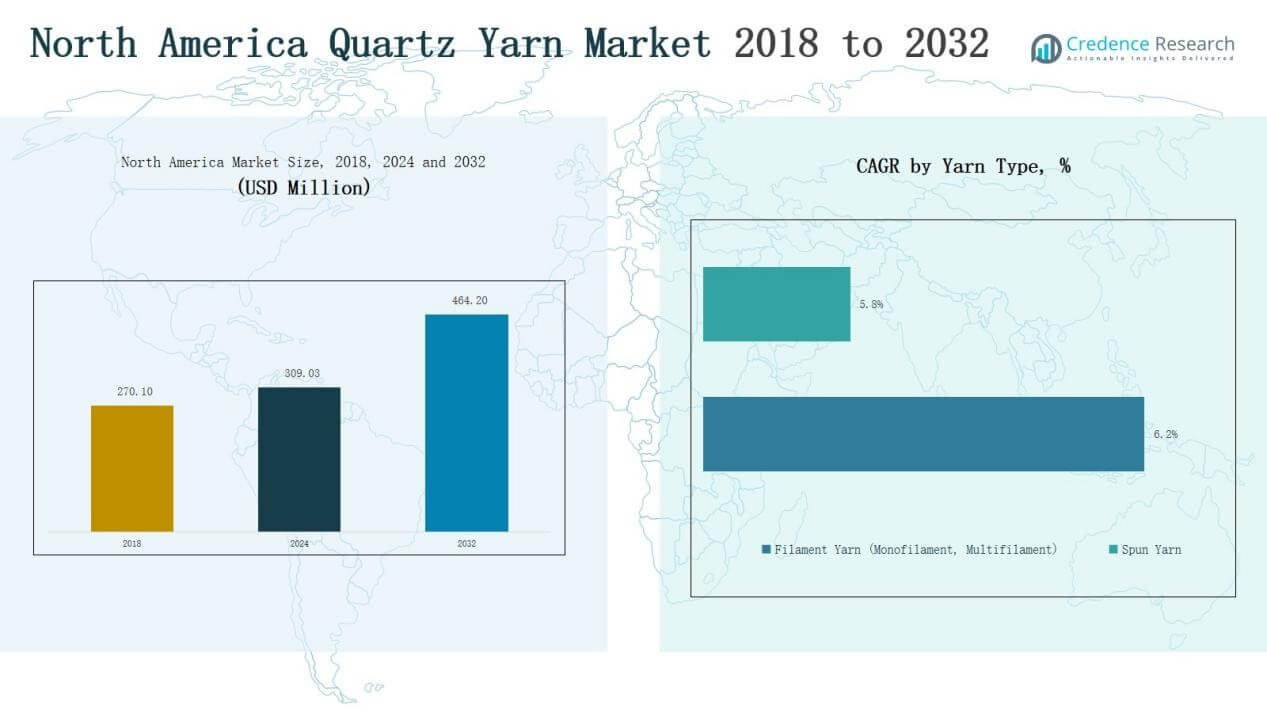

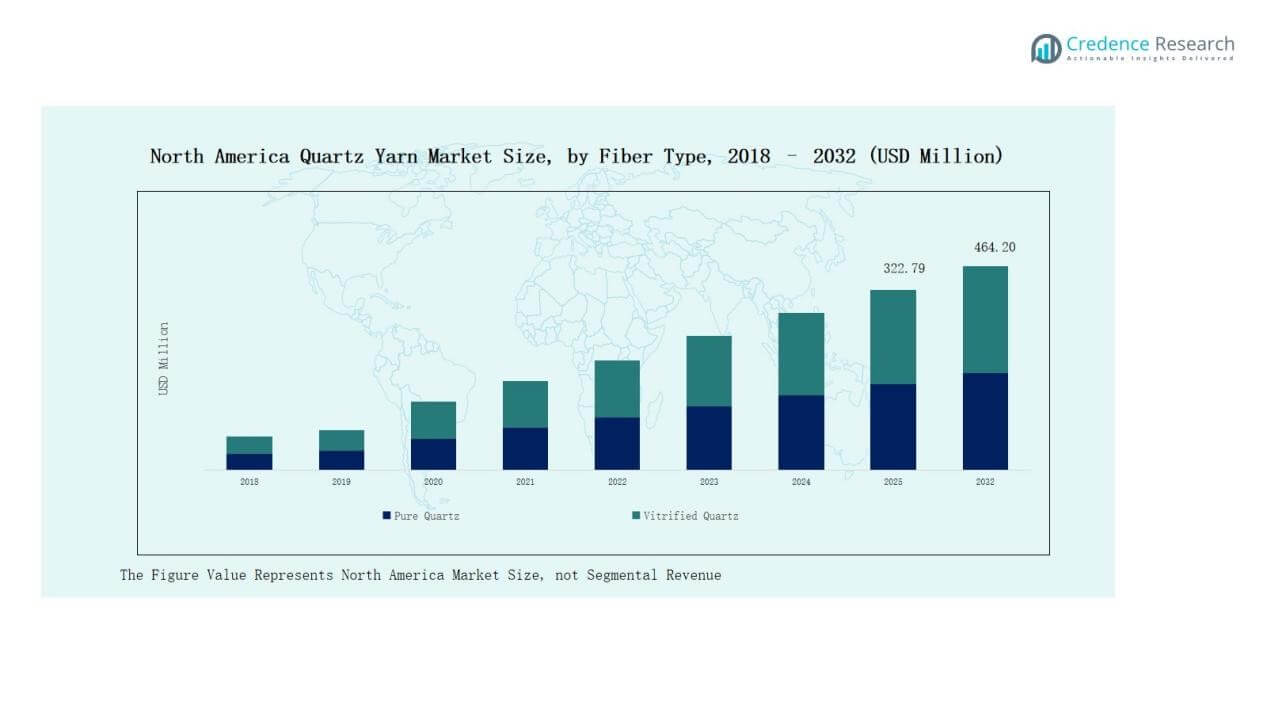

North America Quartz Yarn Market size was valued at USD 270.10 million in 2018, reached USD 309.03 million in 2024, and is anticipated to reach USD 464.20 million by 2032, at a CAGR of 5.22% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Quartz Yarn Market Size 2024 |

USD 309.03 Million |

| North America Quartz Sleeve Market, CAGR |

5.22% |

| North America Quartz Sleeve Market Size 2032 |

USD 464.20 Million |

The North America Quartz Yarn Market is shaped by the presence of key players such as JPS Composite Materials, Saint-Gobain Quartz, 3M Company, AGY Holding Corp., Nippon Electric Glass, and Unifrax. These companies focus on innovation, product diversification, and R&D investments to deliver high-purity, durable, and heat-resistant yarn solutions for aerospace, defense, automotive, and industrial sectors. Strategic collaborations, capacity expansions, and sustainability initiatives further strengthen their competitive positions. The U.S. leads the regional landscape with a 72% share in 2024, supported by its robust aerospace and automotive industries, advanced R&D capabilities, and large-scale manufacturing base.

Market Insights

Market Insights

- The North America Quartz Yarn Market grew from USD 270.10 million in 2018 to USD 309.03 million in 2024 and is projected to reach USD 464.20 million by 2032.

- Pure quartz dominates the fiber type segment with 64% share in 2024, driven by high purity, tensile strength, and thermal resistance for aerospace, electronics, and defense applications.

- Filament yarn leads the yarn type segment with 70% share in 2024, supported by multifilament demand for aerospace composites and filtration, while spun yarn remains limited to insulation and sealing.

- Aerospace and defense account for 36% share in 2024, followed by automotive, chemical processing, construction, and oil & gas, supported by quartz yarn’s resistance to heat, corrosion, and stress.

- The U.S. leads regionally with 72% share in 2024, while Canada holds 15% and Mexico 13%, supported by aerospace, automotive, construction, and industrial manufacturing applications across these countries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Fiber Type

The pure quartz segment dominates the North America Quartz Yarn Market with a 64% share in 2024. Its growth is supported by superior purity, tensile strength, and thermal resistance, making it vital for aerospace and defense applications. Electronics and automotive industries also contribute to rising demand due to the reliability of high-purity quartz. Vitrified quartz, while holding a smaller share, is gaining traction in cost-sensitive applications such as construction and industrial processing where durability remains essential.

By Yarn Type

Filament yarn leads the market, capturing 70% share in 2024, driven by its strength, consistency, and suitability for advanced composite reinforcement. Multifilament yarn dominates within this category, offering flexibility and wider use in aerospace and filtration applications. Monofilament yarn is preferred in specific niches requiring uniformity and high precision. Spun yarn accounts for a smaller share, mainly used in insulation and sealing. The increasing use of lightweight composites in automotive and defense supports filament yarn’s continued dominance in the region.

For instance, Toray Industries announced the expansion of its carbon fiber filament yarn capacity at its Spartanburg, U.S. plant to cater to growing demand from aerospace and automotive composite applications.

By End-Use Industry

The aerospace and defense sector holds the largest share at 36% in 2024, reflecting stringent requirements for heat resistance, lightweight composites, and durability. Quartz yarn is widely used in thermal protection systems, composite structures, and defense-grade insulation. Automotive ranks second, supported by the shift toward fuel efficiency and electric vehicle adoption. Chemical processing, construction, and oil & gas follow, leveraging quartz yarn’s high resistance to heat and corrosion. These properties sustain its role in filtration, sealing, and industrial reinforcement applications.

For instance, industries such as chemical processing, construction, and oil & gas utilize quartz yarn’s exceptional resistance to heat and corrosion, supporting applications in filtration, sealing, and industrial reinforcement.

Key Growth Drivers

Key Growth Drivers

Aerospace and Defense Applications

The aerospace and defense industry remains the largest consumer of quartz yarn in North America, accounting for 36% share in 2024. Quartz yarn offers superior tensile strength, thermal stability, and dielectric properties, making it essential in radomes, thermal protection systems, and composite reinforcements. Increasing aircraft production and defense modernization projects in the U.S. drive sustained adoption. Strategic partnerships between suppliers and aerospace OEMs ensure steady supply for next-generation programs, reinforcing quartz yarn’s critical role in meeting performance and durability requirements.

For instance, Rock West Composites partnered with Renegade Materials to complete a radome prototype using RM-2014-LDk epoxy on quartz fabric, achieving low dielectric constants suitable for high-frequency aerospace applications.

Automotive Light weighting and Electrification

The transition to electric vehicles and lightweight automotive designs is a major growth driver. Quartz yarn composites provide high strength-to-weight ratios, thermal insulation, and resistance to heat, supporting battery enclosures, under-hood components, and thermal shielding in EVs. Rising demand for fuel efficiency and safety standards accelerates the integration of advanced materials across automotive platforms. The U.S. and Mexico, with their strong automotive manufacturing bases, are key contributors to quartz yarn demand. Growing investments in EV production facilities ensure a long-term demand trajectory for advanced composite materials.

For instance, Toray Industries expanded its carbon fiber filament yarn production capacity at the Spartanburg, U.S. plant to 7,000 tons annually, directly supporting lightweight composite adoption in both aerospace and automotive, where quartz yarn-based reinforcements are also integrated for thermal protection.

Expansion in Industrial and Chemical Applications

Industrial sectors such as chemical processing, construction, and oil & gas increasingly rely on quartz yarn due to its resistance to corrosion, heat, and chemical attack. Applications include filtration media, sealing, insulation, and industrial reinforcement. Canada plays an important role with growing demand in construction and renewable energy infrastructure, while Mexico benefits from rising oil & gas projects. Quartz yarn’s durability under extreme conditions positions it as a preferred material across these diverse industries. Expansion of industrial projects and renewable initiatives further supports long-term market growth.

Key Trends & Opportunities

Sustainability and Eco-Friendly Materials

Sustainability initiatives are reshaping production strategies for quartz yarn manufacturers. Companies are investing in low-emission refining processes and recyclable material development to align with environmental regulations. The adoption of green procurement policies in aerospace and automotive sectors further strengthens this trend. Firms that integrate circular economy practices are gaining a competitive edge, offering eco-friendly solutions that meet compliance requirements while enhancing brand positioning in a sustainability-driven market.

For instance, AGC Inc. utilizes oxygen combustion systems and produces high-purity glass and materials for the electronics and aerospace sectors, alongside a commitment to group-wide greenhouse gas reductions. In Chiba, the company produces chemical products and participated in a study aimed at achieving carbon neutrality in the local industrial complex.

Strategic Partnerships and R&D Expansion

R&D investments are unlocking new applications for quartz yarn, particularly in composite reinforcement for aerospace and electric vehicles. Strategic collaborations with OEMs and composite manufacturers are driving innovation, ensuring stable supply chains and application-specific product development. Recent initiatives, such as radome prototypes and advanced oxide-quartz fibers, highlight opportunities for broader aerospace and defense integration. Partnerships and capacity expansions will remain central to capturing new growth avenues across industries.

For instance, Saint-Gobain expanded its manufacturing footprint in Chennai, India, with new facilities for float glass and mineral wool insulation, including a float glass line capable of producing over 1,000 metric tons per day.

Key Challenges

High Production Costs and Supply Chain Risks

Quartz yarn production requires high-purity raw materials and energy-intensive processes, leading to elevated costs. Supply chain disruptions, including quartz mining limitations and logistics bottlenecks, further challenge pricing stability. Smaller players face difficulties competing with established companies that benefit from integrated supply chains and economies of scale. Rising energy costs and raw material scarcity may continue to pressure margins, limiting market expansion unless efficiency improvements are achieved.

Competition from Alternative Advanced Materials

The North America Quartz Yarn Market faces competition from alternative reinforcement fibers such as carbon and ceramic fibers. These materials offer similar or superior strength-to-weight ratios and thermal resistance, depending on the application. Aerospace and automotive sectors often evaluate trade-offs between quartz yarn and competing fibers based on performance, cost, and availability. If alternative materials achieve broader acceptance at lower costs, quartz yarn demand may face constraints, compelling producers to focus on niche, high-performance applications.

Regional Analysis

U.S.

The U.S. leads the North America Quartz Yarn Market with a 72% share in 2024. It benefits from a strong aerospace and defense industry, which drives significant adoption of quartz yarn in composites, insulation, and thermal protection systems. The automotive sector further supports growth with rising demand for lightweight and durable materials, particularly in electric vehicles. Advanced R&D facilities and strong industrial capabilities reinforce the country’s leadership. It continues to dominate the regional market, driven by large-scale production and strategic investments.

Canada

Canada holds a 15% share in 2024, supported by industrial and construction applications. Demand is driven by the country’s focus on energy-efficient infrastructure and sustainable materials. Aerospace and defense also contribute, with local production and collaborations supporting steady adoption. It benefits from growing renewable energy projects, where quartz yarn is applied in insulation and reinforcement. The market remains supported by industrial diversification and government initiatives promoting advanced materials. It positions Canada as a stable growth market in the region.

Mexico

Mexico accounts for a 13% share in 2024, primarily driven by automotive manufacturing and construction industries. The country’s strong role in North America’s automotive supply chain boosts demand for lightweight quartz yarn composites. Oil and gas applications also contribute, where durability and heat resistance are critical. It benefits from increasing foreign investments in industrial production and infrastructure. Mexico’s cost-competitive environment and expanding manufacturing base support wider adoption. It continues to emerge as a significant market within the regional landscape.

Market Segmentations:

Market Segmentations:

By Fiber Type

- Pure Quartz

- Vitrified Quartz

By Yarn Type

- Filament Yarn

- Monofilament

- Multifilament

- Spun Yarn

By End-Use Industry

- Aerospace & Defense

- Automotive

- Chemical Processing

- Construction

- Oil & Gas

By Application

- Composite Reinforcement

- Filtration

- Insulation

- Sealing Threads

By Region

Competitive Landscape

The North America Quartz Yarn Market is moderately consolidated, with both global leaders and regional players competing to strengthen their presence. Key companies include JPS Composite Materials, Saint-Gobain Quartz, 3M Company, AGY Holding Corp., Nippon Electric Glass, and Unifrax. It is defined by continuous investment in R&D to enhance fiber purity, tensile strength, and thermal resistance. Leading firms focus on supplying high-performance solutions to aerospace, defense, and automotive industries, which remain the primary demand centers. Strategic initiatives such as capacity expansions, technology integration, and partnerships with OEMs support competitive positioning. Companies also emphasize sustainable production practices to align with evolving regulatory and industry requirements. Smaller players aim to capture niche markets by offering specialized yarn solutions tailored for industrial and construction use. Intense competition, supply chain optimization, and product innovation are shaping the landscape, compelling all participants to differentiate through performance, cost efficiency, and strong customer relationships.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In May 2024, KCC Corporation fully acquired Momentive Performance Materials, a U.S. company producing quartz and silicone materials.

- In 2025, Triumph Composites / Quartz Fibre acquired Owens-Corning’s quartz fibre business.

- In August 2025, Rock West Composites partnered with Renegade Materials to complete a radome prototype using low-dielectric epoxy on quartz fabric (RM-2014-LDk), highlighting progress in aerospace applications of quartz fibers

- In 2024–2025, Saint-Gobain Advanced Ceramic Composites expanded its oxide and quartz fiber initiatives, reinforcing its role in supplying advanced reinforcement solutions for aerospace and defense.

Report Coverage

The research report offers an in-depth analysis based on Fiber Type, Yarn Type, End Use Industry, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Aerospace and defense will remain the leading demand driver across the region.

- Automotive lightweighting initiatives will boost adoption of quartz yarn composites.

- Electric vehicle expansion will strengthen demand for thermal insulation solutions.

- Chemical processing industries will expand usage in filtration and corrosion-resistant applications.

- Construction projects will integrate durable and sustainable quartz yarn-based materials.

- Oil and gas industries will continue relying on high-temperature sealing and reinforcement.

- R&D investments will improve yarn performance and expand advanced applications.

- Strategic partnerships with OEMs will enhance supply stability and market penetration.

- Sustainability goals will encourage eco-friendly production and recyclable material solutions.

- Regional manufacturers will focus on capacity expansion and competitive differentiation.

Market Insights

Market Insights Key Growth Drivers

Key Growth Drivers Market Segmentations:

Market Segmentations: