Market Overview:

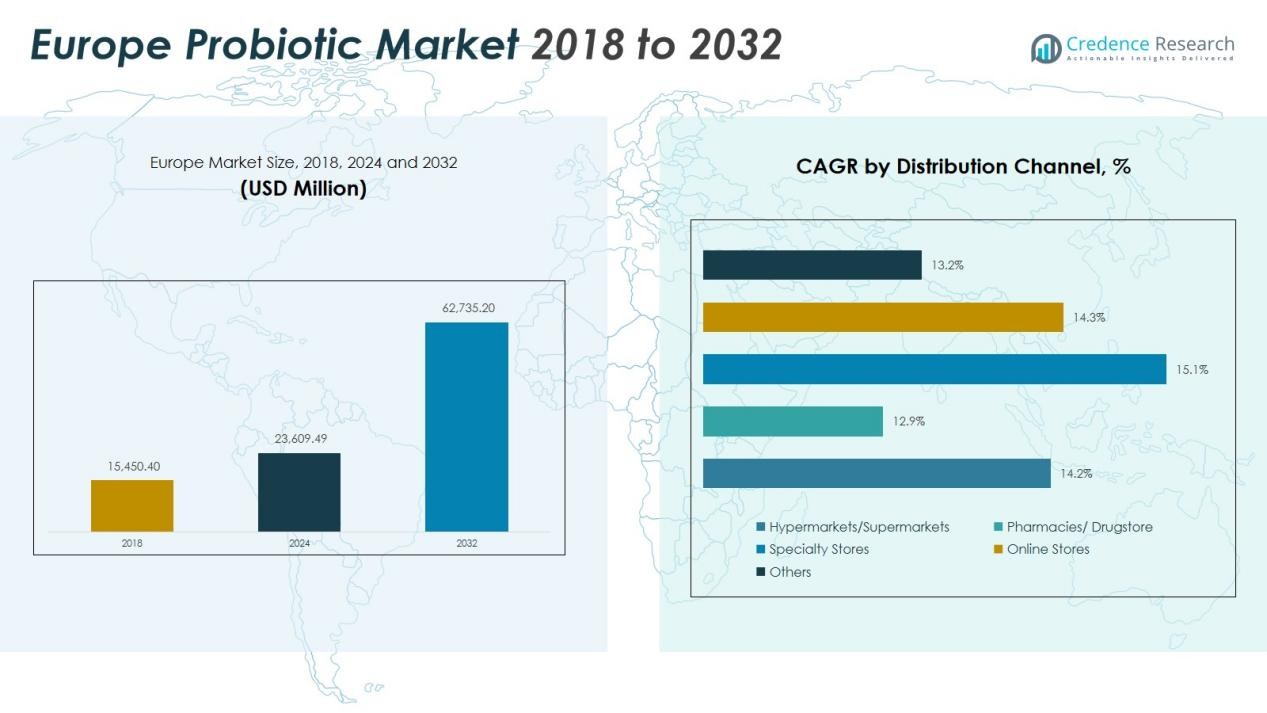

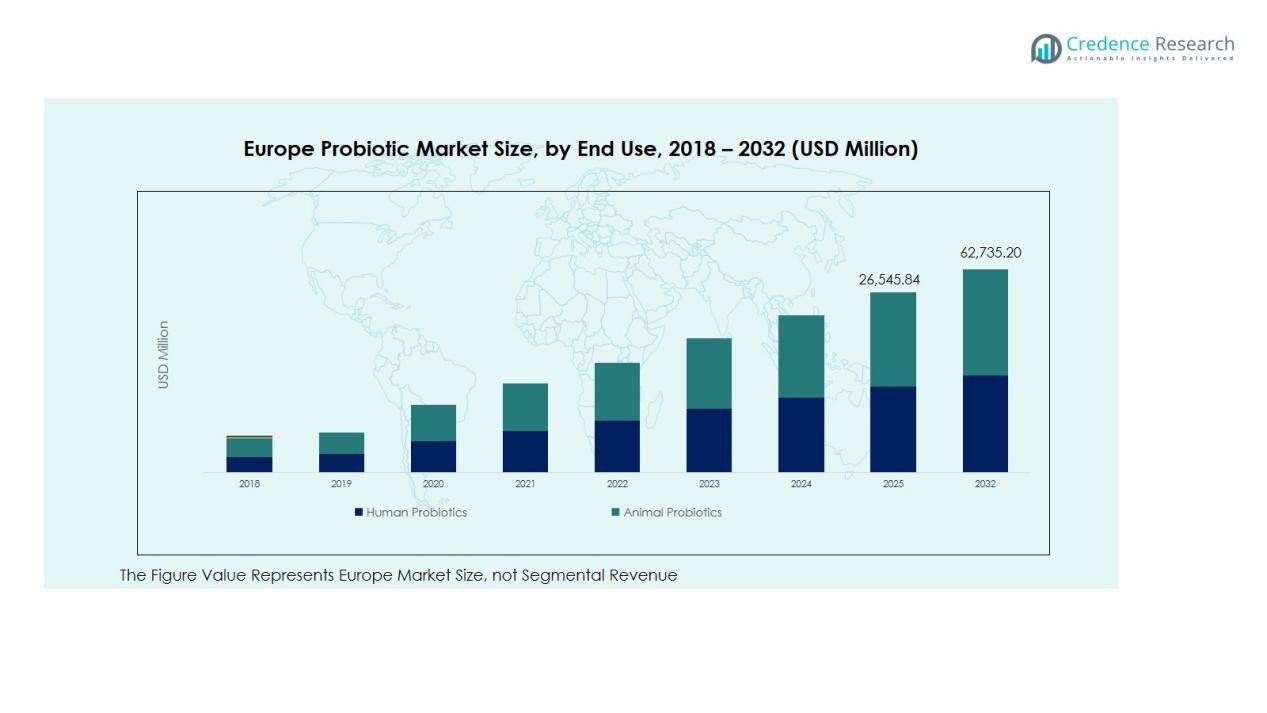

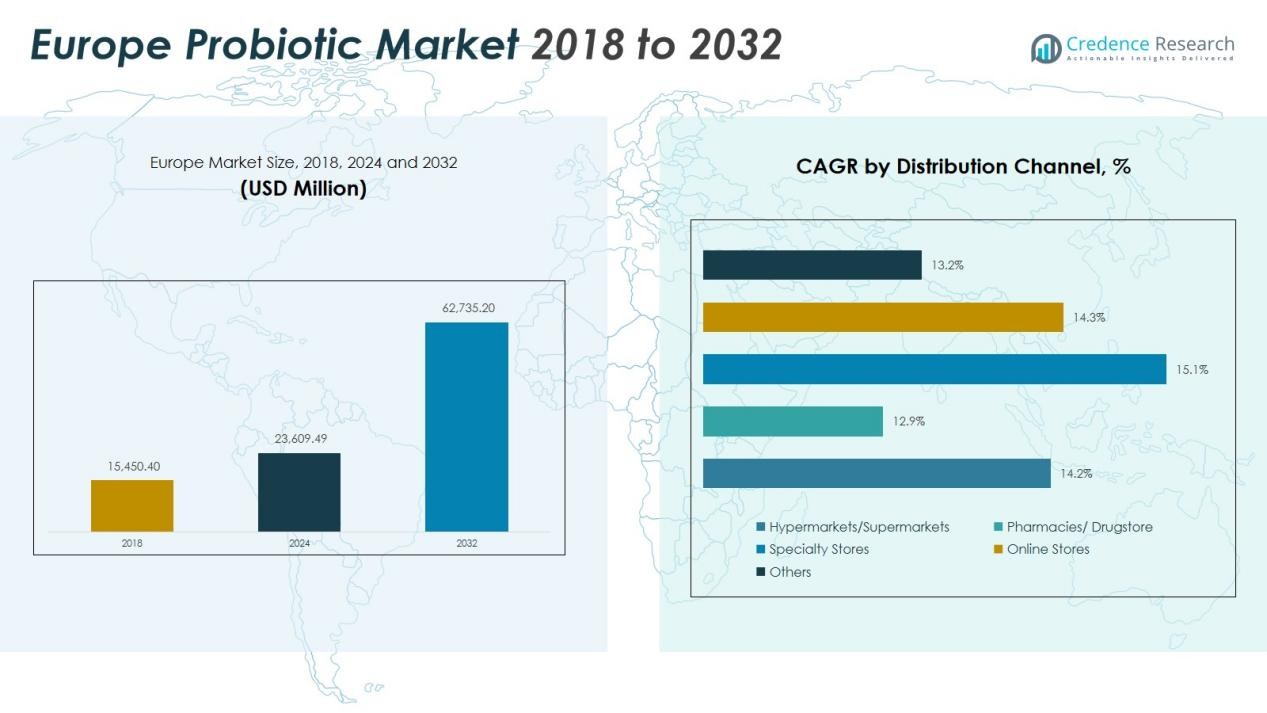

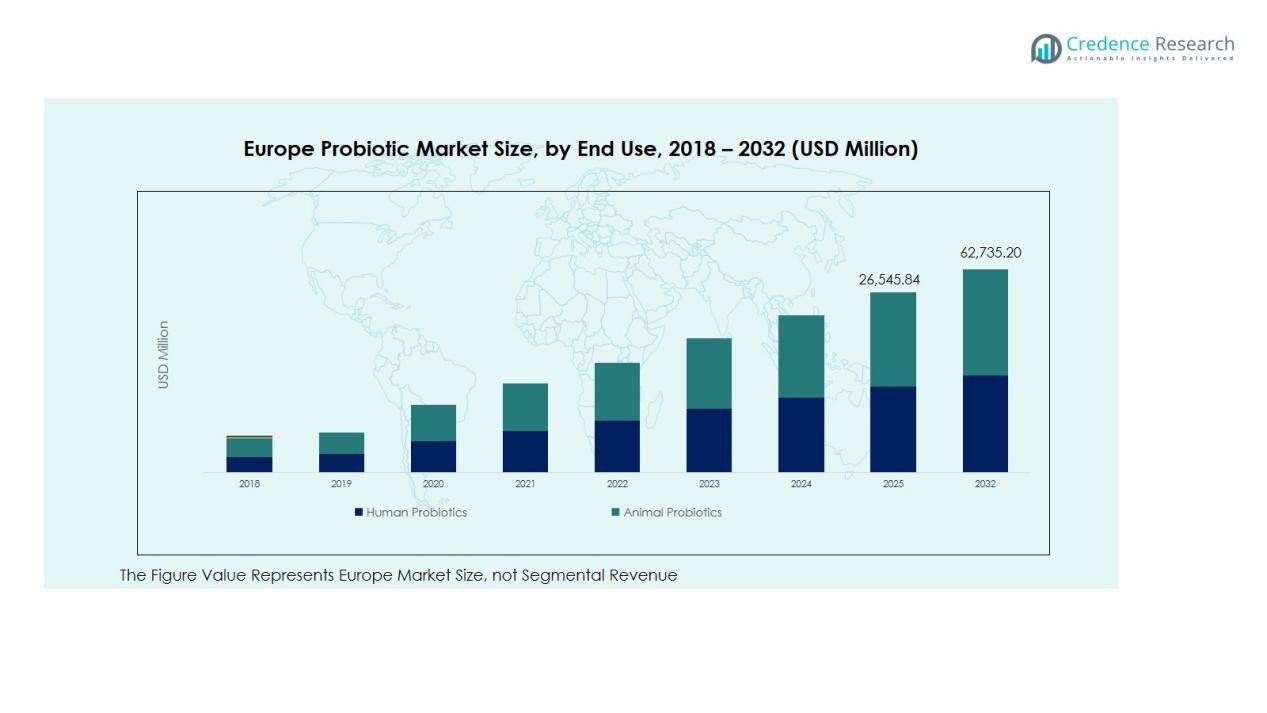

The Europe Probiotic Market size was valued at USD 15,450.40 million in 2018 to USD 23,609.49 million in 2024 and is anticipated to reach USD 62,735.20 million by 2032, at a CAGR of 10.53%. during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Probiotic Market Size 2024 |

USD 23,609.49 Million |

| Europe Probiotic Market, CAGR |

10.53% |

| Europe Probiotic Market Size 2032 |

USD 62,735.20 Million |

Rising health consciousness and preference for preventive care are driving steady demand for probiotics across Europe. Consumers are shifting toward functional foods and supplements that promote gut balance, immune strength, and metabolic wellness. The introduction of scientifically validated strains and advancements in manufacturing processes are enhancing product efficacy and shelf stability. Continuous innovation across dairy and non-dairy segments further accelerates the adoption of probiotic products among diverse age groups.

Regionally, Western Europe dominates the market, led by strong demand from countries such as Germany, France, and the United Kingdom. Northern Europe shows steady adoption supported by advanced retail networks and health-oriented consumer bases. Eastern Europe is emerging as the fastest-growing region, driven by increasing awareness, improving disposable income, and expanding e-commerce penetration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Europe Probiotic Market was valued at USD 15,450.40 million in 2018 and reached USD 23,609.49 million in 2024. It is projected to attain USD 62,735.20 million by 2032, expanding at a CAGR of 10.53% during the forecast period.

- Rising health awareness and preference for preventive care are driving higher consumption of probiotics across Europe.

- Consumers are shifting toward functional foods and supplements that enhance gut health, immunity, and overall wellness.

- Advancements in strain development and encapsulation technology are improving product stability and extending shelf life.

- Western Europe dominates the market with major demand from Germany, France, and the United Kingdom, supported by strong distribution networks.

- Eastern Europe is the fastest-growing region, driven by increasing awareness, disposable income, and expanding e-commerce access.

- High production costs and strict EFSA regulations continue to challenge small manufacturers, limiting innovation speed.

Market Drivers:

Rising Focus on Digestive and Immune Health

Growing consumer awareness about gut health is driving strong demand for probiotic-rich foods. People are prioritizing products that support immunity, digestion, and overall wellness. Functional yogurts, fermented drinks, and dietary supplements are gaining significant popularity. The Europe Probiotic Market benefits from this preventive health trend, as consumers prefer natural solutions over synthetic alternatives.

- For instance, Biotiful Gut Health launched High Protein Kefir drinks in August 2024, combining 20 grams of natural protein with billions of live cultures in a fermented dairy beverage.

Expansion of Functional Food and Beverage Offerings

Manufacturers are expanding their probiotic product lines across dairy, non-dairy, and beverage categories. The market is witnessing strong demand for fortified snacks, juices, and cereal-based products. It is driven by urban consumers seeking convenience and nutritional value in daily diets. The integration of probiotics into common food formats is boosting adoption across various age groups.

- For instance, in October 2025, Yakult Singapore introduced its Y1000 probiotic drink containing over 100 billion live Lacticaseibacillus paracasei Shirota™ cells per bottle, making it the company’s most concentrated probiotic beverage to date and expanding its presence beyond traditional dairy offerings.

Advancements in Strain Development and Manufacturing Technology

Innovations in strain stability, encapsulation, and delivery systems are enhancing product quality and shelf life. Companies are investing in advanced production technologies to preserve bacterial efficacy under varying storage conditions. It enables longer distribution cycles and wider availability across retail channels. The Europe Probiotic Market is also benefiting from rising R&D spending aimed at developing multi-strain formulations.

Supportive Regulatory Framework and Scientific Validation

Favorable EU regulations promoting transparency and safety standards strengthen consumer confidence. Verified health claims supported by clinical studies encourage product acceptance across markets. Governments and research bodies are focusing on probiotic education to enhance awareness. The structured regulatory ecosystem in Europe supports innovation and ensures quality consistency in probiotic formulations.

Market Trends:

Growing Popularity of Non-Dairy and Plant-Based Probiotic Products

The market is witnessing a steady transition from dairy-based probiotics to plant-based alternatives. Consumers with lactose intolerance or vegan preferences are driving this shift. Manufacturers are introducing probiotic-enriched beverages made from soy, oats, almonds, and coconuts. It is helping brands tap into a broader consumer base focused on sustainability and clean-label nutrition. The Europe Probiotic Market is experiencing rising demand for fermented plant-based products that offer digestive and immune benefits. Product innovation supported by advanced fermentation processes is expanding non-dairy offerings in supermarkets and online stores. This diversification is positioning probiotics as part of everyday dietary habits across multiple lifestyles.

- For instance, Califia Farms achieved nearly 28,000 points of distribution within just 4 months after launching its Probiotic Dairy-Free Yogurt Drinks in 2018, which feature 10 billion live active probiotic CFUs powered by the BB-12 strain batch-fermented in almond and coconut bases.

Integration of Personalized Nutrition and Digital Health Solutions

The trend toward personalized nutrition is shaping probiotic development across Europe. Consumers are adopting probiotic supplements tailored to individual microbiome profiles and health goals. Companies are using microbiome testing, mobile apps, and AI-driven recommendations to create customized solutions. It is allowing brands to enhance engagement and improve long-term customer loyalty. The growing collaboration between nutraceutical firms and digital health startups is driving technological integration. Probiotic brands are leveraging online platforms for education and subscription-based supplement delivery. This trend is reinforcing the Europe Probiotic Market’s evolution toward data-driven, personalized health management solutions.

- For Instance, Nourished, a UK-based personalized gummy supplements brand, utilizes patented AI algorithms and 3D printing to produce custom, vegan gummy vitamins, claiming the system can generate “millions of potential different stack combinations

Market Challenges Analysis:

Stringent Regulatory Framework and Claim Restrictions

The European Food Safety Authority (EFSA) maintains strict regulations on probiotic labeling and health claims. Many formulations fail to meet the clinical evidence standards required for approval. It limits manufacturers’ ability to communicate potential health benefits to consumers. The lack of harmonized definitions for probiotics across countries creates confusion in product marketing. The Europe Probiotic Market faces delays in product launches and higher compliance costs. Smaller companies struggle to compete with established players due to complex approval processes. These regulatory hurdles slow innovation and restrict the introduction of novel probiotic strains.

High Production Costs and Formulation Stability Issues

Manufacturing probiotics requires advanced equipment, controlled environments, and continuous R&D investments. Maintaining live bacterial stability throughout storage and distribution remains a significant technical challenge. It increases production costs and impacts product shelf life. The need for refrigeration and sensitive packaging adds logistical complexity. Competitive pricing in retail channels further pressures profit margins. The Europe Probiotic Market must overcome these cost and stability constraints to expand consumer reach and retain quality assurance.

Market Opportunities:

Rising Demand for Preventive Health and Immunity-Boosting Solutions

The growing focus on preventive healthcare is expanding the scope for probiotic-based products. Consumers are adopting probiotics to maintain gut balance and strengthen immune response. It supports the shift toward functional foods and supplements designed for long-term wellness. The trend is encouraging brands to develop products targeting specific conditions such as allergies, digestion, and metabolic health. The Europe Probiotic Market benefits from increasing consumer trust in clinically proven and natural solutions. Continuous public health campaigns highlighting gut-health awareness are also fueling adoption. This demand creates strong potential for innovation in fortified foods and beverages.

Expansion Across E-Commerce and Personalized Nutrition Channels

Online retail platforms are becoming vital for probiotic sales growth across the region. Consumers prefer digital channels for easy access to supplements and brand transparency. It allows companies to offer personalized subscription models and microbiome-based recommendations. Partnerships between probiotic brands and tech-driven health platforms are expanding market presence. Growing adoption of wearable and diagnostic technologies supports tailored probiotic formulations. The Europe Probiotic Market holds vast opportunity in linking personalized nutrition with digital engagement to enhance customer loyalty and brand differentiation.

Market Segmentation Analysis:

By Type

The Europe Probiotic Market is segmented into probiotic food and beverages, probiotic dietary supplements, and animal feed. Probiotic food and beverages dominate the market, driven by high demand for dairy-based products such as yogurt, fermented milk, and kefir. Non-dairy alternatives, including soy, oat, and almond-based drinks, are expanding rapidly due to vegan preferences and lactose intolerance. Probiotic dietary supplements are gaining traction among health-conscious consumers seeking targeted digestive and immune support. It benefits from the growing popularity of capsules, tablets, and powders that offer convenience and longer shelf life.

- For Instance, Danone North America launched a new Activia Proactive yogurt line, featuring 10g of protein per serving and 0g of added sugar.

By Ingredient

The ingredient segment includes bacteria and yeast. Bacterial probiotics, particularly Lactobacillus and Bifidobacterium strains, account for the majority share due to their proven digestive and immune benefits. Yeast-based probiotics, led by Saccharomyces boulardii, are emerging as complementary options for gut health and antibiotic-associated recovery. It supports diverse applications in both food and supplement formulations. Continuous R&D efforts are enhancing strain resilience and bioavailability across both categories.

- For Instance, Chr. Hansen (now part of Novonesis) owns the patented Lactobacillus rhamnosus GG (LGG) strain, a probiotic documented in over 2,000 scientific publications and hundreds of clinical studies.

By End-Use

The market is divided into human probiotics and animal probiotics. Human probiotics hold the dominant share, fueled by strong demand for dietary supplements, fortified foods, and beverages. Animal probiotics are expanding steadily in livestock and pet nutrition sectors to improve gut health and productivity. It reflects rising awareness of sustainable feed practices and antibiotic alternatives within European agriculture.

Segmentations:

By Type

Probiotic Food & Beverages

- Dairy Products

- Non-Dairy

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

Probiotic Dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Supplements

- Infant Formula

- Animal Feed

By Ingredient

By End-Use

- Human Probiotics

- Animal Probiotics

By Distribution Channel

- Hypermarkets/Supermarkets

- Pharmacies/Drugstores

- Specialty Stores

- Online Stores

- Others

By Country

- United Kingdom

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Western Europe Dominates with Strong Market Presence

Western Europe leads the regional market, supported by high consumer awareness and advanced retail infrastructure. Countries such as Germany, France, and the United Kingdom contribute significantly to revenue generation. Demand for functional foods, probiotic yogurts, and dietary supplements remains robust across these markets. It benefits from the presence of established food manufacturers and widespread distribution networks. Strong research capabilities and regulatory alignment encourage innovation in new probiotic strains. The Europe Probiotic Market continues to thrive in Western Europe due to its mature health and wellness ecosystem and strong consumer trust in scientifically backed products.

Eastern Europe Shows Rapid Market Expansion

Eastern Europe is emerging as the fastest-growing regional segment, driven by improving healthcare awareness and disposable incomes. Countries such as Poland, Czech Republic, and Hungary are witnessing rising demand for probiotic supplements and fortified dairy products. It is supported by increasing urbanization, changing dietary habits, and growing retail penetration. Local manufacturers are expanding production capacities to meet domestic and export demand. Government initiatives promoting nutritional health and wellness further stimulate market development. The region’s growth momentum highlights its potential to become a key contributor to overall European probiotic sales.

Northern and Southern Europe Display Stable Growth Patterns

Northern Europe, including Sweden, Denmark, and Finland, demonstrates consistent growth backed by a strong preference for clean-label and organic products. Consumers in these countries value transparency and clinical validation of probiotic formulations. It drives higher adoption of premium probiotic beverages and supplements. Southern Europe, led by Italy and Spain, benefits from a well-established food culture integrating fermented products. Expanding retail formats and digital health awareness are strengthening probiotic consumption in these countries. Together, these regions maintain a balanced contribution to the Europe Probiotic Market with stable long-term growth potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Danone S.A.

- Yakult Europe B.V.

- Nestlé S.A.

- Hansen Holding A/S

- BioGaia AB

- Probi AB

- Lallemand Inc.

- Kerry Group plc

- Arla Foods amba

- Valio Ltd.

- Bayer AG

- ADM (Archer Daniels Midland Company)

- Novozymes A/S

Competitive Analysis:

The Europe Probiotic Market is characterized by strong competition among global and regional players focused on product innovation and clinical validation. Key companies include Danone S.A., Yakult Europe B.V., Nestlé S.A., Chr. Hansen Holding A/S, BioGaia AB, Probi AB, Lallemand Inc., Kerry Group plc, and Arla Foods amba. These firms emphasize R&D investment to develop advanced probiotic strains with proven health benefits and improved stability. It is witnessing strategic partnerships between food manufacturers and biotech companies to strengthen supply chains and accelerate new product launches. Market leaders are expanding their non-dairy and plant-based portfolios to align with changing consumer preferences. Companies are also optimizing digital platforms and personalized nutrition services to build stronger consumer engagement. Intense competition encourages continuous innovation, ensuring product quality, efficacy, and compliance with stringent European regulatory standards.

Recent Developments:

- In July 2025, Danone completed the acquisition of a majority stake in Kate Farms, strengthening its specialized nutrition portfolio in the United States.

- In October 2025, Yakult Singapore launched Y1000, its most concentrated probiotic drink, targeting health-conscious consumers in Asia.

Report Coverage:

The research report offers an in-depth analysis based on By Type, By Ingredient, By End-Use, By Distribution Channel and By Country. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The North America Probiotic Market is expected to maintain steady long-term growth driven by rising consumer focus on gut health and immunity.

- Growing demand for functional foods and beverages fortified with probiotics will strengthen market adoption.

- Manufacturers are investing in advanced strain development and encapsulation technologies to improve product stability and effectiveness.

- It will experience rising popularity of plant-based and non-dairy probiotic alternatives catering to vegan consumers.

- E-commerce expansion and subscription-based supplement models will increase accessibility and customer retention.

- Clinical validation and transparent labeling practices will enhance consumer trust in probiotic formulations.

- Collaborations between food, pharma, and biotech companies will accelerate innovation and product diversification.

- The market will see increasing applications of probiotics in personalized nutrition and microbiome-focused healthcare solutions.

- Technological integration with digital wellness platforms will support data-driven product recommendations.

- Strong awareness campaigns and preventive healthcare trends will continue to expand the consumer base across all age groups.