Market Overview

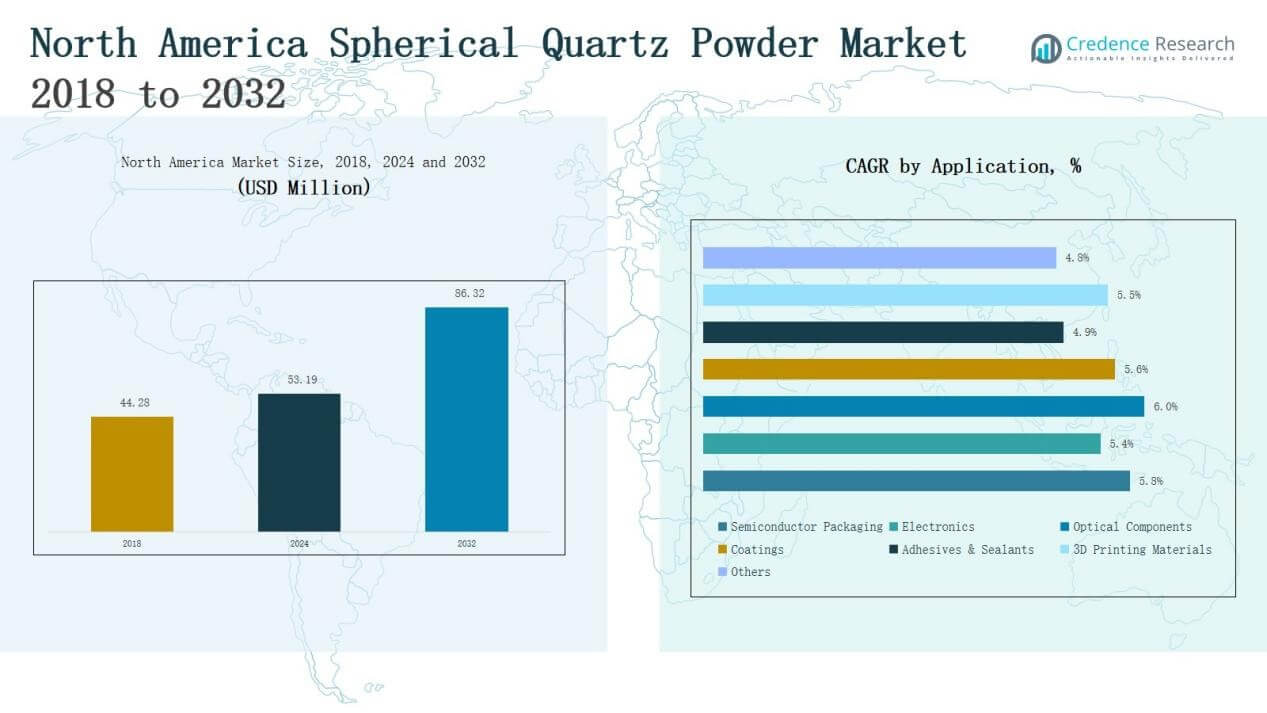

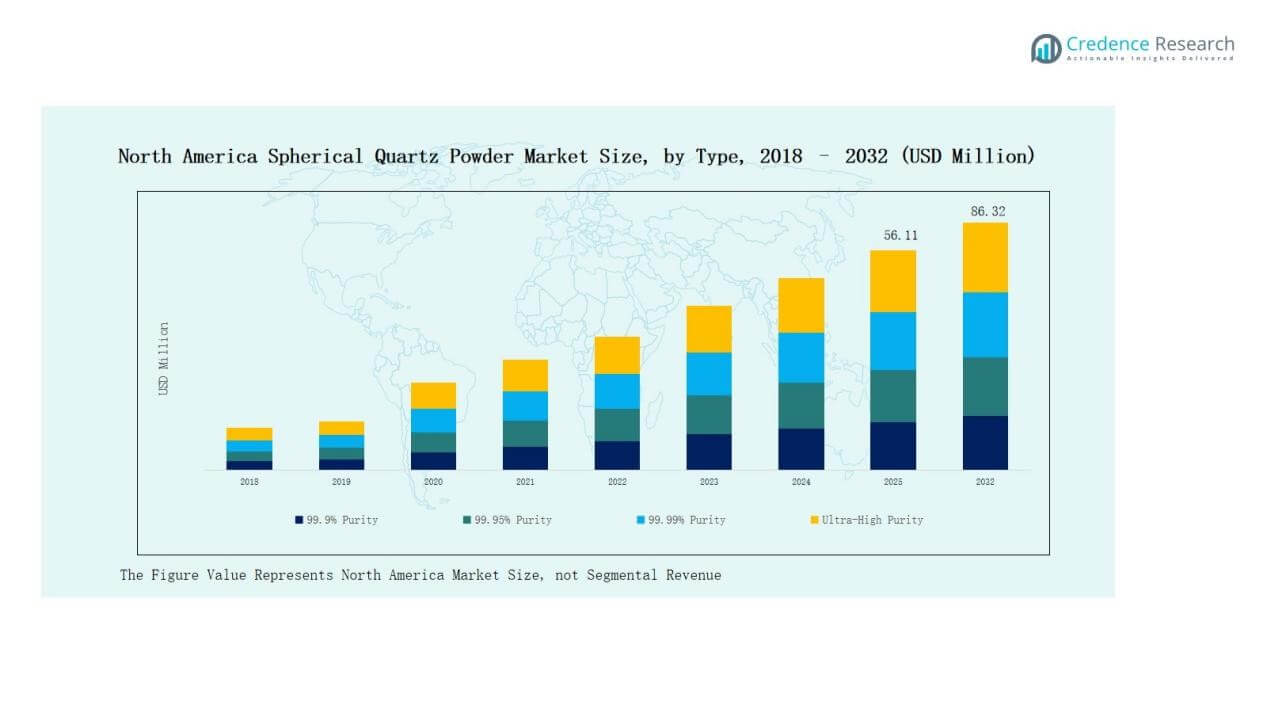

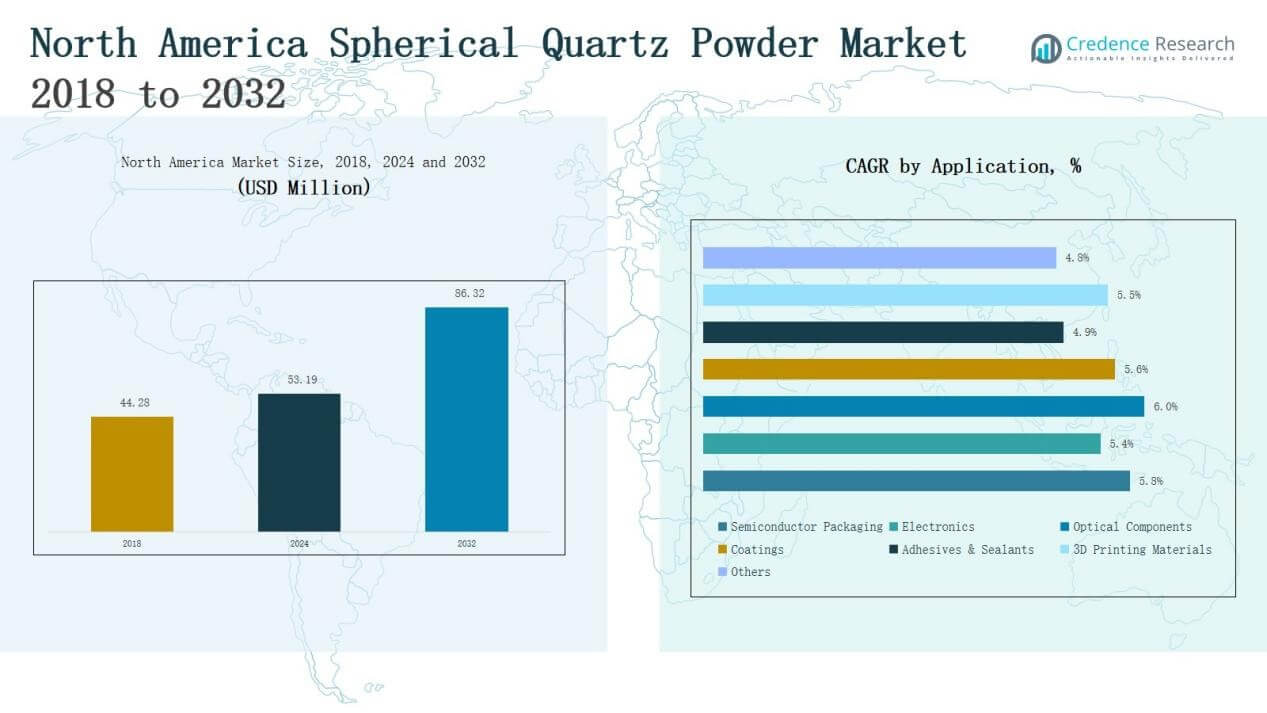

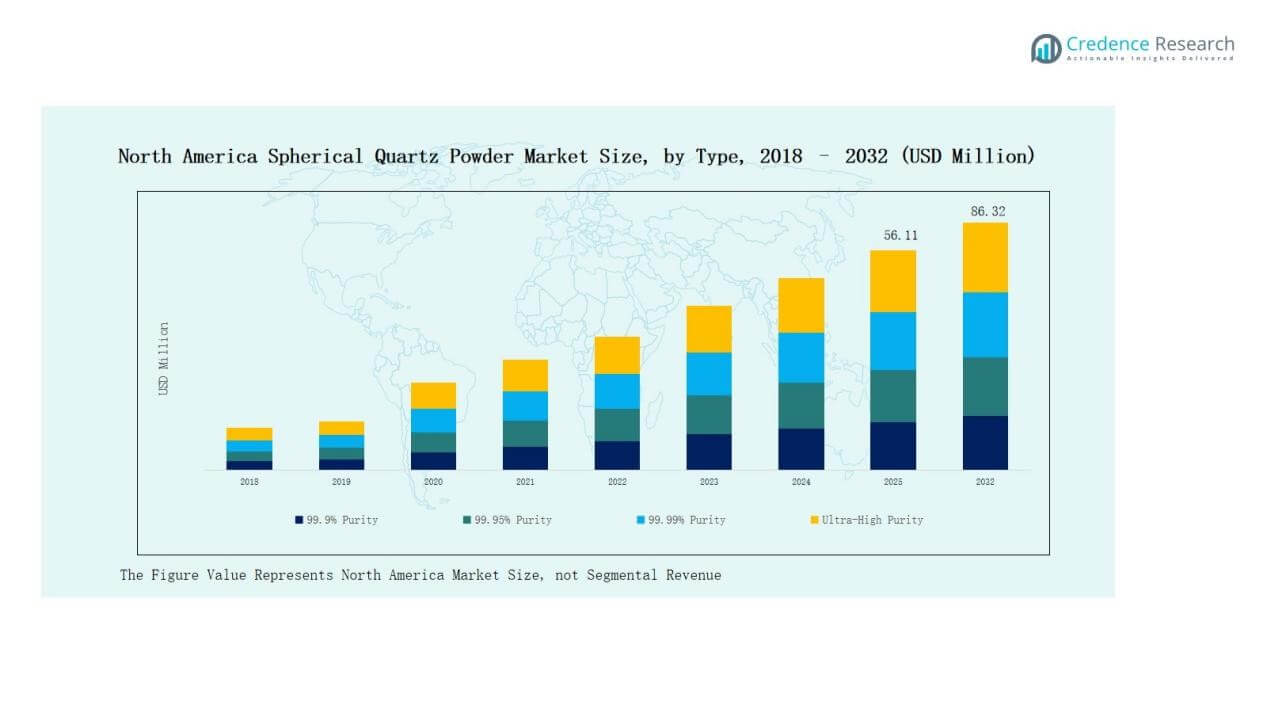

North America Spherical Quartz Powder Market size was valued at USD 44.28 million in 2018, reached USD 53.19 million in 2024, and is anticipated to reach USD 86.32 million by 2032, at a CAGR of 6.24% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Spherical Quartz Powder Market Size 2024 |

USD 53.19 Million |

| North America Spherical Quartz Powder Market, CAGR |

6.24% |

| North America Spherical Quartz Powder Market Size 2032 |

USD 86.32 Million |

The North America Spherical Quartz Powder Market features strong competition from global and regional players, including SINOENERGY GROUP, ALPA Powder Technology, Shin-Etsu Chemical, Tatsumori, Denka, Nippon Chemical, Sinonine, Tanki New Materials, Tongrun Nano Technology, and Micron. These companies focus on high-purity grades, advanced refining technologies, and expanding product portfolios to serve critical applications in semiconductors, electronics, and aerospace. Strategic collaborations and capacity expansions are common to secure long-term supply agreements. The U.S. leads the regional market with a commanding 61% share in 2024, driven by robust semiconductor manufacturing and government-backed supply chain initiatives.

Market Insights

Market Insights

- The North America Spherical Quartz Powder Market grew from USD 44.28 million in 2018 to USD 53.19 million in 2024 and is projected to reach USD 86.32 million by 2032.

- By type, the 99.99% purity segment held the largest share at 38% in 2024, supported by strong demand from semiconductor and electronics industries.

- By application, semiconductor packaging dominated with 42% share in 2024, driven by rising need for integrated circuits, memory devices, and microprocessors.

- By end-use industry, semiconductor and electronics accounted for 47% share in 2024, fueled by U.S. chip manufacturing, exports, and fabrication investments.

- Regionally, the U.S. led with 61% share in 2024, followed by Canada with 22% and Mexico with 17%, highlighting varied industrial strengths across North America.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Type

The North America Spherical Quartz Powder Market by type is dominated by the 99.99% purity segment, accounting for nearly 38% share in 2024. Its high demand is driven by semiconductor and electronics industries, where ultra-low impurity levels are essential for reliable chip production. Growing adoption in high-frequency circuits and precision optical components reinforces this dominance. The ultra-high purity sub-segment is also expanding, supported by increasing use in aerospace and advanced telecommunication applications requiring stable dielectric properties.

By Application

Semiconductor packaging leads the market by application, representing about 42% share in 2024. Rising demand for integrated circuits, memory devices, and microprocessors drives consumption of spherical quartz powder for encapsulation and insulation. Electronics follows closely, fueled by its role in high-performance components and circuit boards. Meanwhile, emerging applications in 3D printing materials and advanced coatings add incremental growth. Strong demand from the U.S. semiconductor supply chain secures packaging as the most influential segment across North America.

For instance, Intel announced plans to expand its semiconductor packaging facility in New Mexico, emphasizing growing reliance on high-purity materials such as spherical quartz for chip insulation and reliability.

By End-Use Industry

The semiconductor and electronics industry holds the largest share, approximately 47% in 2024, within the North America Spherical Quartz Powder Market. Growth is supported by robust U.S. semiconductor manufacturing, rising chip exports, and heavy investments in advanced fabrication technologies. Automotive and aerospace are gaining traction as well, with powder used in sensors, optical devices, and specialized coatings. Telecommunications applications are expanding due to 5G infrastructure rollouts, but the semiconductor sector remains the most dominant growth driver.

For instance, GlobalFoundries is partnered with the U.S. Department of Defense (DoD) to provide secure semiconductor manufacturing. This secure supply is intended for critical aerospace and defense systems.

Key Growth Drivers

Key Growth Drivers

Rising Semiconductor Demand

The market is primarily driven by the growing semiconductor and electronics industry across North America. Increasing investments in chip fabrication, coupled with rising demand for high-performance computing and consumer electronics, directly boost the use of spherical quartz powder in packaging and insulation. The U.S. government’s focus on strengthening domestic semiconductor manufacturing through policy incentives amplifies growth. This consistent demand makes semiconductors the largest end-use segment and a crucial driver of spherical quartz powder consumption.

For instance, Intel has been building two new semiconductor fabs in Ohio, with a planned cleanroom space exceeding 600,000 square feet, requiring extensive use of high-purity quartz materials for photolithography and wafer processing.

Advancements in Optical and Electronic Applications

Spherical quartz powder benefits from its high purity, thermal stability, and dielectric strength, making it indispensable in advanced electronics and optical components. Growing adoption in photonics, precision instruments, and telecommunications systems expands its application base. In addition, industries such as aerospace and defense increasingly utilize quartz-based materials for specialized sensors and devices. These technological advances, paired with continuous innovation in electronic miniaturization, significantly enhance demand for higher-grade quartz powders in North America.

For instance, Corning Incorporated expanded its optical cable manufacturing capacity in North Carolina, with investments of over $500 million since 2020, to help meet the high demand for fiber and broadband deployment.

Expansion of High-Purity Material Usage

The market witnesses rising adoption of ultra-high purity quartz powders, particularly 99.99% grade, across semiconductor, optical, and aerospace applications. Increasing requirements for low contamination materials in integrated circuits and high-frequency communication devices support this trend. Companies are investing heavily in refining and purification technologies to meet strict quality benchmarks. This shift toward superior material quality strengthens the growth outlook, as industries move toward cutting-edge applications requiring minimal impurity levels and stable performance.

Key Trends & Opportunities

Growth of 3D Printing Materials

The use of spherical quartz powder in additive manufacturing is emerging as a major opportunity. Its consistent particle size, thermal resistance, and chemical stability make it ideal for advanced 3D printing applications, particularly in aerospace and industrial manufacturing. Increasing adoption of 3D-printed components in prototyping and specialized production further drives growth. As industries shift toward cost-efficient and customizable production methods, the demand for quartz-based printing materials is expected to accelerate across North America.

For instance, GE Additive announced that its Auburn, Alabama facility had manufactured its 100,000th 3D-printed fuel nozzle tip for LEAP jet engines. The nozzles are produced directly from a cobalt-chrome metal powder using additive manufacturing technologies like Direct Metal Laser Melting, which allows a single, complex part to be created instead of more than a dozen smaller pieces.

Sustainability and Eco-Friendly Manufacturing

A key trend shaping the market is the shift toward sustainable production processes and eco-friendly materials. Manufacturers are adopting energy-efficient refining techniques and minimizing carbon emissions to align with regulatory standards. Growing customer preference for environmentally responsible supply chains also supports adoption. This trend presents an opportunity for suppliers investing in green practices to differentiate themselves in the competitive landscape, while meeting the sustainability goals of end-use industries such as electronics, automotive, and aerospace.

For instance, 3M has implemented sustainability initiatives, including upgrading its manufacturing processes and increasing its use of renewable electricity globally. In 2024, 3M reported a 59.1% reduction in its Scope 1 and 2 greenhouse gas emissions since 2019.

Key Challenges

High Production Costs

Producing spherical quartz powder of ultra-high purity involves expensive refining and advanced processing technologies. The cost-intensive nature of equipment, raw material sourcing, and strict quality control increases overall market entry barriers. These high costs often translate into elevated product prices, limiting adoption in cost-sensitive industries. Smaller manufacturers face significant challenges competing with large, established players capable of leveraging economies of scale and advanced technologies.

Supply Chain Disruptions

The market faces vulnerability to supply chain fluctuations, particularly in sourcing raw quartz and critical processing equipment. Trade restrictions, transportation delays, and global supply shocks can disrupt availability and increase lead times. Semiconductor manufacturers, which depend heavily on consistent quartz supply, are most impacted by these disruptions. Regional players need to strengthen local sourcing and build resilient distribution networks to mitigate risks and maintain steady supply to end users.

Intense Competition from Asian Producers

North American producers face growing competition from Asia-Pacific manufacturers, particularly in China and Japan, who dominate global supply with cost-efficient production and large capacities. These competitors often provide high-purity materials at competitive prices, challenging North American firms to differentiate on quality and innovation. Maintaining market share requires significant R&D investment and strategic partnerships, as regional players struggle to match both the scale and cost efficiency of established Asian suppliers.

Regional Analysis

U.S.

The U.S. dominates the North America Spherical Quartz Powder Market with a 61% share in 2024. Strong demand from the semiconductor and electronics industry supports this leadership position, driven by expanding chip fabrication and packaging capacities. Federal initiatives to strengthen domestic semiconductor supply chains further boost consumption of high-purity quartz powders. It benefits from advanced research and development, enabling the production of ultra-high purity grades for precision electronics. Aerospace and defense applications also contribute significantly, reflecting the country’s diverse industrial base.

Canada

Canada accounts for 22% of the North America Spherical Quartz Powder Market in 2024. Growth is supported by its robust industrial manufacturing base and rising investments in electronics assembly. The country leverages access to high-quality raw materials and develops niche applications in coatings, adhesives, and optical components. Demand is increasing in the telecommunications sector due to the expansion of 5G infrastructure. It also benefits from cross-border trade with the U.S., which strengthens supply chains and market integration.

Mexico

Mexico represents 17% of the North America Spherical Quartz Powder Market in 2024. Its growth is fueled by the expansion of automotive and electronics manufacturing clusters, particularly those supplying the U.S. market. Rising adoption of quartz-based materials in sensors, circuit boards, and optical devices supports demand. It attracts foreign investments in industrial manufacturing, creating opportunities for suppliers of high-purity powders. Telecommunications and aerospace sectors are gradually emerging, supported by growing industrial infrastructure. It continues to expand its role as a cost-effective production hub in the region.

Market Segmentations:

Market Segmentations:

By Type

- 9% Purity

- 95% Purity

- 99% Purity

- Ultra-High Purity

By Application

- Semiconductor Packaging

- Electronics

- Optical Components

- Coatings

- Adhesives & Sealants

- 3D Printing Materials

- Others

By End-Use Industry

- Semiconductor & Electronics

- Automotive

- Aerospace

- Telecommunications

- Industrial Manufacturing

- Others

By Country

Competitive Landscape

The North America Spherical Quartz Powder Market is characterized by the presence of established global suppliers and regional producers competing across purity grades and applications. Key players such as SINOENERGY GROUP, ALPA Powder Technology, Shin-Etsu Chemical, Tatsumori, Denka, and Nippon Chemical focus on high-purity grades to meet semiconductor and electronics demand. It is marked by continuous investment in refining technologies, R&D for ultra-high purity grades, and expansion of product portfolios targeting advanced applications. Competition is further shaped by strategic partnerships, mergers, and capacity expansions aimed at strengthening supply reliability and securing long-term contracts with semiconductor manufacturers. U.S.-based demand pressures suppliers to maintain strict quality standards, while Canadian and Mexican markets open opportunities for niche applications. Intense competition from Asian producers adds pricing pressure, compelling North American firms to differentiate through innovation, customer service, and sustainable manufacturing practices. This dynamic environment drives consolidation and fosters innovation across the regional market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- SINOENERGY GROUP

- ALPA Powder Technology

- Sinonine

- Micron

- Denka

- Tatsumori

- Shin-Etsu Chemical

- Tanki New Materials

- Tongrun Nano Technology

- Nippon Chemical

Recent Developmentsss

- In July 2025, Silicon Metals Corp. announced a 100 % acquisition of five mining claims.

- In 2025, transition.inc is developing its Quartz division via its Snow White Project (Ontario) to expand silica / quartz capacity.

- In October 2024, Momentive Technologies acquired Sibelco’s spherical alumina and spherical silica business, strengthening its ceramics powder portfolio and expanding its presence in the North America spherical quartz powder market.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End Use Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise with increasing semiconductor packaging and chip fabrication in the U.S.

- Ultra-high purity quartz powder will gain momentum in advanced electronics and aerospace sectors.

- Growing 5G infrastructure will drive adoption in telecommunications applications.

- Automotive electronics and sensors will expand usage of quartz-based materials.

- Investments in domestic semiconductor supply chains will strengthen regional consumption.

- 3D printing applications will create new opportunities for high-performance quartz powders.

- Optical components manufacturing will increase demand for superior purity grades.

- Sustainability-focused production processes will shape competitive differentiation.

- Canada will see growth in coatings and industrial manufacturing applications.

- Mexico will expand as a cost-effective hub for electronics and automotive-related demand.

Market Insights

Market Insights Key Growth Drivers

Key Growth Drivers Market Segmentations:

Market Segmentations: