Market Overview

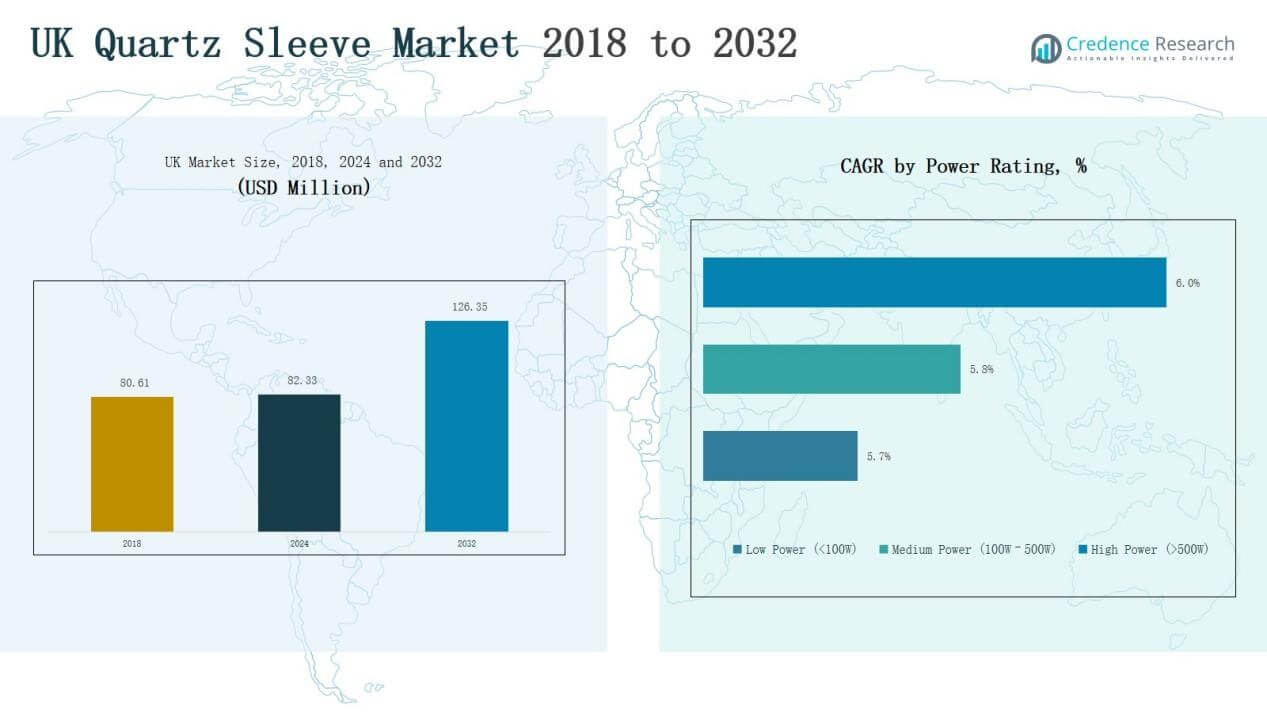

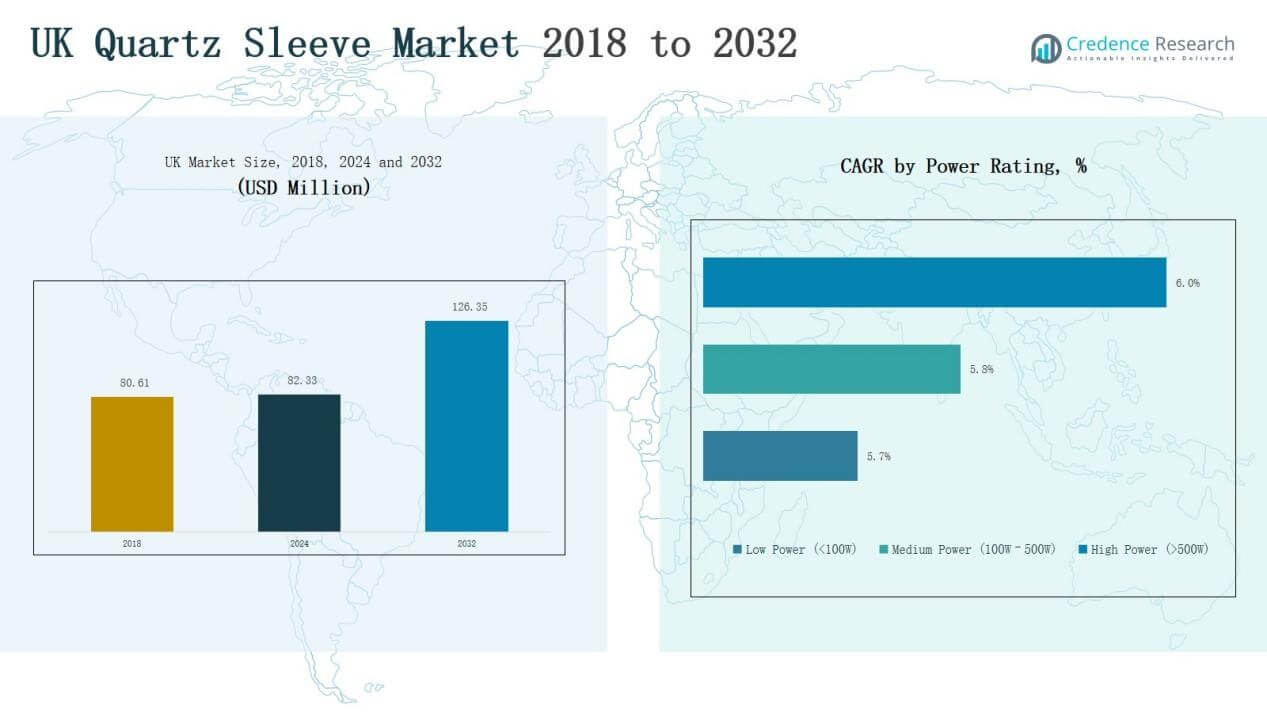

UK Quartz Sleeve Market size was valued at USD 80.61 million in 2018, reached USD 82.33 million in 2024, and is anticipated to reach USD 126.35 million by 2032, at a CAGR of 5.50% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Quartz Sleeve Market Size 2024 |

USD 82.33 Million |

| UK Quartz Sleeve Market, CAGR |

5.50% |

| UK Quartz Sleeve Market Size 2032 |

USD 126.35 Million |

The UK Quartz Sleeve Market is shaped by global leaders and regional specialists competing on innovation, quality, and customization. Key players include Heraeus, Saint-Gobain, Tosoh Corporation, SGL Carbon, Mondi Group, Quartztec Europe, Enterprise Q Ltd, John Moncrieff Ltd, and QSI Quartz, each leveraging advanced manufacturing and distribution strengths to secure market presence. These companies focus on high-purity, fused, and UV-transmissive quartz solutions serving water treatment, semiconductor, and pharmaceutical sectors. Regionally, England led the market with a 46% share in 2024, supported by municipal water projects, healthcare infrastructure, and semiconductor expansion.

Market Insights

- The UK Quartz Sleeve Market grew from USD 80.61 million in 2018 to USD 82.33 million in 2024 and is projected to reach USD 126.35 million by 2032, at a CAGR of 5.50%.

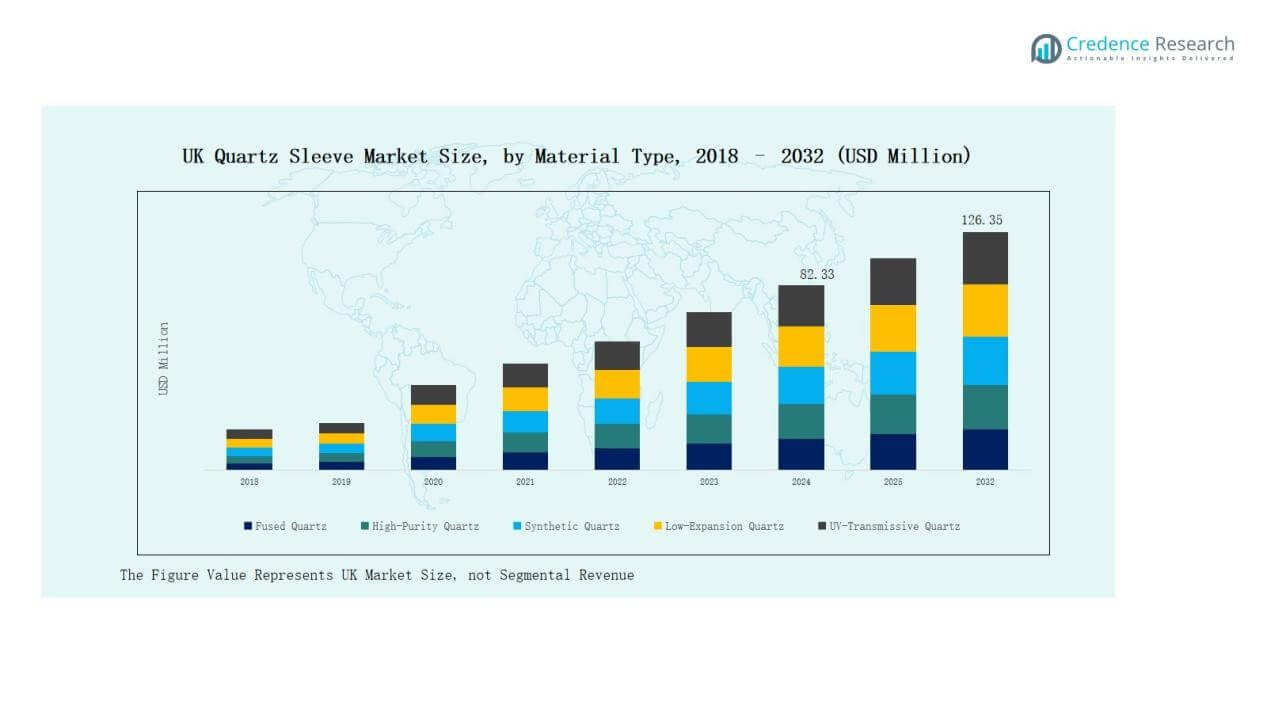

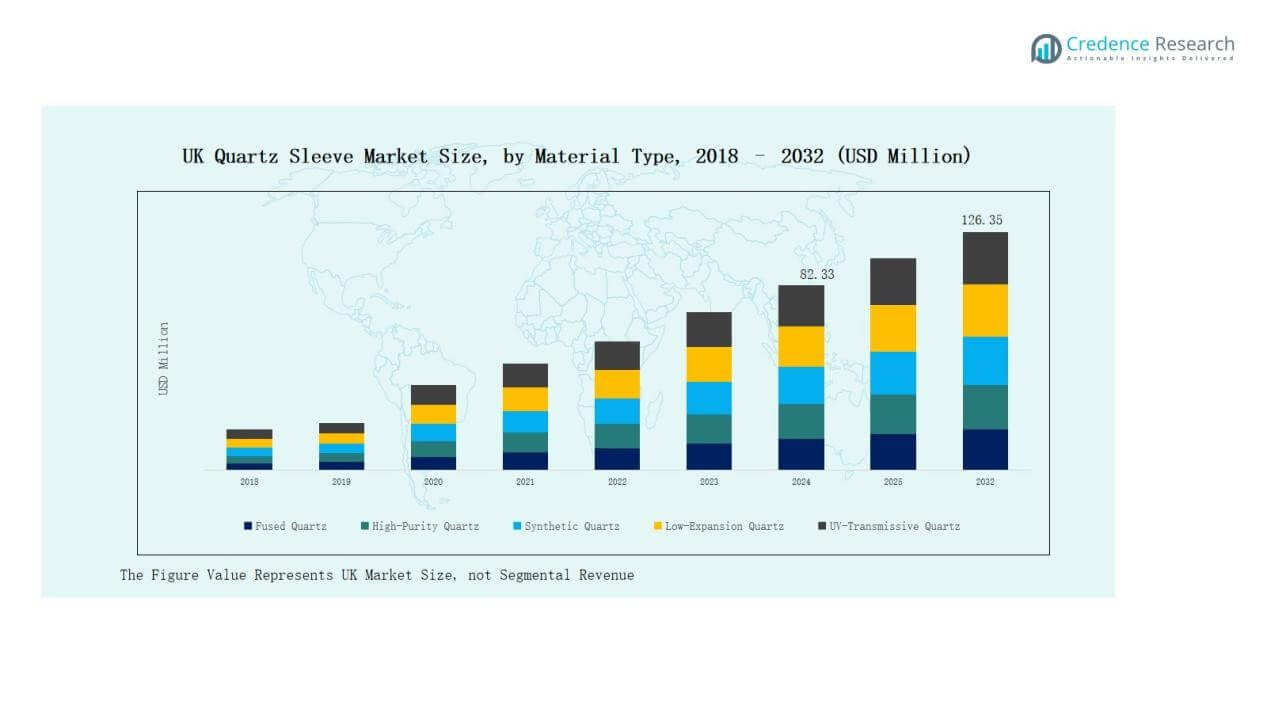

- Fused quartz led the market by material type with a 37% share in 2024, supported by its superior durability, UV transparency, and strong demand in disinfection applications.

- By application, UV water disinfection dominated with a 41% share in 2024, driven by municipal infrastructure projects, clean water initiatives, and strict health regulations.

- Water treatment was the leading end-user, holding a 39% share in 2024, with growing adoption supported by stricter environmental norms and municipal project expansion.

- England led the regional market with a 46% share in 2024, supported by strong municipal water treatment projects, advanced healthcare infrastructure, and expanding semiconductor activities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Material Type

Fused quartz dominated the UK Quartz Sleeve Market in 2024 with a 37% share. Its strong thermal stability, durability, and high UV transparency make it the preferred choice for demanding industrial and disinfection applications. High-purity quartz followed, supported by increasing demand from semiconductor and pharmaceutical industries. Synthetic and UV-transmissive quartz are gaining traction for advanced water treatment and optical applications. Low-expansion quartz holds a niche share, driven by specialized laboratory and precision instrumentation use.

For instance, Heraeus Conamic operates a fused silica production facility in Bitterfeld, Germany, supplying fused quartz for applications including the UV and semiconductor markets.

By Application

UV water disinfection led the UK market with a 41% share in 2024. Growing focus on clean water supply, municipal infrastructure projects, and strict health regulations drive its dominance. UV air disinfection gained momentum post-pandemic, supported by demand in healthcare and commercial buildings. Surface disinfection is expanding across food and beverage facilities. Chemical processing maintains steady adoption due to durability needs in corrosive environments. Other applications include specialized industrial processes where quartz sleeves ensure performance consistency and reliability.

For instance, Xylem’s Wedeco brand has installed more than 250,000 systems globally across private, public utility, and industrial locations, including municipal water treatment plants in Europe. These systems, like other UV disinfection technology, utilize quartz sleeves that require maintenance to preserve UV output for effective pathogen reduction

By End-User

Water treatment emerged as the largest end-user segment, accounting for 39% share of the UK Quartz Sleeve Market in 2024. Expanding municipal water treatment projects and stricter environmental norms drive this leadership. The food and beverage sector increasingly adopts quartz sleeves for UV disinfection, ensuring hygiene and safety. Pharmaceutical and semiconductor industries demand high-purity quartz for sterile and precision operations. Oil and gas usage remains limited but steady, while other segments adopt quartz sleeves for niche industrial processes.

Key Growth Drivers

Rising Demand for Water and Air Disinfection

The UK Quartz Sleeve Market benefits from rising adoption of UV disinfection systems in water and air treatment. Growing concerns about public health and stringent regulatory frameworks drive large-scale municipal water projects. Demand from healthcare, food safety, and residential sectors continues to rise, creating strong momentum for fused and UV-transmissive quartz sleeves. This increasing focus on sustainable and chemical-free disinfection methods strengthens quartz sleeve adoption across industries, positioning it as a critical component in the UK’s environmental and health safety infrastructure.

For instance, Trojan Technologies has installed more than 11,000 municipal UV water treatment systems globally, which is the largest base in the world. These systems use quartz sleeves that are kept clean, often with automatic cleaning systems, to maintain high UV transmittance for effective pathogen inactivation.

Expanding Semiconductor and Electronics Industry

Growth in the UK’s semiconductor and electronics industry supports demand for high-purity quartz sleeves. Quartz provides superior purity, thermal stability, and UV transparency, making it indispensable in chip fabrication and optical components. Rising investments in advanced manufacturing technologies and electronic innovation strengthen the role of quartz sleeves in precision operations. The industry’s continuous need for reliable and contamination-free materials drives steady adoption, particularly in high-value manufacturing clusters. This end-user demand highlights the growing importance of quartz sleeves in ensuring quality and performance in electronics production.

For instance, Shin-Etsu Chemical, through its subsidiary Shin-Etsu Quartz Products Co., Ltd., offers quartz glass crucibles for silicon single crystal pulling applications, which are used in semiconductor fabrication.

Increased Focus on Sustainability and UV Technology Adoption

The UK is increasingly prioritizing sustainable technologies, boosting the adoption of UV-based disinfection over chemical-based alternatives. Quartz sleeves enable the durability and performance required in these systems, supporting growth across water, air, and surface applications. Government initiatives promoting greener solutions in municipal utilities and industries further accelerate this shift. Adoption is also fueled by rising public and industrial awareness of reducing chemical exposure. This trend ensures quartz sleeves remain integral to sustainable development efforts and long-term infrastructure projects, reinforcing their market demand.

Key Trends & Opportunities

Key Trends & Opportunities

Shift Toward Advanced UV-C Solutions

The market is witnessing a strong trend toward the adoption of advanced UV-C disinfection systems, particularly in healthcare, food processing, and residential spaces. These solutions demand quartz sleeves with superior UV transmission and durability. Manufacturers are focusing on innovation in synthetic and high-purity quartz to support this need. Growing adoption of compact, portable UV units further expands opportunities for quartz sleeves in consumer markets. This trend reflects the industry’s alignment with global hygiene priorities and growing demand for advanced, energy-efficient disinfection technologies.

For instance, Signify (Philips UV-C) has deployed UV-C disinfection units in locations such as UK hospitals and schools. These units typically utilize UV-C lamps encased in quartz sleeves, a standard material chosen for its high UV-C transmittance.

Growth in Online and OEM Distribution Channels

UK quartz sleeve suppliers are leveraging e-commerce platforms and direct OEM partnerships to expand reach and improve accessibility. The shift toward online sales provides small and medium enterprises with cost-effective access to products, while OEM collaborations ensure integration of quartz sleeves into advanced UV equipment. This dual-channel expansion creates opportunities for both established players and emerging suppliers. Strong demand for customized and application-specific solutions highlights the potential for further channel innovation, enhancing market penetration across residential, commercial, and industrial sectors.

For instance, Xylem provides Wedeco UV disinfection systems for water treatment projects, collaborating with suppliers for components like quartz sleeves and distributing them through various channels to serve municipal and industrial clients across regions like the UK and Europe.

Key Challenges

High Manufacturing and Processing Costs

Quartz sleeve production involves specialized equipment, precision processing, and high-quality raw materials, resulting in elevated costs. UK manufacturers face pressure from global competitors offering lower-priced alternatives. These high costs limit adoption among price-sensitive end-users, particularly in smaller commercial and residential applications. The challenge is intensified by fluctuating raw material prices and energy costs, which affect margins. Addressing this requires investments in process optimization and partnerships to balance quality and affordability, ensuring competitiveness against global suppliers in the quartz sleeve market.

Dependence on Imports for Advanced Grades

The UK relies heavily on imports for advanced grades of high-purity and synthetic quartz used in semiconductor and pharmaceutical applications. Limited domestic production capacity restricts supply security and increases vulnerability to global trade disruptions. This dependence exposes the market to price volatility and extended lead times. Companies operating in sensitive sectors often face procurement risks that can disrupt operations. Strengthening local manufacturing capabilities or forming long-term supply agreements is essential to mitigate this dependency and support market stability in critical applications.

Market Fragmentation and Competitive Pressure

The UK Quartz Sleeve Market is fragmented, with global leaders, regional specialists, and small suppliers competing on pricing, innovation, and customization. Intense competition leads to margin pressures and limits the ability of smaller players to scale. Differentiation remains challenging due to the commoditized nature of standard quartz sleeves. Companies focusing on application-specific innovations, strong distribution networks, and partnerships are better positioned to compete. However, achieving consistent market share growth requires sustained investment in technology, branding, and service capabilities to counter competitive pressures.

Regional Analysis

England

England accounted for the largest share of the UK Quartz Sleeve Market in 2024, holding 46% of total revenue. Strong municipal water treatment projects and advanced healthcare infrastructure drive high adoption. The region’s growing semiconductor activity also supports demand for high-purity quartz. England’s large population and urban concentration strengthen the need for UV disinfection systems in residential and commercial sectors. It remains the hub for key suppliers and distributors, ensuring reliable supply. Strong regulatory frameworks further enhance market penetration across multiple applications.

Scotland

Scotland contributed 22% share in the UK Quartz Sleeve Market in 2024. Investments in renewable energy and strict water quality standards encourage adoption of quartz-based UV disinfection. The food and beverage sector also plays a vital role, with quartz sleeves ensuring hygiene standards in processing. Scotland’s expanding pharmaceutical presence strengthens demand for high-purity quartz. Regional growth is further supported by government initiatives promoting sustainable solutions. It continues to gain traction in specialized applications requiring durability and high UV transmission.

Wales

Wales represented 17% of the UK Quartz Sleeve Market in 2024. Its demand is driven by rising municipal water treatment needs and industrial projects. The food and beverage industry adopts quartz sleeves for ensuring product safety and compliance. Wales benefits from smaller but expanding healthcare infrastructure requiring reliable disinfection technologies. Market adoption is supported by the availability of distributors catering to regional industries. It is also strengthening presence in niche industrial applications where quartz sleeves provide cost-effective performance.

Northern Ireland

Northern Ireland held 15% share in the UK Quartz Sleeve Market in 2024. Regional growth is supported by increasing demand from water treatment and healthcare projects. Smaller but growing industrial activity requires quartz sleeves for disinfection and chemical processing. Northern Ireland’s focus on improving public health infrastructure drives steady adoption. The semiconductor and electronics sector contributes modestly but remains a potential growth area. It shows consistent uptake across municipal and commercial applications, reflecting the region’s alignment with national sustainability goals.

Market Segmentations:

Market Segmentations:

By Material Type

- Fused Quartz

- High-Purity Quartz

- Synthetic Quartz

- Low-Expansion Quartz

- UV-Transmissive Quartz

By Application

- UV Water Disinfection

- UV Air Disinfection

- UV Surface Disinfection

- Chemical Processing

- Others

By End-User

- Water Treatment

- Food & Beverage

- Pharmaceutical

- Semiconductor & Electronics

- Oil & Gas

- Others

By Power Rating

- Low Power (<100W)

- Medium Power (100W–500W)

- High Power (>500W)

By Distribution Channel

- OEMs (Original Equipment Manufacturers)

- Aftermarket / Distributors

- Direct Sales

- Online / E-Commerce

- Others

By Region

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The UK Quartz Sleeve Market is characterized by a mix of global leaders and regional specialists competing on innovation, quality, and customization. Major players such as Heraeus, Saint-Gobain, Tosoh Corporation, SGL Carbon, Mondi Group, and QSI Quartz maintain strong positions through advanced manufacturing, extensive product portfolios, and strategic distribution networks. Domestic companies including Quartztec Europe, Enterprise Q Ltd, and John Moncrieff Ltd strengthen market competition by offering tailored solutions and servicing niche applications. Competition remains intense, with companies focusing on UV-transmissive and high-purity quartz products to meet rising demand from water treatment, semiconductor, and pharmaceutical industries. The aftermarket and distributor network play a critical role in extending reach across regional industries. Innovation in product durability, sustainability, and application-specific performance continues to define competitive strategies. Strategic collaborations and localized service offerings further help companies secure long-term contracts, particularly within municipal and healthcare sectors, where compliance and reliability are crucial.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Heraeus

- Quartztec Europe

- Saint-Gobain

- Enterprise Q Ltd

- Tosoh Corporation

- John Moncrieff Ltd

- Mondi Group

- SGL Carbon

- QSI Quartz

Recent Developments

- In April 2023, Saint-Gobain Quartz officially evolved into Saint-Gobain Advanced Ceramic Composites, consolidating its quartz, ceramic filament, and composite businesses to target aerospace, connectivity, and industrial markets.

- In 2023, Quartztec Europe’s majority shareholding was acquired by Rosefinch Technology HK, integrating its UK operations into a broader group with expanded manufacturing footprint.

- In 2024, Saint-Gobain’s ACC unit began increasing production of oxide-quartz and continuous ceramic fibers to meet growth in composite demand.

Report Coverage

The research report offers an in-depth analysis based on Market Type, Application, End User, Power Rating, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for quartz sleeves will rise with stricter water and air quality regulations.

- Healthcare facilities will expand UV disinfection adoption, boosting quartz sleeve usage.

- The semiconductor sector will drive growth for high-purity quartz applications.

- Food and beverage industries will increase reliance on UV systems for hygiene

- Online and OEM distribution will gain importance in expanding market reach.

- Sustainability goals will encourage preference for quartz sleeves over chemical alternatives.

- Technological innovation will improve durability and UV transmission performance.

- Regional suppliers will strengthen presence through tailored and cost-effective solutions.

- Strategic partnerships will shape competitive positioning among global and local players.

- Investment in municipal infrastructure will remain a core driver of long-term demand.

Key Trends & Opportunities

Key Trends & Opportunities Market Segmentations:

Market Segmentations: