Market Overview

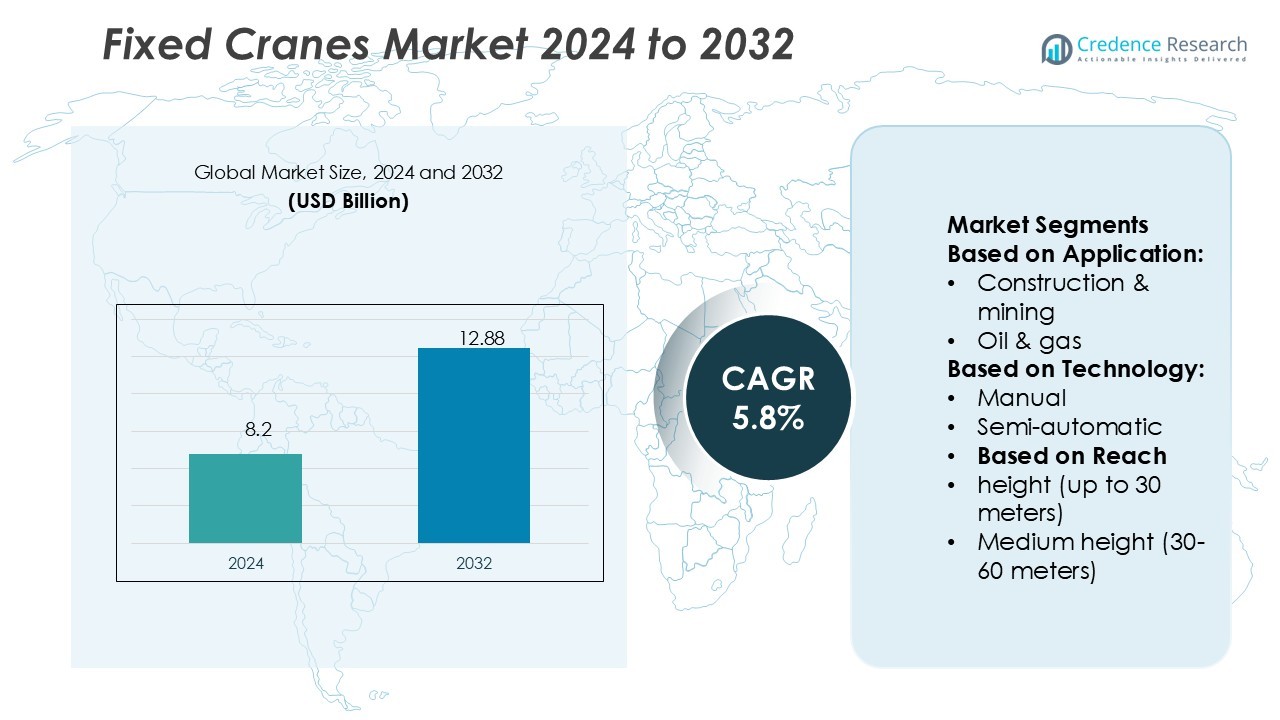

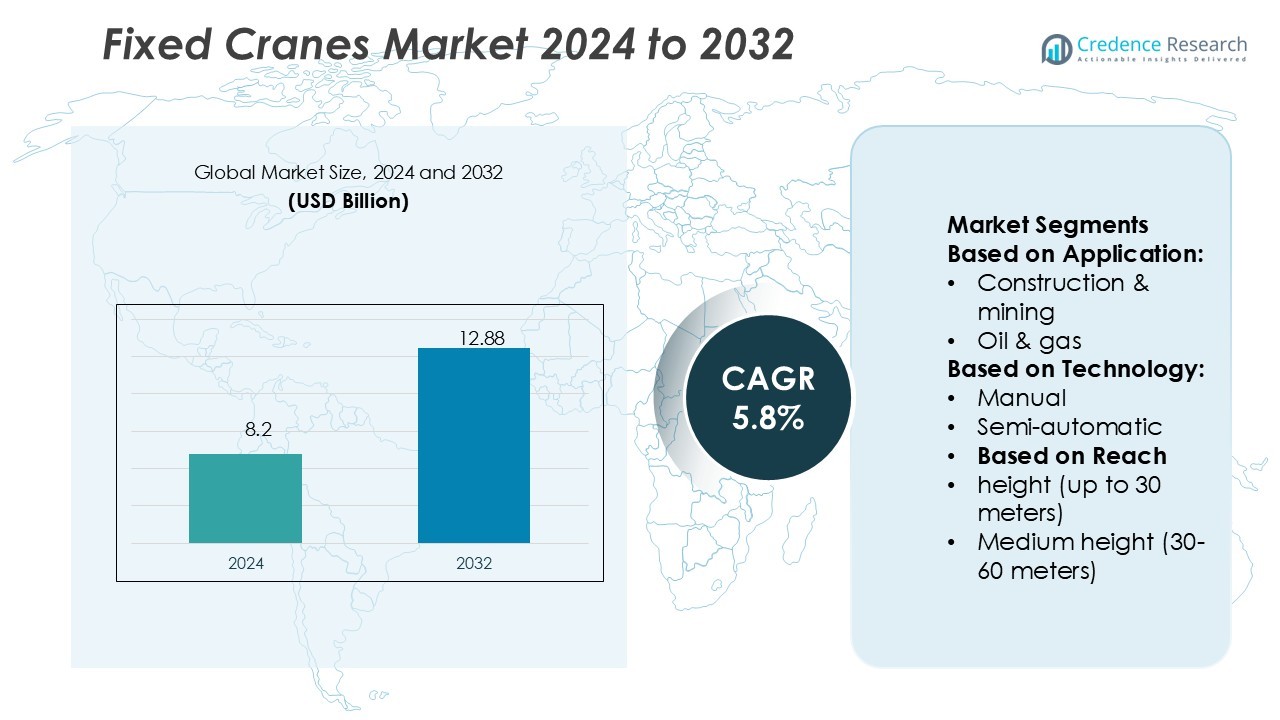

Fixed Cranes Market size was valued USD 8.2 billion in 2024 and is anticipated to reach USD 12.88 billion by 2032, at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fixed Cranes Market Size 2024 |

USD 8.2 Billion |

| Fixed Cranes Market, CAGR |

5.8% |

| Fixed Cranes Market Size 2032 |

USD 12.88 Billion |

The fixed cranes market is shaped by leading players such as Liebherr Group, Zoom lion Heavy Industry Science & Technology Co., Ltd., Konecranes, Terex Corporation, Hitachi Sumitomo Heavy Industries Construction Crane Co., Ltd., Sany Heavy Industry Co., Ltd., Tadano Ltd., XCMG Construction Machinery Co., Ltd., Sumitomo Heavy Industries, Ltd., and Manitowoc Company. These companies compete through innovation, automation, and cost-efficient solutions to meet rising global demand. Asia-Pacific dominates the market with a 34% share, driven by rapid urbanization, large-scale infrastructure investments, and expanding industrial projects across China, India, and Japan, positioning the region as the global leader.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The fixed cranes market size was USD 8.2 billion in 2024 and is projected to reach USD 12.88 billion by 2032, growing at a CAGR of 5.8%.

- Rising infrastructure development and industrial expansion act as key drivers, with construction and mining holding the largest application share of 41% due to high equipment demand in large-scale projects.

- The market shows strong trends in automation, with semi-automatic cranes leading at 46% share, while IoT-enabled monitoring and predictive maintenance solutions gain rapid adoption.

- Competition remains intense, with global players focusing on innovation, cost-efficient solutions, and safety compliance, while high capital costs and regulatory complexities continue to restrain growth.

- Asia-Pacific leads with 34% market share, followed by North America at 31% and Europe at 27%, while Latin America and the Middle East & Africa together account for 8%, reflecting regional opportunities shaped by construction, mining, and energy projects.

Market Segmentation Analysis:

By Application

Construction and mining hold the dominant share of 41% in the fixed cranes market. Large-scale infrastructure projects and expanding urbanization drive demand for high-capacity cranes. Mining operations also require durable, heavy-duty lifting equipment to handle bulk materials, supporting consistent adoption. Growth in emerging economies, where government spending on roads, bridges, and smart cities is high, further fuels this segment. Oil and gas, transportation and shipping, manufacturing, and utilities follow, but construction and mining remain the key growth driver due to their broad and sustained equipment requirements.

- For instance, The Liebherr LR 13000 is one of the most powerful conventional crawler cranes in the world. It has a maximum lifting capacity of 3,000 tonnes and, with a specific boom and jib configuration, can achieve a maximum hook height of 248 meters.

By Technology

Semi-automatic cranes lead the market with 46% share, balancing efficiency and cost-effectiveness. These cranes reduce manual effort while offering better precision than traditional manual models, making them highly preferred in mid- to large-scale projects. Full automation is growing fast, driven by safety compliance, smart monitoring, and integration with IoT systems. However, adoption is slower in cost-sensitive industries where semi-automatic solutions dominate. Manual cranes continue to serve niche markets with low capital budgets, but semi-automatic technology remains the standard choice across construction and industrial sectors.

- For instance, Zoomlion’s ZTC550V532 truck crane uses a 5-section U-shaped boom of 44 m length. It achieves a maximum rated lifting capacity of 55,000 kg and a basic boom load moment of 1,568 kN·m (and 940.8 kN·m at full boom) with an integrated hydraulic proportional control system.

By Reach

Medium height cranes, with reach between 30–60 meters, dominate the market with 52% share. Their versatility makes them suitable for urban construction, manufacturing plants, and port facilities. These cranes provide higher lifting capacity than low-height models while avoiding the extreme costs of high-height cranes. Demand is supported by infrastructure development in cities, where mid-rise buildings and industrial facilities require dependable lifting solutions. While high-height cranes gain traction in mega projects like skyscrapers and offshore platforms, medium height cranes remain the most widely adopted segment due to balanced cost and application flexibility.

Key Growth Drivers

Rising Infrastructure Development

The expansion of large-scale infrastructure projects drives strong demand for fixed cranes. Governments worldwide are investing in roads, bridges, ports, and rail networks to support economic growth. These projects require high-capacity lifting solutions, making fixed cranes essential for efficiency and safety. Rapid urbanization in developing countries also fuels adoption, as cities expand vertically and require advanced construction equipment. This trend continues to strengthen the position of fixed cranes in meeting modern infrastructure needs.

- For instance, Konecranes launched its X-series industrial crane line with a lifting capacity of up to 20 tonnes. It integrates “Rope Angle Features” and other Smart Features to enable more precise control of loads in a wide range of industrial applications.

Increased Mining and Energy Activities

Growing investments in mining and energy sectors significantly boost the demand for fixed cranes. Mining operations depend on cranes for handling raw materials, while oil and gas facilities require them for heavy lifting in refineries and offshore platforms. Rising global energy demand and commodity exploration further amplify adoption. These industries prioritize robust and reliable lifting solutions, driving fixed crane installations across challenging environments. Their need for durability and safety ensures steady market expansion.

- For instance, Terex’s CTL 1600-66 luffing jib tower crane offers a maximum capacity of 66 tonnes and supports a jib tip capacity of 16 tonnes, with a maximum jib length of 75 m, tailored for infrastructure and energy site deployment.

Shift Toward Automation and Safety Compliance

The integration of automation and digital technologies is a key growth driver. Fixed cranes are increasingly equipped with semi-automatic and fully automatic features that enhance operational accuracy and reduce labor dependency. Compliance with safety regulations also pushes industries to adopt technologically advanced cranes. IoT-enabled monitoring and predictive maintenance further improve efficiency while minimizing downtime. This shift not only enhances productivity but also positions fixed cranes as integral assets in high-risk and precision-demanding environments.

Key Trends & Opportunities

Adoption of Smart and IoT-Enabled Cranes

The market is witnessing a strong trend toward smart cranes integrated with IoT sensors and real-time monitoring systems. These technologies enable predictive maintenance, remote operation, and enhanced safety performance. Companies see this as an opportunity to reduce operational costs while boosting reliability. As industries transition toward connected ecosystems, demand for digitally enabled fixed cranes is expected to grow, especially in manufacturing and logistics sectors where efficiency gains directly impact profitability.

- For instance, Sany’s crawler crane SCA1000A includes intelligent features that allow its LMI system to self-diagnose faults down to the wire number. Its 10.1-inch color touchscreen LMI shows real-time data on ground bearing pressure, wind speed, radius, and boom angle.

Growing Demand in Emerging Markets

Emerging economies present a significant opportunity for fixed crane manufacturers. Rapid urbanization, industrialization, and government-led infrastructure programs in Asia-Pacific, Africa, and Latin America create strong growth potential. Local manufacturing hubs and construction booms in these regions require dependable lifting solutions. As developing nations increase investments in energy, utilities, and housing projects, fixed crane adoption is set to accelerate. Market players focusing on affordable yet efficient solutions are likely to gain a competitive advantage.

- For instance, Tadano’s AC 4.080-1 all-terrain crane reaches a maximum capacity of 80 t, with a main boom length of 60 m and a tip height of 78 m. AC 5.250-2 model can lift 14.5 t at a 70 m boom length (radius 12–24 m), or 11 t at 42 m radius with a 47 m boom, and its main boom can extend up to 112 m using an HAV extension.

Key Challenges

High Capital and Maintenance Costs

One of the key challenges in the fixed cranes market is the high upfront investment and ongoing maintenance expenses. Small and medium enterprises often struggle to afford advanced models, which limits adoption in cost-sensitive regions. Additionally, maintenance of heavy-duty cranes requires skilled labor and costly spare parts. These financial barriers slow down market penetration, especially in emerging economies where budgets remain constrained despite growing infrastructure demand.

Regulatory and Safety Compliance Barriers

Stringent safety and regulatory standards pose challenges for manufacturers and end users alike. Different regions have varying compliance requirements, increasing the complexity of production and certification. Failure to meet these standards can delay project execution and raise costs. Moreover, ensuring worker safety in high-risk operations requires continuous training and monitoring. These compliance hurdles not only affect profitability but also create barriers for new players entering the fixed cranes market.

Regional Analysis

North America

North America holds 31% share of the fixed cranes market, driven by strong infrastructure modernization and high adoption in construction and energy sectors. The U.S. leads with large-scale investment in smart cities, bridges, and transportation hubs, while Canada focuses on mining and oil sands projects. Advanced technologies, including semi-automatic and fully automated cranes, see increasing adoption to ensure safety and efficiency. Strict regulatory frameworks encourage the use of high-quality equipment. Growing demand in manufacturing plants and shipping terminals further strengthens regional growth, positioning North America as a mature yet innovation-driven market.

Europe

Europe accounts for 27% of the fixed cranes market, supported by robust construction, manufacturing, and port activities. Germany, France, and the UK dominate with investments in industrial automation and green infrastructure projects. Offshore wind energy projects in Northern Europe also drive adoption of high-capacity cranes. Stringent EU safety regulations push demand for advanced semi-automatic and fully automatic solutions. Increasing renovation of urban infrastructure further supports market expansion. With emphasis on sustainability, European players focus on energy-efficient crane technologies, reinforcing the region’s competitive strength in the global fixed cranes industry.

Asia-Pacific

Asia-Pacific leads the fixed cranes market with a 34% share, fueled by rapid urbanization and industrial expansion. China, India, and Japan dominate demand due to massive infrastructure investments, smart city initiatives, and strong manufacturing growth. Large-scale mining, oil, and port expansion projects further boost crane utilization. Governments in the region actively invest in roads, bridges, and energy plants, accelerating adoption across sectors. Asia-Pacific also shows strong interest in medium-height and semi-automatic cranes, balancing cost and efficiency. The region’s strong economic growth and large-scale construction activities position it as the fastest-growing and most influential market.

Latin America

Latin America represents 5% share of the fixed cranes market, primarily supported by construction, mining, and oil exploration. Brazil and Mexico are the leading markets, with increasing infrastructure investments and energy projects. Mining operations in Chile and Peru also contribute to crane demand. However, high capital costs and economic fluctuations limit widespread adoption of advanced technologies. Despite challenges, opportunities exist as governments prioritize urban development and industrialization. Growing focus on safety standards and adoption of semi-automatic solutions offer moderate but steady growth potential in the region’s fixed cranes industry.

Middle East & Africa (MEA)

The Middle East & Africa account for 3% of the fixed cranes market, driven by oil and gas, construction, and utility projects. The Gulf Cooperation Council (GCC) countries dominate with large-scale investments in refineries, smart cities, and mega infrastructure projects. Africa shows gradual growth through mining and utility expansions, particularly in South Africa and Nigeria. However, regulatory hurdles and budget constraints hinder broader adoption. Despite these challenges, demand for durable and heavy-duty cranes continues to grow, supported by government-backed projects. The region’s reliance on energy and construction ensures steady, albeit smaller, market contribution.

Market Segmentations:

By Application:

- Construction & mining

- Oil & gas

By Technology:

By Reach:

- Low height (up to 30 meters)

- Medium height (30-60 meters)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The fixed cranes market is highly competitive, with major players including Liebherr Group, Zoomlion Heavy Industry Science & Technology Co., Ltd., Konecranes, Terex Corporation, Hitachi Sumitomo Heavy Industries Construction Crane Co., Ltd., Sany Heavy Industry Co., Ltd., Tadano Ltd., XCMG Construction Machinery Co., Ltd., Sumitomo Heavy Industries, Ltd., and Manitowoc Company. The fixed cranes market features intense competition, with companies focusing on technology advancements, safety compliance, and operational efficiency to gain an edge. Manufacturers increasingly invest in automation, integrating IoT and smart monitoring systems to reduce downtime and improve performance. Cost competitiveness is another key factor, with firms offering flexible solutions to cater to both large-scale projects and cost-sensitive markets. Sustainability and energy efficiency are becoming central to product development, driven by global regulations and customer demand. Strong after-sales support, strategic collaborations, and expansion into emerging economies further shape the competitive strategies adopted across the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Liebherr Group

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

- Konecranes

- Terex Corporation

- Hitachi Sumitomo Heavy Industries Construction Crane Co., Ltd.

- Sany Heavy Industry Co., Ltd.

- Tadano Ltd.

- XCMG Construction Machinery Co., Ltd.

- Sumitomo Heavy Industries, Ltd.

- Manitowoc Company

Recent Developments

- In July 2025, Tadano announced acquisition of IHI Transport Machinery’s transportation system business, expanding its lifting product portfolio with jib climbing cranes, port cranes, and wind power cranes. The acquisition strengthens Tadano’s position in offshore wind power market.

- In April 2025, Manitowoc launched the Potain Igo T 139 at bauma 2025, marking it as the largest self-erecting crane in its range with 8-ton maximum capacity and advanced telematics integration. This launch represents significant advancement in urban construction capabilities with compact footprint design.

- In April 2024, LOCATELLI CRANE S.R.L, an Italian crane manufacturer, launched a rough terrain crane of 100-tonne capacity Gril 110.100 in the Intermat 2024 trade show held in Paris, France. The cranes weigh 55 tonnes and have a 47-meter boom in the five sections. This product launch signifies a strategic initiative by the company to enhance its brand visibility and engage with customers.

- In April 2023, Liebherr launched a narrow track crawler crane named LR 1700-1.0W for the assembly of wind turbines. The crane has a lifting capacity from 73 to 120 tons and an option of luffing jib. Liebherr’s product launches are strategically planned to showcase its product offering globally and maintain company’s market share globally.

Report Coverage

The research report offers an in-depth analysis based on Application, Technology, Reach and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see steady growth driven by global infrastructure expansion.

- Adoption of semi-automatic and fully automatic cranes will continue to rise.

- Demand for IoT-enabled cranes will increase as industries prioritize smart monitoring.

- Asia-Pacific will remain the fastest-growing region due to rapid urbanization.

- Sustainability and energy-efficient designs will shape future product development.

- High-capacity cranes will gain traction in mining, oil, and large construction projects.

- North America and Europe will focus on safety-compliant and technologically advanced cranes.

- Emerging markets will offer growth opportunities with rising construction investments.

- Manufacturers will strengthen competitive positions through innovation and partnerships.

- Digitalization and predictive maintenance will become standard features in crane operations.