Market Overviews

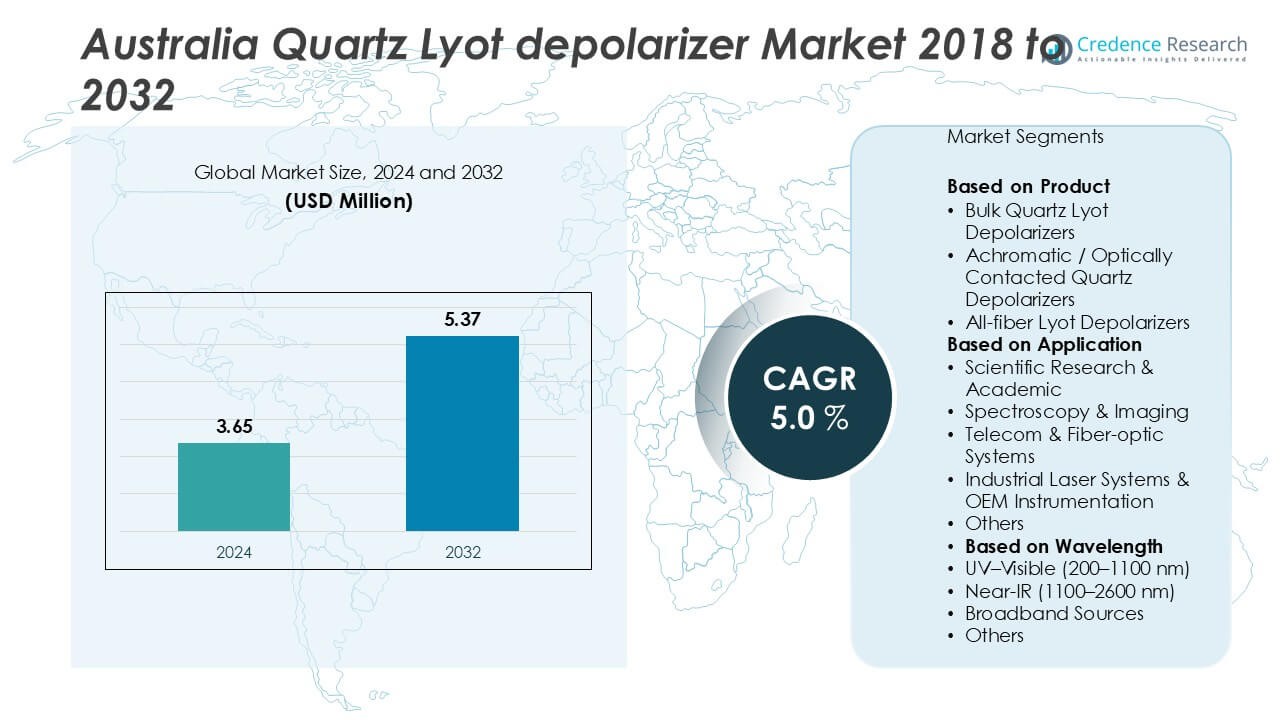

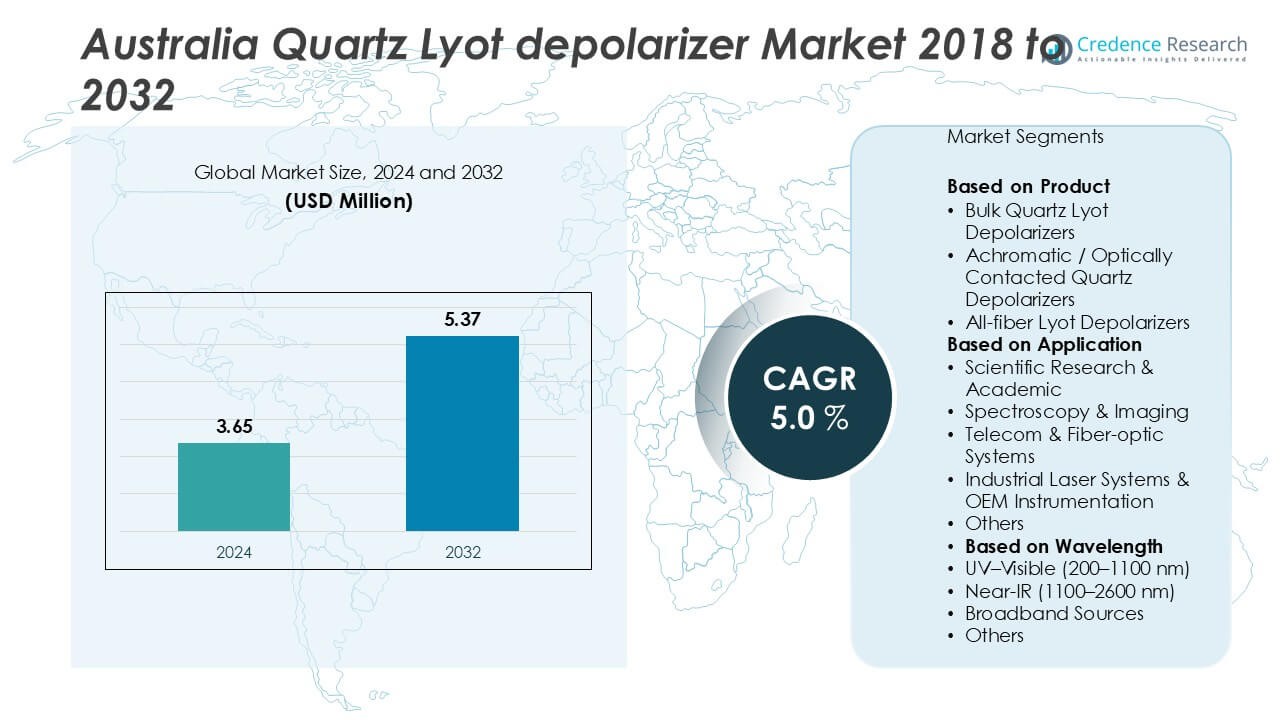

The Australia Quartz Lyot Depolarizer market size was valued at USD 2.92 million in 2018 and reached USD 3.65 million in 2024. It is anticipated to reach USD 5.37 million by 2032, growing at a CAGR of 5.0% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Quartz Lyot Depolarizer Market Size 2024 |

USD 3.65 Million |

| Australia Quartz Lyot Depolarizer Market, CAGR |

5.0% |

| Australia Quartz Lyot Depolarizer Market Size 2032 |

USD 5.37 Million |

The Australia Quartz Lyot Depolarizer market is shaped by both international leaders and regional suppliers. Major players such as Thorlabs, Jenoptik AG, Excelitas Technologies, and Tower Optical Corporation dominate through their broad optical component portfolios and advanced engineering expertise. Specialized firms including Leysop Ltd, OptoSigma, and Edmund Optics India Pvt. Ltd. strengthen the competitive base by delivering tailored depolarizer solutions to research, telecom, and industrial customers. Regionally, New South Wales leads with 36% share, supported by its strong research and telecom ecosystem, followed by Victoria at 27% with growing industrial laser demand. Queensland and Western Australia together account for 30%, driven by mining and automation-related optical applications. The market remains competitive, with innovation in achromatic and broadband depolarizers serving as a key differentiator among companies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Australia Quartz Lyot Depolarizer market was valued at USD 3.65 million in 2024 and is expected to reach USD 5.37 million by 2032, growing at a CAGR of 5.0%.

- Market drivers include rising adoption in telecom and fiber-optic systems, supported by national broadband expansion and increasing demand for stable polarization control in optical communication.

- A key trend is the growing use of achromatic and broadband depolarizers, which deliver high performance across wider wavelength ranges and are increasingly favored in spectroscopy, imaging, and industrial applications.

- The competitive landscape features leading players such as Thorlabs, Jenoptik AG, Excelitas Technologies, and Tower Optical, alongside niche suppliers like Leysop Ltd and OptoSigma, all focusing on product innovation and OEM collaborations.

- Regionally, New South Wales leads with 36% share, followed by Victoria at 27%, while the UV–Visible (200–1100 nm) segment dominated with 40% share in 2024 due to its strong role in research and industrial optics.

Market Segmentation Analysis:

By Product

Bulk Quartz Lyot Depolarizers held the dominant share in 2024, accounting for nearly 45% of the market. Their leadership comes from cost-effectiveness and wide adoption in research and commercial applications. Achromatic or optically contacted quartz depolarizers gained traction for high-precision optical systems requiring broad wavelength performance. Meanwhile, all-fiber Lyot depolarizers are expanding within fiber-optic networks, supported by rising telecom deployments. Growth in bulk depolarizers is mainly driven by their stable performance, durability, and ease of integration into laboratory instruments and OEM systems.

- For instance, Edmund Optics sold quartz depolarizers in 2023, offering achromatic models for applications like spectroscopy and OEM photonics equipment worldwide.

By Application

Telecom and Fiber-optic Systems accounted for the largest share at 38% in 2024. The demand is boosted by expanding broadband infrastructure and advanced optical communication systems. Scientific research and academic use followed closely, with universities and labs investing in polarization control for spectroscopy and imaging studies. Industrial laser systems and OEM instrumentation also contributed steadily, supported by rising automation in manufacturing. The telecom dominance reflects Australia’s increasing investment in high-speed networks, where Lyot depolarizers improve signal stability and minimize polarization-dependent losses.

- For instance, Corning supplies high-performance optical fiber for telecom operators expanding their 5G and high-capacity networks, particularly in regions like Asia-Pacific and Australia. The company continuously develops innovative fiber technology to meet the demands of advanced networking.

By Wavelength

The UV–Visible (200–1100 nm) segment dominated with 40% share in 2024, owing to its extensive use in spectroscopy, imaging, and research instruments. Near-IR applications are growing rapidly, driven by fiber-optic communications and sensing technologies. Broadband sources are also gaining interest due to their suitability across diverse applications, particularly in OEM instrumentation. UV–Visible systems remain dominant because of their strong role in both academic research and industrial optics, supported by demand for precise depolarization in microscopy, laser analysis, and photonics testing setups.

Key Growth Drivers

Rising Adoption in Telecom and Fiber-optic Systems

The rapid expansion of fiber-optic networks across Australia is a major driver of the quartz Lyot depolarizer market. With the nation investing in high-speed broadband infrastructure, demand for components that improve signal quality and reduce polarization-dependent losses has risen sharply. Quartz Lyot depolarizers provide stable polarization control, ensuring efficient transmission in advanced optical communication systems. Telecom providers rely on these solutions to improve bandwidth capacity and support next-generation technologies such as 5G backhaul and data centers. This broad adoption strengthens the position of depolarizers in the telecom supply chain, creating consistent demand.

- For instance, Fujikura supplies fiber optic products, including advanced cables and components, to telecom operators in the Asia-Pacific, supporting the infrastructure for 5G and broadband connectivity. The company offers specialized products like its PANDA Polarization-Maintaining (PM) optical fiber, which is known for its ability to maintain signal stability in demanding applications.

Increasing Use in Scientific Research and Academic Applications

Australia’s research institutions and universities are heavily investing in spectroscopy, imaging, and laser optics. Quartz Lyot depolarizers play a critical role in these areas by delivering precise polarization control across multiple wavelengths. Their integration in microscopy, photonics research, and spectroscopy ensures accurate results and enhances instrument reliability. Government funding in advanced research projects and growing collaborations with global research bodies further accelerate adoption. The focus on photonics and material science research in Australia creates a sustained need for depolarizers, positioning them as vital components in both fundamental and applied research projects.

- For instance, Thorlabs, a major supplier of photonics equipment, provides depolarizers and other components to universities in Australia and worldwide for use in applications like spectroscopy and advanced imaging, supporting regional research capacity in photonics.

Growth of Industrial Laser Systems and OEM Instrumentation

The industrial sector in Australia is increasingly adopting laser-based systems for manufacturing, precision cutting, and material processing. Quartz Lyot depolarizers improve beam quality in these applications, ensuring consistency in industrial lasers and OEM optical instrumentation. Rising automation in sectors such as mining, automotive, and aerospace is creating new opportunities for optical depolarizers. OEMs favor quartz depolarizers for their durability, cost-effectiveness, and broad applicability across industrial setups. As Australian industries prioritize high-precision tools to remain competitive, the use of depolarizers in instrumentation will continue to expand, reinforcing their industrial relevance.

Key Trends & Opportunities

Shift Toward Achromatic and Broadband Solutions

A clear trend in the Australian market is the growing preference for achromatic and broadband Lyot depolarizers. These devices perform efficiently across wider wavelength ranges, making them suitable for spectroscopy, biomedical imaging, and multi-source optical systems. Research labs and OEMs are seeking more versatile depolarization solutions to minimize complexity in optical setups. This shift presents an opportunity for manufacturers to invest in advanced design and fabrication methods. Companies offering broad-spectrum solutions are likely to secure strong positions in both telecom and research markets, tapping into growing demand for flexible optical components.

- For instance, Newport (an MKS Instruments brand) manufactures achromatic depolarizers, which are used in various applications like spectroscopy and biomedical imaging.

Integration with Fiber-optic and Laser-based OEM Platforms

Another emerging opportunity lies in the integration of all-fiber Lyot depolarizers into compact OEM platforms. Fiber-optic and laser system manufacturers are increasingly embedding depolarizers directly into instruments to deliver turnkey solutions. This integration enhances performance, reduces installation complexity, and drives higher adoption in industrial and telecom applications. As OEMs seek reliable, miniaturized optical components, demand for integrated depolarizers will rise. Vendors focusing on product customization and compatibility with diverse platforms stand to benefit significantly from this trend, aligning their innovations with market needs.

Key Challenges

High Production Costs and Technical Complexity

Manufacturing quartz Lyot depolarizers requires precision engineering, advanced crystal cutting, and strict quality controls. These factors increase production costs, making the devices expensive compared to alternative depolarization technologies. Smaller research labs and cost-sensitive industrial players may hesitate to adopt them, slowing market penetration. Additionally, technical complexity in aligning depolarizers within optical systems adds to integration challenges. Vendors face pressure to balance cost reduction with maintaining high optical performance, which limits scalability and hinders widespread adoption in budget-sensitive projects.

Competition from Alternative Polarization Control Technologies

The market also faces challenges from emerging polarization management technologies, such as liquid crystal depolarizers and advanced thin-film coatings. These alternatives often provide more compact, cost-effective solutions for specific applications. In telecom and spectroscopy, such technologies can replace quartz depolarizers where precision is less critical. This competition pushes quartz depolarizer manufacturers to continuously innovate and emphasize superior stability, wavelength range, and durability. Without consistent innovation, quartz-based solutions risk losing share to newer, disruptive technologies, especially in markets prioritizing affordability and compact designs.

Regional Analysis

New South Wales

New South Wales led the market in 2024 with 36% share, supported by its strong base of research institutions, universities, and telecom infrastructure. The state’s investment in advanced photonics and optical communication projects has increased the adoption of quartz Lyot depolarizers in both academic and commercial applications. Sydney’s role as a technology hub drives demand across spectroscopy, imaging, and telecom systems. The presence of major research centers and ongoing expansion of fiber-optic networks make NSW the largest regional market, setting the foundation for continued dominance through 2032.

Victoria

Victoria accounted for 27% of the market share in 2024, driven by growing applications in industrial laser systems and OEM instrumentation. Melbourne’s manufacturing ecosystem has adopted precision optics and laser-based technologies across automotive and aerospace sectors. Additionally, the state’s universities contribute to high usage in spectroscopy and imaging research. The combination of industrial adoption and academic focus ensures steady growth. Victoria’s market is expected to expand as more industries integrate laser-based processes, while research institutions enhance investment in photonics and optical sciences.

Queensland

Queensland represented 18% share of the market in 2024, with growing use of Lyot depolarizers in fiber-optic communication systems and mining-related laser applications. The state’s strong focus on industrial automation, particularly in mining and energy, is creating opportunities for quartz depolarizers in OEM instrumentation. Universities in Brisbane are also advancing optics research, which supports broader academic usage. Although smaller than NSW and Victoria, Queensland’s market is expanding rapidly, reflecting the state’s efforts to modernize infrastructure and strengthen its role in optical communication and industrial innovation.

Western Australia

Western Australia held 12% share in 2024, mainly supported by industrial applications in mining and energy sectors. Demand for quartz Lyot depolarizers is tied to the growing use of laser-based systems for exploration and material processing. Research institutions in Perth also contribute through niche photonics projects, though at a smaller scale than eastern states. The state’s reliance on resource-driven industries makes it a specialized but important market. As industrial automation deepens, Western Australia is expected to maintain steady adoption, especially in high-power laser instrumentation.

Other Regions

Other regions, including South Australia, Tasmania, and the Northern Territory, collectively accounted for 7% share in 2024. Demand in these areas is largely driven by academic research, small-scale spectroscopy applications, and localized industrial projects. While their market contribution is relatively limited, opportunities exist in specialized photonics research and niche manufacturing. Growth in these regions is slower compared to larger states, but targeted government support for research and regional industrial initiatives could help strengthen adoption of quartz Lyot depolarizers in select projects by 2032.

Market Segmentations:

By Product

- Bulk Quartz Lyot Depolarizers

- Achromatic / Optically Contacted Quartz Depolarizers

- All-fiber Lyot Depolarizers

By Application

- Scientific Research & Academic

- Spectroscopy & Imaging

- Telecom & Fiber-optic Systems

- Industrial Laser Systems & OEM Instrumentation

- Others

By Wavelength

- UV–Visible (200–1100 nm)

- Near-IR (1100–2600 nm)

- Broadband Sources

- Others

By Geography

- New South Wales

- Victoria

- Queensland

- Western Australia

- Other Regions (South Australia, Tasmania, Northern Territory)

Competitive Landscape

The competitive landscape of the Australia Quartz Lyot Depolarizer market is shaped by a mix of global manufacturers and specialized optics companies that supply advanced depolarization solutions. Leading firms such as Thorlabs, Jenoptik AG, Excelitas Technologies, and Tower Optical Corporation hold strong positions due to broad product portfolios and established global distribution networks. Regional players and niche suppliers like Leysop Ltd, OptoSigma, and Edmund Optics India Pvt. Ltd. further enhance market competitiveness by offering specialized or cost-effective solutions tailored to research, telecom, and industrial needs. Companies are actively focusing on expanding their portfolios with achromatic and broadband depolarizers to capture demand from spectroscopy and telecom applications. Strategic collaborations with research institutions and OEM manufacturers are becoming a key growth approach, while investments in precision engineering and fiber-integrated depolarizers strengthen product performance. The market remains highly competitive, with innovation, customization, and technical reliability serving as core differentiators among players.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Leysop Ltd

- Thorlabs, Inc.

- Tower Optical Corporation

- Jenoptik AG

- Excelitas Technologies Corp.

- Foctek Photonics, Inc.

- Hunan Dayoptics, Inc.

- OptoSigma Corporation

- Edmund Optics India Private Limited

- Fujian Enlumen Tech Co., Ltd.

- Other Key Players

Recent Developments

- In 2023, Thorlabs launched a new generation of integrated depolarizers focused on improving efficiency and reducing device size.

- In 2023, OptoSigma released a smaller, more compact version of its popular depolarizer model

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Wavelength and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with consistent demand from telecom and fiber-optic systems.

- Research institutions will continue driving adoption through advanced spectroscopy and photonics projects.

- Industrial laser applications will see higher integration of depolarizers for precision manufacturing.

- Achromatic depolarizers will gain preference due to their broad wavelength performance.

- All-fiber depolarizers will rise in demand with growth in compact optical systems.

- Regional dominance of New South Wales will remain strong with telecom and academic support.

- Victoria will strengthen its role through industrial automation and OEM instrumentation growth.

- Competition will intensify as global players invest in customized and broadband solutions.

- Technical challenges of cost and integration will encourage innovations in simplified designs.

- Market outlook is positive, supported by ongoing investments in photonics and telecom infrastructure.